Session 2010/2011

Northern Ireland Assembly Commission

Report on the

FinancialSupport and Pensions for Members of the Northern Ireland Assembly

Report: NIA 28/10/11R (Northern Ireland Assembly Commission)

Membership and Powers

The Northern Ireland Assembly Commission (the Commission) is the body corporate of the Northern Ireland Assembly. It has the responsibility, under section 40(4) of the Northern Ireland Act 1998, to provide the Assembly, or ensure that the Assembly is provided, with the property, staff and services required for the Assembly’s purposes.

Powers

Extract from Paragraph 3, Schedule 5, of the Northern Ireland Act 1998

(1) Subject to sub-paragraph (4), the Commission may do anything which appears to it to be necessary or expedient for the purpose of or in connection with the discharge of its functions.

(2) That includes, in particular -

(a) holding property;

(b) charging for goods or services;

(c) entering into contracts;

(d) investing sums not immediately required in relation to the discharge of its functions; and

(e) accepting gifts.

(3) The Commission may sell goods or provide services, and may make arrangements for the sale of goods or provision of services, to the public.

(4) The Commission may borrow sums in sterling by way of overdraft or otherwise for the purpose of meeting a temporary excess of expenditure over sums otherwise available to meet that expenditure.

(5) The Commission may borrow money only under sub-paragraph (4) and may borrow under that sub-paragraph only with the special or general approval of the Assembly.

The Commission is appointed by resolution at the start of each new Mandate and is made up of the Speaker and five other Assembly Members.

The membership of the Commission is as follows:

- The Speaker - Mr William Hay (Chairperson)

- Rev Dr Robert Coulter

- Mr Pat Doherty

- Mr Pat Ramsey

- Mr Peter Weir

- Mr Sean Neeson

All correspondence should be addressed to:

The Clerk to the Assembly Commission, Northern Ireland Assembly, Room 151,

Parliament Buildings, Stormont, BT4 3XX.

Tel: (028) 9052 1930; e-mail: assembly.commission@niassembly.gov.uk.

Contents

3 The Adoption of the Ten Principles

4 The Establishment of an Independent Financial Review Panel

5 Governance and Expenditure Issues for Members of the Northern Ireland Assembly

6 Summary of Recommendations from the Assembly Commission

Annexes

Annex 1: The Northern Ireland Assembly (Members’ Expenditure) Determination 2010

Section 1

Background

Section 1: Background

1.1 The Review Body on Senior Salaries (SSRB)

1.1.1 On 4 May 2007, prior to the restoration of devolution and the de-suspension of the Assembly Commission (the Commission), the Secretary of State wrote to the Chairman of the Review Body on Senior Salaries (SSRB) seeking its agreement to conduct a review of the existing structure for salaries, expenditure and pension benefits payable to Members and Office Holders of the Northern Ireland Assembly. In June 2007, the newly appointed Commission engaged with the SSRB and agreed terms of reference for a Review.

1.1.2 The SSRB consulted with Members of the Legislative Assembly (MLAs) through a variety of qualitative methods during 2007 and 2008. They employed consultants, namely the Hay Group, to look in detail at the roles of MLAs, Ministers and Office Holders in the Assembly to assess their respective job weights[1]. The SSRB then completed its report[2] in November 2008 and the Commission initially considered the Review recommendations at their meeting on 13 January 2009. The final report made twenty five recommendations in relation to the pay, pensions and expenditure for MLAs.

1.1.3 Recommendations arising from the SSRB report were originally included within the Commission’s Report on the Pay, Pensions and Financial Support for Members of the Northern Ireland Assembly. However, the motion on that Report was not moved in Plenary on 30 November 2009. This was largely due to a lack of cross party agreement on the proposed salary increases contained within the Report.

1.1.4 The Commission agreed at this point to take forward a further report which excluded any reference to pay arrangements for MLAs and leave those decisions for an Independent Financial Review Panel (IFRP) upon its establishment. At this point the necessary legislative process was initiated for the establishment of the IFRP. A public consultation process was initiated and the Assembly Members (Independent Financial Review and Standards) Bill was introduced to the Assembly on Monday 15 November 2010.

1.1.5 In relation to the second report, the Commission consulted with Party Leaders in March 2010 and on the belief that full consensus had been obtained, initiated the legislative process to repeal the Allowances Act required to give effect to recommendations within the Report. However, based on concerns raised, the Commission agreed at a special meeting on 21 June 2010 not to move the Repeal Bill and not to present the Commission Report on Financial Support and Pensions for Members of the Northern Ireland Assembly.

1.1.6 The Commission has been mindful of developments occurring, within other legislatures, in the area of financial support for Members and has drawn on best practice in developing a series of recommendations, within this report, to ensure that the systems operating within the Northern Ireland Assembly address the specific needs of all MLAs whilst creating an open, robust and transparent regime. The Commission will continue to monitor developments in other legislatures and ensure that best practice is adopted where appropriate.

1.2 The Committee on Standards and Privileges

1.2.1 In addition to the proposals from SSRB, the Commission also considered issues referred to it as identified within the 4th and 5th Reports[3] (2009) of the Committee on Standards and Privileges. The recommendations made by the Committee related to the Assembly’s rules governing the use of Members’ financial support in the areas of accommodation and dual mandate. A further four recommendations have been included within this report to reflect the recommendations made by the Committee on Standards and Privileges.

1.3 The Review of the Financial Support for Members Handbook

1.3.1 In light of issues raised in the report from the SSRB and in correspondence from the Committee on Standards and Privileges, the Commission agreed in May 2009 to review the existing Financial Support for Members Handbook. The Speaker, in his capacity as Chairman of the Commission, initiated a consultation process with Party Leaders in June 2009. The Speaker invited Party Leaders to respond to a series of key questions and issues to be addressed within the review and proposed a number of general principles which might underpin the system of financial support. The Commission considered all the responses from the Parties when deliberating on the existing guidance and structures for the provision of financial services to Members. Arising from those deliberations the Commission has proposed further recommendations in relation to changes to the Financial Support for Members Handbook.

1.3.2 On the basis that the motion on the original Report was not moved in Plenary on 30 November 2009, further meetings were held with Party Leaders in March 2010 to consider a way forward. The Assembly Commission agreed, at their meeting in April 2010, that a two strand approach would be adopted to progress the issues. The first involved taking forward a draft Members’ Expenditure Determination to the Assembly for approval, which is the focus of this Report and the second involved taking forward all the remaining non-legislative recommendations by inclusion in the draft Financial Support for Members Handbook. Following consideration of the Report by the House, the Commission will then give consideration to the implementation of the revised draft Financial Support for Members Handbook.

1.4 The Committee on Standards in Public Life

1.4.1 The Committee on Standards in Public Life (the Committee) published its report[4] on the reform of the system of MPs’ expenses and allowances on Wednesday 4 November 2009. The inquiry into MPs’ expenses was launched by the Committee in April 2009. The Committee received over 700 written submissions and heard evidence from a range of witnesses at nine public hearings. The report made sixty recommendations on the future structure of the expenses regime.

1.5 The Independent Parliamentary Standards Authority (IPSA)

1.5.1 The recommendations within the report by the Committee on Standards in Public Life were then referred for consideration to the Independent Parliamentary Standards Authority (IPSA). IPSA is the independent body created by the Parliamentary Standards Act in 2009. Independent of both government and Parliament, IPSA is focused on establishing a new scheme of expenses for MPs that helps to restore public confidence and enables MPs to do the work they are elected to do. IPSA further consulted widely with interested parties and has now published the new Members Expenses Scheme for MPs. The Commission has considered the guidelines as outlined within the new Members Expenses Scheme for MPs and has adopted a number of the key changes.

1.6 Independent Financial Review Panel

1.6.1 Until recently, Section 47 of the Northern Ireland Act 1998, which provided for the Northern Ireland Assembly to determine and pay Members’ salaries and allowances, explicitly prevented the Assembly from delegating the function of making a determination.

