Session 2008/2009

Third Report

Public Accounts Committee

Report on Statement of Rate

Levy and Collection 2006-07

Together with the Minutes of Proceedings of the committee

relating to the report and the minutes of evidence

Ordered by The Public Accounts Committee to be printed 16 October 2008

Report: 13/08/09R (Public Accounts Committee)

This document is available in a range of alternative formats.

For more information please contact the

Northern Ireland Assembly, Printed Paper Office,

Parliament Buildings, Stormont, Belfast, BT4 3XX

Tel: 028 9052 1078

Membership of Powers

The Public Accounts Committee is a Standing Committee established in accordance with Standing Orders under Section 60(3) of the Northern Ireland Act 1998. It is the statutory function of the Public Accounts Committee to consider the accounts and reports of the Comptroller and Auditor General laid before the Assembly.

The Public Accounts Committee is appointed under Assembly Standing Order No. 51 of the Standing Orders for the Northern Ireland Assembly. It has the power to send for persons, papers and records and to report from time to time. Neither the Chairperson nor Deputy Chairperson of the Committee shall be a member of the same political party as the Minister of Finance and Personnel or of any junior minister appointed to the Department of Finance and Personnel.

The Committee has 11 members including a Chairperson and Deputy Chairperson and a quorum of 5.

The membership of the Committee since 9 May 2007 has been as follows:

Mr Paul Maskey*** (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr Thomas Burns**

Mr Jonathan Craig

Mr John Dallat

Mr Trevor Lunn

Mr Ian McCrea*

Mr Mitchel McLaughlin

Mr George Robinson****

Ms Dawn Purvis

Mr Jim Shannon*****

* Mr Mickey Brady replaced Mr Willie Clarke on 1 October 2007

* Mr Ian McCrea replaced Mr Mickey Brady on 21 January 2008

* Mr Jim Wells replaced Mr Ian McCrea on 26 May 2008

** Mr Thomas Burns replaced Mr Patsy McGlone on 4 March 2008

*** Mr Paul Maskey replaced Mr John O’Dowd on 20 May 2008

**** Mr George Robinson replaced Mr Simon Hamilton on 15 September 2008

***** Mr Jim Shannon replaced Mr David Hilditch on 15 September 2008

Table of Contents

List of abbreviations used in the Report

Report

The Management of the IT Project

Defective Financial and Operational Controls

The High Level of Rate Arrears following the Introduction of the New Reforms

Appendix 1:

Appendix 2:

Appendix 3:

Update from Mr Leo O’Reilly, Accounting Officer, Department of Finance and Personnel

Appendix 4:

Appendix 5:

List of Abbreviations used in the Report

The Department/DFP Department of Finance and Personnel

The Agency/LPS Land and Property Services

IT Information technology

C&AG Comptroller and Auditor General

SRO(s) Senior Responsible Officer(s)

DC&AG Deputy Comptroller and Auditor General

The Minister The Minister for Finance and Personnel

OCG Office of Government and Commerce

Executive Summary

Introduction

1. This report considers the reasons for the financial and operational difficulties that have overwhelmed Land and Property Services, an Agency of the Department of Finance and Personnel, in its assessment, administration and collection of rates. The report examines the management of rate collection activity during a time of considerable change in policy, systems and management structures and, in particular, the decisions taken in implementing these changes.

2. The Committee has given priority to considering this topic given the importance that the collection of rates revenue has on both central and local government finances. Rate assessments amount to some £1 billion annually.

Overall conclusions

3. The Committee’s overall conclusion is that the implementation of the new IT system was very poorly managed. This has resulted in significant additional costs being incurred to resolve basic failings in the system which had not been discovered before the system went live. The Committee is amazed that shortcuts were taken to implement a complex and large IT system and substantial resources transferred from operational duties to ensure that the system was in place to issue domestic rates bills based on the new reforms.

4. The Committee considers that the Department and the Agency were trying to do too much in too short a timescale. The Agency was attempting to manage significant change on three different fronts; policy, systems and structures.

5. The Committee considers that the decision to proceed with the implementation of the new system was based on a fundamentally flawed risk assessment. It is crystal clear that the Department’s risk assessment did not take sufficient account of the huge risks of inadequate system testing, the impact of transferring front line staff to work on the introduction of rate reforms and the enormous financial consequences of postponing the collection of arrears. The Committee accepts that the Department achieved its objective of successfully calculating and issuing bills based on capital values by April 2004, however, the price paid for meeting this deadline outweighed the benefit many times over. The timetable objective may have been achieved but in the process of achieving it the business was thrown into chaos.

6. The Committee noted that the bills successfully issued did not provide either central or local government with any additional revenue. The Committee accepts that the new reforms may have led to a fairer allocation of rates between ratepayers with some paying less, others more and various reliefs and allowances introduced for those in great need, such as the Lone Pensioner Allowance, however, the Committee is of the view that a properly considered risk assessment would have avoided many of the problems noted in this report by postponing the reforms for one year.

7. There are a number of important recommendations for the Department of Finance and Personnel and Land and Property Services to ensure that what went wrong is fixed and that the resulting adverse consequences to ratepayers, Councils and staff are quickly resolved. There are also wider lessons on implementing complex new IT systems.

The Management of the IT Project

8. The IT specification was incomplete even though it ran to some 800 pages in length. The Committee was informed that the specification mostly got mainstream business processes correct but DFP regretted that some areas were missed and some functional errors made. The Committee disagrees with this assessment by the Department. Areas missed included the systems ability to chase arrears, a core operation of the Agency, validation controls over manual input errors and an audit trail to enable the C&AG to give assurance on the accuracy of the accounts. The Committee is most concerned that so many errors were made that led to such significant, additional sums being paid to the contractor.

9. The Committee accepts that the accuracy of the specification was the responsibility of the Agency but also considers that a number of the deficiencies in the software should have been, at least, challenged by the contractor, before proceeding. For example the Committee is very surprised that the system allows some ratepayers to be incorrectly issued with million pound bills due to simple keying in errors. IT systems should be designed to prevent and detect manual errors of this nature. It beggars belief that such a basic matter as this was overlooked by all involved in the development of the system’s software.

10. The Committee is concerned that the cost of the IT project has escalated from an initial estimate of £10.5 million to a revised estimate in the C&AG’s report of £11.5 million and now this cost has increased by a further £1.5 million to £13 million. The Committee is of the opinion that the contractor is doing very well out of the increasing value of the contract. Errors or omissions from the specification provide contractors with a rich revenue stream that is not subject to competitive tendering.

11. The Gateway Review process sounded alarm bells on the risk of not delivering. The Committee is not convinced that all the Gateway recommendations were implemented as effectively and as quickly as was necessary, particularly the concerns raised by the Gateway team about time pressures and adequacy of resources. The Committee can only conclude that the Department is mistaken in its positive assessment of the actions it took and/or the speed with which it took them.

12. This case has exposed a worrying IT skills deficit which the Department is now taking steps to address. The public service needs talented, commercially orientated IT specialists that can negotiate effective outcomes with private sector contractors. The Committee also considers that the project lacked sufficient accounting and management expertise. Better accounting skills should have assisted in reducing the volume of basic financial deficiencies in the system specification and design. Better management skills may have led to better decision making in terms of what needed to be done to create stable post implementation operations.

13. Both the quality of the data transferred from the existing IT system to the new one and the testing of the new system with test data were substandard. Much of the data on the old system was unstructured and it was therefore apparently difficult to establish rules for its transfer. The Department admitted that more resources should have been allocated to this. The Committee is surprised by this given that a new system had been in the planning since 2001. Moreover, test data was used to check whether the system worked properly but the data used did not test all potential eventualities and therefore did not reveal certain crucial errors in the specification leading to adverse performance and cost implications.

Defective Financial and Operational Controls

14. The Comptroller and Auditor General could not, in the circumstances, give any assurance on the 2006-07 accounts as it was not possible to verify a number of very material figures reported in the accounts. This was due to significant control problems arising from the poor specification of the IT system and certain key controls not functioning.

15. The Committee is concerned that a new IT system dealing with hundreds of thousands of bills requires so much manual data input. Where data is input manually, the Committee noted that there were insufficient validation controls built into the system software to detect keying in errors. These are basic controls which have been standard in IT system designs for decades.

16. Weaknesses in financial procedures in the new IT system, as detailed in this report increase the risk of fraud, as well as error. They also reduce the likelihood of detection of fraud. Given this extremely weak control environment, the Committee was therefore surprised that DFP, the department responsible for issuing best practice guidance, did not yet have a whistle-blowing policy in place. It must be currently one of the few departments without one.

17. The Committee welcomes the fact that the Department conducted a staff attitude survey for all its staff, including those at the Agency, during what has been a very challenging time for all those working there. It also welcomes the introduction of an action plan to improve staff morale at the Agency.

18. Customer service has suffered appallingly as a result of the system problems and the transfer of experienced front line staff to help with the implementation of the new system. Not responding to customer enquiries is unacceptable. Many ratepayers have legitimate worries as a result of receiving inaccurate bills and vulnerable ratepayers need help in obtaining allowances, which can be complicated to claim, let alone understand. The Committee records the obvious point that administrative backlogs and poor customer care are not a good combination and must be avoided by public sector service providers.

19. During 2006-07, the Agency abandoned its inspections of vacant properties, that is, properties which are not billed for rates. Through such inspections, properties notified as vacant can be found to be occupied and rates payable. This important work was deferred as staff were needed to assist with the introduction of rate reforms.

20. It is vital that there is an accurate up to date list of all properties so that all those liable to pay rates are assessed and billed. The Committee was concerned that there was evidence of both old and new properties that had been overlooked.

21. The Committee is most concerned that DFP was not providing Councils with sufficiently accurate penny product information to enable them to do their corporate planning. Small percentage errors in forecasts have a very significant impact on their finances. It seemed to the Committee that insufficient resources have been provided to improving accuracy in this important area, perhaps, because DFP considered this to be more of a problem issue for Councils than for itself. While the Committee notes DFP’s comments that more co-operation had been introduced recently, this seems to the Committee to be too little and too late.

The High Level of Rate Arrears following the Introduction of the New Reforms

22. The Committee finds it difficult to understand the decision taken to defer recovery of arrears, given its effect on public finances. The Committee is not convinced that other options, such as timetable adjustment, were sufficiently explored.

23. Arrears were £48 million in 2006 but rose to £124 million by 2008. Pursuing arrears is time-consuming, particularly if it is not done in a timely manner. With the delay in recovery action, more people will have moved house or will avoid payment or simply will not be able to afford payment of rate arrears on top of the arrival of the next year’s bill. More time and money will also be spent arranging assistance to those in financial difficulty to pay off arrears by instalments.

24. All of this has a significant cost. At one stage the Agency had only seven people tasked with pursuing arrears. DFP informed the Committee that it is now putting a lot of time and effort into this. Staff involved in the catchup exercise has risen to 80. The Committee is very concerned with, not only the spiralling level of arrears as a result of the decision to defer, but also with the spiralling cost of collection given the number of staff needed to undertake recovery action.

25. Irrecoverable arrears are estimated to double from £2 million to £4 million each year but the Department noted that this estimate was subject to a fair amount of uncertainty. It was a question of just waiting to see what happens. In the Committee’s view the £4 million estimate seems very much understated given the current economic difficulties people are facing with enormous rises in electricity and gas prices and the lack of credit now available.

26. Under current arrangements, Councils will have to fund the higher cost of collection in the years to come as well as sharing with central government any loss of funds through irrecoverable arrears. This may mean less money for Councils to spend on services, as a result of the estimated doubling of irrecoverable arrears. The Committee finds it intolerable that Councils will have to ‘pick up the tab’ for systemic failure in a central government agency.

27. DFP does not presently have any robust target for arrears. DFP is seeking to carry out benchmarking with other collection authorities to establish what the future level of arrears should be. The Committee is concerned that arrears will not be reduced to the levels achieved some years previously when the Agency was one of the better performing collection authorities.

Next Steps

28. The Department has referred to some of the measures it is taking to stabilise the Agency’s rate collection business. These should now be put to the Committee in the form of a comprehensive action plan which sets out what is needed to resolve the key problem issues.

Summary of Recommendations

1. The Committee recommends that risk assessments for new projects and programmes include a full assessment and evaluation of the costs of any steps taken to override normal implementation controls, to re-prioritise front line staff and to reduce customer services, particularly when challenging or fixed deadlines must be met (see paragraph 14).

2. Strong and realistic leadership from the programme board is essential to recognise what is and what is not achievable given the available timescales and resources. The Committee recommends Departments to invoke strong governance arrangements over such risk assessments, including consideration by the Department’s Audit Committee (see paragraph 15).

3. Implementation of new IT systems in the public sector has regularly caused difficulties. This is particularly the case if implemented at the same time as major policy changes. The Committee recommends that major new IT systems should not go live until major policy changes are finalised. In exceptional circumstances where this cannot be avoided, such IT projects should be assessed and managed on the basis that there is a high risk of failure, risks must be fully evaluated and adequate resources and contingency plans put in place to minimise the likelihood of post implementation failure and/or significant additional costs occurring. Risk of failure should also be mitigated through skilful project management and ensuring that whatever resources are needed are secured to check and test the adequacy of the design changes. Shortcuts in quality control measures must not be taken (see paragraph 16).

4. Transferring key operational staff to the project to meet the go live deadline led to significant operational problems post implementation of the new system. The Committee recommends that sufficient resources must always be found to ensure core business functions, customer service and performance standards are maintained rather than allow these to deteriorate in order to meet a project deadline, no matter how important that project might be (see paragraph 17).

5. The Committee recommends that DFP examines, in consultation with the Office of Government Commerce, why the Gateway process did not lead to a better outcome in this case. There are obviously lessons to be learnt. The Committee wishes to be informed of the results of this review (see paragraph 21).

6. The completeness and accuracy of specifications for large, complex and/or Mission Critical IT systems are essential if a system is to be successful. The Committee recommends that IT personnel, business users, the finance team, internal auditors and the IT contractor must work closely and effectively together. In addition they must have a clear understanding of the knowledge and expertise each must bring to the successful development of a specification that meets operational and financial requirements. Roles and responsibilities must be clearly defined (see paragraph 28).

7. The Committee considers it essential that all projects, but particularly IT projects, have project teams with the skills and experience proportionate to the size, complexity and importance of the project. The Committee recommends that a general pool of experts from the wider public sector, who have extensive skills and experience of successfully delivering IT projects, is formed and if necessary enhanced by recruitment. This pool must have sufficient breadth of experience to meet the longer term future needs of the Northern Ireland Civil Service. These experts should be allocated to lead large and complex Mission Critical projects (see paragraph 32).

