Session 2010/2011

Fourth Report

Committee for Finance and Personnel

Third Report on the Inquiry into

the Role of the Northern Ireland

Assembly in Scrutinising the

Executive's Budget and Expenditure

Together with the Minutes of Proceedings of the Committee

relating to the Report, Written Submissions, Memoranda and the Minutes of Evidence

Ordered by The Committee for Finance and Personnel to be printed 21 March 2011

Report: NIA 61/10/11R Committee for Finance and Personnel

Committee Remit, Powers and Membership

Powers

The Committee for Finance and Personnel is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 48. The Committee has a scrutiny, policy development and consultation role with respect to the Department of Finance and Personnel and has a role in the initiation of legislation.

The Committee has the power to;

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- approve relevant secondary legislation and take the Committee Stage of primary legislation;

- call for persons and papers;

- initiate inquiries and make reports; and

- consider and advise on matters brought to the Committee by the Minister of Finance and Personnel.

Membership

The Committee has eleven members, including a Chairperson and Deputy Chairperson, with a quorum of five members. The membership of the Committee during the current mandate has been as follows:

Mr Daithí McKay (Chairperson)[1]

Mr David McNarry (Deputy Chairperson)[2]

Dr Stephen Farry

Mr Paul Frew[3]

Mr Paul Girvan[4]

Mr Simon Hamilton

Ms Jennifer McCann

Mr Mitchel McLaughlin

Mr Adrian McQuillan

Mr Declan O'Loan

Ms Dawn Purvis

[1] Mr Daithí McKay replaced Ms Jennifer McCann as Chairperson on 19 January 2011, having replaced Mr Fra McCann on the Committee on 13 September 2010. Ms McCann replaced Mr Mitchel McLaughlin as Chairperson on 9 September 2009.

[2] Mr David McNarry was appointed Deputy Chairperson on 12 April 2010 having replaced Mr Roy Beggs on the Committee on 29 September 2008.

[3] Mr Paul Frew joined the Committee on 13 September 2010; Mr Ian Paisley Jr left the Committee on 21 June 2010 having replaced Mr Mervyn Storey on 30 June 2008.

[4] Mr Paul Girvan replaced Mr Jonathan Craig on 13 September 2010; Mr Jonathan Craig had been appointed as a member of the Committee on 13 April 2010. Mr Peter Weir left the Committee on 12 April 2010. Mr Peter Weir had replaced Mr Simon Hamilton as Deputy Chairperson on 4 July 2009. Mr Simon Hamilton replaced Mr Mervyn Storey as Deputy Chairperson on 10 June 2008.

Contents

List of Abbreviations and Acronyms used in the Report

Key Conclusions and Recommendations

Improving the Budget Scrutiny Process and Information Flow

Arrangements and Experience to date

Strengthening Assembly Standing Orders

Memorandum of Understanding on Information Provision

Assembly Commission Budget

Central Budget Committee

Resourcing Budget Scrutiny

Option 1: Appoint advisers to Committees under existing provisions

Option 2: Establish a unit within the Northern Ireland Civil Service

Option 3: Provide a dedicated unit within Assembly Research & Library Service

Option 4: Redesign the Committee support staffing structure to include public finance expertise

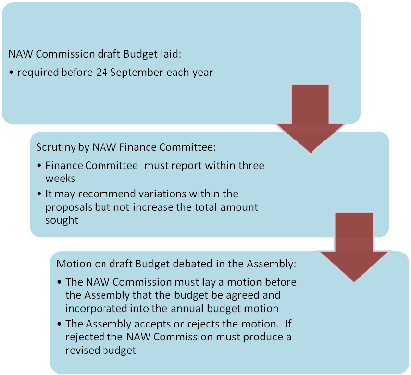

Option 5: Establish a parliamentary budget office – either within or external to the Assembly

Option 6: Support from the Northern Ireland Audit Office

Approaches to Budget Scrutiny

Incremental Budgeting

Zero-based Budgeting

Performance-based Budgeting

Participatory Budgeting

HM Treasury: Clear Line of Sight Reforms

Forecast Outturn Information

Account NI

Appendix 1

Minutes of Proceedings (Extracts)

Appendix 2

Minutes of Evidence

Appendix 3

Written Submissions and Memoranda

Appendix 4

Statutory Committee Submissions

Appendix 5

Research Papers

List of Abbreviations and Acronyms used in the Report

C&AG Comptroller and Auditor General

CAL Committee for Culture, Arts and Leisure

CFP Committee for Finance and Personnel

CIPFA Chartered Institute of Public Finance and Accountancy

CLOS Clear Line of Sight

CSR Comprehensive Spending Review

DEL Department for Employment and Learning

DFP Department of Finance and Personnel

DHSSPS Department of Health, Social Services and Public Safety

DPR Departmental Position Reports

DRD Department for Regional Development

HMT Her Majesty's Treasury

ETI Enterprise, Trade and Investment

FSU Financial Scrutiny Unit

IMF International Monetary Fund

MLA Member of the Legislative Assembly

MoU Memorandum of Understanding

NAO National Audit Office

NAW National Assembly for Wales

NDPB Non-Departmental Public Bodies

NI Northern Ireland

NIAO Northern Ireland Audit Office

NICS Northern Ireland Civil Service

OFMDFM Office of the First and deputy First Minister

OECD Organization for Economic Cooperation and Development

ONS Office for National Statistics

PfG Programme for Government

PSA Public Service Agreements

R&LS Assembly Research and Library Service

RBM Resource Budget Management

SPCB Scottish Parliamentary Corporate Body

SPICe Scottish Parliament Information Centre

UK United Kingdom

Executive Summary

This Third Report marks the completion of the Committee's Inquiry into the Role of the Northern Ireland Assembly in Scrutinising the Executive's Budget and Expenditure, which it commenced in July 2008. The Inquiry aimed to maximise the Assembly's contribution to the Northern Ireland budget process and to enhance the role of Assembly statutory committees and Members in budget and financial scrutiny.

The first report of the Inquiry, published in October 2008, formed the Committee's submission to the Department of Finance and Personnel's Review of the Northern Ireland Executive Budget 2008-11 Process, which reported in May 2010. The second report of the Inquiry, completed in June 2010, provided a co-ordinated response to the Department's review on behalf of all Assembly statutory committees. This final report further examines the process and procedures for scrutinising and agreeing Executive budgets and also considers the resources available to assist Assembly committees and Members in this regard and the approaches to such scrutiny.

To inform its consideration of these issues, the Committee took evidence from representatives of scrutiny units in the Scottish Parliament and Westminster, and from the Northern Ireland Audit Office. Comparative research was commissioned on best practice in respect of budget processes in other jurisdictions and on the resources and information provision available to support legislatures in scrutinising budgetary proposals. The Committee also received submissions from other Assembly committees regarding potential options for enhancing support for budget scrutiny.

In previous consideration of Executive spending plans and the draft Budget 2011-15, members noted that a majority of Assembly statutory committees were dissatisfied at the level of engagement with their respective departments and the level of detail available on departmental spending proposals. The Committee is concerned that such repeated failures compromise the ability of the Assembly to fulfil its scrutiny role effectively, and believes this is exacerbated by the lack of a regularised budget process. A number of practical measures are therefore set out in this Report, aimed at establishing stronger procedures and processes, which will enable the Assembly to fully exercise its role in this regard.

The arrangements for scrutinising and agreeing the Assembly's budget emerged as an issue during the Budget 2011-15 process, and the Committee agreed at that time to examine this further within this Report. To help inform its deliberations in this regard, research was commissioned on practices for agreeing budgets for other legislatures and the view of the Assembly Commission was also received. The Committee considers it essential that robust procedures are put in place for scrutinising and agreeing the Assembly's budget, which are in line with best practice and ensure the independence of the legislature.