1.6.2 After considering the SSRB report, the Commission, in line with the views expressed by Assembly Parties, supported the recommendation raised by the SSRB and agreed at a meeting in June 2009 that the Commission should consider an independent mechanism for the future determination of salaries, pensions and financial support for Members.

1.6.3 To take this forward, the Commission recommended that an amendment to the Northern Ireland Act 1998 should be made to enable the Northern Ireland Assembly to delegate the function of determining salaries, pensions and financial support to an Independent Financial Review Panel. The Northern Ireland Assembly Members Act 2010, which received Royal Assent on 8 April 2010 amends sections 47 and 48 of the Northern Ireland Act 1998 and allows the Northern Ireland Assembly to determine salaries and allowances or, by resolution, to delegate the function to the Commission or, by an Act of the Assembly, to an independent body.

1.6.4 In order to establish that body, the Commission has already agreed that an Assembly Bill should be developed. A paper was put before the Commission at its meeting on 18 February 2010. That paper set out various policy and process issues on which guidance was sought from Commission Members so as to establish the basis from which to develop a draft Bill. Following consultation with Parties, the Commission reviewed each of the policy considerations in respect of the establishment of an Independent Financial Review Panel, including developments in Westminster and the Welsh Assembly, and has agreed a policy document for the creation of an Independent Financial Review Panel. This policy document issued for public consultation on 29 June 2010 with a closing date of 31 August 2010. A total of 2 responses were recieved.

1.6.5 The Assembly Members (Independent Financial Review and Standards) Bill was drafted jointly by the Assembly Commission and the Assembly Committee on Standards and Privileges. The purpose of the Bill is to provide for the establishment of a panel to determine the pay, pensions and other financial support for members of the Northern Ireland Assembly; to establish the post of Northern Ireland Assembly Commissioner for Standards; and for connected purposes. The Assembly Members (Independent Financial Review and Standards) Bill was introduced to the Assembly on Monday 15 November 2010.

1.7 Publication of Expenses

1.7.1 As part of the Commission’s drive for greater openness and transparency, it also agreed to the publication, down to transaction level, of the expenditure of all Members from Office Costs Expenditure (OCE). OCE details for the period from April 2008 to July 2009 were released at the end of September 2009. A further set of OCE information for the period from April 2003 to March 2008 was also released at the end of October 2009. Publication now takes place on a quarterly basis.

Section 2: Executive Summary

2.1 This report has been developed following extensive consideration of a number of issues relating to the financial support and governance regime for MLAs. To inform the Commission’s deliberations, several key documents were taken into account, namely:

- A report by the Review Body on Senior Salaries (SSRB), reviewing the pay, pensions and expenditure of the Northern Ireland Assembly, which encompasses findings made by the Hay Group in relation to the assessment of job weightings for the roles of MLAs, Ministers and Office Holders; and

- Recommendations made by the Interim Commissioner for Standards which were referred to the Commission by the Committee on Standards and Privileges.

2.2 In addition to the above, the Commission agreed in May 2009 to initiate a review of existing guidance as set out in the Financial Support for Members Handbook. It was agreed that this review would take into account recommendations proposed by the SSRB which did not require supporting legislation and matters referred to the Commission by the Committee on Standards and Privileges, as well as incorporating developments in best practice within other legislatures.

2.3 Following agreement to proceed with the review of the Handbook, the Speaker consulted with Party Leaders. Parties were also invited to submit their views on issues which might be addressed within the review. One outcome of these discussions was the development of a set of ten draft principles to underpin the basis on which salaries, expenditure and pensions would be paid to MLAs.

2.4 At a Commission meeting on 1 December 2009, it was agreed that further consideration would be required, on a range of possible options, to progress the recommendations set out in the Commission’s Report on Pay, Pensions and Financial Support for Members of the Northern Ireland Assembly. These options were presented on the basis that the motion on the Commission’s Report was not moved in Plenary on 30 November 2009. Additionally there was a consensus that further meetings with Party Leaders would be necessary to map out a way forward. Meetings took place with Party Leaders in March 2010 and Parties were further invited to submit proposals on the Policy Considerations for the drafting of a Bill to set up an Independent Financial Review Panel and other pay and allowance issues.

2.5 To this end a twin track approach to the issues contained within the Commission’s Report on Pay, Pensions and Financial Support for Members 2009 was adopted. This approach involved consideration of a number of recommendations arising from the earlier SSRB Report and proposals for setting up an Independent Financial Review Panel and the Commission agreed that these matters would be taken forward to the Assembly for approval.

2.6 The second strand involved progressing recommendations for ensuring that the most appropriate arrangements for governance and accountability were put in place. The Commission agreed that these matters would be progressed as part of the review of the draft Financial Support for Members Handbook. Additionally consideration of the issues arising from problems within the expenses regime in Westminster, the Committee on Standards in Public Life and matters raised by the Standards and Privileges Committee have now been factored into this Report.

2.7 The Commission is proposing 17 recommendations for consideration in Plenary. The Commission is mindful of the public interest in the area of financial support provided to Members and is confident that by supporting these recommendations, the Assembly will not only create more efficient and effective systems for Members’ expenditure but will also improve transparency and accountability and increase public confidence in the governance of the Assembly.

2.8 To assist in the consideration of the issues raised within this report, the Commission has framed its recommendations under three key headings, namely:

- Those recommendations relating to the adoption of the Ten Principles which should underpin the system of financial support;

- Those recommendations relating to the establishment of an Independent Financial Review Panel; and

- Those recommendations relating to entitlement and the governance of expenditure incurred by Members.

2.9 On the basis that the motion on the Commission’s Report was not moved in Plenary on 30 November 2009, the Commission decided not to proceed with any recommendations relating to Member’s pay until the Independent Financial Review Panel reports. The Commission notes that Members of the Northern Ireland Assembly have not received a pay increase since May 2007 and that relativity to an MPs’ salary has fallen from 70.4% in 2007 to 65.6% in 2010.

2.10 A brief summary of the Commission’s conclusions in relation to each of the groupings is given below and considered in greater detail in the following sections:

Section 3: The Adoption of the Ten Principles

2.11 Section three of the report proposes Ten Principles, developed in consultation with Party Leaders, which would underpin the basis on which salaries, expenditure and pensions would be paid.

Section 4: The Establishment of an Independent Financial Review Panel

2.12 Section four of this report addresses the proposed establishment of an Independent Financial Review Panel to determine the future pay, pensions and financial support arrangements for Members of the Northern Ireland Assembly. The Commission, in line with the views expressed by Assembly Parties, supports the recommendations raised by the SSRB that there should be independence in the setting of salaries, pensions and financial support for MLAs. In order to establish that body, the Commission has already agreed that an Assembly Bill should be developed. A paper which set out various policy and process issues was presented to the Commission in order to establish the basis on which to develop a draft Bill. Following consultation with Parties, the Commission reviewed each of the policy considerations for the establishment of an Independent Financial Review Panel, including developments in Westminster and the Welsh Assembly. The Commission agreed the policy document in relation to the creation of an Independent Financial Review Panel to set future pay, pensions and financial support matters for the Northern Ireland Assembly. This policy document issued for public consultation on 29 June 2010 with a closing date of 31 August 2010. A total of 2 responses were recieved.

2.13 The Commission at their meeting in October 2010 considered the submissions received through consultation, discussed the policy issues in relation to commencement, disqualifications and dismissal and agreed that the draft Bill should be amended accordingly. The Assembly Members (Independent Financial Review and Standards) Bill was introduced to the Assembly on Monday 15 November 2010.

Section 5: Governance and Expenditure issues for Members of the Northern Ireland Assembly

2.14 Section five of this report proposes 15 recommendations in relation to the entitlements and governance of expenditure incurred by MLAs. In relation to the pension arrangements for MLAs and Office Holders, the Commission is not recommending any changes to the current arrangements for the pension scheme, provided for in the Assembly Members’ Pension Scheme (NI) 2008.