8. The Committee recommends that there must be clear lines of communication between project sub-teams and Senior Responsible Officers (SROs) reporting to the main project board. This is particularly important given the failure to cope with the various interdependencies which, in this project, were not properly identified and/or communicated (see paragraph 33).

9. The Committee strongly recommends that sufficient planning, time and resources must be given to the quality of data transfers and the adequacy of data testing before a system goes live. Shortcuts with testing data must never be taken no matter how important the deadline might be as the cost of any subsequent flaws can be very substantial in terms of fixing an underperforming, live system. The Committee makes this recommendation recognising that it is a very basic and self-evident point but one that was not followed in this project, given the pressures arising from the tight implementation deadline (see paragraph 36).

10. The Committee strongly recommends that DFP ensures that all major systems problems that have led to a lack of proper audit trail are fully resolved. The Committee acknowledges that these audit trail deficiencies remain inherent within the 2007-08 accounts but expects DFP to ensure that the 2008-09 accounts are properly supported by the books and records so that the C&AG can provide the Assembly with an unqualified opinion on the accounts (see paragraph 41).

11. The Committee expects DFP to prepare accurate and timely accounts, initially on a cash basis. The Committee recommends that DFP puts in place arrangements for the preparation of a modern style annual report, as soon as possible that includes accruals based financial information. DFP should liaise closely with the Audit Office in devising the accounting policies and disclosures for these accounts (see paragraph 42).

12. The Committee recommends that all software systems should be designed to reduce the amount of manual data input and limit the extensive use of supervisory test checking that has for so long been the resource intensive practice employed in the public sector. Information should only be input once with all aspects of the system updated electronically. IT systems must have strong validation controls that prevent or, at the very least, substantially reduce human error. In this particular case, DFP should amend the system accordingly and robustly negotiate the cost of doing so with the contractor given the Committee’s view that such system failings should have been obvious to the contractor when designing the software (see paragraph 49).

13. The Committee is particularly concerned that the new system contained a major system weakness in cash procedures which increased the risk of fraud. The Committee recommends that all outstanding system problems are resolved as a matter of urgency and that this Committee is provided with a timetable for their resolution. The Committee expects DFP’s audit committee to closely monitor and challenge progress made and obtain sufficient evidence that there are no other significant system weaknesses (see paragraph 54).

14. The Committee reiterates the recommendation made previously in its report on Tackling Public Sector Fraud that it would like to see much more emphasis given to whistle-blowing as an important means of identifying potential fraudulent activity. There is no excuse for 25% of departments and agencies not having whistle-blowing policies in place and expects DFP to ensure this deficit is addressed and that full compliance is achieved. The Committee also expects DFP to ensure that departments are proactive in training and encouraging staff to blow the whistle and for DFP to include an analysis of activity levels of whistle-blowing across departments as part of its annual Fraud Report (see paragraph 57).

15. The Committee recommends that meaningful and challenging performance targets are set for staff morale and that the implementation of the action plan is monitored by DFP’s audit committee (see paragraph 61).

16. The Committee also recommends that a further survey of the Agency’s staff is conducted in Autumn 2009 (see paragraph 62).

17. The Committee recommends that DFP radically improves the quality of its customer care to its ratepayers, including its handling of phone calls and introduces strong, measurable performance criteria in this area, which should be monitored closely. The Committee wants DFP to report back on what performance targets it has put in place to measure customer service and its timeframe for achieving them. These performance measures should be reported and commented upon in the Annual Report (see paragraph 69).

18. The Committee recommends that demanding targets are set for a reduction in the level of incorrectly recorded vacant properties, over each Council area, and for increasing the amount of rateable assessments for so called vacant properties (see paragraph 72).

19. The Committee recommends that co-operation is needed with Councils to maximise district and regional rate revenues and recommends that the Department conducts a research study in conjunction with Councils with a view to having an agreed strategy on assessing and billing all eligible properties in a timely manner(see paragraph 73).

20. The accuracy of penny product information is essential to the effective financial planning of Council services. While the Committee recognises that forecasting is not an exact science, the Committee is of the view that DFP has not invested sufficient energy into developing systems for calculating the actual penny product and into estimating subsequent year(s) penny product. The Committee recommends that DFP places more resources into the system and develops a more robust budgetary model to estimate future Council revenue (see paragraph 79).

21. The collection of arrears is a core business activity of the Agency. The collection of rate revenue is an important source of funding for central government and a vital one for Councils. The Committee recommends that sufficient resources should always be allocated to the collection of arrears and that these should be ring-fenced. Collection of arrears should never be deferred (see paragraph 92).

22. The Committee recommends that DFP introduces robust measurable performance criteria for the management and collection of rate arrears. This should include a target level of overall arrears, and more detailed targets for each Council area (see paragraph 93).

23. The Committee recommends that revenue forgone and additional costs of collection as a result of the problems with the new system will not be passed on to Councils. The Committee would like an assurance of this from DFP (see paragraph 94).

24. The Department has referred to some of the measures it is taking to stabilise the Agency’s rate collection business. The Committee recommends that these should be put to the Committee in the form of a comprehensive action plan which sets out what is needed to resolve the key problem issues. In particular, the action plan must deal with the following:

a. governance and the control environment;

b. leadership and management skills;

c. communication with stakeholders; and

d. the IT systems.

DFP’s Audit Committee must closely monitor the progress made against this action plan (see paragraph 95).

25. The Committee also considers it essential that the Department’s Audit Committee monitors closely the governance and control environment of Land and Property Services and the performance of its constituent parts that now include rates assessments, property valuations, mapping and land registration (see paragraph 96).

26. The Agency’s problems are so wide ranging that the Committee would suggest that the Assembly’s Committee for Finance and Personnel pays particular attention to the regular monitoring of progress made in stabilising the business and strengthening the governance arrangements (see paragraph 97).

27. The Committee recommends that DFP introduces as soon as possible measurable performance criteria for the assessment and collection of rates. These should include:

a. rates assessments, including a target for improving the completeness of the register of rateable properties and inaccuracies in the number of properties treated as vacant;

b. billing;

c. collection, including the cost of collection per £1 of rates;

d. stakeholder satisfaction; ratepayers, District Councils and staff;

e. irrecoverable rates; and

f. accuracy of penny product estimates.

The standard for these performance criteria should be set at a level that is comparable to the best results achieved in other collection authorities and take account of the needs of key stakeholders (see paragraph 98).

28. All public bodies need to think realistically and carefully about the number of complex change management or IT projects that they can manage and resource at the same time, particularly given the short supply of skilled and experienced project managers and specialists. The Committee recommends that DFP disseminates information on lessons learnt in terms of skills, project management and specialists during this process to other departments where there are multiple significant changes occurring, to avoid similar issues arising in the future (see paragraph 101).

Introduction

1. The Public Accounts Committee met on 18 September 2008 to consider the Comptroller and Auditor General’s report on the “Statement of Rate Levy and Collection 2006-07” which was published within his General Report on “Financial Auditing and Reporting: 2006-2007” (NIA 193/07-08, Session 2008-09). The witnesses were:

- Mr Leo O’Reilly, Accounting Officer, Department of Finance and Personnel (DFP);

- Mr John Wilkinson, Accounting Officer, Land and Property Services (LPS);

- Mr Arthur Scott, Director of Operations, Land and Property Services;

- Ms Anne Johnston, Programme Manager for the Rating Reform and Modernisation Programme, Land and Property Services ;

- Mr Kieran Donnelly, Deputy Comptroller and Auditor General (DC&AG); and

- Mr David Thomson, Treasury Officer of Accounts, Department of Finance and Personnel.

The Committee also took written evidence from DFP.

2. On 1 April 2007, domestic rates bills were issued under a completely new regime. Annual rates bills were for the first time calculated on the basis of the estimated selling price of a home rather than, as had been the case for many years, using rental values determined some 30 years previously. A new computer system was installed in October 2006, to process bills based on the policy. At the same time, senior management and staff were handling the additional challenge of setting up a new Agency, Land and Property Services, created by merging the Rate Collection Agency and the Valuation and Lands Agency and preparing for the inclusion of Ordnance Survey and Land Registers from 1 April 2008.

3. In his report, the Comptroller and Auditor General (C&AG) stated that he could not give any assurance to the Assembly on the assessment and collection of rates for the year 2006-07, due to significant system control problems which arose following the introduction of the new IT system. His report highlighted not only numerous problems in relation to checking the accuracy of the figures in the accounts but also, control failures that impacted on LPS’s performance in administrating and collecting rates.

4. In taking evidence, the Committee focused on three key areas. These were:

- the management of the IT project;

- defective financial and operational controls;

- the huge escalation in the level of arrears of rates following the introduction of the new reforms;

The Management of the IT Project

Priority given to implementing rating reforms

5. The Committee noted that the key priority of DFP and its Agency, LPS, was to issue domestic rates bills on 1 April 2007, based on the new rating reforms. Senior management in the Agency were having to cope simultaneously with:

- the introduction of unprecedented change in rating reform, legislation and policy;

- the implementation of a new IT system that was needed to process the changes in reform; and

- managing the formation of a new Agency, created by the merger of the Rate Collection Agency and the Valuation and Lands Agency on 1 April 2007 and one year later the inclusion of two further Agencies, Ordnance Survey and Land Registry.

6. Current guidance[1] on delivering successful programmes and projects recommends that no government initiative (including legislation) dependent on IT should be announced before analysis of risks and implementation options have been undertaken. DFP informed the Committee that risks were identified and those that were thought to severely threaten the overall outcome of the programme were considered by the programme board.

7. The Committee was informed by the Agency that, at times, the job was colossal with the main focus and effort put into rating reform. Agency staff were transferred from front line service delivery to assist in this. As a result, backlogs arose in dealing with customer enquiries and resolving problems arising from flaws in the new IT system which had been rushed in to meet the reform deadline. The Committee was informed that collection of rate arrears had to be deferred due to the need to drive through the reforms and because the new system could not issue the necessary documentation.

8. DFP pointed out that changes in policy were still being made after the new IT system went live in October 2006. The Department informed the Committee that continuing policy development created additional work and required them to, sometimes, work around the recently implemented IT system. This created additional risks to the system’s ability to process transactions accurately and caused disruption and delays in administering ratepayers’ allowances.

9. The Committee asked DFP why the timescales for these reforms were not adjusted to give some breathing space so that the system could be implemented in a more organised way. DFP informed the Committee that it had carried out an intensive review of whether the system would be capable of issuing the new bills from 1 April 2007; all options were considered and a decision was taken to introduce the system from that date.

10. The Department advised the Committee that the decision to proceed also took account of concerns over the operational effectiveness of the existing IT system, first introduced in 1994. DFP pointed out that, following the decision to proceed, the majority of bills were issued accurately but acknowledged that the decision had led to significant operational and financial management difficulties. The Committee pressed DFP as to whether it had identified all the risks to the system before its decision to proceed. DFP responded that it had identified all the threats and risks to the system and sought to manage these as best as it could.

11. DFP informed the Committee that the Minister was kept fully advised leading up to the decision to proceed with rating reform using the new IT system. The Department also pointed out that there was no requirement for a Ministerial direction as nothing was being requested that was considered to pose a major risk to the system or was judged to be inappropriate.

12. The Committee considers that the decision to proceed with the implementation of the new system was based on a fundamentally flawed risk assessment. It is crystal clear that the Department’s risk assessment did not take sufficient account of the huge risks of not testing the system adequately, the impact of transferring front line staff to work on the introduction of rate reforms and the enormous financial consequences of postponing the collection of arrears. The Committee accepts that the Department achieved its objective of successfully calculating and issuing bills based on capital values by April 2007. However, it is clear that the price paid by the various stakeholders in meeting this deadline outweighed the benefit many times over. The timetable objective may have been achieved but in the process of achieving it the organisation was thrown into chaos.

13. The Committee accepts that the new reforms may have led to a fairer allocation of rates between ratepayers with some paying less, others more and various reliefs and allowances introduced for those in great need, such as the Lone Pensioner Allowance. The Committee is of the view that a properly considered risk assessment would have avoided many of the problems noted in this report by postponing the reforms for one year.

Recommendation 1

14. The Committee recommends that risk assessments for new projects and programmes include a full assessment and evaluation of the costs of any steps taken to override normal implementation controls, to re-prioritise front line staff and to reduce customer services, particularly when challenging or fixed deadlines must be met.

Recommendation 2

15. Strong and realistic leadership from the programme board is essential to recognise what is and what is not achievable given the available timescales and resources. The Committee recommends Departments to invoke strong governance arrangements over such risk assessments, including consideration by the Department’s Audit Committee.

Recommendation 3

16. Implementation of new IT systems in the public sector has regularly caused difficulties. This is particularly the case if implemented at the same time as major policy changes. The Committee recommends that major new IT systems should not go live until major policy changes are finalised. In exceptional circumstances where this cannot be avoided, such IT projects should be assessed and managed on the basis that there is a high risk of failure, risks must be fully evaluated and adequate resources and contingency plans put in place to minimise the likelihood of post implementation failure and/or significant additional costs occurring. Risk of failure should also be mitigated through skilful project management and ensuring that whatever resources are needed are secured to check and test the adequacy of the design changes. Shortcuts in quality control measures must not be taken.

Recommendation 4

17. Transferring key operational staff to the project to meet the go live deadline led to significant operational problems post implementation of the new system. The Committee recommends that sufficient resources must always be found to ensure core business functions, customer service and performance standards are maintained rather than allow these to deteriorate in order to meet a project deadline, no matter how important that project might be.

Gateway Reviews signalled implementation problems

18. The Gateway process is used to assist with the successful delivery of large procurement projects, particularly IT ones. The Office of Government Commerce (OGC) introduced the Gateway review process in Great Britain in 2001 and it was adopted for IT projects in Northern Ireland in 2003. It provides a structured approach to project management by carrying out reviews at five key decision points or “gateways” in the life of the project; three before the award of a contract and two covering service implementation. Reviews are conducted by a team of experts who are independent of the project. Reports are made at each Gateway giving a red, amber or green status depending on the urgency of any action required to ensure the project’s successful progress. Red requires action to be taken immediately while amber requires action to be taken by the next Gateway review and green, take action as required.

19. This IT project has had four Gateway reviews, three of which were assessed as having red status and one amber. DFP informed the Committee that, for each review, it addressed the concerns that had been identified and that it believed that sufficient remedial action had been taken to allow the implementation of the project.

20. The Committee is surprised by this response given the significant pressures faced by almost every part of the business, at that time, and the resultant chaos that ensued. Many of the problems arose due to the rush to meet a deadline that is set in stone. Shortcuts were taken with the system’s implementation and resources re-allocated from the Agency’s day to day business to meet the deadline. The Committee is not convinced that all the Gateway recommendations were implemented as effectively and as quickly as was necessary, particularly the concerns raised by the Gateway team about time pressures and the adequacy of resources. The Committee can only conclude that the Department is mistaken in its positive assessment of the actions it took and/or the speed with which it took them.

Recommendation 5

21. The Committee recommends that DFP examines, in consultation with the Office of Government Commerce, why the Gateway process did not lead to a better outcome in this case. There are obviously lessons to be learnt. The Committee wishes to be informed of the results of this review.

Deficiencies in the design and development of the IT system

22. DFP informed the Committee that the new system was very complex with a specification of some 800 pages and that staff, across the Agency, were involved in reviewing it. DFP commented that it is sometimes difficult for business users to understand the detail that is required in an IT specification. The Committee was advised by DFP that it had mostly got mainstream business processes correct but regretted that some areas were missed and some functional errors made. The Committee disagrees with this assessment. Areas missed included:

- the system’s ability to issue final reminders, a core operation of the Agency;

- initiating legal proceedings;

- validation controls over manual input errors; and

- an audit trail that enabled the C&AG to give adequate assurance on the accounts.

23. The Committee asked who was responsible for the specification; the Agency or the IT contractor. The Department informed the Committee that the detail of the specification rested fully with the Agency although it was assisted by the contractor. The Department emphasised that the contractor had to deal with significant changes, some very late in the day, as a result of revisions to rating policy.

24. The Committee accepts that many of these problems were the responsibility of the Agency but also considers that a number of the deficiencies in the software should have been, at least, picked up by the contractor, before proceeding. For example, the Committee is very surprised that the system allows some ratepayers to be incorrectly issued with million pound bills due to simple keying in errors. IT systems should be designed to prevent and detect manual errors of this nature.

25. The Committee wanted to know from DFP whether the system could now be confirmed as stable, as far as operational and financial needs are concerned, and that the system meets the Agency’s needs for the foreseeable future. The Department informed the Committee that the Agency has made major progress on the post ‘go live’ IT system issues with regard to operational needs, including accounting and financial management and control. The Agency’s ongoing full review of the system’s financial specification has identified a number of improvements and projects to deliver these have started. Nevertheless new demands on the system will continue to emerge as further changes to the rating system and associated rating reliefs are introduced following decisions by the Executive and the Assembly. DFP concluded that such changes to the system will require development, testing and implementation.

26. The Department informed the Committee that additional requirements, including expert advice, requirements over and above the contracted work and improvements to functionality add further costs to the system. The estimated total cost of the IT replacement project at the time of its closure in June 2008 is £13 million. This figure, which excludes the costs arising from the Review of Rating, is just outside the original risk analysis for the approved business case.

27. The Committee is concerned that the cost has escalated from an initial estimate of £10.5 million to a revised estimate in the C&AG’s report of £11.5 million and now this cost has increased by a further £1.5 million to £13 million. The Committee is of the opinion that the contractor is doing very well out of the increasing value of the contract. Errors or omissions from the specification provide contractors with a rich revenue stream that is not subject to competitive tendering.

Recommendation 6

28. The completeness and accuracy of specifications for large, complex and/or Mission Critical[2] IT systems are essential if a system is to be successful. The Committee recommends that IT personnel, business users, the finance team, internal auditors and the IT contractor must work closely and effectively together. In addition they must have a clear understanding of the knowledge and expertise each must bring to the successful development of a specification that meets operational and financial requirements. Roles and responsibilities must be clearly defined.

Skills and Competencies

29. DFP advised the Committee that the entire rating reform project was managed within an overall project delivery framework that was fully compliant with OGC arrangements. There was an overall programme board led by a Senior Responsible Officer (SRO) and individual IT projects beneath this main board, each with their own SRO. DFP emphasised to the Committee that this radical and extensive programme of reform involved introducing new systems over a very short timescale. DFP remarked that the separate project teams may have, at times, worked against a successful outcome by not taking full account of the interdependencies between each sub-project. DFP also noted that appropriately skilled and experienced people for such large projects are in short supply.

30. The Committee welcomes the Department’s candour on these deficiencies. This case has exposed a worrying IT skills deficit which the Department is now taking steps to address. The public service needs talented, commercially orientated IT specialists that can negotiate effective outcomes with private sector contractors.

31. The Committee also considers that the project lacked sufficient accounting and management expertise. Better accounting skills should have assisted in reducing the volume of basic financial deficiencies in the system specification and design. Better management skills may have led to better decision making in terms of what needed to be done to create stable post implementation operations.

Recommendation 7

32. The Committee considers it essential that all projects, but particularly IT projects, have project teams with the skills and experience proportionate to the size, complexity and importance of the project. The Committee recommends that a general pool of experts from the wider public sector, who have extensive skills and experience of successfully delivering IT projects, is formed and if necessary enhanced by recruitment. This pool must have sufficient breadth of experience to meet the longer term future needs of the Northern Ireland Civil Service. These experts should be allocated to lead large and complex Mission Critical projects.

Recommendation 8

33. The Committee recommends that there must be clear lines of communication between project sub-teams and SROs reporting to the main project board. This is particularly important given the failure to cope with the various interdependencies which, in this project, were not properly identified and/or communicated.

Data transfer and data testing problems

34. DFP informed the Committee that both the quality of the data transferred from the old IT system to the new one and the testing of the new system with test data were sub-standard. DFP explained that much of the data on the old system was unstructured and it was therefore difficult to establish rules for its transfer. The Department admitted that more resources should have been allocated to this. The Committee is alarmed by this given that a new system had been in planning since 2001.

35. Test data was used to check whether the system worked properly. The data used did not test all potential eventualities and therefore did not reveal certain crucial errors in the specification. For instance, following the IT system going live, it was discovered that there were insufficient, inbuilt software checks validating data input manually.

Recommendation 9

36. The Committee strongly recommends that sufficient planning, time and resources must be given to the quality of data transfers and the adequacy of data testing before a system goes live. Shortcuts with testing data must never be taken no matter how important the deadline might be as the cost of any subsequent flaws can be very substantial in terms of fixing an underperforming, live system. The Committee makes this recommendation recognising that it is a very basic and self-evident point but one that was not followed in this project, given the pressures arising from the tight implementation deadline.

Defective Financial and Operational Controls

Adequacy of financial accounts

37. The C&AG recommended as far back as 2005-2006[3] that DFP strengthened accountability arrangements for rates assessments and collection. Presently no annual report or financial statements are prepared or laid at the Assembly on what is a billion pound business. The current accounts consist of a one page, cash based statement. The Committee is astonished that the long established principle of commercial style accruals accounting has not yet been introduced to such a significant source of public sector revenue. This must be one of the few remaining accounts prepared in this basic and most uninformative manner.

38. DFP informed the Committee that a project has commenced that will enhance the accountability arrangements in due course. The Department noted that the restatement of the Statement of Rate Levy and Collection from a cash to an accruals basis will be a complex and challenging process. In order to ensure a clear focus on this task, the Agency has appointed a professionally qualified accountant to lead a project team to manage and oversee the transition to the new arrangements. This team will work to the delivery of a fully auditable resource based collection account by 2009-10.

39. The Committee noted that the receipts figure of £847 million could not be traced through to bills paid and included a £4 million pounds balancing figure. Vacancy deductions of £22 million included another £4 million pounds balancing figure. Even the bank account was not reconciled, the most basic but critical of accounting controls. The Committee notes, however, that the C&AG could not, in the circumstances give any assurance on the 2006-07 accounts as it was not possible to verify a number of very material figures reported in the accounts. This was due to significant control problems arising from the poor specification of the IT system and due to certain key controls not functioning.

40. The Committee has reviewed the updated information provided by the Agency on progress made since the preparation of the C&AG’s report. While there is evidence of some progress, there is still much to be done.

Recommendation 10

41. The Committee strongly recommends that DFP ensures that all major systems problems that have led to a lack of proper audit trail are fully resolved. The Committee acknowledges that these audit trail deficiencies remain inherent within the 2007-08 accounts but expects DFP to ensure that the 2008-09 accounts are properly supported by the books and records so that the C&AG can provide the Assembly with an unqualified opinion on the accounts.

Recommendation 11

42. The Committee expects DFP to prepare accurate and timely accounts, initially on a cash basis. The Committee recommends that DFP puts in place arrangements for the preparation of a modern style annual report, as soon as possible that includes accruals based financial information. DFP should liaise closely with the Audit Office in devising the accounting policies and disclosures for these accounts.

Financial control weaknesses

Validation controls

43. The Committee is of the view that it is incredible that the new IT system allowed ratepayers to receive incorrect bills in the value of millions of pounds. The Committee is concerned that the Department was unable to provide any assurance that smaller errors were or would be detected.

44. The Committee is concerned that a new IT system dealing with hundreds of thousands of bills requires so much manual data input. Where data is input manually, the Committee noted that there are insufficient validation controls built into the system software to detect keying in errors. These are basic controls which have been standard in IT system designs for decades.

45. The omission of such validation controls, in the Committee’s view, is an extremely serious oversight on the part of those at the Agency who prepared the specification and indeed on the contractor who wrote the software. It beggars belief that such a basic matter as this was overlooked by all involved in the development of the system’s software.

46. DFP informed the Committee that this was a very large system going through significant change and errors and omissions occurred in the specification and design of the system around certain non-standards transactions. The Department informed the Committee that any shortcomings in the system affecting a very small percentage of transactions can affect thousands of ratepayers. The Committee noted that, in this environment, considerable time and resources are required to resolve the backlog of errors and complaints that inevitably arise.

47. The Department pointed out that it was considering introducing supervisory checks in the absence of these embedded software controls. The Committee considers that this type of extensive supervisory checking should not normally be required in a properly designed IT system.

48. The Committee understands that mistakes are made by staff when a high number of transactions must be processed each day. This was compounded by employing casual staff unfamiliar with the business to replace experienced staff who were reassigned to ensure the reforms were introduced on time. In the Committee’s view the Agency’s staff who were not given the basic IT tools to avoid the normal levels of human error in processing significant amounts of data each day.

Recommendation 12

49. The Committee recommends that all software systems should be designed to reduce the amount of manual data input and limit the extensive use of supervisory test checking that has for so long been the resource intensive practice employed in the public sector. Information should only be input once with all aspects of the system updated electronically. IT systems must have strong validation controls that prevent or, at the very least, substantially reduce human error. In this particular case, DFP should amend the system accordingly and robustly negotiate the cost of doing so with the contractor given the Committee’s view that such system failings should have been obvious to the contractor when designing the software.

Landlord and agency allowances

50. The Committee also questioned DFP about the £5 million of allowances received by landlords and agents for prompt payment, even though some may not have qualified. The Department explained that the bills were issued under the old IT system but payment of them processed on the new system. There were difficulties processing these receipts on the new system which meant that they were input individually. The Department informed the Committee that staff did not follow procedures given to them.

51. The Committee is concerned that senior management considered this problem to be one where staff did not follow procedure rather than, as the Committee concludes, a management failure to introduce effective systems.

Bank reconciliations

52. The Committee noted that bank reconciliations, which are probably the most basic and key control of any business no matter how small, remain outstanding since 2006. DFP regretted that the main bank reconciliation was not working in 2006-07; this was due to a backlog in the Agency after the new system was installed. Significant progress has been made since then. The Agency noted that there are now just 352 that relate to 2006-07 and 180 items relating to 2007-08 that remain to be reconciled. The 2008-09 bank reconciliation is now being carried out daily. Queries that have been identified are investigated immediately and resolved promptly. The three other accounts that are used for rate revenue money are all up to date. The Committee was assured, at least, that this control is finally in place.

Cash Office Procedures

53. Internal Audit highlighted fundamental flaws in cash office procedures following the implementation of the new IT system in October 2006. Cashiers could remove a receipt from the system and this would not be picked up by any reconciliation. This was a serious control failing. The Department informed the Committee that this weakness arose because the permission levels for users were weak. Also, an individual had inappropriately obtained a supervisor’s password and used that password to reverse receipts already issued. Following investigation action was immediately taken to address these control failures. A manual process was designed, quality assured by DFP Internal Audit, and implemented from February 2007 until a system ‘fix’ was developed, tested and implemented in September 2007.

Recommendation 13

54. The Committee is particularly concerned that the new system contained a major system weakness in cash procedures which increased the risk of fraud. The Committee recommends that all outstanding system problems are resolved as a matter of urgency and that this Committee is provided with a timetable for their resolution. The Committee expects DFP’s audit committee to closely monitor and challenge progress made and obtain sufficient evidence that there are no other significant system weaknesses.

Fraud risk

55. Weaknesses in financial procedures such as those noted above, increase the risk of fraud, as well as error. Moreover, they reduce the likelihood of detection of fraud. The Committee asked how many frauds has been discovered in the last three years. The Department informed the Committee that, in the last three years, following investigations and, including the case referred to above, the Agency has detected two internal frauds. In both these cases, legal proceedings are under way.

56. Given this extremely weak control environment, the Committee was therefore amazed that DFP, the Department responsible for issuing best practice guidance, did not yet have a whistle-blowing policy in place.

Recommendation 14

57. The Committee reiterates the recommendation made previously in its report on Tackling Public Sector Fraud[4] that it would like to see much more emphasis given to whistle-blowing as an important means of identifying potential fraudulent activity. There is no excuse for 25% of departments and agencies not having whistle-blowing policies in place and expects DFP to ensure this deficit is addressed and that full compliance is achieved. The Committee also expects DFP to ensure that departments are proactive in training and encouraging staff to blow the whistle and for DFP to include an analysis of activity levels of whistle-blowing across departments as part of its annual Fraud Report.

Staff morale

58. The Committee enquired about the impact that the system problems were having on staff morale and asked DFP for a copy of a staff survey conducted in 2007 covering all staff at the Department and its agencies. The Committee has now received this survey and has found the results relating to the Agency to be very disturbing. 43% of the Agency’s staff believed that they had insufficient resources to do their job properly, 43% felt customers did not receive a good quality service and a staggering 47% did not have overall confidence in senior management. All of these results were considerably worse than those of the Department as a whole.

59. The Agency informed the Committee that 50% of staff had responded to the survey and the comments quoted above were made by individuals. The Committee was informed that the Agency hopes that attitudes have improved, given the effort that has been made since then to support the business. The Agency noted that a further survey is to be conducted soon and will be provided to the Committee by January 2009. As a result of the outcome of the 2007 staff attitude survey, the Committee has been advised that an action plan has been initiated for 2008-09. All Agency staff were consulted on the plan. The plan contains 26 steps to be taken to improve performance in the key areas of leadership/management, customer focus and communications.

60. The Committee welcomes the fact that a staff attitude survey was conducted during what has been a very challenging time for all those working at the Agency. It also welcomes the introduction of an action plan and the fact that staff were consulted on its content.

Recommendation 15

61. The Committee recommends that meaningful and challenging performance targets are set for staff morale and that the implementation of the action plan is monitored by DFP’s audit committee.

Recommendation 16

62. The Committee also recommends that a further survey of the Agency’s staff is conducted in Autumn 2009.

Customer service

63. From the evidence presented to the Committee, it is very evident that customer service has suffered appallingly as a result of these problems. During the past nine months elected representatives have been inundated with reports of people receiving the wrong rates demands, receiving a bill for the house next door or vulnerable pensioners who are waiting for their much needed allowances. Examples were given of ratepayers repeatedly being unable to contact the Agency.

64. The Department informed the Committee that this was not acceptable and there is no excuse for it. It added that it is conscious of the importance of people being able to make telephone contact rapidly and that is why it is developing a new contact system, called ‘Northern Ireland Direct’. This will come into operation later in the year. Northern Ireland Direct will provide callers with a three digit telephone number for government services; one of its initial priorities is those people who want to contact the Agency.

65. Some £7.2 million of receipts were unallocated to ratepayer accounts at 31 March 2007. The Committee asked DFP if this meant that those that had paid their rates find themselves being pursued for late payment. DFP pointed out that, if the Agency is unable to allocate receipts to the correct accounts because the necessary details have not been provided, then it is likely that the ratepayers will receive a final notice. However, this normally triggers the ratepayers to make contact with the Agency to say that they have already paid the bill and, once they have provided the information needed, the receipt can be allocated to them.

66. DFP advised the Committee that some £6.9 million has now been allocated to customer accounts. The remaining £273,000 has been allocated to suspense accounts[5] and the Agency is working to allocate these receipts to the correct ratepayer accounts. Every effort will continue to be made to allocate payments received to the correct accounts.

67. The Committee notes the Department’s explanation for unallocated cash but would point out that the C&AG’s report notes that the £7.2 million of unallocated cash was due to continued problems with the IT system. Nevertheless, notwithstanding the reason, the Committee is concerned that there are still a considerable number of ratepayers whose payments for 2006-07 have still not been allocated some 18 months later and are probably being pursued as if they are in arrears. The Committee is concerned that they probably have given up trying to contact the Agency given the comments above.

68. The Committee agrees with DFP that not responding to customer enquiries is unacceptable. Many ratepayers have legitimate worries as a result of receiving inaccurate bills and vulnerable ratepayers need help in obtaining allowances, which can be complicated to claim let alone understand. The Committee records the obvious point that administrative backlogs and poor customer care are not a good combination and must be avoided by public sector service providers. Life is difficult enough for the ordinary ratepayer in the unprecedented economic difficulties. Citizens expect and deserve a lot better than this from the public sector.

Recommendation 17

69. The Committee recommends that DFP radically improves the quality of its customer care to its ratepayers, including its handling of phone calls and introduces strong, measurable performance criteria in this area, which should be monitored closely. The Committee wants DFP to report back on what performance targets it has put in place to measure customer service and its timeframe for achieving them. These performance measures should be reported and commented upon in the Annual Report.

Identifying all rateable properties

70. During 2006-07, the Agency abandoned its inspections of vacant properties, that is, properties which are not billed for rates. Through such inspections, properties notified as vacant can be found to be occupied and rates payable. This important work was deferred as staff were needed to assist with the introduction of rate reforms. The Committee asked why the consequences of the drive to introduce reforms were not foreseen earlier and managed better. DFP noted that it had taken the view, at the time, that the work could be caught up later. But in hindsight it admitted that it should have committed more resources to this and other deferred activities during 2006-07 towards the end of the lengthy rating reform process.

71. It is vital that the Agency has an accurate up to date list of all properties so that all those liable to pay rates are assessed and billed. The Committee was concerned that there was evidence of both old and new properties that had been overlooked. The Department commented that there could never be 100% accuracy due to the nature of changes occurring in the property market and the volume of properties to be recorded. The Agency informed the Committee that it obtains information from a variety of sources, the most important of which were District Councils. An exercise is currently being carried out with Belfast City Council’s building control department to improve the accuracy of the property list in its area with a view to extending it out throughout NI.

Recommendation 18

72. The Committee recommends that demanding targets are set for a reduction in the level of incorrectly recorded vacant properties, over each Council area, and for increasing the amount of rateable assessments for so called vacant properties.

Recommendation 19

73. The Committee recommends that co-operation is needed with Councils to maximise district and regional rate revenues and recommends that the Department conducts a research study in conjunction with Councils with a view to having an agreed strategy on assessing and billing all eligible properties in a timely manner.

Problems with the calculation of the penny product

74. The penny product is a statistical analysis used to derive the district rate. The Agency prepares an estimate of it that is used by District Councils to forecast their future revenue as part of the operational planning. There has been a history of errors in calculating the penny product that has led to amounts repaid by some Councils and others receiving additional revenue. The Committee noted that Councils have regularly expressed concerns over the accuracy of the amounts estimated by the Agency.

75. The Committee noted that assurances had been given to the Committee of Finance and Personnel in 2001 that calculations in future would be accurate. The Committee asked DFP why an error had reoccurred in 2006-07. DFP explained that a control had been compromised but that the error had been quickly found by staff and revised estimates issued. Any calculation of the penny product is now fully reperformed by another person to ensure accuracy of calculation. The Committee was of the view that reperformance was a very outdated solution and that better technology was needed.

76. The Committee questioned DFP why amounts were clawed back from a number of Councils. DFP pointed out that these were not the result of errors but differences that arise as events crystallise differently than forecast. Estimates are a prediction of future events and are rarely exactly accurate. DFP noted that estimates for most Councils were within 2%, although it was admitted a number of Councils had a much wider margin of difference. DFP explained that it was learning from past results and had recently worked in greater partnership with Councils to share information and identify gaps in the data used in the calculations.

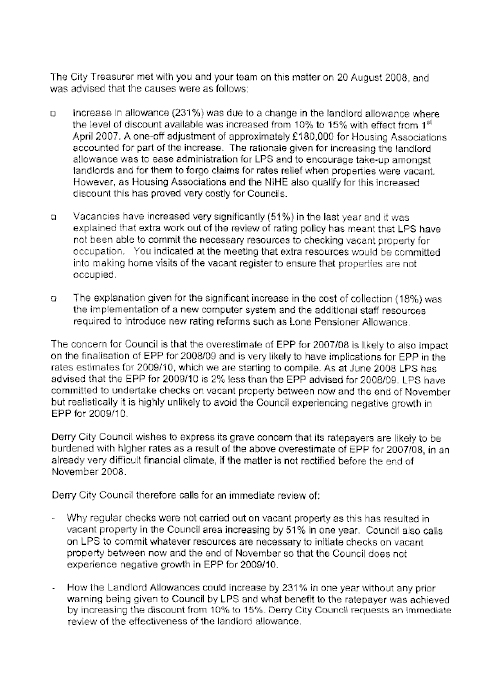

77. Since the evidence session, the Committee received correspondence from Derry City Council which notes the Council’s grave concern over the impact that overestimates of penny product are likely to have in future years on ratepayers through higher rates. The Council also expressed concern at the loss of revenue from vacant properties as a result of the deferral of regular checks and the above inflation increase in the Agency’s cost of collection which it must pay.

78. The Committee is extremely concerned that DFP was not providing Councils with sufficiently accurate information to enable them to do their their corporate planning. Small percentage errors have a very significant impact on their finances. It seemed to the Committee that insufficient resources have been provided to improving accuracy in this important area, perhaps, because DFP considered this to be more of problem issue for Councils than for itself. While the Committee notes DFP’s comments that more partnership working had been introduced recently, this seems to the Committee to be too little and too late.

Recommendation 20

79. The accuracy of penny product information is essential to the effective financial planning of Council services. While the Committee recognises that forecasting is not an exact science, the Committee is of the view that DFP has not invested sufficient energy into developing systems for calculating the actual penny product and into estimating subsequent year(s) penny product. The Committee recommends that DFP places more resources into the system and develops a more robust budgetary model to estimate future Council revenue.

The High Level of Rate Arrears following the Introduction of the New Reforms

80. Throughout this report, the Committee has been critical of the adverse impact that the priority which DFP gave to implementing the reforms in domestic rates by 1 April 2007 has had on the development of the IT system, the performance of the Agency on behalf of its customers and on its financial accounting. However, the decision to defer the collection of arrears is, in the Committee’s view, the most incredible decision of all.

81. The prior record of the Agency in collecting rates had been good with rate arrears of £24 million in 2004 but, following this decision, arrears rose to £88 million in 2007 and £124 million in 2008. The Committee asked DFP if it had considered other options and if it had estimated what the impact of the decision to defer collection would have on public finances. DFP responded that it had carefully considered the options available at the time but a clear decision was taken to give high priority to ensuring that the system was in a sufficient state of readiness to collect more than £1 billion of rates revenue (based on the new reforms) that was due for billing on 1 April 2007. The potential risk to collection of this revenue was judged to take a higher priority than the risk (which materialised) of not being able to use the new IT system to process debt proceedings against those who had failed to pay their rates bills on time. As the C&AG’s report highlights, rate arrears increased by some £40 million in 2006-07.

82. DFP informed the Committee that central government finances would have been in trouble, because of higher arrears, if it were not for significant underspends in other areas. The shortfall of revenue collected over the amount budgeted was £54 million in 2006-07 and £30 million on 2007-08. If and when the backlog in arrears is collected that money will fund spending. The Department accepted that if extra money had been received from rates, it could have adjusted expenditure upwards to allow more money to be used on public services. If and when the shortfalls are recovered, through recovery of arrears, this money will be used in spending plans.

83. The Committee finds it difficult to understand the decision taken to defer recovery of arrears, given its effect on public finances. The Committee is not convinced that other options, such as timetable adjustment, were sufficiently explored.

84. Every day’s delay in recovering arrears increases the cost of its collection and the risk of bad debt. Pursuing arrears is time-consuming, particularly if it is not done in a timely manner. More people will have moved house or will avoid payment due to the delay in pursuing them or simply will not be able to afford repayment of rate arrears on top of the arrival of the next year’s bill. More time and money will also be spent arranging assistance to those in financial difficulty to pay off arrears by instalments.

85. DFP informed the Committee that pursuing older debt and tracing ratepayers who have moved is time-consuming. It should, nevertheless, be noted that the Agency does not write off debt until all possible rate recovery actions have been exhausted.

86. All of this has a significant cost. At one stage the Agency had only seven people tasked with pursuing arrears. DFP informed the Committee that it is now putting a lot of time and effort into this. Staff involved in the catchup exercise has risen to 80. The Committee is very concerned with, not only the spiralling level of arrears as a result of the decision to defer, but also with the spiralling cost of collection given the number of staff needed to undertaking recovery action. The Department estimates that the extra cost of this is in the region of £700,000. This is based on cost of staff to deal with the backlogs in revenue and benefits (£340,000), the costs of casual staff to ‘backfill’ these posts (£300,000), and the costs of data matching to trace ratepayers who have moved (£60,000).

87. The Committee asked what impact these additional amounts were having on the cost of collecting rates. The Department then informed the Committee that this information is not currently available as unit cost targets, which were published annually by the former Rate Collection Agency, were discontinued with effect from 2005-2006 due to the additional work necessary for the programme of rating reforms.

88. The Committee finds it unacceptable that the preparation and publication of such key performance information was discontinued to accommodate the introduction of rating reforms. The Department informed the Committee that the best alternative information available is the unit cost of collecting rates that is, raising assessments and pursuing collection for each rateable property. The estimate for 2007-08 was £20.00 (£11.00 in 2005-06). The estimated cost for receiving and processing Housing Benefit applications was £36.00 (£28.00 in 2005-06). The Department informed the Committee that the Agency will reintroduce unit costs for revenues and benefits from 1 April 2009. These will be benchmarked with similar appropriate revenue and benefits bodies in Great Britain and Ireland. The Committee is concerned at the significant increases in these figures over two years.

89. The Committee also wanted to know what impact the decision to defer recovery action would have on levels of irrecoverable rates. DFP informed the Committee that it estimates irrecoverable arrears to double from £2 million to £4 million each year but noted that this estimate was subject to a fair degree of uncertainty. The Department’s view was that “it was a question of just waiting to see what happens”. In the Committee’s view the £4 million estimate seems very much understated given the current economic difficulties people are facing with enormous rises in electricity and gas prices and the lack of credit now available.

90. DFP informed the Committee that, under current arrangements, Councils would have to fund the higher cost of collection in the years to come as well as sharing with central government any loss of funds due to irrecoverable rates. This means less money to spend on public services. The Committee finds it intolerable that Councils will have to ‘pick up the tab’ for systemic failure in a central government agency.

91. The Committee asked DFP when arrears would return to the levels experienced in 2004, when the Agency’s performance was good when benchmarked against other agencies. DFP commented that a return to 2004 levels would be difficult given the amount of collectable debt over the past five years has grown by 50% and that the Agency now has non domestic vacant rates to collect, which were not in place in 2004. DFP assured the Committee that there is no acceptable level of arrears but it is seeking to carry out benchmarking with other collection authorities to establish what the future level of arrears should be. The Committee is concerned that there is no robust target established and that the DFP could not say when the normal target of collecting 98% of assessments will be achieved.

Recommendation 21

92. The collection of arrears is a core business activity of the Agency. The collection of rate revenue is an important source of funding for central government and a vital one for Councils. The Committee recommends that sufficient resources should always be allocated to the collection of arrears and that these should be ring fenced. Collection of arrears should never be deferred.

Recommendation 22