The Committee asks that, early in the new Assembly mandate, the successor Committee for Finance and Personnel, in conjunction with other applicable Assembly committees, pursues the key findings and recommendations set out in this Report.

Key Conclusions and Recommendations

1. Given the repeated failure by a majority of executive departments to meet the needs of their Assembly scrutiny committees in terms of the provision of appropriate and timely information on budgetary proposals, the Committee believes that the Assembly's potential in contributing constructively to the development of Executive budgets and to overseeing the subsequent delivery of the Executive's strategic spending priorities can be fully realised only if the Assembly takes decisive steps to establish stronger procedures and processes for exercising its role in this regard. (Paragraph 7)

2. While the Committee and DFP are agreed on the benefit of early and more structured engagement between executive departments and Assembly committees, members believe that this will only happen in the context of a formal agreement between the Assembly and Executive on a regularised budget process, which includes clearly defined pre-draft Budget stages that provide for early Assembly input, irrespective of whether an annual or multi-year budget cycle is followed. The Committee is also of the view that the provision of formal opportunities for the Assembly to influence budgetary matters early in the process would help facilitate the potential streamlining of the latter stages in the budget and estimates process, including the associated plenary debates. The Committee recommends that the successor CFP works to address this matter early in the next mandate, in liaison with DFP and possibly as part of a co-ordinated Assembly input to the Executive's forthcoming Review of the Financial Process, the outcome of which is to be reported to the Assembly early in 2012. (Paragraph 24)

3. While the Committee is of the view that regular use of the existing statutory powers of Assembly scrutiny committees to call for persons and papers would be unnecessarily bureaucratic and time consuming, members believe that committees should consider exercising these powers in circumstances where there is a continued failure by departments to provide the financial information needed for scrutiny of departmental budgets and expenditure. (Paragraph 27)

4. CFP calls on the Procedures Committee to undertake an urgent review of Assembly standing orders, early in the next mandate, for the purpose of strengthening the procedural basis for the Assembly's scrutiny of the Executive's budgets and expenditure. In particular, this exercise should, where feasible, develop specific proposals for amendments to standing orders to:

- provide a minimum time period for committees to scrutinise departmental budgetary proposals or spending plans;

- codify the role of CFP in co-ordinating budget scrutiny by Assembly committees and in scrutinising cross-cutting public finance issues;

- provide a minimum time period in which CFP may prepare co-ordinated reports on Executive budgetary proposals;

- provide for CFP to also lead a review of departmental expenditure plans once per year, as part of its annual consideration of estimates and budget bills; and

- establish a requirement for the provision of pre-draft Budget information in advance of the introduction of budget bills. (Paragraph 36)

5. The Committee recommends that, early in new mandate, the successor CFP also oversees the development of an MoU between the Assembly and the Executive on the provision of financial information by departments for the purpose of facilitating scrutiny by Assembly committees. Members consider that the MoU document could also be agreed as part of the deliberations on the Executive's Review of the Financial Process. (Paragraph 42)

6. Within the context of the proposed review of Assembly standing orders, the Committee would also recommend that the wording of Standing Order 42(2) is reviewed to determine if an amendment is required to clarify that CFP should have regard to wider considerations, including the views of the other appropriate committees and compliance by departments with the MoU, when deciding whether to grant accelerated passage to budget bills. (Paragraph 43)

7. The Committee recommends that, early in the new mandate, the successor CFP works with the next Assembly Commission to establish robust procedures for scrutinising and agreeing the Assembly's budget, which are in line with international best practice and ensure the independence of the legislature. The Committee considers that this issue could potentially be addressed as part of the wider review of Assembly standing orders, which this Report proposes should be undertaken in conjunction with the Procedures Committee. (Paragraph 53)

8. The Committee believes that the idea of reforming the Assembly financial scrutiny system to establish a more powerful central budget committee should be reconsidered in the future, if the proposed reforms to processes and procedures that are set out in this Report fail to have the desired outcome. (Paragraph 55)

9. In recognising that decisive measures are needed to strengthen the support to the Assembly and its committees in undertaking financial scrutiny, the Committee recommends that:

- the Assembly Secretariat undertakes a detailed appraisal to determine the most effective and best value-for-money combination of option 1 (Appointment of Specialist Advisers to Committees), option 3 (Provide dedicated Financial Scrutiny Unit within Assembly Research & Library Service) and option 6 (Support from Northern Ireland Audit Office); and that

- while this exercise should commence early in the new mandate and should take account of the changed budgetary context, priority will need to be given to addressing the budget process and information flow issues identified. (Paragraph 81)

10. The Committee recommends that the successor CFP works with DFP to refine and improve the format of the available forecast outturn data to facilitate straightforward comparisons between planned spending and actual spending by departments. The provision of appropriate information in this regard could assist in identifying trends in in-year reduced requirements by departments early enough to avoid significant year-end underspend, which is critical in view of the removal of End Year Flexibility, and will also facilitate scrutiny of the standards of financial forecasting and monitoring by departments. (Paragraph 107)

11. The Committee recommends that the successor CFP works with DFP to explore the potential for the Account NI system to be used to provide information to Assembly statutory committees on departmental expenditure against PSA targets and outcomes. The Committee recognises that a "one size fits all" approach to Assembly committee budget scrutiny would not be feasible, given the differences in the nature, scale and structure of departmental budgets; but considers that efforts should be made to exploit the full potential of Account NI to meet individual committee needs. The Committee considers that this matter should be examined as part of the work in specifying the information needs of committees and in developing the MoU. (Paragraph 109)

Introduction

1. In July 2008, the Committee for Finance and Personnel (the Committee/CFP) agreed terms of reference[1] for an Inquiry into the Role of the NI Assembly in Scrutinising the Executive's Budget and Expenditure. The aim of the inquiry would be to maximise the Assembly's contribution to the Executive's budget process and to enhance the role of the Assembly statutory committees and members in budget and financial scrutiny.

2. The Committee published its report on the first part of Stage 1 of the inquiry in October 2008[2]. This formed the Committee's contribution, on behalf of the Assembly, to the review of the Executive's budget process being undertaken by the Department of Finance and Personnel (DFP). The second part of Stage 1 was to consider and respond to the DFP review; however, given the lengthy delay in completion of the DFP review, the Committee was not in a position to complete this part of its inquiry and print its report until June 2010[3].

3. In addition to examining the budget process, the inquiry has sought to examine other requirements for effective budget scrutiny, including the provision of financial information from executive departments to scrutiny committees and the resources available within the Assembly to assist committees and members in undertaking budget and financial scrutiny. Related to its wider examination of the process for scrutinising and agreeing the Executive's Budget, the Committee has also given initial consideration to the subsidiary issue of how formal procedures might be put in place for scrutinising and agreeing the Assembly's budget, which safeguard the operational independence of the legislature. The Committee's deliberations on the interrelated issues of budget process, information flow and scrutiny support/resources has been informed by comparative research on practices and experience in other appropriate jurisdictions and the associated Assembly research papers are provided at Appendix 5.

4. To inform its consideration of how the Assembly's capacity for budget and financial scrutiny could be enhanced, the Committee commissioned an Assembly research paper to examine the resources available to support other legislatures undertaking scrutiny in this regard (Appendix 5). This paper identified options for consideration and a related research paper provided a preliminary assessment of the costs associated with each option (Appendix 5). To help inform its deliberations, the Committee invited comments on the research paper, Resources for budget scrutiny, from the other Assembly statutory committees. The responses from other committees are included at Appendix 4.