2.15 The Commission has agreed that it would be more appropriate not to take a view on certain recommendations detailed by the SSRB in relation to Dual Mandates, as the matter falls under the responsibility of the Assembly and Executive Review Committee. However, assuming that some dual mandates may continue until 2015, the Commission has proposed a series of related recommendations regarding claims under Office Costs Expenditure (OCE) and Winding Up Expenditure. Additionally, the Commission, in support of recommendations raised by the Committee for Standards and Privileges, is also recommending the immediate development of protocols for splitting expenses claimed by MLAs who are also MPs or Councillors.

2.16 Also, in supporting Members in their role as employers, the Commission is recommending the development of a capped ‘bonus system’ for Member’s support staff, in defined circumstances, in the event that Members choose to pay a bonus to their staff. The Commission has considered the recommendation made by the Independent Standards Parliamentary Authority in the new Expenses Scheme for MPs in relation to the restriction imposed on new MPs for ‘receiving Staffing Expenditure for the salary of no more than one employee who is a connected individual’ and is recommending a similar approach be adopted within the Northern Ireland Assembly.

2.17 In the interests of accountability and securing public confidence, the Commission is recommending that independent valuations of constituency office rents are undertaken. The Commission is recommending that all constituency offices be compliant with the statutory obligations placed on the leased premises. The Commission has also considered the recommendation made by the Independent Standards Parliamentary Authority in the new Expenses Scheme for MPs in relation to Constituency Office Rental Expenditure and has recommended that no expenses should be claimed relating to a Member’s rental of a property, where the Member or a connected party is the owner of the property or holds a lease in relation to the property in question as defined within the text of this Report.

2.18 The Commission is proposing changes to the existing calculations used to determine Resettlement Allowance, Ill-health Retirement Allowance and Winding Up Allowance. The Commission is also suggesting that, from the start of the next mandate, the mileage allowance for business travel in excess of 10,000 miles will be paid at 25p in line with the Income Tax (Earning and Pensions) Act 2003.

Legislative requirements

2.19 A number of the recommendations contained in this report require a legal mechanism to bring them into effect. Section 47 (2) of the Northern Ireland Act 1998 provides that the Assembly may determine the allowances which are paid to Members of the Assembly. Those provisions therefore require that changes which are proposed to the existing allowances can only be made by a formal determination of the Assembly. The Commission therefore recommends that the Assembly approves the draft determination as set out in Appendix A of this report.

2.20 It has also agreed that the Allowances to Members of the Assembly Act 2000 should be repealed (so that expenditure on Winding Up, Resettlement and Ill-Health retirement could be provided for by determination). The determination will take effect from the date in which the Allowances to Members of the Assembly Act (Northern Ireland) 2000 is repealed.

Section 3: The Ten Principles

3.1 The Assembly Commission believes that the financial support regime for Members of the Northern Ireland Assembly should be underpinned by a set of principles, consistent with the ‘seven principles in public life’: selflessness, integrity, objectivity, accountability, openness, honesty and leadership.

3.2 Following individual meetings with Party Leaders and a collective meeting on 18 June 2009, a set of Ten Principles was developed. The Ten Principles will underpin the basis on which expenditure[5] will be paid to Members. The Commission is proposing that Members should adhere to the principles when making claims in relation to expenditure.

3.3 The ten principles developed in consultation with Party Leaders are as follows:

Principle 1: MLAs have a duty to observe the seven Nolan principles of public life in all aspects of incurring and claiming expenditure. (The Nolan Principles are set out in Annex 2).

Principle 2: MLAs have a right to be properly supported in carrying out their Assembly duties.

Principle 3: Any amount claimed must be in respect of expenditure that has been wholly, exclusively and necessarily incurred in respect of a Member’s Assembly duties.

Principle 4: The system for claiming expenditure incurred by MLAs in performing their Assembly duties should be based on the recovery of actual expenditure, not on an entitlement to allowances.

Principle 5: Openness and transparency about expenditure incurred by Members will predominate, subject only to data protection, security considerations and inordinate or disproportionate costs.

Principle 6: Resources provided to enable MLAs to undertake their Assembly duties must not, directly or indirectly, benefit party political funding or be used for party political activities.

Principle 7: Arrangements should be avoided which may give rise to an accusation that an MLA – or someone close to an MLA – is obtaining an element of profit from public funds, or that public money is being diverted for the benefit of a political organisation.

Principle 8: MLAs will seek to ensure that any expenditure incurred provides value for money for the tax-payer.

Principle 9: MLAs will take personal responsibility for ensuring that any claims made in their name for expenditure incurred in respect of their Assembly duties are correct and proper.

Principle 10: For all expenditure claimed, MLAs must act within the spirit of the rules as well as within the letter of the rules. The Commission will publish the rules and detailed guidance on the system for claiming expenditure, and Assembly officials will provide any further guidance that may be required by Members.

3.4 Application of the principles

3.4.1 In the majority of cases, the application of the Ten Principles will be straightforward. However, the role of a Member is evolving, and each Member will have different needs and different ways of serving his/her constituents and performing his/her Assembly duties. There may be areas of uncertainty, where a Member may need to exercise his/her individual judgement.

3.4.2 While not exhaustive, it is proposed that the following list of questions be included within the new Financial Support for Members Handbook to assist each Member in ascertaining whether an item of expenditure can be appropriately claimed:

i. Is the expenditure compatible with the Ten Principles?

ii. Has this expenditure been wholly, exclusively and necessarily incurred by me in my role as a Member of the Legislative Assembly, as opposed to my personal capacity or in a party political role, or in any other official role?

iii. Is this purchase of goods supporting me in carrying out my Assembly duties, as defined in paragraph (3) of the Northern Ireland Assembly (Members’ Expenditure) Determination 2009?

iv. Does the claim for expenditure match the purpose of Office Costs Expenditure (OCE) as set out in the Handbook?

v. Have I considered this claim under the guidance for ‘admissible and inadmissible’ expenditure as detailed in the Handbook?

vi. Could the claim in any way have a negative impact on the reputation of the Assembly or its Members?

3.5 Breaches and Sanctions

3.5.1 The Commission recognises the need to have appropriate systems in place to address any potential breaches of the rules on claiming and use of expenses reimbursed to MLAs by the Assembly. The Commission welcomes the new Code of Conduct for Members developed by the Committee on Standards and Privileges and the arrangements for investigations and sanctions in respect of breaches of the Code. The Clerk/Director General, as Accounting Officer for the Assembly’s funds, will consider any potential breaches of the rules set out in legislation and the new Financial Support for Members Handbook which may arise from the scrutiny work of the Assembly’s Finance Office or from external and internal audit reviews. Where concern exists that a breach may have occurred the Accounting Officer will refer the matter to the Assembly Commissioner for Standards.

Recommendation 1The Commission recommends the formal adoption of the Ten Principles as set out in this report. |

Section 4: The establishment of an Independent Financial Review Panel

4.1 The SSRB Review proposed that the Assembly should commit to accepting the outcome of future ‘independent’ reviews on salaries, allowances and pensions without modification, thereby respecting the impartiality of the external review process in determining appropriate salaries, pensions and allowances. This was proposed in response to Members’ desire to be distanced from deciding their own salaries and financial support arrangements. Following individual meetings with Party Leaders and a collective meeting on 18 June 2009, there was general agreement that the Commission should consider an independent mechanism for the future determination of salaries, pensions and financial support for Members. The Commission is of the view that it would be too early to conduct another review in 2010 as recommended by SSRB.

4.3 Following amendment of the Northern Ireland Act 1998, the Commission is recommending that a Bill be brought forward to establish an Independent Financial Review Panel to make decisions on all aspects of financial support services for Assembly Members and other related areas as requested. The Commission would then be informed of decisions made by that body. The decisions of such a body would be binding on the Assembly without amendment. The Commission will also have due regard to issues arising from the Report from the Committee on Standards in Public Life in relation to the MPs’ expenses regime in respect of the independent regulator at Westminster.

