Session 2009/2010

Third Report

Committee for Finance and Personnel

Report on the Preliminary Inquiry into Public Sector Efficiencies

Together with the Minutes of Proceedings of the Committee

Relating to the Report, Written Submissions, Memoranda and the Minutes of Evidence

Ordered by The Committee for Finance and Personnel to be printed 2 June 2010

Committee for Finance and Personnel

Report: NIA 60/09/10R

Committee Powers and Membership

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 48. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to;

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members.

The membership of the Committee since its establishment on 9 May 2007 has been as follows:

Ms Jennifer McCann (Chairperson)

[2] Mr David McNarry** (Deputy Chairperson)

[3] Mr Jonathan Craig***

Dr Stephen Farry

Mr Simon Hamilton

Mr Fra McCann

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Declan O'Loan

[1] Mr Ian Paisley Jnr*

Ms Dawn Purvis

[1]* Mr Ian Paisley Jnr replaced Mr Mervyn Storey on the Committee on 30 June 2008

[2]** Mr David McNarry replaced Mr Roy Beggs on the Committee on 29 September 2008

[3]*** Mr Jonathan Craig replaced Mr Peter Weir on the Committee on 13 April 2010

Table of Contents

Table of Contents

List of abbreviations and acronyms used in the Report

Executive Summary

Key Conclusions and Recommendations

Introduction

Context

Terms of Reference

The Committee's Approach

Consideration of Evidence

Background to the Efficiency Drive

Budgetary Savings or Efficiency Gains?

Leadership, Skills and Cultural Issues

Planning, Delivering and Monitoring Efficiencies

Improving Public Sector Efficiency in the Future

Other Related Challenges

Appendix 1

Minutes of Proceedings Relating to the Report

Appendix 2

Minutes of Evidence

Appendix 3

Memoranda and Papers – Department of Finance and Personnel

Appendix 4

Memoranda and Papers – Others

Appendix 5

Assembly Research Papers

List of Abbreviations and Acronyms used in the Report

List of Abbreviations and

Acronyms used in the Report

BCS Business Consultancy Service

C&AG Comptroller and Auditor General

CAL Centre for Applied Learning

CAP Common Agricultural Policy

CBI Confederation of British Industry

CIPFA Chartered Institute of Public Finance and Accountancy

CoPE Centre of Procurement Expertise

CPD Central Procurement Directorate

CSR Comprehensive Spending Review

CRT Capital Realisation Taskforce

DARD Department of Agriculture and Rural Development

DCAL Department of Culture Arts and Leisure

DE Department of Education

DEL Department for Employment and Learning

DETI Department of Enterprise Trade and Investment

DFP Department of Finance and Personnel

DHSSPS Department of Health, Social Services and Public Safety

DID Delivery and Innovation Division

DOE Department of the Environment

DRD Department for Regional Development

DSD Department for Social Development

EDP Efficiency Delivery Plan

ePIMS Electronic Property Information Mapping Service

ERINI Economic Research Institute of Northern Ireland

ETN Efficiency Technical Note

EU European Union

FSA Financial Services Authority

FTE Full-Time Equivalent

GAE General Administration Expenditure

GB Great Britain

GDP Gross Domestic Product

HMRC Her Majesty's Revenue and Customs

HR Human Resources

ICT Information and Communication Technologies

LPS Land and Property Services

MLA Member of the Legislative Assembly

NAO National Audit Office

NISRA Northern Ireland Statistics and Research Agency

NDPB Non-Departmental Public Body

NHS National Health Service

NI Northern Ireland

NIAO Northern Ireland Audit Office

NICS Northern Ireland Civil Service

ODPM Office of the Deputy Prime Minister

OFMDFM Office for the First Minister and Deputy First Minister

OGC Office of Government Commerce

OSNI Ordnance Survey of Northern Ireland

PAC Westminster Public Accounts Committee/ NI Assembly Public Accounts Committee

PEDU Performance and Efficiency Delivery Unit

PfG Program for Government

PSA Public Service Agreement

PSD Public Spending Directorate

PMDU Prime Ministers Delivery Unit

SSA Social Security Agency

SR Spending Review

TPI Total Place Initiatives

UK United Kingdom

VfM Value-for-Money

Executive Summary

While the full implications for Northern Ireland from the current deficit in UK public sector finances have still to emerge, there can be little doubt that the coming years will see a period of exceptional budgetary constraint for the local public sector. The pressure is already mounting on government departments and public bodies to maintain, or even increase, service delivery with decreasing resources. Terms such as "budget cuts", "value-for-money savings"and "efficiency gains" are being used interchangeably to describe approaches to addressing the public expenditure pressures, while there is increasing public concern over the impact of these measures on priority frontline services. This situation presents the Executive with an immense challenge going forward, especially given the scale and immediacy of the additional budgetary pressures and the fact that Northern Ireland departments have already been working to achieve cumulative efficiencies of between 2% to 3% over each of the last six years.

It is in this context that the Assembly Committee for Finance and Personnel decided to undertake this preliminary inquiry, with the aim of examining how the Executive can maximise efficiencies without having an adverse impact on essential front-line services and strategic policy priorities. As part of its investigation, the Committee also sought to establish some clarity around the nature of proper efficiency gains and how they differ from straightforward budget cuts. The Inquiry also examined approaches to monitoring and overseeing the delivery of efficiencies, including the identification of issues and lessons which will be of help to all the Assembly statutory committees in scrutinising the performance of their departments in this area. Consideration has also been given to the opportunities for realising further efficiency savings in the future and to the types of accompanying measures needed to ensure that our public services are delivered effectively as well as efficiently.

To inform its considerations, the Committee received evidence from a number of expert witnesses, with experience of efficiency programmes locally and in other jurisdictions. The Inquiry has also drawn on a wide range of other sources, including: relevant plenary debates; Ministerial responses to Assembly Questions on efficiency savings across departments; guidance issued by the Department of Finance and Personnel on efficiency delivery plans; the Department's own Efficiency Delivery Plan; Assembly Research papers; correspondence with other Assembly committees; in addition to a wider literature review of best practice in this subject area.

A number of key themes have emerged from the Inquiry findings. Foremost of these is the need for the Executive to set out clearly the essential services and strategic policies which are to receive priority, in terms of ensuring that there is no diminution in the level and quality of services delivered or outcomes achieved as a result of the planned savings. A further theme is that it will be vitally important for the Executive to take a strategic approach to targeting, delivering and monitoring the additional efficiency gains. This will help to avoid both a crude "salami slicing" of departmental budgets and a disjointed or silo approach by individual departments, which can be counterproductive in terms of the efficiency of the wider public sector.

As all public sector bodies move into this period of constrained spending, the Committee recognises that there is much more work to be done. This will involve more input from the key stakeholders, including the other Assembly statutory committees and wider public engagement, to fully explore the issues raised. The report findings and recommendations aim to provide a useful starting point for discussion and a positive contribution to the debate about the best way forward in driving out further public sector efficiencies.

Key Conclusions and Recommendations

Background to the Efficiency Drive

1. The Committee is mindful that the public sector in Northern Ireland has been working to achieve cumulative efficiencies of between 2% to 3% over each of the last six years. Moreover, the pressure on departments to deliver "more with less" continues to mount in 2010-11, with additional savings of £123m forming part of the £367m in in-year budgetary pressures confirmed in April, with a further £128m to be imposed on the Northern Ireland Block as announced in May. The Committee does not underestimate the challenge that this presents to the Executive, both in terms of the current year and, more especially, as regards the, as yet to be quantified, additional budgetary reductions in the period 2011-14. The proposals arising from this preliminary inquiry are, therefore, intended as a positive contribution to the deliberation on how to meet this challenge. (Paragraph 33)

Budgetary Savings or Efficiency Gains?