5. The Committee also took oral evidence from the Budget Adviser to the Scottish Parliament's Finance Committee together with representatives from the Scottish Parliement's Financial Scrutiny Unit and the Scrutiny Unit at Westminster; the Northern Ireland Audit Office; and Assembly Research & Library Service. The Official Reports of the evidence sessions are at Appendix 2, with written submissions provided at Appendix 3.

Improving the Budget Scrutiny Process and Information Flow

6. In the Second Report on this Inquiry, the Committee highlighted the importance of committees having access to relevant and timely information from departments.[4] The Committee considers this issue to be critical to the success of any resources, either existing or yet to be put in place, for supporting Assembly committees and members in budget and financial scrutiny. A further requirement for effective scrutiny is that the Assembly and its committees are afforded sufficient time to consider departmental budget proposals, to take the views of key stakeholders and to examine the outcome of any public consultations by the Executive or departments before arriving at an informed position on the proposals and making evidence-based recommendations for improvement.

7. In its Report on the Review of 2010-11 Spending Plans for NI Departments[5], published in March 2010, the Committee noted that a number of other Assembly statutory committees had expressed dissatisfaction with regard to the provision of information on the plans for their respective departments. The Committee was strongly critical with regard to the lack of meaningful engagement between departments and their respective Assembly committees. The Committee was disappointed to note that the same issues have again arisen in the recent draft Budget 2011-15 process, when seven out of the other eleven committees, in addition to the Chairpersons' Liaison Group, expressed some degree of dissatisfaction with regard to the level of engagement on spending and savings plans for their respective departments. Given the repeated failure by a majority of executive departments to meet the needs of their Assembly scrutiny committees in terms of the provision of appropriate and timely information on budgetary proposals, the Committee believes that the Assembly's potential in contributing constructively to the development of Executive budgets and to overseeing the subsequent delivery of the Executive's strategic spending priorities can be fully realised only if the Assembly takes decisive steps to establish stronger procedures and processes for exercising its role in this regard.

Arrangements and Experience to date

8. The Committee accepts that the approach of agreeing multi-year budgets, as in the cases of 2008-11 and 2011-15, offers advantages in terms of more strategic planning. That said, members are aware that, with the move from annual to multi-year budgets at the beginning of the current mandate, there has been a corresponding loss of regularity in the budget cycle and reduced opportunity for the Assembly to scrutinise and influence proposed public expenditure.

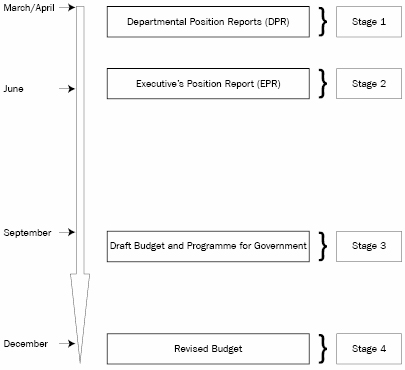

9. Members note that the annual budget process that was used during the first Assembly mandate (between 1998 and 2002) consisted of four stages, as summarised in the diagram below.

The Budget Process used in the first NI Assembly mandate[6]

10. This four-stage process gave the Assembly the opportunity to debate and influence the proposed allocations during the first two stages:

- Stage 1 - Departmental Position Reports (DPR) were published in March/April and provided each statutory committee with an opportunity to receive oral or written briefing from its department and consult upon the DPR. Following the period of consultation, each committee provided feedback to its department, who then submitted the finalised DPR to DFP in April.

- Stage 2 - The Executive's Position Report (EPR) was issued jointly by DFP and OFMDFM in June and summarised each department's position report and allowed for consultation with committees, etc. in advance of the preparation of the draft Budget and Programme for Government. This was the stage to reflect upon the relative priority attached to different policies and programmes, and the scope for reducing services or improving them through efficiency improvements. The committees were briefed by departmental officials once again, and consulted as necessary. CFP co-ordinated committees' responses to the EPR and submitted these to DFP in August to inform the preparation of the draft Budget.

11. The Committee is mindful that, in the current mandate, the process altered and stages 1 and 2 have not occurred, leaving aside the change from annual to multi-year budgets. However, in evidence to the Committee on the outcome of the DFP Review of the 2007 Budget Process, on 12 May 2010, departmental officials recognised that early engagement between departments and Assembly committees is vital as "movements between draft and final Budgets tend to be minimal".[7]

12. From the Assembly research, members note that the International Monetary Fund (IMF) suggested good practice advises that "the legislature should be provided with an opportunity for a pre-budget review of the government's main budget orientations and proposals for the upcoming fiscal years, especially the next year's annual budget strategy and main aggregates." The Assembly research acknowledged that "the presentation of a draft budget by the Executive to the Assembly provides an opportunity for this sort of pre-budget review before it is formally presented" but also pointed out that the decision by the Executive to present multi-year budgets "could be seen as undermining the opportunity to debate the next year's annual budget strategy".[8] In was in this context, therefore, that the Committee has called for the establishment of a regularised annual budgetary review mechanism within any multi-year budgetary framework, as alluded to below.

13. At various junctures in this Assembly mandate, the Committee has pressed for the restoration of a formal and structured budget process to maximise the added value which can be realised from the advice and scrutiny role of the Assembly and its committees, particularly in terms of the earlier stages of the budget cycle when there is greater opportunity for committees to exercise influence. In its Report on the Executive's Draft Budget 2008-11, the Committee considered that the future budget process and timetable needed to be settled early in 2008 to enable the Assembly statutory committees to schedule the necessary scrutiny into their work programmes and thereby provide departments with notice in terms of the future information and briefing requirements of committees.[9] Subsequently, in its First Report on this Inquiry, the Committee recommended:

"That a budget process is established which maximises the opportunity for Assembly committees to provide early input. The future process should include a stage similar to the Departmental Position Report/Executive's Position Report stage of the process in the first mandate, which should be timetabled to ensure completion before the Assembly goes into summer recess"; and

"That a set timetable is agreed to determine when departments will provide information to committees."[10]

14. The Committee's continuing concern around the absence of a formal budget process, similar to that which existed in the first mandate, was highlighted again in successive reports. In its report on the Review of 2011-12 Spending Plans of NI Departments, the Committee concluded:

"…that some of the difficulties encountered in the current mini-budget process, including in terms of insufficient engagement both by departments with their Assembly committees and by the Executive with the public, could have been minimised or avoided had DFP attached greater urgency to the completion of the Review of the Executive's Budget Process 2008-11 and the establishment of a future Budget process."

15. The Committee went on to call for "the urgent establishment of a formal process for Assembly scrutiny of future Executive Budgets and expenditure, which will both enable the statutory committees to plan the necessary scrutiny and will focus departments' attention on meeting the future briefing requirements of their committees. Members further recommended that "the detail of the future Budget process is determined in conjunction with the Assembly statutory committees and subsequently launched with an awareness programme for all Assembly Members."[11]

16. A similar theme was highlighted in the following extract from the Committee's Second Report in this Inquiry:

"Whilst it considers that the setting of a clear timetable to include key milestones at the start of each budget process is of vital importance, the Committee believes that clarity is required on the shape, frequency and duration of future budget cycles. In noting that the Budget 2010 process will develop departmental spending plans for the four-year period from 2011-12 to 2014-15, the Committee recommends that a regularised annual budgetary review process is established within this framework, with a pre-determined timetable, to enable the Executive and Assembly to make interim reappraisals of departmental allocations against progress in delivering PfG priorities and savings".