4.4 The Northern Ireland Assembly Members Act 2010 commenced on 1 July 2010. This Act was required in order to permit the Assembly to delegate to an independent body the functions of determining pay, pensions and allowances for Members. The Commission has already agreed that an Assembly Bill to establish the body should be developed and at its meeting on 16 April 2010 approved a proposed way forward. This policy document issued for public consultation on 29 June 2010 with a closing date of 31 August 2010. A total of 2 responses were recieved.

4.5 Until recently, Section 47 of the Northern Ireland Act 1998, which provided for the Northern Ireland Assembly to determine and pay Members’ salaries and allowances, explicitly prevented the Assembly from delegating the function of making a determination. The Northern Ireland Assembly Members’ Act 2010, which received Royal Assent on 8 April 2010 amended sections 47 and 48 of the Northern Ireland Act 1998 and allows the Northern Ireland Assembly to determine salaries and allowances, or by resolution , to delegate the function to the Commission or, by an Act of the Assembly, to an independent body.

4.6 The Commission at their meeting in October 2010 considered the submissions received through consultation, discussed the policy issues in relation to commencement, disqualifications and dismissal and agreed that the draft Bill should be amended accordingly. The Assembly Members (Independent Financial Review and Standards) Bill was introduced to the Assembly on Monday 15 November 2010. This body, the Independent Financial Review Panel, will be established by this draft Bill, subject to the approval of the Assembly.

4.7 The Commission notes that the functions of administering the payment of salaries and expenditure incurred by Members of the Scottish Parliament and Members of the National Assembly for Wales are currently undertaken within the Secretariats of those institutions. The Commission believes that retaining the function within the Northern Ireland Assembly Secretariat for administrating the expenditure incurred by MLAs is the most efficient method of delivering an effective service to Members. This would also avoid the need for additional governance and administrative costs.

4.8 It is proposed that the members of the Body would be independent of the Assembly and would be recruited on the basis of having appropriate expertise.

Recommendation 2The Commission recommends that an Independent Financial Review Panel be established to make determinations after the next Assembly Elections in 2011 on the pay, pensions and financial support for Members of the Assembly and any other requirements which are included within the Assembly Members (Independent Financial Review and Standards) Bill. |

Section 5: Governance and Expenditure issues for Members of the Northern Ireland Assembly

5.1 Pensions

5.1.1 On 30 June 2008, the Assembly resolved to confer upon the Commission the power to amend the Assembly Members’ Pension Scheme. The Commission exercised this power on 1 July 2008 when making a number of changes to the Scheme rules as proposed by the Pension Trustees. At their meeting on 2 April 2009 the Commission accepted the following recommendations, proposed by the Northern Ireland Assembly Pension Trustees, to amend the Assembly Members’ Pension Scheme (NI) 2008:

- that the accrual rate for the Members’ Pension Scheme be increased from 1/50th to 1/40th of final salary for each year of service, with effect from 1 April 2009; and

- that the higher accrual rate and increased member contribution of 11.5% be accepted as the default position from 1 April 2009 with an opt-out for Members who wish to revert to the lower rate of 1/50th.

5.1.2 In line with Members’ desire to distance themselves from decisions relating to their pension arrangements, the Commission is recommending that pension arrangements for MLAs should be transferred to the Independent Financial Review Panel following its establishment.

Recommendation 3The Commission recommends that the current arrangements for the pension scheme for MLAs and Office Holders should be maintained as amended in the Assembly Members’ Pension Scheme (NI) 2008. |

Recommendation 4The Commission recommends that the current authority delegated to the Commission in relation to pension arrangements for Members of the Northern Ireland Assembly should be transferred to the proposed Independent Financial Review Panel as and when it is established. |

5.2 Office Costs Expenditure

5.2.1 The Commission believes that the current level of Office Costs Expenditure (OCE) is appropriate. The Commission has agreed to undertake an audit of a random sample of 25% of MLAs’ OCE claims on an annual basis. The initial audit of OCE claims took place in January 2010 as a desk based exercise and it is proposed that, as part of the programme for 2010/11, the audit would include a sample of on-site verification visits to strengthen the audit process.

5.2.2 The Commission has also agreed a range of revised terminology in respect to the administration of expenditure payments to be reflected in the appropriate regulations. These include:

- the term ‘allowances’ replaced by the term ‘expenditure’ or ‘payment’;

- Office Costs Allowance be renamed Office Costs Expenditure;

- Travel Allowance be renamed Travel Expenditure;

- Disability Allowance be renamed Disability Grant;

- Subsistence Allowance be renamed Subsistence Expenditure;

- Temporary Secretarial Allowance be renamed Temporary Secretarial Expenditure;

- Winding Up Allowance be renamed Winding Up Expenditure; and

- Staff Pensions and Redundancy Allowance be renamed Staff Pensions and Redundancy Expenditure.

5.3 Dual Mandate

5.3.1 The issue of dual mandates has been discussed in Plenary and by the Assembly and Executive Review Committee. Following a debate on Tuesday 10 March 2009, the Assembly with cross-community support ‘agreed to note that the issue of multiple mandates, including council membership, was to be further considered by the Assembly and Executive Review Committee; and believes that a phased approach to this matter represents the best way forward.’

5.3.2 The Commission is also of the view that the issue of dual mandates does not fall under its responsibility but rather to the Assembly and Executive Review Committee. It is expected that this matter will be resolved prior to the Assembly elections in 2015. Assuming that dual mandates may continue into the next mandate, the Commission recommends that, in line with the recommendations made by SSRB, MLAs who are also Members of Parliament at Westminster should only be able to claim Office Costs Expenditure up to 50% from the start of the next mandate, if they already claim expenses as a Member of Parliament at Westminster. In addition, and again in line with SSRB, the Commission is further recommending that from the start of the next mandate MLAs who are also Members of Parliament at Westminster should be able to claim Winding Up Expenditure only up to one third of the level of the Office Costs Expenditure as abated for MPs.

5.3.3 In addressing this issue further, the Standards and Privileges Committee has also made a number of recommendations to increase the effective management of the existing financial systems for MLAs who hold dual mandates. The Commission is proposing, to improve clarity and accountability in this area that, protocols should be developed to assist in splitting expenses for those MLAs who hold a dual mandate as a Member of Parliament at Westminster and/or a local Councillor in Northern Ireland.

Recommendation 5The Commission recommends that MLAs who are also Members of Parliament at Westminster should only be able to claim Office Costs Expenditure up to 50% of the OCE limit in any year, from the start of the next mandate in 2011, if they already claim expenses as a Member of Parliament at Westminster. |

Recommendation 6The Commission recommends that from the start of the next mandate, MLAs who are also Members of Parliament at Westminster should be able to claim Winding Up Expenditure only up to one third of the level of the Office Costs Expenditure as abated for MPs. |

Recommendation 7The Commission recommends that protocols are developed with the House of Commons authorities (with the Independent Parliamentary Standards Authority) for splitting expenses claimed by MLAs who are also MPs. |

Recommendation 8The Commission recommends that protocols are developed through the Northern Ireland Local Government Association (NILGA) for splitting expenses claimed by MLAs who are also Councillors (e.g. Mobile phones/travel etc). |

5.4 Administration of Expenditure Payments

5.4.1 The administration of allowances and expenditure is the responsibility of the Commission. The Commission has produced guidance in the form of the Financial Support for Members’ Handbook, which the Assembly Secretariat utilises to administer payment of allowances to Members. The Commission is recommending that it should continue to administer the allowances scheme and is asking the Assembly to approve the Northern Ireland Assembly (Members’ Expenditure) Determination 2010, which provides that Members’ expenditure will be paid in accordance with the Financial Support for Members Handbook produced by the Commission.