2. The Committee recognises that the scale and immediacy of the current public expenditure pressures facing the Executive means that straightforward budgetary savings are required in 2010-11. However, the Committee believes that these can and should be achieved without having an adverse impact on essential public services and strategic policy priorities. This necessitates a thorough-going reassessment of spending programmes to identify those which have achieved or are no longer fulfilling their intended purpose and those which are lowest priority and therefore offer scope for allocative savings. (Paragraph 35)

3. The Committee also contends that, in addressing the immediate public expenditure pressures for 2010-11 through budgetary savings, the Executive should not lose sight of the benefits of achieving real public sector efficiency gains in the medium to long term, as this will assist in minimising and managing any further public expenditure pressures in the years ahead. (Paragraph 36)

4. The Committee is concerned that there is no clear audit trail to give assurance that the 3% cumulative savings deducted from departments in the Budget for 2008-11 have been allocated to key frontline services and Programme for Government priorities. Arising from the recent Review of 2010-11 Spending Plans for Departments, the Committee highlighted similar concerns around the lack of information on how departments will manage the additional in-year budgetary pressures to safeguard essential services and strategic policy priorities. The Committee therefore calls on the Department of Finance and Personnel and the wider Executive to make the necessary arrangements to ensure that, in future, the requisite information and transparency is provided to enable the Assembly and the wider public to track how such savings are applied. (Paragraph 39)

The Need for a Strategic Approach

5. The Committee recommends that the Executive develops a co-ordinated strategy for targeting, identifying and realising further efficiencies, which protects essential frontline services and strategic policy priorities and avoids the imposition of pro rata budgetary cuts across all departments. Whilst the Committee believes that this further efficiency drive should include measures to improve the efficiency of front-line services as well as back-office operations, it calls for robust safeguards to ensure that that there is no consequential diminution in the level and quality of service provision in priority areas. (Paragraph 46)

6. The Committee believes that the 2008-11 Programme for Government and Public Service Agreement framework is cumbersome and overly complex in terms of the need to prioritise at a time of exceptional budgetary constraint. As such, the Committee calls on the Executive to urgently review its Programme for Government, which is due to expire in the current financial year, and set out clearly the services and policies to receive highest priority during the upcoming period of further budgetary savings and efficiencies. (Paragraph 50)

7. The Committee recommends that, as part of its central monitoring of the efficiency programme, the Department of Finance and Personnel should provide continual assurance to the Executive and Assembly that: (a) the short-term focus on savings is not adversely affecting the achievement of key long-term objectives at a departmental and Executive level; and (b) efficiencies being claimed at a departmental level are not having a negative effect on the efficiency of the wider public sector. (Paragraph 54)

8. The Committee recommends that, in its central personnel role, the Department of Finance and Personnel should ensure that the skills exist and are marshalled within departments, and their arms-length bodies, to effectively examine systems and processes for the purpose of identifying valid efficiencies; and, more generally, that a culture of efficient delivery is embedded into the routine responsibilities of public sector managers. The Committee also believes that assurances are required in terms of the capability of departmental boards and the governing bodies of public bodies to lead and oversee the efficiency drive. (Paragraph 59)

Planning, Delivering and Monitoring Efficiencies

9. The Committee would encourage the Northern Ireland Audit Office to urgently review the performance of departments to date in achieving efficiency gains, including both in terms of the reliability of the identified efficiencies and the progress which has been reported against departmental efficiency delivery plans. The Committee considers that the findings and lessons from such a review could be valuable in informing any further efficiency drive following the next UK Spending Review. (Paragraph 72)

10. The Committee recommends that, pending any Northern Ireland Audit Office review of the efficiency programme in Northern Ireland, the Department of Finance and Personnel should examine the findings and recommendations from the work of both the National Audit Office and the Westminster Public Accounts Committee in relation to the efficiency programme in Whitehall and ensure that all applicable lessons and action points have been addressed by Northern Ireland departments. (Paragraph 73)

11. The Committee recommends that, in fulfilling its central monitoring role, the Department of Finance and Personnel should ensure that a clear definition of valid efficiencies is applied consistently both in its guidance to departments and by departments in their efficiency delivery plans. It is the view of the Committee that a lack of consistency and transparency in this area risks both confusion within the public sector and controversy in the political and public domain in terms of the rationale and outworking of the efficiency programme. (Paragraph 77)

12. The Committee calls on the Department to facilitate a process whereby a single Efficiency Delivery Plan for each department is published in a central location to allow effective monitoring of efficiency delivery plans both centrally by the Department of Finance and Personnel and by the Assembly's statutory committees. In addition, the Department of Finance and Personnel and the relevant statutory committee should subsequently be informed by departments of any amendments made to their efficiency delivery plans. (Paragraph 83)

13. The Committee recommends that both the Department of Finance and Personnel centrally and each Assembly statutory committee encourage departments to provide clear quantitative and qualitative evidence on the inputs and outputs associated with the specific services which they provide, for the purpose of ensuring more effective validation and measurement of efficiency gains. (Paragraph 91)

14. The Committee calls on the Department of Finance and Personnel centrally to determine whether it is appropriate for increased income from charging to be included in departments' efficiency delivery plans, given that it is not included in the Efficient Government Programmes in Whitehall or Scotland. The Committee believes that, if budgetary savings and other measures are to be included in efficiency delivery plans, then these should be distinguished from proper efficiencies. (Paragraph 102)

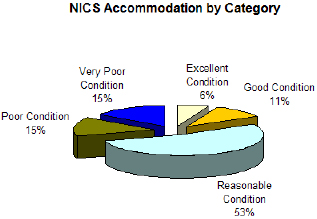

15. The Committee is concerned to find evidence that Full-Time Equivalent staff numbers in the Northern Ireland Civil Service had increased notably by April 2009, following the achievement of the Fit for Purpose reductions in April 2008. Moreover, the Committee sees scope for closer monitoring of efficiencies achieved in accommodation expenditure and calls on the Department to provide a detailed breakdown of accommodation efficiencies achieved since April 2008, including clear evidence to verify the further reductions in Full-Time Equivalent posts being projected by departments. (Paragraph 106)

16. The Committee has concerns that, as baselines for efficiency targets from 2008–2011 were set in the Budget in January 2008, departments could claim to be achieving efficiencies by living within these baselines, even if they receive additional funds for these programmes in subsequent quarterly monitoring rounds. The Committee calls on the Department of Finance and Personnel to examine this issue to determine whether this has happened to date and how this anomaly might be addressed going forward. (Paragraph 110)

17. Given the concerns expressed in the evidence around the potential for departments to circumvent limits on administration expenditure, the Committee calls on the Department of Finance and Personnel to provide a detailed analysis of administration spend by departments in 2008-09 and 2009-10, including the extent to which targets have been achieved at both departmental and block level. (Paragraph 114)

18. The Committee wishes to highlight, as a case in point, the tardiness on the part of the Department of Finance and Personnel in updating and reporting progress on its Efficiency Delivery Plan and seeks an assurance from the Department that this matter will be given higher priority going forward. (Paragraph 117)

19. The Committee recommends that all Assembly statutory committees give increased attention to examining the efficiency delivery plans of their respective departments, including progress to date. In undertaking this scrutiny the committees may wish to draw on the practical advice received from the expert witnesses to this Inquiry. In this regard, the committees may also wish to seek evidence on how departmental boards and governing bodies of arms-length bodies are applying the good practice efficiency checklist published recently by the Northern Ireland Audit Office. (Paragraph 124)

20. The Committee has concerns with the central reporting of progress by departments in achieving efficiency targets, both with the time lag in receiving co-ordinated progress reports from the Department of Finance and Personnel and as regards the reliability of the risk levels attached by departments to efficiency achievement. Also, the Committee is alarmed to note from the most recent progress report that almost 50% of planned savings for 2010-11 are considered to be "on track with significant risk" or "not on track". This is especially worrying given the additional savings that have subsequently been announced for 2010-11. The Committee considers that the Department of Finance and Personnel's central monitoring of departmental efficiency delivery plans needs to be more robust and that the outcomes should be reported to Assembly statutory committees, via the Committee for Finance and Personnel, on a more timely basis. (Paragraph 137)

Improving Public Sector Efficiency in the Future

21. The Committee recognises that scope exists for achieving additional efficiencies in the Northern Ireland public sector by further reducing bureaucracy, eliminating the duplication of services and improving Human Resources management practices. The Committee believes that this will require strong leadership at both the political and managerial levels of government, together with combining the strategic "top down" and "bottom up" approaches to effecting organisational and cultural change across all public bodies. (Paragraph 146)

22. The Committee continues to see shared services as offering significant potential for realising true efficiencies in the medium to long term. However, it notes with concern that, in the recent report on performance against Public Service Agreements and departmental business targets for 2009-10, the Department of Finance and Personnel has attached an amber status to the benefits realisation plans for HRConnect, Account NI, and Records NI. Whilst welcoming the continued focus on the benefits realisation targets within the Department of Finance and Personnel business plan for 2010-11, as the reform programme moves forward, the Committee will wish to receive regular updates on the performance of the shared services, including substantiation of reported efficiencies. (Paragraph 156)

23. The Committee sees scope for more strategic co-ordination of the public procurement function to realise additional efficiencies, including in terms of e-procurement and collaborative purchasing between the different levels of government. The Committee reiterates its previous call for a new target to be set for achieving further efficiencies from public procurement, to include a monetary value and baseline for such savings, with an associated implementation plan which links to individual departmental efficiency delivery plans. (Paragraph 160)