17. The Committee went on to call on DFP to build in adequate provision for the Executive decision-making process and for the Assembly calendar when developing future budgetary timetables, with a view to ensuring sufficient time for engagement with the Assembly and other stakeholders.[12] Finally, in its recent Report on the Executive's Draft Budget 2011-15, the Committee, in referring to the limitations to the in-year monitoring process, reiterated its call for the establishment of a regularised annual budgetary review mechanism, set to a pre-determined timetable, which it considers will aid transparency and better enable the Executive to adapt its plans to deal with changing circumstances and unforeseen pressures.[13] The Committee will be recommending that its successor committee pursues this issue in the new mandate.

18. Arising from its Review of the 2007 Budget Process, DFP called for "early and more structured engagement between departments and Assembly Committees setting out the key issues and pressures facing NI departments" and saw this as preferable to the publication of the Position Reports, which it considered could become a "bureaucratic exercise".[14] While welcoming this recognition of the need for earlier engagement by departments with their committees, which should be more structured in order to provide greater standardisation in the material provided, the Committee is concerned that no progress has been made in this regard and that this is unlikely in the absence of a regularised budget process.

19. On 17 February 2011, the Department provided the Committee with the Terms of Reference (ToR) for the forthcoming Review of Financial Process in NI, as agreed by the Executive on 9 February 2011 (Appendix 3). This initiative has been influenced partly by HMT's "Clear Line of Sight (CLOS)" programme, which aims to more closely align the documentation associated with budgets, estimates and accounts, which is described in more detail later in the report. The Review ToR state that its overall aim is "to examine and make recommendations on the options to create a single coherent financial framework that is effective, efficient and transparent and enhances scrutiny by and accountability to the Assembly, taking into account the needs of the Assembly." Moreover, the ToR state that "the strategic objectives of the review are:-

- To align the Budget, the Estimates and the Accounts as far as practicable to improve transparency, and

- To synchronize the presentation of the Budget, the Estimates/departmental expenditure plans, the Budget Bills, the Rates legislation and the Accounts in order to create a single co-ordinated public revenue and expenditure process."[15]

20. The Committee supports the objective of alignment of the relevant financial documents, including budgets, estimates and resource accounts, and notes that this is in keeping with its previous call for such documents to be "simplified and harmonised to increase transparency and enhance the relationship between allocations and performance and also to ensure that they are more readily scrutinised by Assembly committees and accessible to the wider public".[16]

21. In terms of the second objective of the Review, concerning synchronising the presentation of spending plans and associated legislation, the Committee gave initial consideration to this issue in its Second Inquiry Report. Arising from its Review of the 2007 Budget Process, DFP concluded that that the current process for agreeing and debating the Budget and Main Estimates encourages "significant amounts of repetition, duplication and confusion" and recommended that "the Final Budget Statement and debate should be combined with the Main Estimates process". This would follow the approach in Scotland, whereby both are taken forward simultaneously and the Department explained that this would mean that:

"…rather than voting on the revised Budget in December or January, the Vote on Account in February and the Main Estimates in June, this process would mean that the revised Budget and Main Estimates and Budget Bill are combined in December or January, negating the need for a Vote on Account."[17]

22. In its response to this initial proposal from DFP, the Committee agreed that it was, in principle, supportive of the recommendation as this should make for a more streamlined and harmonised approach. However, the Committee pointed to the need for consultation on the detail of the proposal and emphasised its firmly held view "that such change should only be made in the context of a settled future budget process, which will require to be agreed between the Executive and the Assembly".

23. Members also note that, in the plenary debate on the Second Report in this Inquiry, on 20 September 2010, the Finance Minister pointed to the Review of the Financial Process as an opportunity for Assembly Members to make clear how financial/budgetary information "could be more usefully presented and how the debates and discussions throughout the process might best be conducted."[18]

24. While the Committee and DFP are agreed on the benefit of early and more structured engagement between executive departments and Assembly committees, members believe that this will only happen in the context of a formal agreement between the Assembly and Executive on a regularised budget process, which includes clearly defined pre-draft Budget stages that provide for early Assembly input, irrespective of whether an annual or multi-year budget cycle is followed. The Committee is also of the view that the provision of formal opportunities for the Assembly to influence budgetary matters early in the process would help facilitate the potential streamlining of the latter stages in the budget and estimates process, including the associated plenary debates. The Committee recommends that the successor CFP works to address this matter early in the next mandate, in liaison with DFP and possibly as part of a co-ordinated Assembly input to the Executive's forthcoming Review of the Financial Process, the outcome of which is to be reported to the Assembly early in 2012.

25. In terms of information flow to the Assembly, members note from the Assembly research that there is an "indirect obligation" on Ministers and their departments via the Ministerial Code, which states that "Ministers must at all times:

- be accountable to users of services, the community and, through the Assembly, for the activities within their responsibilities, their stewardship of public funds and the extent to which key performance targets and objectives have been met; and

- ensure that all reasonable requests for information from the Assembly…are complied with."[19]

26. In light of the aforementioned lack of engagement by departments, this, therefore, raises the question of whether the provisions of the Ministerial Code are sufficiently robust in terms of the requirements of statutory committees, and indeed what recourse is available should a committee consider that a Minister has breached the terms of the Ministerial Code.

27. The Committee notes that Assembly research also points to the ability of statutory committees to invoke section 44 of the Northern Ireland Act 1998 – the power to call for witnesses and documents. While the Committee is of the view that regular use of the existing statutory powers of Assembly scrutiny committees to call for persons and papers would be unnecessarily bureaucratic and time consuming, members believe that committees should consider exercising these powers in circumstances where there is a continued failure by departments to provide the financial information needed for scrutiny of departmental budgets and expenditure. While the section 44 powers provide a fall-back option, the Committee agrees that a less cumbersome mechanism would be helpful.

28. The Committee considered three options by which a more structured process could be put in place and access to information for the Assembly improved — these are:

(i) Primary legislation;

(ii) Additions or amendments to the Assembly's Standing Orders; and/or

(iii) Memoranda of Understanding (MoU) between appropriate parties.

29. The timescale for the development of primary legislation, its passage through the Assembly and implementation can be lengthy. As such, this is not a preferred option for the Committee at this time; however, members believe that this matter should be revisited at a later date if deemed necessary by the Assembly.

Strengthening Assembly Standing Orders

30. In its Report on the Review of 2010-11 Spending Plans of NI Departments, the Committee undertook to "examine how the Assembly's scrutiny of the Executive's Budget and expenditure might be underpinned by having a stronger procedural basis in Assembly Standing Orders". In this regard, the Committee is mindful that the purpose of standing orders, which are a form of subordinate legislation, is to regulate the proceedings of the Assembly. That said, members believe that there may be scope for amending standing orders to provide for more structured involvement in the budget process by Assembly statutory committees.

31. One of the key concerns raised by committees (and external stakeholders) in the last two budget processes has been that insufficient time has been made available to reach a considered position on departmental budgetary proposals. However, the Committee notes, for example, that the timescale for a committee's consideration of a bill is provided for in standing orders (e.g. standing orders 33(2) and 35(7)); given this, members believe that, procedurally, it should therefore be possible for standing orders to be amended to provide that statutory committees are afforded a minimum period of time for scrutinising, taking evidence and agreeing positions on departmental budgetary proposals.

