Committee for Enterprise, Trade and Investment

Report on the Debt Relief Bill

Together with the Minutes of Proceedings of the Committee

Relating to the Report and the Minutes of Evidence

Ordered by The Committee for Enterprise, Trade and Investment to be printed 24 June 2010

Report: NIA 67/09/10R Committee for Enterprise, Trade and Investment

Session 2009/2010

First Report

Powers and Membership

Powers

The Committee for Enterprise, Trade & Investment is a Statutory Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, Section 29 of the Northern Ireland Act 1998 and under Assembly Standing Order 46. The Committee has a scrutiny, policy development and consultation role with respect to the Department for Enterprise, Trade & Investment and has a role in the initiation of legislation.

The Committee has power to:

- Consider and advise on Departmental Budgets and Annual Plans in the context of the overall budget allocation;

- Approve relevant secondary legislation and take the Committee stage of relevant primary legislation;

- Call for persons and papers;

- Initiate inquiries and make reports; and

- Consider and advise on matters brought to the Committee by the Minister for Enterprise, Trade & Investment.

Membership

The Committee has 11 members, including a Chairperson and Deputy Chairperson, and a quorum of five members.

The membership of the Committee is as follows:

Mr Alban Maginness (Chairperson) [1]

Mr Paul Butler (Deputy Chairperson) [5]

Ms Jennifer McCann

Mr Leslie Cree

Mr Daithí McKay [6], [7]

Mr David Simpson MP [3]

Mr Gregory Campbell MP [4]

Mr Stephen Moutray [2]

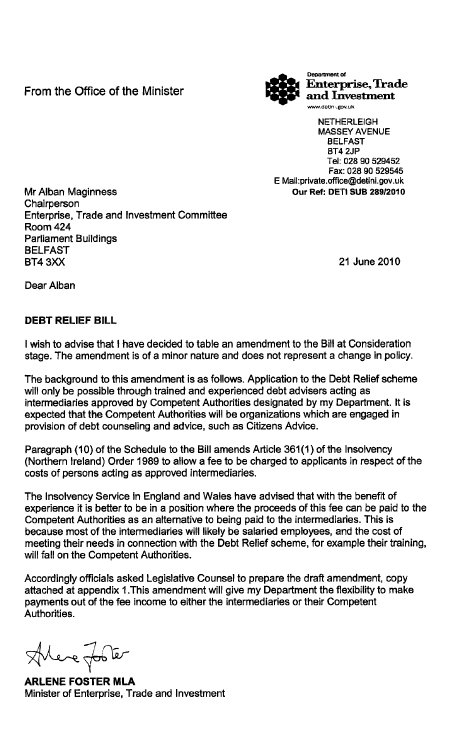

Dr Alasdair McDonnell MP

Mr Gerry McHugh

Mr Sean Neeson

[1] With effect from 30 June 2009 Mr Alban Maginness replaced Mr Mark Durkan.

[2] With effect from 14 September 2009 Mr Stephen Moutray replaced Mr Simon Hamilton.

[3] With effect from 14 September 2009 Mr David Simpson replaced Mr Robin Newton.

[4] With effect from 14 September 2009 Mr Gregory Campbell replaced Mr Jim Wells.

[5] With effect from the 14 September 2009 Paul Butler replaced Jennifer McCann as Deputy Chairperson

[6] With effect from the 31 March 2010 Mr Alan McFarland stood down from membership of the committee

[7] On 13th April 2010 Mr Daithí McKay was appointed as a Member of the Committee for Enterprise, Trade and Investment.

Table of Contents

Main Report

Clause by Clause Scrutiny of the Bill

Appendix 1

Appendix 2 – Minutes of Evidence

18 February 2010 - Department of Enterprise, Trade and Investment

20 May 2010 - Department of Enterprise, Trade and Investment

3 June 2010 - Department of Enterprise, Trade and Investment

10 June 2010 - Committee for Enterprise, Trade and Investment

Appendix 3 – Written Submissions

1. Advice NI response to proposed Debt Relief Scheme (October 2006)

2. Advice NI response to Debt Relief Scheme (May 2009)

3. Advice NI submission regarding Debt Relief Orders (June 2009)

4. Advice NI response to Debt Relief Bill (April 2010)

5. Consumer Credit Counselling Service (April 2010)

6. Debt Managers Standards Association (DEMSA) (April 2010)

7. Federation of Small Businesses (FSB) (April 2010)

8. Northern Ireland Courts and Tribunals Service (April 2010)

Appendix 4 – Memoranda and Papers from DETI

1. DETI letter regarding outcome of public consultation, incorporating Annex A and B) (May 2009)

2. Letter from DETI regarding Advice NI response (May 2010)

3. Correspondence from GB Insolvency DETI regarding queries on Debt Relief Bill (June 2010)

4. Letter from the DETI Minister regarding Clause 2 (June 2010)

Appendix 5 – Research Papers

1. Research Paper from the Northern Ireland Assembly Research and Library Service

Appendix 6 – List of Witnesses

List of WitnessesExecutive Summary

Purpose

1. The Report details the Committee for Enterprise, Trade & Investment's consideration of the Debt Relief Bill (the Bill). The Bill is intended to provide access to a remedy for those who can neither fund an individual voluntary arrangement nor afford the cost of petitioning for bankruptcy and are therefore unable to free themselves from a lifetime burdened by debt they have no reasonable prospect of being able to pay.

Principles of the Bill

2. The Committee welcomed the introduction of the Bill. The Committee who considered the principles of the Bill to be the provision of a debt relief solution to debtors with relatively low liabilities, no realisable assets and little or no disposable income with which to make contributions to creditors.

3. The Committee engaged in a public consultation exercise and consulted with a range of stakeholders with a variety of interests. Written responses were not received from any stakeholders as a result of the public consultation however the Committee also requested evidence from a number of stakeholders who had responded to the Departmental consultation on the principles of the Bill. One response was received. Oral evidence was received from Advice NI.

Key Issues

4. The Committee had concerns relating to timelines on investigations, lack of provision to cover unforeseen changes in an individual's circumstances and upper time limits of Debt Relief Restriction Orders. The Committee also sought clarity in relation to provisions in the Bill for a fee to be charged to organisations seeking to act as approved intermediaries in the provision of advice and information on debt relief.

5. The Committee considered that the key issues relating to the Bill were as follows:

- The provision of a debt relief solution to debtors who have no reasonable prospect of ever being able to pay their debts.

- The establishment of structures whereby the Department of Enterprise, Trade & Investment will be entitled to provide advice and information to the public about relief of debt and related matters or make arrangements with others to do so.

The provision of a debt relief solution to debtors who have no reasonable prospect of ever being able to pay their debts.

6. The Committee received representation from Advice NI (Appendix 3) asking for the Bill to provide clear guidance and timelines on investigations, provisions to cover unforeseen changes in an individual's circumstances and upper time limits of Debt Relief Restriction Orders. The Department responded to the Committee's concerns by clarifying details in relation to the provisions in the Bill and, in the case of unforeseen changes in an individual's circumstances, by obtaining detail on the impact of equivalent legislation in England and Wales and further information from the Minister for Enterprise, Trade & Investment (the Minister).

The establishment of structures for the provision of advice and information

7. Following representations from Advice NI, the Committee sought clarification from the Department on any plans it may have to charge a fee, as provided for in the Bill, to organisations seeking to act as approved intermediaries. The Committee was content with the Department's response that it currently has no plans to charge a fee in connection with the granting or maintenance of designation as a competent authority.

Introduction

8. The Debt Relief Bill was introduced to the Northern Ireland Assembly on 9th March 2010. The Assembly debated the principles of the Bill in the Second Stage on 23rd March 2010 when the Bill was passed to the Committee for Enterprise, Trade & Investment. The Committee sought and received the approval of the Assembly in Plenary Session to extend their consideration and scrutiny of the Bill to 2nd July 2010.

9. The Department of Enterprise, Trade & Investment conducted a public consultation from 11th February to 6th May 2009 on its proposals to legislate to set up a debt relief scheme. Departmental officials briefed the Committee about its proposals on 16th October 2009.

10. The Bill contains nine clauses and one schedule. In relation to debt relief, the Bill operates by inserting new provisions into the Insolvency (Northern Ireland) Order 1989.

11. The Committee launched a consultation on 16th April 2010.

12. In total one written evidence submission was received from Advice NI. Officials from Advice NI gave oral evidence to the Committee.