24. Given the potential to realise further efficiency savings from accommodation expenditure, the Committee welcomes moves by the Department of Finance and Personnel to develop a policy on remote working, which is likely to entail measures such as the use of local satellite offices and shared desking, and to facilitate this through improvements to the Northern Ireland Civil Service information technology and telecommunications systems. The Committee is mindful that the concept of remote working has been under consideration for some time and urges the Department to establish policy promptly in this area, including in terms of implementation targets, in the context of finalising the development of the Northern Ireland Civil Service Accommodation Plan 2010-11 to 2012-13. (Paragraph 165)

25. Given the importance of good practice asset management and capital realisation to wider public sector efficiency, the Committee recommends that surplus government properties, together with the annual costs involved, should be fully disclosed in a more user friendly and meaningful way. In this regard, the Committee believes that a comprehensive, mandatory central asset register for all public bodies – as recommended in the report of the Capital Realisation Taskforce in December 2007 – should be established without further delay. The Committee also recommends that, in its central finance role, the Department of Finance and Personnel should ensure that an exercise to identify surplus property is a regular feature of annual budget processes within departments and that a mechanism is used to independently assess the outcomes of such exercises. (Paragraph 171)

26. Whilst the Committee is disappointed at the low level of uptake of the Performance and Efficiency Delivery Unit services by departments to date, it acknowledges that this issue can only be addressed through agreement amongst Executive Ministers. The Committee therefore calls on the Department of Finance and Personnel to put forward options to the Executive for ensuring that the Performance and Efficiency Delivery Unit functions are exercised effectively across all departments. This might include maintaining the Performance and Efficiency Delivery Unit in its existing form, with each Executive Minister committing to utilise its services on a more proactive basis. However, other options for consideration might include, for example: establishing the Unit as an independent body in statute; relocating the Unit elsewhere outside the Department of Finance and Personnel; or retaining the business function within the Department of Finance and Personnel by merging the work of the Performance and Efficiency Delivery Unit with the Business Consultancy Service to provide a more comprehensive service to departments. (Paragraph 185)

27. Overall, the Committee is supportive of the Invest to Save initiative and considers that it is another useful tool for incentivising departments to make efficiency savings. While at this stage the Committee would, in principle, be supportive of a continuation of this initiative in future budgetary cycles, it will wish to consider the outcome of any scrutiny by the relevant Assembly statutory committees of the implementation of the programme during 2010-11 to assess its effectiveness. (Paragraph 191)

Other Related Challenges

28. The Committee considers that the efficiency drive will need to be accompanied by an equally important focus on effectiveness in public service delivery. This will necessitate a range of business improvement measures across the public sector, including the consistent application of best practice in governance, management and budgeting, aimed at optimising the allocation and use of resources and raising the performance and effectiveness of public services. The Committee also notes calls for the Executive to consider revenue-raising measures to support public services. While the scope of this preliminary inquiry did not enable a detailed examination of these accompanying measures, the Committee believes that such issues will take on greater significance in this time of exceptional budgetary constraint. (Paragraph 213)

Introduction

Context

1. In a submission to the Committee in November 2009 the Economic Research Institute of Northern Ireland (ERINI) suggested that:

"As the UK financial position deteriorates the push to increase the efficiency with which the public sector uses increasingly scarce public expenditure resources to deliver services is being constantly ratcheted up."[1]

2. The new Chancellor's announcement[2] on 24 May 2010 of a further £6.2bn savings in 2010-11 has given an indication of how the incoming Westminster Government intends to begin to address the UK's budget deficit in the short-term. Whilst the full implications for NI departments are as yet unclear, the Department of Finance and Personnel (DFP) has estimated that NI's share of this round of cutbacks will be £128m. The Minister of Finance and Personnel stated that the three options before the Executive were: to implement all the cuts in the current financial year, to defer some, or to postpone all until 2011-12. The Minister further suggested that some of the necessary savings could be realised from monies surrendered by departments during the in-year monitoring process.[3] At the time of agreeing this report, however, the Committee awaits confirmation as to how and when the Executive plans to address these additional savings.

3. In terms of further pressures on public expenditure over the period 2011-12 to 2013-14, ERINI has concluded that, based on projections from the Institute for Fiscal Studies, "even in a most favourable case where large spending departments in Whitehall that have more or less total comparability with NI departments are protected the outcome is still the loss of between £500 – 600 million in real terms over three years."[4]

4. Concern felt by Assembly Members over the potential impact of efficiency savings on front line services has been expressed during plenary debates and through a number of Assembly Questions (see Appendix 4). In evidence to the Committee on 29 April 2009, a DFP official acknowledged that "it is always difficult when efficiencies cross the line and become cuts."[5]

5. It is therefore timely that the Committee for Finance and Personnel, given its key role in scrutinising a range of strategic and cross-cutting issues which have an impact on public expenditure and financial performance across the Northern Ireland Civil Service, pays particular attention to the issue of efficiency savings. The Committee believes that consideration of such medium-to-long term strategic finance issues is important at this stage, in terms of minimising and managing any further public expenditure pressures in the years ahead.

Terms of Reference

6. At its meeting on 14 October 2009, the Committee agreed that, as part of its role in scrutinising strategic public finance issues, the efficiency programme for NI departments merited further examination and agreed to invite expert witnesses to assist its scrutiny. The Committee agreed that the primary focus of this preliminary inquiry would be on how departments can maximise efficiency savings without affecting priority frontline services, but that it would also seek expert evidence on the following:

7. Whilst the Committee had originally intended that its analysis of the evidence from expert witnesses would form part of its co-ordinated report on the Review of 2010-11 Spending Plans of NI Departments[6], it subsequently decided to present its findings in this separate report, which looks beyond 2010-11.

8. The Committee believes that the findings from this initial inquiry will offer a basis for informing future Assembly scrutiny of the efficiency drive across departments. However, the Committee anticipates that, once there is clarity on the quantum of additional savings required from departments following the next UK Spending Review, there will be a need for a more in-depth and co-ordinated inquiry by the Assembly statutory committees aimed at ensuring that efficiencies are maximised across departments, whilst safeguarding key frontline services and Programme for Government (PfG) priorities. The Committee considers that this further inquiry could be informed by work in other jurisdictions, including the outcome from the ongoing inquiry into the efficient delivery of public services which is being undertaken by the Finance Committee in the Scottish Parliament.[7]

The Committee's Approach

9. The Committee subsequently took oral evidence from the following:

10. The Committee also received written submissions from Professor Arthur Midwinter, who has undertaken major studies of local government finance and devolution finance and is a Budget Adviser to the Finance Committee of the Scottish Parliament. A written submission was also received from the Chartered Institute of Public Finance and Accountancy (CIPFA). The written submissions from the expert witnesses are available at Appendix 4.

11. By way of background information, a written briefing was prepared for each of the witnesses in advance of receiving their evidence. This included a background paper prepared by the Assembly Research Service; guidance on preparing efficiency delivery plans that was issued by DFP to other departments; DFP's own EDP; and Ministerial responses to Assembly Questions on the impact of efficiency savings.

12. Having considered the expert evidence received, the Committee took evidence from DFP on its own EDP and held a further oral evidence session with officials from DFP's Central Finance Group on its strategic role in monitoring efficiency plans. An oral evidence session was also held with DFP officials on the role and performance of the Performance and Efficiency Delivery Unit (PEDU). The Official Reports of these evidence sessions are available at Appendix 2.

13. To further inform its thinking, the Committee commissioned Assembly Research to prepare two additional research papers. The first paper, on "Methods of Budgeting", presented different approaches to budgeting in the public sector, while the second looked at public sector efficiencies within the context of a "Systems Thinking" approach. Both papers assisted members in reflecting on the tools available to NI public sector bodies seeking to improve the effectiveness and efficiency of their activities.

14. In October 2009 the Chairperson, acting in her capacity as an individual Assembly Member, tabled a question to each Executive Minister seeking information on what impact, if any, planned efficiency savings within their departments was having on frontline services. A full set of responses is available at Appendix 4.

15. A number of plenary debates have also informed the Committee's report, including a Private Members' Motion on inviting PEDU to investigate potential non-front line savings within the Department of Health, Social Services and Public Safety (DHSSPS); the "Take Note" debate on the Review of 2010-11 Spending Plans for NI Departments; and the Minister of Finance and Personnel's motion on the Revised 2010-11 Spending Plans.[8]

16. During the course of this Inquiry the Committee has taken a particular interest in the role which PEDU can play in assisting departments as they seek to deliver efficiency savings. As such, the Committee sought views from the other statutory committees on the current or potential use of PEDU within their respective departments.