32. A further question arises in relation to the time afforded for CFP to perform its role in co-ordinating the responses of all the relevant Assembly committees to the Executive's budgetary proposals, including its role in scrutinising public finance issues at a strategic level. In preparing its co-ordinated reports in response to Executive budgets, CFP must gather evidence from expert witnesses, take account of the views of other relevant committees and lead a "take note" debate on the Executive's proposals; ideally, it would also wish to take account of the outcome of any public consultation undertaken on the draft Budget by DFP/the Executive. The consultation period allowed for the recent draft Budget 2011-15 presented the Committee (and, as a consequence, all statutory committees) with a considerable challenge to consider all the issues and respond within the required timescale. Furthermore, the Committee did not have any details on the outcome of the public consultation prior to reaching a position on the various issues and agreeing its Report, as would normally be the case in major policy development exercises undertaken by DFP. Members believe that it should also be possible for standing orders to be amended to set a minimum period of time for CFP to fulfil this co-ordination role.

33. A further point which members have noted is that CFP's co-ordination role is exercised by convention rather than as a consequence of any specified duty. The exercise of this co-ordination role has ensured that DFP and the Executive have been provided with both a "joined up" response from Assembly committees and a critique of proposals at a strategic level. In this regard, the cross-cutting role of CFP aligns with that of the Minister of Finance and Personnel and his department. Members are therefore also of the view that consideration should be given to amending standing orders to codify the co-ordination role of CFP in respect of the Assembly response to the Executive's budgetary proposals.

34. As alluded to above, the opportunity for Assembly committees to influence changes in departmental spending proposals between the Draft Budget and Revised Budget stages is, in practice, minimal. The Committee has called for a regularised budget process to be established early in the new mandate, which includes clearly defined pre-draft Budget stages, similar to the previous DPR and EPR stages, that provide for early Assembly input. Members are mindful, however, that while section 64 of the NI Act 1998 provides a statutory requirement for a draft Budget to be laid in the Assembly, there is presently no statutory duty on departments to prepare DPRs or similar pre-draft Budget proposals. Nonetheless, it is noted that standing orders (e.g. SO 30 and SO 41) currently place duties on Ministers and Members in respect of preliminaries to the presentation of a bill. The Committee believes that a review of standing orders, proposed below, should include consideration of whether it would be possible to establish a requirement for the provision of pre-draft Budget information and time for scrutiny in advance of the introduction of budget bills.

35. Reference has been made above to the Committee's repeated call for a regularised annual budgetary review mechanism to be provided for within the existing multi-year budgetary framework. The Committee recommends that its successor committee should press for this facility to be agreed as part of any reforms arising from the Executive's Review of the Financial Process. In tandem with this, members believe that consideration should also be given to whether it might be possible to provide in standing orders that CFP considers departmental expenditure plans once per year, having regard to the views of the other statutory committees, possibly linked to its annual consideration of estimates and budget bills.

36. CFP calls on the Procedures Committee to undertake an urgent review of Assembly standing orders, early in the next mandate, for the purpose of strengthening the procedural basis for the Assembly's scrutiny of the Executive's budgets and expenditure. In particular, this exercise should, where feasible, develop specific proposals for amendments to standing orders to:

- provide a minimum time period for committees to scrutinise departmental budgetary proposals or spending plans;

- codify the role of CFP in co-ordinating budget scrutiny by Assembly committees and in scrutinising cross-cutting public finance issues;

- provide a minimum time period in which CFP may prepare co-ordinated reports on Executive budgetary proposals;

- provide for CFP to also lead a review of departmental expenditure plans once per year, as part of its annual consideration of estimates and budget bills; and

- establish a requirement for the provision of pre-draft Budget information in advance of the introduction of budget bills.

The Committee would expect that the successor CFP will be kept fully apprised of the progress of this proposed review of standing orders as it is taken forward by the Procedures Committee as a priority in the next mandate.

Memorandum of Understanding on Information Provision

37. In both written and oral evidence to the Committee, the Assembly Research & Library Service recommended that an MoU is agreed between the Assembly and the Executive to improve the flow of information. During the evidence session on 26 May 2010, the Committee heard that such protocols are in place within the Scottish Parliament, where there is an "agreement in principle to cooperation" (Appendix 2). Under this agreement, the Scottish Parliament's Financial Scrutiny Unit will not request information that may be readily available elsewhere, or which may be unnecessarily burdensome, while the Scottish Government will provide timely information which will be helpful to the Scottish Parliament and the Scrutiny Unit. The Committee was advised that it was beneficial to have an employee seconded to the Unit from Audit Scotland as they know "exactly what questions to ask, what information is available and what is easy to access".

38. The Committee believes that the development of a similar MoU between the Assembly and the Executive would be beneficial in terms of enhancing the quality and effectiveness of financial scrutiny undertaken by the Assembly. Members recognise that that the development of such an MoU will require committees to specify their financial information requirements, including it terms of the nature, level and timing of information required.

39. It is necessary to consider, however, what recourse is available in the event of non-compliance by departments with MoUs. One option could be for Assembly standing orders to be amended to place a requirement on CFP to report to the Assembly on any breaches of the MoU. This becomes particularly significant when considered in the context of Standing Order 42(2), whereby a Budget Bill can only proceed by accelerated passage:

"where on or before the Second Stage of a Budget Bill the chairperson of the Committee for Finance and Personnel…confirms to the Assembly that the committee is satisfied that there has been appropriate consultation with it on the public expenditure proposals contained in the Bill".

40. This suggests that, should CFP consider that appropriate consultation has not taken place – for example, as a result of breaches of any obligations in the MoU relating to the provision of financial information – then the Budget Bill would not be able to proceed by accelerated passage, but instead would be subject to scrutiny at the Committee Stage, as set out in Standing Order 33. In this regard, it is worth noting that any decision by CFP not to grant accelerated passage to a Budget Bill would not of itself result in departments running out of money, as provision exists in legislation for an authorised officer of DFP to authorise payment of sums out of the Consolidated Fund and the use of resources.[20]

41. A further point which members note in relation to the wording of Standing Order 42(2) is that the decision on whether to grant accelerated passage is on the basis of whether the Committee is satisfied that there has been appropriate consultation "with it". Members consider that this wording should be interpreted – and if necessary amended to provide clarity – as meaning that CFP should also have regard to the views of the other appropriate committees in terms of their experience of consultation at departmental level. This would be important given that budget bills encompass expenditure provisions for all executive departments and non-ministerial departments and not just for DFP. Moreover, members believe that decisions by CFP under Standing Order 42(2) should also have regard to whether any agreed pre-budgetary process was followed by the Executive and adherence by departments to any agreed MoU on the provision of financial information.

42. The Committee recommends that, early in new mandate, the successor CFP also oversees the development of an MoU between the Assembly and the Executive on the provision of financial information by departments for the purpose of facilitating scrutiny by Assembly committees. Members consider that the MoU document could also be agreed as part of the deliberations on the Executive's Review of the Financial Process.

43. Within the context of the proposed review of Assembly standing orders, the Committee would also recommend that the wording of Standing Order 42(2) is reviewed to determine if an amendment is required to clarify that CFP should have regard to wider considerations, including the views of the other appropriate committees and compliance by departments with the MoU, when deciding whether to grant accelerated passage to budget bills.

Assembly Commission Budget

44. In its Report on the Executive's Draft Budget 2011-15, the Committee undertook to consider the future arrangements for setting the budget for the NI Assembly Commission, in the context of international best practice and to ensure independence of the legislature. The decision to include initial consideration of this matter within this Report, arose when it was noted that there had been an apparent breach on the part of the Executive of the existing convention for agreeing the Assembly Commission budget during the preparation of the Executive's draft Budget 2011-15. A further locus for CFP in this area arises from the fact that it has responsibility for considering budget bills – and, as outlined above, for deciding on accelerated passage of such bills under Standing Order 42(2) – which include provisions for expenditure by the Assembly Commission.

45. To inform its deliberations, the Committee commissioned an Assembly research paper on appropriate comparator arrangements. In the paper, Scrutiny procedures for the Scottish Parliamentary Corporate Body and National Assembly for Wales Commission budget proposals, Assembly research noted that there is no formal approach to setting the Assembly's budget. There do appear to be established arrangements which, while not codified, were outlined in the Executive's Budget 2010 guidance issued to all departments in June 2010:

"In line with previous arrangements, the NI Assembly and the NI Audit Office will be provided with the level of funding required by each organisation (both current expenditure and capital investment) in order to carry out their respective functions, as agreed by the Assembly Commission and the Public Accounts Committee (sic) respectively".

46. This is the convention that was seemingly disregarded, however, in the draft Budget 2011-15 announced on 15 December 2010, which proposed real-term cuts for the Assembly Commission which were considerably in excess of the quantum of real-term cuts proposed not only by the Commission itself, but also for any Executive department and for comparable institutions such as the Scottish Parliament and Welsh Assembly. While the resultant concerns about the ability of the Assembly to fulfil its functions effectively have been allayed with revised allocations in the final Budget 2011-15, the Committee is nonetheless keen to see more robust arrangements being put in place for scrutinising and agreeing the Assembly budget in the future.

47. In examining this issue, Assembly research noted that the IMF's Role of the Legislature in Budget Processes states:

"Parliament can perform its role effectively when it is adequately funded and when it has autonomy for preparing its own budget. Many OECD countries' legislatures prepare their own budgets, which typically are not altered by the executive".

48. The IMF also highlights the following points as good practice:

- While parliaments' budgets should be prepared independently from that of the executive, parliaments should nonetheless be subject to the same general procedures for executing and reporting on spending of their own budgets.

- In particular, parliaments should not abuse their powers by increasing parliament's operating and investment expenses so that they become out of line with other national constitutional entities (e.g. expenses of the judiciary, the external auditor).

49. In respect of the Scottish Parliament, the Scottish Parliamentary Corporate Body's (SPCB) budget is top-sliced from the Scottish Consolidated Fund before the Scottish Government makes any other allocations. Members note that the process for agreeing the budget for the SPCB is set out in a written agreement between the Scottish Executive and the Scottish Finance Committee. The Finance Committee scrutinises the SPCB's budget proposals separately as part of the budget process, and may recommend whether or not they should be approved. As outlined in the written agreement,

"Should the Scottish Ministers wish to challenge the budget proposed by the SPCB, they will do so by means of an amendment to the Budget Bill to allow debate on the specific issue".

50. Assembly research noted that none of the recommendations arising from a wide-ranging review of the budget process undertaken by the Scottish Parliament's Finance Committee related to the way in which the budget for the SPCB is set or agreed. This may indicate that the procedure is considered to be operating effectively.

51. The procedure for agreeing or amending the budget for the National Assembly for Wales (NAW) Commission is set out in the Welsh Assembly's standing orders. The NAW Commission must lay its draft Budget by 24 September, which is scrutinised by the Finance Committee. The Finance Committee may propose amendments within the proposals but cannot recommend an increase to the total amount sought, and it is obliged to report on the Commission's draft budget within three weeks of it being laid in the Assembly. An NAW Commission motion is subsequently laid before the Assembly to enable the budget to be agreed and incorporated into the annual budget motion; if not agreed, the NAW must bring forward a revised budget. Should the Assembly not agree the NAW Commission's budget by 20 November, standing orders provide that

"the budget for the Commission to be incorporated in the annual budget motion…is to comprise, for each service or purpose for which resources or cash were authorised to be used by the Commission in the previous financial year, 95% of the amount so authorised".

52. Assembly research notes that an ongoing review of the NAW's standing orders is not expected to amend the way in which the Commission's budget is set and agreed. It was noted by the NAW Finance Committee, however, that timing issues have meant that it has been necessary to temporarily amend standing orders. For example, the 2010 Spending Review announcement on 20 October came after the date by which the NAW Commission must lay its budget before the Assembly; it was therefore necessary to introduce a temporary Standing Order to put the timetable back. In its input to the review of standing orders, the Welsh Finance Committee states that it considers that

"a better approach would be for Standing Orders to set out the principles that apply to the various budget scrutinies and the time that should be allowed for each part of the scrutiny process. However, in order to take account of specific events, such as a Comprehensive Spending Review, the specific dates that would apply each year could be set, perhaps by the Business Committee, in the light of circumstances that apply at the time".

53. In view of the issues raised with regard to the NI Assembly's budget in the 2011-15 budget process, the Committee sought the views of the Assembly Commission on the Assembly research paper, Scrutiny procedures for the Scottish Parliamentary Corporate Body and National Assembly for Wales Commission budget proposals. In its response, the Assembly Commission considered that the process for scrutinising and agreeing the NAW Commission's budget "merited further consideration" and agreed that it "provided an appropriate model for increased transparency and a clear mechanism for the scrutiny of Commission budget proposals". The Committee recommends that, early in the new mandate, the successor CFP works with the next Assembly Commission to establish robust procedures for scrutinising and agreeing the Assembly's budget, which are in line with international best practice and ensure the independence of the legislature. The Committee considers that this issue could potentially be addressed as part of the wider review of Assembly standing orders, which this Report proposes should be undertaken in conjunction with the Procedures Committee.

Central Budget Committee

54. In the Second Report relating to this Inquiry, the Committee briefly considered the merits of the establishment of a central budget committee within the Assembly, commissioning research in this regard.[21] Members noted that the research paper cited a number of issues that would need to be more fully considered, including the need to:

- explore whether a budget committee's remit could be expanded to include monitoring of cross-cutting issues, including the delivery of PfG and PSA targets;

- examine if existing legislative provision allows for a budget committee to be established, or whether an amendment to legislation is required; and

- consider the potential membership of a budget committee and if there would be the possibility for a conflict of interest where a Member might sit on both it and a statutory committee.

55. The Committee therefore concluded that a scrutiny model which included a central budget committee warranted more consideration in the future, and stated "In the longer term, there is a case for the Assembly considering how its financial scrutiny system, including committee structures, could be reformed for enhanced effectiveness". The Committee believes that the idea of reforming the Assembly financial scrutiny system to establish a more powerful central budget committee should be reconsidered in the future, if the proposed reforms to processes and procedures that are set out in this Report fail to have the desired outcome.

Resourcing Budget Scrutiny

56. In the Assembly research paper, Resources for budget scrutiny, it is noted that many legislatures have mechanisms in place to provide analytical support with regard to budget and financial scrutiny which is independent of the Executive or Government. Such support ranges from specialist advisers contracted on a short-term basis to fully staffed scrutiny units or offices. In this respect, the Assembly research considered that NI "lags behind" many other jurisdictions.

57. As referred to above, the DFP Review of the Northern Ireland Executive Budget 2008-11 Process included a recommendation for "earlier and more structured engagement between departments and Assembly Committees setting out the key issues and pressures facing NI Departments". In its response to this recommendation, the Committee found that decisive measures would be required in order to put this recommendation into practice, not least the development of standard guidance on the timing and provision of relevant information to Assembly statutory committees.[22] Members hope that the reforms to processes and procedures, proposed in this Report, will facilitate the implementation of this recommendation. Nonetheless, implementation of the recommendation will intensify the requirement for additional analytical support for Assembly committees.