Summary of the Draft Debt Relief Bill as Presented to the Committee for Enterprise, Trade and Investment in the Committee Stage

Clause 1: Debt relief orders

13. Clause 1 inserts a new Part 7A into the 1989 Order, thereby establishing a new individual insolvency procedure based on the Official Receiver being able to provide eligible individuals with relief from debt through the making of a debt relief order ("DRO"). It includes articles relating to:

- Debt Relief Orders;

- Making of an application;

- Duty of Official Receiver to consider and determine an application;

- Presumptions applicable to the determination of an application;

- Making of DROs;

- Effect of DROs on administration order;

- Moratorium from qualifying debts;

- The moratorium period;

- Discharge from qualifying debts;

- Providing assistance to Official Receiver etc.;

- Objections and investigations;

- Power of Official Receiver to revoke or amend a DRO;

- Power of High Court in relation to DROs;

- Inquiry into debtor's dealings and property;

- False representations and omissions;

- Concealment or falsification of documents;

- Fraudulent disposal of property;

- Fraudulent dealing with property obtained on credit;

- Obtaining credit or engaging in business;

- Offences: supplementary;

- Approved intermediaries;

- Debt relief restrictions offers and undertakings;

- Register of DROs; and

- Interpretation.

Clause 2: Conditions for making a debt relief order

14. Clause 2 inserts a new Schedule 2ZA into the 1989 Order. Schedule 2ZA sets out the conditions for making a debt relief order.

Clause 3: Debt relief restrictions orders and undertakings

15. Clause 3 inserts a new Schedule 2ZB into the 1989 Order. Schedule 2ZB creates a regime of debt relief restrictions orders and undertakings.

Clause 4: Advice in relation to relief of debt and related matters

16. Clause 4 empowers the Department of Enterprise, Trade and Investment to itself provide advice and information to the public about relief of debt and related matters or to make arrangements with others to do so. The Department is given the right to make grants or loans in connection with the provision of such advice and information.

17. Clause 4 also empowers the Department to either itself carry out research in relation to debt relief and related matters or to assist others in carrying out such research, including through the provision of financial assistance.

Clause 5: Power to make consequential amendments, etc.

18. Clause 5 allows the Department to make such supplementary, incidental, transitional, transitory, or consequential provisions by order as it considers appropriate in connection with the Bill.

Clause 6: Minor and consequential amendments

19. Clause 6 gives effect to the Schedule which contains minor and consequential amendments.

Clause 7: Commencement

20. Clause 7 contains provision for the commencement of the Bill.

Clause 8: Interpretation

21. Clause 8 contains definitions of words and phrases used in the Bill.

Clause 9: Short title

22. Clause 9 provides that the new legislation shall be known as the Debt Relief Act (Northern Ireland) 2010.

Schedule

23. The Schedule makes minor and consequential amendments to the Insolvency (Northern Ireland) Order 1989 and other legislation.

Summary of Consideration

24. All additional documents referred to in this section are at Appendix 4 to the report.

Clause 1: Debt relief orders

25. The Committee received representation from Advice NI asking for the Bill to provide clear guidance and timelines on investigations. They expressed concern about investigations described in paragraph 208K(5) as no timelines are given. They suggested that this could result in an investigation being carried out any time after discharge which could be several years.

26. The Department confirmed that the Bill places no limit on the time within which an investigation must be started or completed. Paragraph (6) of draft Article 208K expressly provides for the power to carry out an investigation to be exercisable after, as well as during, the moratorium period which follows the making of a Debt Relief Order. This is in line with section 251K(6) of the Insolvency Act 1986 applying in England and Wales.

27. The Department considers that no time limit should apply for the following reasons:

- Debt Relief is intended to be a highly automated, streamlined, low-cost system for dealing with low levels of debt. Investigation is to be very much the exception, not the norm, and will normally only be carried out following a complaint from a creditor. Therefore the power to carry out investigation will only affect a small minority of debtors.

- Debt Relief is to be an affordable alternative to bankruptcy. It is a statutory requirement that the Official Receiver investigates all bankruptcies unless he thinks that investigation in unnecessary. Article 262 of the Insolvency (Northern Ireland) Order 1989 places no limits on when an investigation can be carried out in a bankruptcy. The Debt Relief scheme is being set up for one specific purpose: to give those unable to afford to petition for bankruptcy access to a more affordable means to obtain relief from debt they cannot pay. It is not an aim or purpose of the scheme that debtors should be treated differently or more leniently than they would be if they were bankrupt.

- It is expected that in practice most investigations would take place as a result of a creditor having objected to the making of a Debt Relief Order. Objections will have to be made within strict time limits.

- The Debt Relief scheme must enjoy the confidence of creditors and the public at large if it is to survive and become an acceptable means of dealing with problem debt. It is accepted that there is potential for the unscrupulous to use the scheme to avoid paying debts which they would be perfectly capable of paying. To deter such conduct it is essential to have in place a robust set of offences and penalties. To set a limit on the time within which any allegation or evidence of improper conduct could be investigated would dilute the value of that deterrent and could critically undermine confidence in the scheme.

28. The Committee was content that the Department's response adequately addresses the issues raised. However, towards the end of the Committee Stage, the Minister wrote to advise the Committee that she had decided to table an amendment to the Bill at Consideration Stage which would allow a fee to be charged to applicants in respect of the costs of persons acting as approved intermediaries. This was following advice from the Insolvency Service in England and Wales that, because most of the intermediaries will likely be salaried employees, it is better to be in a position where the proceeds of this fee can be paid to the Competent Authorities as an alternative to being paid to the intermediaries. The Committee was content to note the proposed amendment. Clause 2: Conditions for making a debt relief order.

Clause 2: Conditions for making a debt relief order

29. In relation to Schedule 2ZA Paragraph 5, which defines the six-year rule for reapplying for a DRO, Advice NI asked that an exceptional circumstances clause be added. They stated that, such a clause should take into account unforeseen changes in an individual's situation, for example, a life event such as illness or death of a partner which could mean that the person can no longer cope with their financial situation. They believe that these cases should be looked at on their merit and circumstance. Advice NI informed the Committee that the legislation in England and Wales does not contain an exceptional circumstances clause and that this has given rise to problems including examples of people being unable to cope with their financial situation.

30. The Department responded that the debt relief scheme is intended to be simple, uncomplicated and low cost. It gives individuals who otherwise could not afford it the opportunity to unburden themselves of debt which they cannot pay. The gain for the individual is not without cost to others. The making of a Debt Relief Order removes any hope that those to whom he is indebted have of recovering what is due to them. The Department's response further states that this is so even if the individual's financial circumstances improve after having been discharged from the one year moratorium which follows the making of a Debt Relief Order. The Department believes that, irrespective of the reasons for the indebtedness it would be neither fair nor equitable to those trying to make a living in business, including proprietors of small businesses, if customers were able to make repeat use of the Debt Relief scheme to run up debt and not pay it.

31. To qualify for a Debt Relief Order an individual's assets must not be worth more than £300 and they must not have more than £50 left in the month after meeting essential living expenses. Anyone who obtains a Debt Relief Order should know that if they accept further credit they will not be able to meet their obligation to repay it. The possibility of escaping any consequences arising from such conduct by applying for a further Debt Order within six years should not be open to them irrespective of the circumstances giving rise to the further indebtedness.

32. A further consideration put forward by the Department is that operation of the Debt Relief scheme will depend on assessment of applicants' circumstances by debt advisers acting as intermediaries. It would not be possible to draw up a comprehensive list of adverse circumstances which could befall an individual and to attempt to do so would be contrary to the intention of the scheme of keeping it simple and operating costs low.

33. Following the Department's response one member still had concerns that there could be exceptional circumstances where people were unable to cope with their financial situation. The Committee therefore asked the Department to obtain evidence from their counterparts in England and Wales on the impact of equivalent legislation in that jurisdiction. The Department provided the Committee with a response from the Insolvency Service stating that the Insolvency Service still believes that allowing a six-year ban on re-entry is appropriate and that it strikes the right balance between providing access to the procedure and ensuring that there is no abuse. The Insolvency Service further states that the provision is easy to understand and enables entry costs to be kept at a low level because no person has to make a subjective decision on what could count as an exceptional circumstance and that this would add significant cost to the process. The response from the Insolvency Service also states that there has been no problem identified with this provision, there are no plans to amend or alter the provision and that the provision has not been challenged.