5.4.2 The new Financial Support for Members Handbook will set out the rules in relation to the payment of expenditure to Members of the Assembly, and payment will be made strictly in accordance with the new Handbook. The revised Handbook will contain a number of new rules in relation to the payment of expenditure to Members and will reflect the recommendations contained in this report. The Assembly should note that the new Financial Support for Members Handbook may include additional changes which are not included in this report and that the Commission may amend the Financial Support for Members Handbook from time to time in the future.

5.4.3 The changes which the Commission proposes to make to the allowances and expenditure Scheme largely stem from the recommendations of the SSRB report and consultation with Party Leaders. The SSRB was asked to consider the administration of the Assembly’s allowances regime as part of their Report and noted that “allowances are often perceived as an addition to salary, as opposed to their real purpose which is to cover the necessary expenditure incurred when performing duties associated with the role (with rare exceptions such as the Resettlement Allowance which is payable as a fixed amount)."[6]. The following recommendations originate in SSRB’s consideration of this issue. The intent behind the recommendations is to improve the understanding and transparency of the allowances regime and to further strengthen the governance of Members’ allowances. The Commission has made a number of changes within the new Financial Support for Members Handbook in relation to the payment of Office Cost Expenditure to Members, which are set out below.

5.4.4 First, the Commission has agreed that where a Member chooses to pay a bonus to a member of support staff in defined circumstances, the Member would be required to submit clear justification for the additional payment in writing prior to any payment being made. The maximum bonus payment to a member of support staff per annum would be £500 and this should be reduced on a pro rata basis for part-time staff.

5.4.5 As recommended in the Committee for Standards and Privileges ‘Report on the review of the NIA Code of Conduct and the Guide to the rules relating to the conduct of Members’, the Commission will publish standard job descriptions and salary bands for MLAs’ support staff. The Commission will ensure that this information is made publicly available.

5.4.6 The Commission has agreed that from the beginning of the next mandate, no salary payments should be made to Members’ support staff who are to be employed for more than one month until a signed and dated Statement of Employment Particulars (Contract of Employment), including job title and job description, has been provided to the Assembly Secretariat. Similarly, no payments should be made to Members’ support staff who are to be temporarily employed for less than one month until a signed copy of the terms of assignment has been provided to the Assembly Secretariat. The Commission will also ensure that MLAs are provided with further guidance on the designation, management and deployment of voluntary workers to ensure compliance with minimum wage legislation.

5.5 Staffing Expenditure

5.5.1 The Commission has also considered the recommendation made by the Independent Standards Parliamentary Authority in the new Expenses Scheme for MPs in relation to the restriction imposed on new MPs for receiving Staffing Expenditure for the salary of no more than one employee who is a connected individual or organisation.

5.5.2 The Independent Standards Parliamentary Authority has stated within their new Expenses Scheme that a Member will not receive funds from Staffing Expenditure for the salary of more than one employee who is a connected party. Their definition of a ‘connected party’ is defined as

- a spouse, civil partner or cohabiting partner of the Member;

- parent, child, grandparent, grandchild, sibling, uncle, aunt, nephew or niece of the Member or of a spouse, civil partner or cohabiting partner of the Member; or

- an individual or organisation where there exists a relationship as set out in the Companies Act 2006.

5.5.3 The Independent Parliamentary Standards Authority has also proposed a transitional arrangement in relation to the implementation of the rule in that ‘Staffing Expenditure may be claimed in relation to such connected parties until the date when the party in question ceases to be employed or otherwise to provide staffing assistance.’

5.5.4 The Commission is not convinced that the Companies Act 2006 relationship is appropriate regarding staffing expenditure. However, it thinks IPSA has not gone far enough and considers it necessary to include self employment and paid consultancy claimed under Office Costs Expenditure.

5.5.5 The Assembly Commission has considered this approach and is recommending that the Assembly place similar restrictions on the employment of ‘family members’ for Members of the Northern Ireland Assembly, as defined as

- a spouse, civil partner or cohabiting partner of the Member; and

- parent, child, grandparent, grandchild, sibling, uncle, aunt, nephew or niece of the Member or of a spouse, civil partner or cohabiting partner of the Member.

5.5.6 The Commission, in line with the rules set out in the Expenses Scheme for MPs, recommends that transitional arrangements should be introduced for existing MLAs to allow them to claim staff costs in relation to a family member who is employed or otherwise engaged by the Member from the beginning of the next mandate until the date when the individual ceases to be employed or otherwise provide secretarial, clerical, research or administrative assistance.

5.5.7 The Commission has considered the recommendation that further guidance is issued to MLAs regarding voluntary workers and this is being taken forward as part of the redrafting of the Financial Support for Members Handbook. The Commission will ensure that this information is made publicly available.

Recommendation 9The Commission recommends that from the commencement of the Determination, Members of the Northern Ireland Assembly are restricted from claiming Office Costs Expenditure in respect of employing or otherwise engaging (e.g. through self employment or paid consultancy) no more than one person who is a family member as defined at 5.5.5 above. |

Recommendation 10The Commission recommends that transitional arrangements are put in place for the introduction of Recommendation 9 to allow for existing MLAs to claim staff costs in relation to a family member who is employed or otherwise engaged by an MLA from the commencement of the Determination until the date when such persons cease to be employed or otherwise engaged to provide secretarial, clerical, research or administrative assistance. |

5.6 Accommodation

5.6.1 The SSRB recommended that an independent assessment of MLAs’ constituency offices should be undertaken by a chartered surveyor to ensure that rental charges are reasonable for the area in which the constituency office is located. The Commission agrees with this recommendation. It is proposed that from the start of the next mandate a nominated chartered surveyor will undertake an initial valuation of all constituency office rental costs for premises occupied by MLAs. This will take into account the terms of existing lease agreements and the rental value which applied at the time the lease was drawn up. Further in-depth valuations will only be undertaken where there is evidence that the initial valuation shows a rental cost materially in excess of costs for property in the area.

5.6.2 The Commission also recommends that on an ongoing basis independent valuations are sought prior to the renewal of existing leases and prior to entering into new leases. If the independent valuation recommends an amount less than the proposed rental value, then an amount equal to the independent valuation should be the maximum amount allowed to be claimed under OCE.

5.6.3 At the Commission meeting on 21 May 2009, it was agreed that the review of the Financial Support for Members Handbook would consider matters referred to the Commission from the Standards and Privileges Committee, namely:

- The setting of a maximum level of rent which could be claimed under Office Cost Expenditure;

- The setting of standards for office accommodation; and

- prohibiting of the use of Office Cost Expenditure to create a property asset for an MLA’s family member/relative; for a close business associate ; or for a political party.

5.6.4 The SSRB further proposed setting a maximum space allocation for constituency office accommodation that Members could not exceed. The Commission considered the principle behind this recommendation as, up to now, the guidance issued to Members has not been prescriptive about such matters. Having done so, the Commission is of the view that MLAs should retain discretion as to how the fixed amount of OCE is used.

5.6.5 The Commission recommends that Members should be required to ensure that their constituency offices comply with the required standards in respect of all of their statutory obligations, and that they be required to provide a declaration to that effect at renewal of existing leases or when entering into a new lease agreement.

5.6.6 As part of the consultation process with Party Leaders, a series of questions was asked to seek the views of the Parties in respect of the issues detailed above. The responses from the Parties demonstrated broad agreement that there should be the prohibition of the use of OCE to create a property asset for an MLA’s political party.

5.6.7 The Commission in line with the views of Assembly Parties and as outlined within the rules governing the Expenses Scheme for MPs has agreed that no expenses should be claimed relating to a Member’s rental of a property, where the Member or a connected party is the owner of the property or holds a lease in relation to the property in question. The Assembly Commission agrees that the definition of a connected party should be defined as:

- a spouse, civil partner or cohabiting partner of the Member; and/ or

- parent, child, grandparent, grandchild, sibling, uncle, aunt, nephew or niece of the Member or of a spouse, civil partner or cohabiting partner of the Member.

5.6.8 The Commission further proposes to write to the Committee on Standards and Privileges recommending that Members declare in the Register of Members’ Interests any case where they rent accommodation from Political Parties or a close business associate. The declaration of family members in this regard is already in place through the revised Code of Conduct for MLAs.

Recommendation 11The Commission recommends that from the start of the next Mandate in 2011, for all lease agreements, if the independent valuation recommends an amount which is less than the proposed rental value, an amount equal to the independent valuation will be the maximum amount allowed to be claimed under OCE. |

Recommendation 12The Commission recommends that Members should be required to ensure that their constituency offices comply with the required standards in respect of all of their statutory obligations, and that they be required to provide a declaration to that effect at renewal of existing leases or when entering into a new lease agreement. |

Recommendation 13The Commission recommends that no expenses should be claimed relating to a Member’s rental of a property, where the Member or a connected party is the owner of the property or holds a lease in relation to the property in question as defined within the text of this Report from the start of the next Mandate. |

5.7 Other Expenditure

5.7.1 This grouping has been devised to give consideration to a series of general recommendations from the SSRB’s review of Members’ salaries and expenditure.

Mileage Expenditure

5.7.2 The SSRB report recommended that the threshold for a reduction in mileage rates be lowered from the current 20,000 miles to 10,000 miles in line with the motor mileage rates set by the Income Tax (Earnings and Pensions) Act 2003 Act (i.e. motor mileage allowance rates would be set at 40p per mile for the first 10,000 miles and 25p per mile thereafter).

5.7.3 The Commission proposes that the recommendation made by SSRB should be adopted by the Assembly. In reaching this conclusion, the Commission notes that the rates of motor mileage allowance set by the Act are used across much of the public sector in Northern Ireland. In addition, the Commission notes that a Member who travels 20,000 miles per year would receive a motor mileage allowance of £6,500 if the SSRB recommendation was accepted. A conservative estimate of the cost of fuel to travel 20,000 miles (based on a vehicle that does 35 miles per gallon and an average cost of £5.00 per gallon) is £2,855 per annum, leaving a surplus of £3,645 per annum. The Commission is aware that the motor mileage allowance relates solely to the cost of business use of a private vehicle and does not include any element of reimbursement for the cost of acquiring a vehicle for business use. With this in mind, the Commission considers that £3,645 is a reasonable amount to reimburse Members for the costs incurred through the business use of a Member’s private vehicle. Clearly, this surplus will increase or decrease depending on actual miles travelled but the corresponding costs should also increase or decrease in the same proportion.

5.7.4 The Commission recognises, however, that the immediate implementation of the SSRB recommendation in respect of mileage rates would particularly affect those MLAs travelling from distant rural constituencies. In recognition of this, the Commission recommends that the reduction proposed by SSRB is introduced at the start of the next financial year. However, the Commission also notes that the Independent Parliamentary Standards Authority has made a number of recommendations which in effect tighten the regime for MPs’ travel expenses.

Resettlement Expenditure

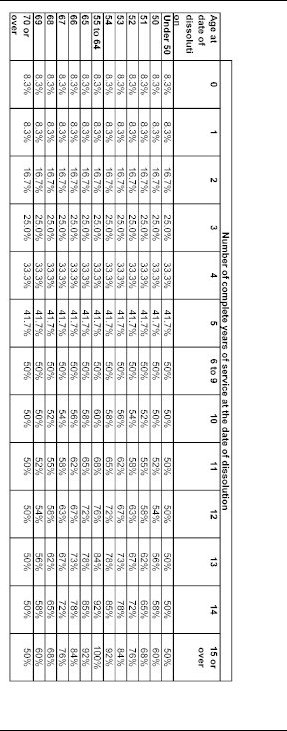

5.7.5 Each former MLA who is not returned following an election (either through standing down or through non-election) is entitled to receive a resettlement allowance. This allowance is based on the ‘salary as a Member’ (i.e. excluding any Office Holder’s allowance) and is calculated according to the Schedule to the Allowances to Members of the Assembly Act (Northern Ireland) 2000. The Schedule provides a matrix that shows the percentage to be applied to the salary as a Member in order to calculate the resettlement allowance. That percentage is based on a Member’s age at the date of dissolution and the length of his or her service. The Schedule specifies that all Members who have less than 10 years’ service as a Member receive the same level of allowance regardless of their age. This was an issue at the 2007 election as all Members received the same level of allowance even though some had been MLAs since the inception of the Assembly while others had only been Members for a matter of months. The SSRB report suggested that resettlement allowance should, like a redundancy payment, reflect length of service.

5.7.6 Having considered both of these issues the Commission is recommending that the Resettlement Payment be calculated in a manner consistent with the SSRB suggested approach (i.e. based on length of service) for Members with less than 10 years’ service at the date of dissolution. For members with 10 years’ service or more, the current provision should continue to apply. However, for Members with less than 10 years’ service, the Commission is recommending that the maximum number of years that could be counted towards for entitlement to Resettlement Payment should be limited to 6. This recommendation should remove the anomaly present at the last election where a Member with service of less than one year could receive the same Payment as a Member with almost 10 years’ service. By continuing to use the present system for Members with 10 years or more service, no Member would receive an enhanced level of Resettlement Payment as could have occurred under the SSRB proposal. The Commission considers that Resettlement Payment should continue to be paid to any person who is a Member of the Assembly immediately before its dissolution who does not stand for election to the Assembly, or if he/she does, is not returned as a Member. The impact of this recommendation will become effective following the commencement of the Determination on Northern Ireland Assembly (Members’ Expenditure) 2010.

5.7.7 The Commission notes that the Committee on Standards in Public Life has recommended that an MP who stands down at an election should receive a payment of 8 weeks’ salary, rather than the Resettlement Payment. This is a matter that the Independent Financial Review Panel will consider in due course

Ill-Health Expenditure

5.7.8 A Member who retires through ill-health is covered by the provisions of section 2 of the Allowances to Members of the Assembly Act (Northern Ireland) 2000. The Act allows the Commission to pay an amount to a Member who retires through ill-health, calculated using exactly the same methodology as if that Member had received a resettlement payment (see above). The Assembly Members’ Pension Scheme (Northern Ireland) 2000 also provides for pension benefits in respect of a Member who retires through ill-health. The Commission is therefore recommending that Ill-Health Retirement Payment be calculated in the same way as the Resettlement Payment.

Winding Up Expenditure

5.7.9 On leaving the Assembly, Winding up Expenditure is available to assist an outgoing Member to meet the costs of winding up his/her Assembly business. This is designed to cover the cost of terminating contractual obligations, including notice to vacate rented premises, pay in lieu of notice for staff or to continue paying salaries for staff who continue to work for the Member to support the winding up of their business. It is not restricted to the items of expenditure admissible from OCE, however it is not possible to claim for the purchase of equipment from Winding up Expenditure. The Maximum level of Winding up that can be claimed by an MLA is set by the Allowances to Members of Assembly Act (Northern Ireland) 2000. The SSRB Report sought to update the expenditure regime by creating a link between the rate of OCE and Winding up Expenditure. The Commission is therefore recommending that the Winding Up Expenditure limit be set and remain at a third of the Office Costs Expenditure each time the level of the Office Costs Expenditure is increased. As outlined within the Financial Support for Members Handbook this would equate to £25,285 for the financial year 2010-2011.

Equipment and Furniture Expenditure

5.7.10 Currently any capital expenditure in respect of items such as IT and Office equipment/office furniture is claimed out of Office Costs Expenditure and the equipment/furniture remains the property of the MLA. The Commission is recommending that the Independent Financial Review Panel consider an appropriate system for the provision and disposal of Information Technology, other office equipment and office furniture currently claimed under Office Cost Expenditure for Members’ constituency offices.

