Session 2007/2008

Sixteenth Report

PUBLIC ACCOUNTS COMMITTEE

Report on Northern Ireland Tourist Board – Contract to Manage the Trading Activities of Rural Cottage Holidays Limited

TOGETHER WITH THE MINUTES OF PROCEEDINGS OF THE COMMITTEE

RELATING TO THE REPORT AND THE MINUTES OF EVIDENCE

Ordered by The Public Accounts Committee to be printed 17 June 2008

Report: 35/07/08R Public Accounts Committee

This document is available in a range of alternative formats.

For more

information please contact the

Northern Ireland Assembly, Printed Paper

Office,

Parliament Buildings, Stormont, Belfast, BT4 3XX

Tel: 028 9052

1078

Public Accounts Committee

Membership and Powers

The Public Accounts Committee is a Standing Committee established in accordance with Standing Orders under Section 60(3) of the Northern Ireland Act 1998. It is the statutory function of the Public Accounts Committee to consider the accounts and reports of the Comptroller and Auditor General laid before the Assembly.

The Public Accounts Committee is appointed under Assembly Standing Order No. 51 of the Standing Orders for the Northern Ireland Assembly. It has the power to send for persons, papers and records and to report from time to time. Neither the Chairperson nor Deputy Chairperson of the Committee shall be a member of the same political party as the Minister of Finance and Personnel or of any junior minister appointed to the Department of Finance and Personnel.

The Committee has 11 members including a Chairperson and Deputy Chairperson and a quorum of 5.

The membership of the Committee since 9 May 2007 has been as follows:

Mr Paul Maskey*** (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr Thomas Burns** Mr Trevor Lunn

Mr Jonathan Craig Mr Mitchel

McLaughlin

Mr John Dallat Ms Dawn Purvis

Mr Simon Hamilton Mr Jim

Wells*

Mr David Hilditch

* Mr Mickey Brady replaced Mr Willie Clarke on 1 October 2007

* Mr Ian McCrea replaced Mr Mickey Brady on 21 January 2008

* Mr Jim Wells replaced Mr Ian McCrea on 27 May 2008

** Mr Thomas Burns replaced Mr Patsy McGlone on 4 March 2008

*** Mr Paul Maskey replaced Mr John O’Dowd on 20 May 2008

Table of Contents

List of abbreviations used in the Report

Report

Executive Summary

Summary of Recommendations

Introduction

The Ethical Standards Required from Public Officials

The Adequacy of Guidance on Handling Conflicts of Interest

The Promotion of a Culture of Open Reporting to Those with a Governance Role

Commercial Realism and Building Exit Strategies into Poorly Performing Programmes and Projects

Appendix 1:

Minutes of Proceedings

Appendix 2:

Minutes of Evidence

Appendix 3:

Clerk’s letter of 2 May 2008 to Mr Stephen Quinn CB, Accounting Officer, Department of Enterprise, Trade and Investment

Correspondence of 21 May 2008 from Mr Stephen Quinn CB, Accounting Officer, Department of Enterprise, Trade and Investment

Appendix 4:

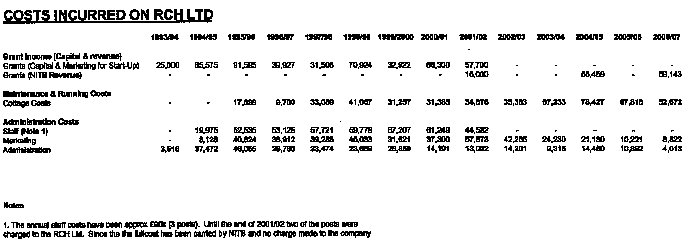

List of Witnesses

List of Abbreviations used in the Report

LEDU Local Enterprise Development Agency

The Department Department of Enterprise, Trade and Investment

The Tourist Board Northern Ireland Tourist Board

C&AG Comptroller and Auditor General

CIPFA Chartered Institute of Public Finance and Accountancy

DFP Department of Finance and Personnel

NICS Northern Ireland Civil Service

Executive Summary

Introduction

1. This report addresses two main areas of concern – shortcomings in the handling of a senior official’s conflicts of interest by the Northern Ireland Tourist Board and the Tourist Board’s commercial involvement at the public expense, in activities related to holiday cottage accommodation.

2. Government departments and their sponsored bodies administer large sums of public money and are responsible for the proper conduct of public business. This Committee and the public expect that Government bodies will do this to the highest standards. When conflicts of interest are not disclosed or managed properly this undermines public confidence in the standards of public administration.

3. Good governance has been a major theme of this Committee’s work and the effective and transparent management of conflicts of interests has been a key aspect of this work. This is not difficult but simply a basic principle of good public administration.

4. This case is one in a string of conflicts of interest with which this Committee has had to deal. The Committee considers this is an important case study as it provides valuable lessons to the wider public sector on how to deal with, and how not to deal with, conflicts of interest.

5. Lessons have also been set out in this report for public bodies when they engage in commercial activities. The initial business plan envisaged the company would break even and become self sustaining in three years. A decade and a half on, the company is still losing money. The public expects that public money will be committed only after a careful and realistic assessment of commercial prospects, and having provided for an economical way out if things go wrong. The Committee reiterates the warning given in 2001 that departments need to be alert to the dangers of optimistic assumptions in investment decisions.[1]

The Ethical Standards Required from Public Officials

6. This Committee, in its report on the ‘Hospitality Association of Northern Ireland: A Case Study in financial management and the public appointments process’[2] said it expects the senior public officials to show real leadership in relation to upholding probity and standards in public life. This case demonstrates that chief executives of arm’s length bodies also need to provide clear leadership on ethical issues. It is essential that they instinctively recognise the dangers of conflicts, actual or perceived and get to grips with them when they come to light.

7. A personal relationship in public business almost invariably creates a situation which is at least capable of being perceived as prejudicial to the public interest. The appropriate response to potential conflicts of interest will almost always be that the official should declare that interest, it should be recorded, and he or she should withdraw from involvement with any aspect of the case.

The Adequacy of Guidance on Handling Conflicts of Interest

8. The Committee was disappointed that lessons had not been learned from cases of conflicts of interest previously examined – including a previous Public Accounts Committee report on the Tourist Board in 2002[3]. Over time, cases such as this erode the public’s trust in the behaviour of senior officials. The Committee agrees with the Department of Finance and Personnel’s view, expressed by the Treasury Officer of Accounts, that guidance is and should remain based on principles. The Committee was told it would be impossible have a rule for every situation. The session also highlighted, however, that officials who are faced with conflicts of interest would benefit from more accessible guidance on assessing, managing and reporting conflicts.

9. Although witnesses were generally content with the guidance currently available on conflicts of interest, the Committee considers that there is considerable potential for it to be improved and strengthened. It also needs to be consolidated into a short, straightforward guide that is readily available to public officials. It would be particularly useful for recruits from the private sector if the guidance gave worked examples of the principles being applied.

10. The Committee has previously emphasised the importance of whistle-blowing and the importance of achieving full compliance with the requirement for whistle-blowing policies[4]. Sometimes when things go wrong, as in this case, the involvement of whistle-blowers is the reason that the truth comes out. Robust and well-publicised arrangements are an important alert system and this case illustrates their value.

The Promotion of a Culture of Open Reporting to Those with a Governance Role

11. The Committee emphasises that senior officials must be open and forthcoming with Board members and, in the case of arm’s length bodies, with sponsoring departments. Officials must provide them with the information they need to make properly informed judgements. If officials are not open with those who are best placed to advise them, they should not be surprised when things go wrong.