58. Furthermore, the DFP review also recommended that "In responding to the draft Budget, any proposal to increase spending on a particular service by a Committee should be accompanied by an equally detailed proposal as to how this could be funded". While the Committee noted this with interest, it concluded that the structure and support are not currently in place within the Assembly to enable committees to carry out this function.[23]

59. Assembly research identified five options by which the support available to Assembly committees and Members could be enhanced:

1. Appoint advisers to Committees under existing provisions;

2. Establish a unit within the Northern Ireland Civil Service;

3. Provide a dedicated unit within the Assembly Research & Library Service;

4. Redesign the Committee support staffing structure to include public finance expertise; or

5. Establish a parliamentary budget office – either within or external to the Assembly.

60. In the course of the Inquiry, the Committee also found that the National Audit Office and Audit Scotland provide support to committees and scrutiny units in Westminster and the Scottish Parliament respectively. The potential of similar support being provided to the Assembly by the Northern Ireland Audit Office (NIAO) was therefore considered as an additional option ("Option 6").

61. The Committee's consideration of each of these options against the written and oral evidence received is set out below, together with recommendations for the way forward in this regard. In the course of its deliberations, the Committee was mindful of the budgetary constraints arising from the Budget 2011-15, that were not known when the evidence was originally taken.

Option 1: Appoint advisers to Committees under existing provisions.

62. Assembly committees and members are provided with a comprehensive research and information service by the Assembly's Research & Library Service. In addition, existing Assembly procedures allow for a committee to appoint specialist advisers where it considers that the information or expertise required is not readily available. This can be with regard to a specific inquiry being undertaken by a committee, or can cover a particular aspect of a committee's remit. In general terms, advisers have, to date, been appointed for specific, time-bound pieces of work or projects (e.g. with regard to a committee inquiry, as opposed to being standing advisers appointed to advise on a particular aspect of a committee's remit over the longer term).

63. In considering that better use could be made of the existing provisions for appointing specialist advisers, the Assembly research states that

"The Committee for Finance and Personnel could appoint an adviser and recommend to the other Statutory Committees that they do the same at least for the period of consideration of a draft budget or engagement with their respective departments over their requests for resources".

It notes, however, that the appointment of specialist advisers in this manner would not result in resources being available to the Assembly as a whole, as support is more likely to be offered on a sectoral, committee-centred basis. In this respect, while a preliminary assessment of the financial costs for the appointment of specialist advisers for budget and financial scrutiny was the lowest of the five options identified by Assembly research, it was considered to be least likely to deliver non-monetary benefits.[24]

64. It should also be noted that, during the Budget 2010 process, both the Health Committee and the Education Committee attempted to recruit specialist advisers to support their scrutiny. Neither procurement exercise was successful in securing specialist advisers. This may underline the significance of establishing a "call off panel".

65. The benefits of the appointment of specialist advisers and experts could potentially be increased by the selection of a panel which would operate on a "call off" basis. During the evidence session with officials from the Scottish Parliament and Westminster on 26 May 2010, the Committee heard that a call-off framework comprising eight experts is currently in place in the Scottish Parliament. Reviewed on a year-to-year basis, those on the framework are available to undertake specific pieces of work within short timescales (e.g. the provision of costings for alternative spending proposals). Additionally, a budget adviser has been appointed as a standing adviser to the Finance Committee on a two-year contract to assist in scrutiny of the Budget and the budget process, and also any other inquiries which that committee deems appropriate. As well as supporting the Finance Committee, the budget adviser engages with advisers to other committees with regard to the strategic budget position.

Option 2: Establish a unit within the Northern Ireland Civil Service.

66. The Assembly research suggests that the Assembly could request the Executive to set up a unit within an appropriate NICS department to provide the Assembly, its committees and members with budgetary and financial analysis. In its Report on the Review of the Budget Process, the Scottish Finance Committee considered a similar option. It argued, however, that "this could constitute a conflict of interest for the civil servants themselves and that opposition parties might not have confidence in the response they received, given that a degree of judgement might require to be exercised and that there might be a range of answers for costing policies."[25]

67. In their responses to the options laid out in the Assembly research, the Agriculture and Rural Development Committee and the Regional Development Committee both contend that any additional support must be independent of the Executive. CFP concurs with this view. Furthermore, in view of the current economic climate and the need to reduce public sector spending, departments may be unwilling or unable to provide staff with the necessary expertise to undertake such work for the benefit of the Assembly.

Option 3: Provide a dedicated unit within Assembly Research & Library Service.

68. To assist in its deliberations with regard to the provision of a dedicated unit within the Assembly's existing Research & Library Service, the Committee took oral evidence from representatives of specialist scrutiny units in the Scottish Parliament and Westminster. The Committee heard that the Scrutiny Unit in Westminster was established in 2002 to assist select committees engage in financial scrutiny more effectively. The Unit works primarily through committees, supporting the detailed scrutiny of forecasts and proposals for their respective departments. The Unit also provides advice and assistance to committees to determine what information should be requested from departments. Committees do not generally develop alternative spending proposals, although the Unit does on occasion assist the Treasury Committee in this regard. In addition, the Unit works with HMT officials to improve the clarity and quality of financial information.

69. The Financial Scrutiny Unit (FSU) in Scotland was initially set up as a pilot in October 2009. The Unit is a small, specialist team within the Scottish Parliament Information Centre (SPICe) which supports members and committees in budget and financial scrutiny, including costings for alternative spending proposals. The location of the FSU within SPICe is regarded as advantageous, as they are able to collaborate with researchers who have detailed knowledge of specific subject areas, e.g. health expenditure. A recent review of the work of the FSU concluded that it

"seems to be a welcome mechanism which has enhanced and improved the effectiveness of budget scrutiny during a period of economic downturn and tighter budget settlements."

The review put the anticipated costs of the FSU at £350,000 for 2010-11; however, it expected that these costs would be met by the transfer of existing staff and "reallocating other financial resources from within the Research, Information and Reporting Group".

70. In its submission to the Committee, the Assembly's Research & Library Service (R&LS) advised that

"Minor adjustments to planned recruitment could establish a Public Finance Scrutiny Unit with a similar resource base as that available to the Scottish Parliament".

In its oral evidence, R&LS asserted that this could be done at very little cost, and would involve the permanent appointment of a junior economist, with a senior economist appointed on a fixed-term basis. It was also noted that a member of staff from Audit Scotland has been seconded to the FSU in the Scottish Parliament; similarly, the Scrutiny Unit at Westminster includes financial analysts seconded from the National Audit Office (NAO) The R&LS therefore proposed that such a unit in the Assembly could be further enhanced with secondees from the NIAO being appointed on a fixed-term basis. This issue is examined in more detail at paragraph 78 below.

71. Members were especially interested in seeing this option explored further, including how it might be used in combination and as a complement to some of the other options under consideration. The Committee believes that any further consideration of this option should examine how the proposed Public Finance Scrutiny Unit could integrate policy/performance scrutiny with financial/budget scrutiny.

Option 4: Redesign the Committee support staffing structure to include public finance expertise.

72. The Assembly research suggests that the Committee Secretariat could be redesigned to incorporate public finance expertise (e.g. each committee team could include an officer responsible for providing analytical support in terms of budget and financial scrutiny). It points to the staffing structure for the Australian Senate, which includes an estimates officer for each committee. The role of the estimates officer includes the provision of "administrative, research and report writing support to the committee, particularly in relation to estimates and review of annual reports of agencies".[26] Most estimates officers have tertiary level qualifications and the role is regarded as developmental in terms of career progression.

73. A key benefit of the inclusion of an officer to provide such support in each committee team is that public finance expertise would be embedded throughout the Secretariat. That said, as with the appointment of individual advisers to committees, such support would be sectoral and committee-centred, and may not therefore necessarily enhance the scrutiny of the overall strategic budget position. The costs of appointing an additional member of staff to each of the twelve Assembly statutory committees are estimated to be in excess of £400,000 per annum, with additional costs arising from the necessary recruitment exercise. The Committee therefore considers that the costs of this proposition may outweigh the benefits.

Option 5: Establish a parliamentary budget office – either within or external to the Assembly.

74. The Assembly research considered parliamentary budget offices across a number of legislatures, which have been established to provide analytical support for budget and financial scrutiny, and also to increase transparency within the budget process. It found that the remit of budget offices varies widely. For example, the Canadian Parliamentary Budget Officer (PBO) has a mandate to:

"provide independent analysis to Parliament on the state of the nation's finances, the government's estimates and trends in the Canadian economy; and upon request from a committee or parliamentarian, to estimate the financial cost of any proposal for matters over which Parliament has jurisdiction."[27]

75. The Ugandan Budget Office, however, is much wider and includes functions to:

(a) provide budget-related information to all Committees in relation to their jurisdiction;

(b) submit reports on, but not limited to, economic forecasts, budget projections and options for reducing the budget deficit;

(c) identify and recommend on Bills that provide an increase or decrease in revenue and the Budget;

(d) prepare analytical studies of specific subjects such as financial risks posed by Government sponsored enterprises and financial policy; and

(e) generally give advice to Parliament on the Budget and National economy.[28]

76. The Assembly research also found that budget offices vary widely in size: the Canadian PBO has 15 staff, 10 of which are full time, and the Ugandan Budget Office is staffed by 21 economists, while the Korean National Assembly Budget Office has over 100 staff and the United States Congressional Budget Office has 200 staff.

77. In considering the option to provide an additional resource through the establishment of a budget office, the Committee agreed that more detailed work would need to be undertaken to determine what form a budget office might take, its remit and size. It also noted that legislation may be required to establish a budget office. In the absence of detail on the shape and size of any proposed budget office, Assembly research asserted that the costs of this option were difficult to assess; however, based on the assumption that the office would be small scale and independent of the Executive and Assembly, it was estimated that salary costs would be approximately £330,000 per annum. In addition, further expenditure would be incurred in terms of office costs.

Option 6: Support from the Northern Ireland Audit Office

78. As noted at Option 3 above, staff have been seconded from Audit Scotland to the Financial Scrutiny Unit in the Scottish Parliament, and a similar arrangement exists in Westminster with the NAO. Additionally, as well as undertaking its key role in assisting the Committee of Public Accounts in Westminster, the NAO provides support to other select committees in both the House of Commons and the House of Lords. In 2008 this support included

"analysis of financial statements, financial management and reporting, value for money, performance evaluation, regulation, and policy implementation"[29].

79. The Committee took evidence on from the Comptroller and Auditor General (C&AG) and staff from the NIAO on how additional support might be provided to Assembly statutory committees. The C&AG outlined three options:

- Performance briefings – statutory committees could receive briefings based on a number of factors, including most recent annual reports, internal or external departmental performance reviews and financial and value for money audits. Resource constraints would prevent such briefings being provided on an annual basis to each statutory committee; however they could be established initially on a cyclical basis.

- Financial management reviews – such reviews could provide "an independent perspective on the procedures that have been implemented by Public Bodies to ensure that they are meeting policies and priorities in an economic, efficient and effective manner whilst striving for continuous improvement".

- Secondments to a financial scrutiny unit, should the Assembly consider that such a resource should be established. The NIAO is restricted from questioning the merits of policy objectives and the C&AG concedes that this can place some limitations on the extent of support that can be provided to statutory committees; however, he firmly believes that secondees to a scrutiny unit would provide valuable support in terms of a skills transfer in the difficult and complex arena of public finance together with independent expert advice.

80. It should be noted that the options outlined by NIAO are not mutually exclusive; for example, secondments to a scrutiny unit could be additional to the provision of reviews or briefings. Also, this could marry the detailed financial and accountancy expertise of secondees with the existing capacity of Assembly research subject specialists for policy analysis. In noting that the witnesses from the Scottish Parliament consider that there are clear benefits in having an employee from Audit Scotland seconded to the FSU, the Committee believes that further consideration should be given to introducing a similar arrangement between Assembly research and the NIAO.

81. In recognising that decisive measures are needed to strengthen the support to the Assembly and its Committees in undertaking financial scrutiny, the Committee recommends that:

- the Assembly Secretariat undertakes a detailed appraisal to determine the most effective and best value-for-money combination of option 1 (Appointment of Specialist Advisers to Committees), option 3 (Provide dedicated Financial Scrutiny Unit within Assembly Research & Library Service) and option 6 (Support from NIAO); and that

- while this exercise should commence early in the new mandate and should take account of the changed budgetary context, priority will need to be given to addressing the budget process and information flow issues identified.

Approaches to Budget Scrutiny

82. In considering the most effective approaches to scrutinising departmental budgets and expenditure, the Committee has examined the range of possible approaches to budgeting in the public sector, in comparison to the approach currently taken by executive departments. As outlined below, Assembly research has highlighted the advantages and disadvantages associated with each of the main approaches.

Incremental Budgeting

83. Members note that, in NI, departmental allocations are currently made based on the method of "incremental budgeting". With this type of budgeting, allocations made in the previous budget are adjusted at the margin, up or down. This process of incremental budgeting takes into account a number of factors including:

- inescapable and previously committed expenditure;

- salary increments;

- developments in legislative requirements;

- changes to service requirements;

- inflation; and

- increases /decreases in government revenue.

84. The Committee is conscious that the process of incremental budgeting has some advantages, including: it is easily understood and administratively straightforward; it is useful when outputs are difficult to quantify; and it can induce stability through a process of gradual change. Nevertheless, members are concerned that, due to the scale of budget cuts faced by NI as a result of the 2010 Spending Review, the use of incremental budgeting in the 2011-15 Budget has led to a number of problems – not least the absence of a clearly defined and explicitly stated rationale for the level of allocations made to each department and to individual business areas within departments.

85. The Committee notes the disadvantages with the use of incremental budgeting, including that it:

- focuses more on the previous budget than on future operational requirements;

- does not allow for overall performance overview;

- does not help managers to identify budgetary slack;

- can often be underpinned by data which are no longer relevant;

- can encourage "empire building";

- tends to be reactive rather than proactive; and

- assumes that existing budget lines are relevant and satisfactory.

86. The Committee expressed particular concern in its Report on the Executive's Draft Budget 2011-15 that the draft Budget failed to adequately address concerns that the delivery of government services was inefficient. In particular, the Committee highlighted that the Budget failed to detail how the planned allocations would meet the outcome targets set in the 2008 Programme for Government. The Committee also raised concerns that the allocations made in the draft Budget did not address the need to resource proactive early intervention programmes.

87. The Committee is therefore of the opinion that, partly due to the use of incremental budgeting, the Executive has failed to obtain an overall picture of performance and that ineffective and inefficient uses of resources has perpetuated. The Committee is anxious that the approach of "salami slicing" departmental budgets has been identified as being a crude or blunt tool that is easy to implement but that is "extremely damaging," particularly in the long term. Crucially, however, the Committee agrees with the conclusions reached in the Assembly research paper and is concerned that the use of incremental budgeting has stifled the Executive's creative thinking.

Zero-Based Budgeting