Recommendation 14The Commission recommends that from 1 April 2011, the mileage allowance for business travel in excess of 10,000 miles will be paid at 25p per mile in line with the Income Tax (Earning and Pensions) Act 2003. |

Recommendation 15The Commission recommends that Resettlement Payment be calculated as set out in the attached determination and paid to any person who is a Member of the Assembly immediately before its dissolution who does not stand for election to the Assembly, or if he/she does, is not returned as a Member (This will come into effect from the commencement of the Determination). |

Recommendation 16The Commission recommends that Ill-Health Retirement Payment be calculated in the same way as the Resettlement Payment (This will come into effect from the date of the Determination). |

Recommendation 17The Commission recommends that the Winding Up Expenditure limit be set and remain at a third of the Office Costs Expenditure each time the level of the Office Costs Expenditure is increased (This will come into effect from the date of the Determination). |

Section 6: Summary of Recommendations from

the Assembly Commission

Section 3: Adoption of the Ten Principles

Recommendation 1 The Commission recommends the formal adoption of the Ten Principles as set out in this report.

Section 4: The establishment of an Independent Financial Review Panel

Recommendation 2 The Commission recommends that an Independent Financial Review Panel be established to make determinations after the next Assembly Elections in 2011 on the pay, pensions and financial support for Members of the Assembly and any other requirements which are included within the Assembly Members (Independent Financial Review and Standards) Bill.

Section 5: Governance and Expenditure issues for Members of the Northern Ireland Assembly

Recommendation 3 The Commission recommends that the current arrangements for the pension scheme for MLAs and Office Holders should be maintained as amended in the Assembly Members’ Pension Scheme (NI) 2008.

Recommendation 4 The Commission recommends that the current authority delegated to the Commission in relation to pension arrangements for Members of the Northern Ireland Assembly should be transferred to the proposed Independent Financial Review Panel as and when it is established.

Recommendation 5 The Commission recommends that MLAs who are also Members of Parliament at Westminster should only be able to claim Office Costs Expenditure up to 50% of the OCE limit in any year, from the start of the next mandate in 2011, if they already claim expenses as a Member of Parliament at Westminster.

Recommendation 6 The Commission recommends that from the start of the next mandate, MLAs who are also Members of Parliament at Westminster should be able to claim Winding Up Expenditure only up to one third of the level of the Office Costs Expenditure as abated for MPs.

Recommendation 7 The Commission recommends that protocols are developed with the House of Commons authorities (with the Independent Parliamentary Standards Authority) for splitting expenses claimed by MLAs who are also MPs.

Recommendation 8 The Commission recommends that protocols are developed through the Northern Ireland Local Government Association (NILGA) for splitting expenses claimed by MLAs who are also Councillors (e.g. Mobile phones/travel etc).

Recommendation 9 The Commission recommends that from the commencement of the Determination, Members of the Northern Ireland Assembly are restricted from claiming Office Costs Expenditure in respect of employing or otherwise engaging (e.g. through self employment or paid consultancy) no more than one person who is a family member as defined at 5.5.5 above.

Recommendation 10 The Commission recommends that transitional arrangements are put in place for the introduction of Recommendation 9 to allow for existing MLAs to claim staff costs in relation to a family member who is employed or otherwise engaged by an MLA from the commencement of the Determination until the date when such persons cease to be employed or otherwise engaged to provide secretarial, clerical, research or administrative assistance.

Recommendation 11 The Commission recommends that from the start of the next Mandate in 2011, for all lease agreements, if the independent valuation recommends an amount which is less than the proposed rental value, an amount equal to the independent valuation will be the maximum amount allowed to be claimed under OCE.

Recommendation 12 The Commission recommends that Members should be required to ensure that their constituency offices comply with the required standards in respect of all of their statutory obligations, and that they be required to provide a declaration to that effect at renewal of existing leases or when entering into a new lease agreement.

Recommendation 13 The Commission recommends that no expenses should be claimed relating to a Member’s rental of a property, where the Member or a connected party is the owner of the property or holds a lease in relation to the property in question as defined within the text of this Report from the start of the next Mandate.

Recommendation 14 The Commission recommends that from 1 April 2011, the mileage allowance for business travel in excess of 10,000 miles will be paid

at 25p per mile in line with the Income Tax (Earning and Pensions)

Act 2003.

Recommendation 15 The Commission recommends that Resettlement Payment be calculated as set out in the attached determination and paid to any person who is a Member of the Assembly immediately before its dissolution who does not stand for election to the Assembly, or if he/she does, is not returned as a Member (This will come into effect from the commencement of the Determination).

Recommendation 16 The Commission recommends that Ill-Health Retirement Payment be calculated in the same way as the Resettlement Payment (This will come into effect from the date of the Determination).

Recommendation 17 The Commission recommends that the Winding Up Expenditure limit be set and remain at a third of the Office Costs Expenditure each time the level of the Office Costs Expenditure is increased (This will come into effect from the date of the Determination).

Annex 1

The Northern Ireland Assembly

(Members’ Expenditure) Determination 2010

The Northern Ireland Assembly in exercise of the powers conferred on it under sections 47(2) and 48(1) of the Northern Ireland Act 1998 makes the following determination:

Citation and commencement

1. This determination may be cited as the Northern Ireland Assembly (Members’ Expenditure) Determination 2010 and shall have effect from the relevant date.

Interpretation and effect

2. (1) The Interpretation Act (Northern Ireland) 1954 shall apply to this determination as it applies to an Act of the Northern Ireland Assembly.

(2) In this determination:

“aircraft" means any aircraft used for carrying passengers on predetermined routes at separate fares;

“bus" means any motor vehicle used for carrying passengers on predetermined routes at separate fares;

“Commission" means the Northern Ireland Assembly Commission;

“connected person" in relation to a member means:

a family member or

a person with whom the member is “connected" within the meaning of section 252(2)(b), (c), (d) and (e) and section 254 of the Companies Act 2006;

“employee" in relation to a member means any person who is employed by the member to provide research, secretarial, clerical or administrative assistance to the member in connection with the member’s Assembly duties;

“family member" in relation to a member means:

a spouse, civil partner or cohabiting partner of the member or

a parent, child, grandparent, grandchild, sibling, uncle, aunt, nephew or niece of the member or of his spouse, civil partner or cohabiting partner;

“Greater London area" means the City of London and the 32 London boroughs surrounding the City of London;

“hire car" means any motor vehicle, other than a private motor vehicle, leased or hired by a member for the purpose of one or more particular journeys;

“member" means a member of the Assembly;

“motor vehicle" includes a motor cycle;

“pedal cycle" means a unicycle, bicycle, tricycle, or cycle having four or more wheels, not being in any case mechanically propelled unless it is an electrically assisted pedal cycle;

“private" in relation to a motor vehicle used by a member for a journey means owned by the member or a member of his family and for this purpose a vehicle is owned by a person where it is leased or hired by that person under a hire purchase or similar agreement;

“the Act" means the Northern Ireland Act 1998;

“vessel" means any vessel, including a hovercraft, used for carrying passengers on predetermined routes at separate fares; and

“year," except in relation to a complete year of a members’ service, means a period of 12 months starting on 1 April.

(3) In this determination, “the relevant date" is the date on which the Allowances to Members of the Assembly Act (Northern Ireland) 2000 is repealed.

(4) For the purposes of this determination, “Assembly duties" in relation to any member means the undertaking of any task or function which he may reasonably be expected to carry out in his capacity as a member including:

(a) attending a sitting of the Assembly;

(b) attending a meeting of a committee or sub-committee of the Assembly of which he is a member or which he is required to attend by virtue of the fact that he has responsibility for a Bill or other matter under consideration by the committee or sub-committee or for any other valid reason relating only to the business of the committee or sub-committee;

(c) undertaking research or administrative functions which relate directly to the business of the Assembly;

(d) establishing and maintaining a constituency office or offices;

(e) providing an advice service to constituents;

(f) attending meetings for the purpose of representing electors in Northern Ireland including meetings with a constituent or constituents;

(g) attending, with the approval of the Commission, any ceremony or official function or national or international conference as a representative of the Assembly but not including attendance that relates wholly or mainly to that member’s role as a party spokesperson or representative.

(5) In this determination, other expressions which are also used in the Act shall have the same meaning as in the Act.

Revocation

3. The Northern Ireland Assembly (Members’ Allowances) Determination 2000 is revoked.

Compliance

4. (1) The recovery of expenditure under this determination shall be subject to a member complying with the requirements of such guidance or directions as may be issued from time to time by the Commission.

(2) Subject to sub-paragraph (1), the Commission shall pay to any person the recoverable expenditure or amounts payable under this determination.

Members’ travel expenditure

5. (1) Subject to sub-paragraph (3), a member shall be entitled to recover the expenditure referred to in sub-paragraph (2) in respect of travel by the member which has been necessarily undertaken by him in carrying out his Assembly duties.

(2) The recoverable expenditure is:

(a) where a member has travelled by rail, bus, aircraft, or any vessel, the cost of the fare of each journey;

(b) where a member has travelled by private motor vehicle prior to 1 April 2011, 40 pence for the first 20,000 miles travelled in any year and 25 pence per mile thereafter;

(c) where a member has travelled by private motor vehicle on or after 1 April 2011, 40 pence for the first 10,000 miles travelled in any year and 25 pence per mile thereafter;

(d) where a member has travelled by hire car, 40 pence for every mile travelled;

(e) where a member has travelled by taxi, the cost of the fare of each journey;

(f) where a member has travelled by pedal cycle, 20 pence for every mile travelled.

(3) Members shall only be entitled to recover expenditure under sub-paragraph (2)(d) or (e) in respect of any journey where the use of a hire car or taxi is necessary for reasons of urgency or because it is not practicable to use any means of transport referred to in sub-paragraph (2)(a).

Subsistence expenditure

6. (1) Subject to sub-paragraph (4), where a member is entitled to recover expenditure under paragraph 5 and the travel has necessarily involved an overnight stay at a place away from the member’s normal place of residence, the member shall be entitled to recover the expenditure referred to in sub-paragraph (2) or (3).

(2) In relation to an overnight stay within the United Kingdom, the recoverable expenditure is:

(a) the sum of £18.30 towards the cost of meals and other living expenses for each night of the stay;

(b) the cost of overnight accommodation on a bed and breakfast basis in a hotel or similar accommodation, up to a maximum of £175 per night in the Greater London area and a maximum of £130 per night in any other part of the United Kingdom.

(3) In relation to an overnight stay outside the United Kingdom, the recoverable expenditure is:

(a) the sum of £18.30 towards the cost of meals and other living expenses for each night of the stay;

(b) the cost of overnight accommodation on a bed and breakfast basis in a hotel or similar accommodation, up to a maximum of £300 per night.

(4) A member is not entitled to recover expenditure under this paragraph in connection with duties within his constituency.

Office costs expenditure

7. (1) Subject to sub-paragraphs (2) to (5), a member shall be entitled to recover the expenditure which he incurs in any year in respect of secretarial, clerical or administrative assistance (including the provision of any equipment, facilities or services associated therewith) required by the member in connection with the carrying out of his Assembly duties.

(2) The maximum amount which a member is entitled to recover in any year under sub-paragraph (1) is £75,857.04.

(3) If a member is in receipt, under any scheme prepared by the Independent Parliamentary Standards Authority, of payments or allowances in connection with carrying out his duties as a Member of the House of Commons, the maximum amount which he is entitled to recover in any year under sub-paragraph (1) is reduced by 50% from the date of the next poll for the election of the Assembly after the coming into effect of this determination.

(4) A member shall not be entitled to recover expenditure under sub-paragraph (1) in respect of the employment of, or the provision otherwise of secretarial, clerical or administrative assistance by, more than one family member at any given time, except in respect of any family member who is employed by the member or otherwise providing secretarial, clerical or administrative assistance to the member on the relevant date and who does not thereafter cease to be employed by the member or otherwise cease to provide such assistance.

(5) A member shall not be entitled to recover office costs expenditure in respect of the rental of a property owned or leased by the member or a connected person.

Disability expenditure

8. (1) Subject to sub-paragraph (2), a member shall be entitled to recover any additional expenditure which he incurs in carrying out his Assembly duties where the additional expenditure is wholly or mainly attributable to any disability which the member has.

(2) The maximum amount of additional expenditure which the member can recover under sub-paragraph (1) is £10,000 in any year plus the cost of paying national insurance for an employee where that employment is additional expenditure wholly or mainly attributable to a disability which the member has.

(3) In this paragraph, “disability" has the same meaning as in the Disability Discrimination Act 1995.

Recall expenditure

9. A member shall be entitled to recover any expenditure incurred by him which is wholly and necessarily attributable to his attendance at the Assembly during any recall which takes place during a recess.

Employees’ travel expenditure

10. (1) Subject to sub-paragraphs (3), (4) and (5), a member shall be entitled to recover the expenditure referred to in sub-paragraph (2) which is wholly and necessarily incurred by him in meeting the expenses of any of his employees in travelling by rail, bus, private motor vehicle, hire car, taxi or pedal cycle to or from Parliament Buildings in Belfast in connection with that employee’s employment by the member.

(2) The recoverable expenditure is:

(a) in the case of journeys by rail or bus, the cost of the fare of each journey;

(b) in the case of journeys by private motor vehicle, 40 pence for every mile travelled;

(c) in the case of journeys by hire car, 40 pence for every mile travelled;

(d) in the case of journeys by taxi, the cost of the fare of each journey;

(e) in the case of journeys by pedal cycle, 20 pence for every mile travelled.

(3) A member shall not be entitled to recover expenditure in respect of more than an aggregate of 18 single journeys in any year by all of his employees.

(4) In any year a member shall not be entitled to recover expenditure under sub-paragraph (1) in respect of more than one employee who is a family member except in respect of a family member who is employed by the member on the relevant date and does not thereafter cease to be employed by the member or otherwise cease to provide secretarial, clerical or administrative assistance.

(5) A member shall only be entitled to recover expenditure under sub-paragraph (2)(c) or (d) in respect of any journey where the use of a hire car or taxi is necessary for reasons of urgency or because it is not practicable to use any means of transport referred to in sub-paragraph (2)(a), (b) or (e).

Staff pensions and redundancy expenditure

11. (1) In addition to any expenditure recoverable under paragraph 7, and subject to sub-paragraphs (2), (3) and (4), a member shall be entitled to recover the expenditure incurred by him in making:

(a) a contribution towards the pension of any employee; or

(b) redundancy payments to any such employee.

(2) In each year the amount recoverable under sub-paragraph (1)(a) shall be whichever is the less of:

(a) 10 per cent of salary or fee payments subject to an overall limit of 10 per cent of the actual allowance paid to that member in the year under paragraph 7; or

(b) the actual cost to the member of making the contribution concerned.

(3) In each year the amount recoverable under sub-paragraph (1)(b) shall be the actual cost to the member of meeting statutory redundancy payments.

(4) In each year a member shall not be entitled to recover expenditure under sub-paragraph (1) in respect of more than one employee who is a family member, except in respect of a family member who is employed by the member on the relevant date and does not thereafter cease to be employed by the member or otherwise cease to provide secretarial, clerical or administrative assistance.

(5) In this paragraph, “statutory redundancy payments" in relation to any member means the redundancy payments which the member, as an employer, is required to make to his employee under a statutory provision for the time being in force in Northern Ireland.

Temporary secretarial expenditure

12. (1) Subject to sub-paragraph (2), a member shall be entitled to recover additional expenditure which he has incurred in temporarily engaging a person to replace a permanent employee where: