Research and Library Services

Research Paper

08/10/07

An International Comparison of Local Government Taxation

Jodie Carson

Research Officer

Research Papers are compiled for the benefit of Members of The Assembly and their personal staff. Authors are available to discuss the contents of these papers with Members and their staff but cannot advise members of the general public.

1. Introduction

Recent changes to domestic rating in Northern Ireland were met with considerable criticism, resulting in the announcement of a Rating Review. This ongoing review is a twofold one; it is considering ways in which the existing system might be improved in the short to medium-term, and the feasibility of longer-term tax alternatives and/or supplements. This paper refers to the international experience of local government taxation and seeks to identify any potentially relevant considerations for NI.

2. Context

The review is divided into two ‘strands’; strand 1 is reviewing specific details of the existing property-based tax system, and is sub-divided into 1A and 1B:

Strand 1A covers amendments which could be made in the short-term 1, including:

-

Changes to the level of the maximum cap

-

Introduction of Minimum Payment

-

Introduction of Rating of Vacant Domestic Property

-

Amendments to the Rate Relief Scheme

-

Revision of the Existing Provision for Education and Training Relief

-

Introduction of the Deferment Scheme for home owning pensioners

-

Revision of the Early Payment Discount

-

Re-profiling the Transitional Relief Scheme

Strand 1B is similarly concerned with changes to the existing scheme; however, these are medium-term options, in that they would require primary legislation:

-

Graduated tax system

-

Single Person Discount

-

Single Pensioner Discount

-

Automatic Pensioner Discount

-

Broadening of the existing Disabled Persons Allowance provision

-

Circuit breakers

-

Enhanced discount for farmers

-

Discount for owner occupiers

-

Rates credit

Strand 2 encompasses the wider issue of whether the existing system of domestic rates is fiscally optimal. Longer-term (replacement and/or supplementary) options, some of which would require amendment to the Northern Ireland Act 1998, are being considered in this regard, including:

-

Banding of Capital Values

-

Local Income Tax

-

Income Tax Varying Powers

-

Local Sales Tax’

-

Poll Tax

-

Tourist Tax

-

Road Charging

-

Green Taxes

-

Land Value Taxation

-

Derelict Land Taxation

3. Outline

The paper begins by presenting a comparative overview of differential regimes of local taxation, focusing on the international prevalence (or otherwise) of property based systems. The following section considers the international experience of property taxation and attempts to identify specific practices and/or lessons which might be applicable to Strand 1 considerations. The subsequent section considers alternative tax sources which are employed internationally; and any implications for Strand 2. The final section identifies any additional issues which have emerged.

4. Overview: Comparative Regimes of Local Taxation

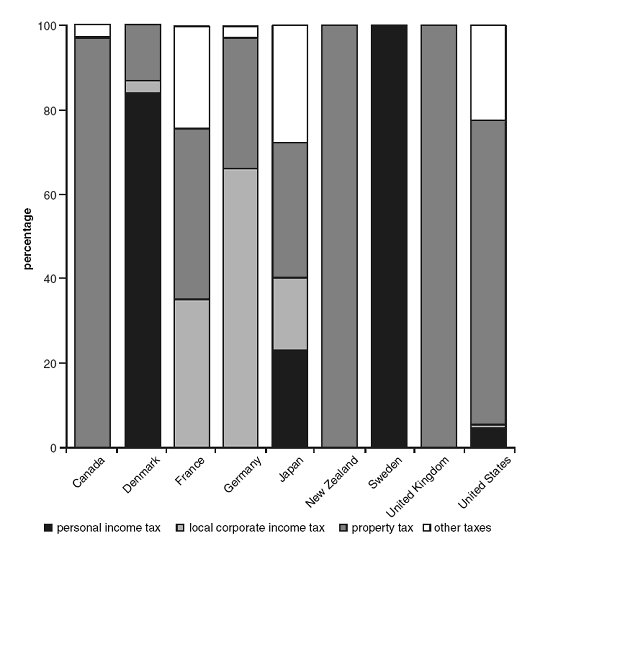

Countries’ systems of local taxation tend to fall into two broad categories; those primarily reliant on income tax, and those dependent upon property tax. Generally, within the EU, income taxes dominate. In Belgium, Denmark, Finland, Germany, Iceland, Luxembourg, Norway, Sweden, and Switzerland, more than 80 percent of tax revenues are derived from personal and/or corporate income tax. On the other hand, property taxes contribute more than 80 per cent of local tax revenues in Australia, Canada, Ireland, the Netherlands, New Zealand, the U.K and the U.S.A. Other countries which employ a local property tax, albeit to a lesser degree, include Austria, Finland, Germany, Portugal, Spain, Belgium, Denmark and France.

However, a number of countries use a combination of both taxes. The table below shows that property taxation is frequently used in conjunction with income, and other, taxes.

Table 1: Local Authority Taxation 2

Country |

Local Authorities Taxes |

|---|---|

U.S.A |

Property tax |

|

Sales tax |

Canada |

Property tax |

Australia |

Property tax |

Germany |

Property tax |

|

Business tax |

U.K. |

Property tax |

France |

Property tax |

Business tax |

|

Residents’ income tax |

|

Belgium |

Personal income tax surcharge |

|

Property tax |

Switzerland |

Personal income tax surcharge |

|

Corporate income tax surcharge |

|

Property tax |

Norway |

Personal income tax |

|

Property tax |

Denmark |

Personal income tax |

|

Property tax |

Austria , France, Greece, Italy, Portugal and Spain are unusually fiscally diversified; they rely on a mixture of local tax sources 3. On the other hand, as indicated above and illustrated bellow, the U.K. is somewhat unusual in its exclusive reliance upon property taxation:

Figure 1: Composition of Local Tax Revenues by Country (2001)

Source: http://siteresources.worldbank.org/PSGLP/Resources/LocalGovernanceinIndustrial.pdf

5. Strand 1: International Experiences of Property Taxation

5.1 Why use a local Property Tax?

It is largely accepted that property tax is best suited to generating revenue to finance local government infrastructure investment and the provision of local services 4. Furthermore, due to visibility and immobility, property tax is hard to avoid, stable, and is easily enforceable.

5.2 Comparative International Regimes of Local Property Tax

By way of comparative analysis, this section considers a selection of international property taxation systems 5. In particular, any features relevant to Strand 1 options are outlined.

USA

In the U.S, property taxes are the principal revenue source of local governments. As in NI, a capital value system is used; however, some states define the taxable value as a fraction of market value. These percentages differ between states, depending on the type of the property 6.

Various reliefs (depending on the State) are offered to certain taxpayers or types of property. These include owner-occupiers, pensioners, veterans, disabled, etc. Many states also place upper limits on tax rates. In California, there is a limit on both actual rate liability and on future increases. In an attempt to ensure affordability, ‘Proposition 13’ was passed in 1978, stating that the tax rate on any property can not exceed 1% of its assessed value (based on 1975-6 values). Furthermore, the assessed value of a property can not increase by more than 2% per year, (or inflation – whichever is less) except when there is a change of ownership, or when value-adding improvements have been made 7. During the 1980s, many other states followed this example and imposed similar tax limits.

A similar scheme of rate limitation was introduced in Florida, known as “Save Our Homes”. This seeks to assist pensioners and low-income families and is based upon the assumption that these individuals have considerably less mobility (i.e. they move house less) than other taxpayers. In the same way as Proposition 13, this amendment provides that the growth in the assessed value of an owner-occupied property can not exceed 3% per annum or the percentage change in the Consumer Price Index (whichever is lower).

It should be noted that ‘Proposition 13’-type schemes have had what is referred to as a ‘lock in’ effect, whereby homeowners became reluctant to move house (and to invest in improvements). The scheme created a disincentive to move (and/or improve), distorting the workings of the property market – an outcome which is economically unfavourable. In attempt to alleviate this an extension to Proposition 13 was approved in 1986, whereby residents aged 55 and older are entitled to carry the benefit with them when moving within participating counties, and to a property of equal or lesser value.

New Zealand

Rates on property are also the most important single source of revenue for local government in New Zealand.The property rate is levied on land and property, and is relatively complex in that municipal councils can choose from among various rate-levying methodologies. They can choose between levying rates on the capital value of land, or on the annual land value; in practice, 50 Territorial Local Authorities (TLAs) use land value, 23 TLAs use capital value, and a single TLA imposes actual rental value. In terms of exemptions, the Local Government (Rating) Act 2002 excludes various categories of land from rates, including land used for charitable, educational, religious purposes, and Crown land and national parks.

Canada

Property and related taxes are the main source (about 63% overall) of own source revenues in Canada.Real property taxes (taxes on land and improvements) provide, on average 41.9% of total revenues – the remainder is attributable to business taxes, payments in lieu of taxes from other governments / agencies, lot levies, and special assessments. The property tax base includes land, buildings and structures, and in some provinces machinery and equipment attached to the property are included.

The assessment of property in Canada is based on market value, but special consideration is given to agricultural land, forests and mining property. Assessments also favour residential property, especially that pertaining to owner-occupiers. Rates vary widely among municipalities; however, a property tax equivalent to 1 to 2 per cent of market value would be typical for residential property.

Europe

European local governments have some leeway over the property tax, with the exception of Danish countries, where the rate is centrally determined. As is the case in the UK, local governments in Germany, Ireland and Belgium have the discretion to set the rate. However, the Belgian regions can temporarily put a ceiling on the rate. In Spain and Finland, local governments can set the rates between limits.

In Finland, property taxation was introduced in 1993 as part of the income tax reform. The rate applies to land and buildings, with farmland and forest exempted; municipalities are free to set their own rate, within limits set by law. In France, property tax is also paid on buildings and land, however, the assessment basis is the rental value of the property. In the Netherlands, property tax is based upon the value of the property, which is re-evaluated every four years. The rate can be set at the discretion of municipalities, however limits apply. For example, the tax rate applicable to owner-occupiers must not exceed 1.25 times that applied to tenants.

Summary Comparative Property Tax Systems:

Country |

Rate Applies to: |

Valuation Basis: |

Limits/ Caps: |

Exemptions/ Reliefs: |

USA |

- Property - Some states impose higher rates on land than improvements |

Capital Value Or Percentage of Capital Value |

- Limits in most states. - In California rate increase limited to 2%p.a 8. - In Florida rate increase limited to 3%pa |

- owner-occupiers - military - elderly - disabled - agricultural land credit - family farm credit |

New Zealand |

- Land and property |

Capital Value/ Land Value/ Rental Value |

|

- certain categories of land

|

Canada |

- Land, building and structures - In some cases, machinery and equipment |

Market Value |

|

- owner-occupiers - certain categories of land |

Finland |

Land, buildings |

|

- Limits set |

- farmland - forest |

France |

Land, buildings |

Rental Value |

|

|

Netherlands |

Property |

Capital value |

- Rate applicable to owner-occupiers most not exceed 1.25 times that of tenants |

|

5.3 Other Strand 1 Considerations

In addition to the comparative characteristics identified above, the following specific considerations are relevant to Strand 1:

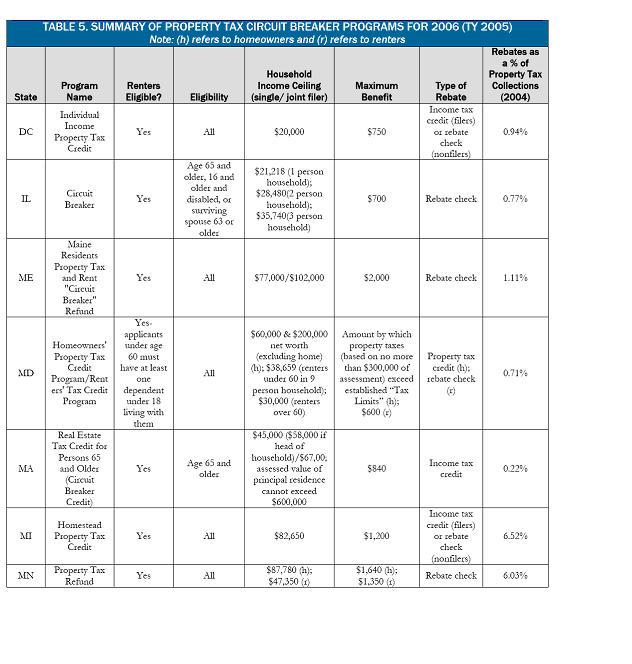

Circuit Breakers

Many of the perceived shortcomings of the existing domestic rates system are due to the fact that property taxes are inherently ‘regressive’, (they represent a larger burden for low-income taxpayers), resulting in the perception that they are ‘unfair’ and not linked with ‘ability to pay’ 9 . Circuit Breakers can be used to alleviate some of these inherent shortcomings. The idea behind circuit breakers is to introduce sensitivity to ratepayers’ ‘ability to pay’. In practice, they would give relief to tax-payers earning below a certain income level when their rates bill exceeds a certain percentage of their income. Specific design can vary considerably; however, there are two basic types:

-

Threshold –defines an ‘acceptable’ property tax level, as a given percentage of income, and grants relief when this is exceeded. E.g. if the acceptable threshold is defined as 4%, relief is granted when rate liability is in excess of £400 if income is £10,000, £800 if income is £20,000, etc. The relief offered may be 100% of the excess liability, or a proportion thereof. Some states use multiple threshold percentages that increase with income, targeting relief at lower income tax-payers.

-

Sliding Scale – this methodology defines several income ‘bands’ and specifies a property tax relief percentage for each. E.g. the proportion of property tax relief may be 95% if income is £5,000 or less; 90% if £5,001-£10,000; 75% if £10,001-£20,000…..zero if income exceeds £30,000 10.

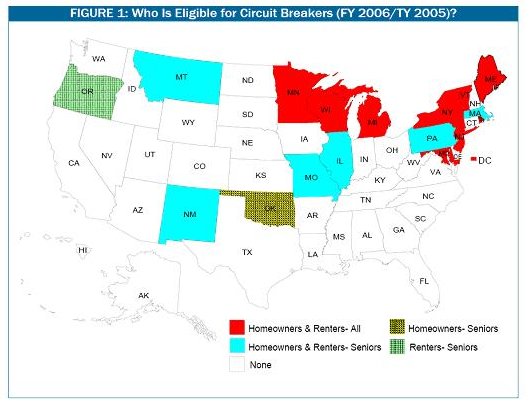

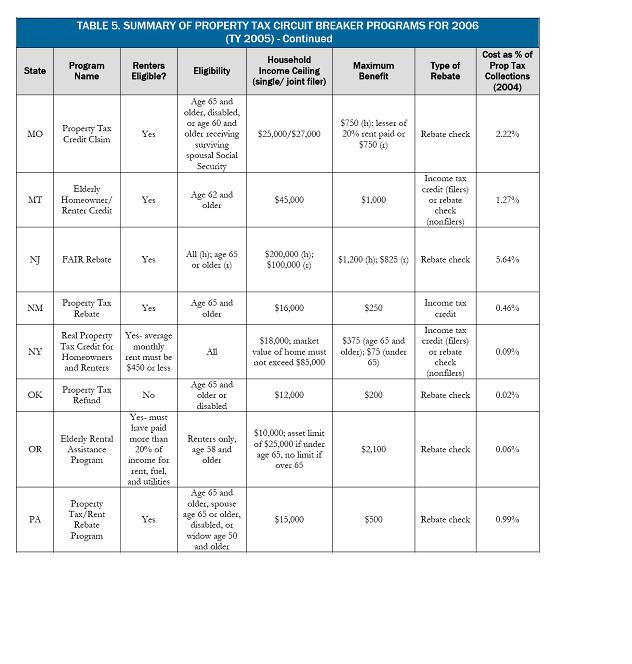

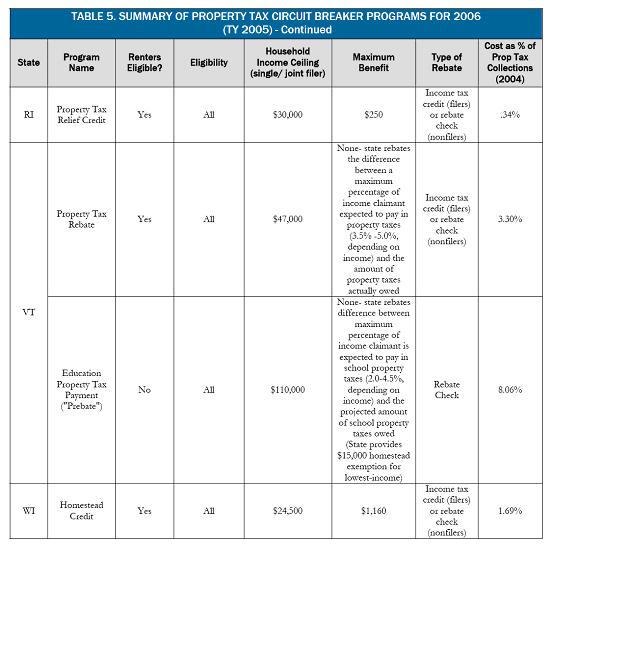

The international experience of circuit breakers is considerable; they were initially pioneered in Wisconsin over forty years ago and are now extensively used in the US 11. The diagram below illustrates the incidence of, and groups targeted by, US circuit breakers.

Source: “The Property Tax Circuit Breaker”, Center on Budget and Policy Priorities, Washington, 21 March 2007

Annex 1 provides further details on the specifics of each of these schemes, including who is eligible, the household income ceilings, and levels of maximum benefits:

Potential Considerations for NI

- Circuit Breakers are an alternative to ‘caps’;

- They enable a more ‘targeted’, as opposed to ‘blanket’, relief – for example, they are often designed to benefit pensioners and those on fixed incomes;

- This targeted approach can make them less costly than general caps;

- They introduce some of the advantages of income tax (over property tax), without the associated shortcomings (as identified in Section 5).

Introduction of the Deferment Scheme for home owning pensioners

Many U.S. jurisdictions have recently adopted property tax deferral programs. In the U.S., it is typical for interest to accumulate on the deferred portion of the property tax. It is important to note that if the market rate of interest is applied, the deferral is a loan rather than a subsidy. The US experience is that specific reliefs or limits, rather than deferrals, are preferred since ratepayers obviously favour ‘gifts’ over ‘loans’ 12 .

It is worth considering whether a scheme such as this would have a similar side-effect as that of Proposition 13 in California, i.e. ‘locking-in’ homeowners, by creating a disincentive to sell.

Potential Considerations for NI

- If interest is levied on deferred amount, may be unpopular, and possibly perceived as ‘regressive’, since this would add to the actual (long-term) burden for pensioners;

- Many pensioners may not wish to go back into debt for a home that has been paid for over a working lifetime;

- May also act as a disincentive to sell (if liability is realised upon sale of property). This could have implications for the property market; restricting supply could cause price increases.

- Given the potential side-effects, the consistency of this scheme with policy on addressing housing shortages may be questionable.

Introduction of Discount for Owner Occupiers

A number of U.S. States offer discount to owner-occupiers, often known as ‘Homestead Exemption’. For example, the District of Columbia exempts $60,000 of value for owner-occupied residences. Virginia offers a similar relief, however to qualify for this, ratepayers must meet income and net worth limits, as set by the state 13.

Potential Considerations for NI

- Unless means tested (as in example above), might be perceived as ‘unfair’, since favours (potentially wealthy) home-owners;

- Could be perceived as ‘regressive’ if it penalises those who can not afford to buy.

5.4 Summary Strand 1 Findings

Option |

International Experience |

Potential Lessons for NI |

Strand 1 Options |

|

|

Limits/ Caps |

Proposition 13 in California: Rate can not increase by more than 2% (or the rate of inflation) in any year – unless the property has been improved or is sold. |

Proposition 13 created a horizontal inequity, i.e. an unequal tax burden between ratepayers. It placed a higher burden on new buyers, (since the rate can increase when the property is sold) as opposed to existing owners. It has also had the result that virtually identical properties have significantly different tax bills – another feature which could lead to questions of “fairness”. Additionally, since this tax is essentially one on ‘mobility’ it would act as a disincentive to sell (and improvements) – a factor which could have implications for property prices. |

Circuit Breakers |

Extensively used in US, first implemented 40 years ago. |

- Ongoing use in US indicates effectiveness - More targeted approach to relief - Can be less costly (than blanket caps) since limited to certain groups |

Introduction of deferment scheme |

In operation in U.S. |

- If interest is applied (as is typical in US) may be unpopular in cases where homeowners (e.g. pensioners) have paid off mortgages, and begin to accrue debt, once again, on their property. It might also act as a disincentive to sell a property, potentially adversely affecting the property market. |

Discount for Owner-Occupiers |

Used in a number of states, including the Districts of Columbia and Virginia |

- May be perceived as unfair, favouring home-owners and penalising (potentially less wealthy) renters |

6. Strand 2: International Experiences of Alternative Taxation

This section considers the international usage of alternative (i.e. non-property based) tax sources. In accordance with the results of recent UK based studies into the feasibility of various alternative taxes, it focuses on what are arguably the most viable options; namely income and (derelict) land tax.

6.1Why Consider Alternatives to Property Tax?

It has been shown that the UK is unusual in its exclusive reliance on property taxation 14. This is potentially disadvantageous in that property taxes are not as buoyant as other tax alternatives; associated revenues may stagnate due to lags in revaluation. The revaluation process can be difficult and costly to administer, particularly in a market where property prices are rapidly changing – as in NI – since this creates scope for discretion and disagreement 15.

Secondly, as has already been stated, (and per the consultation outcomes), property tax can be regressive in nature, resulting in a disproportionate burden being placed upon low or fixed income ratepayers. Recently, criticism of property tax has prompted many U.S. states to limit property tax revenues. Local governments have been increasingly relying on other broad-based taxes to finance local spending; income taxes and retail sales taxes have been used in this regard.

Thirdly, a local authority’s choice of tax is an important one for another reason; fiscal policy also creates incentives and can cause tax competition between regions. This is an important consideration in assessing alternative tax options. In introducing local taxes; it is important to chose / adapt the tax base so as to minimise economic distortions. Resident based taxes (such as those on land, labour and capital) are generally preferable to source based taxes (those on goods and services) in minimising tax-induced distortions, in that they reduce the scope for tax exporting 16.

6.2 Alternative Taxation: International Examples

Local Income Tax:

International Experience

Six EU countries – Belgium, Denmark, Finland, Italy, Spain and Sweden have local income taxes which account for a significant source of revenue for their local government. In the case of Sweden, income tax is in fact the only source of locally-raised revenue. In general, local income tax rates are levied at a flat, locally established rate on the same base as the national income tax and collected by central government. However, in Belgium and Switzerland, the tax is levied as a percentage of the national tax liability (i.e. as a percentage of local tax receipts), rather than on the national income tax base.

In the US, property tax provides the primary source of local government revenue, however, in some states this is supplemented by local income taxes. In 11 U.S. states, local governments are given the option of imposing additional local taxes on incomes. These states are Delaware, Indiana, Iowa, Kentucky, Maryland, Michigan, Missouri, New Jersey, New York, Ohio, and Pennsylvania. Rates of income tax are generally low and quite simple. For example, in Maryland, the flat rates across counties vary from 1.25% to 3.10% of taxable income. However, in New York tax rates are progressive, with a maximum marginal rate of 4.25% on incomes above $150,000 for married couples, and $100,000 for individuals.

Potential considerations for NI

-

Whilst less regressive than property tax and better linked with ‘ability to pay’, a specific criticism of local income tax is based upon the ‘Tiebout hypothesis’. This states that an individual chooses where he/she wants to live, at least in part, by weighing costs (taxes) against associated benefits (public services) – known as “voting with feet”. The validity of this hypothesis will depend upon the extent of mobility within a particular region; assuming a mobile population, a local income tax might result in taxpayers moving out of a region. This may be a particularly important consideration for NI, given the land border with ROI. This is perhaps especially noteworthy, given the existing inter-regional (corporation) tax competition;

-

Some studies find that this is an issue faced by US states in determining tax policy. If states levy a higher personal income tax than its neighbouring jurisdictions, there is evidence that its mobile citizens emigrate (or move their capital there) to enjoy a lower tax burden 17;

-

Denmark provides another example; despite having no official limits on local income tax rates, in practice, the freedom to vary these are restricted by mobility levels in a country which is small and has a strong political culture of striving for equity and fairness 18;

-

However, it should also be noted that there is some evidence which refutes this theory. Evidence from other OECD countries does not support the hypothesis that small tax differentials could lead to significant movements in population. In this sense, it might be argued that the United States is different from European states, including the U.K., in terms of social mobility.

- International cases of local income tax are generally associated with local governments with considerable service responsibilities, (e.g. Denmark). Northern Ireland does not have this level of local responsibility;

- Some of the European countries which have introduced local income tax have encountered problems of excessive taxation;

- The international experience presents another potential problem with the implementation of a local income tax: the reluctance of central government to share this tax base with local government 19.

- The yield from a local income tax would be compromised during periods of economic downturn.

Income Tax Varying Powers

International Experience

The Scottish Executive has the power to adjust income tax by a maximum of 3p, which they have never enforced 20. However, this only applies to income earned at the basic rate; a factor which has implications for perceived “fairness” and “ability to pay”. Earnings beyond the ‘basic rate’ are effectively protected from local tax – a characteristic of the system which has been widely criticised, and may explain (at least in part), why the power has never been enforced.

In Spain, similar powers are in held by local governments; the autonomous communities get 33 per cent of the income tax and they have discretion over setting the rate – within limits of more or less than 20 per cent of the state rate. Similarly, local governments in Italy can, within certain limits, levy an additional tax on top of the state rates 21.

Potential considerations for NI

-

Potential (dis)/advantages per local income tax

-

A system such as that in Scotland would be likely to be perceived as ‘unfair’ and ‘regressive’, given restriction to the ‘basic rate’

Local Sales Tax

International Experience

International comparisons show that sales taxes are frequently used in combination with other taxes. In federal countries, such as Australia, Austria, Canada, Germany and the United States, they tend to form a significant share of tax revenues for state government (typically 25-40% and around 50% for USA), but considerably less for local government, (nil for Australia; less than 10% for Canada and Germany; 20-30% for Austria and USA) 22. This tendency is perhaps largely due to the argument that sales tax (or more generally, consumption taxes) is not appropriate at local level, because inter-regional mobility leads to cross-border shopping or tax exporting 23.

Potential Considerations for NI

- International evidence indicates prevalence at ‘state’, rather than local, level;

- Likely to motivate cross-border shopping / tax exporting;

- The Burt review raised the question as to whether a local sales tax would comply with EU law. For Scotland, it was considered likely that a separate rate of VAT would be incompatible with EU law, as it does not permit differential tax rates within states 24. A similar issue could exist for Northern Ireland.

(Derelict) Land Value Taxation

Rationale

The general idea behind land-value tax (LVT, also known as “site value tax”) is that it applies to the value of land, rather than that of any buildings, and is payable by the owner, not the occupier. The rationale is that it encourages optimal use of the land, as the tax liability will be the same whether the land is left derelict or is fully utilised. In terms of ‘Derelict’ Land Taxation specifically, it has been argued that, when faced with penal rates of tax, owners often found it easier to make the property derelict rather than bringing it back into use 25. This tax would specifically relate to derelict property and brownfield land.

Proponents argue that existing property taxes create a disincentive to developing land and improving properties, since those developments result in tax. One study suggested that current UK fiscal policy is actively undermining attempts to increase the supply of housing. Specifically, it argued that the current UK taxes 26:

-

Frustrate development and infrastructure funding

- Weaken, rather than promote, macroeconomic stability

- Impose arbitrary burdens on certain taxpayers

International Experience

There were four previous instances of land taxation in the UK, none of which were significantly successful 27. They were known at the time as ‘development taxes’ and were as follows:

-

1947-1953 Development Land Tax: levy on 100% of value uplift in land value due to granting of planning permission;

- 1967-1971 Betterment Levy: levy on 40%, rising over time;

- 1974 Development Gains Tax: interim tax on capital gains from disposal of land / buildings with development value / potential

Internationally, more than 700 cities worldwide apply land tax, including cities in Australia, Eastern Europe and the US State of Pennsylvania. Advocates of LVT have, in the past, frequently referred to Denmark and New Zealand as examples of its potential success. However, both countries have recently removed the major forms of LVT. It has been suggested that the system was discontinued in New Zealand for practical and political reasons 28. Nonetheless, proponents suggest that this option should not be dismissed, quoting its ongoing success in South Africa, some Caribbean states and Western Canada.

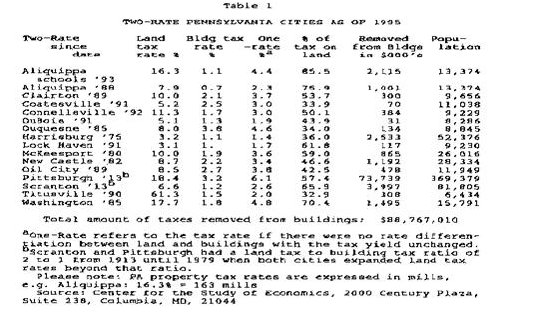

Pittsburgh provides an interesting example of a seemingly successful regime. Fifteen Pennsylvania cities now use a two rate approach to property tax; the tax on buildings is decreased, thereby providing an incentive to build and improve properties; the levy on land is increased, thus discouraging land speculation and encouraging development. The table below outlines the various rates used:

Source: “ Pennsylvania’s Success with Local Property Tax Reform: The Split Rate Tax”, American Journal of Economics and Sociology, Vol. 56, April 1997

Following the introduction of this system of land taxation in Pittsburgh, there has been a considerable expansion in building activity 29. Furthermore, 85 per cent of homeowners pay less with this policy than they do with the traditional approach; those who do pay more tend to be the wealthier homeowners.

Harrisburg has enjoyed a particularly favourable outcome from this tax policy. Once considered amongst the most distressed cities in the nation, it has sustained an impressive economic resurgence. It taxes land value at three times the rate of buildings, and (arguably resultantly) boasts the following improvements 30:

-

The number of vacant structures, over 4200 in 1982, is today less than 500;

-

With a resident population of 53,000, there are 4,700 more residents employed today (than in 1982);

-

The crime rate has dropped 22.5% since 1981.

-

The fire rate has dropped 51% since 1982.

However, it should be noted that this scheme of land value based local finance has not been without its mistakes. For example, the City of Uniontown reverted back to a flat rate system after an initial experience proved unsuccessful. Having introduced the two-rate system in conjunction with an overall tax increase in the same year, a number of irate residents had the policy rescinded. This provides a valuable lesson; should a two rate system be introduced, it should only ever be done so while maintaining a revenue neutral tax base – at least initially. A generally accepted guideline is that a maximum of 20% should be shifted off buildings and onto land each year, for a period of 5 years, or 10% each year for a period of 10 years 31.

Potential Considerations for NI

-

May have specific applicability to shortage of housing in Northern Ireland, could motivate development. Pittsburgh case indicates success in this area;

-

There could be issues regarding fluctuations in land values and interactions with the planning system. For example, would speculators be awarded a Land Value credit if the value of their land fell?

-

Could result in redistribution of the tax burden, away from residential ratepayers, towards commercial and/or agricultural;

-

Appropriate exemptions would be required to protect conservation areas etc.

-

Could affect pensioners with very low incomes but valuable property; those with considerable land could be worse off under land value taxation;

-

Essential that this be introduced on a phased, and revenue neutral, basis.

6.3 Summary Strand 2 Considerations

Local Income Tax |

Previous UK studies reported favourably Used in numerous U.S. states to supplement local property tax Maryland , Indiana, Michigan, etc levy low and simple rates. Rates in New York are progressive (more burdensome for high-earners) |

- Previous studies have identified this as a potentially suitable as supplement / alternative to domestic rates. However, it has been suggested that it could be expensive and difficult to administer. - The applicability of Tiebout’s hypothesis of ‘voting with feet’ should be borne in mind for NI. High levels of taxation might act as a disincentive for (particularly professional / managerial) taxpayers to live and work in NI. Accordingly, high comparatively high levels of income tax could compromise economic growth in NI. ( New York represents a unique exception to this in that it is effectively a monopoly economy– the risk of residents relocating is unusually low.) - Additionally, on the issue of predictability and buoyancy, the yield from a local income tax could be compromised during periods of economic downturn. - In some countries where a local income tax has been adopted, there have been problems with excessive taxation. - The international experience presents another potential problem with the implementation of a local income tax: the reluctance of central government to share this tax base with localgovernment 32. |

Income Tax Varying Powers |

3p Tax Varying Power exists in Scotland – has never been used. |

- Assuming the implementation of a system similar to the Scottish one, this would be likely to be perceived as regressive. |

Local Sales Tax |

Used by numerous U.S. states; second most important source of local government revenue

|

- Typically used at state level; involves high administrative and compliance costs. - Proximity with ROI is an issue since problems might arise with cross-border shopping / tax exporting. - Potential problems with EU compliance. |

(Derelict) Land Value Taxation |

Various unsuccessful. Pittsburgh appears to offer example of successful land value taxation |

- Could ‘marry’ well with the current strategy to relieve housing shortages in NI, by encouraging development Pittsburgh provides evidence of potential success in this regard. - Could be issues with fluctuations in land value – should a credit be awarded if value falls? - Could redistribute tax burden towards commercial / agricultural (appropriate exemptions would be required to protect certain land / ratepayers) - Economic theory suggests that taxing scarce resources results in improved efficiency; implies that a local land tax could be beneficial (unlike some other taxes) for the local economy. - Could affect pensioners with very low incomes but valuable property; those with considerable land could be worse off under land value taxation - Essential to be phased in and revenue neutral. |

6.4 Additional Considerations

-

A generally important point is that recent improvements in assessment methods, (for example, more frequent assessments and the use of computer-based comparisons) have significantly enhanced Canadian property taxation, notably in Ontario.

-

A “Transport Tax” is employed in France. About 150 transport “organising authorities” in urban areas have the power to levy a tax, versement transport. The tax is actually a wage tax, paid by all enterprises with more than 10 employees and is based on wages – it is known as a transport tax because the proceeds are earmarked for public transportation.

-

A “Property Registration Tax” alsoexists in France; departments levy droits d’enregistrement on sales of all buildings in the jurisdiction.

-

‘User Charges’: Some countries raise a significant proportion of revenue from this source – for example, in New Zealand user charges account for 20 per cent of local government finance 33. An advantage of user charges, and the associated concept (paying for services used), is that they are in line with the principle of ‘fiscal equivalence’ (that your tax burden represent the amount you use). Specific international examples include 34;

- Italy has a municipal tax on advertising and billboards, and one on household waste linked to the cost of collection;

- France has a tax on household waste disposal, based on the rental value of the property. It also has one on electricity.

- The Netherlands has a sewerage tax linked to the volume of water used or the level of water pollution.

-

In March 2002, the Republic of Ireland (ROI) became the first country to introduce a “Plastic Bag Tax”. Local authorities are central to the enforcement of the levy on the ground, the revenues of which contribute to the Environment Fund 35.

Sources:

-

“State and Local Taxation”, Feld, L. Economics Working Paper, Austria 2000-2005

www.econ.jku.at/papers/2000/wp0005.pdf -

“Local Governance in Industrialised Countries“, The World Bank, 2006

http://siteresources.worldbank.org/PSGLP/Resources/LocalGovernanceinIndustrial.pdf -

“Local Governance in Industrialised Countries“, The World Bank, 2006

http://siteresources.worldbank.org/PSGLP/Resources/LocalGovernanceinIndustrial.pdf -

“Local Government Taskforce Finance Sub-Group”, Final Report, July 2006

www.doeni.gov.uk/lgrt_fin_recommendations_to_thetaskforce.pdf -

“Local Governance in Industrialised Countries“, The World Bank, 2006

http://siteresources.worldbank.org/PSGLP/Resources/LocalGovernanceinIndustrial.pdf -

In 2003, Kate Barker a business economist and member of the Monetary Policy Committee of the Bank of England was commissioned by the then Chancellor Gordon Brown to report on the stickiness fo the housing market in the UK and to propose remedies.

The Barker Review rejected land tax on the basis of these policies having failed. -

“Local Governance in Industrialised Countries“, The World Bank, 2006

http://siteresources.worldbank.org/PSGLP/Resources/LocalGovernanceinIndustrial.pdf -

“Local Government Taskforce Finance Sub-Group”, Final Report, July 2006

www.doeni.gov.uk/lgrt_fin_recommendations_to_thetaskforce.pdf