| Homepage > The Work of the Assembly > Committees > Regional Development > Reports > Report on the Department for Regional Development’s Draft Budget 2011-2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

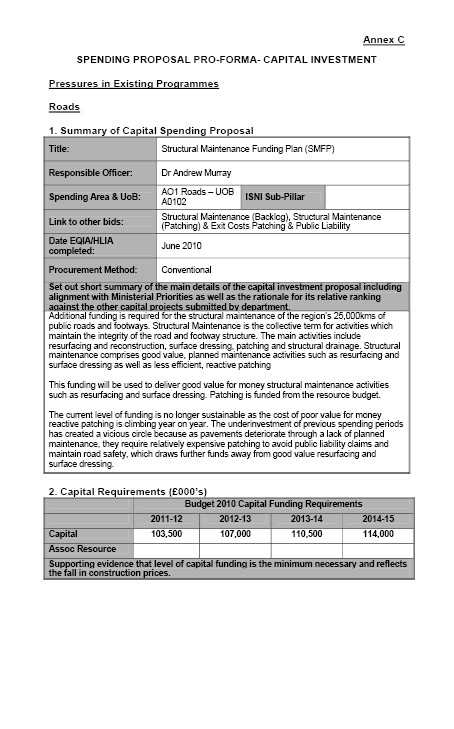

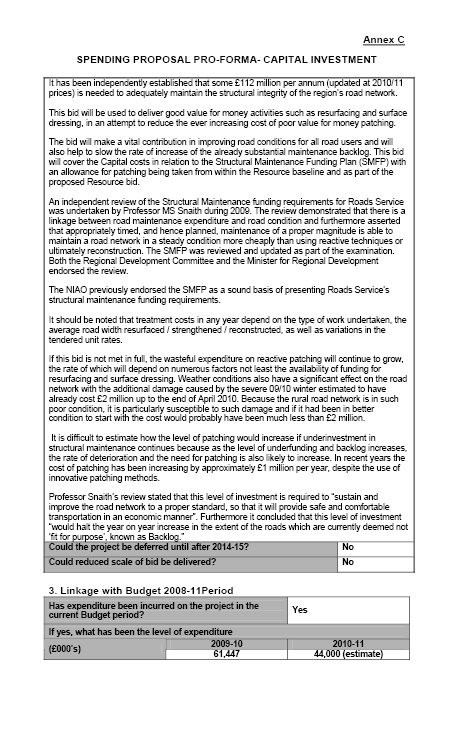

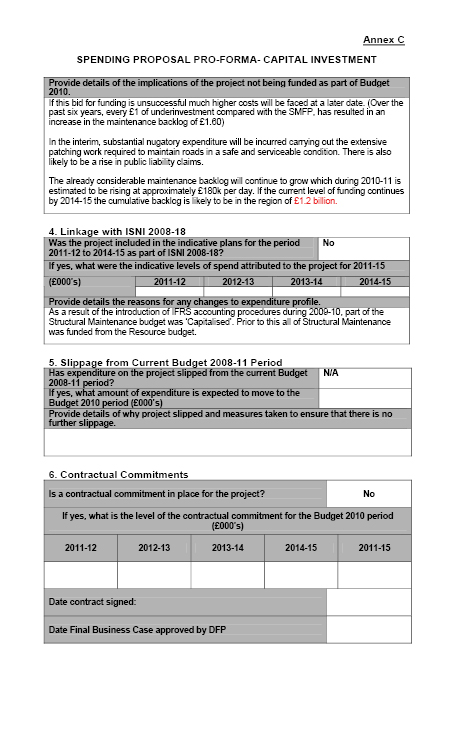

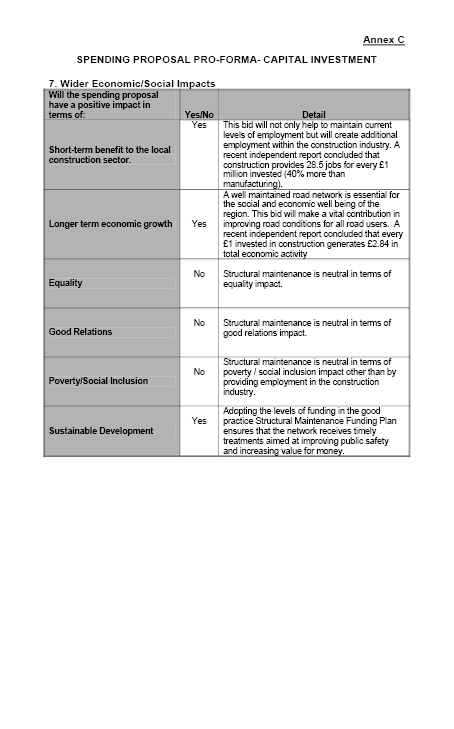

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

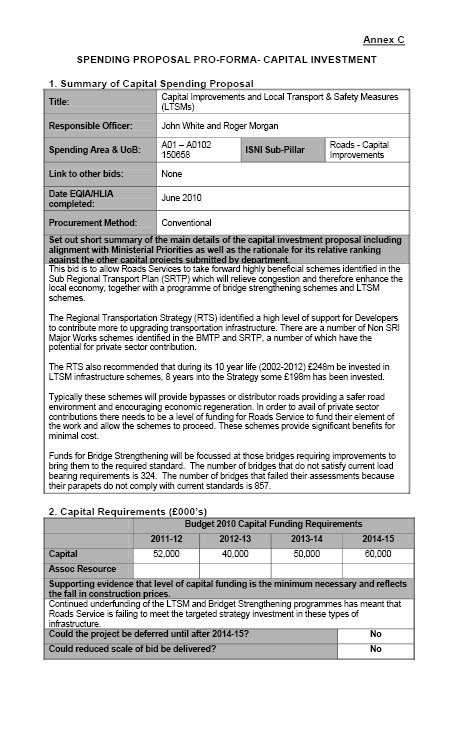

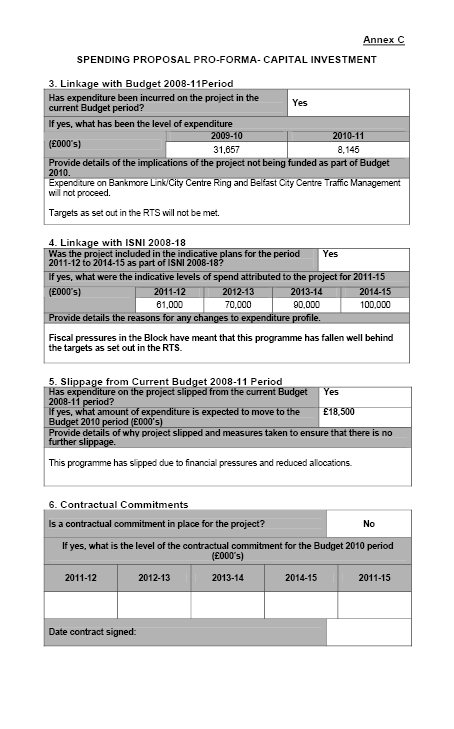

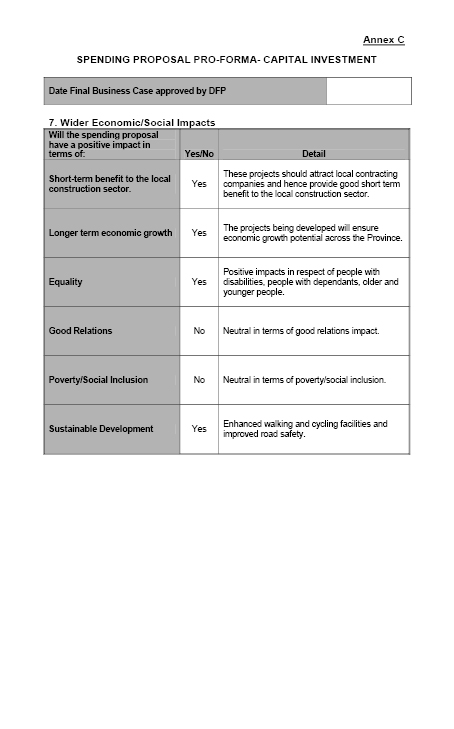

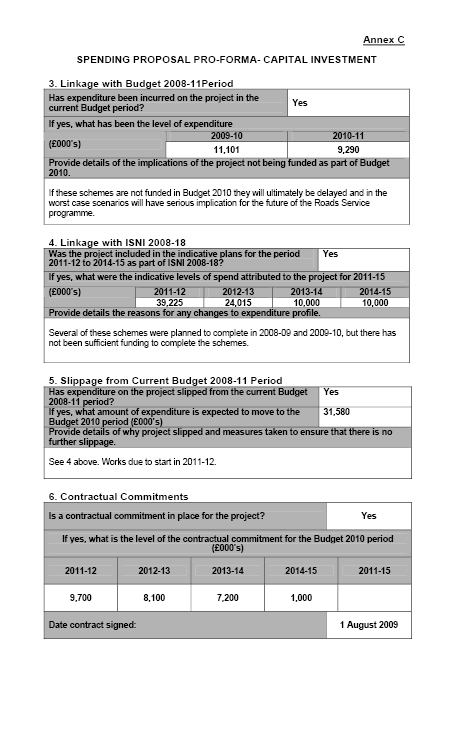

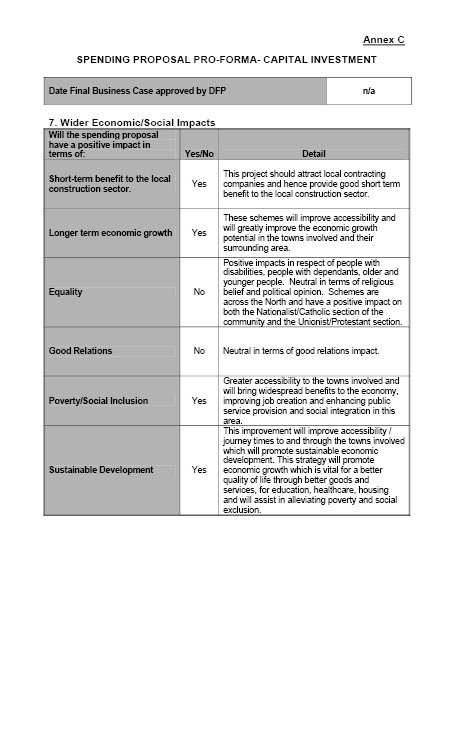

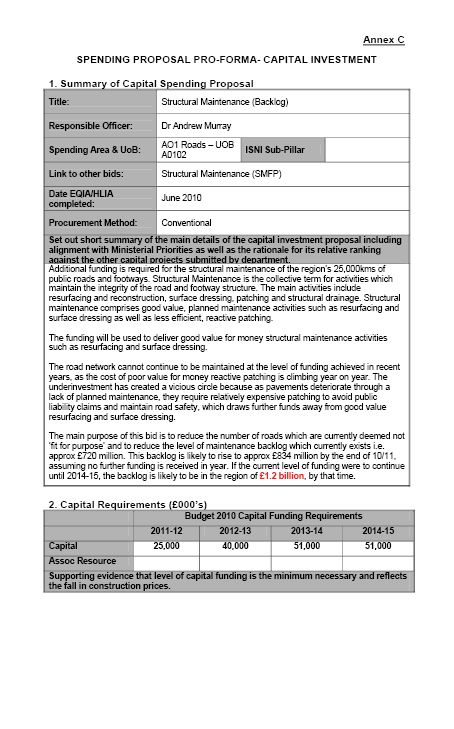

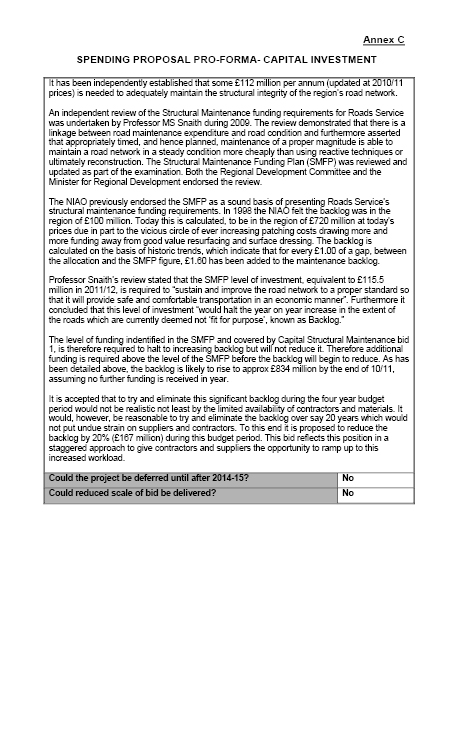

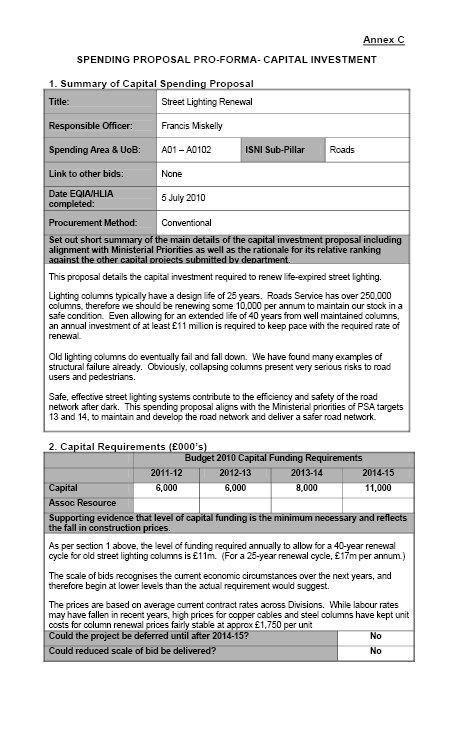

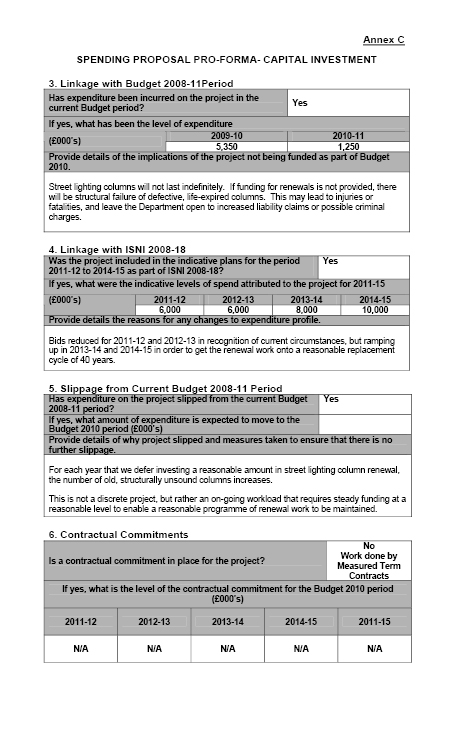

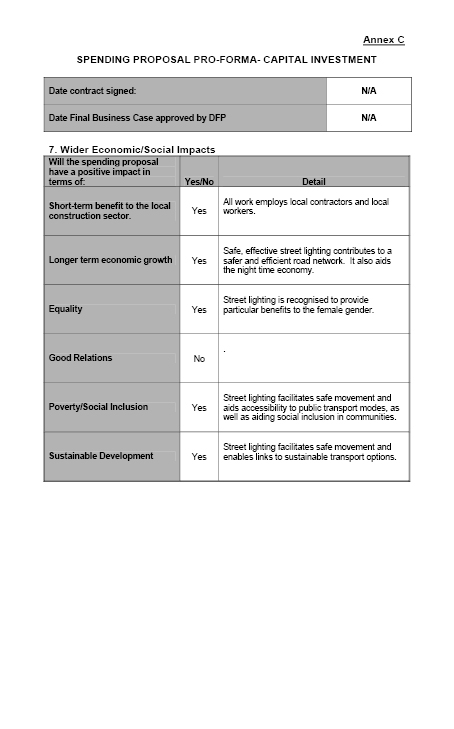

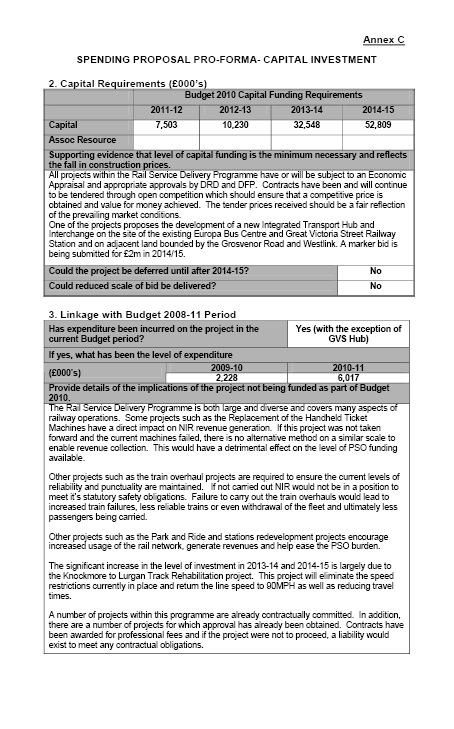

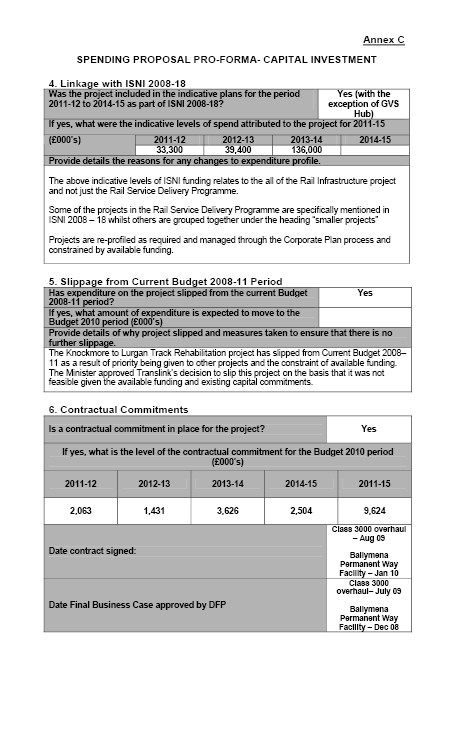

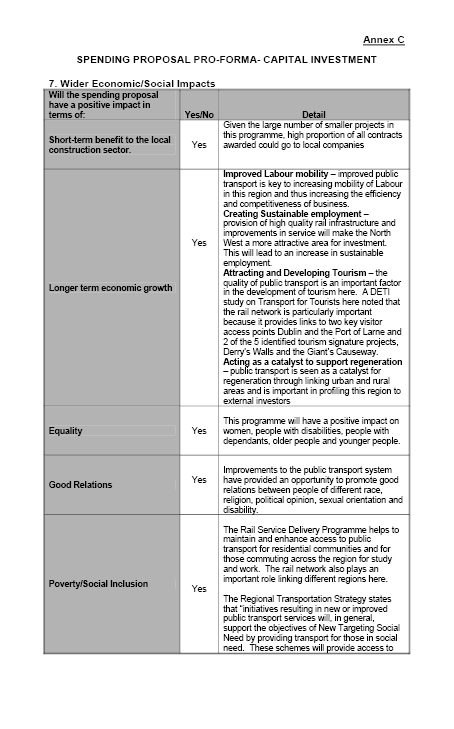

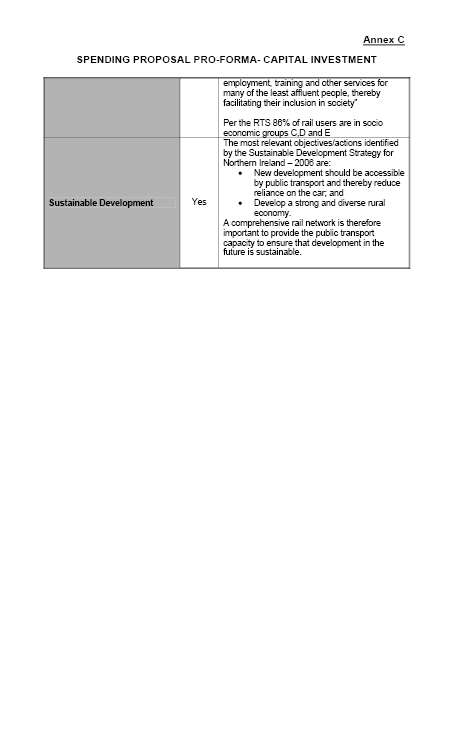

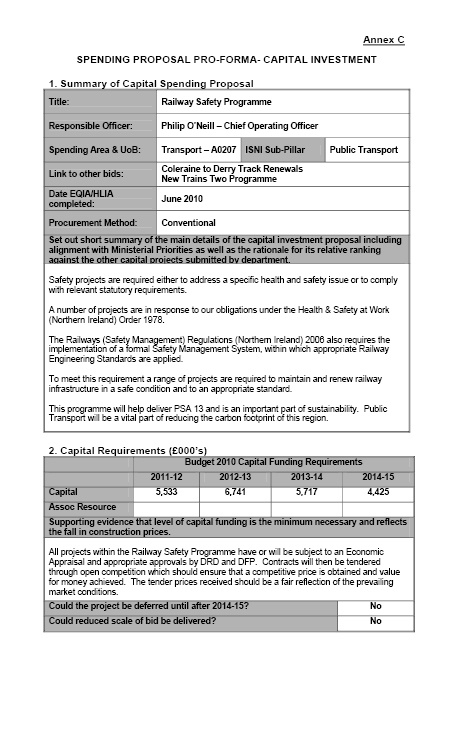

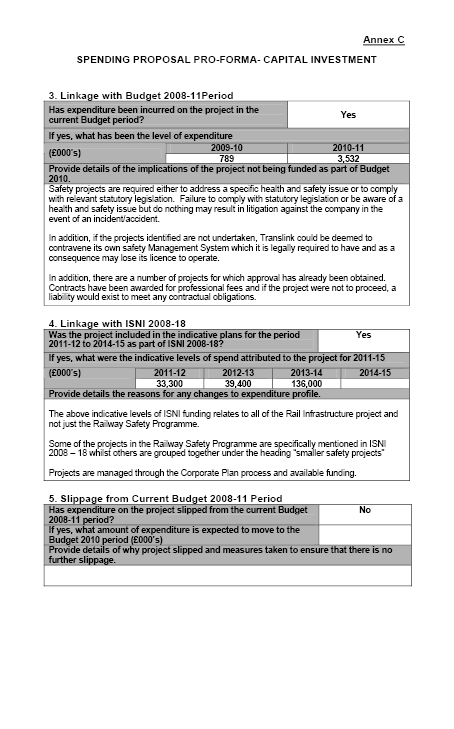

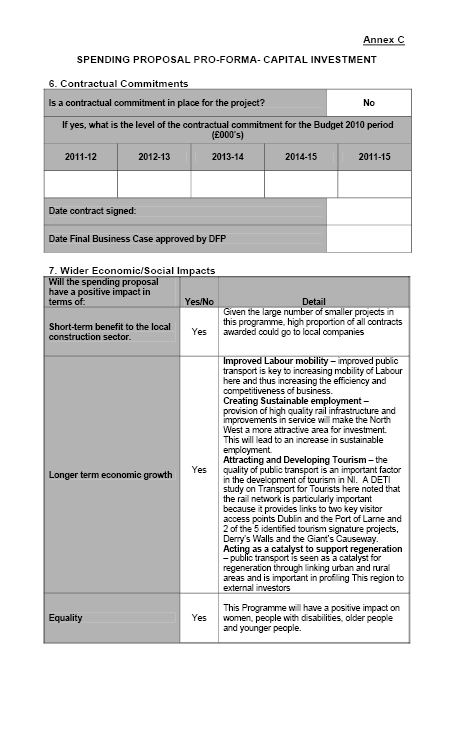

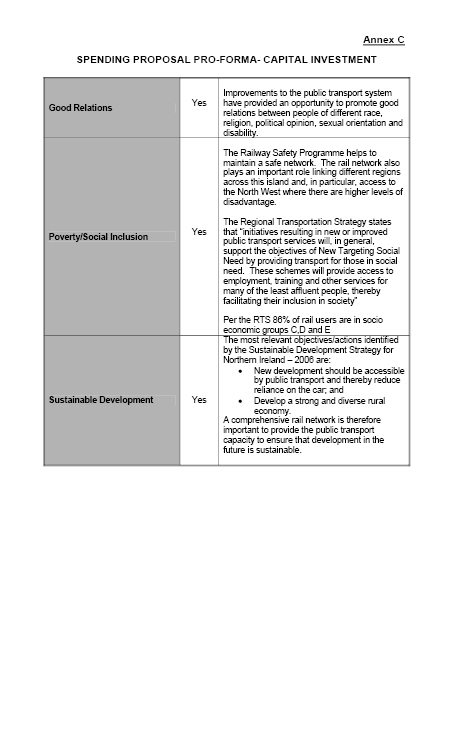

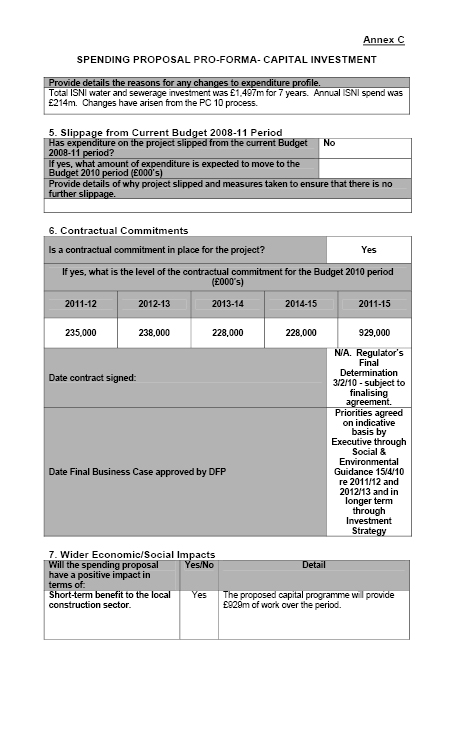

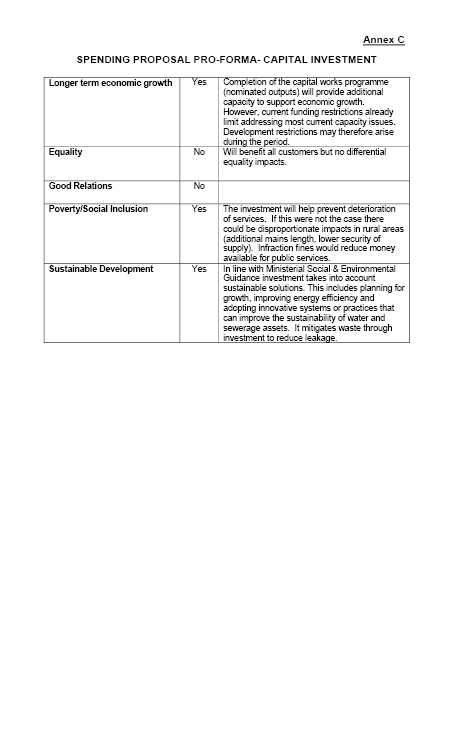

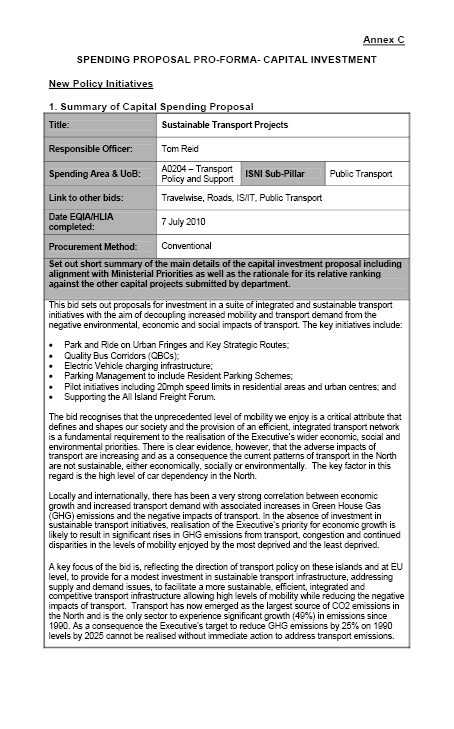

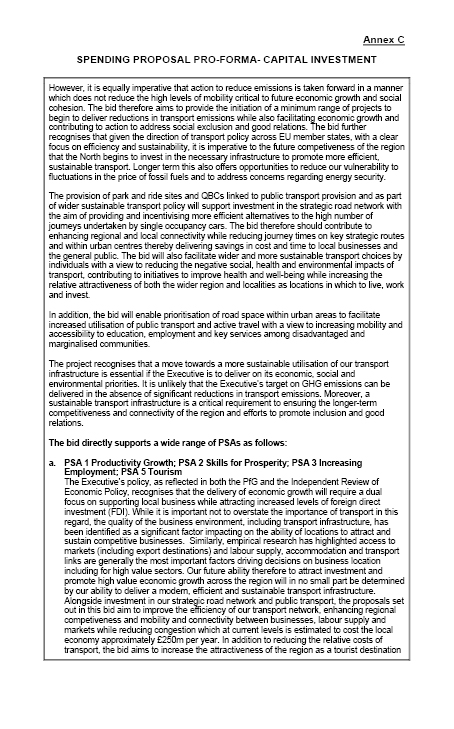

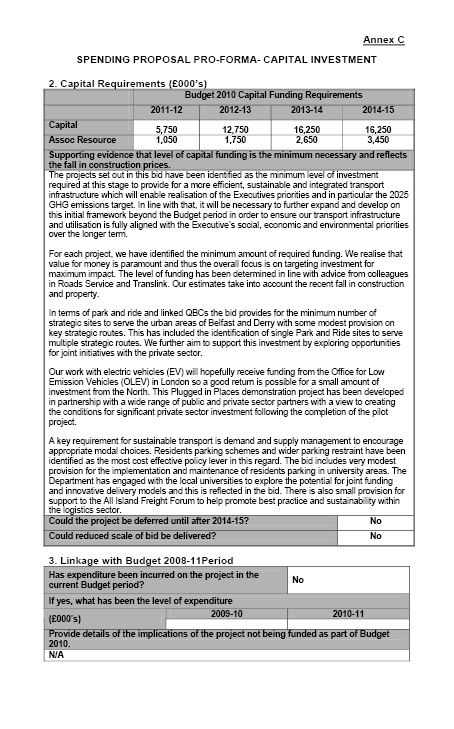

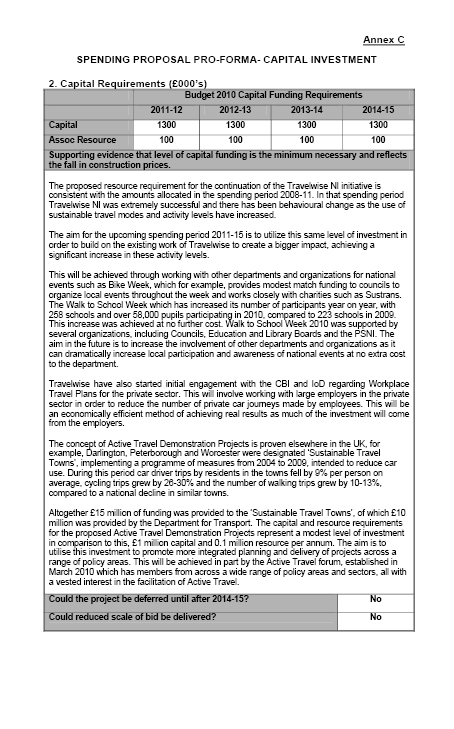

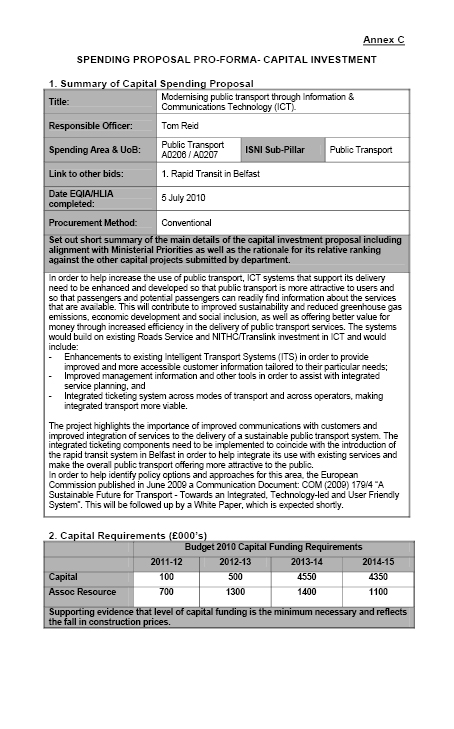

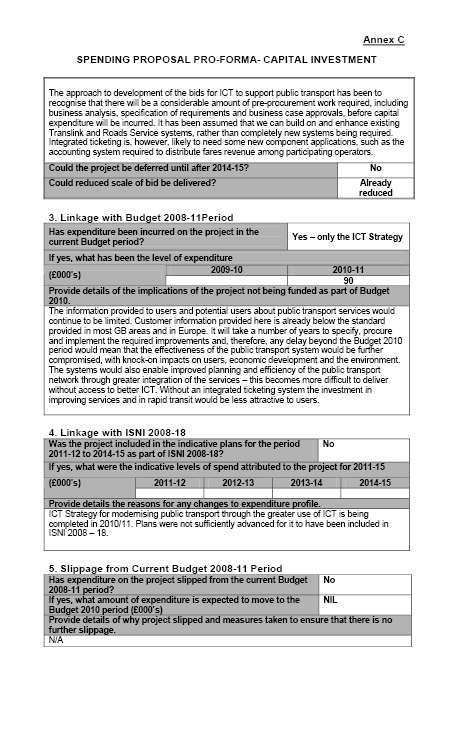

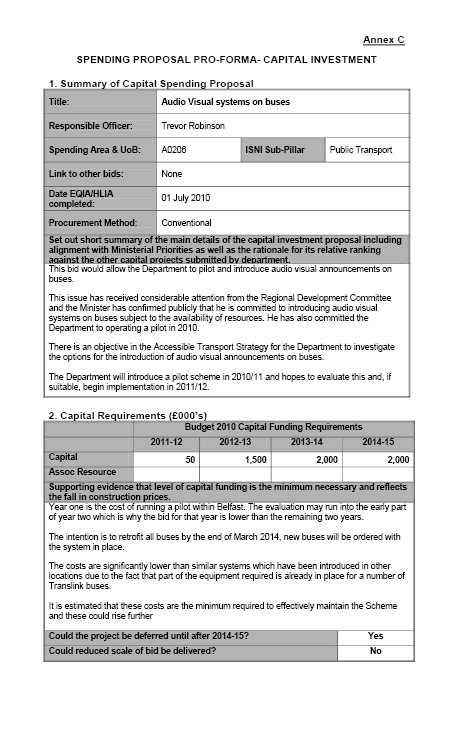

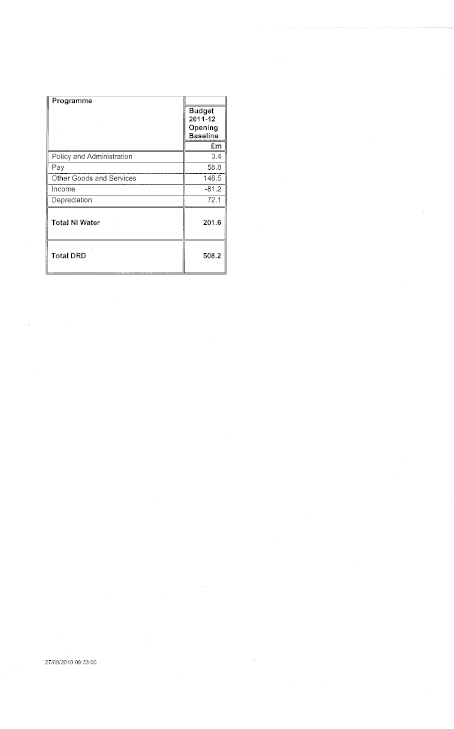

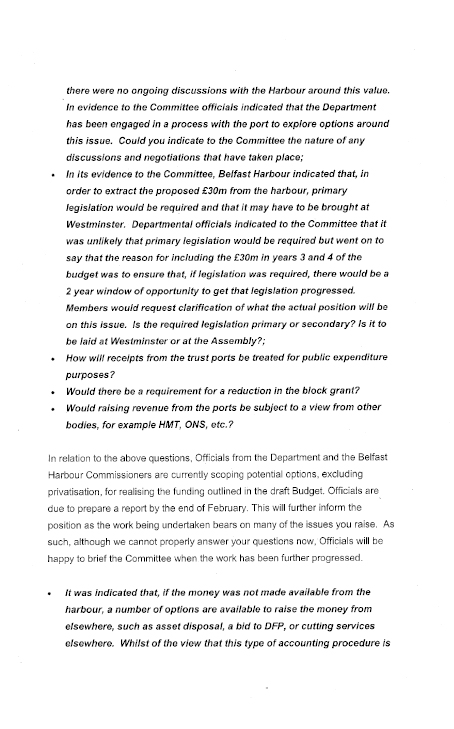

| PC 10 Final Determination (PE terms) | Budget 2007/ Draft Budget 2010 | Difference | Difference | |

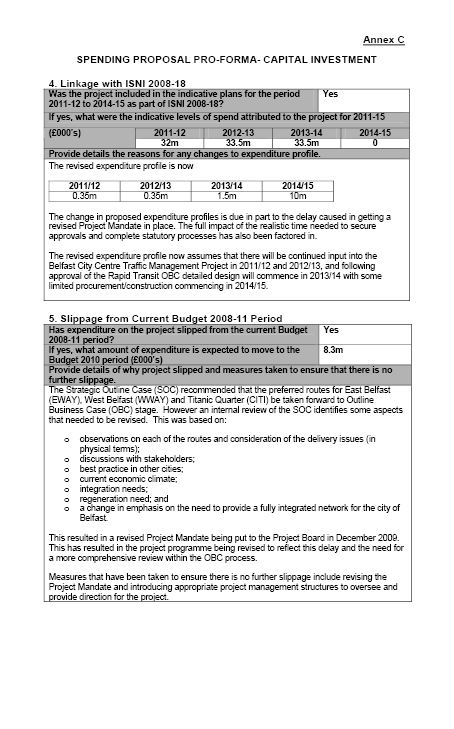

|---|---|---|---|---|

| £m | £m | £m | % | |

2010/11 |

194.2 |

201.00 |

7.7 |

4.0% |

2011/12 |

188.4 |

202.00 |

14.1 |

7.5% |

2012/13 |

195.9 |

145.0 |

-50.9 |

-26.0% |

PC10 Total |

578.5 |

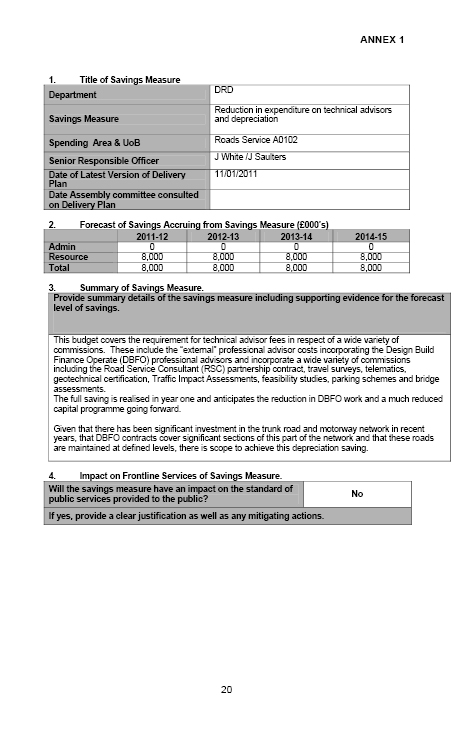

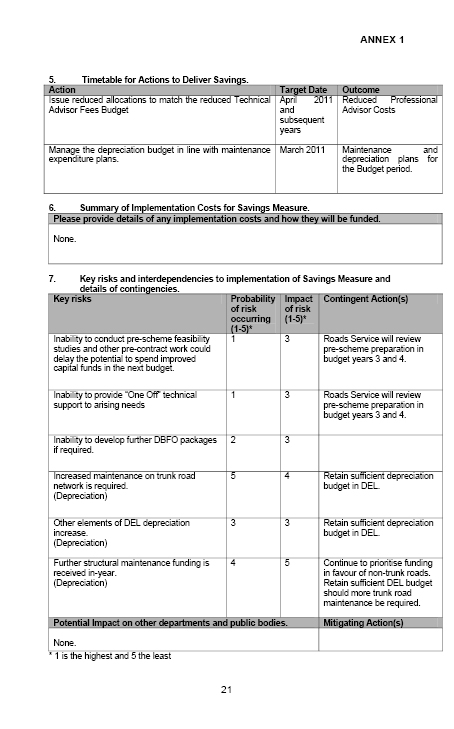

549.0 |

-29.1 |

-5.0% |

2013/14 |

-- |

140.0 |

-- |

-- |

2014/15 |

-- |

180.0 |

-- |

-- |

Draft Budget Total |

667.5 |

-- |

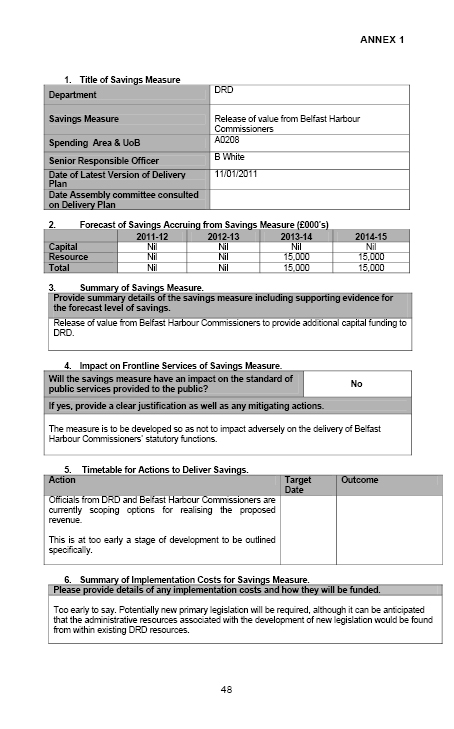

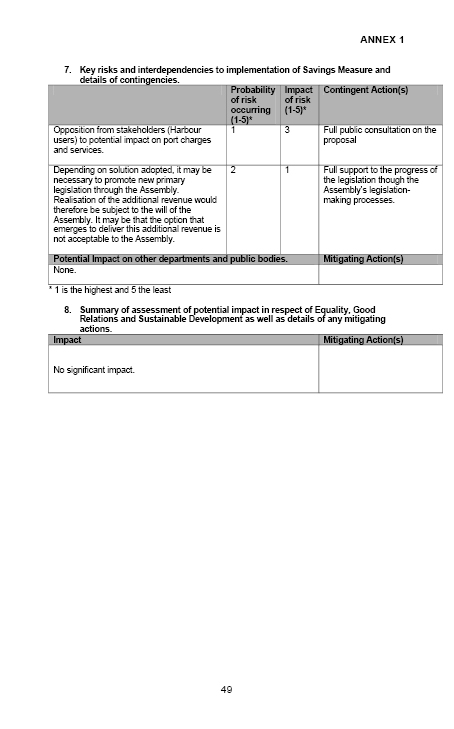

-- |

Source: Letter from NIAUR, 26 January 2011 and DALO 489 12 January 2011.

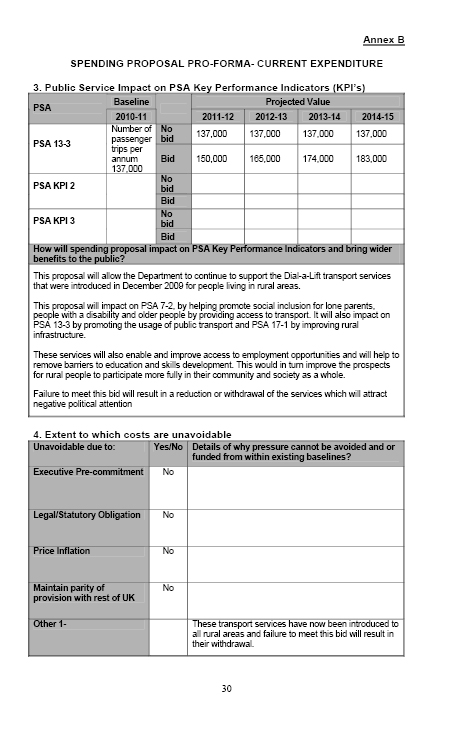

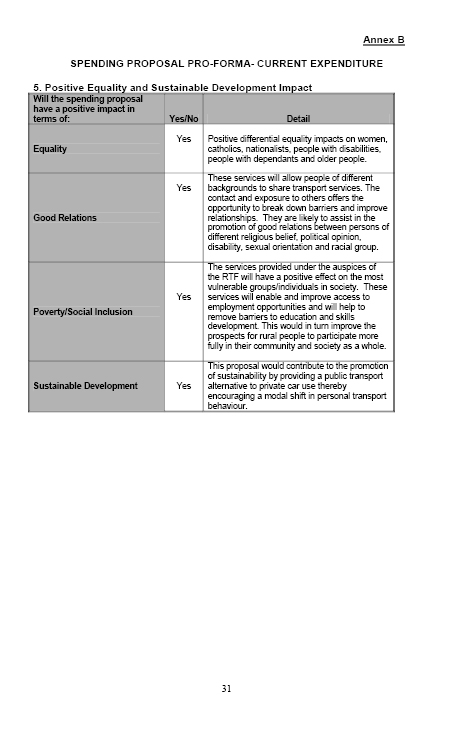

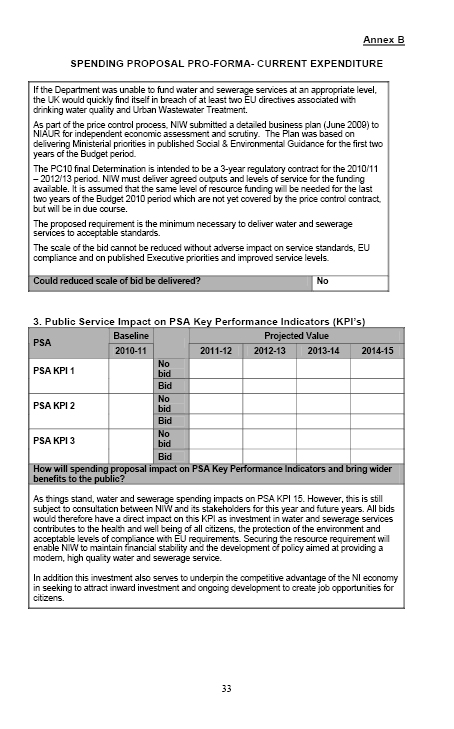

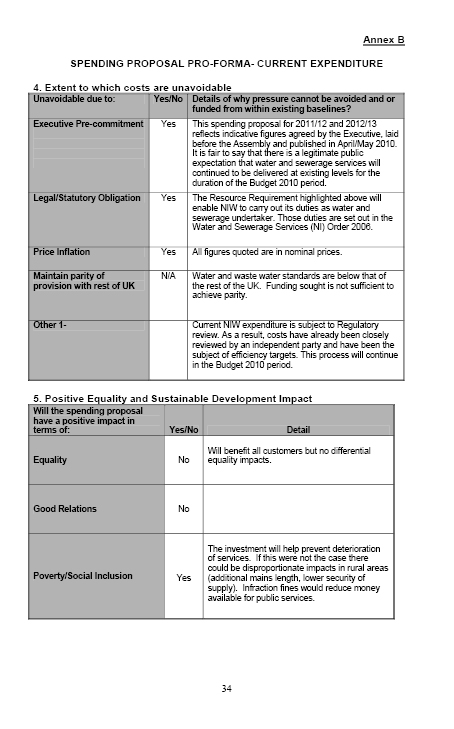

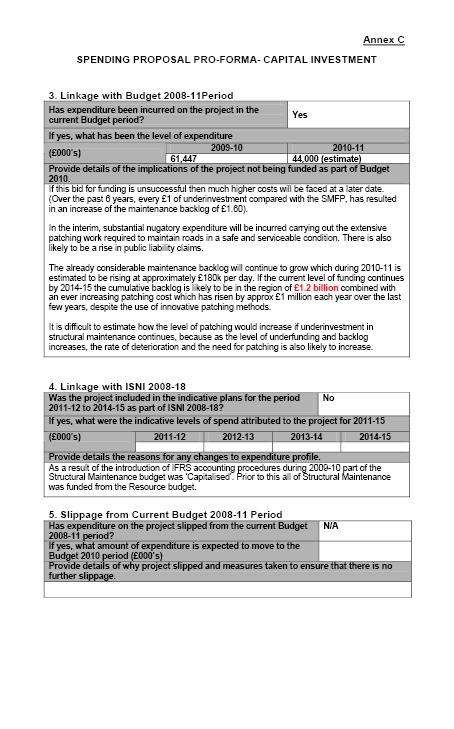

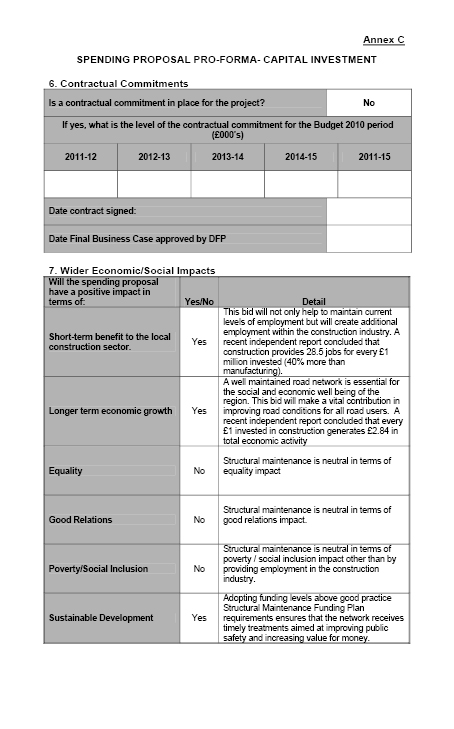

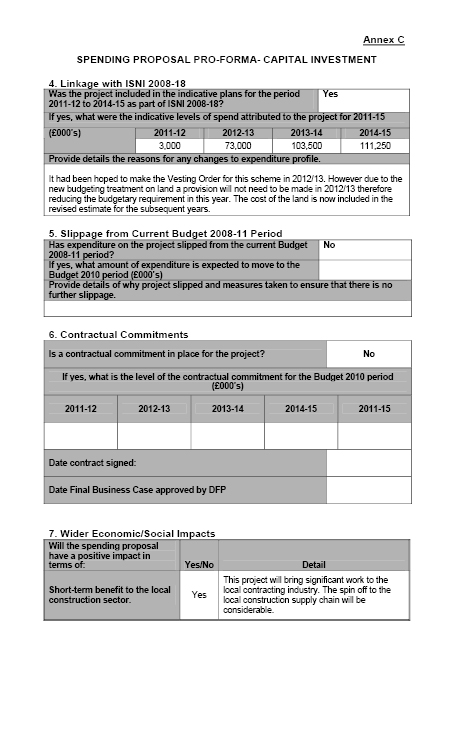

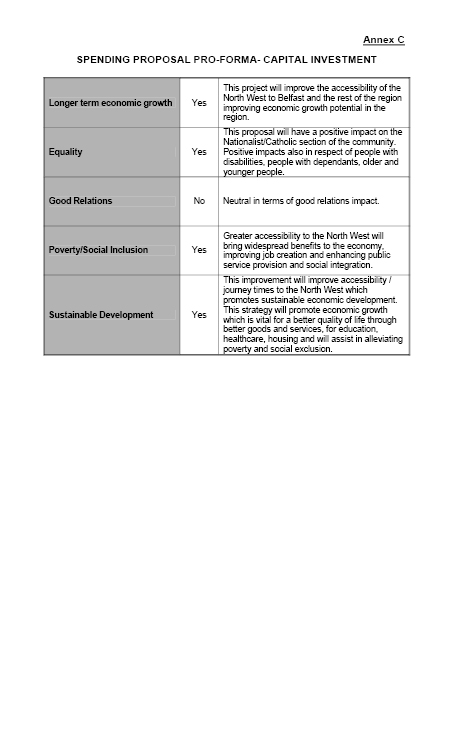

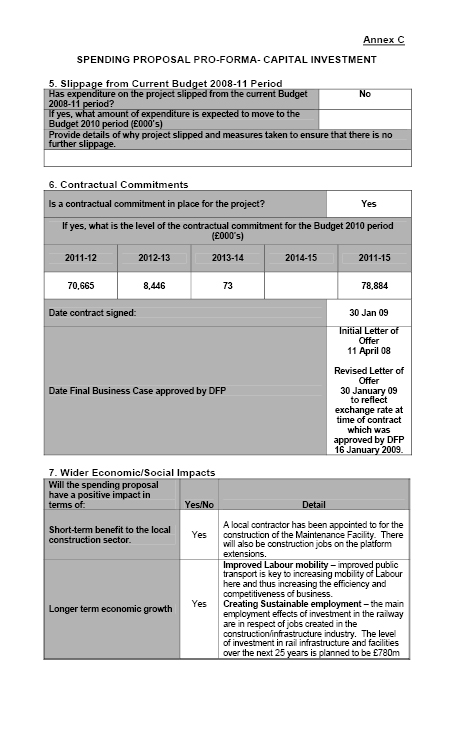

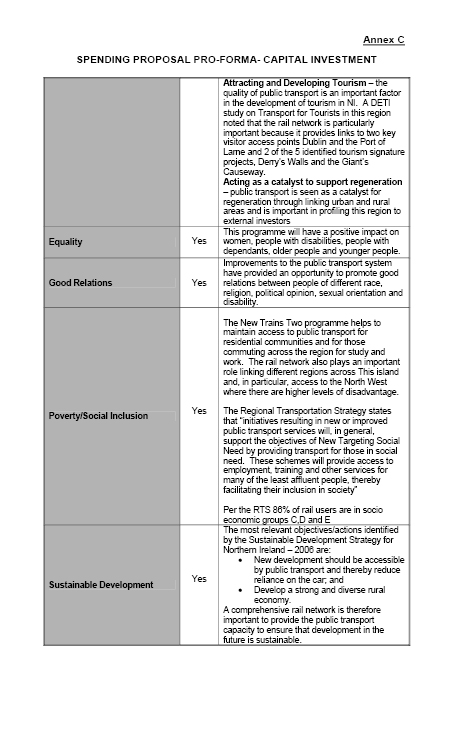

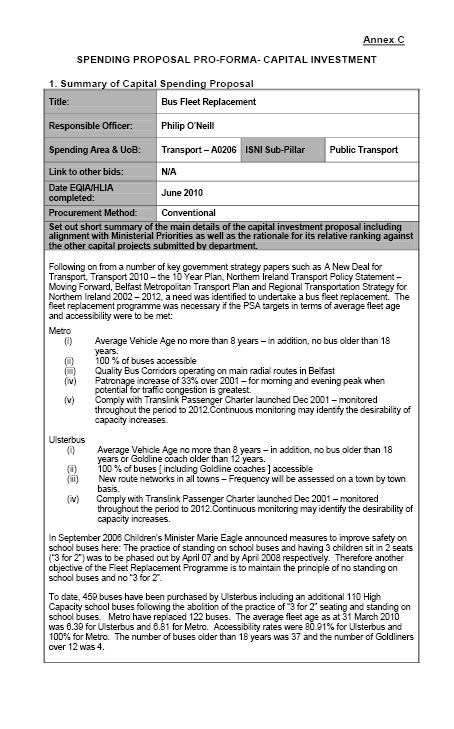

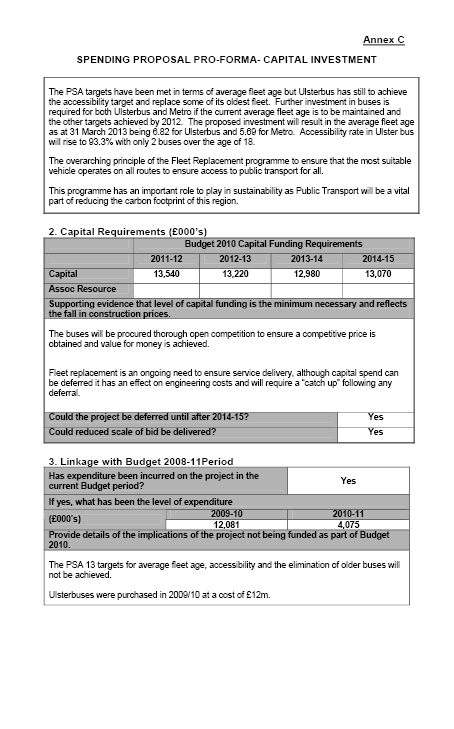

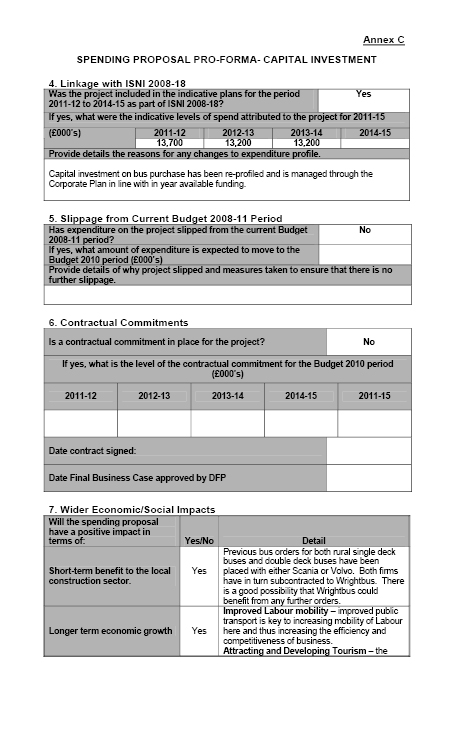

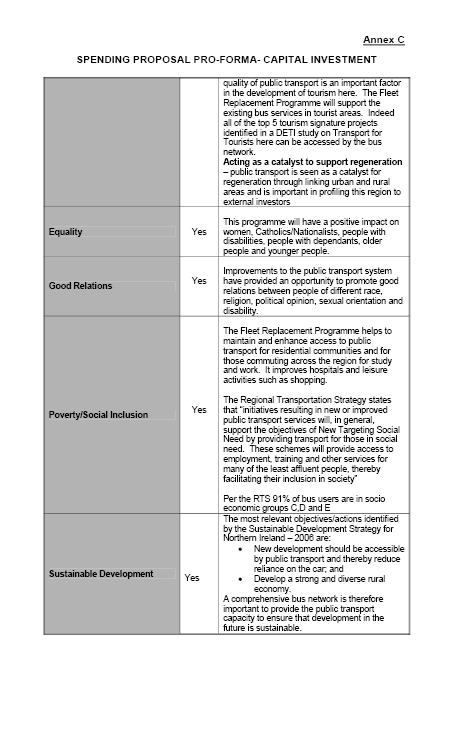

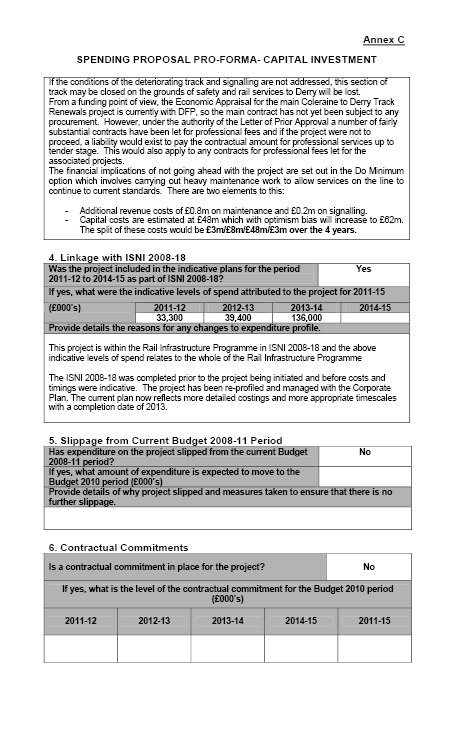

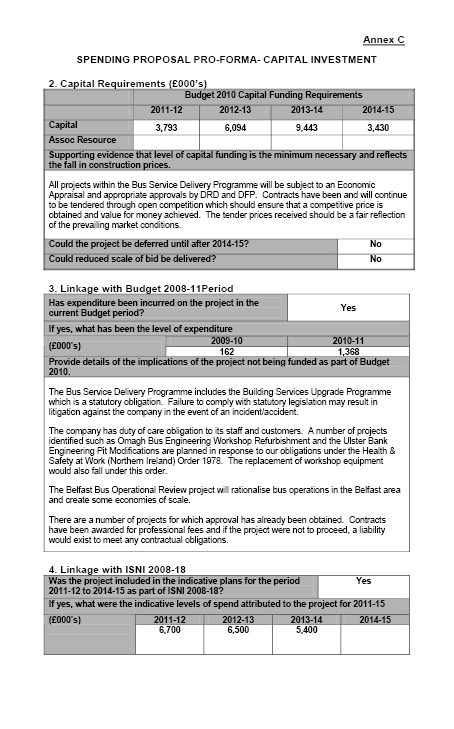

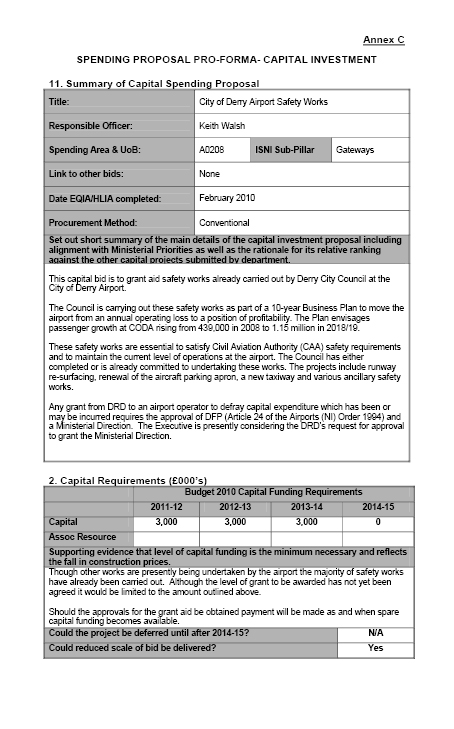

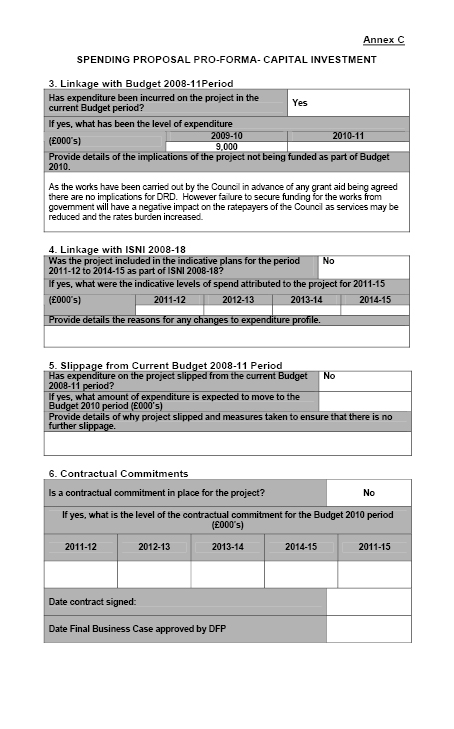

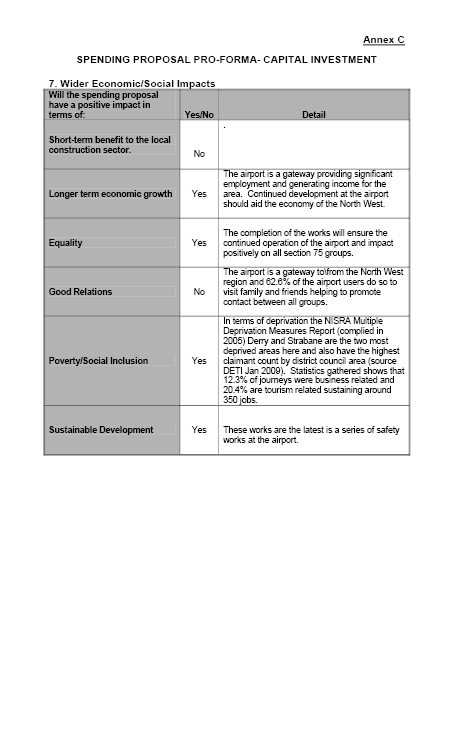

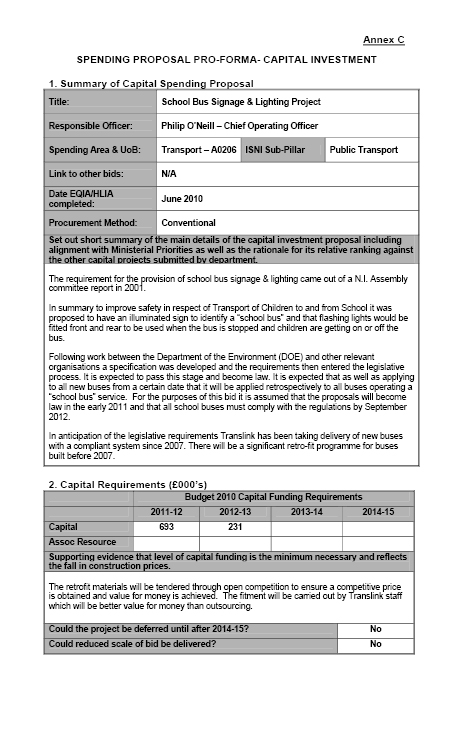

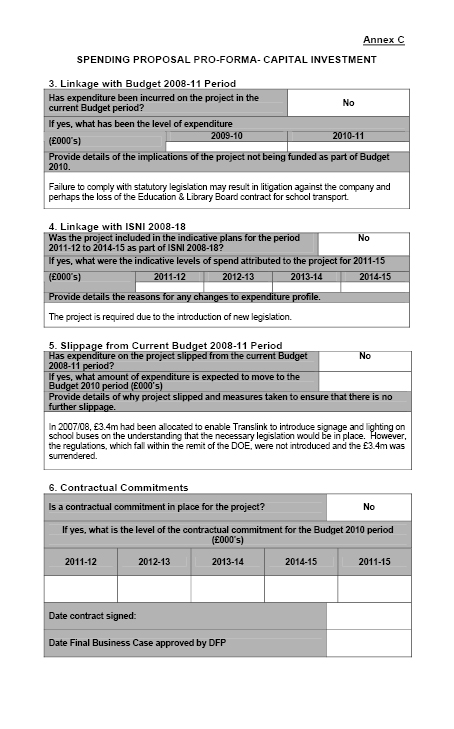

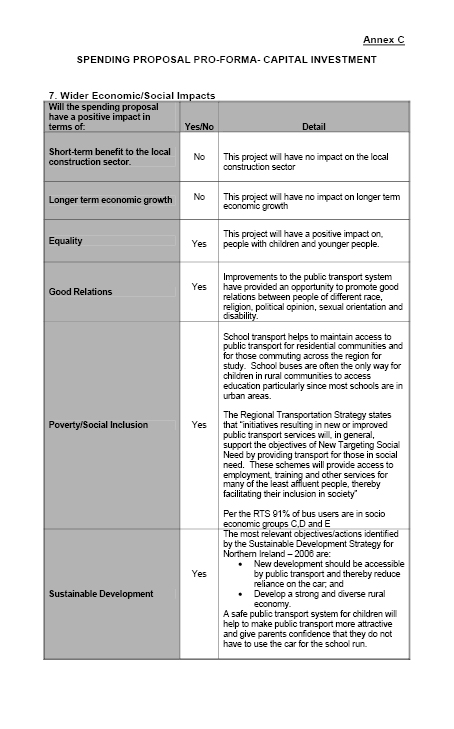

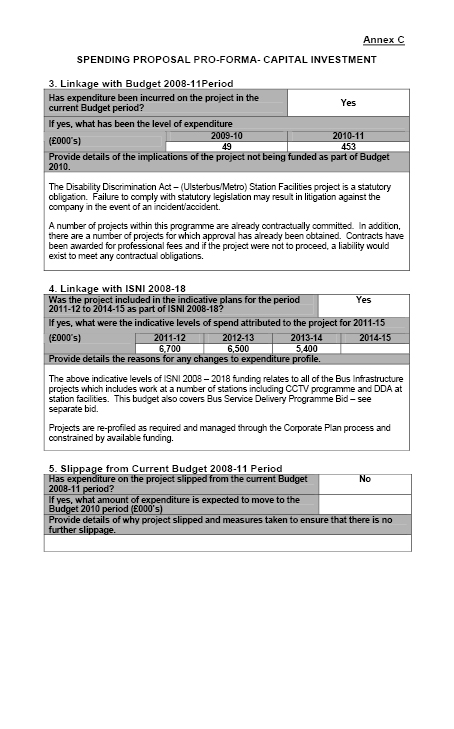

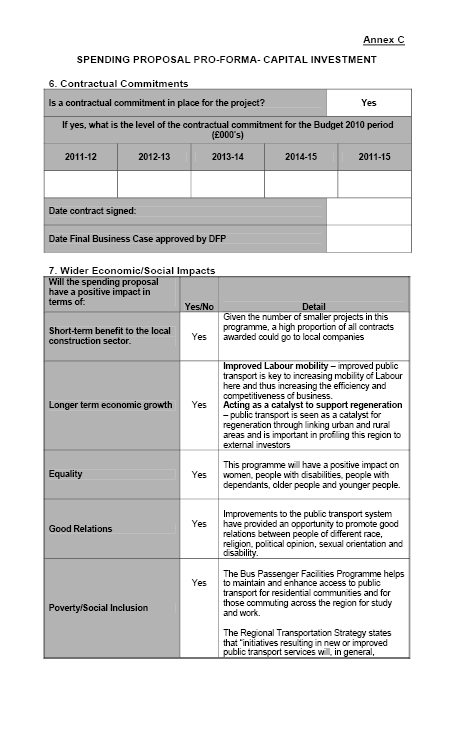

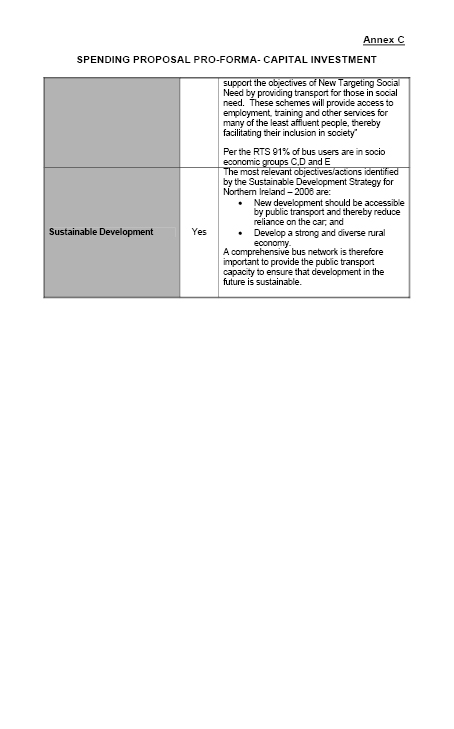

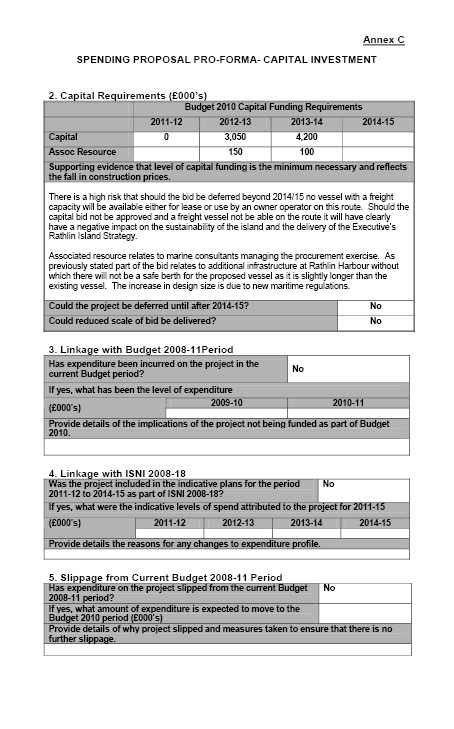

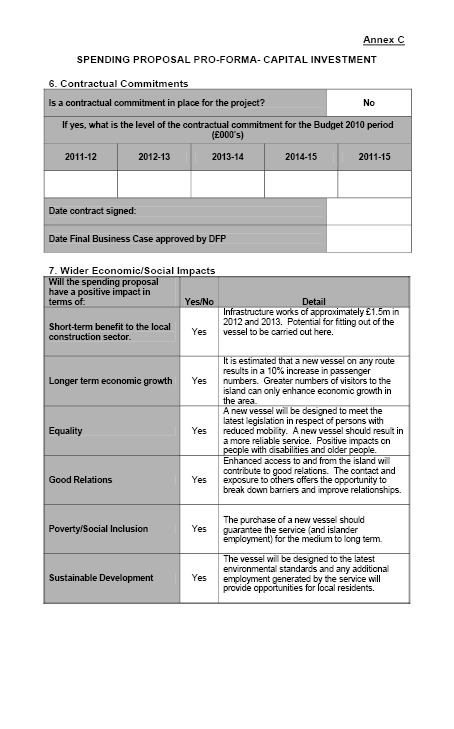

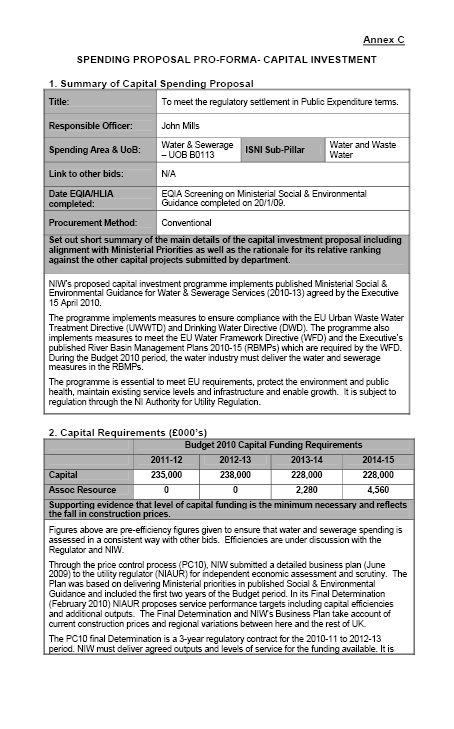

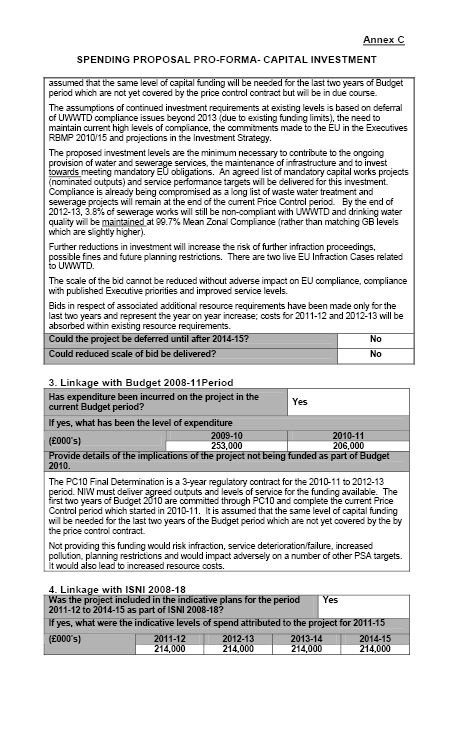

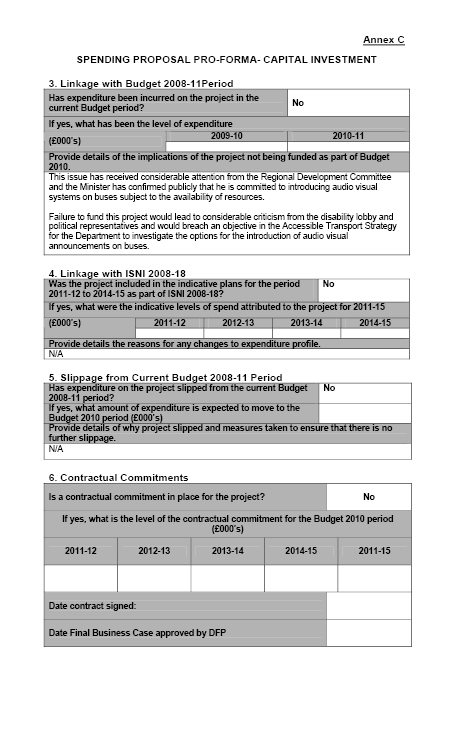

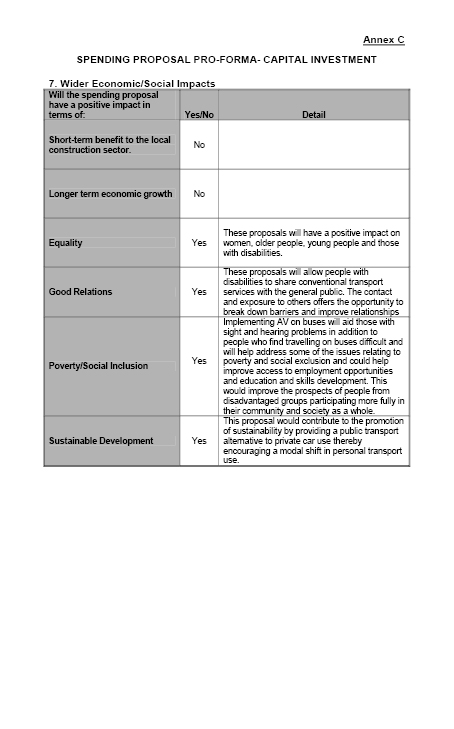

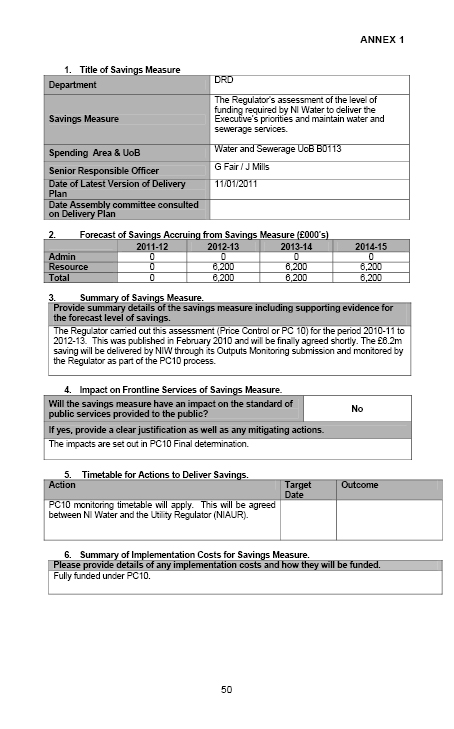

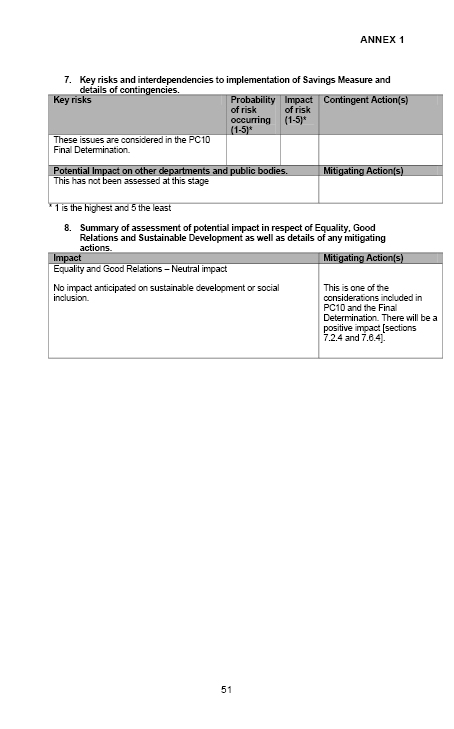

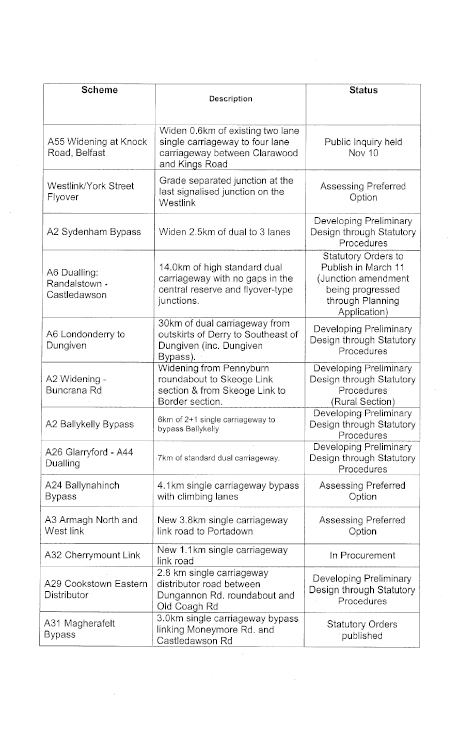

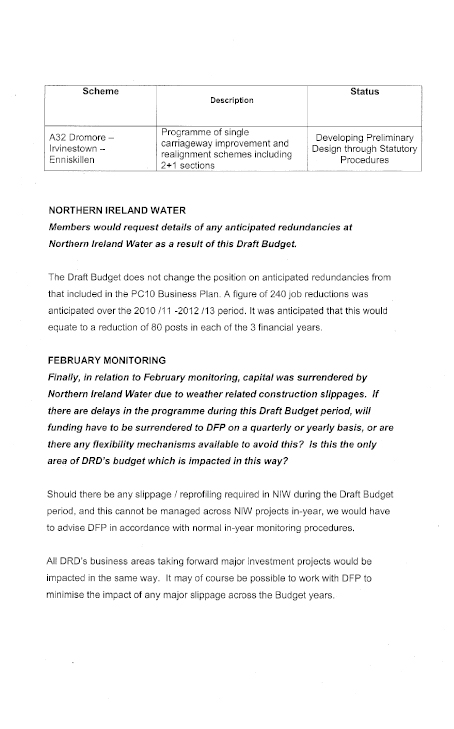

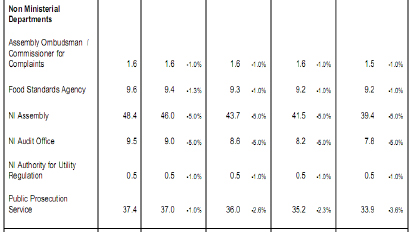

33. The Committee notes that in year one of the Draft Budget (year two of the PC10 period) there is an indicative capital investment allocation some 7.5% in excess of the level recommended in the agreed PC10 determination, however this is followed by an allocation which is £50million (26%) lower than the level agreed in PC10. Members recognise the constraints facing Northern Ireland Water, particularly in the current economic climate, however they were concerned about the impact this may have on Northern Ireland Water’s ability to deliver the investment in infrastructure which was agreed as necessary during the PC10 process.

34. Looking at the profile of capital expenditure for water and sewerage services in the Draft Budget, it begins at a level, has a significant dip in years two and three, and increases again in year four. This “u-shape" profile is the opposite of what might be expected for relatively large scale infrastructure investment programmes carried out over a number of years. In profile, such projects tend to have lower expenditures in the early years, with an expenditure peak at the mid-point and slightly beyond (an “inverted u-shape").

35. Briefing from the Utility Regulator identifies the potential implications of the Draft Budget profile for capital expenditure in Northern Ireland Water (NIW) as:

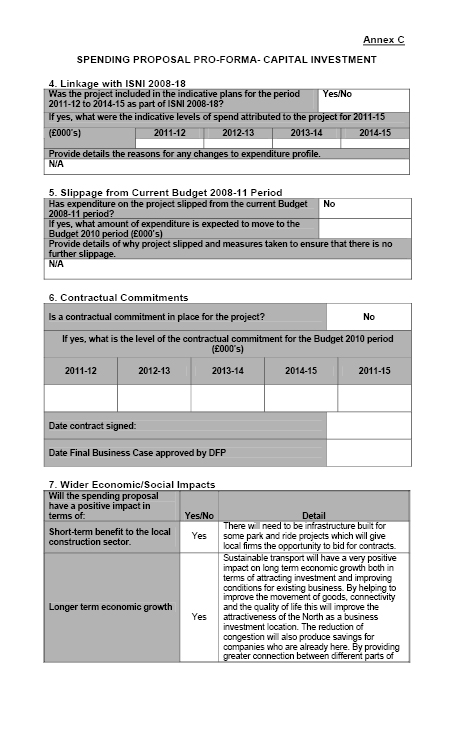

36. Members wish to highlight the factors driving the need for capital investment in NIW.

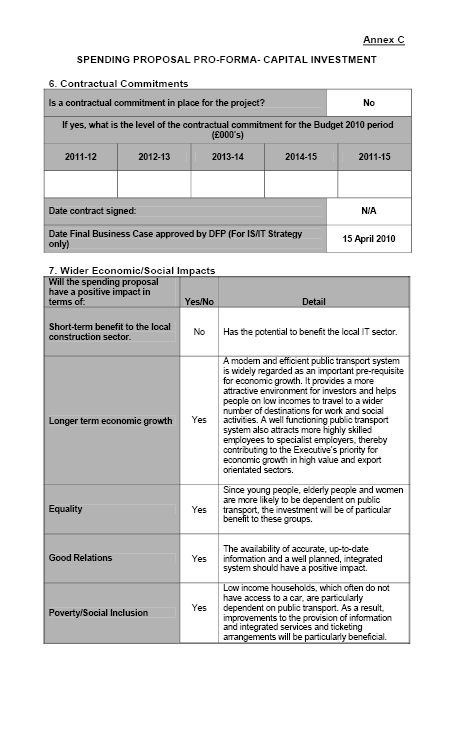

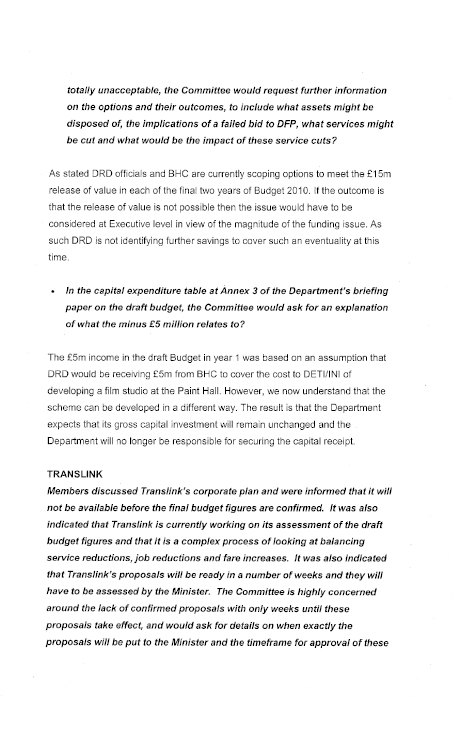

| % Capital Investment | Driven by: |

|---|---|

44.4% |

Need to maintain the asset base and sustain current level of performance and service. |

29.3% |

Need to meet quality compliance / EU directives |

18.9% |

Need to facilitate growth or development needs |

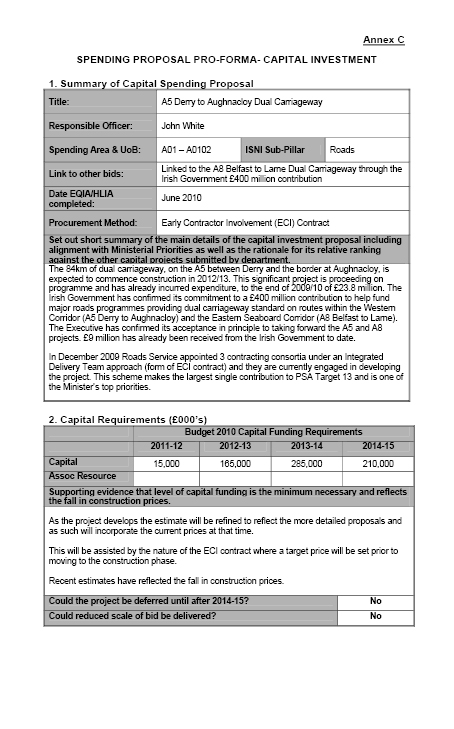

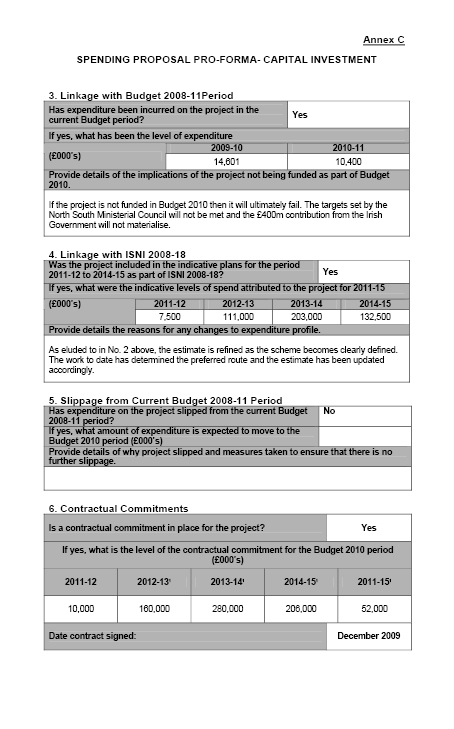

7.3% |

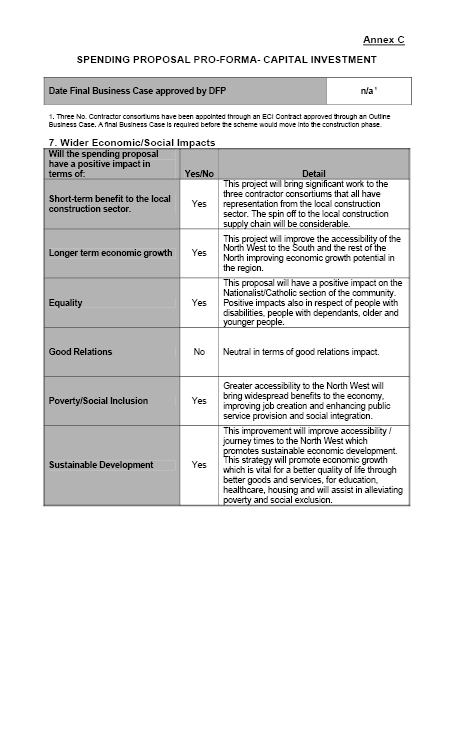

Enhancing the level of performance |

Source: Letter from NIAUR, 26 January 2011

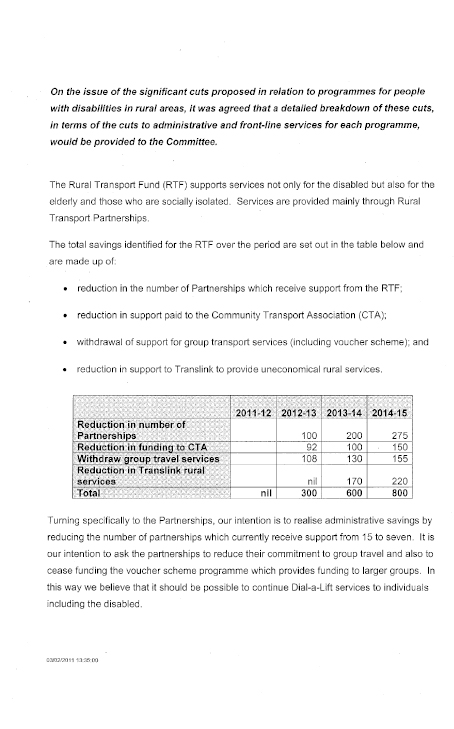

37. The Committee understands that work is ongoing to identify and investigate options for re-profiling the capital investment programme, however Members are concerned. As can be seen above, the majority of capital investment, almost 74% is driven by the need to maintain current levels of service and performance and to meet compliance standards. A reduction of 26% in the level of capital investment in year two, with a further reduction in year three of the Draft Budget period, cannot but have an impact on the levels of service and compliance currently provided by NIW. There could be little or no room for service or performance improvements or development over the coming years.

38. Again, the Committee hopes to explore this issue with the Department the budget period.

39. The Committee heard from representatives of Belfast Harbour on the inclusion in the Department’s spending and saving proposals of revenue of £15m in year three and £15m in year four of the Draft Budget period. In correspondence, noted at the Committee meeting of 16 February 2011, clarification was provided by the Department on how this element was incorporated into the Department’s draft budget allocation. This letter states that the £30m was reflected in the DRD Draft Budget allocation arising from “a commitment given by the DRD Minister to the Finance Minister on 14 December 2010 that he was recommending changes to the current Ports legislation to allow the Executive to introduce an additional funding stream on up to £125 million over the budget period; and that this would also allow for an ongoing dividend from the Ports."

40. The Committee is disappointed that this was not made clear in the briefings provided to the Committee on the Department’s spending and saving proposals, particularly as it had taken a keen interest in the development of ports legislation. The Committee also understood that the Minister had withdrawn the legislation on Ports Policy from the legislative programme, in June 2010, and was not aware that other changes to ports legislation were being considered.

41. The Committee held a stakeholder engagement event on Wednesday 26 January 2011 on the impact of the Department’s spending and savings delivery plans. Whilst the Committee has not had a chance to consider the feedback received during this event in detail, the following paragraphs are not exhaustive but they provide a flavour of the contributions made during the event. These are organised under the headings of social, economic and environmental impacts, however the Committee is keenly aware that these are interlinked and cross-cutting categories.

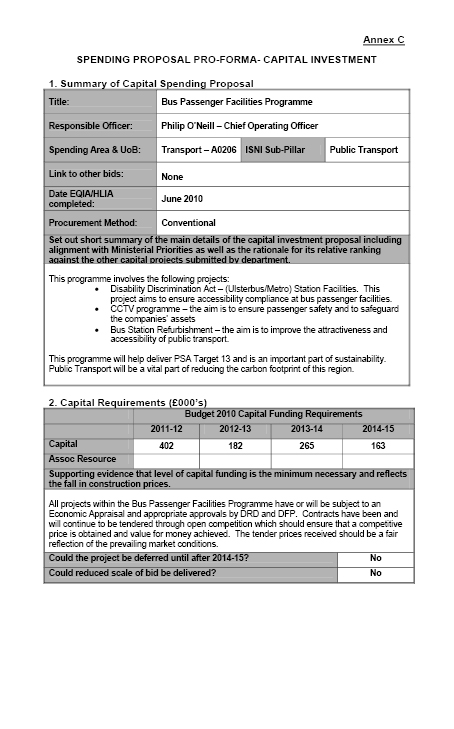

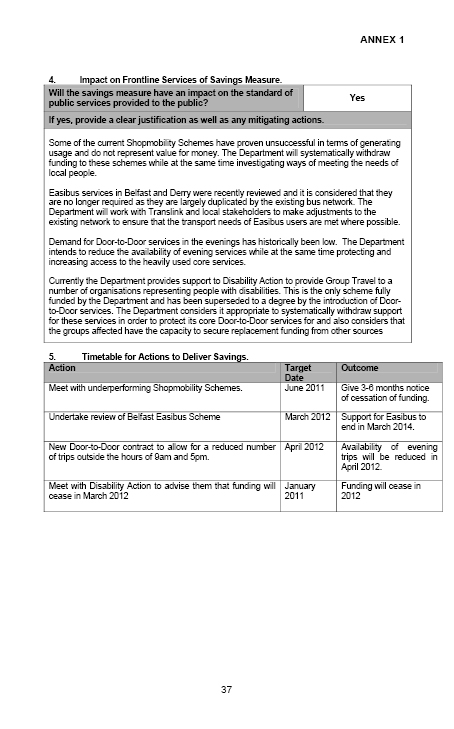

42. There was a significant amount of discussion of the social impacts of the Department’s spending and savings delivery plans. Contributions were received from organisations that included the Consumer Council, the Community Transport Association (CTA), Disability Action, the Inclusive Mobility Transport Advisory Committee (IMTAC), Shopmobility, and Translink.

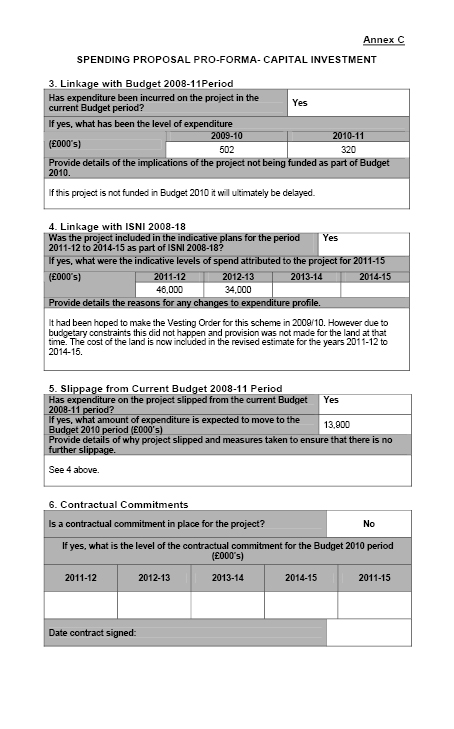

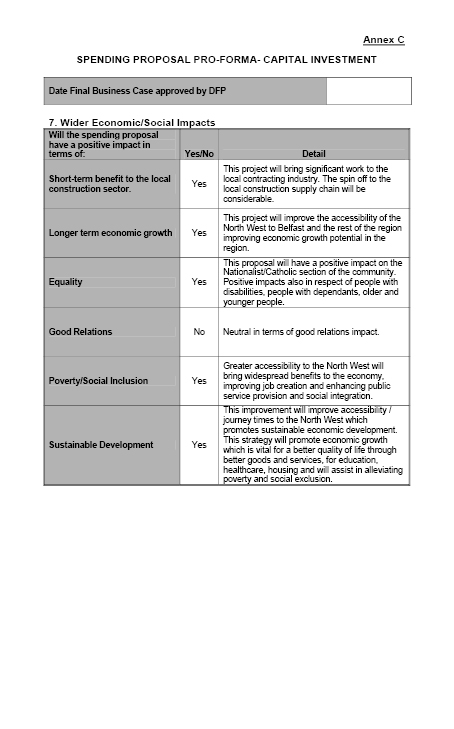

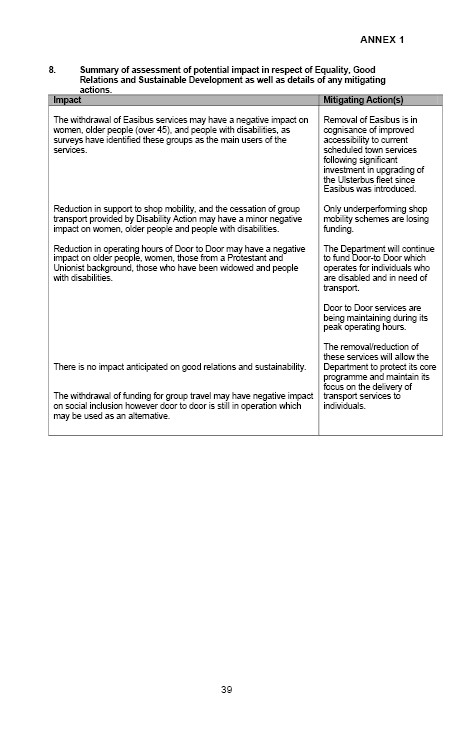

43. There was agreement among many of the stakeholders at the Committee’s event that the proposals in the Department’s spending and savings delivery plans would have a disproportionately negative impact on older people, people with disabilities, and people reliant on public transport, especially in rural areas.

44. The Committee heard from IMTAC that restrictions in the door-to-door service to core hours will limit the ability of older people and people with disabilities to go out in the evening and at weekends: an impact also identified by Disability Action. IMTAC stated that the combination of measures in the draft budget proposals will limit Shopmobility schemes; reduce support for rural and group travel schemes; reduce subsidy for rural public transport; reduce the number of Rural Community Transport Partnerships; and reduce the level of subsidy to Translink. The cumulative impact of these proposals will be to reduce the supports available to many vulnerable people, and in IMTAC’s view this will cause social exclusion, isolate many people in their homes and reverse the dramatic progress Northern Ireland has made in the past 15-20 years for disabled people, young people, older people and those who have no access to a car.

45. The CTA was also of the view that reductions in the rural transport fund and transport programme for people with disabilities will have significant impact on communities by 2015, with increased problems in terms of rural isolation, exclusion and access for the most vulnerable in society. Reductions in the Rural Community Transport Network would mean that 25%-30% of people in rural areas will not be able to access transport solutions, CTA said.

46. CTA also stressed the need to consider the linkages between community transport provision and reductions to Translink’s budget. The impact of potential reductions in rural routes and service frequencies, together with the possibility of increasing fares, will place further pressures on community transport to deliver the alternative access solution.

47. The impact on those older people, people with disabilities, people with mobility difficulties and their families, arising from the proposed reductions in support for Shopmobility schemes was also discussed. Shopmobility highlighted its success in generating much of its own funding, and emphasised that the trips taken as a result of Shopmobility schemes put money back into the economy. This local economic benefit would be lost, as well as the obvious benefits to the vulnerable members of society who make use of the schemes, should the proposals go ahead as they currently stand.

48. IMTAC stated that millions of pounds have been spent in the past on providing accessible public transport infrastructure, but this will be lost if people cannot get to the public transport network to use the accessible buses and trains. IMTAC called for a creative re-examination of alternative approaches based on evidence of usage patterns, rather than an across the board approach. The CTA was of the view that transport should receive priority if further monies became available during the budget period. It also highlighted the need to look for joined-up solutions, to share costs and savings across departments including health and education.

49. Translink made a number of points on the social impacts of the spending and savings proposals. It stressed that it wanted to minimise any negative impacts in terms of services and jobs. In contributions, Translink stressed it was cognisant of its social and sustainability objectives and the need to provide for the travel requirements of older people, people with disabilities and those living in rural communities – at an individual level and also at a community level.

50. Translink stated that it was trying to protect the geographical coverage of the network as far as possible and indicated that connectivity and integration were important considerations. As it makes changes, it has to ensure that people still have access and connections to the main network. However, Translink explained that it was duty bound to examine the poorest performing parts of the network and that, ultimately, is down to passenger numbers, services that are unnecessary or those that can be covered through a combination of other services. It also stated that it would be looking at parts of the network where it thought services could be improved or enhanced to grow passenger numbers.

51. NILGA welcomes proposals to secure a better deal for the supply of street lighting energy but was very concerned to note that one of the contingencies, if this doesn’t happen, is dimming or removal of street lights or introducing shorter burning hours. In NILGLA’s view, there is a paradox in this proposal in terms of DRD’s commitment to contributing to the health and well being of the community. Better street lighting helps improve road safety, as well as reducing crime and the fear of crime. It also helps to create happy and healthier communities by promoting social inclusion and sustainable transport patterns by encouraging people to walk or cycle.

52. Again, there was wide ranging discussion on the economic impacts of the Department’s spending and savings proposals. The Confederation of British Industry (CBI), the Quarry Products Association Northern Ireland (QPANI), the Federation of Small Businesses (FSB), the Northern Ireland Local Government Association (NILGA) and the Freight Transport Association (FTA) all made contributions on this aspect of the Draft Budget proposals.

53. CBI welcomed the broad approach taken and the investment commitment set out in the Draft Budget. Continuing to invest in the strategic road network and public transport are high priorities for the CBI, and it supports the schemes to upgrade the A5 and A8. QPANI also welcomed the commitment to capital spending on the A5 and A8. However, it was of the opinion that if the contribution from the Republic of Ireland government was not forthcoming following the general election, that the planned capital allocations in DRD’s budget should be reallocated to strategic programmes and schemes across Northern Ireland that will positively maximise the impact on jobs.

54. CBI expressed its disappointment that other key roads, which it saw as priority schemes, particularly the A6 Randalstown-Castledawson and the York Street flyover, were not to proceed.

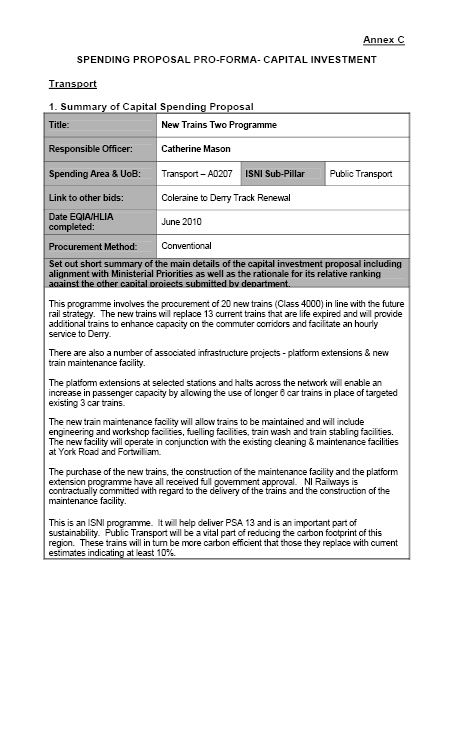

55. CBI welcomed the commitments to proceed with investment in transport, including Rapid Transit, but sought clarification on the need for another train maintenance facility. Translink provided clarification on this issue, stating that the need for a new train maintenance facility is a reflection of the substantial increase in the capacity of the railways as the new trains are brought in. Maintenance is required to optimise that additional rail capacity and to physically maintain the trains.

56. The FTA highlighted the importance of freight to the economy. It stated that freight deliveries must be cost efficient as margins are low and times are hard for business. The freight industry needs to work smarter to make best use of its existing assets, and with high fuel costs, a good infrastructure is a key requirement for the FTA’s members to meet their goals but also to encourage inward investment to Northern Ireland.

57. By way of example, the FTA identified that Belfast Harbour handles 60% of seaborne trade. Congestion on the roads serving that hub needs to be addressed and fixed quickly. In its view, proposals for Belfast on the move and rapid transit would reduce lane space and would force traffic out onto the Westlink. In its view, the York Street flyover and the Westlink junction were priorities for action to improve inward investment, improve journey times, reduce congestion and to improve air quality in that area. Briefly, the FTA welcomed the work proposed for the A8, highlighted the very heavy daily traffic on the A6/ M22, the need to dual the M1/A1 at Sprucefield to accommodate the 42,000 vehicles travelling daily into Belfast, and questioned the daily vehicle numbers (13,500) on the A5 relative to the cost of the scheme proposed for that route.

58. On the issue of the savings delivery plans, QPANI welcomes a more focused approach on minor maintenance activities and would suggest that many maintenance activities should be outsourced to the private sector. QPANI also welcomed the rationalisation of Roads Service depots and section offices and would urge Roads Service to continue to identify opportunities for savings that can be delivered to front line services.

59. FSB expressed its disappointment that options, such as privatisation, were not considered. In its view, this limited the discussion and the scope for going forward, not least because in its absence there would have to be a myriad of ways of raising revenue throughout the economy. Its concern was that these other revenue raising options would effectively add stealth charges to the cost of living and doing business in Northern Ireland, whilst ignoring one of the key ways that the gap in funding could have been closed. FSB also encouraged more innovative thinking about how our existing infrastructure is used, such as using technology for reversing the direction of roads at certain times of the day so as to make better use of the existing infrastructure.

60. The CBI stated that the savings identified in the Department’s consultation document have been set out in detail. In its view, a number of these will clearly impact on service provision but from a broad strategic economic perspective, it did not believe that any of them would undermine economic recovery.

61. It did, however, express its surprise that in a key area such as delivering savings, it could see no evidence of administrative savings being identified or prioritised by the Department or of how DRD will improve its productivity and manage its pay bill over the budget period. Neither could it see proposals for what, in its view, would be ambitious reforms such as process reengineering or outsourcing. It was disappointed at proposals to transfer £6m from capital to revenue funding and challenged this move asking why administrative savings were not looked for instead.

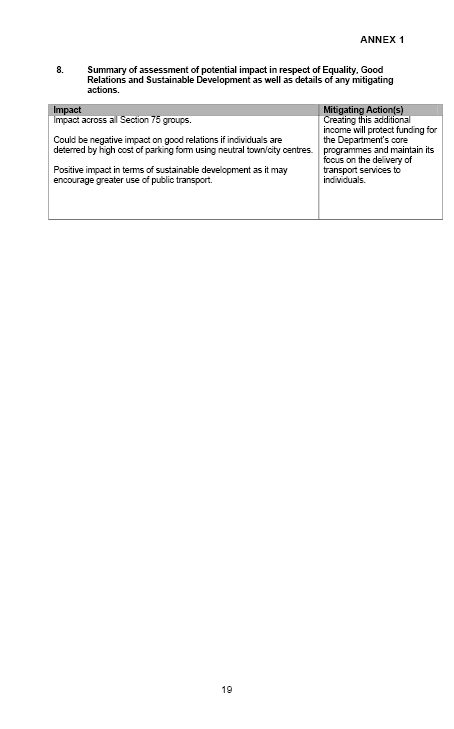

62. FSB questioned how planned increases in parking charges would fit with the Department for Social Development’s plans for town centre regeneration. From the FSB point of view, the two do not appear to mesh cohesively. On a related point, NILGA was of the view that on-street car parking charges could potentially increase illegal parking in towns which would exacerbate town centre congestion. This would put people off shopping in towns and would encourage the use of out-of-town shopping outlets where parking is free. NILGA stated that local businesses need as much help as they can get if they are going to survive the current economic difficulties. In contrast, CBI was of the view that proposals to raise revenue from increased car parking charges were proportionate and sensible.

63. Opinion was somewhat varied on the issue of raising revenue from Belfast Harbour. FSB had concerns over the taking of a dividend from the port in terms of the cost of doing business and its impact on both importing and exporting costs. QPANI welcomed the proposed release of £15 million for two years from Belfast Harbour, and CBI welcomed this approach to revenue raising as proportionate and sensible.

64. Investment in water and sewerage services also arose during a number of contributions to the Committee’s draft budget event. For the CBI, it was vital that we continue to invest in water and sewerage services at a high level, and it was concerned that allocations in years two and three of the budget were below those recommended in the PC10 final determination. Concerns in relation to the allocations below those set out in PC10 were also identified by the Consumer Council. QPANI also underlined the need for continued investment in the water and sewerage network in order to comply with European quality standards and to ensure that the network can cope with severe winter weather. In its contribution, CBI expressed the view that deferring water and sewerage charges was making funding more difficult, not just for transport and water and sewerage infrastructure, but also for the broader package. QPANI also called for the reintroduction of water charges to pay for our water and sewerage services network.

65. For the FSB, infrastructure is one of the keys to businesses leading the economic recovery, not just the infrastructure itself but the perception of the quality and reliability of the infrastructure. In its view, recent problems with water sent a very poor signal to investors and damaged consumer confidence.

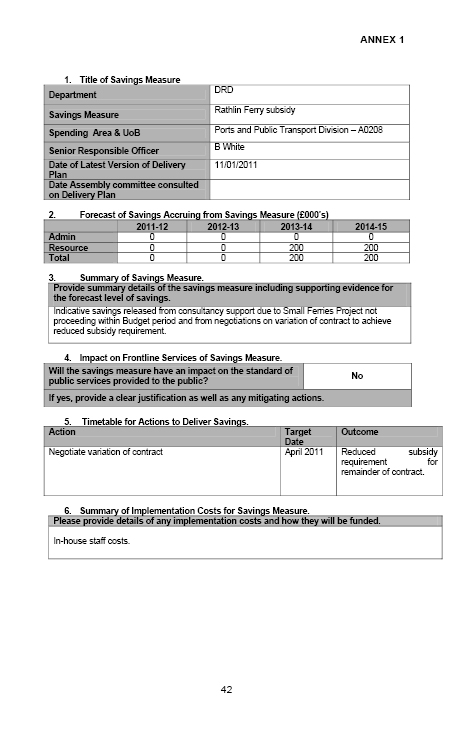

66. NILGA also expressed concerns that the planned reduction in subsidy to the Rathlin Ferry Service would increase costs for islanders and have a negative impact on tourism in the area.

67. In response to a comment from the Chairperson that the Committee’s concern was to take cars off the roads, and that there were no incentives in the budget to do this, Translink stated that the solution lay in integrated travel solutions that are attractive, sustainable and good value, but that sustainability was key.

68. The Consumer Council shared the view that there was little in the budget to create a modal shift from car to public transport, and in many ways it goes against what consumer research demonstrated consumers wanted from public transport, which was value for money, more frequent services and a wider network.

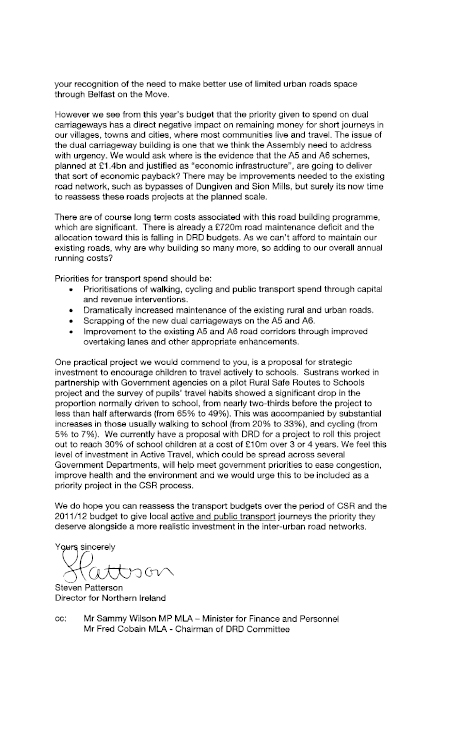

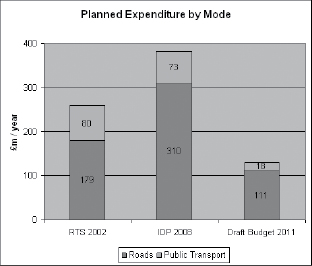

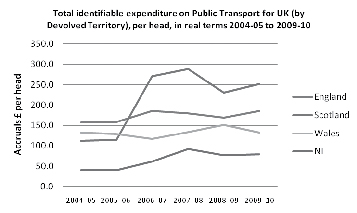

69. The Consumer Council also stressed that in many areas of Northern Ireland the choice to use public transport as a more sustainable travel option was not available. Its contribution reflected that ambitious plans and strategies are in place to support public transport, cycling and walking but these are often lost when it comes to delivery. By way of example, it was stated that the Regional Transportation Strategy (RTS) in 2002 suggested a spending ratio for roads to public transport (including walking and cycling) of 65% and 35%, and that this has never been achieved. In addition, there is a very strong sustainability message throughout the revised RDS but it will be very difficult to achieve this and the modal shift, against the backdrop of this budget. The funding profile for rapid transit, and other reductions in investment in integrated transport, means that the traffic management improvements identified in the Belfast on the move initiative may not be optimised.

70. The Consumer Council identified that the Enterprise service is also likely to be affected as there will be speed restrictions on the line, again providing more encouragement to move away from public transport and into the car.

71. QPANI recognised and supported the need to reduce carbon emissions but argued that it is not roads that create carbon emissions, but the vehicles using then. It does not believe that Northern Ireland has the population to support and finance a profitable and efficient train network but was of the view that a well funded, bus-based park and ride, integrated public transport network fuelled on low carbon fuels was the solution to sustainable transport. QPANI expressed its support for rapid transit for Belfast and government incentives to encourage the use of low carbon fuels. QPANI also stressed that it had made representations to Roads Service on the need to look to lower carbon products, and that some progress had been achieved with more sustainable bitumen products and processes. On balance, QPANI did not think that sustainability would be achieved because of constraints on the budget, but that a balance needed to be struck. QPANI expressed the view that the economy needs to be prioritised because the only way we can be in a position to offer better services in the future is by increasing the tax take from the economy and growing the private sector.

72. The CBI view was that sustainability clearly covers economic, social and environmental issues. CBI welcomed the investment in the rapid transit system and believes it will help achieve the modal shift in transport. It was CBI’s view that the focus of public transport should be on the high traffic volume routes, and on building on the investment made in recent years in the Metro service to improve connectivity.

73. Addressing congestion through investment in roads projects was also identified by the CBI and the M22 at Castledawson was identified as a priority. The FTA also identified the junction at Dee Street, Belfast, as an example of where relatively small changes in the roundabout could ease congestion and thus address air quality and particulates levels.

74. In its contribution, Sustrans stated that congestion only accounts for one third of transport costs, and that it is important to factor in the longer term environmental and health benefits of more active travel patterns. It pointed out that a cost benefits analysis shows that money spent on infrastructure for active travel delivers gains in excess of those delivered by building roads. Sustrans asked that the Draft Budget re-examines the safety measures that benefit children, the impact on people that do not have access to a car, and more environmentally sustainable modes of travel. It points out that in this version of the budget road safety, traffic calming, pedestrian and cycling measures are, in its view, virtually eliminated and suggests that there is a need to get the balance back whereby we incorporate active travel into the budget and look to the benefits that arise from active travel.

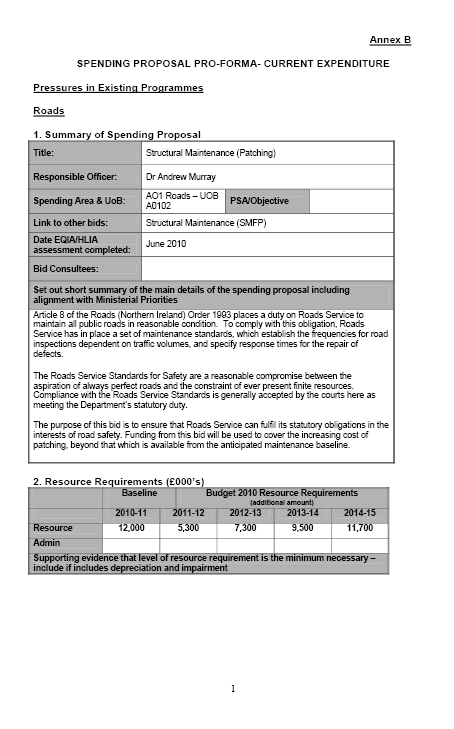

75. The Committee’s views on the importance of securing adequate funding for structural maintenance are well known and rehearsed. Indeed, the Committee has expressed its support for funding for structural maintenance in monitoring rounds and in debates on budget bills and draft budgets since the beginning of this mandate. However, Members wish to take this opportunity to underline the contribution to economic competitiveness, value for money and road safety arguments for providing adequate funding for structural maintenance.

76. In terms of stakeholder comments, QPANI highlighted the importance of investment in structural maintenance, given the current condition of the roads network and the additional damage that has been done over the past two years with the severe winter weather. It welcomes the allocation of £94m in the first year for structural maintenance, and points out that this allocation will sustain 1,200 jobs in the construction industry. However QPANI considers this allocation to be a way short of what the Snaith Report established was required on an annual basis, which estimates that £112m per annum was the amount needed. Over the four years of the budget period, there will be a shortfall of £168m against the funding recommended in that report, which will further add to the backlog in investment in this vital area. QPANI also pointed out that the £94m allocation in year one will not have the same purchasing power as in other years because of increasing fuel and bitumen costs, and the impact of the loss of the aggregates levy.

77. NILGA stressed the longer term value for money implications of failing to deliver adequate structural maintenance as filling pot holes is costly compared to a planned preventative maintenance programme.

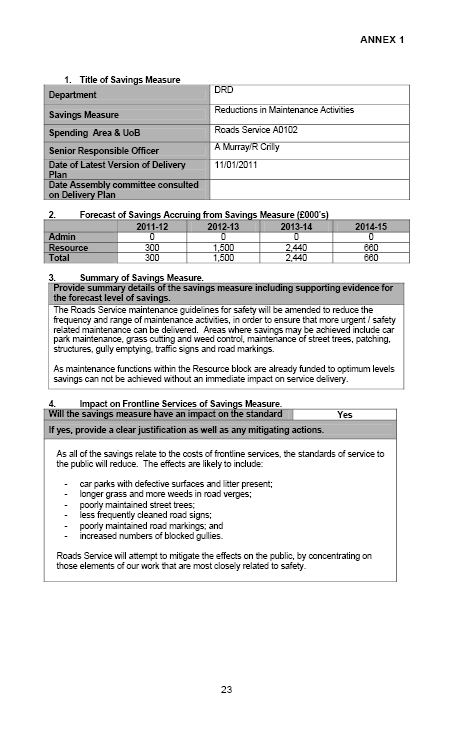

78. Representatives from NILGA highlighted the following points as being of particular relevance for local government. NILGA was concerned about the negative impact reductions in maintenance activities will have on local government and the possible impact on rate payers. Reduction in maintenance and gully emptying budgets could exacerbate the problem of localised flooding after heavy downpours. It was also concerned that hidden costs were being passed to councils. DRD proposed reduced frequency of grass cutting, weed killing and litter picking: these services are currently augmented by local councils. However the reductions in these activities by DRD are likely to lead to councils having to pay for this. The issue of salting footpaths was also mentioned. NILGA stated that concerns remained over resources, liabilities, and indemnities however options for a more acceptable long-term solution are currently being explored.

[1] Research and Library Service Briefing Note, 17 January 2011 Draft Budget 2010: DRD Spending Proposals

[2] Letter from NIAUR, 26 January 2011.

Introduction

Draft Budget 2011-15: Spending and Saving Proposals within the Department for Regional Development:

Issues of Concern to the Committee for Regional Development

Draft Budget 2011-15: Spending and Saving Proposals within the Department for Regional Development:

Issues of Concern to the Committee for Regional Development

Draft Budget 2011-15: Spending and Saving Proposals within the Department for Regional Development:

Issues of Concern to the Committee for Regional Development

Engagement with stakeholders on the impact of the Department’s spending and savings delivery plans

Engagement with stakeholders on the impact of the Department’s spending and savings delivery plans

Engagement with stakeholders on the impact of the Department’s spending and savings delivery plans

Present: Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Willie Clarke MLA

Danny Kinahan MLA

Billy Leonard MLA

Ian McCrea MLA

Conall McDevitt MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Tara McKee (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Fred Cobain MLA (Chairperson)

Allan Bresland MLA

Trevor Lunn MLA

George Robinson MLA

10.38am The meeting commenced in open session.

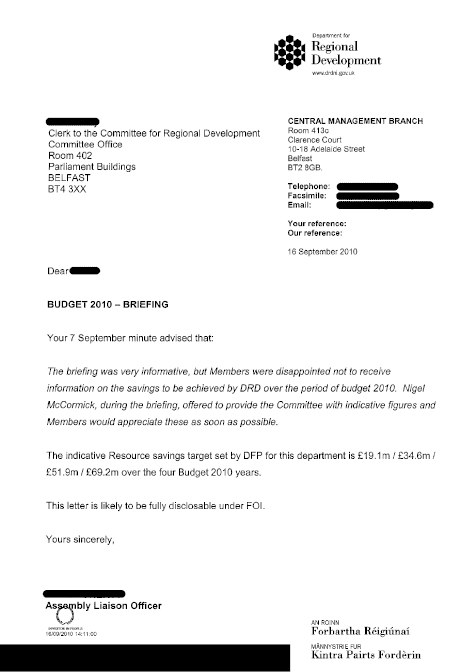

The Committee received briefing from Departmental officials, Nigel McCormick and Roger Downey, and from Roads Service officials, Dr Andrew Murray and Terry Deehan, on the Department’s Revised Expenditure Plans for 2010-2011.

Agreed: Members noted a report of the Northern Ireland Audit Office in relation to improving public sector efficiency and agree to defer consideration of the report to the Committee meeting on 30 June 2010.

Agreed: The Committee agreed to request additional information from the Department for Regional Development on the Budget 2010 timetable and process; to schedule an additional briefing on the issue on 30 June 2010; and to consider, if necessary, convening an additional meeting of the Committee in July, prior to the deadline for receipt of Departmental responses by the Department of Finance and Personnel.

1.04pm The Deputy Chairperson adjourned the meeting.

[EXTRACT]

Present: Michelle McIlveen MLA (Deputy Chairperson)

Willie Clarke MLA

Danny Kinahan MLA

Billy Leonard MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Fred Cobain MLA (Chairperson)

Cathal Boylan MLA

Allan Bresland MLA

Trevor Lunn MLA

Ian McCrea MLA

10.44am The meeting commenced in open session.

Agreed: Members considered correspondence from the Department in relation to this issue and agreed to review additional information from the Department as received during July and to schedule a meeting during summer recess to address the issue, if Members consider it necessary. Members also agreed to convene an additional meeting of the Committee on 7 September 2010 to consider the Committee’s response to the Minister on this issue.

1.23pm The Deputy Chairperson adjourned the meeting.

[EXTRACT]

Present: Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Allan Bresland MLA

Willie Clarke MLA

Danny Kinahan MLA

Trevor Lunn MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Fred Cobain MLA (Chairperson)

Billy Leonard MLA

Ian McCrea MLA

10.14am The meeting commenced in public session.

The Committee received briefing from Departmental officials, Nigel McCormick, Roger Downey, Stewart Barnes and Terry Deehan, in relation to bids and proposed savings delivery plans for Budget 2010.

Agreed: The Committee agreed to consider the requirement for further briefing on this issue at the meeting of 8 September.

Agreed: Members agreed to consider proposals, at the meeting of 8 September 2010, for a stakeholder engagement event in relation to the Budget 2010 process.

2.53pm The Deputy Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Danny Kinahan MLA

Billy Leonard MLA

Trevor Lunn MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Allan Bresland MLA

Willie Clarke MLA

10.38am The meeting commenced in open session.

Agreed: Members noted a paper from the Committee office outlining proposals for the Committee’s stakeholder evidence event on Budget 2010 and agreed to defer further consideration of the issue to the meeting of 15 September 2010.

12.38pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Allan Bresland MLA

Danny Kinahan MLA

Billy Leonard MLA

Trevor Lunn MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: None.

10.43am The meeting commenced in open session.

Agreed: The Committee noted correspondence from the Department for Regional Development in relation to Budget 2010 and agreed to write to the Department in relation to issues raised.

Agreed: The Committee noted the response to the Comprehensive Spending Review (CSR) process from Action for Children Northern Ireland and agreed to consider this response as part of the Committee’s consideration of Budget 2010.

12.47pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Trevor Lunn MLA

George Robinson MLA

10.33am The meeting commenced in open session.

Members noted correspondence from the Department for Regional Development, dated 11 October 2010, in relation to Budget 2010 spending priorities.

Members noted correspondence from the Department for Regional Development, dated 25 October 2010, on the implications of the spending review on the Department’s budget.

1.04pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Trevor Lunn MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Billy Armstrong MLA

10.45am The meeting commenced in open session.

Members noted correspondence from the Committee for Finance and Personnel regarding the outcome of the UK Spending Review Budget 2011-2015.

1.03pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Ian McCrea MLA

10.37am The meeting commenced in open session.

Members noted correspondence from the Committee for Finance and Personnel in relation to Ministerial correspondence on the draft Budget 2011-15.

Agreed: Members noted correspondence from the Finance and Personnel Committee on the Confederation of British Industry’s (CBI) revenue raising proposals and agreed to consider the correspondence as part of the Committee’s work on Budget 2010.

Agreed: Members noted correspondence from Sustrans on priorities for transport elements of the budget and agreed to consider the correspondence as part of the Committee’s work on Budget 2010.

11.53pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Allan Bresland MLA

Billy Leonard MLA

Conall McDevitt MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Billy Armstrong MLA

Cathal Boylan MLA

Anna Lo MLA

Fra McCann MLA

Ian McCrea MLA

George Robinson MLA

9.35am The meeting commenced in open session.

Agreed: The Committee agreed to schedule briefings on 12 January 2011 from key stakeholders on the Executive’s draft Budget. The Committee also agreed to request a paper from Assembly Research Service on the content of the draft Budget and its implications for the work of the Department for Regional Development.

9.58am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Anna Lo MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

10.50am The meeting commenced in open session.

Agreed: The Committee considered and agreed correspondence to the Finance and Personnel Committee requesting an extension to its deadline for receipt of submissions from Statutory Committees on the Executive’s Draft Budget 2011-15. The Committee also agreed to postpone its stakeholder evidence gathering event, scheduled for 12 January 2011, on the Draft Budget.

1.44pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Ian McCrea MLA

10.09am The meeting commenced in open session.

Agreed: The Committee noted a statement from the Utility Regulator in relation to Northern Ireland Water’s acceptance of the PC10 determination and agreed to consider the statement as part of the Committee’s consideration of Budget proposals.

Response to the Finance and Personnel Committee on the Draft Budget

Agreed: The Committee agreed to write to the Speaker to highlight the continued pressure on committees’ time to scrutinise Departmental budget proposals and to provide submissions to the Committee for Finance and Personnel.

12.54pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Allan Bresland MLA

Billy Leonard MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Cathal Boylan MLA

Ian McCrea MLA

10.04am The meeting commenced in closed session.

The Committee received a briefing from Assembly Research and Library Service analysing the Department for Regional Development’s Draft Budget position.

Following the briefing, the Committee continued its consideration of the Department’s Draft Budget proposals.

Agreed: The Committee agreed to schedule evidence sessions from key stakeholder organisations on the Draft Budget for 26 January 2011.

Agreed: The Committee agreed to schedule an additional meeting, to agree its response on the Draft Budget to the Finance and Personnel Committee, on Thursday 27 January 2011.

10.52am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

Anna Lo MLAIan McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Fra McCann MLA

9.50am The meeting commenced in closed session.

The Committee received additional briefing from Assembly Research and Library Services analysing the Department for Regional Development’s Draft Budget position.

The Committee continued its consideration of the outstanding issues on the Department’s Draft Budget proposals.

Agreed: The Committee considered and agreed a number of additional organisations to be invited to its stakeholder event on the Draft Budget on 26 January 2011.

10.21am The meeting moved into public session.

Committee stakeholder event on the Draft Budget and subsequent meeting

Agreed: The Committee noted and agreed arrangements for its evidence event on the Draft Budget on 26 February 2011 and decided to meet on Thursday 27 January 2011 to agree its response to the Finance and Personnel Committee.

The Committee noted the Equality Impact Assessment consultation document on the Draft Budget 2011-2015, as published on 19 January 2011.

The Committee received further briefing from Departmental officials, Mrs Doreen Brown, Mr John Mills and Mr Roger Downey, and from Mr Geoff Allister of Roads Service, on the Department for Regional Development’s planned spending allocations and savings delivery plans for 2011-2015.

Agreed: The Committee agreed to write to the Department seeking clarification on a number of issues raised during the briefing and on issues arising from the meetings of 12 January, 18 January and the closed session of 19 January 2011.

1.13pm The Deputy Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Anna Lo MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Cathal Boylan MLA

Allan Bresland MLA

Billy Leonard MLA

10.14am The meeting commenced in public session.

Agreed: Members noted correspondence from the Freight Transport Association (FTA) on the Draft Budget proposals and agreed to consider the correspondence as part of the Committee’s consideration of the budget proposals.

Agreed: Members noted an Assembly research paper, received from the Finance and Personnel Committee, on preventative spending and agreed to consider the paper as part of the Committee’s consideration of the budget proposals.

Agreed: Members noted correspondence from the Quarry Products Association (QPANI) on the Department’s Draft Budget proposals and agreed to consider the correspondence as part of the Committee’s consideration of the budget proposals.

Committee stakeholder event on the Draft Budget and subsequent meeting

Agreed: The Committee noted and agreed arrangements for its evidence event on the Draft Budget on 26 February 2011 and decided to meet at 9.30am on Friday 28 January 2011 to agree its interim response to the Finance and Personnel Committee on the Draft Budget.

Agreed: The Committee also agreed to consider a final response after it has received the additional information requested from the Department at the Committee meeting of 19 January 2011 and having considered the Hansard transcript of today’s stakeholder event on the Draft Budget. It was agreed that the final response will be published on the Committee’s pages of the Assembly website and also forwarded to the Minister for Regional Development, the Department of Finance and Personnel and the Finance and Personnel Committee.

10.26am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Cathal Boylan MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

11.50am The meeting commenced in open session.

The Committee considered and agreed, subject to amendment, its response to the Finance and Personnel Committee on the Department for Regional Development’s Draft Budget proposals.

Agreed: The Committee agreed that its response, as amended, be forwarded to the Finance and Personnel Committee for consideration.

11.57am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Allan Bresland MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Billy Armstrong MLA

Cathal Boylan MLA

Billy Leonard MLA

Ian McCrea MLA

11.10am The meeting commenced in open session.

Agreed: Members noted correspondence from Sustrans to the Department for Regional Development, and the Department’s response, on the Draft Budget and agreed that any concerns that Members might have in relation to this correspondence should be addressed during the Departmental briefing on the Draft Budget, requested for 9 February 2011.

The Committee noted follow-up information provided by the Freight Transport Association as a result of the Committee’s stakeholder event on the Draft Budget on 26 January 2011.

Agreed: The Committee considered, and agreed for issue, correspondence from the Chairperson to the Speaker on the timeline for consideration of the Draft Budget and Budget 2011-15.

Agreed: The Committee agreed to schedule briefings on 9 February 2011 from the Department for Regional Development and Belfast Harbour on the Draft Budget.

11.42am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Billy Leonard MLA

Ian McCrea MLA

10.17am The meeting commenced in open session.

The Committee noted a response to the Department’s consultation on the Draft Budget 2011-15 from Professor Austin Smyth of the University of Westminster and Mr Stephen Wood of Stephen Wood Consultancy. The Committee also received an update on the meeting with Professor Smyth and Mr Wood on 7 February 2011.

The Committee also noted a paper on the Draft Budget from Mike Tomlinson and Grace Kelly of PSE UK.

12.39pm Mr Armstrong and Mr Boylan returned to the meeting.

12.40pm Mr Robinson left the meeting.

The Committee received a briefing from representatives of Belfast Harbour, Len O’Hagan, Maurice Bullick and Joe O’Neill on the implications of the Draft Budget on ports.

12.48pm Mr Robinson returned to the meeting.

12.56pm Miss McIlveen returned to the meeting.

The Committee also received a briefing from Departmental officials Doreen Brown and Stewart Barnes, and from Geoff Allister of Roads Service, on the issues arising from the Departmental briefing on the Draft Budget on 20 January 2011 and from the take-note debate on the Draft Budget on 31 January 2011.

The Chairperson and Members thanked Doreen Brown for her work with the Committee and wished her a long and happy retirement.

Agreed: The Committee agreed to write to Belfast Harbour and the Department in relation to the issues discussed during the briefings.

1.29pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Anna Lo MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Allan Bresland MLA

Billy Leonard MLA

George Robinson MLA

10.16am The meeting commenced in open session.

The Committee noted a report from NICVA and PricewaterhouseCoopers providing comment on the Northern Ireland Draft Budget 2011-2015.

Agreed: The Committee noted correspondence from the Department for Regional Development providing clarification on a number of issues discussed during the evidence session to the Committee on the Draft Budget on 9 February 2011 and agreed to defer consideration of the correspondence to the meeting of 23 February 2011.

The Committee noted correspondence from the Regeneration Strategy Board for Derry-Londonderry on the Draft Budget.

Agreed: The Committee considered and agreed, subject to amendment, a response to the Minister for Regional Development on the Department’s spending and savings proposals for the Draft Budget.

12.58pm The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Allan Bresland MLA

Anna Lo MLA

Fra McCann MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Cathal Boylan MLA

Billy Leonard MLA

Ian McCrea MLA

10.12am The meeting commenced in open session.

The Committee noted correspondence from the Department for Regional Development providing clarification and further information following the briefing on 9 February 2011 on the Draft Budget relating to the Port of Belfast.

Agreed: Members noted Sustrans’ response to the Department for Regional Development on the Draft Budget and its Equality Impact Assessment and decided to consider the Sustrans response as part of the Committee’s report on the Draft Budget.

Agreed: Members noted correspondence from the Dungiven Bypass Committee on the Draft Budget and decided to consider the correspondence as part of the Committee’s report on the Draft Budget.

Agreed: Members noted IMTAC’s response to the Department for Regional Development on the Draft Budget and its Equality Impact Assessment and on the Equality Impact Assessment for the Department’s arrangements for the purchase of rail tickets using the half fare Smartpass and decided to consider IMTAC’s Draft Budget response as part of the Committee’s report on the Draft Budget.

Agreed: The Committee considered a draft of its report on the Draft Budget. Members decided to forward suggested amendments to the Committee office by 25 February 2011 and to consider a revised report, incorporating the proposed amendments, at the meeting of 2 March 2011.

10.33am The Chairperson adjourned the meeting.

[EXTRACT]

Present: Fred Cobain MLA (Chairperson)

Michelle McIlveen MLA (Deputy Chairperson)

Billy Armstrong MLA

Cathal Boylan MLA

Allan Bresland MLA

Anna Lo MLA

Fra McCann MLA

Ian McCrea MLA

Conall McDevitt MLA

George Robinson MLA

In Attendance: Roisin Kelly (Assembly Clerk)

Trevor Allen (Assistant Assembly Clerk)

Andrew Larmour (Clerical Supervisor)

Alison Ferguson (Clerical Officer)

Apologies: Billy Leonard MLA

10.36am The meeting commenced in open session.

Members noted correspondence from the Minister for Regional Development acknowledging the Committee’s response to the Department on the Draft Budget 2011-15.

Agreed: The Committee noted correspondence from the Department for Regional Development and from Belfast Harbour providing clarification on a number of issues raised during briefing on 9 February 2011 and agreed to consider these items of correspondence as part of the Committee’s report on the Draft Budget.

Agreed: The Committee considered a draft of its report on the Draft Budget 2011-2015 and, subject to agreed amendments, decided that the report be published.

12.41pm The Deputy Chairperson adjourned the meeting.

[EXTRACT]

Members present for all or part of the proceedings:

Mr Fred Cobain (Chairperson)

Miss Michelle McIlveen (Deputy Chairperson)

Mr Billy Armstrong

Mr Cathal Boylan

Mr Allan Bresland

Mr Billy Leonard

Ms Anna Lo

Mr Fra McCann

Mr Conall McDevitt

Mr George Robinson

Witnesses:

Mr Geoff Allister |

Department for Regional Development |

1. The Chairperson (Mr Cobain): I welcome Dr Malcolm McKibbin and his departmental colleagues who are here to brief the Committee on the draft Budget.

2. Dr Malcolm McKibbin (Department for Regional Development): Good morning. I am conscious that the Committee has only just received the relevant papers. I will, therefore, give a longer overview than I might otherwise have given. When, in subsequent meetings, Committee members wish to delve into the detail, I assure them that we will provide officials to help members to understand fully the consequences of the draft Budget.

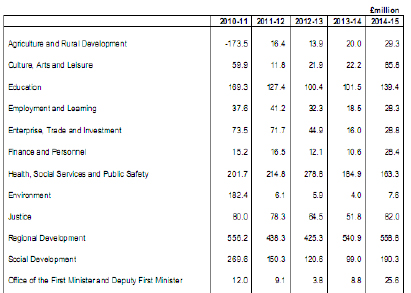

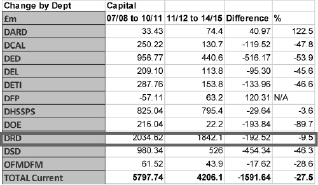

3. I will begin by pointing out that, last October, the UK spending review announcement left Northern Ireland facing its most difficult fiscal challenges in decades. After years of sustained public expenditure growth, the coalition Government’s proposals resulted in real-terms reductions in public expenditure across the UK. As members are probably aware, up to 2014-15, the Executive face real-terms capital decreases of about 40% and current expenditure decreases of 8%. The 40% reduction in capital will have a big impact on the Department for Regional Development (DRD) and the region, as we are the major investor in infrastructure here.

4. The 8% current expenditure reduction in the Northern Ireland block grant will also be extremely difficult to manage, especially because the Department of Health, Social Services and Public Safety’s (DHSSPS) large current budget has not only been protected but enhanced by about £330 million over the Budget period. Therefore, DRD faces difficult choices among a wide range of competing yet important priorities.

5. As members know, the Executive’s priority is to stimulate the economy, tackle disadvantage, protect the most vulnerable in society and protect front-line services as far as possible. As the largest capital Department historically, DRD’s role is to invest in infrastructure and to support the Executive’s aims within the funding that is available to it.

6. What does the draft Budget mean as far as DRD is concerned? I will go into some detail, as I am aware that members have not had time to go through the relevant papers. It is important that the Committee appreciate the overall strategic challenges that the Department faces. It is a very difficult Budget for DRD, as it is for the Executive. The allocations that we receive in the draft Budget will help to continue to improve elements of our roads, water and transport infrastructure, and they will also allow us to continue to fund the majority of our existing programmes, albeit at a fairly significantly reduced level.

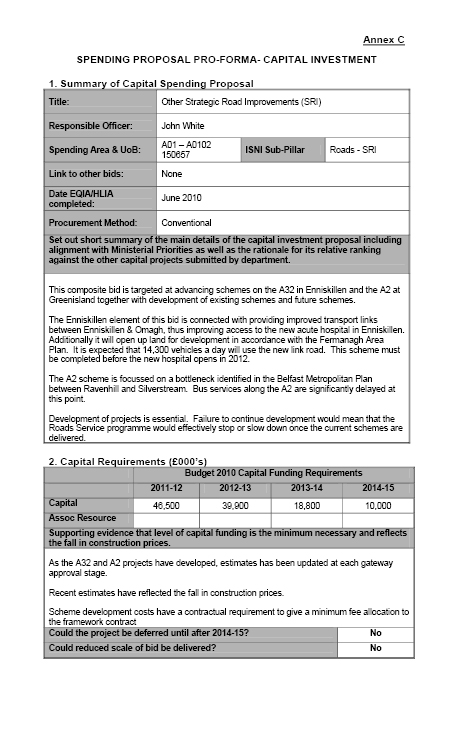

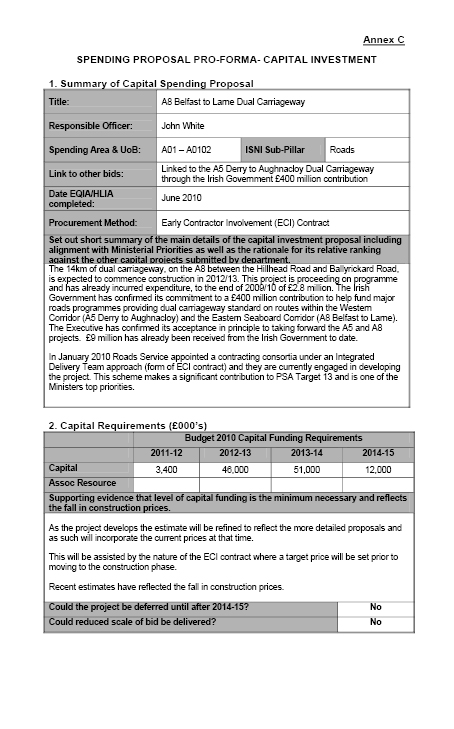

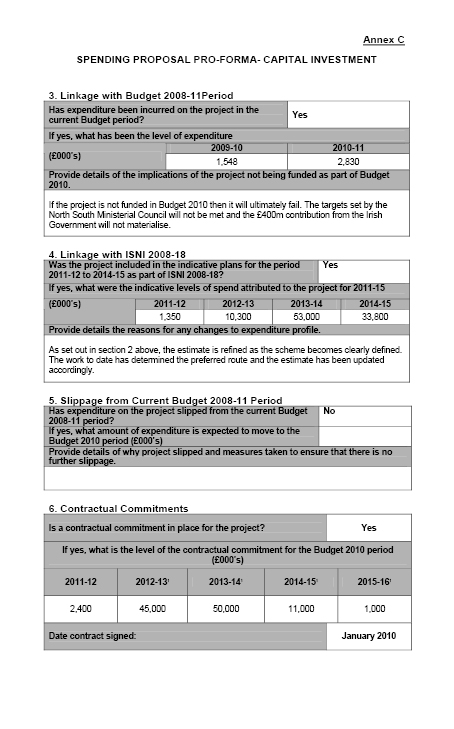

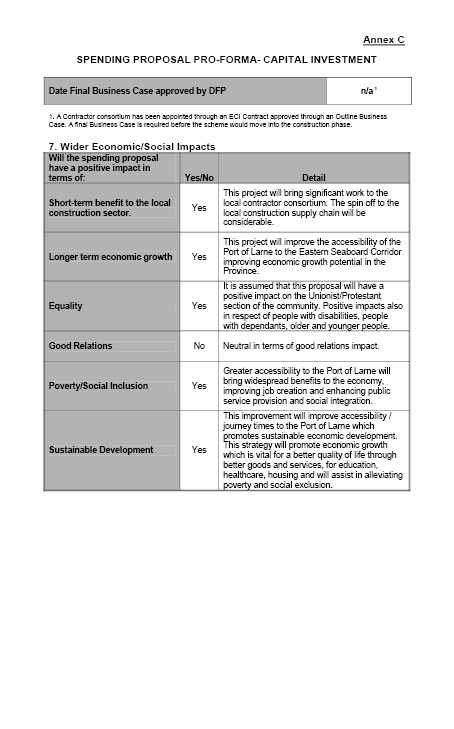

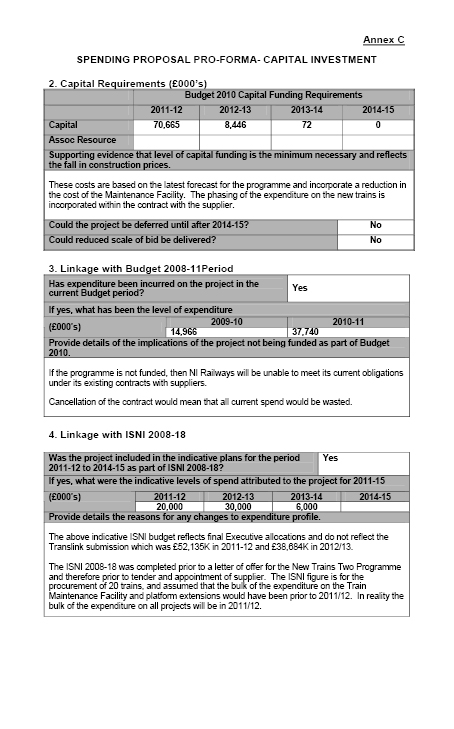

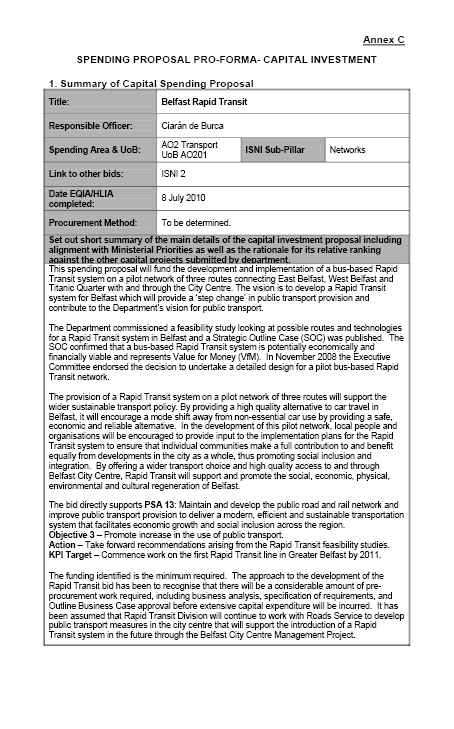

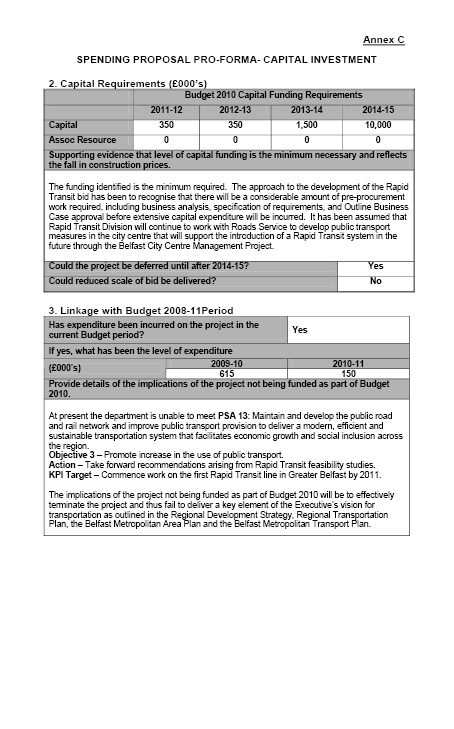

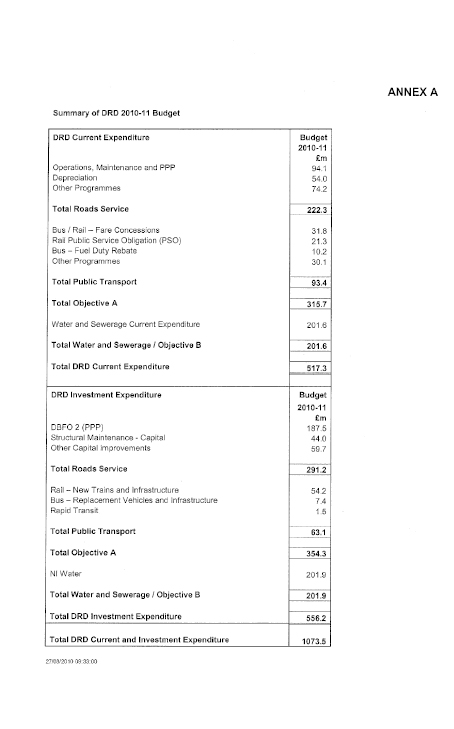

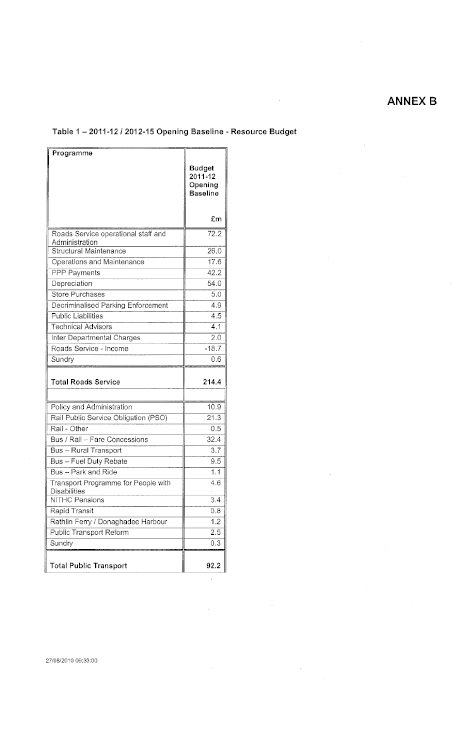

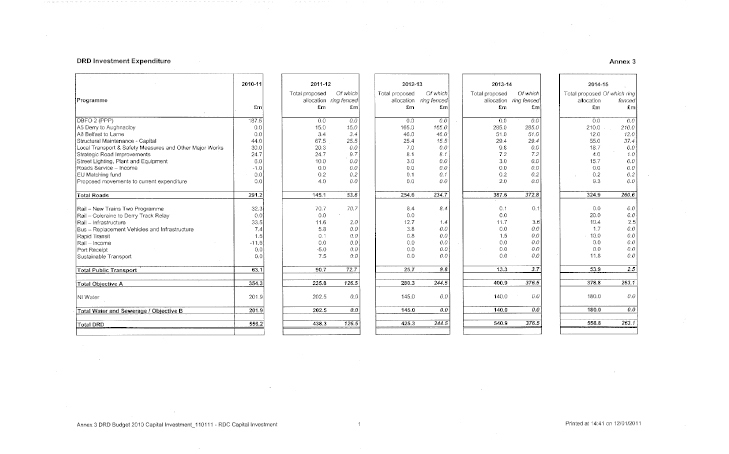

7. I will begin with capital expenditure. The draft Budget allocations would provide capital budgets to DRD of about £2 billion over the Budget period. That includes about £1·1 billion for roads, £185 million for public transport and about £665 million for water. However, the key issue is that about £790 million of that large capital sum — approximately 70% of the roads allocation — is specifically allocated to the A5 and A8 road schemes. That tends to distort the capital budget quite significantly. Members will also be aware that the Republic of Ireland will contribute about £400 million to the A5 and A8 schemes, about £274 million of which will be contributed during the period of the Budget.

8. Nevertheless, the overall reduction of 40% in the Executive’s spending review settlement and the scale of those schemes mean that there are no allocations to commence construction on other major road schemes, such as the A6 Randalstown to Castledawson scheme, the A2 Greenisland scheme, the York Street flyover, the Sydenham bypass widening project and some other schemes along the A6. In addition, there will be significant reductions in capital improvement programmes, such as walking and cycling, traffic calming, collision remedial works, traffic management works, safety schemes and bridge strengthening.

9. The impact will be most severe in years two and three of the Budget. The ring-fenced allocation for the A5 and A8 schemes also reduces the available capital funding for public transport programmes throughout the Budget period. That means that there is no funding for the Knockmore to Lurgan railway track replacement. There will also be an impact on the water and sewerage programmes, with the result that there is insufficient funding to match the Utility Regulator’s recommended capital funding levels in 2012-13. That is despite the Department and the Minister having shifted funds from other programmes to try to bolster water and sewerage investment.

10. What will DRD be able to do over the Budget period? The Budget 2010 proposals permit Roads Service to progress the 84 km of the A5 dualling scheme in accordance with the previously envisaged timetable. Subject to the public inquiry that will be held in May 2011, they also enable us to start that construction phase in 2012. We will also be able to dual 14 km of the A8 Belfast to Larne road, which is being taken forward in conjunction with the A5 scheme and, indeed, was subject to some of the funding assistance from the Republic of Ireland. Again, subject to a successful public inquiry, construction could commence in 2012.

11. Residual road funding means that only one other capital roads scheme will be able to be completed in the Budget period, namely the A32 Cherrymount link road, which, as members know, facilitates access to the new hospital in Enniskillen. The Department will be able to continue development work on the A6 Dungiven to Derry scheme to ensure that, if money becomes available, we will be in a position to commence construction.

12. The other important area in roads is structural maintenance, to which the draft Budget allocates £94 million, £52 million, £56 million and £82 million during the Budget period, a total of approximately £280 million. Compared with the structural maintenance funding plan, we are about £200 million short of what is required properly to maintain the network over the Budget period. Obviously, that is of major concern to us. Coupled with reductions in other road maintenance activities, we predict that the network will be less resilient to severe weather events such as freeze-thaw cycles, similar to that which we have just experienced, or, indeed, flooding.

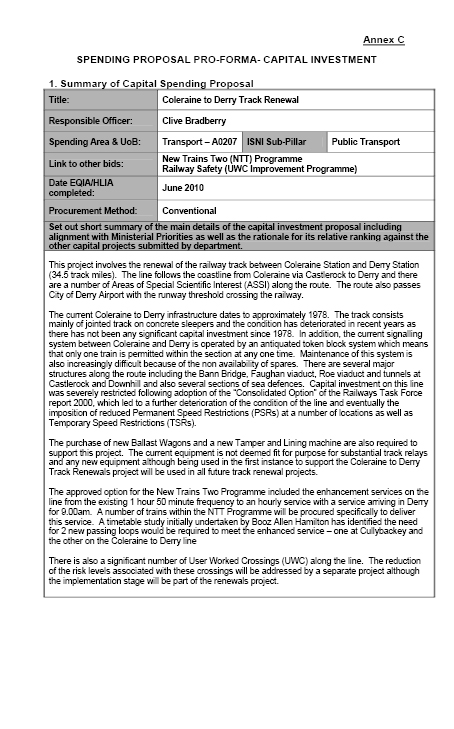

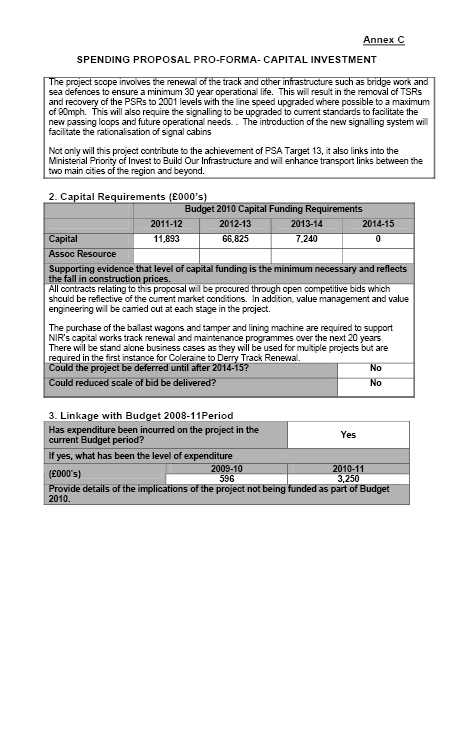

13. About £185 million has been allocated to the capital budget for public transport. I will start with railways: the draft Budget allocation would allow for the delivery of 20 new trains and for the necessary platform extensions and stabling facilities associated with them. However, pressure on the revenue that supports railways, which I will discuss in a moment, may mean that some new trains will not be utilised to their optimum extent. The draft Budget also allows for railway safety works to be carried out on the current rail network. Some smaller projects, such as rail hand-held ticketing, can be taken forward.

14. The allocation, however, does not allow for the Knockmore to Lurgan upgrade or track replacement, which could lead to speed restrictions being imposed on that part of the network during the Budget period. Plans to commence the Coleraine to Derry track upgrade must also be delayed, but they are expected to commence in the fourth year of the Budget period. Other capital projects for public transport may have to be deferred. The Northern Ireland Transport Holding Company (NITHCo), representatives of which will, I understand, meet the Committee shortly, is working to identify and prioritise relevant projects as we speak.

15. There is limited provision for bus replacement or bus service delivery. It is likely that that will impact on service standards and on the average age of the bus fleet. As far as rapid transit is concerned, the draft Budget allocations also allow for the continuation of the planning phase, primarily, of the pilot rapid-transit network around Belfast. As regards sustainable transport, capital is available in 2011-12 to try to bring forward the Belfast on the Move initiative, which has been presented to the Committee previously. It also allows the progression of a number of other key public transport initiatives, such as the Derry cross-city bus priority measures, and working with the private sector to explore opportunities to utilise new and emerging technologies in areas such as ticketing and passenger information and to help to promote that modal shift to public transport. It also supports the Office for Low Emission Vehicles (OLEV), which has been awarded funding to support the installation of the charging infrastructure for electric vehicles that throughout Northern Ireland. There will be opportunities to carry out pilot demonstration projects on active travel.

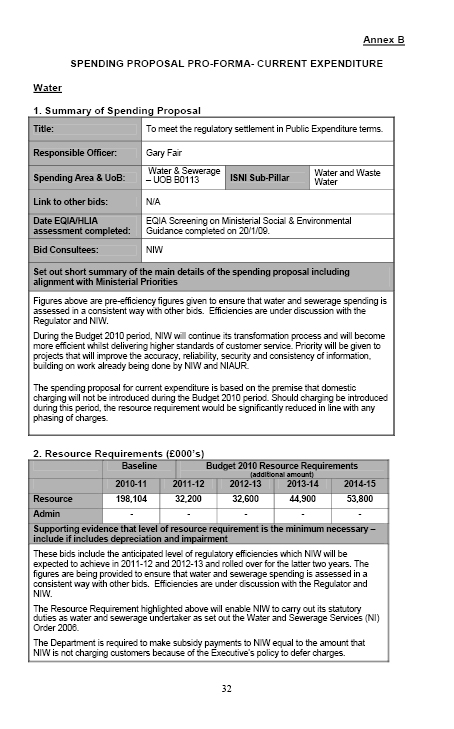

16. Members will be aware that, in April 2010, the Executive agreed investment priorities for water and sewerage. The priorities are to improve that infrastructure, to deliver sustainable and affordable levels of service to customers and to meet the EU compliance requirements to which we are obligated to adhere. Proposals for the level of investment to meet those priorities are based on the Utility Regulator’s assessment of what funding NIW needs. That was set out in the price control (PC) 10 final determination to cover the period to 2013.

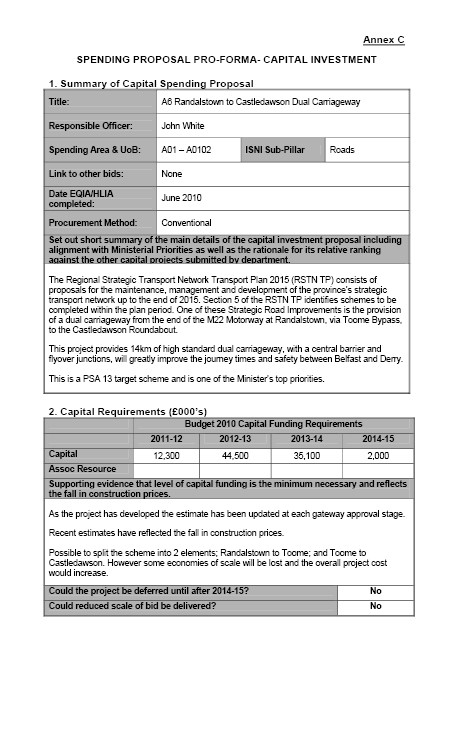

17. The investment targets the need to maintain the high level of drinking-water quality and waste-water treatment, which, last year, were the highest that had been achieved. In relation to sustainability, planned investment will be targeted at reducing leakage and increasing the amount of energy obtained from green sources. The regulator has set some extremely challenging efficiency targets in that regard. To deliver those improvements, NI Water has embarked on a fairly extensive capital works programme over the PC10 period and has delivered 900 km of water mains for rehabilitation; four new trunk main schemes; quality improvements at two water treatment works; increased capacity at 13 service reservoirs, renewal of more than 70 km of sewers and quality improvements at 43 waste-water sites. NI Water has also addressed more than 100 intermittent sewage discharges that were unsatisfactory.

18. The recent interruptions to water supplies over the Christmas period highlighted the ongoing need for adequate investment in the water and sewerage infrastructure, and investment in years one and four of the Budget period is largely as expected. However, in years two and three, only three quarters of the desirable level of investment in water infrastructure will be afforded. It would have been even less than that had we adhered to the Department of Finance and Personnel (DFP) proposals, but we have bolstered that investment from other programmes.

19. Although there are some problematic funding issues in years two and three, it is still a significant level of investment: £203 million in year, £145 million in year 2, £140 million in year three and £180 million in year four of the Budget period. That uneven profile presents its own challenges in relation to delivery and it makes capital project profiling more difficult. NIW is considering the implications of that on the quantum of the spend. We work closely with the Utility Regulator on those issues.

20. The Executive will seek to claw in more revenue through the Budget period, and should any additional funding become available, we will allocate that to the priority projects to which I referred, such as the Knockmore and Lurgan railway, projects to advance road schemes on the A6 and water investment.

21. I mentioned that the current expenditure reductions will also be difficult to manage. DRD is the only spending Department that will take a year-on-year reduction over the four-year period. Indeed, our proportional reduction is higher than that of the other main spending Departments, falling by 12·2% in 2014, which is equivalent to about £62 million in that year alone. The reduction in current expenditure over the four-year period of the Budget is £163 million. The Department is treating those reductions as the overall savings target, but there are some other proposals to make further savings in order to allocate additional funding to help with the railway public service obligation (PSO) pressures.

22. It has been a difficult task to identify that level of savings. We have reviewed programmes right across DRD, and the only real areas of our budget that are being untouched are roads, PPP payments, public liability claims and PSO, for obvious reasons. We can divide the savings into the three areas. On roads, there are £85 million of savings, and we have to effect an increase in income generation to reduce the pain of some of those savings. To generate income, we propose to increase existing car-parking tariffs by an average of 15% in each of the four years; increase the penalty for parking illegally from £60 to £90; introduce on-street parking charges into all towns and cities covered by the subregional transport plan; and extend the charging hours for all car parks and on-street car-parking places.

23. Further savings have been identified in technical adviser costs, depreciation, street-lighting energy contracts and a revised car-park services contract and maintenance. Full details are set out in the savings delivery plans. Members have not had a chance to study those yet, but they will be able to do so in the coming days. However, the draft Budget provides for existing levels of winter maintenance, and, based on average winter weather, Roads Service considers that provision to be adequate.

24. As far as public transport savings are concerned, the impact of the draft Budget on NITHCo is particularly difficult. No bids have been met to address the existing pressures, let alone the new pressures that we face. Therefore, reductions in current expenditure have been restricted to £9·5 million for the two bus companies over the Budget period. However, that must be viewed in the context of more than £50 million of pressures that have not been met: £30 million on the bus side and more than £25 million on the railway side.

25. The exact level of unfunded pressures is difficult to compute — it will depend on trends in concessionary travel, fuel duty and levels of rail service — but we estimated it based on recent trends. The pressures will probably be most pronounced in Northern Ireland Railways, particularly in the initial Budget period, but they will also apply to bus services. The draft Budget must be considered in the context of the overall NITHCo group’s financial position and the impact that the proposal for savings will have on its profitability. I am sure that NITHCo and Translink will provide you with more information on that front.

26. The overall impact of savings and unfunded pressures on the two bus companies will result in a combination of fare increases and efficiency savings above the level set out in the outline business case for public transport reform. Despite anticipated increases in concessionary travel and fuel duty, the draft allocations restrict the level of revenue support for the bus companies. That will require Translink to consider further ways of reducing costs and generating income, including from the fare box. To achieve further significant efficiency savings, it will be necessary to reduce services in Belfast and across the Ulsterbus network. That will be based on current and projected usage. Service reductions could lead to job losses, and Translink will need to bear redundancy costs, if there are any.

27. The overall impact of existing unfunded pressures on Northern Ireland Railways is fairly immediate. The projected shortfall in the level of public subsidy required in the context of the network’s increasing costs, which resulted from the introduction of new trains, employer pension costs and rates and tax changes, is likely to result in fare increases, service reductions and possible redundancies, or some combination of those three. NITHCo itself will need to bear the costs of any redundancies. To mitigate the pressure on railways over the Budget period, the Department proposes to allocate about £13 million internally from additional savings and from a reclassification of capital expenditure. That is designed to help ease the existing and projected public service obligation pressures.

28. DRD is discussing with NITHCo the implications of the funding available — indeed, I will meet NITHCo this afternoon — and the impact of the savings and unfunded pressures on Translink. NITHCo will produce its corporate plan to show exactly how it will address the savings and what the impact on the business will be. However, it will not be able to do that finally until the Budget is ultimately agreed.

29. The proposals also include some scaling back of the rural transport fund, the transport programme for people with disabilities, the Rathlin ferry service, the concessionary fares policy, technical advisers and public transport reform. We will try to keep the level of that scaling back to a minimum, and every effort will be made to maintain the integrity of those programmes on the ground.

30. As far as ports are concerned, you will be aware that the Belfast Harbour Commissioners are exploring options to release the moneys identified in the Executive paper: £5 million capital in year one and £15 million current expenditure in each of years three and four. The Belfast Harbour Commissioners are working with the Department and have been asked to report to the Budget review group by around the end of February.

31. As far as water and sewerage are concerned, the Committee will be aware that NIW has already been through the price control process and that savings of £34 million went towards DRD’s 2010-11 savings target. Those savings had to be rolled forward into the current Budget period, and, therefore, there is less capacity to generate additional savings. However, the provisions pressure that NIW faces is expected to be less in 2012-13 than it was this year. Additional funding savings totalling about £19 million can, therefore, be identified from that year.

32. As far as administration is concerned, no allocations have been made to existing programmes or to the administration budget. However, the Department will have to absorb pay progression, other inflationary pressures and potentially increased hard charging from DFP for shared services. That is in the context of already having delivered administration savings of £5·4 million in 2010-11 and transferring £5·8 million to DFP for shared services. The Department proposes to absorb the administration pressures by natural wastage and by any savings that might become available when we work through the full implications of the Budget on staffing.

33. As regards switching money between capital and current resource budgets, I mentioned earlier that, to mitigate the pressure on PSO, the Department proposes to reclassify nearly £8 million from capital over the Budget period, which should help. The Department also proposes to reclassify a further £7·8 million from capital to current to mitigate the significant current expenditure reductions that we will face in year four.

34. That was a long overview, but, in conclusion, the draft Budget is a very difficult settlement for the Executive and for DRD. I took the decision not to sugar-coat the information to the Committee today.

35. The Chairperson: I hope that you have not done so, Malcolm.

36. Dr McKibbin: People need to understand the implications of these cuts to our budget. They are not without pain to the Department and to the receivers of services. The Committee must be fully aware of that when considering the matter. Although we have been allocated capital funding to take forward a range of capital schemes, we wanted to do significantly more, particularly in the areas of road improvements, maintenance and PSOs. The Committee will also be aware that our programmes support the construction industry through jobs and the contribution that those make to the economy. As I said, we will, quite clearly, have to examine ways of increasing income generation and of addressing the unfunded pressures in NITHCo.

37. However, we are all conscious that the Executive are working within a fixed sum and that, if money is found for one area, another area will have to go without. Nevertheless, I would welcome the Committee’s initial impressions — although, by the look on your face, Chairperson, I am not so sure. Once we get into the detail of what lies ahead of us in the consultation, a number of stakeholders and others will say that they need more of this, that and the other. I agree with them; we certainly will want more money. However, it will have to be put to them that, if they want more in one area, we would welcome their assistance in indentifying a lower priority area in which they believe that expenditure should be reduced. We would find that particularly helpful, rather than simply receiving claims for further expenditure.

38. That is as much as I wish to say at the moment. We are happy to take questions and/or comments.

39. The Chairperson: These are the first cuts that we have had of this nature, and, speaking for myself, I am stunned by some of them. I have several concerns: the vast majority of money is being spent on two roads and, despite this Committee’s supporting public transport over many years and encouraging the Department to provide new trains and buses and more access to public transport, we are now in reverse. We will have less public transport, dearer fares and a reduced service.

40. Secondly, over the years, Committee members have spent a huge amount of time discussing rapid transit, thinking that we were in the process of delivering such a system. I am disappointed to hear that there will be no movement on that.

41. I am also concerned about rural transport. We have discussed the issue of people who live in rural areas and are socially excluded from society and how we can help them. The move to address that has practically disappeared. I could go on and on, but members of the Committee will have their say.

42. I have chaired the Committee for four years, since the beginning of the mandate. Members of the Committee had a vision of what they wanted to achieve in public transport and had a new vision for Northern Ireland based on that. Part of that vision was that cars would be taken off the road and that people would use trains and buses, which would have had a positive environmental impact on us all. All of that has been destroyed. The Committee will have to go through the proposals. These are only my initial remarks.

43. The other issue that genuinely worries me, and has worried the Committee from the beginning, is that of road maintenance. Many companies skip maintenance for a couple of years when they get into financial difficulty, because it is an easy way out. This is the fifth year in which there has been a huge underspend on road maintenance. The red lights have been flashing: outside experts told us that you spent 40% less on road maintenance than you should. That has been happening over a protracted period. Other members can give their views, but I have noticed deterioration even on main roads, never mind rural roads. I wrote down what you said about road maintenance during “average winter weather". Will somebody explain to me what constitutes average winter weather?

44. I must say that I am deeply disappointed by your proposals.

45. Mr McDevitt: Mr McKibbin, before you even published your spending plan, your Department was the big loser in the draft Budget, was it not?

46. Dr McKibbin: On the resource side, there are significant reductions.

47. Mr McDevitt: Therefore, it is clearly not a political priority for anyone.