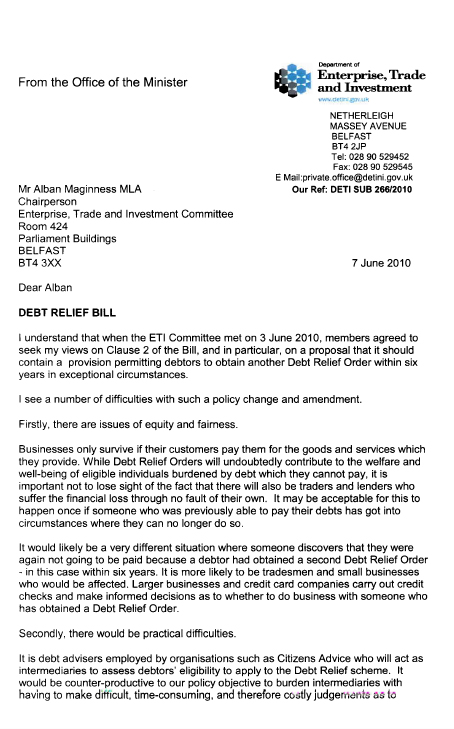

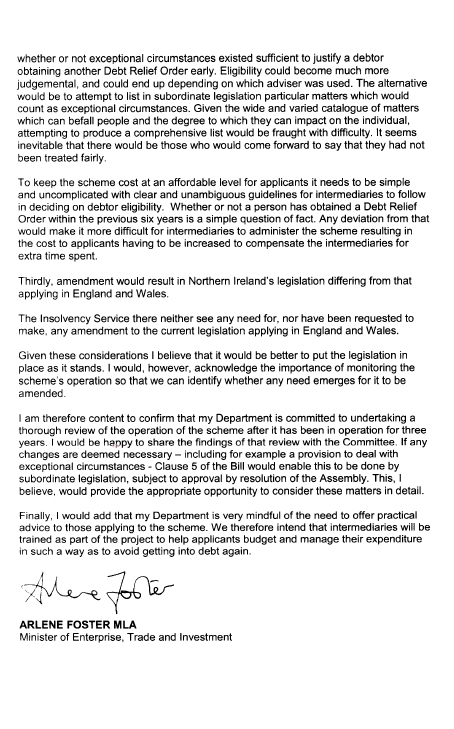

34. As concerns remained unresolved the Committee agreed to write to the Minister to obtain her views on Clause 2 and, in particular, the possibility of the inclusion of an exceptional circumstances clause on the six-year rule. The Committee also asked the Minister to outline what would be done to assist those most vulnerable people that will not be able to apply for a second Debt Relief Order within the six-year time period.

35. The Minister responded that there are three main reasons why she believes there should not be such an amendment. Firstly, issues of equity and fairness (debtors versus lenders and traders, particularly those in small businesses). Secondly, practical difficulties in determining 'exceptional circumstances'. Thirdly, it would result in Northern Ireland legislation differing from that applying in England and Wales. The Minister also clarified the situation with regard to training that intermediaries will undergo as part of the project to help applicants budget and manage their expenditure in such a way as to avoid getting into debt again.

36. The Committee was content that the responses from the Department and the Minister adequately address the issues raised.

Clause 3: Debt relief restrictions orders and undertakings

37. The Committee received representation from Advice NI expressing concerns regarding the upper time limits of Debt Relief Restriction Orders, 9(2b). The organisation sought clarification regarding the application of the 15 year restriction and information as to how decisions will be made to enforce the 2-year or 15-year restriction and anything in between. While giving oral evidence to the Committee Advice NI agreed with the Chair that this is purely precautionary. They agreed that it would be desirable in the circumstances but not absolutely essential.

38. In response to Advice NI's concerns the Department informed the Committee that it will be possible for someone subject to a Debt Relief Order to be placed under continuing restrictions following the ending of the moratorium period which ensues after the making of a Debt Relief Order. This can happen in two ways. It can result from an application to the High Court by the Department or the Official Receiver on the Department's direction, or it can result from an undertaking to the Department given by a debtor. Paragraph 9(2) of draft Schedule 2ZB provides that a Debt Relief undertaking cannot be for less than two years and must not be for more than 15 years. This is exactly as stipulated in relation to Bankruptcy Restrictions Undertakings by paragraph 9(2) of Schedule 2A to the Insolvency (Northern Ireland) Order 1989.

39. Details of Bankruptcy Restrictions Undertakings maintained by the Insolvency Service in England and Wales are used as a guide when accepting Bankruptcy Restrictions Undertakings in Northern Ireland to determine the bracket into which the bankrupt's conduct would appropriately fall. The Department informed the Committee that it is intended to use the same information when setting time limits for Debt Relief Restrictions Undertakings, until such time as similar database has built up in England and Wales for Debt Relief Restrictions Undertakings. It will be possible to do so because the behaviours, to be taken into account under paragraph (2) of Schedule 2ZB in the Bill, when deciding whether to seek a Debt Relief Restrictions Order, will be in line with those to be taken into account under the bankruptcy provisions contained in paragraph (2) of Schedule 2A to the Insolvency (Northern Ireland) Order 1989.

40. The Committee was content that the Department's response adequately addresses the issues raised.

Schedule

41. Advice NI informed the Committee that the organisation is keen to act as an approved intermediary and sought clarity on the process and remuneration related to this. They also recommended that any registration fee identified in 248A(11a,b) be proportional to the status of the organisation seeking to become a designated body.

42. The Department informed the Committee that it currently has no plans to charge a fee in connection with the granting or maintenance of designation as a competent authority. None is charged under the corresponding provision for England and Wales (section 415A(A1) of the Insolvency Act 1986). Both provisions have been included so that the facility to charge fees is there should it ever be decided that it would be desirable to do so. In oral evidence to the Committee Advice NI agreed that, as the Department has no plans to charge a fee in connection with the granting or maintenance of designation as a competent authority, the organisation's request in this regard does not now apply.

43. The Committee was content that the Department's response adequately addresses the issues raised.

Clause by Clause Scrutiny of the Bill

Clause 1: Debt relief orders

Clause 2: Conditions for making a debt relief order

Clause 3: Debt relief restrictions orders and undertakings

Clause 4: Advice in relation to relief of debt and related matters

Clause 5: Power to make consequential amendments, etc.

Clause 6: Minor and consequential amendments

Clause 7: Commencement

Clause 8: Interpretation

Clause 9: Short title

44. The Committee for Enterprise, Trade & Investment is content with clauses 1 to 9 as drafted.

Schedule

45. The Committee for Enterprise, Trade & Investment is content with the schedule as drafted.

Long Title

46. The Committee for Enterprise, Trade & Investment is content with the long title as drafted.

Appendix 1

Minutes of Proceedings

of the Committee

Relating to the Report

Appendix 1 – Minutes of Proceedings

Thursday, 16 October 2008

Room 21, Parliament Buildings, Belfast

Present: Mr Mark Durkan MP (Chairperson)

Ms Jennifer McCann (Deputy Chairperson)

Mr Leslie Cree

Mr Simon Hamilton

Mr Alan McFarland

Mr Sean Neeson

Mr Robin Newton

Mr Paul Butler

Mr Jim Wells

In Attendance: Ms Lucia Wilson (Assembly Clerk)

Mr Paul Connolly (Assistant Assembly Clerk)

Mr Stephen White (Clerical Supervisor)

Mr Jim Nulty (Clerical Officer)

10.36 a.m. The meeting opened in public session.

6. Debt Relief Bill

11.37 a.m. Officials joined the meeting.

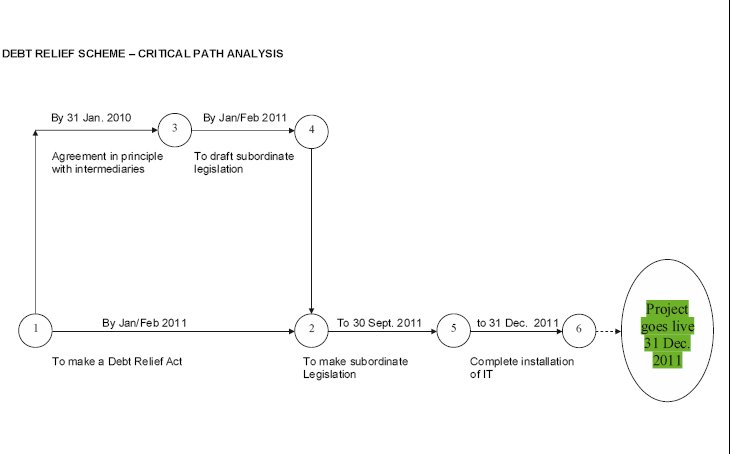

Departmental Officials Reg Nesbitt, John Hinds and Jack Reid briefed the Committee on the Departments' proposal to introduce a Debt Relief Bill. Key issues discussed included the rationale behind the proposal, how the scheme might operate and the timeframe for its introduction.

12.07 p.m. Leslie Cree left the meeting.

12.13 p.m. Robin Newton left the meeting.

12.21 p.m. Jennifer McCann left the meeting.

12.36 p.m. Officials left the meeting.

Agreed: The Committee agreed to commission research from the Assembly Research and Library Services on the introduction of the Bill in GB.

Agreed: The Committee also agreed to write to stakeholders in the Advice sector about the proposed bill.

[Extract]

Thursday, 20 November 2008

Health And Safety Executive Headquarters, Belfast

Present: Mr Mark Durkan MP (Chairperson)

Ms Jennifer McCann (Deputy Chairperson)

Mr Leslie Cree

Mr Simon Hamilton

Mr Alan McFarland

Mr Gerry McHugh

Mr Jim Wells

In Attendance: Mr John Torney (Principal Clerk)

Mr Jim McManus (Assembly Clerk)

Mr Paul Connolly (Assistant Assembly Clerk)

Mr Stephen White (Clerical Supervisor)

Mr Jim Nulty (Clerical Officer)

Apologies: Mr Sean Neeson

Mr Robin Newton

Dr Alasdair McDonnell MP

Mr Paul Butler

10.38 a.m. The meeting opened in closed session.

11.00 a.m. The meeting went into public session

8. Draft Response on proposed Debt Relief Bill

The Committee considered its initial response to the Department's policy proposal on the Debt Relief Bill.

Agreed: A draft response, to issue from the Clerk, was agreed.

[Extract]

Thursday, 28 May 2009

Room 21, Parliament Buildings

Present: Mr Mark Durkan MP (Chairperson)

Dr Alasdair McDonnell MP

Mr Leslie Cree

Mr Alan McFarland

Mr Gerry McHugh

Mr Paul Butler

Mr Sean Neeson

In Attendance: Mr Jim McManus (Assembly Clerk)

Mr Paul Connolly (Assistant Assembly Clerk)

Ms Sohui Yim (Assistant Assembly Clerk)

Mr Jim Nulty (Clerical Supervisor)

Mr Diarmaid Elder (Clerical Officer)

Apologies: Mr Simon Hamilton

Mr Robin Newton

Ms Jennifer McCann (Deputy Chairperson)

Mr Jim Wells

10.35 a.m. The meeting opened in public session.

10.50am. Alan McFarland joined the meeting.

6. Debt Relief Bill

Members received an oral briefing from Reg Nesbitt, Head of Insolvency Services, Jack R eid and Chris Nesbitt from Insolvency Services. Key issues included background of Bill, why it is necessary and timeframe/procedural needs to put the Bill into place.

Agreed: The Committee is content to allow Bill to proceed as requested.

[Extract]

Thursday, 18 February 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Dr Alasdair McDonnell MP

Mr Stephen Moutray

Mr David Simpson MP

Mr Sean Neeson

Mr Gerry McHugh

Mr Leslie Cree

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Alan McFarland

10.33am The meeting began in public session.

4. Debt Relief Bill: Oral Briefing

10.58am The Officials joined the meeting.

The Committee received an oral briefing from Reg Nesbitt, Director DETI Insolvency Service and Jack Reid DETI Insolvency Service. Key issues included the proposed timing for the legislation, current status of the Bill and key aspects of the Bill.

11.21am The Officials left the meeting.

Agreed: Content for the Department to submit the Bill to the Executive for approval.

Agreed: To receive a full list of consultees and consultation responses from the Department.

Agreed: To write to the Social Development Committee to welcome DSD's strategy for an integrated advice service across Northern Ireland and suggest that DSD remain mindful of the DETI proposals for debt relief in the Debt Relief Bill.

[Extract]

Thursday, 11 March 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Dr Alasdair McDonnell MP

Mr Alan McFarland

Mr Leslie Cree

Mr Sean Neeson

Ms Jennifer McCann

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Stephen Moutray

Mr David Simpson MP

Mr Gregory Campbell MP

Mr Gerry McHugh

10.34 am The meeting began in public session.

3. Matters arising

Members noted the introduction of the Debt Relief Bill.

[Extract]

Thursday, 18 March 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Dr Alasdair McDonnell MP

Mr Alan McFarland

Mr Leslie Cree

Mr Stephen Moutray

Mr Sean Neeson

Mr Gerry McHugh

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Gregory Campbell MP

Mr David Simpson MP

Ms Jennifer McCann

10.23am The meeting began in public session.

3. Matters arising

Members discussed a draft public notice for the Debt Relief Bill and a list of key stakeholders for the Bill.

Agreed: Content with the public notice

Agreed: To write to a selection of the key stakeholders for the Bill.

Agreed: To receive an informal short presentation from the Bill Clerk before the start of next week's meeting.

[Extract]

Thursday, 15 April 2010

Soni Building, Castlereagh House, Belfast

Present: Mr Alban Maginness (Chairperson)

Mr Leslie Cree

Mr Gerry McHugh

Ms Jennifer McCann

Mr Sean Neeson

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Paul Butler (Deputy Chairperson)

Mr David Simpson MP

Mr Gregory Campbell MP

Mr Stephen Moutray

Mr Daithí McKay

Dr Alasdair McDonnell MP

11.50am The meeting began in public session.

3. Matters arising

Members noted a draft motion to extend the Committee stage of the Debt Relief Bill.

Agreed: Content with the motion and the requested extension date.

[Extract]

Thursday, 22 April 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Ms Jennifer McCann

Mr Daithí McKay

Dr Alasdair McDonnell MP

Mr Leslie Cree

Mr Gerry McHugh

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Stephen Moutray

Mr Gregory Campbell MP

Mr David Simpson MP

Mr Sean Neeson

10.35am The meeting began in public session.

7. Assembly Research Paper on Debt Relief Bill –Written briefing

Members discussed the written briefing as well as written responses on the Bill, from Advice NI, FSB, Consumer Credit Counselling Service and the NI Courts and Tribunals Service.

Agreed: To copy Advice NI's response to the Department to request its views on Advice NI's concerns.

Agreed: To receive the Department's views in time for consideration at the next meeting, 13 May.

Agreed: To have Departmental officials on stand-by at the meeting of 13 May to address the Committee's questions (if any) during consideration of the response.

[Extract]

Thursday, 13 May 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Ms Jennifer McCann

Mr Stephen Moutray

Mr Gregory Campbell MP

Mr David Simpson MP

Dr Alasdair McDonnell MP

Mr Sean Neeson

Mr Leslie Cree

Mr Gerry McHugh

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Daithí McKay

10.04am The meeting began in public session.

5. Debt Relief Bill – Oral Evidence

12.14pm Officials joined the meeting.

Members received oral evidence from Bob Stronge, CEO, Advice NI and Sinead Campbell, Money Advice Co-ordinator. Key issue discussed included the Debt Relief Bill.

12.26pm Stephen Moutray left the meeting.

12.28pm Gregory Campbell left the meeting.

Agreed: To consider the written evidence on this item next week.

12.35pm Officials left the meeting.

[Extract]

Thursday, 20 May 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Mr Gregory Campbell MP

Mr Leslie Cree

Ms Jennifer McCann

Dr Alasdair McDonnell MP

Mr Gerry McHugh

Mr David Simpson MP

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Daithí McKay

Mr Stephen Moutray

Mr Sean Neeson

10.34am The meeting began in closed session.

1. Consideration of Debt Relief Bill: Internal Memo from the Examiner of Statutory Rules

Members discussed the memo.

Agreed: Content with the Examiner's comments.

10.37am The meeting opened in public session.

8. Consideration of the Debt Relief Bill – Written briefing

Members discussed the Debt Relief Bill.

11.27 am Officials from DETI's Insolvency Service joined the meeting to answer members' questions.

Jennifer McCann had reservations regarding Clause 2, Part I and suggested that the Bill might benefit from an 'exceptional circumstances clause,' as suggested by Advice NI, to take into account unforeseen changes in an individual's situation.

Agreed: To await Departmental officials' response after their discussions with their counterparts in GB regarding problems that have arisen from Debt Relief Orders in England.

11.53am The officials left the meeting.

[Extract]

Thursday, 3 June 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Ms Jennifer McCann

Mr Daithí McKay

Mr Gregory Campbell MP

Mr Sean Neeson

Mr Gerry McHugh

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr Stephen Moutray

Dr Alasdair McDonnell MP

Mr Leslie Cree

10.49am The meeting began in closed session.

6. Debt Relief Bill – Consideration of additional papers: Written briefing

Members discussed a consultation document from the Department for Business, Innovation and Skills (BIS), inviting views on whether Debt Relief Order (DRO) eligibility criteria should be changed to address the issue of the pension criteria.

Agreed: To recommend that the Department take into account the outcomes of the BIS consultation when bringing forward secondary legislation on the Debt Relief Bill.

7. Debt Relief Bill: Formal Clause-by-Clause scrutiny

The Committee formally scrutinised, clause-by-clause, The Debt Relief Bill and agreed the following:

Clause 1 – Debt Relief Orders

Question put and agreed: That the Committee is content with Clause 1, as drafted.

12.05pm Members called officials from DETI's Insolvency Branch to join the meeting - Reg Nesbitt, Jack Reid and Eileen Glenn.

Clause 2 – Conditions for making a Debt Relief Order

Question put and agreed: That the Committee referred Clause 2 for further consideration.

Clause 3 – Debt Relief Restrictions, orders and undertakings

Question put and agreed: That the Committee is content with Clause 3, as drafted.

Clause 4 – Advice in relation to relief of debt and related matters

Question put and agreed: That the Committee is content with Clause 4, as drafted.

Clause 5 – Power to make consequential amendments

Question put and agreed: That the Committee is content with Clause 5, as drafted.

Clause 6 – Minor and consequential amendments

Question put and agreed: That the Committee is content with Clause 6, as drafted.

Clause 7 – Commencement

Question put and agreed: That the Committee is content with Clause 7, as drafted.

Clause 8 – Interpretation

Question put and agreed: That the Committee is content with Clause 8, as drafted.

Clause 9 – Short Title

Question put and agreed: That the Committee is content with Clause 9, as drafted.

Schedule – Minor and consequential amendments

Question put and agreed: That the Committee is content with the Schedule, as drafted.

Long Title

Question put and agreed: That the Committee is content with the long title, as drafted.

Agreed: That the Committee is content with all clauses, subject to no consequential amendments that may arise from amendments to Clause 2.

Agreed: To receive the Minister's view on Clause 2 of the Bill, and in particular, the proposal for an exceptional circumstances clause on the 6-year rule and also what will be done to assist those most vulnerable people that will not be able to apply for a second DRO within the 6-year time period.

Agreed: To defer consideration of Clause 2 until receiving the Minister's views.

12.20pm Officials left the meeting.

Agreed: To schedule an extra meeting, if required, to ensure the Bill meets the deadline for reporting to the Assembly.

[Extract]

Thursday, 10 June 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Dr Alasdair McDonnell MP

Mr Gregory Campbell MP

Mr Stephen Moutray

Mr Leslie Cree

Mr Sean Neeson

Mr Gerry McHugh

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Ms Jennifer McCann

10.33am The meeting began in closed session.

7. Further Clause-by-Clause Consideration of the Debt Relief Bill: Written Briefing

Members discussed a letter from the Minister regarding her views on an amendment to Clause 2 of the Debt Relief Bill which would allow debtors to obtain another debt relief order within 6 years in exceptional circumstances.

Members had no comments on Clause 2 of the Bill.

[Extract]

Thursday, 17 June 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Mr Daithí McKay

Dr Alasdair McDonnell MP

Mr Gregory Campbell MP

Mr Stephen Moutray

Mr Leslie Cree

Mr Sean Neeson

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Ms Jennifer McCann

10.39am The meeting began in public session.

5. Consideration of the Debt Relief Bill – 1st Draft of Report: Written briefing

The Committee formally scrutinised each paragraph of the report.

Agreed: That the executive summary at paragraphs 1-7 stands part of the report.

Agreed: That the introduction at paragraphs 8-12 stands part of the report.

11.58am Daithí McKay rejoined the meeting.

Agreed: That the summary of consideration of the Bill by the Committee at paragraphs 24-43 stands part of the report.

Agreed: That the clause-by-clause consideration of the Bill at paragraphs 44-46 stands part of the report.

Agreed: That the entire report with minutes of proceedings, minutes of evidence and written evidence will be considered at next week's meeting.

[Extract]

Thursday, 24 June 2010

Room 30, Parliament Buildings

Present: Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Dr Alasdair McDonnell MP

Mr Gregory Campbell MP

Mr Leslie Cree

Mr Sean Neeson

Mr Gerry McHugh

Ms Jennifer McCann

In Attendance: Mr Jim McManus (Assembly Clerk)

Ms Sohui Yim (Assistant Clerk)

Mr Jim Nulty (Clerical Supervisor)

Ms Michelle McDowell (Clerical Officer)

Apologies: Mr David Simpson MP

Mr Stephen Moutray

10. Consideration of Debt Relief Bill – Final Draft of Report: Written briefing

The Committee formally scrutinised each appendix of the final Bill report and considered a letter from the Minister stating that she is planning to table an amendment to the Bill during consideration stage and the suggested amendment.

Agreed: To note the Minister's letter and suggested amendment.

Agreed: Content to include the Minister's letter and proposed amendment in appendix 4.

Agreed: That the following papers should be appended to the Committee's report:

Minutes of Proceedings

Minutes of evidence (Hansards)

Written submissions

Memoranda and papers from DETI

The Assembly Research Paper

List of witnesses

Members considered an amendment to paragraph 28 of the Debt Relief Bill Report.

Agreed: Content that paragraph 28, as amended, stands part of the report.

Agreed: Chair to approve an extract from today's minutes which reflect the read-through of the Report.

Agreed: To lay to report in its entirety in the Assembly Business Office after today's meeting.

Agreed: To order 150 reports with a CD ROM and 35 full reports for printing.

Appendix 2

Minutes of Evidence

18 February 2010

Members present for all or part of the proceedings:

Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Mr Leslie Cree

Dr Alasdair McDonnell

Mr Gerry McHugh

Mr Stephen Moutray

Mr Sean Neeson

Mr David Simpson

Witnesses:

Mr Reg Nesbitt |

Department of Enterprise, Trade and Investment |

1. The Chairperson (Mr A Maginness): I welcome Mr Reg Nesbitt and Mr Jack Reid from the Insolvency Service of the Department of Enterprise, Trade and Investment. Gentlemen, I will ask you to make your presentation, after which members will ask you questions.

2. Mr Reg Nesbitt (Department of Enterprise, Trade and Investment): Chairman, may I first congratulate you on your appointment as Chairman of the Committee?

3. The Chairperson: Thank you very much.

4. Mr Nesbitt: For your benefit and for that of any other member who is new to the Committee, I will outline our previous engagements with the Committee and then provide a résumé of the Bill's provisions and the stage that we are at.

5. On 16 October 2008, we briefed the Committee about the Department's proposal to legislate to set up a debt-relief scheme, and advised that we were planning to carry out a public consultation. On 28 May 2009, we informed the Committee of the outcome of the consultation and provided a detailed outline of what we proposed to include in a Bill to set up a debt-relief scheme. The Committee agreed to the Minister's seeking Executive agreement to the drafting of a Bill.

6. Executive agreement was given on 30 July 2009, and a Bill has since been drafted and agreed; the Minister has sent the Committee a copy of it along with the explanatory and financial memorandum. The Bill's main purpose is to enable the Department to set up a scheme to address the difficulty that the least well-off have in accessing relief from debt burdens. It is possible to get relief from debts that one cannot pay — but only if one can afford it. That is done by petitioning the Northern Ireland High Court to be made bankrupt; however, one will have to pay a £345 deposit, payable to the Insolvency Service, and a £115 fee to the court. Bankruptcy provides one year's protection against action by one's creditors. At the end of the year, one's liability to pay most categories of unsecured debt will be completely cancelled. Those who cannot afford to pay the deposit and fee will be left burdened by debt, possibly for the rest of their lives. It has been recognised that the making of an order to relieve debt on a debtor's application is a purely administrative task that could be carried out by the Official Receiver at far lower cost.

7. The central theme of the Bill is to give individuals who are burdened by debt the right to apply to the Official Receiver for what is termed a debt-relief order, which will have a similar effect to a bankruptcy order that is made by the court. That is set within the confines of arriving at a scheme that is simple, straightforward and cheap to administer, and, at the same time, of striking a balance between the need to assist the least well-off to become financially rehabilitated and protecting creditors' interests.

8. Application for a debt-relief order will be possible only through a trained debt advisor. That will provide an opportunity for applicants' financial circumstances to be assessed and for checks to be made to ensure that they meet the eligibility criteria that will apply. Debt advisors will have to be approved by the competent authorities that the Department designates. Strict eligibility criteria will apply: the scheme is for people with debts at the lower end of the scale. A ceiling on total debts will, therefore, be set in subordinate legislation. The scheme is for people with no prospect of being able to pay their debts. Ceilings will, therefore, be set in subordinate legislation on the total value of the assets that applicants are allowed to have and on the surplus income that they may have left over after meeting essential living expenses.

9. Bankruptcy, with its emphasis on investigation, will remain as the more appropriate remedy for people with higher levels of debt and for homeowners. Homeowners will, in practice, be barred from the scheme, because their house will be treated as an asset even if in negative equity. A debt-relief order will provide a one-year moratorium that protects the debtor against legal proceedings or enforcement action by their creditors. Liability to repay debts that are covered by the order will be completely cancelled at the end of that year. A fee will be payable to the Official Receiver, but it is intended that that will be less than one third of what it costs to petition for bankruptcy. The fee will go towards the cost to the Department for administering the scheme, which is estimated at between £80,000 and £90,000 a year. The set-up cost, mainly to provide IT processes to operate the scheme, is estimated to be about £100,000 and is covered by the Department's budget.

10. The scheme incorporates measures to prevent it being abused by those out to defraud their creditors, including the establishment of a regime of offences and penalties. The scheme will offer timely relief to those affected by the recession. Estimates suggest that there could be between 500 and 1,000 applicants to it each year. The Bill to set up the scheme is exactly as outlined to the Committee on 28 May 2009. It is also, for the most part, in parity with legislative provision that is included in the Tribunals, Courts and Enforcement Act 2007, under which a similar scheme was set up in England and Wales that came into operation on 6 April 2009.

11. Extensive consultation that was carried out between February 2009 and May 2009 produced 22 responses, 16 of which were substantive. Of the 12 respondents who commented on the merits of the scheme, only two opposed it from a particular standpoint: one opponent was a council that was concerned about the effect on its rating revenue; the other was a body representing credit unions. However, examination shows that the effect on rating revenue should be minimal; for one thing, the scheme will not be open to homeowners. It was pointed out to the body representing credit unions that its members could protect their interests by insisting on borrowers holding a savings balance above the asset level for eligibility to the scheme.

12. We now need, through our Minister, to seek Executive approval for the Bill to be introduced in the Assembly. We hope that the matter can be dealt with on 11 March 2010 if an Executive meeting takes place on that day. We intend for the Bill to be introduced on 22 March 2010; it is important that the Bill be introduced on that date so that it is not delayed. We are seeking the Secretary of State's consent to have reserved matters included in the Bill in the shape of offences and penalties; we do not expect there to be any difficulties with that.

13. The Chairperson: Thank you for your presentation. I wish to ask you about the general thrust of the Bill. It is to provide a cheaper, more efficient and effective way of dealing with debt rather than going through High Court bankruptcy proceedings, and it is aimed at people with a lower level of debt than the unlimited range of debt in High Court bankruptcy proceedings. Is that the thrust of the Bill?

14. Mr Nesbitt: A person can still apply for an ordinary bankruptcy if they owe more than £750. That is enshrined in legislation.

15. The Chairperson: Therefore no one is prevented from doing that.

16. Mr Nesbitt: No one is prevented from going into bankruptcy if that is what they desire; if they have enough assets, they may want to go down that route. The Debt Relief Bill is for people who have no income and no assets. In England, the upper ceiling for liabilities is £15,000, so the Bill will probably affect people on very low incomes, who do not have a house, probably live in rented accommodation, and have probably run up credit card debts to a ceiling of £15,000.

17. The Chairperson: Is that likely to be the ceiling here as well?

18. Mr Nesbitt: It is.

19. The Chairperson: A debt-relief order seems to be given on the basis of an application, which is filled out by authorised intermediaries. Is that right?

20. Mr Nesbitt: Yes.

21. The Chairperson: Do they have to accept what is stated in the application?

22. Mr Nesbitt: The Official Receiver will, generally speaking, accept what is on an application, because intermediaries are their primary contact. Those intermediaries are normally debt advisers; they could be from a citizens' advice bureau or from Advice Northern Ireland, for example. They give advice every day, so they will guide the applicant. They will decide the proper route for the applicant because they have to satisfy the criteria; therefore the advisers will need some training so that they can identify whether an applicant qualifies for the scheme.

23. The Chairperson: Can the intermediaries carry out an in-depth search on a person's financial background?

24. Mr Nesbitt: Yes; they have to determine an applicant's income and expenses.

25. Mr Jack Reid (Department of Enterprise, Trade and Investment): The intermediaries, who will be trained debt advisers, will be required to look at documentary proof of the applicant's income to verify that their circumstances are as stated in the application form.

26. The Chairperson: Therefore you are not dealing with people who simply assert what their income is.

27. Mr Nesbitt: Certainly not.

28. The Chairperson: Proof is given to the intermediary.

29. Mr Reid: That is correct.

30. The Chairperson: Therefore the Official Receiver would work on that basis.

31. Mr Reid: It is not the Official Receiver who works on that basis; it is a preliminary process carried out before the application is submitted to the Official Receiver. One of the intermediaries' roles is to examine documentary proof of income.

32. The Chairperson: Are you satisfied that the process will be rigorous?

33. Mr Nesbitt: Yes.

34. The Chairperson: If an order is granted, a one-year moratorium would come into effect from the date that the application is granted.

35. Mr Reid: It comes into effect from the date that the making of a debt-relief order is entered in a register of debt-relief orders. That should happen shortly after the making of an order.

36. The Chairperson: Does that avoid all court proceedings?

37. Mr Reid: No. A creditor who objects to what is taking place or to the Official Receiver's handling of a case can apply to the court, which will have a range of options available to it, including revoking an order.

38. Mr Nesbitt: The Official Receiver can go to the court for directions if he so desires.

39. The Chairperson: What happens at the end of the one-year moratorium?

40. Mr Reid: The cancellation of debts takes place as in bankruptcy; however, in the case of a debt-relief order, only debts that have been listed and covered by the order will be cancelled. If a debtor were to forget about a debt, he or she would still be liable. Bankruptcy cancels all debts, subject to certain statutory exceptions. Debt relief covers those debts that the debtor has listed in his application.

41. Mr Nesbitt: If knowledge of a debt that pushed the debtor over the £15,000 ceiling came to the attention of the Official Receiver, he may revoke the order within the moratorium period.

42. The Chairperson: The Bill covers those who have no assets or whose income is very low or non-existent and who cannot cover outstanding debts.

43. Mr Nesbitt: Yes; it covers people who are unlikely ever to be able to repay debts that would be a millstone round their neck for quite a long time.

44. The Chairperson: For the rest of their lives, in effect.

45. Mr Butler: The last time you were here you said that the eligibility criteria related to people who did not have a surplus of £50 a month?

46. Mr Nesbitt: Yes.

47. Mr Butler: How can you distinguish between a family and a single person? A £50 surplus seems a stringent criterion. Advice NI had some concerns about that as the figure is quite small.

48. Mr Reid: Frankly, our intention is that the £50 surplus limit would apply, irrespective of family size. The scheme should not place the debtor in a better position than they would be in bankruptcy; it should give people who meet the criteria cheaper and easier access to relief from their debt. In bankruptcy, if a person has a surplus income of more than £50 a month, they are liable, irrespective of the size of their family, to have deductions made from their income for the benefit of their creditors. Therefore, it would not be fair or reasonable to give people under this scheme the ability to retain a higher level of income.

49. Mr Butler: How do you work that out?

50. Mr Reid: It is worked out through the common financial statement, which is used to assess a person's needs and takes into account their dependents.

51. Mr Butler: Fifty pounds a month is not a great deal of money.

52. Mr Reid: I agree.

53. Mr Nesbitt: All the issues are taken into account in arriving at the £50 figure.

54. Mr Butler: Does it include family emergencies?

55. Mr Nesbitt: Yes.

56. Mr Butler: Have concerns been raised about that?

57. Mr Reid: Not in relation to bankruptcy.

58. Mr Nesbitt: I do not think that we can depart from the normal bankruptcy rules; this is just another form of bankruptcy.

59. Mr Neeson: It is unfair to exclude homeowners from the scheme. Many of my elderly constituents who go into nursing homes have to sell their homes to pay for their upkeep. It is a question of Northern Ireland adopting the Scottish scheme for free personal care for the elderly. The qualifying threshold is very low indeed.

60. Mr Nesbitt: Once houses are included and the scheme is expanded into other areas, massive expense is run up. Bankruptcy is an expensive business for the Department to administer — it must be investigated for a start. Although such cases can be investigated, the general trend is not to do so. For example, attendant charges would involve getting a qualified person to determine a house's value after mortgages and charges.

61. The Chairperson: My understanding is that the Bill is aimed at a small, specific number of people with no assets and on no or very low income.

62. Mr Nesbitt: Exactly.

63. The Chairperson: Including homeowners would widen that net considerably.

64. Mr Nesbitt: Yes; and homeowners have the remedy of bankruptcy.

65. The Chairperson: Yes.

66. Mr Cree: There has been a need for such a debt-relief scheme for some time. However, I am concerned about protection for others. What scope is there to prevent repeat offences, such as the accumulation of rates bills, which was flagged up in the consultation? Could the scheme be manipulated to avoid paying other debts, for instance, to credit unions? How will the scheme link into debt-advice centres run by the Department for Social Development?

67. Mr Nesbitt: If no homeowners are involved, the rate dilemma disappears. Most of the applicants will not be homeowners; therefore rates will not come into it. The only way that rates might enter into consideration —

68. Mr Cree: One need not be a homeowner to pay rates.

69. Mr Reid: We have checked the position regarding Housing Executive tenants. The Housing Executive pays rates, irrespective of whether the tenant pays them or not. Therefore, the scheme would not result in councils losing rating revenue. Only private tenants whose property value is above a certain ceiling — I think that it is £100,000 — can be eligible to pay rates, and then only if the tenancy agreement states that they are liable for the rates. Hence, there should not be a huge loss of revenue.

70. Mr Cree: A tenancy agreement that did not deal with the issue of rates would be unusual.

71. The Chairperson: It is still DSD's responsibility.

72. Mr Reid: I mean that there will not be a loss of rating revenue because a landlord is responsible for paying rates; however, that raises other issues: is the debt-relief scheme being used as a means to avoid paying rent and rates arrears to a landlord? The scheme is aimed at people who cannot pay bad debts whether the scheme exists or not. Someone whose income allows them a surplus of just £50 a month will not be in a position to pay off an outstanding rates bill of several hundred pounds.

73. Mr Cree: What about the proposed DSD debt centres?

74. Mr Reid: It will be possible for anyone who meets the criteria to become a competent authority to apply to the Department to be designated as such; that would include advice centres.

75. Mr Cree: There could be repeat offences. If a debt-relief order was issued and the slate was wiped clean after one year, the same difficulty could arise a year later.

76. Mr Reid: The person will not be able to apply for a further debt-relief order for six years in order to avoid the problem of serial applications.

77. Mr Cree: Thank you.

78. Mr Reid: A further measure will be put in place called a debt-relief restrictions order: if there is evidence of culpable conduct, such as making repeat applications, it will be possible to apply to the courts to have the person placed under restrictions to stop him doing people out of money.

79. Mr Cree: It will be complex.

80. Mr Reid: It is similar to bankruptcy.

81. The Chairperson: However, it seems that there are safeguards to dissuade repeat offenders.

82. Mr Reid: It is designed to protect everyone.

83. Mr Nesbitt: There is a range of penalties under various headings.

84. Mr McHugh: It is certainly complex; the more one works at it the less sensible it seems. Whom does the Bill help most, and how many will it help, because it excludes more and more people. However, the debt-relief scheme is being brought into effect because of the amount of credit-card debt accumulated by people who had absolutely nothing in the first place. Indeed, during the boom time banks gave 100% loans to people who did not have the ability to repay them; the banks should not have done that. Is the Bill targeted at those people?

85. Mr Nesbitt: The Bill is largely for people who cannot afford to make themselves bankrupt because they have very low income or no assets; they live in rented property and will not be able to pay off their debts. There is no point in creditors chasing debtors and not obtaining a result. The Bill is designed to relieve the unnecessary pressure under which those people are placed. It will also help the credit industry, because it will stop wasting money chasing bad debts.

86. Mr McHugh: There is also almost an acceptability of the present practice of people providing services to run as long as you can and pay no one. We do not necessarily want to encourage that either, because those who are genuinely trying to work are in trouble every day because of it. There is that side of the whole issue. With regard to establishing proof of ownership, there is always the question of proof of disposal of property, whether someone sold a house, and what they did with the money. Will that feature in the Bill?

87. Mr Nesbitt: That issue would be examined in a bankruptcy.

88. Mr Reid: There will be scope for creditors to bring to the attention of the Official Receiver evidence that a person transferred ownership of a house or did something with the proceeds that they perhaps should not have. One of the receiver's roles will be to investigate such matters. There will also be a question on the application form about the past transfer of property, and a person will be committing a criminal offence if he does not declare that truthfully.

89. The Chairperson: Thank you for your attendance. It is a complex area on which your advice has been very helpful.

90. Mr Reid: Are you happy, Chairperson, for us to take the Bill forward to the Executive with a view to introducing it?

91. The Chairperson: Yes, I think that there is consensus on that.

Members indicated assent.

92. The Chairperson: That is formally agreed by the Committee.

13 May 2010

Members present for all or part of the proceedings:

Mr Alban Maginness (Chairperson)

Mr Paul Butler (Deputy Chairperson)

Mr Gregory Campbell

Mr Leslie Cree

Ms Jennifer McCann

Mr Stephen Moutray

Mr Sean Neeson

Mr David Simpson

Witnesses:

Ms Sinéad Campbell |

Advice NI |

93. The Chairperson (Mr A Maginness): Appearing before the Committee are Mr Bob Stronge, the chief executive of Advice Northern Ireland, and Ms Sinéad Campbell, the money advice project manager of the same organisation. Both are welcome. Departmental officials are on standby to address the Committee's concerns if necessary.

94. Mr Bob Stronge (Advice NI): Good afternoon, members. I hope that we will not keep you as long as the previous, very interesting discussion. I felt like I was back in the Economic Development Forum.

95. First, we support the Debt Relief Bill. It is an important piece of legislation that will protect very vulnerable people with whom advice networks such as ours and others deal. Sinéad Campbell will run through some of the key issues in the Bill that we feel that the Committee may want to address. After that members will have the opportunity to question us.

96. Ms Sinéad Campbell (Advice NI): The legislation aims to benefit vulnerable people who are already experiencing considerable stress due to their debt situation. Advice NI is concerned that no timelines are given for objections and investigations, as described in proposed new articles 208K(5) and (6). That could mean that an investigation could be carried out at any time after discharge, which could be several years. That could place further stress on the debtor, so Advice NI wants clear guidance and timelines for investigations.

97. Although Advice NI supports responsible spending and debtors taking ownership of their actions, it is concerned about the upper time limits of debt relief restriction orders that are referred to in paragraph 9(2)(b) of proposed new schedule 2ZA. We seek clarification regarding the application of the 15-year restriction and information on how decisions will be made to enforce the two-year or 15-year restrictions or anything in-between.

98. Paragraph 5 of proposed new schedule 2ZA clearly defines the six-year rule for reapplying for a debt relief order. Advice NI believes that an exceptional circumstances clause should be added to take account of unforeseen changes in an individual's situation; for example, a life event such as illness or the death of a partner, which may leave a person unable to cope with their financial situation. We feel that such cases should be considered on their merit and the circumstances.

99. Advice NI is keen to act as an approved intermediary and to seek clarification on the process and remuneration related to that. We also recommend that any registration fee identified in proposed new article 248A(11)(a) and (b) be proportional to the status of the organisation seeking to become a designated body.

100. I will now outline some issues that have been encountered in England and Wales. The expected take-up rate was around 36,000 claimants; however, to date, only 1,978 debt relief orders have been issued, which is less than 5·5% of the anticipated uptake. That seems to highlight the possibility that there is something fundamentally wrong with the eligibility criteria. Advice NI recommends that that issue be fully researched before debt relief orders are implemented in Northern Ireland.

101. We recognise that the estimated target group of beneficiaries is quite small, standing at approximately 1,000 people. We believe that amending the qualifying criteria slightly would lead to the legislation having a greater impact and would ensure that borderline cases do not slip through the net. We propose that the debt liability be increased to £20,000 and that the requirement to have less than £50 in surplus income should be flexible, to take circumstances into account and allow for some protection for those who fall just outside the threshold.

102. Our initial response gave the example of a single parent with four children and a surplus income of £51 who would be excluded from the order, compared with a single person who has no children and a surplus income of £49, who would be eligible. However, we envisage that the use of the common financial statement will provide some safeguards in that area.

103. Advice NI has previously highlighted concerns around the realisable assets limit of £300, which includes occupational and private pensions. Our sister organisation, AdviceUK, has found that 90% of those seeking a debt relief order had pension pots and, therefore, were excluded. A pension is necessary to provide older people with an income when they are no longer earning a regular income from employment. We seek an assurance that private and occupational pensions are not included as an asset when deciding the criteria for a debt relief order.

104. The £1,000 limit for the value of vehicles is another issue that concerns us in relation to realisable assets. Anecdotal evidence from debt advisers in our organisation suggests that average car values are above that limit. We suggest that the limit for the value of vehicles is raised to £3,000, which is equivalent to that available under bankruptcy proceedings and is more realistic.

105. We understand that in England and Wales a van that is used for business purposes will not be classed as a tool of the trade in the order and will, therefore, count towards the limit. If a client's only transport is a van, it must be worth less than £1,000. If a client owns a car for personal use and a van, the van would only be worth £300, meaning that a debt relief order is unsuitable. That is unfair and penalises tradespeople, who have been among those most affected by the economic downturn in Northern Ireland.

106. Our understanding is that in England and Wales, disability benefits count as income for applicants seeking a debt relief order. Those benefits are awarded specifically to help the recipient cope with their disability and should not be counted as income. Advice NI seeks assurance that benefits will not be regarded as income.

107. We understand that numerous changes to the guidelines have been published in England and Wales. That has created confusion among applicants and intermediaries. Advice NI seeks assurance that the Insolvency Service thoroughly researches and publishes one clear set of concise guidance on debt relief orders.

108. Since the introduction of the scheme in England and Wales there have been many problems with the online application forms. In their current format, the forms have proved difficult for the clients and intermediaries to complete. It was originally envisaged that the online forms would allow the clients to fill in some details, such as balances, and an intermediary could assist with the overall completion of the form. However, the design is such that the first page must be fully completed before moving on to the next page. That has caused difficulties for clients and intermediaries and has resulted in the intermediaries having to complete the application form themselves. That disempowers the client and adds to the role of the intermediaries.

109. Advice NI is keen that the Insolvency Service enters into a meaningful partnership with the debt advice sector and that it does not see the voluntary sector as a cheap option. Advice NI is also keen that intermediaries are adequately remunerated for obtaining the relevant information about the debtors' affairs, forming an opinion as to whether the debtor would be eligible, ensuring that the application is completed correctly and, where appropriate, sending the form electronically to the official receiver.

110. We ask that consideration be given to the additional workload created as a result of the order assessment, as not all assessed cases will be suitable for the order. We ask also that a remuneration scheme similar to that in operation for benefit uptake campaigns with the Social Security Agency is applied. In other words, we seek a two-tier system whereby payment is made for advice and information and for applications.

111. We also have concerns over the focus on closed cases. That has the potential to move the focus from client need on to statistical outcomes. That does not fit with the current systems-thinking approach being applied across the UK. That approach is client-need driven, rather than target driven. There is a danger that the order could become more about targets and moneys than about actual client need. That should be considered in any evaluation or review of the implementation of the order.

112. Advice NI is willing to be designated as a competent authority to nominate, train and monitor the performance of the intermediaries to implement the scheme, provided that the necessary support and liaison with the Insolvency Service is available. We seek reassurance that the commercial sector is prohibited from acting as intermediaries, as the incentive might be to get the client through the door and sell them other services that may not be in their best interests.

113. Our further recommendations include reassurance that intermediaries are not held accountable for falsely declared assets by the debtor; reassurance that the initiative will not lead to further financial exclusion; the up front fee to be fixed for a three-year period, with consultation on any proposal to increase it; and that the order be reviewed annually rather than every three years. That review should take account of the impact and relationship with the debt advice sector. Advice NI is keen to engage with the Insolvency Service in the implementation and review of the order in Northern Ireland.

114. The Chairperson: Thank you; that has been helpful. You stated that proposed new article 208K(5) of the Bill provides that creditors are permitted to object to the making of debt relief orders. You also said that you would like clear guidance and timelines on the investigations. Is that in any way different to the English legislation and, if not, why should we differ on that point?

115. Mr Stronge: It is about being clear about the timelines in relation to that. That is a weakness. We looked at the experience of the order as it stands in England, so we are picking out areas where improvements could be made when making the order here.

116. The Chairperson: Has that aspect given rise to any problems in England?

117. Mr Stronge: I will have to check that.

118. The Chairperson: Is yours a more precautionary approach?

119. Mr Stronge: Yes.

120. The Chairperson: What is your view on the 15-year restriction? The Department states that it will be possible for someone who is subject to a debt relief order to be placed under continuing restrictions following the ending of the moratorium period that ensues after the making of the order. Is the point that you are making not, therefore, unnecessary?

121. Mr Stronge: The point regarding the application of the 15-year restriction is about how decisions will be made about the enforcement of that and the timelines between two and five years. It is a cautionary thing that we are —

122. The Chairperson: Is it precautionary?

123. Mr Stronge: Yes.

124. The Chairperson: So it would be desirable in the circumstances, but not absolutely essential?

125. Mr Stronge: Yes.

126. The Chairperson: Paragraph 5 of proposed new schedule 2ZA states that a person may not reapply for a debt relief order within six years. You believe that an exceptional circumstances clause should be added. Is there an exceptional circumstances clause in the English legislation?

127. Mr Stronge: There is not.

128. The Chairperson: Has that given rise to any problems?

129. Mr Stronge: It has. There have been some examples of people being unable to cope with their financial situation due to an illness or the death of a partner, for example. We are asking for some flexibility, such as an exceptional circumstances clause that may provide some relief.

130. The Chairperson: In proposed new articles 248A(11)(a) and (b) as set out in clause 4, the schedule contains minor consequential amendments to provide that the Department of Enterprise, Trade and Investment may designate approved intermediaries. I assume that you are interested in participating in that.

131. Mr Stronge: Yes.

132. The Chairperson: It appears that the Department has no plans to charge a fee in connection with the granting or maintenance of designation as a competent authority. In that sense, what you are asking for does not really apply.

133. Mr Stronge: That is fine. We were not aware of whether the Department was doing that.

134. The Chairperson: That seems to be the Department's view, unless there is any change.

135. Mr Butler: Thank you for your presentation. You mentioned the legislation in England. I am not too sure how long it has been in place there.

136. Ms S Campbell: It has been in place since April 2009, so it is early days.

137. Mr Butler: It is too early to get an independent assessment of how it has operated. I have a concern about the £50 threshold. That seems quite restrictive. What if someone has £51 or £52? Perhaps that will be dealt with in subordinate legislation. There are different views of the liability level of £20,000. I know that credit unions say that that is too high. The vehicle value limit in the legislation is £1,000, but you think that that should be £3,000.

138. Mr Stronge: It should be the same level as the bankruptcy terms.

139. Mr Butler: Is it £1,000 in the English legislation?

140. Ms S Campbell: Yes.

141. The Chairperson: However, the bankruptcy threshold is £3,000.

142. Mr Butler: Yes, and Advice NI wants it to follow the bankruptcy legislation.

143. I am also concerned about the £50 limit. How can we get around that? The legislation will obviously set some limit on it.