Commercial Realism and Building Exit Strategies into Poorly Performing Programmes and Projects

12. By the time the Tourist Board came to let the Rural Cottage Holidays contract, the business was run down and in a very weak financial position. The Tourist Board did not have an exit strategy in place from the outset and it is still trying to find a way out.

13. The Committee was told that getting involved in the scheme in the first place, back in the 1990s, when the situation in Northern Ireland was very different from today, was a classic case of “optimism bias” in economic appraisal. This was an understatement. It has cost the taxpayer several hundreds of thousands of pounds to date and the onerous outstanding lease commitments are still costing public money. The Committee considers that the positive financial outlook painted for the venture in the 1990s was even less realistic then that it appears today, and at no stage was the company likely to be commercially viable.

Summary of Recommendations

The Ethical Standards Required from Public Officials

1. The Committee recommends that the most appropriate response to any potential conflict of interest must be that the official should declare that interest, it should be recorded, and, if appropriate, he or she should withdraw from involvement with any aspect of the case. All personal relationships between public officials and people they have contact with in an official role should be treated in the same way as any business relationship (see paragraph 18).

3. The Committee recommends that, where conflicts cannot be avoided because there are exceptional and persuasive reasons for continuing involvement, strong mitigating controls must be put in place to ensure that the principles of objectivity and integrity are not compromised. The decision to manage the conflict and the adequacy of the controls implemented should be documented and approved by a senior official. Any conflicts that are managed rather than avoided should be reported to audit committees who should ensure that the controls are adequate and have been applied effectively (see paragraph 19).

4. The Memorandum issued to Accounting Officers on their appointment makes clear their duty to uphold high standards of propriety. The Committee recommends that, as part of this Departmental Accounting Officers should ensure that their arm’s length bodies have provided staff with adequate training on ethical issues. Particular attention should be given to the quality of induction training and mentoring for officials recruited from the private sector (see paragraph 20).

5. The Committee recommends that each Department should designate an existing senior official as being responsible for supporting the Accounting Officer on ethical matters and for monitoring on and advising on ethical behaviour across the Department and its arm’s length bodies. The Committee sees this as analogous to the developing practice in the private sector and the requirement for private sector accounting firms to have a designated ethics partner (see paragraph 21).

The Adequacy of Guidance on Handling Conflicts of Interest

6. The Committee recommends that the Department of Finance and Personnel should issue a short guide consolidating the guidance on conflicts of interest, including succinct case studies, so all public officials have a handy guide to avoiding, recognising, recording and managing conflicts of interest. Such a document would be especially useful to recruits from the private sector who are often not as familiar with public sector standards and who are quite likely to encounter conflicts of interest, having moved to the public sector (see paragraph 26).

7. The Committee recommends that a test of public perception should be an important aspect of determining whether action is required for potential conflicts of interests. Finely honed arguments about what may or may not be prejudicial to the public interest may well be made but the public will always be wary of perceived favouritism by officials (see paragraph 27).

8. The Committee recommends that the Department of Finance and Personnel ensures that all public bodies have robust, well publicised (internally and externally) whistle-blowing arrangements in place (see paragraph 28).

The Promotion of a Culture of Open Reporting to Those with a Governance Role

8. The Committee emphasises that Board and Audit Committee roles must be fully respected. They are responsible for ensuring the proper governance of public bodies and officials must be open with them (see paragraph 36).

9. The Committee recommends that when officials commission independent reports on governance matters they must provide them to their audit committees and sponsoring departments. Commissioning such reports is not done lightly and it is self-evident that their results should be reported in an open and timely manner (see paragraph 37).

10. The Committee recommends that all departments obtain regular assurance statements from their arm’s length bodies. The Committee expects reports on governance matters to feature in assurance statements. It is clear that the standard of regular assurance obtained depends on full and open disclosure, particularly from sponsored bodies (see paragraph 38).

Commercial Realism and Building Exit Strategies into Poorly Performing Programmes and Projects

11. The Committee recommends that a reasonable balance must be achieved in the equitable sharing of risks and rewards in projects between the private and public sectors. Both in terms of renovating the 11 cottages and the marketing operation, this case highlights what can go wrong when the public sector dabbles in commercial activities. The cottage owners secured exceptionally favourable terms with the Tourist Board in the 1990s as did the agent when it offloaded the contingent liabilities to the public sector in 2005 (see paragraph 44).

12. The Committee recommends that credible exit strategies should be a condition of approval for long term commitments. The various reviews described to the Committee in this case have not led to a clear way out. The Committee is amazed that the Department and Tourist Board let Rural Cottage Holidays drift on for so long. The Committee wishes to be kept informed of the progress towards ending these onerous public sector financial commitments and expects a report on the cost of doing so (see paragraph 45).

13. Time and again this Committee has examined the unfortunate consequences when the public sector sets up companies to distribute taxpayers’ money, for example, LEDU, the Emerging Business Trust, the NI Events Company and now Rural Cottage Holidays is just another. The Committee expects that where any new companies are set up there must be an undoubted case for doing so. Where this is the case, which should be rare, the Committee would wish that the Department of Finance and Personnel rigorously ensures that the business case and governance, accountability and financial management arrangements are watertight (see paragraph 46).

Introduction

1. The Public Accounts Committee met on 1 May 2008 for an evidence session with the Department for Enterprise, Trade and Investment (the Department) and the Northern Ireland Tourist Board (the Tourist Board). The session related to the Comptroller and Auditor General’s (C&AG’s) report: “Northern Ireland Tourist Board: Contract to Manage the Trading Activities of Rural Cottage Holidays Limited”.

2. The witnesses were:

- Mr Stephen Quinn CB, Accounting Officer, Department of Enterprise, Trade and Investment;

- Mr Alan Clarke, Chief Executive, Northern Ireland Tourist Board;

- Ms Kathryn Thomson, Chief Operating Officer, Northern Ireland Tourist Board;

- Mr David Thomson, Treasury Officer of Accounts; and

- Mr Kieran Donnelly, Deputy Comptroller and Auditor General.

3. The Committee examined the C&AG’s report on the Tourist Board’s management of a number of conflicts of interest, arising at various different times, on the part of one of its senior officials.

4. This case shows what happens when public bodies do not fully manage a conflict from the start. Mistakes made at the outset left the Tourist Board open to criticism of undue favouritism, particularly given the late disclosure of the first conflict and the way it developed.

5. The case also highlights the very serious consequences for the senior official concerned in failing to declare fully his conflicted business relationship. All public officials have an overriding duty of candour. The senior official’s dismissal should send out a clear signal to all public officials on the importance of understanding and espousing the highest standards of integrity expected from public officials. The Committee welcomes the strong action ultimately taken by the Tourist Board.

6. The Committee considered the Tourist Board’s involvement with Rural Cottages Holidays from the 1990s onward. The Committee recognises the different economic circumstances and Government priorities that existed when support was provided to rural tourism at that time. The sales and marketing operation was clearly a long term loss making project which the 200 rural cottage owners could use at their discretion during the low season. There was no exclusive agreement with them to use the booking system and consequently it must have been a cheap service available to rural cottage owners.

7. The Committee is concerned that the Tourist Board also locked itself into a deal that afforded significant advantages to the cottage owners, whose derelict properties were renovated and continue to be maintained into the long term at public expense. These arrangements clearly did not provide value for money and were packaged in a way that the Tourist Board cannot easily get out of.

8. In taking evidence on the C&AG’s report, the Committee focused on four main issues. These were:

- the ethical standards required from public officials;

- the adequacy of guidance on handling conflicts of interest;

- the promotion of a culture of open reporting to those with a governance role;

- commercial realism and building exit strategies into poorly performing programmes and projects.

The Ethical Standards Required

from Public Officials

9. Public officials must declare and make known their interests so that an independent assessment can be made as to whether the conflict can be avoided or, if not, effectively managed. Equally, Accounting Officers are responsible for providing clear, decisive leadership on ethical standards to public officials. The Department told the Committee that it operated interlocking mechanisms which are designed to develop a culture of awareness of the ongoing importance of corporate governance and financial control that would include managing potential conflicts of interest.

10. In its evidence to the Committee, the Tourist Board fully accepted that it had made some mistakes in handling the conflicts of interest in this case. The Chief Executive said that, if circumstances similar to those which emerged in February 2005, that is, the disclosure by the senior official of a friendship with one of the bidders for the contract, came to light now, he would respond differently. The Tourist Board told the Committee that, although a personal relationship existed, it was not prejudicial to the public interest. Nevertheless the Tourist Board acknowledged that it would have been much better, from a perception point of view, to have removed the official from the process immediately.

11. The Committee considers that a personal relationship in public business will almost always create a situation which is at least capable of being perceived as prejudicial to the public interest. This case demonstrates this clearly. All public officials must be alert to this risk.

12. The Committee acknowledges that the Tourist Board assigned responsibility for the assessment of the bids to the then Finance Director and that this was an important step in managing the risk. But the failure to remove the official from the negotiations showed a lack of understanding of the risks associated with the disclosure. The Committee notes that the disclosure of the friendship in February 2005 was some three months after the official was aware that his friend’s company was one of the bidders, during which time he was in charge of the negotiations. The fact that this belated disclosure was not recorded and that minutes were not kept of discussions with him were important failures of procedure and led to a disagreement over the timing of the declaration of the conflict. The delay in disclosure in itself should have been an immediate cause for concern and led to his immediate removal from the procurement process. By not doing so there was, at the very least, a perception of favouritism. The Department admitted that, by not doing so, this left a residual concern about public perception and about whether the official was making information available to a third party.

13. A feature of this case was the rolling nature of disclosures. The Tourist Board said that by November 2005, when it became aware that the official’s wife was working for his friend, concerns were already being raised. Much was made by the Tourist Board in its evidence of its subsequent reliance on legal advice and a consultant’s report.

14. From an early stage, it was obvious that a conflict of interest existed. The Committee is of the view that the legal advice and consultant’s report served to drag out the process and hindered prompt notification to those who should have been told what was going on, and in particular, the Audit Committee. Even if there had been room for doubt as to the significance of what was emerging, the appropriate response would have been for it to have been recorded, reported and the relevant official withdrawn from any involvement with Rural Cottage Holidays.

15. The Committee considered whether adequate training was provided in the exacting ethical standards of conduct and behaviour required of public officials. The official concerned was damning about the poor quality of training provided to him. The Tourist Board denied this and told the Committee that the training provided included training in public accountability and the offer of the assistance of a mentor in Invest NI, as he had been recruited from the private sector. The Department told the Committee that, by and large, it leaves the design and delivery of induction training and guidance in public sector ethics to its non-departmental public bodies and does not monitor it routinely.

16. The Committee was told that many individuals recruited into the Department and its arm’s length bodies will already have a professional background. The Department noted that they include people who are qualified accountants and company secretaries who are fully exposed to issues of corporate governance and financial control by virtue of their professional training and development. For example, the Committee was advised that it was a member of the corporate finance group in Invest NI who spotted the problems in the Emerging Business Trust. While the Committee accepts that professional qualifications are an important source of financial skill, public sector standards of propriety and accountability are not necessarily part of the professional training, particularly for those who qualified while in the private sector.

17. The Committee is concerned at the number of poorly managed conflicts of interest that are reported to it and considers that there is an insufficient awareness of the high standards expected in the proper conduct of public business, which in part, may be due to the quality and frequency of training. The Committee was concerned that the Department was not much more pro-active in ensuring its arm’s length bodies (such as Invest NI and the Tourist Board) had provided their staff with adequate training on ethical issues.

Recommendation 1

18. The Committee recommends that the most appropriate response to any potential conflict of interest must be that the official should declare that interest, it should be recorded, and, if appropriate, he or she should withdraw from involvement with any aspect of the case. All personal relationships between public officials and people they have contact with in an official role should be treated in the same way as any business relationship.

Recommendation 2

19. The Committee recommends that, where conflicts cannot be avoided because there are exceptional and persuasive reasons for continuing involvement, strong mitigating controls must be put in place to ensure that the principles of objectivity and integrity are not compromised. The decision to manage the conflict and the adequacy of the controls implemented should be documented and approved by a senior official. Any conflicts that are managed rather than avoided should be reported to audit committees who should ensure that the controls are adequate and have been applied effectively.

Recommendation 3

20. The Memorandum issued to Accounting Officers on their appointment makes clear their duty to uphold high standards of propriety. The Committee recommends that as part of this, Departmental Accounting Officers should ensure that their arm’s length bodies have provided staff with adequate training on ethical issues. Particular attention should be given to the quality of induction training and mentoring for officials recruited from the private sector.

Recommendation 4

21. The Committee recommends that each Department should designate an existing senior official as being responsible for supporting the Accounting Officer on ethical matters and for monitoring on and advising on ethical behaviour across the Department and its arm’s length bodies. The Committee sees this as analogous to the developing practice in the private sector and the requirement for private sector accounting firms to have a designated ethics partner.

The Adequacy of Guidance on

Handling Conflicts of Interest

22. The Tourist Board told the Committee that reasonably robust guidelines on conflicts of interest were in place at the time of the initial disclosure in February 2005. These were enhanced in 2006 as a result of the independent consultant’s findings following the disclosure of a further conflict involving the senior official and the interested party in the original conflict. Guidance used included the code of conduct contained within the staff handbook. The conflict was assessed using guidance issued by the Chartered Institute of Public Finance and Accountancy (CIPFA). Yet the Tourist Board admitted that mistakes were still made.

23. The Department and the Department of Finance and Personnel (DFP) told the Committee that the current guidance on conflicts was accessible, robust and serviceable, based on the fundamental principle that public servants must always be aware of the potential for conflicts of interest. Both Departments pointed out that civil servants should look to the Northern Ireland Civil Service’s (NICS) Code of Ethics and the NICS Staff Handbook, documents addressed to civil servants and issued by DFP. The Committee was advised that there are also references to the need to avoid conflicts of interest in guidance available to the wider public sector, including Government Accounting and in a range of documents issued by Her Majesty’s Treasury. DFP had concluded that the guidance was sufficient and that it was impossible to have a rule for every situation.

24. The Committee completely agrees that guidance should be principles based. Nevertheless, the Committee notes that despite all of this guidance being available, it was still not sufficient in this case to prevent the mistakes which the Department and Tourist Board both acknowledged were made. Indeed further guidance from an accountancy body was needed to assess whether the conflicts were prejudicial to the public interest. Both the Department and the Tourist Board fully accepted that the official should have been removed from the case when he first notified the Tourist Board of his friendship with a bidder.

25. This case also demonstrates that whistle-blowers can make a real impact in raising concerns over poor standards of public administration. Sometimes the involvement of whistle-blowers is the only means by which the truth comes out, for example, when an interest is not disclosed, deliberately or otherwise.

Recommendation 5

26. The Committee recommends that the Department of Finance and Personnel should issue a short guide consolidating the guidance on conflicts of interest, including succinct case studies, so all public officials have a handy guide to avoiding, recognising, recording and managing conflicts of interest. Such a document would be especially useful to recruits from the private sector who are often not as familiar with public sector standards and who are quite likely to encounter conflicts of interest, having moved to the public sector.

Recommendation 6

27. The Committee recommends that a test of public perception should be an important aspect of determining whether action is required for potential conflicts of interests. Finely honed arguments about what may or may not be prejudicial to the public interest may well be made but the public will always be wary of perceived favouritism by officials.

Recommendation 7

28. The Committee recommends that the Department of Finance and Personnel ensures that all public bodies have robust, well publicised (internally and externally) whistle-blowing arrangements in place.

The Promotion of a Culture of Open Reporting to those with a Governance Role

29. One of the most surprising features of this case was that the Tourist Board’s Audit Committee and Board were not told about the conflict until very late in the day. Furthermore, the significant change in the final agency agreement, with the liabilities being retained by the public sector, was not communicated to the Board. Clearly it should have been.

30. In recent years, the roles of Boards and Audit Committees have become very well defined. They are now a crucial part of the corporate governance set up in the public sector and provide the type of checks and balances that are absolutely necessary at the top of any well run organisation. In this case officials took advice from legal advisers, consultants and the Department’s internal auditors – and no doubt good advice was obtained from these sources. However, the Committee is concerned that not only was advice not sought from the Board and Audit Committee, they were not even told what was going on until the very end of the matter.

31. The Committee put it to the Department that a secrecy culture remains at the Tourist Board. This was not accepted by the Department, although it acknowledged that there were shortcomings in formal recording and reporting. The Department said that there have been considerable improvements in the Tourist Board’s systems and controls since the previous Public Accounts Committee severely criticised it in 2002. This was acknowledged in the C&AG’s report.

32. The Committee accepts that the Tourist Board has progressed from a low point in 2002 and made very necessary improvements. However, the Committee encourages the further promoting and embedding of a culture of openness and disclosure.

33. The Committee noted that the independent consultant’s report was not presented to the Board of the Tourist Board or the Department as recommended by the consultants. The Department of Finance and Personnel pointed out that any report prepared by consultants containing significant issues of concern should be passed to the Audit Committee once such issues had been assessed by management. This case illustrates what can go wrong when reports do not reach the Audit Committee or the Northern Ireland Audit Office. If officials are not open with those who are best placed to advise them, they should not be surprised when things go wrong.

34. The Department described an interlocking mechanism of monitoring systems intended to mutually reinforce each other and keep good governance very much on the radar of all senior staff in the Department and non-department public bodies. The Accounting Officer noted that he personally sees and comments on all internal audit reports and indeed reviews, in advance, draft reports that indicate limited opinions. The Committee was impressed with the direct and timely interest in governance reports taken at the very top of the organisation.

35. The Committee probed why these mechanisms did not work in this case and why a reference to the conflict of interest at the Department’s Audit Committee was not followed up. The Department’s Accounting Officer said he had racked his brains about that and his best recollection is that it was mentioned in general terms as a potential conflict that was being managed. He was vexed that it was not minuted. This Committee is of the view that the reference to the matter at the Audit Committee must have been very vague for this Accounting Officer not to have noted it. In any case, it clearly should have been minuted. A senior official in the Department was told about it by phone in January 2006, but no record was made of the call. The Department accepted that the case had been handled very casually at times. The Committee was told the best way to have dealt with it formally would have been through quarterly assurance statements from the Tourist Board to the Department but that they were, at that time, newly introduced and had not been properly completed.

Recommendation 8

36. The Committee emphasises that Board and Audit Committee roles must be fully respected. They are responsible for ensuring the proper governance of public bodies and officials must be open with them.

Recommendation 9

37. The Committee recommends that when officials commission independent reports on governance matters they must provide them to their audit committees and sponsoring departments. Commissioning such reports is not done lightly and it is self-evident that their results should be reported in an open and timely manner.

Recommendation 10

38. The Committee recommends that all departments obtain regular assurance statements from their arm’s length bodies. The Committee expects reports on governance matters to feature in assurance statements. The standard of regular assurance obtained depends on full and open disclosure, particularly from sponsored bodies.

Commercial Realism and Building Exit Strategies into Poorly Performing Programmes and Projects

39. The Tourist Board told the Committee that Rural Cottage Holidays had a wide remit geared towards stimulating the rural economy and providing real gains to the economy. The Department told the Committee that it was set up in the 1990s when the situation in Northern Ireland was very different from today. The Tourist Board admitted it is unlikely that it would address these issues by setting up a limited company now. This method of structuring the project has complicated any exit strategy. The Department told the Committee that the 200 cottage owners who used the sales and marketing service, including the booking system, were meant to be the ultimate beneficiaries of the policy and that the whole point of the project was to create revenue that would flow to the owners. The Department noted that the lack of an exclusivity deal was of great benefit to the owners. Rural Cottage Holidays was used only as a vehicle to top up less saleable periods in the year.

40. The Tourist Board presented the Committee with a rather forlorn picture of Rural Cottage Holidays’ financial viability in the run up to the agency agreement to offload the sales and marketing function. It said that the company was struggling to provide a service and the brand and reputation were deteriorating. There was little interest due to the low value of the brand and the company’s poor trading history. The Department told the Committee that if the company’s contingent liabilities were allowed to be a deal breaker, and to block the late proposal of the preferred bidder to change the procurement from an outright sale of the company to an agency agreement, its accumulating losses would have been left with the taxpayer. The Committee is disappointed that the Department allowed this situation to get to this non negotiable position. Rural Cottage Holidays should never have been allowed to be a burden on the public purse for so long.

41. It very much looks as though the only winners are the owners of the properties rather than the wider rural economy or the public purse. Derelict properties were renovated using mostly public money. Public money was and is committed to carrying out maintenance and repairs and after the 21 year lease expires these properties revert to the owners. The Department advised the Committee that some £500,000 had been spent on maintenance alone between 1993-94 and 2006-07, including some £53,000 spent in 2006-07. Cottage owners’ maintenance costs continue to be an on going cost to the taxpayer. This was an exceptionally good deal for them.

42. The Committee identified that the Tourist Board did not originally have an exit strategy. There have been numerous reviews from 1999 onwards to try to find a way out. This included testing the market in 2001 in an attempt to sell the company but no buyer was found. The Tourist Board told the Committee it now has an exit strategy involving negotiating the termination of complex lease agreements.

43. Given that Rural Cottage Holidays’ financial performance is so spectacularly different from its original objective of becoming self sustaining within 3 years, it is difficult to see how the initial case was justified, even during a period when rural tourism and the rural economy faced difficult times. The Department said that the business case was clearly based on market failure. It told the Committee that the Tourist Board and others were trying to find a way of generating revenue streams for people in rural areas, and that was a laudable policy objective. The Department admitted this was a classic case of what is now called “optimism bias” in economic appraisal. The Committee was told that if the Department were to do the same thing again, it would get a different answer with the business case.

Recommendation 11

44. The Committee recommends that a reasonable balance must be achieved in the equitable sharing of risks and rewards in projects between the private and public sectors. Both in terms of renovating the 11 cottages and the marketing operation, this case highlights what can go wrong when the public sector dabbles in commercial activities. The cottage owners secured exceptionally favourable terms with the Tourist Board in the 1990s as did the agent when it offloaded the contingent liabilities to the public sector in 2005.

Recommendation 12

45. The Committee recommends that credible exit strategies should be a condition of approval for long term commitments. The various reviews described to the Committee in this case have not led to a clear way out. The Committee is amazed that the Department and the Tourist Board let Rural Cottage Holidays drift on for so long. The Committee wishes to be kept informed of the progress towards ending these onerous public sector financial commitments and expects a report on the cost of doing so.

Recommendation 13

46. Time and again this Committee has examined the unfortunate consequences when the public sector sets up companies to distribute taxpayers’ money, for example, LEDU, the Emerging Business Trust, the NI Events Company and now Rural Cottage Holidays is just another. The Committee expects that where any new companies are set up there must be an undoubted case for doing so. Where this is the case, which should be rare, the Committee would wish that the Department of Finance and Personnel rigorously ensures that the business case and governance, accountability and financial management arrangements are watertight.

[1] Report on Grants Paid to Irish Sport Horse (NIA 4/00/R, Session 2000-01)

[2] Report on Hospitality Association of Northern Ireland: A Case Study in financial management and the public appointments process (NIA 36/07/08R Session 2007-2008)

[3] Report on the Northern Ireland Tourist Board. (NIA 01/02R, Session 2002-03)

[4] Report on Tackling Public Sector Fraud (NIA 13/07/08R, Session 2007/2008)

Appendix 1

Minutes of Proceedings

of the Committee Relating

to the

Report

Thursday, 1 May 2008

Senate Chamber, Parliament Buildings

Present: Mr Roy Beggs (Deputy Chairperson)

Mr Jonathan Craig

Mr Simon

Hamilton

Mr David Hilditch

Mr Trevor Lunn

Mr Mitchel McLaughlin

Ms

Dawn Purvis

In Attendance: Mrs Patricia Casey (Assembly Clerk)

Mrs Gillian Lewis

(Assistant Assembly Clerk)

Mrs Nicola Shepherd (Clerical Supervisor)

Mr

John Lunny (Clerical Supervisor)

Apologies: Mr John O’Dowd (Chairperson)

Mr John Dallat

Mr Ian

McCrea

The meeting opened at 2.00pm in public session, with the Deputy Chairperson in the Chair.

2.02pm Mr Hamilton joined the meeting.

3. Evidence on the NIAO Report ‘Northern Ireland Tourist Board – Contract to Manage the Trading Activities of Rural Cottage Holidays Ltd’.

The Committee took oral evidence on the NIAO report ‘Northern Ireland Tourist Board – Contract to Manage the Trading Activities of Rural Cottage Holidays Ltd’ from Mr Stephen Quinn, Accounting Officer, Department of Enterprise, Trade and Investment, Mr Alan Clarke, Chief Executive, Northern Ireland Tourist Board (NITB), and Ms Kathryn Thomson, Chief Operating Officer, NITB.

The witnesses answered a number of questions put by the Committee.

2.27pm Mr Craig left the meeting.

Members requested that the witnesses should provide additional information to the Clerk on some issues raised as a result of the evidence session.

3.35pm The evidence session finished and the witnesses left the meeting.

[EXTRACT]

Thursday, 17 June 2008

Room 375, Parliament Buildings

Present: Mr Roy Beggs (Deputy Chairperson)

Mr Simon Hamilton

Mr David

Hilditch

Mr Trevor Lunn

Ms Dawn Purvis

Mr Jim Wells

In Attendance: Mr Jim Beatty (Assembly Clerk)

Mrs Gillian Lewis (Assistant

Assembly Clerk)

Mrs Nicola Shepherd (Clerical Supervisor)

Mr Darren Weir

(Clerical Officer)

Apologies: Mr Paul Maskey (Chairperson)

Mr John Dallat

Mr Mitchel

McLaughlin

The meeting opened at 12.23pm in closed session with the Deputy Chairperson in the Chair.

4. Consideration of the Committee’s Draft Report on Northern Ireland Tourist Board – Contract to Manage the Trading Activities of Rural Cottage Holidays Limited.

The witnesses attending were Mr Kieran Donnelly, Deputy C&AG, Mr Stephen McCormick, Director, and Mr Joe Campbell, Audit Manager, NIAO.

The Committee considered the main body of the report paragraph by paragraph.

Paragraphs 1 – 10 read and agreed.

Paragraph 11read, amended and agreed.

Paragraphs 12 – 14 read and agreed.

12.30pm Ms Purvis joined the meeting.

Paragraphs 15 and 16 read and agreed.

Paragraph 17 read, amended and agreed.

Paragraph 18 read and agreed.

Paragraph 19 read, amended and agreed.

Paragraph 20 read and agreed.

12.40pm Mr Wells left the meeting.

Paragraph 21 read, amended and agreed.

Paragraphs 22 - 29 read and agreed.

Paragraph 30 read, amended and agreed.

Paragraphs 31 read and agreed.

Paragraph 32 read, amended and agreed.

Paragraphs 33 – 38 read and agreed.

12.55pm Mr Wells rejoined the meeting.

Paragraph 39 read and agreed.

Paragraphs 40 – 42 read, amended and agreed.

Paragraph 43 read and agreed.

Paragraphs 44 – 46 read, amended and agreed

The Committee considered the Executive Summary of the report.

Paragraphs 1 – 4 read and agreed.

Paragraph 5 read, amended and agreed.

Paragraphs 6 and 7 read and agreed.

Paragraph 8 read, amended and agreed.

Paragraph 9 read and agreed.

Paragraph 10 read, amended and agreed.

Paragraphs 11 – 13 read and agreed.

Agreed: Members ordered the report to be printed.

Agreed: Members agreed that the Chairperson’s letter to Mr Stephen Quinn CB, requesting additional information and the response would be included in the Committee’s report.

Agreed: Members agreed to embargo the report until 00.01am on Thursday, 3 July 2008, when the report would be officially released.

Agreed: Members agreed not to hold a press conference to launch the report.

[EXTRACT]

Appendix 2

Minutes of Evidence

1 May 2008

Members present for all or part of the proceedings:

Mr Roy

Beggs (Deputy Chairperson)

Mr Jonathan Craig

Mr Simon Hamilton

Mr David

Hilditch

Mr Trevor Lunn

Mr Mitchel McLaughlin

Ms Dawn Purvis

Witnesses:

|

Mr Stephen Quinn |

Department of Enterprise, Trade and Investment | |

|

Mr Alan Clarke |

Northern Ireland Tourist Board |

Also in attendance:

|

Mr Kieran Donnelly |

Deputy Comptroller and Auditor General | |

|

Mr David Thomson |

Treasury Officer of Accounts |

1. The Deputy Chairperson (Mr Roy Beggs): I remind members and visitors that mobile phones must be turned off; even if they are on silent mode, they interfere with the recording equipment.

2. On behalf of the Public Accounts Committee, I extend a warm welcome to the members of the Tynwald Public Accounts Committee, who are visiting the Northern Ireland Assembly and watching today’s proceedings, which I hope will benefit them.

3. Apologies have been received from John O’Dowd, the Chairperson, who has a previous engagement, and from John Dallat and Ian McCrea, who are also otherwise engaged.

4. This afternoon, the Committee will discuss the Northern Ireland Audit Office report ‘Northern Ireland Tourist Board: Contract to Manage the Trading Activities of Rural Cottage Holidays Limited’. I welcome Stephen Quinn, accounting officer of the Department of Enterprise, Trade and Investment; Alan Clarke, chief executive of the Northern Ireland Tourist Board (NITB); and Kathryn Thomson, chief operating officer of the Northern Ireland Tourist Board. Thank you all for attending.

5. The Committee is examining the Northern Ireland Audit Office report on the contract for the management of Rural Cottage Holidays and ascertaining how lessons can be learned from that experience. Good governance has been a major theme of the Committee’s work. The effective and transparent management of conflict of interests is a key plank in that work. It is not rocket science; it is a basic principle of good public administration. When conflicts are not managed properly, public confidence in the quality of Government is undermined.

6. The Committee will examine the case study and what can go wrong. It will also consider what lessons must be learned by the wider public sector. That is perhaps the reason that the report is of particular interest to the Committee.

7. I emphasise that the purpose of this session is not to investigate the conduct of any individual. The Committee will use the points raised in the report to consider any shortcomings in the actions of the public body in question, and it is hoped that lessons will be learned from which that organisation — and the wider public sector — will benefit.

8. Mr Quinn, at a senior level, your Department did not know about the conflict of interest in the deal until one of the unsuccessful bidders complained to the Minister.

9. The Department had monitoring arrangements in place with the Tourist Board, and, given previous problems, you should have had the board on special watch. Indeed, your Department had given evidence to the Public Accounts Committee previously on matters that concerned the board. That means that there have been previous governance problems in your Department’s sponsored bodies. What assurances can you give the Committee that your Department now has sufficiently robust processes so that such problems can be picked up on and nipped in the bud early?

10. Mr Stephen Quinn (Department of Enterprise, Trade and Investment): Thank you very much, Chairman.

11. The Department first became aware of a conflict of interest when it was informed by the Northern Ireland Tourist Board in January 2006, which was before the Minister received the letter from the unsuccessful bidder in December 2006.

12. Regarding your point about systems, there is a concern that not only should there be guidance in place, but that it is applied effectively and in a practical way. Our system can be split into several sections: audit programmes; audit committees; risk management processes; assurance statements; and oversight and liaison arrangements.

13. Internal audit reports are an essential source of empirical evidence on corporate governance and financial control in the Department and its non-departmental public bodies (NDPBs). I see, and comment on, all internal audit reports. I see, in advance, those draft internal audit reports that are beginning to indicate a limited assurance. I receive internal audit annual assurance reports from our internal audit service. I see all NIAO management letters in regard to the Department and its NDPBs. Therefore, I receive continuous intelligence about issues that are raised in the internal and external audit processes.

14. The DETI audit committee signs off the annual internal audit programme. Our most recent meeting was last month, when the Audit Office representative complimented the scope and coverage of the Department’s audit programme. At audit committees, we also consider specifically and routinely everything that has shown a limited internal audit opinion. DETI representatives attend meetings of the Northern Ireland Tourist Board audit committee.

15. The Department and its NDPBs have risk registers, which are updated quarterly. The departmental audit committee and the departmental board are made aware of any significant new risks and changes to existing risks. The NDPBs have similar risk management arrangements.

16. I receive quarterly assurance statements from the Department’s two deputy secretaries and from the chief executives of the NDPBs. I then take advice from the Department’s accountability branch, which consults the Department’s sponsor division and internal audit. Therefore, we always seek assurance that those statements are comprehensive and that they pick up on relevant issues. I also see the draft annual statements of internal control.

17. Oversight and liaison arrangements constitute quarterly meetings between senior staff in both the Department and the NDPBs. Risk, audit and accountability matters are a standing element of that quarterly agenda.

18. The Department and its NDPBs have registers of interest that are updated from time to time. Furthermore, anyone who attends a departmental board meeting, or an audit committee meeting, must declare a conflict of interest at the outset.

19. That is an outline of the main systems that put our guidance into practice. Each element is intended to mutually reinforce the others. We hope that if one element does not pick up on a problem, another element will. The systems comprise not only mechanisms and processes; they are designed to create a culture in which senior staff, and, indeed, all staff, in the Department and its NDPBs are given an ongoing sense of the importance of corporate governance and financial control.

20. The Deputy Chairperson: Do you accept that you were advised of the potential and of the actual conflict of interest at a very late stage?

21. Mr Quinn: Yes.

22. The Deputy Chairperson: Mr Clarke, you did not tell the Audit Office about the potential and the actual conflict of interest, and you told the Department of Enterprise, Trade and Investment about them only at a very late stage. They were not discussed in your statement of internal control, you did not tell the Northern Ireland Tourist Board’s audit committee or board, and you mentioned them to the Department only in passing.

23. Why was the matter not freely disclosed to the Audit Office at a much earlier stage? I am sure that it would have helped to keep you right. As its role is not just to protect the Department and public funding, it would have protected you had you sought advice. Given that, why was the information not shared? Your failure to share it has almost created an impression that you were trying to sweep the matter under the carpet.

24. Mr Alan Clarke (Northern Ireland Tourist Board): The report makes clear that there was a series of rolling disclosures on the matter. I will discuss those three disclosures briefly. The first disclosure was made around February 2005. At that time, it related to a personal conflict, and we managed it internally. The second disclosure was made in November 2005, and at that stage I took advice on the matter from internal human resources. I followed that up by taking legal advice. We had a meeting with the Department in December 2005, during which we drew the matter to the attention of the internal audit service, which advised that we should proceed with an independent investigation of the matter. There was then a change of circumstances during December 2005.

25. In early 2006, I discussed the matter with the chair of the audit committee and the chair of the Tourist Board, and we agreed — following the advice from the internal audit service — to carry out an independent investigation of the matter. That report was concluded in March 2006, and it then went to the chair of the audit committee, with copies sent to myself and to the chairman of the Tourist Board. We make it very clear in paragraphs 52 and 59 of the Audit Office report that we should have brought the matter to the attention of the audit committee at a much earlier juncture than we did.

26. The independent investigation raised certain issues that required clarification from the director. On the basis of the consultant’s report, we took further legal advice in March 2006. That stated that we should await the director’s return to work before we concluded the investigation so that certain outstanding questions could be dealt with. That investigation was completed in July 2006, at which stage I took it to the chair of the audit committee. At that time, we had already implemented an action plan as a result of the report. Paragraph 58 of the Audit Office report makes it clear that some sensitivities existed in relation to the matter.

27. The chair of the audit committee and I then decided that the action plan had been well advanced. In January, we informed the Department of our intention to carry out the independent investigation. We acknowledge in the report that we should have brought it to the audit committee, and had we done that, we would have apprised the Audit Office and the internal audit service of the Department at a much earlier juncture than we did. We accept that fully.

28. The Deputy Chairperson: There is a quotation from the Chairman of the Westminster Committee of Public Accounts in the Treasury handbook on regularity and propriety that reads:

“Potential conflicts of interest are very serious matters indeed. We do not have to prove that something wrong has happened as long as the potentiality for that wrongdoing exists”.

29. Do you accept that, in the early stages, the matter was approached very casually — for example, by having verbal conversations — and that written documentation should have existed early on?

30. Mr A Clarke: Yes, we accept that. That is clarified and acknowledged in paragraph 50 of the report. The initial conversation concerned a friendship. I took action at that time, but I accept fully that that should have been documented.

31. The Deputy Chairperson: Thereafter, it seems that the lack of written documentation had an impact on how other issues were dealt with. Do you accept that that may have resulted in the issues not being handled with the appropriate level of seriousness?

32. Mr A Clarke: A series of rolling disclosures was made. As outlined in paragraph 50, there was no written record of the first disclosure; however, I removed the director from the assessment process and Kathryn took control of that and of the bids.

33. The second disclosure was fully documented. We took legal advice and advice from human resources, we commissioned an independent investigation, and I reported to the chairperson of the audit committee. At that stage, we acknowledged that we should have informed the entire audit committee, and the chairman of the Tourist Board was fully aware of the situation. There was no attempt to conceal the matter: I liaised openly with the board. However, we fully accept that the matter should have been referred to the entire audit committee.

34. Mr Craig: I want to follow up on some of the Deputy Chairperson’s remarks, Mr Clarke. You said that by 2004 or 2005 you knew that there was a potential conflict of interest. Paragraph 68 of the Audit Office report states:

“The Department told PAC in 2002 that new guidelines on conflict of interest would be at the forefront of its process for appointing a new NITB Chairman”.

35. That deals with a past conflict of interest that became a problem. Given that the incident happened as long ago as 2002, why were lessons not learnt about the problems that can be created by a conflict of interest? Why was the 2005 matter not dealt with more quickly?

36. Mr A Clarke: Based on what happened in 2002, and after the Public Accounts Committee covered conflicts of interest in the same year, we devised and implemented a full action plan. Paragraph 4 of the report recognises that “considerable improvements” have been made in the board’s corporate governance since 2002. Reasonably robust guidelines on conflict of interest were in place at the time of the first disclosure. After we commissioned an investigation by external consultants into the second disclosure in November 2005, we enhanced that guidance in 2006.

37. At the time of the first disclosure, I read the guidance that existed at that time, which clarifies the relationship between public duties and private interests. However, the process was based on a code of conduct that was contained in the staff handbook. As paragraph 13 makes clear, I made an assessment of the conflict of interest based on guidance from the Chartered Institute of Public Finance and Accountancy (CIPFA). I used the existing code from our staff handbook to assess the conflict of interest and CIPFA guidance on whether to take the matter forward. My assessment was that the external consultants had assessed the submitted bids, and the work that we were doing at that time was on the leases of the 11 cottages. However, I accept fully, as is acknowledged in the report, that the matter would have been much clearer had the director of industry development been off the issue in February 2005.

38. Mr Craig: Did you not recognise that you were taking a risk, at least where public perception was concerned, which is a serious issue for bodies such as yours?

39. Mr A Clarke: I acknowledge that the issue was more perceived than actual. The actual issue was resolved by putting Kathryn in charge of the assessment of the bids. Also, at that stage, most of the work was connected to the 11 leased cottages rather than the tenders, which was on the sales and marketing side. To reduce the impact on public perception, it would have been better had the director been removed in February 2005.

40. Mr Craig: I want to ask Mr Quinn a similar question, although I do not want the same answer, because the Deputy Chairperson mentioned this subject earlier. You have tightened up all the procedures, and I assume that public perception will be taken into account more in future. Is that the case?

41. Mr Quinn: Absolutely; I agree entirely. I find myself in complete agreement with the chief executive’s evidence. The substance of the February 2005 disclosure was dealt with by putting the finance director in charge of the assessment and the subsequent recommendation. However, that left a residual concern about the perception and maybe about whether or not the member of staff with the conflict of interest might be making information available to a third party. Paragraph 50 of the report details the Tourist Board’s acknowledgement that the individual should have been removed from further involvement, and the Department readily endorses that view.

42. Mr Craig: The final bullet point of paragraph 30 at appendix E of the Audit Office report states:

“It is a matter of record from Senior Management Team colleagues that I frequently questioned the appropriateness of me being present at Senior Management Team meetings where the subject of RCH (Travel Solutions/Cottages in Ireland) was discussed.”

That is a damning and alarming statement from the former director of industry development. As an accounting officer, Mr Clarke, do you accept that you have a responsibility to your staff to give them clear, decisive leadership on the ethical standards that are expected of them?

43. Mr A Clarke: Absolutely.

44. Mr Craig: I accept that. Do you accept that it is not enough to rely on external training providers when you need to be satisfied that senior members of your team — not to mention the rest of the staff — understand the rules and, more importantly, the boundaries?

45. Mr A Clarke: First, regarding paragraph 30, Ms Thomson and I attended those senior management team meetings, and neither of us can recollect any such statement being made. If it had been made, it would have been minuted, and the director would have had the opportunity to correct the minutes at a subsequent meeting.

46. Secondly, regarding the training aspect, paragraph 4 of the report recognises that there have been improvements to the Tourist Board’s corporate governance. That has not happened by accident; we have put a lot of emphasis on corporate governance over the past number of years. All directors attend our audit committee now, for example, and all members of the senior management team are given public accountability training. It is not merely a case of putting the training into place; we also ensure that it operates in practice.

47. Mr Quinn mentioned the internal audit service reports. They are sent to our audit committee and are scrutinised there. Any weaknesses in the system are picked up and approved during that process. We have received an “overall satisfactory” opinion from internal audit service for the past number of years.

48. Mr Craig: I accept that the situation regarding that individual’s presence at senior management team meetings is one person’s word against another, but it is alarming to see it in the report. However, I accept your word.

49. The situation came about because an unsuccessful bidder complained that a director failed to disclose his connections to Travel Solutions. That highlights and demonstrates the value of whistle-blowers in these scenarios, and sometimes their involvement is the only reason that one gets to the bottom of a lot of the situations. Given that nothing is 100% foolproof, what else have you done to ensure that arrangements for whistle-blowers are as robust as they can be? Have the arrangements been publicised across your area of responsibility?

50. Mr Quinn: I draw the Committee’s attention to paragraph 36 of the Audit Office report, which makes the point that there is a duty of candour on employees to declare their interests. However, a full declaration was not made in this case. The Tourist Board could not have been expected to know about the individual’s directorship; it would not have come into their line of sight. Therefore, no blame should be attached to the Tourist Board. I commend the Tourist Board for the promptness and effectiveness of its actions following the whistle-blower’s disclosure to the Minister.

51. Matters relating to this case have never had a higher level of general awareness than they have now, and that is due to your Committee’s report on the Tourist Board in 2002 and to the Westminster PAC’s report into the Emerging Business Trust (EBT) in 2006, meetings on which I attended. I mentioned the interlocking mechanisms that we operate, each of which require people to think about potential conflicts of interest, corporate governance and financial control issues.

52. Therefore, the systems are quite robust, and I am sure that the guidance is robust. I read the guidance that was in place in early 2005, and it was perfectly robust and serviceable. It was improved in 2006, but those improvements were incremental rather than fundamental.

53. It is worth emphasising two points. First, the director clearly knew that he was obliged to make declarations, because he made two — the first in February and the second in November 2005. Secondly, the chief executive knew that he was obliged to manage conflicts because the key point in respect of the February disclosure was that he put the finance director in charge of the assessment and recommendation processes.

54. Mr Hamilton: I want to discuss Rural Cottage Holidays Ltd in general and, principally, the financial situation, which appendix A of the Audit Office report outlines in stark detail. It indicates that £1·5 million was available for capital and marketing investment in the project in 1993. It also reveals that only 11 of the initially identified 27 cottages were renovated.

55. What criteria were used to select those 11 cottages, given the conflict of interest that the report highlighted? The Committee seeks assurances that there are no connections between the owners of those 11 properties and anybody who is connected to the Tourist Board.

56. Mr A Clarke: The project was set up in the early 1990s, when tourism in Northern Ireland was very different to what it is today. It was set up to develop rural tourism and to be a demonstration project that was based roughly on the French gîte system.

57. The original objective of the scheme was to have many more leased cottages in place than currently exist. The focus was primarily on TSN areas, that is, those parts of rural Northern Ireland where both need and market failure were greatest.

58. I am not totally aware of the criteria that were used — perhaps Kathryn has more detail. Most of the 11 cottages that are currently leased to the Northern Ireland Tourist Board are primarily in TSN areas in the glens of Antrim. In the early 1990s, there was a call under the scheme for cottage owners to come forward. I must say that the way in which the process operated was somewhat historical.

59. Ms Kathryn Thomson (Northern Ireland Tourist Board): I cannot give answers about the criteria today, but we can certainly get that information and provide it to the Committee. I am not aware of any connections between the current cottage owners and anybody employed by the NITB.

60. Mr Hamilton: You might not have this information available either, but what other costs were incurred in addition to the initial capital outlay? Is it possible to provide the Committee — either now or at a later date — with the renovation, maintenance and administrative backup costs that were incurred?

61. Ms K Thomson: We can certainly provide a detailed analysis of all the costs that were incurred. At a high level, the company has been running at a loss of approximately £20,000 a year. Additionally, the Tourist Board incurred costs for staff and administration that were never charged to the company.

62. Mr Hamilton: You mentioned the losses of £20,000 a year. The accumulated loss is approximately £200,000. That runs very much contrary to the initial plan, which was to break even and be self-sustaining within three years and then to transfer back into the private sector and run at a profit. Clearly, that has not happened.

63. The Tourist Board has been left in the position of having to fund Rural Cottage Holidays Ltd by approximately £40,000 or £50,000 every year. Presumably, that will continue for the entire lease period, which has around 21 years yet to run. Is it fair to say that that was not a good use of taxpayers’ money?

64. Mr A Clarke: I will answer that question in two ways. At a strategic level, Rural Cottage Holidays had two arms: first, it had the leased cottages with the intention of renovating them to make them available for holiday visits; and secondly, the wider aspect of the plan was to provide a sales and marketing arm for rural cottages throughout Northern Ireland. Well over 100 cottages participated in the sales and marketing element of the scheme. It had the renovation capital element of improving cottages in rural parts of the Province for visitors. It also had a much wider remit, which was more geared towards stimulating the rural economy and providing real gains to that economy.

65. One might argue whether a company limited by guarantee was the right vehicle to achieve that. In many ways it was not. I take you back to a previous answer: it was set up in the early 1990s when the situation in Northern Ireland was very different from that of today. I do not imagine that we would ever tackle it in that way today. Kathryn might be able to add more details.

66. Ms K Thomson: In tendering the contract, the NITB was seeking to find a mechanism to continue to provide a sales and marketing booking facility to support rural tourism and to protect the income stream to rural tourism providers. Now that NITB has secured that, it is looking at how it manages what it has left. It is looking at pursuing an option of trying to transfer those leases back to the owners. We recognise that it is not, as Alan has said, how we would manage the situation today.

67. Mr Hamilton: That is a fair point. It looks as though the bigger winners were the owners of the properties rather than the rural economy or the public purse. On first impression, it does not look like a bad idea to target rural cottages and traditional buildings that might attract foreign visitors. Why has it not broken even, given the fact that — as Mr Clarke said — tourism has changed radically since the early 1990s and we have a much bigger market? The cumulative losses suggest that the occupancy rate is fairly low. What is the occupancy rate?

68. Mr A Clarke: I am not sure what the occupancy rate is overall. The figures have increased over the past four or five years. One of the reasons why it is not as commercially viable as it should be is the fact that there never were exclusive contracts between Rural Cottage Holidays Ltd and the cottage owners. Most commercial businesses operate on the basis of an exclusive contract, whereby they sell all 50 or 52 weeks to the customer. Due to the market failure and historic nature, the cottage owners had the rights to sell the cottages directly at peak periods. Rural Cottage Holidays Ltd was used only as a vehicle to top up the less saleable periods of the year. For example, July and August and Christmas and the new year generally were sold and no commission was paid. Part of the sales and marketing contract was to try to move it to a more commercial business.

69. Mr Hamilton: I have a question for Mr Quinn about the deficit. Obviously the public purse will have to pick up the tab of the majority, or 90%, of the cost of the cottages for the foreseeable future. Given that it is spectacularly different financially from the original objective, it is difficult to see how the initial business case would have been justifiable. What was the business case and how did it differ so widely?

70. Mr Quinn: I have not gone as far back as the 1993 business case. However, it appears that the business case was clearly based on market failure. Northern Ireland tourism was not a good proposition in the early 1990s — certainly not rural tourism. The Tourist Board and others were trying to find a way of generating revenue streams for people in rural areas, and that was a laudable policy objective. However, it strikes me as a classic case of what is now called “optimism bias” in economic appraisal. During the 1990s, the Treasury revised the economic appraisal guidelines to require one to make an allowance for what is called optimism bias. People might assume that a scheme will break even in three years, when, realistically, one has to add a contingency to provide for optimism against that. If we were to do the same thing again, we would get a different answer with the business case.

71. Mr Hamilton: If we were doing it again — “if” being the operative word.

72. Is there any explanation as to why the sharing of risk and reward is so imbalanced and slanted towards the cottage owners?

73. Mr Quinn: No, and I will defer to my Tourist Board colleagues on that point. The cottage owners were meant to be the beneficiaries of the policy. The whole point of the project was to create and encourage revenue streams that would flow to the rural cottage owners. They did get a good deal. The lack of an exclusive deal was a very good deal for the rural cottage owners, but they were meant to be the beneficiaries of the policy.

74. Mr Hamilton: Is there any explanation as to why the public purse is locked in for such a long period? There is no obvious exit strategy available to insulate the public purse from such a high risk.

75. Mr Quinn: I believe there is such an exit strategy. However, I will ask Ms Thomson to discuss that.

76. Ms K Thomson: We have an exit strategy, and we are currently carrying out an appraisal to ascertain how best to pursue this. NITB has been left with — and currently holds — the 11 long-term leases on the cottages. Those leases are quite complex in their make-up. We have been taking legal advice and working with both DETI and the Department of Finance and Personnel (DFP) to come to an arrangement to terminate those leases.

77. Mr Quinn: The staff subsidy that went to the sales and marketing operation has now been dealt with. That was bought out with the marketing grant over the first three years, but following that, the burden on the taxpayer should be removed.

78. Mr Hamilton: Therefore, there was no exit strategy originally. That means that the strategy that you refer to has been developed only recently. I suppose that this goes back to the optimism bias at the time and the fact that there did not seem to be a need for an exit strategy at that early stage.

79. Ms K Thomson: Over the years, there have been several reviews of operations. In 1999, we conducted our first review to examine the operations, as they were not profit-making. At that time the capital programme was still ongoing, and the conclusion of that review was to halt the capital programme. That is why NITB currently has only the 11 cottages.

80. A further review was carried out in 2000 because the company continued to be loss-making. In 2001, as a result of the findings of that review, we market-tested in an attempt to sell the company. Unfortunately, no one declared an interest in purchasing the company. NITB continued to manage the company, but the situation did not improve.

81. In 2003-04, we again commissioned a review to consider how best we could divest of this activity. We did not want to simply shut down the company as we were mindful to protect the interest Mr Quinn has outlined, to protect rural tourism, and to protect the income stream to rural tourism providers and to people in areas of social need, whom the project had been set up to benefit.

82. Mr Hamilton: Paragraph 69 of the Audit Office report states that when the Department of Finance and Personnel was asked about conflicts of interest, it said that “substantial guidance” was available outlining how public servants should act. This case suggests that that substantial guidance was perhaps not enough to stop it from becoming a problem. Furthermore, I am aware that the Department has made it clear that it will review that guidance in the light of this case. What guidance is currently in place, and, more importantly, where can a public servant access easily the best-practice rules to handle a conflict such as this?

83. Mr David Thomson (Treasury Officer of Accounts): I agree with Mr Quinn; I do not believe that there is anything wrong with the guidance. It is based on fundamental principles that public servants should look for interests. However, just because an interest exists does not necessarily mean that it is prejudicial. If there is a conflict, they should either eliminate or manage it. The guidance has been in place for some time. We play around at its margins, but it is there.

84. Civil servants look to the code of ethics, the Nolan principles and the Northern Ireland Civil Service handbook. For public bodies, we recently re-issued the model code of practice for board members, and there is a guide for Departments and public bodies. All those documents contain guidance on conflicts of interest.

85. The guides are principle based, and the principles are clear. It is impossible to have a rule for every situation, and I would resist trying to develop rules for every situation. I would like to keep it principle based, and that is what has been done. People must apply the current principles. We conducted a review, and we believe that the guidance does not need changed.

86. Mr Hamilton: Perhaps awareness and training, rather than guidance, is the key?

87. Mr D Thomson: Over the past two or three years the training standard has increased. For example, as Mr Quinn mentioned, people on public bodies must complete corporate governance training, of which conflict of interest is a key element.