17. The Committee considers that the Inquiry findings and recommendations provide an initial contribution from the Assembly to the ongoing deliberations and focus on efficiencies during the current period of increased budgetary constraint. However, this is only a first step and, as alluded to above, a more in-depth and co-ordinated inquiry, involving both input from the other statutory committees and wider public engagement, will be necessary to fully explore the issues raised.

18. The key issues arising from the evidence considered by the Committee are detailed in the remainder of the report.

Consideration of the Evidence

Background to the Efficiency Drive

19. In its written submission, ERINI helpfully put the efficiency drive in the public sector into context and detailed the background to date, both for the efficiency agenda at Whitehall and its subsequent consequences for NI. The ERINI submission also sounded a note of caution in the following statement:

"Efficiency savings seem to hold out the promise of sustaining, or even improving services at the cost of little, or no pain. Terms such as 'cutting waste', 'taking up the slack' and 'slashing bureaucracy to release resources for the frontline', reinforce this perception of getting something for nothing. In reality, however, securing true efficiency gains in delivering public services can be difficult both to achieve and to measure."

20. The present approach to efficiencies has largely been dictated in the UK by the 2004 report by Sir Peter Gershon, former chief executive of the UK Government's Office of Government Commerce (OGC), who was commissioned to identify the scope for making efficiency savings across the public sector as a whole. His report, Releasing Resources to the Front Line: Independent Review of Public Sector Efficiencies, defines efficiencies as "those reforms to delivery processes and resource (including workforce) utilisation that achieve:

i. reduced numbers of inputs (e.g. people or assets), whilst maintaining the same level of service provision; or

ii. lower prices for the resources needed to provide public services; or

iii. additional outputs, such as enhanced quality or quantity of service, for the same level of inputs; or

iv. improved ratios of output per unit cost of input; or

v. changing the balance between different outputs aimed at delivering a similar overall objective in a way which achieves a greater overall output for the same inputs ('allocative efficiency')."

21. In its evidence, NIAO informed the Committee that the key theme of this report was to embed a culture of efficiency change, and to tighten the definitions of efficiencies and what they are about. As to the extent to which this culture has been embedded into NI departments, it stated that "the process has not gone as far as it can go. It is a lot better than it was in the past, but the potential exists to improve and tighten the process and to subject it to more rigorous validation."

22. OGC classifies efficiency gains as cashable and non-cashable. Cashable efficiency savings release financial resources that could be deployed elsewhere, whilst maintaining outputs and their quality. Non-cashable efficiency gains take place when productivity or quality increases without releasing financial resources. In general, cashable efficiency implies less expenditure for the same outcomes and non-cashable gains occur where better outcomes are achieved for a given amount. The following table presents a summary of cashable and non-cashable efficiency gains.

Table 1: Cashable and Non-Cashable Efficiency Gains

| Cashable Gains | Non-Cashable Gains |

| Reduce the level of inputs for the same outputs | Get greater outputs for the same inputs |

| Decrease outputs in return for a proportionately larger decrease in inputs | Increase outputs by a proportionately smaller increase in inputs |

| Improvements in service quality for the same inputs |

23. In his report, Gershon also identified the following six "workstreams", (i.e. broad areas of public sector activity, with the potential to deliver cashable and non-cashable efficiency savings):

24. Flowing from the Gershon report, Spending Review 2004 put 2.5% cumulative efficiency targets in place for all departments.

25. Subsequently, in the Comprehensive Spending Review (CSR) 2007, the UK Government significantly increased the target for Value-for-Money (VfM) savings from efficiency measures. VfM savings under CSR 2007 differed from efficiency savings under the Gershon Efficiency Programme in a number of important ways:

i. VfM savings take account of upfront and ongoing costs whereas efficiency gains under Gershon could be reported gross;

ii. only cashable savings were recognised as VfM savings (up to 40% of Gershon efficiency savings were classified as "non-cashable");

iii. VfM savings can be termed "allocative" – i.e. savings from stopping, or reducing, low priority activities as long as there is no adverse impact on Public Service Agreement targets or Departmental Strategic Objectives; and

iv. the Gershon Efficiency Programme allowed departments to reinvest savings in front line services. However, CSR 2007 removed the money saved from Whitehall departments' resource allocations for the years 2008 to 2011 with the exception of HMRC, the Department for Work and Pensions, and the Ministry of Defence.

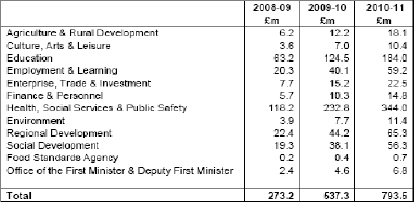

26. For the 2008-11 period covered by CSR 2007, NI departments were required to find 3% cashable efficiency savings. These were included in the Executive's Budget for 2008-11 and are set out in Table 2 below.

Table 2: Comprehensive Spending Review 2007 Cash Releasing Efficiency Targets by NI Department

| 2008-09 £m |

2009-10 £m |

2010-11 £m |

|

| Agriculture & Rural Development | 6.2 | 12.2 | 18.1 |

| Culture, Arts & Leisure | 3.6 | 7.0 | 10.4 |

| Education | 63.2 | 124.5 | 184.0 |

| Employment & Learning | 20.3 | 40.1 | 59.2 |

| Enterprise, Trade & Investment | 7.7 | 15.2 | 22.5 |

| Finance & Personnel | 5.7 | 10.3 | 14.8 |

| Health, Social Services & Public Safety | 118.2 | 232.8 | 344.0 |

| Environment | 3.9 | 7.7 | 11.4 |

| Regional Development | 22.4 | 44.2 | 65.3 |

| Social Development | 19.3 | 38.1 | 56.3 |

| Food Standards Agency | 0.2 | 0.4 | 0.7 |

| Office of the First Minister & deputy First Minister | 2.4 | 4.6 | 6.8 |

| Total | 273.2 | 537.3 | 793.5 |

Source: Budget 2008-11[9]

27. The amounts in this table were removed upfront from departmental budgets and reallocated for additional service provision in NI. Each department was then required to produce an Efficiency Delivery Plan (EDP) which was to set out how these targets would be achieved.

28. In his Budget 2009 statement, the then Chancellor announced plans to find an additional £5bn in efficiency savings from Whitehall departments in 2010-11, on top of the £30bn for 2008-11 already identified in CSR 2007.[10] The implications for NI became clearer when, on 12 January 2010, the Minster of Finance and Personnel made a statement to the Assembly announcing the Review of 2010-11 Spending Plans for NI Departments. This Review was initiated as the Executive faced spending pressures totalling £367 million in 2010-11, and DFP reported that the consequence for NI of the additional £5bn in efficiencies at Whitehall was that, through the workings of the Barnett Formula, existing funding for 2010-11 would be reduced by £122.8m.[11] In subsequent evidence, however, the Department explained that, while this figure was offset by an increase of £95.6m in additional Barnett allocations received as part of the Budget and Pre-Budget Report, since the Block Grant for 2010-11 was first set in the 2007 CSR, there remained a net reduction.

29. Arising from the written evidence from Professor Midwinter, the Committee queried with DFP whether the reduction in planned expenditure through Barnett consequentials for 2010-11 represented a reduction in the rate of growth rather than in the current budget baseline. During an evidence session with Departmental officials on 17 February 2010, the Committee sought further clarification from DFP as to the basis for including the £122.8m in the calculations for the £367m public expenditure pressures for 2010-11. DFP followed up by providing a table setting out the changes in the 2010-11 Block Grant since CSR 2007 (Appendix 3) and explained that the net reduction had resulted in a spending pressure because the Executive had fully allocated the previous Barnett additions to departments who had planned their programmes on that basis.

30. In its subsequent report on the Review of 2010-11 Spending Plans for NI Departments, the Committee echoed the dissatisfaction expressed by a majority of Assembly statutory committees with shortcomings in the information provided by departments on their revised spending proposals for 2010-11. In particular, this included the detail that departments were expected to provide on "the proposed measures to be taken to deliver additional savings whilst at the same time minimising the impact on the delivery of priority frontline public services."[12]

31. In terms of future years, in his Budget 2009 statement, the then Chancellor additionally imposed a further £9bn in efficiency savings from 2011-14, with the NI media speculating at the time that this will mean a reduction in the NI Block of £75m per year during this period. In its evidence to the Committee, ERINI was of the view that the Chancellor's Budget reference to these new efficiency savings was somewhat vague and more detail will not be available until the next Spending Review covering these years, the timing of which should become clearer following the recent Westminster election. Until further clarification is obtained on whether these future efficiency savings will be spread across all Whitehall departments, or targeted on specific areas, it is not possible to calculate the NI consequentials precisely. ERINI did however estimate a cut of £220m over the three years (2011-14), which would be added to the Barnett consequentials of any programme cuts at Whitehall, needed to bring borrowing under control. The Committee also heard evidence from ERINI of the Chancellor's need to reduce the borrowing requirement from 12% to 6% of Gross Domestic Product (GDP) within four years.

32. In relation to the potential for further efficiency savings to be imposed on NI departments, the Committee heard evidence from DFP officials on 29 April 2009, shortly after the Chancellor's Budget 2009 statement, when a senior DFP official informed the Committee that:

"To put Northern Ireland efficiencies into context, we should not forget that the 2004 spending review put 2·5% cumulative efficiency targets in place, which ran for three years through the Gershon work. The 2007 Comprehensive Spending Review (CSR) layered another 3% of cumulative efficiencies on top of that. Therefore efficiencies have been carried out for five or six years here, at a rate of around 2% to 3% per annum. Instinct suggests that all of the low-hanging fruit has been grabbed, so we will need to work hard. There is scope for efficiency in the system: I defy anyone to appear before a Committee and say that the system is completely efficient. The question is whether £123 million can be eased out in the period under discussion."[13]

33. The Committee is mindful that the public sector in NI has been working to achieve cumulative efficiencies of between 2% to 3% over each of the last six years. Moreover, the pressure on departments to deliver "more with less" continues to mount in 2010-11, with additional savings of £123m forming part of the £367m in in-year budgetary pressures confirmed in April, with a further £128m to be imposed on the NI Block as announced in May. The Committee does not underestimate the challenge that this presents to the Executive, both in terms of the current year and, more especially, as regards the, as yet to be quantified, additional budgetary reductions in the period 2011-14. The proposals arising from this preliminary inquiry are, therefore, intended as a positive contribution to the deliberation on how to meet this challenge.

Budgetary Savings or Efficiency Gains?

34. In its evidence, ERINI drew the Committee's attention to the McCarthy Report in the Republic of Ireland, which identified what could properly be achieved through efficiencies and highlighted that major savings could only be achieved through changes in policy. NIAO noted that this report was produced on the back of an emergency, when a sudden change in public finances occurred, but considered it important that consideration is given to worst case scenarios as it is almost impossible to deliver any real efficiencies in the short-term. In its written submission (at Appendix 4), CIPFA stated that:

"To reduce public expenditure on the scale required means that some less essential and lower priority public services will have to be cut, together with cost cutting of 'back office' expenditure. Therefore, we believe it should not be a pre-condition that all front line services should be protected from reductions in expenditure. This will require the Executive and the Northern Ireland Assembly to manage expectations about the provision of public services."

35. In this regard, the Committee recognises that the scale and immediacy of the current public expenditure pressures facing the Executive means that straightforward budgetary savings are required in 2010-11. However, the Committee believes that these can and should be achieved without having an adverse impact on essential public services and strategic policy priorities. This necessitates a thorough-going reassessment of spending programmes to identify those which have achieved or are no longer fulfilling their intended purpose and those which are lowest priority and therefore offer scope for allocative savings.

36. The Committee also contends that, in addressing the immediate public expenditure pressures for 2010-11 through budgetary savings, the Executive should not lose sight of the benefits of achieving real public sector efficiency gains in the medium to long term, as this will assist in minimising and managing any further public expenditure pressures in the years ahead.

37. In a recent report on efficiencies, Jamie Bartlett of the think-tank DEMOS, argued that when seeking to increase efficiency:

"The natural tendency will be for the government to continue what it is doing, only more cheaply: by reducing unit costs in procurement; by cutting up-front investment for long-term change; or, even worse, by 'salami slicing' — which means making across-the-board percentage cuts in departmental budgets. These strategies might secure initial savings, but will make things more expensive in the long term. No matter how 'efficient' you make a public service in monetary terms, if it does not solve the problem it is intended to, or does not achieve the desired outcomes, it is a poor use of public money."[14]

This latter point is discussed later, in terms of the need to for the drive for increased efficiency to be accompanied by a focus on improving the effectiveness of public services.

38. ERINI informed the Committee that there are two mechanisms through which efficiency savings in Whitehall departments may be transmitted to NI. One mechanism is an announcement that HM Treasury is taking a percentage efficiency saving across the board from departments; therefore the NI Executive is required to take that percentage saving on the block grant. However, the mechanism which has tended to be used is to take the cuts in England through the Barnett Formula and to deliver the finalised figure against the block grant. As outlined earlier, in the Executive's Budget for 2008-11, it agreed to deliver the efficiency target by setting 3% cumulative efficiency targets for all departments.

39. In Professor Arthur Midwinter's forthcoming paper, Efficiency Savings in the Scottish Budget: Problems of Accounting Practice, which he helpfully shared with the Committee, in relation to the reallocation of efficiency savings in Scotland, he states that the use made of resources released is not highlighted in the Scottish Budget or in the subsequent EDPs and that "for most plans there is no clear audit trail from budget line to budget line to permit proper accountability for financial management."[15] The Committee queried the approach taken in NI in this regard. During oral evidence on 13 January 2010, DFP officials acknowledged that it is very difficult to clearly link the savings, which were removed upfront from departmental baselines, with allocations to frontline services, and explained that the savings formed part of the overall pot of money available to the Executive and which was allocated to departments, based on the bids presented. In a subsequent written response to the Committee, DFP stated that "all planned efficiency savings in the 2008-11 Budget process were used to fund allocations to departments, which were made on the basis of the achievement of the targets for improved public services in the Programme for Government." Whilst it understands the process which was followed in funding allocations to departments, the Committee is concerned that there is no clear audit trail to give assurance that the 3% cumulative savings deducted from departments in the Budget for 2008-11 have been allocated to key frontline services and PfG priorities. Arising from the recent Review of 2010-11 Spending Plans for Departments, the Committee highlighted similar concerns around the lack of information on how departments will manage the additional in-year budgetary pressures to safeguard essential services and strategic policy priorities. The Committee therefore calls on DFP and the wider Executive to make the necessary arrangements to ensure that, in future, the requisite information and transparency is provided to enable the Assembly and the wider public to track how such savings are applied.

The Need for a Strategic Approach

40. The view was expressed in the Committee that savings should be sought in specific policy areas rather than across the board from all departments. The Committee believes that there is still evidence of departments operating within their own silos and issuing statements on the monetary value of the efficiencies which they can achieve on a departmental basis. As further public expenditure pressures take effect, there may need to be a process for prioritising frontline services and protecting these from future budgetary savings, although the Committee recognises that this may invite a certain amount of conflict at Executive level. However, if the drive for efficiencies translates into drawing a red line through an output for which a particular Department is responsible, the Committee believes that this outcome must be agreed by the Executive.

41. This view was supported by ERINI, who considered that departments should not be focused departmentally, but generically, on strategic targets in the Programme for Government, such as improving the economy. ERINI saw the strategic approach to efficiencies as a way of encouraging departments from their silos and making them co-operate. Professor Talbot informed the Committee that the worst way to implement efficiencies is by top-slicing across the board, as it damages what you want to keep and protects what you do not want to keep. He concluded, however, that most Western governments resort to top-slicing as a quick fix, which is easy to implement and a way of sharing the pain, but it is extremely damaging, especially in the long-term.

42. The Committee has previously flagged up the possibility that the 3% cumulative efficiency targets imposed on all departments by the Executive may be more easily achievable for some departments and put enormous pressure on others. In its Report on the Executive's Draft Budget 2008-11, the Committee commented that the nature and structure of a department's budget and the particular demands thereon, will have a bearing in this regard.[16] The Committee considered that some departments may be in a position to achieve efficiencies over and above the 3% target, and called on DFP to keep under review the comparative impact which the efficiency target is having on individual departments in delivering public services. In its response to the recommendations in the Committee's Report, DFP stated that the 3% per annum efficiency target had been inherited from Direct Rule Ministers and had been agreed by the Executive for the purposes of the Budget for 2008-11. DFP undertook to keep the situation under review.

43. In January 2010 the Committee noted an update from the Department on the monitoring of efficiency savings by NI Departments for 2008-09. All departments reported that they had achieved their savings target with two, the Department of Agriculture and Rural Development (DARD) and the Department for Social Development (DSD) slightly exceeding the target set. Aside from this, it was not possible to determine from the evidence provided whether some departments were more easily achieving their targets than others.

44. On 21 April 2010 members received a six-month progress report on the efficiency savings achieved by departments from April–September 2009. The delay in the report was due to late returns from several departments. The report indicated that, within the first six months, all departments had achieved over 50% of their efficiency savings target, with both the Department of Enterprise, Trade and Investment (DETI) and the Food Standards Agency already meeting their full year target. In the case of DETI, this is because the Department now had plans to deliver more savings than it had originally intended. Whilst over 12% of EDPs were considered to be "On Track with Significant Risk" or "Not on Track", DFP had not identified to which departments these figures relate. Again, on the basis of the progress report provided, it was difficult to ascertain if some departments are having more difficulty in meeting their targets than others, or which specific areas are at risk.

45. In his oral evidence, however, Professor Talbot confirmed for the Committee that some areas of the public sector will find it easier to achieve efficiency savings and there therefore needs to be a differentiating system to identify areas where major efficiency savings could be made and, conversely, areas where no efficiency savings are achievable. He stated that this must be examined in a much more fine-grained way than has traditionally been the case.

46. The Committee recommends that the Executive develops a co-ordinated strategy for targeting, identifying and realising further efficiencies, which protects essential frontline services and strategic policy priorities and avoids the imposition of pro rata budgetary cuts across all departments. Whilst the Committee believes that this further efficiency drive should include measures to improve the efficiency of front-line services as well as back-office operations, it calls for robust safeguards to ensure that that there is no consequential diminution in the level and quality of service provision in priority areas.

47. In its evidence, CIPFA highlighted the need for political will and strong leadership in the NICS to take and implement tough decisions, including the need "to review the Programme for Government to identify key priorities." CIPFA was also in favour of delegating priorities and budgets to departments to ensure delivery, and stated that "this will ensure that only those priority public services are provided and savings are made by cutting out the non essential, low priority, services."

48. On a similar tack, NIAO has recently highlighted the need for a priority-based approach to budgeting and spending, which considers the competing priorities and decides where to target the limited funds available. NIAO advises that "in considering whether policies and services deliver value for money, leaders should consider which ones:

49. In terms of the need for the Executive to clearly identify its key priorities, as far back as December 2007, the Committee echoed calls from a number of the Assembly statutory committees for greater clarity and simplification in this regard. It was noted at the time that within the draft PfG there was one overarching aim, five strategic and interrelated priorities of which one was the top priority, two cross-cutting themes and 38 goals, in addition to 23 PSAs, encompassing 95 objectives above a myriad of actions and targets.[18]

50. The Committee believes that the 2008-11 PfG and PSA framework is cumbersome and overly complex in terms of the need to prioritise at a time of exceptional budgetary constraint. As such, the Committee calls on the Executive to urgently review its PfG, which is due to expire in the current financial year, and set out clearly the services and policies to receive highest priority during the upcoming period of further budgetary savings and efficiencies.

51. Some concern was expressed by the Committee that the current drive for savings may cause an element of misdirection in the NICS, with focus on the achievement of long-term objectives being sacrificed for short-term gains. In other words, when the public purse is under pressure, there may be a temptation to cut services to effect short-term savings. NIAO informed the Committee that a short-term perspective of this nature creates risks for the public sector and that it had reported on a number of themes where investment now can generate greater savings in the future. For example, its review into obesity and type 2 diabetes concluded that the effective targeting of health promotion strategies could help to reduce the not inconsiderable cost burden of the disease. Similarly, its review of the Control of Bovine TB concluded that DARD did not have enough internal vets to test the cattle and so had to engage more expensive private sector vets. NIAO also informed the Committee that robust business cases needed to be in place for such initiatives, but that this was an area which needed to be protected in the current economic climate.

52. The Committee noted that CIPFA argued for greater delegation of authority and accountability from DFP to departments and Non-Departmental Public Bodies (NDPBs), with the scrutiny and challenge functions undertaken by Boards, the work of internal and external audit, the Accounting Officer and ultimately the Public Accounts Committee (PAC). In the view of CIPFA, this delegated oversight model would mean greater budgetary flexibility for departments and would "lead to greater clarity of roles, more focused accountability, the potential for Departments and NDPBs to be more flexible and innovative in their approaches to service delivery, thereby unshackling these organisations to deliver, and still be held accountable for, better performance and greater efficiencies."

53. In his evidence to the Committee, however, Professor Talbot emphasised the risk of localised efficiency savings having a negative effect on the efficiency of the whole system. He referred to the system introduced in England, where hospitals stopped prescribing for outpatients, or people leaving hospital and referred these on to the local GP. Whilst the hospitals claimed efficiency savings, Professor Talbot informed the Committee that it cost the National Health Service (NHS) three times as much to fill a prescription through a local GP and dispense it through a private pharmacist, than dispensing it through a hospital. He also picked up on the example (also quoted by NIAO), where the NHS nationally claimed efficiency improvements of £1 billion in getting people out of hospital more quickly, but did not include statistics on the fact that emergency readmissions within 28 days were on the rise as patients had been discharged too early. Professor Talbot also informed the Committee that HMRC had claimed £650m efficiency savings under the Gershon Review, when it was simultaneously losing £9 billion in tax credit mistakes, which no one had included in the efficiency equation.

54. The Committee recommends that, as part of its central monitoring of the efficiency programme, DFP should provide continual assurance to the Executive and Assembly that: (a) the short-term focus on savings is not adversely affecting the achievement of key long-term objectives at a departmental and Executive level; and (b) efficiencies being claimed at a departmental level are not having a negative effect on the efficiency of the wider public sector.

Leadership, Skills and Cultural Issues

55. In its submission to the Committee, CIPFA contended that successful delivery of efficiency savings will depend on how senior executives and boards within departments and NDPBs "execute their responsibilities; develop the necessary skills to successfully undertake their scrutiny and challenge roles within the efficiency and financial management agendas; and exhibit leadership in embracing best practice in delivering efficiencies and better performance." CIPFA also offered a number of practical suggestions to promote increased professionalism amongst boards and governing bodies of public bodies to ensure they exercise a strong challenge and oversight function.

56. The CIPFA evidence also identified a range of requirements associated with the culture and capacity of organisations to ensure delivery of further savings. These included, for example: having a VfM culture within the organisation; monitoring and incentivising staff according to what they save instead of what they spend; having the courage to abandon projects that are not going to deliver benefits; and recognising that some projects require several years to deliver a financial return on investment.

57. In its evidence, ERINI stated that the question of whether departments can make decisions on efficiencies for themselves has traditionally been sidestepped. It questioned their capability to make tough decisions on efficiencies and considered that departments' current EDPs contained examples of taking the easier options (e.g. increasing charges or passing costs on, or proposing emotive efficiencies which are politically unpalatable, rather than getting to the core of the efficiency issue).

58. On whether the skills currently existed within departments to examine systems of delivery and make valid efficiencies, ERINI was of the view that the NICS is mostly a generalist body in the senior ranks, so specialist expertise is hard to find and the practice of moving people around every few years to give them breadth of experience is usually at the expense of depth. It stated that there is considerable talent in the public services which has perhaps not been organised to promote the systematic pursuit of efficiency. ERINI also stated that achievement of efficiencies should be built into the DNA of the public sector and be part of a manager's daily activities, rather than as a result of a one-off exercise imposed from the centre. That said, it expressed the view that there will be some aspects of efficiencies that involve major changes in processes, practices or structures and that the system can only cope with major upheavals infrequently without becoming destabilized and putting services at risk.

59. The Committee recommends that, in its central personnel role, DFP should ensure that the skills exist and are marshalled within departments and their arms-length bodies to effectively examine systems and processes for the purpose of identifying valid efficiencies; and, more generally, that a culture of efficient delivery is embedded into the routine responsibilities of public sector managers. The Committee also believes that assurances are required in terms of the capability of departmental boards and the governing bodies of public bodies to lead and oversee the efficiency drive.

Planning, Delivering and Monitoring Efficiencies

Work of the National Audit Office (NAO) and the Westminster Public Accounts Committee (PAC)

60. NIAO informed the Committee that NAO had produced two reports examining the accuracy and reliability of efficiency savings claimed by GB departments, including a number of recommendations to improve the measurement of efficiency gains. In particular, NAO recommended that, for each reported efficiency gain, departments should ask:

61. Other key recommendations made by NAO in its reports on efficiency savings included:

62. NAO specifically made two recommendations to OGC, the body in charge of driving and monitoring the efficiency programme at that time:

The implication being that the challenge function was not sufficiently robust and that the programme was not sufficiently open to scrutiny.

63. Both the NAO reports referred to above were taken as evidence sessions by the Westminster PAC. NIAO stated that, amongst the main conclusions drawn by the PAC were the following:

i. There were some doubts, and measurement weaknesses, around the reliability of the claimed efficiencies;

ii. There was also evidence that some efficiency projects may be having an adverse impact on service quality;

iii. Departments need a portfolio of indicators to identify more accurately factors contributing to changes in quality;

iv. Some of the claimed improvements in efficiency may not be sustainable. If lasting change is to be demonstrated, departments need to develop measures which reflect the unit cost of delivering key services and outputs over time;

v. Departments were reporting efficiencies without netting off the expenditure incurred to achieve them. Consequently, they may have over-stated their efficiency gains;

vi. The basis for some claimed efficiencies had not been sufficiently challenged. PAC recommended that the Treasury should adopt a more rigorous process for reviewing the supporting evidence for departments' claims, using qualified analysts and statisticians when required; and

vii. The full potential to achieve efficiencies was not being realised. Efficiency improvements were being sought from the narrow basis of a small collection of projects in each department. This was not encouraging departments to look at efficiency in the round.

64. According to NIAO, the PAC at Westminster has cast doubt on nearly three-quarters of the efficiencies claimed there and concluded that there was insufficient evidence to say with complete confidence that these were genuine efficiencies which did not compromise service delivery. The PAC's work at Westminster concluded that efficiency cannot be measured in isolation and must be considered in the context of a wider basket of performance indicators, particularly in service delivery. It also found that Westminster departments were reporting recurring efficiencies when they were one-off, short term gains which would not be repeated, and that some efficiencies were reported without netting off the expenditure incurred to achieve them. The Westminster PAC also recommended that a more robust challenge function should be in place to ensure that claimed efficiencies were genuine. The findings of the Westminster PAC were recently reflected in an open letter from the outgoing Committee Chairperson, Edward Leigh, to his successor, when he stated:

"If efficiency gains are to be anything other than empty words, more must be done to make them real and demonstrable. They must not be one off cuts, but savings deliverable year after year. And they are not genuine if, as we have found in a number of cases, they are achieved at the expense of the quality of service provided."[20]

65. In a House of Commons Treasury Committee report of July 2009 "Evaluating the Efficiency Programme", the Treasury Committee expressed concerns about whether the reported savings of that programme represented real efficiencies:

"The [National Audit Office] interim report about Gershon efficiency savings highlighted serious problems in measuring efficiency. We are concerned the NAO did not audit the final Gershon efficiency savings. This has led to a lack of confidence on the part of some organisations in the reported savings. We heard from the Treasury Minister that using resources to check Gershon savings would not be efficient, but we believe it is important to check that efficiencies have actually been achieved. At a time when the public sector will be pressed to make further efficiencies, it is vital that any savings made are properly recognised and quantified. We want the Government to continue to work with the NAO to ensure that future efficiencies are accurately measured."[21]

66. In his written evidence to the Committee (Appendix 4), Professor Midwinter outlined the key findings from Audit Scotland's review of the efficiency programme in Scotland, particularly in relation to the need for a clearer specification of savings as a necessary improvement to the financial information and the absence of appropriate output information to validate efficiency gains. Audit Scotland concluded that "efficiency savings and targets must be properly planned and integrated within the ongoing business of an organisation. Efficiency targets should therefore be included within corporate objectives, as well as service and departmental plans. Public bodies must also have identified baseline levels of service delivery and have effective systems for measuring and monitoring delivery of efficiency savings."

Work of NIAO to date

67. The public sector in NI was set a target to achieve cumulative efficiency gains of 2.5% per year from 2004-07, at least half of which would release resources to priority frontline services. In order to measure these efficiencies, DFP required all departments to produce Efficiency Technical Notes (ETNs), meant to provide a robust means of measuring, monitoring and quantifying the targeted financial impacts. DFP invited NIAO to review the initial drafts of these ETNs and to advise whether they would form a reliable basis for measuring efficiency savings.

68. The Committee heard that, although NIAO's work was unpublished, the key findings were presented to DFP senior management with a view to helping them improve the quality of ETNs. These included:

i. The basis upon which savings were to be generated was not always clear, headcount reductions had not been specified and there was uncertainty as to whether any additional investment costs had been netted off from the efficiency saving;

ii. There was considerable scope to improve performance measurement. Baselines were described in general terms, there was often no attempt to measure the volume or quality of outputs and costing methodologies were vague;

iii. Data sources and proposed monitoring arrangements were often very high level in nature and it was unclear how specific efficiency initiatives would be tracked. There was also limited reference to ensuring that service quality would not deteriorate as a result of the focus on efficiency; and

iv. There was limited attention to the issue of data quality – potential data quality risks and limitations were not assessed or disclosed.

69. In its oral evidence to the Committee, NIAO summarised its findings on these ETNs as "a lack of robust baseline data, a failure to identify measures of service quality and a failure to include the investment costs associated with the delivery of efficiency-based projects." NIAO informed the Committee that it has not yet examined the current departmental EDPs from 2008-11, but undertook to give this active consideration. Nevertheless, it indicated that it would be fair to read the NAO/Westminster PAC findings across to the situation here and had no reason to assume that the situation in NI is any better than the situation in GB where major problems still exist.

70. The finances available to the public sector have been restricted since the NIAO review of ETNs for 2004-07 and recent announcements at Westminster show that this will continue to be the case. The Committee is concerned that both NAO and PAC at Westminster have identified significant weaknesses in the efficiency programme there, whereas the EDPs for NI departments for 2008-11 have not been audited to date. The Committee believes that, in addition to its statutory role, NIAO has a particular insight into the complex issues involved in NI's current efficiency programme and, in his evidence to the Committee, the Comptroller and Auditor General recognised that NIAO has something to bring to the table in respect of measurement and providing the Assembly with independent information on the reliability of efficiency measures.

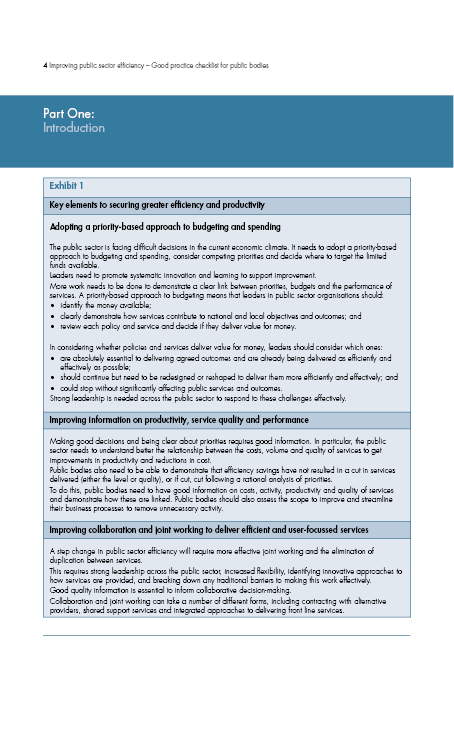

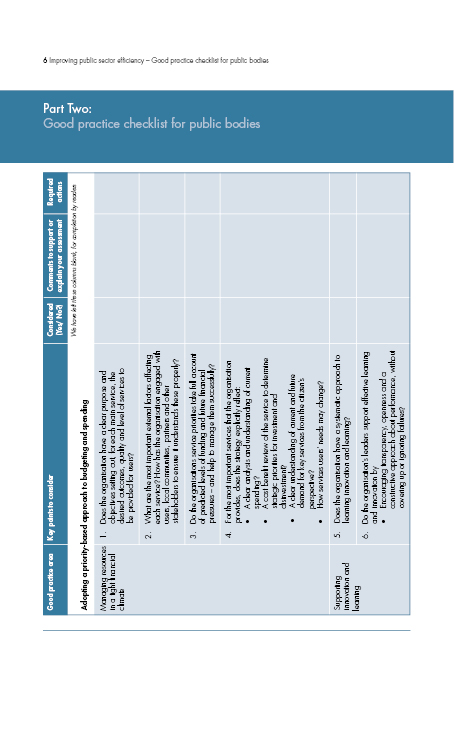

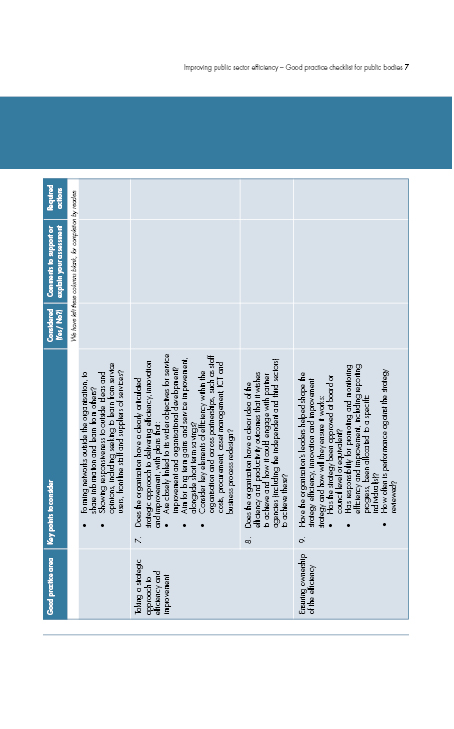

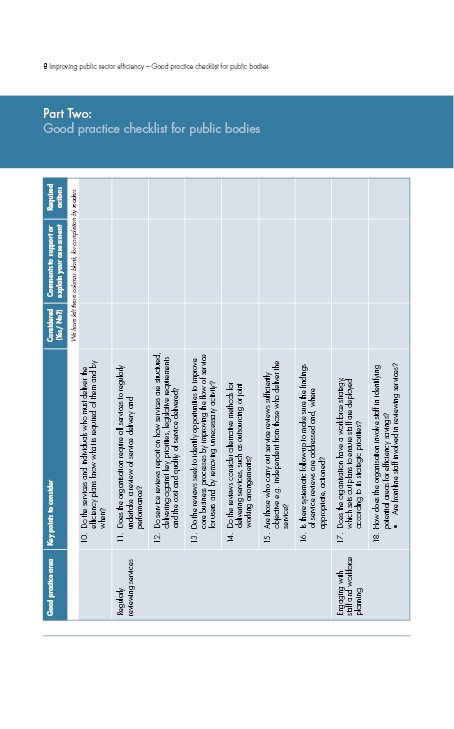

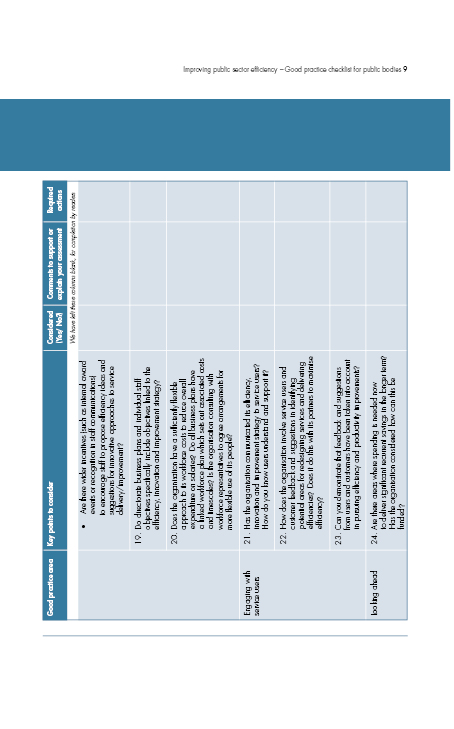

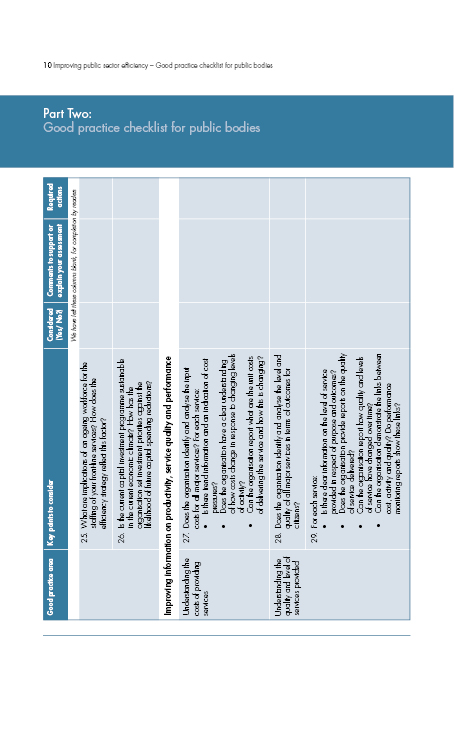

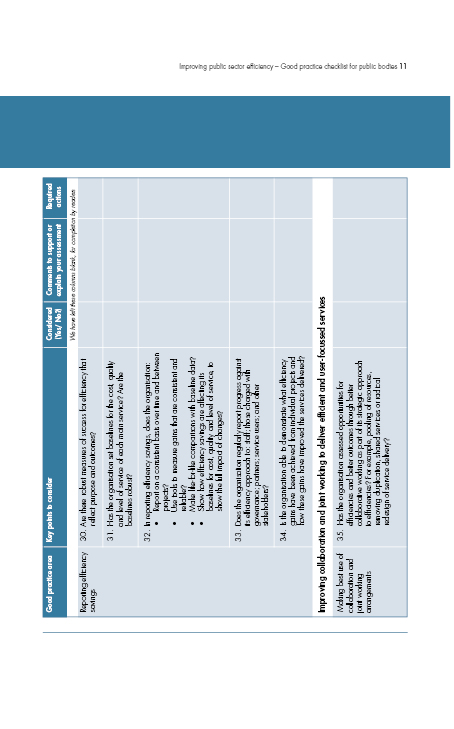

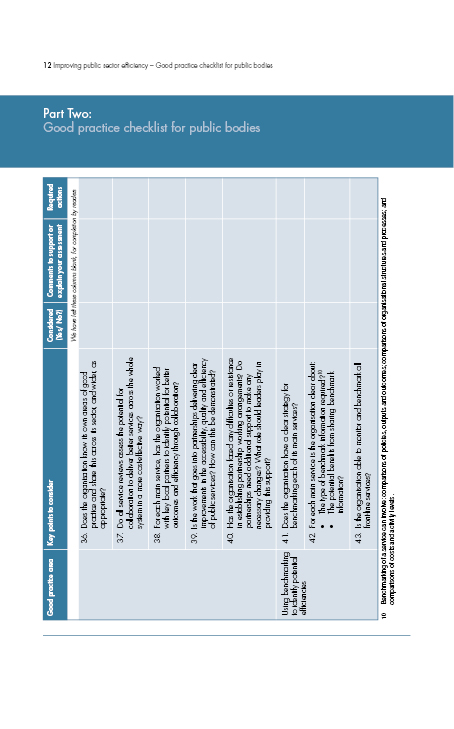

71. The Committee welcomes the recent publication of a good practice efficiency checklist which has been developed by NIAO, Audit Scotland and the Wales Audit Office. The checklist sets out three key elements to securing greater efficiency and productivity, including:

The checklist is intended as an aide-memoire for board members, elected members and senior managers in their oversight function and includes a series of questions, under the three key elements, which can be used to self assess an organisation against good practice and to identify actions for improving efficiency and productivity.[22]

72. Given the mounting pressure on the public sector to deliver more with less, the Committee would encourage NIAO to urgently review the performance of departments to date in achieving efficiency gains, including both in terms of the reliability of the identified efficiencies and the progress which has been reported against departmental EDPs. The Committee considers that the findings and lessons from such a review could be valuable in informing any further efficiency drive following the next UK Spending Review.

73. The Committee recommends that, pending any NIAO review of the efficiency programme in NI, DFP should examine the findings and recommendations from the work of both the NAO and the Westminster PAC in relation to the efficiency programme in Whitehall and ensure that all applicable lessons and action points have been addressed by NI departments.

Definitions Used

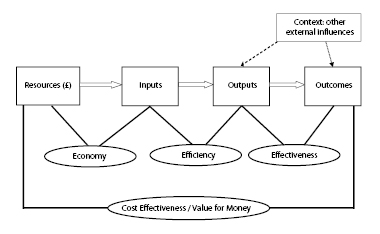

74. In the simplest of terms, NAO has defined "efficiency" as being about turning inputs into outputs for maximum impact. Efficiency is not about reducing costs if it compromises the quality or quantity of outputs.[23] The Committee has been unable to find evidence of a formal central definition of efficiencies laid down for NI departments, and considers that there are therefore no clear parameters within which departments are to achieve efficiency targets. For example, the guidance to all departments for the development of EDPs, which was noted by the Committee, does not have a stated definition of an efficiency saving.

75. In a written response to the Committee, DFP officials outlined the definition of efficiency that was to be used within the context of the 2007 CSR:

"In the CSR 07 context a broader definition of efficiency is used beyond the 'pure' efficiency concept of outputs increasing/decreasing at a faster/slower rate than inputs. Also included is 'allocative' efficiency whereby resources are transferred from low to high priority/effectiveness areas in terms of service delivery."

76. It is the view of the Committee that this is neither an adequate definition, nor does it provide robust parameters for departments in their consideration of appropriate efficiency savings within their business areas. In its evidence, ERINI agreed with the view expressed in the Committee that there needed to be clearer definitions of efficiency savings, and that these should be made public.

77. The Committee recommends that, in fulfilling its central monitoring role, DFP should ensure that a clear definition of valid efficiencies is applied consistently both in its guidance to departments and by departments in their EDPs. It is the view of the Committee that a lack of consistency and transparency in this area risks both confusion within the public sector and controversy in the political and public domain in terms of the rationale and outworking of the efficiency programme.

DFP's Central Monitoring Role

78. In response to an Assembly Question, the Minister of Finance and Personnel has stated that: