Session 2008/2009

First Report

AD HOC COMMITTEE ON CRIMINAL DAMAGE COMPENSATION

Report on the Draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008

Together with the Minutes of Proceedings of the Committee,

the Minutes of Evidence, and written submissions relating to the report

Ordered by the Ad Hoc Committee to be printed 17 October 2008

Report: 12/08/09R (Ad Hoc Committee on Criminal Damage Compensation)

This document is available in a range of alternative formats.

For more information please contact the

Northern Ireland Assembly, Printed Paper Office,

Parliament Buildings, Stormont, Belfast, BT4 3XX

Tel: 028 9052 1078

Membership and Powers

Ad Hoc Committee on the Draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008

The Committee was established by resolution of the Assembly on Monday 15 September 2008 in accordance with Standing Order 53(1). The remit of the Committee was to consider the proposal for a draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008, referred by the Secretary of State for Northern Ireland, and to submit a report to the Assembly by 4 November 2008.

The Committee had twelve members, including a Chairperson and Deputy Chairperson. Its quorum was five. The membership of the Committee was as follows:

Mr Peter Weir, Chairperson

Mr Alban Maginness, Deputy Chairperson

Dr Stephen Farry

Mr John O’Dowd

Mr Danny Kennedy

Mr Declan O’Loan

Mr Raymond McCartney

Mr Ian Paisley Jnr

Mr David McNarry

Mr David Simpson

Mr Alex Maskey

Mr Jimmy Spratt

The Report and Proceedings of the Committee are published by the Stationery Office by order of the Committee. All publications of the Committee are posted on the Assembly’s website at http://archive.niassembly.gov.uk

Table of Contents

Background to the Report

Establishment and Remit of the Ad Hoc Committee

Overview: Proposed Draft Criminal Damage

(Compensation) (Amendment) (Northern Ireland) Order 2008

Committee’s Considerations, Conclusions and Recommendations

The Committee’s Consideration of the Main Objective

The Proposed Three-Year Life of the New Provisions (the Sunset Clause)

Equality Impact Screening of the Proposals

Publicity for the New Provisions

Appendix 1: Relevant Legislation

Draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008

Extract from the Rates (Northern Ireland) Order 1977

Recreational Charities Act (Northern Ireland) 1958

Appendix 2: Minutes of Proceedings

Appendix 3: Minutes of Evidence

Appendix 4: List of Witnesses before the Committee

Appendix 5: Written Submissions to the Committee

Law Society of Northern Ireland

Committee Briefing Paper 01/08

Submission from NIO regarding Equality Issues

Background to the Report

Proposed draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008

1. On 25 June 2008, the NIO published for consultation a draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008 and asked for comments on the proposals by 10 November 2008.

2. In accordance with Section 85 of the Northern Ireland Act 1998, Mr Paul Goggins MP, on behalf of the Secretary of State for Northern Ireland, referred the Draft Order to the Assembly for its consideration.

3. Copies of the draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008 and the accompanying Explanatory Document issued by the Northern Ireland Office (NIO) are accessible under current consultations on the NIO’s website at http://www.nio.gov.uk

For ease of reference a copy of the draft legislation is reproduced at Appendix 1.

Establishment and Remit of the Ad Hoc Committee

4. On Monday 15 September 2008 the Assembly agreed, in accordance with Standing Order 53(1), to establish an Ad Hoc Committee with the remit:

To consider the draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008 and to submit a report to the Assembly by 4 November 2008.

5. This is a Report made by the Ad Hoc Committee and it describes its work during the period 18 September to 17 October 2008.

Proceedings of the Committee

6. At its first meeting on 18 September 2008, the Committee elected Mr Peter Weir as Chairperson and Mr Alban Maginness as Deputy Chairperson. The Committee agreed a schedule of further meetings and a list of organisations that should be invited to give oral evidence. The Committee also agreed to place a Public Notice in the main newspapers, inviting written submissions on the proposals from interested parties, and a Press Release to describe the remit and membership of the Committee.

7. At its meeting on 23 September 2008, the Committee was given an overview of the draft Order by officials from the Northern Ireland Office, the Compensation Agency and Land and Property Services of the Department of Finance and Personnel.

8. The Committee held further meetings on 30 September and on 7 and 14 October. The Minutes of Proceedings for all the meetings are included at Appendix 2.

9. In the course of its proceedings, the Committee received oral evidence from the representatives of the following organisations:

- The Northern Ireland Office

- The Compensation Agency

- The Department of Finance and Personnel, Land and Property Services

- Oval James Insurance Brokers and Zurich Commercial Insurance Company

- The Grand Orange Lodge of Ireland

- The Royal Black Institution

10. A complete list of those representatives who gave oral evidence to the Committee is included at Appendix 4.

11. The Minutes of Evidence for the oral evidence sessions are included at Appendix 3.

12. Written submissions received by the Committee are attached at Appendix 5.

Acknowledgement

13. The Committee would like to express its sincere thanks to the representatives of all the organisations who provided written and oral evidence at relatively short notice. That evidence was very beneficial to the Committee’s understanding of the proposed draft Order.

Overview of the Proposed Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008

14. This overview of the draft Order has been adapted from the NIO’s Explanatory Document.

15. A copy of the draft Order is reproduced at Appendix 1. An Explanatory Document, which explains the background to and purpose of the draft Order, can be accessed on the NIO website www.nio.gov.uk

16. The draft Order introduces an additional criterion, relating specifically to community halls, in the statutory criminal damage compensation scheme.

Current Arrangements

17. The Compensation Agency is responsible for the administration of statutory Compensation Schemes on behalf of the Secretary of State. The legislation under which compensation can be paid for criminal damage to property is the Criminal Damage (Compensation) (Northern Ireland) Order 1977 (“the 1977 Order”).

Background to Change

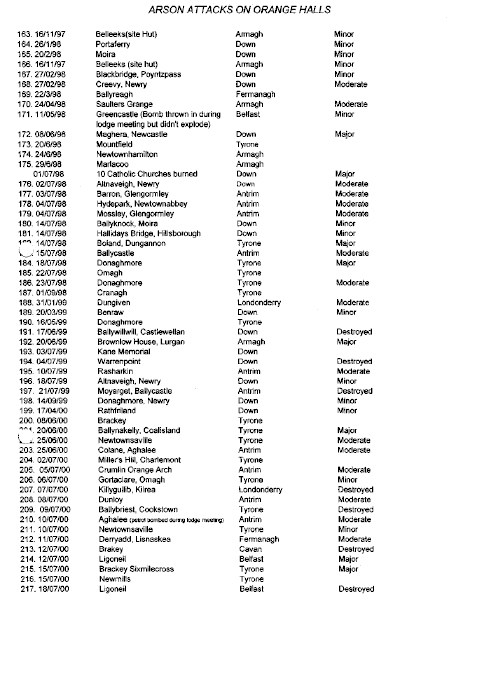

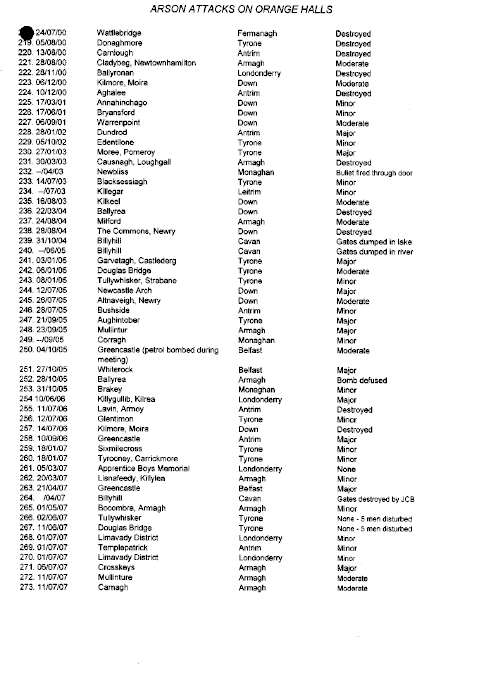

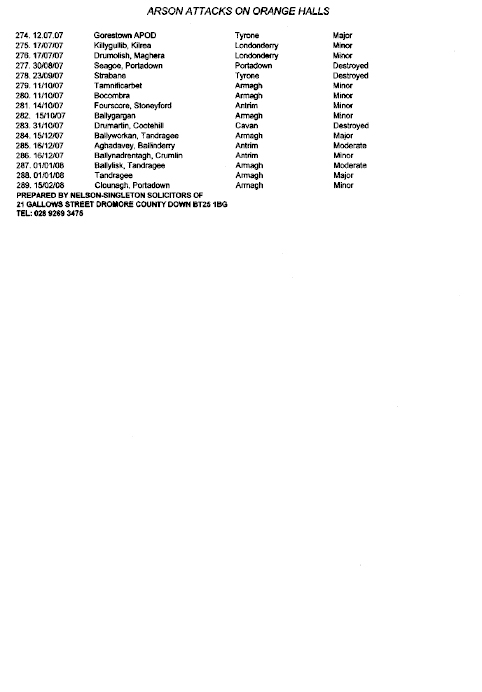

18. The proposal to amend the 1977 Order has been prompted by concerns about an increase in criminal attacks on community halls, resulting in claims which have sometimes not qualified for criminal damage compensation under the 1977 Order. These claims may not have been eligible for compensation either due to difficulty in obtaining evidence to prove that the damage was caused by three or more people, or because the police were unable to establish and certify that damage was the result of paramilitary activity.

19. There were 17 claims for criminal damage compensation resulting from attacks on community halls in 2007, compared to an average of 3 per annum between 2001 and 2006.

20. In 2007 criminal damage claims relating to attacks on community halls, mainly Orange halls, amounted to around £600k. Around two thirds of these are expected to be eligible for statutory compensation under the scheme as it currently stands. The previous six years generated successful claims amounting to an average of £85k in criminal damage compensation paid out per annum.

21. In bringing forward this draft legislation, the Government is acknowledging that the role played by community halls is vital in maintaining and strengthening the social infrastructure in the communities they serve. It recognises that the damage caused by these attacks, the loss of the facility and the costs falling to the community halls of repairing that damage, can have a significant impact on the local communities which use the halls.

Government Proposal

22. The Government is proposing to support local communities suffering from attacks on these community facilities, by introducing an amendment to the current criminal damage compensation scheme.

23. The aim of the proposal is to create a targeted approach to compensation for community halls that are criminally damaged but which do not meet the criteria of the current compensation scheme. The intention is to create additional provisions that will compensate community halls for criminal damage above the statutory deduction level without the need to prove that the damage (a) was carried out by three or more persons or (b) as a result of a malicious act by a person acting on behalf of, or in connection with, an unlawful association.

24. The new provisions to be added to the 1977 Order will be specific to community halls that are eligible for rates exemption relating to their use, or availability for use, for charitable purposes as set out in the Recreational Charities Act (Northern Ireland) 1958 (“the 1958 Act”).

25. The 1958 Act defines as charitable the provision of, or assisting in the provision of, facilities for recreation or other leisure-time occupation, if the facilities are provided in the interests of social welfare.

26. It is proposed that buildings that are exempt from rates under Article 41(2)(e) or Article 41A of the Rates (Northern Ireland) Order 1977 should be eligible for statutory compensation where they are criminally damaged at a cost of more than the statutory deduction (currently £200). Details of the relevant rates legislation are provided at Appendix 1.

Three-year Clause

27. The Government proposal is that the additional provisions will be time-limited, recognising that the recent increase in the level of attacks on community halls runs against the prevailing trend, and is not expected to continue in the medium term. Reflecting this, a sunset clause of three years is provided for in the draft legislation. This means that the additional criterion will cease to have effect three years after its introduction, unless the Secretary of State considers that the legislation is still required. In such circumstances the provisions could be extended by a further period or periods of three years.

Committee’s Considerations, Conclusions and Recommendations

General Background

28. At its first meeting on 18 September 2008 the Committee agreed that a press notice should be placed in the main newspapers seeking written comments on the proposals by 6 October 2008. The Committee also agreed that representatives of the NIO, the Compensation Agency and the Department of Finance and Personnel should be invited to give a presentation on the background to, and purpose of, the legislation. Furthermore it was agreed that four organisations should be contacted and invited to give oral evidence to the Committee: the Grand Orange Lodge of Ireland; the Ancient Order of Hibernians; the Association of Insurers; and the Law Society.

29. The Ancient Order of Hibernians decided not to provide evidence to the Committee but indicated, via the Committee Clerk, that the Order was generally content with the draft legislation. The Law Society decided to provide written comments only and these are reproduced at Appendix 5. The Grand Orange Lodge and representative of the insurance industry provided written and oral evidence (see Appendices 3 and 5). No other written comments were received by the 6 October deadline in response to the press notice.

30. This section of the Report sets out the Committee’s considerations, conclusions and recommendations on the issues covered by the draft Order, taking account of the oral and written evidence provided by organisations.

Rationale for Extending the Compensation Legislation

31. As outlined to the Committee by NIO officials, the aim of the draft Order is to provide additional access to statutory compensation for designated community halls which are subject to criminal damage. The damage caused by attacks, the loss of the facilities and the repair costs for the community halls can have a serious detrimental impact on local communities. As these halls play a vital role in maintaining the strength of social infrastructure in the areas they serve, the Government believes that they should be supported through the proposed amendment to the Criminal Damage (Compensation) (Northern Ireland) Order 1977.

32. The general trend in criminal damage has been downwards in recent years, and the Government views that as part of the normalisation strategy. In the past the Government took the view that criminal damage to buildings such as community halls was a matter for the commercial insurance industry rather than the statutory system and the current limited statutory criminal damage scheme was seen as being sufficient. It focuses on damage caused by three or more persons or by a paramilitary organisation (the latter case resulting in the issue of a Chief Constable’s certificate).

33. Many of the Orange halls that have been damaged are isolated, and often do not have large memberships or commercially related links, such as bar facilities, to provide a source of income. Some, due to their isolation, cannot meet the criteria under the current statutory compensation arrangements. Sometimes there is no evidence to support a claim. Even though three or more people may have attacked a hall, no one may have seen the attack taking place, particularly if it happened in the middle of the night. The police therefore have had difficulty in obtaining evidence to prove that the damage was caused by three or more people, or they have been unable to certify that the damage was the result of paramilitary activity. In these circumstances the Compensation Agency has not been in a position to conclude that compensation is appropriate.

34. The increase in attacks on halls has caused further problems for their owners because the attacks have had a detrimental effect on their insurance premiums. Some have become even more vulnerable because they were not insured and did not have access to statutory compensation. In 2007 there was an unexpected increase in the number of attacks on isolated and vulnerable Orange halls.

35. In May 2006, the Democratic Unionist Party (DUP) proposed an amendment at Westminster that sought to include community halls under sub-section 4 of the Criminal Damage (Compensation) (Northern Ireland) Order 1977. Had the amendment been successful, community halls would have been treated as if they were agricultural buildings for the purpose of criminal damage legislation and access to compensation would have been automatic. The DUP amendment at Westminster was supported by the UUP and SDLP representatives in the Commons, and by the Conservatives and Liberal Democrats, but it was defeated in the parliamentary vote.

36. The Government, however, subsequently decided to give further consideration to the issue. Ministers and officials met representatives of the insurance industry, with the aim of looking for a commercial insurance solution to the problem. Unfortunately, the outcome of those meetings was inconclusive, and with the number of attacks increasing in 2007, NIO Ministers decided that consideration should be given to amending the current criminal damage provisions. The result was the Government’s decision to add further criteria to the current Compensation legislation to give all eligible community halls easier access to compensation for criminal damage.

The Terms of the Proposed Amended Compensation Scheme

37. Most community buildings are covered by insurance and the Government did not want to distort the insurance market by giving wide access to statutory compensation where it was not necessary. It decided therefore to focus the legislation to address the problem of compensating designated community facilities, but at the same time ensuring that the legislation was not so wide-reaching that it could result in a distortion of the insurance market and have a significant impact on the public purse. The Government concluded that the new criteria should be targeted specifically at community halls that were exempt from rates under the Rates (Northern Ireland) Order 1977, and in particular halls that qualify under either:

(a) Article 41(2)(e) of the Rates Order, which relates to a small number of halls or facilities that are deemed as being used for charitable purposes under the Recreational Charities Act (Northern Ireland) 1958; or

(b) Article 41A of the Rates Order, which in effect covers facilities belonging to the following eight organisations

Ancient Order of Hibernians

Apprentice Boys of Derry

Grand Lodge of Freemasons of Ireland

Grand Orange Lodge of Ireland

Independent Loyal Orange Institution

Order of the Knights of St. Columbanus

Royal Antediluvian Order of Buffaloes

Royal Black Institution

38. Eligibility for compensation under the proposal, therefore, will be dependent on the hall being exempt from rates under the relevant part of the rates legislation and it will be relatively straightforward for the Compensation Agency to identify halls that are covered. These arrangements were considered by the Government to be the fairest and simplest way of focusing the legislation on community halls that are being used, or able to be used, for community welfare purposes. The majority of such facilities would already be eligible for compensation under the existing statutory criteria. For example, it is estimated that about two thirds of facilities suffering criminal damage would normally be covered under the “three or more persons involved” or “a Chief Constable’s certificate” criteria. The new criteria proposed in the draft Order create an additional route to give designated community halls easier access to statutory compensation. Community facilities that have drink licences or other commercial activities will be excluded from the arrangements.

Loyal Orders’ Evidence

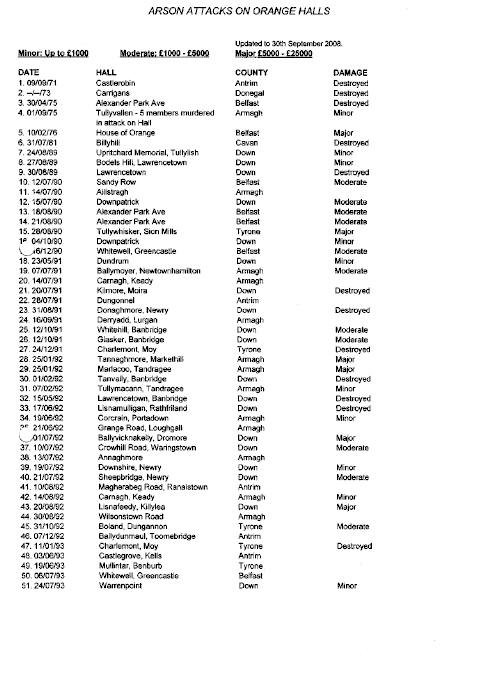

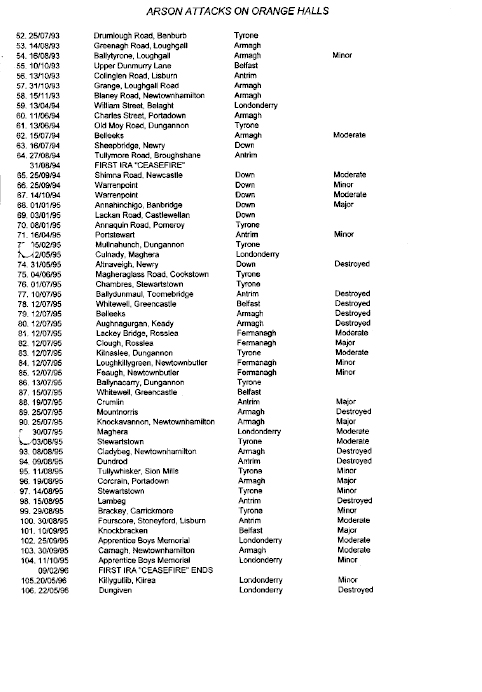

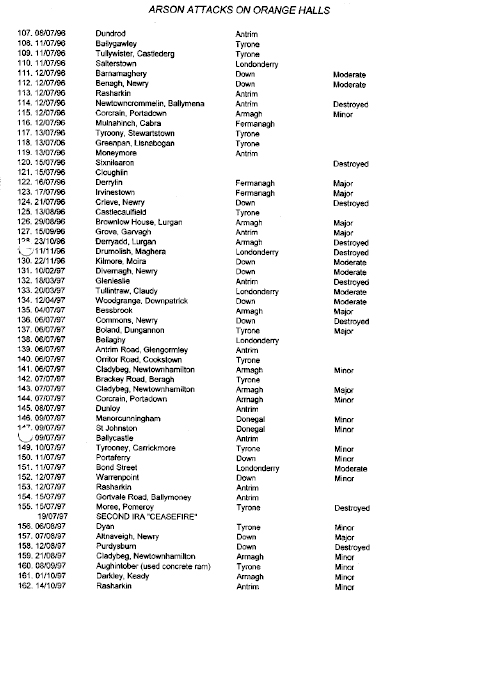

39. In its evidence to the Committee the representatives of the Loyal Orders outlined the difficulties that their local branches have faced as a result of attacks and increased insurance premiums. They said that the aim of the Compensation (NI) Order 1977 was to compensate owners for the failure of the state to protect their properties. However, with the majority of the 600 plus Orange Halls being situated in rural areas, it is sometimes practically impossible for the police either to prevent attacks on properties or to detect the persons involved in attacks.

40. The police, the Committee was told, appear to be reluctant to issue a Chief Constable’s certificate. The witnesses said that since the ceasefires, the police have taken the view that the level of involvement of proscribed organisations in the attacks has been reduced, although they still issue certificates in very particular circumstances. As a result the trustees of Orange halls have had to rely more on the “three or more persons” criterion, which has also proved extremely difficult to prove.

41. The trustees of many properties therefore have not had access to statutory compensation and have had to fall back on their insurance. As a result, a huge financial burden and penalty has been put on the owners of the halls and their communities, in the form of increased insurance premiums, the absence of compensation or the shortfall between compensation and the cost of repairs. That burden is also felt when halls cannot be used by the community that they serve because they have no insurance and the trustees cannot open them up for public use.

42. The Loyal Orders, therefore, fully supported the main objectives of the draft Order but they strongly opposed the proposed three-year life of the new provisions (the so-called sunset clause) set out in the draft Order under which the provisions would cease unless renewed. Further details about the sunset clause are provided later in this section of the Report.

The Committee’s Consideration of the Main Objective

43. DUP and UUP Members of the Committee fully supported the main objective of the draft Order as a means of addressing the problem of attacks on community halls and the consequential increase in insurance premiums. The Alliance Member supported the objective as the simplest way forward but raised some concerns about the equality screening. Sinn Féin Members were broadly sympathetic to the objective of the legislation but said that a full equality impact assessment would have to be undertaken before they could support the proposal. SDLP Members acknowledged the problems that Orange halls faced, particularly in rural areas. However they were not convinced that the proposed amendment was the best method of addressing the issue and proposed that the measure should be wider in its scope and application.

Committee Conclusion

The Committee agreed to give a broad welcome to the general objective of the draft Order.

Insurance Issues

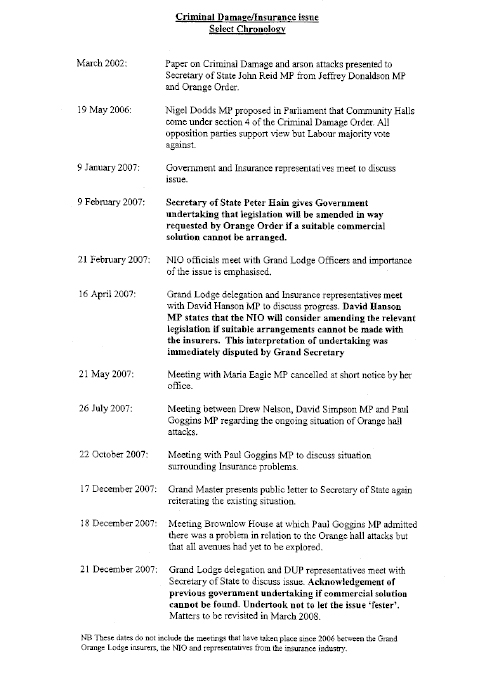

44. The Committee heard evidence from representatives of the insurance industry about the difficulties experienced, particularly by Orange halls, in obtaining insurance at reasonable premiums since 2001. The written submission to the Committee, titled “The Story So Far” is reproduced at Appendix 5. That paper and the oral evidence from insurance representatives described the problems that affected Orange halls, particularly as a result of the general hike in insurance premiums, following the events of 11 September 2001 in New York, and subsequent decisions by a large number of Orange halls to switch their insurance to an Edinburgh-based company which, it later transpired, had no proper insurance cover.

45. The Committee was informed that the break in long-standing relationships between halls and insurance companies proved costly as premiums increased and the insurance market subsequently considered that Orange halls, because of fire-damage attacks, were not a commercially viable risk. Insurers took the decision not to reconnect with them, leaving 200 - 250 halls without insurance cover. In January 2003 insurance brokers approached the insurance market on behalf of these halls but companies were reluctant to assist halls that had severed relationships in the past or with whom they had never had a relationship. However, following representation to all local insurers, three insurance companies agreed to combine to provide cover to halls, albeit at substantially increased rates (circa £1000 for a small hall).

46. While the vast majority of halls insured under the new arrangement were Orange halls, a couple of Hibernian halls and a couple of halls belonging to the Masonic Order were also covered. Brokers managed to negotiate reductions in subsequent years but then in 2007 there were a number of well-publicised attacks on Orange halls and insurers wanted to increase rates. However, after discussions it was agreed to maintain the rates for 2007-08.

47. The insurance representatives told the Committee that approximately 300 community halls are currently insured under the negotiated arrangement and that premiums are calculated on the same basis across Northern Ireland, so for example, a hall in Fermanagh will pay the same as a similar hall in Ballycastle, regardless of the level of attacks in those areas. With a current annual premium of about £945, this is substantially more than the estimate for a similar-type hall in Wales, the north of England or Scotland. Premiums are also about double the amounts that church halls might expect to pay. In addition, there are a number of halls with no insurance cover at present. The representatives confirmed that although there is an obligation on insurance companies to provide employers’ liability cover, there is no such obligation to provide property insurance and no compulsion on companies to take on an unattractive risk.

48. Insurance representatives anticipated that insurance rates may increase next year across the board, but advised the Committee that, if the draft legislation becomes law, then insurance rates for community halls would more than likely reduce. Furthermore the proposed legislation would open opportunities for halls that have not been insured to come back into the ordinary insurance market

Committee Conclusion

The Committee commended the work that had been undertaken by representatives of the insurance industry in recent years to broker insurance cover for many community halls that had been adversely affected by attacks and increased premiums.

The Proposed Three-Year Life of the New Provisions (the Sunset Clause)

49. NIO officials informed the Committee that the Government recognises that the proposed new provisions focus on community halls at a time when society is moving forward and criminal damage is generally on the decline. Therefore the need for the legislation, to address a specific short-term problem, had to be weighed against the commitment to promoting normalisation of arrangements in a post-conflict society. It was estimated that an open-ended commitment to extending statutory compensation could distort the commercial insurance market and involve a commitment of further public expenditure.

50. The Government considers the proposal to be an exceptional arrangement and one that should end as society normalises. For that reason, it was proposed that the legislation would have a sunset clause, so that it is time-limited to a period of three years. This is in recognition of the fact that the recent increase in the level of attacks on community halls runs against the prevailing trend because, even since 2007, there has been a downward trend in the number of attacks on halls.

51. The Government sees a need for the legislation at present but hopes and expects that the need will disappear and that the legislation can be allowed to lapse. Therefore three years after introduction, the legislation would lapse unless the Minister at the time assessed the situation and decided that the legislation was still required. In such circumstances, the Minister would have the power to extend the legislation for a further period or further successive periods, each not exceeding three years.

Loyal Orders’ Evidence

52. The Loyal Orders in their evidence vehemently opposed the sunset clause. They made the case that confidence had to be instilled in the insurance market, and that the insurance industry worked on five-year cycles. Confidence, they considered, could simply not be achieved within a three-year period. If insurance companies knew that policies were due to come up for renewal every third year and they work on a five-year cycle, they would not reduce the premiums or address the issues. Inclusion of the sunset clause in the draft Order would in their view negate the whole impact of the legislation. In response to questions from Members, representatives of the Loyal Orders provided statistics indicating that one third of the 620 Orange halls have been attacked and there have been approximately 75 repeat attacks. Insurers lack the confidence to provide buildings cover on those properties and representatives of the Loyal Orders expressed the view that even a 5-year or a 10-year sunset clause would not be enough to put confidence back in the insurance market.

Insurance Representatives’ Evidence

53. Representatives of the insurance industry confirmed that a normal insurance policy would have a five-year claims experience attached to it. However, with community halls/Orange Halls, a much longer period of a hall’s history would have to be considered because of the longer history of attacks. A way needed to be found to give insurance companies confidence when it comes to considering insurance for these halls. Introduction of the draft Order would remove that risk from the insurance market and allow Government to deal with the matter. They speculated that discussions on the proposed legislation over the past nine months and a condemnation of such attacks by all political parties had resulted in a reduction in the number of attacks. The legislation, they said, would give confidence to insurers, but it would also make people realise that there is no point in attacking community halls because the cost of repairs would be borne by the public purse.

54. The insurance representatives expressed some surprise at the inclusion of a sunset clause. They informed the Committee that insurance underwriters always look for trends, and that three years would not be long enough for a trend to be established and confidence to be restored, even if the situation were to remain relatively calm over the next three years. They also speculated that having a sunset clause of three years could possibly lead to some insurers taking on the insurance of halls but only for the three years for which the statutory arrangements are in place. In the event of the legislation not being renewed subsequently, that insurer might decide that the comfort of underwriting that business had gone and let the traditional insurers who previously had the business take it back. The three-year period would therefore create uncertainty as to what might happen after that period.

55. In summary, the insurance representatives considered that the proposed legislation, would take attacks on community halls out of the insurance market and had the potential to give insurance companies confidence about the position. However omission of the sunset clause would maximise that confidence on a long-term basis.

The Committee’s Consideration of the Sunset Clause

56. Sinn Féin Members were content with the sunset provisions as drafted. SDLP Members expressed the hope that the circumstances that have led to attacks on halls may not exist in the future. They were therefore content with the clause but qualified this stance with their proposal for a different and wider approach to be taken on the scope and application of the legislation. The Alliance Member was opposed to a sunset clause but felt that the legislation should be subject to review after a few years. DUP and UUP Members strongly opposed the provisions on the grounds that they would be needed as long as attacks continued and to provide confidence to the insurance market.

Committee Recommendation

The Committee recommended that the sunset provisions should be removed from the draft Order.

Funding the New Provisions

57. The Committee questioned NIO officials on the resources that would be made available to cover extension of the compensation scheme. Officials confirmed that account had been taken of an analysis of claims over a number of years and that an additional £300,000 per year had been factored into the Compensation Agency’s spending plans.

Committee Conclusion

The Committee acknowledged the assurance that provision had been made in the NIO’s Comprehensive Spending Review for up to an additional £300k per annum to cover the extended compensation scheme.

Equality Impact Screening of the Proposals

58. Following the Law Society’s written submission, which highlighted the duty on public authorities, under Section 75 of the Northern Ireland Act 1998, to promote equality of opportunity, the Committee received legal advice on the equality screening exercise carried out by the NIO as outlined in its Explanatory Memorandum. The advice raised concerns that the NIO, in undertaking an equality screening, had relied on an equality analysis of Article 41A of the Rates (Northern Ireland) Order 1977, which had been carried out in 2006 on a policy of rates exemption, and that Article 41(2)(e) of the same legislation had never been subject to a full equality screening. The NIO subsequently provided additional comments to the Committee about its Section 75 responsibilities and its equality screening exercise (a copy is included at Appendix 5). The Committee noted the concerns raised with regard to the adequacy of the equality screening exercise. Sinn Féin and SDLP Members proposed that a full equality impact assessment should be recommended. The Alliance Member shared some of the concerns about the equality screening and suggested that the NIO needed to ensure that the process was robust and that the Order was not vulnerable to challenge. The DUP, UUP and Alliance Members thought that a full equality impact assessment might not be necessary. After discussion the Committee agreed unanimously the following recommendation:

Committee Recommendation

While Members expressed a range of views as to whether a full equality impact assessment was needed, the Committee recommended that the NIO must demonstrate that the proposed legislation has been sufficiently equality-proofed.

Publicity for the New Provisions

59. The Committee was informed during its evidence sessions that there had been a decline in attacks on community halls since the early months of 2008. There was speculation from representatives of the insurance industry that this reduction could be linked to the condemnation of attacks across the political parties but possibly also to a growing awareness among those perpetrating attacks that such actions were futile since the Government’s proposals would ensure that halls would be repaired or replaced from the public purse.

Committee Recommendations

The Committee recommended that when the Draft Order is commenced the NIO should publicise the arrangements as a possible deterrent to persons who may contemplate attacks on community halls.

The Committee further recommended that the NIO should write to all relevant governing bodies listed under Article 41A and to any organisations which may qualify under Article 41(2)(e) of the Rates Order, alerting them to the extended coverage under the criminal damage compensation scheme.

Appendix 1

Relevant Legislation

Extract from the Rates

(Northern Ireland) Order 1977

Recreational Charities Act

(Northern Ireland) 1958

1958 Chapter 16

An Act to declare charitable the provision in the interests of social welfare of facilities for recreation or other leisure-time occupation and for purposes connected therewith.

[25th November 1958]

1 General provision as to recreational and similar trusts, etc

(1) Subject to the provisions of this Act, it shall be and be deemed always to have been charitable to provide, or assist in the provision of, facilities for recreation or other leisure-time occupation, if the facilities are provided in the interests of social welfare:

Provided that nothing in this section shall be taken to derogate from the principle that a trust or institution to be charitable must be for the public benefit.

(2) The requirement of sub-section (1) that the facilities are provided in the interests of social welfare shall not be treated as satisfied unless—

(a) the facilities are provided with the object of improving the conditions of life for the persons for whom the facilities are primarily intended; and

(b) either—

(i) those persons have need of such facilities as aforesaid by reason of their youth, age, infirmity or disablement, poverty or social and economic circumstances; or

(ii) the facilities are to be available to the members or female members of the public at large.

(3) Subject to the said requirement, sub-section (1) applies in particular to the provision of facilities at village halls, community centres and women’s institutes, and to the provision and maintenance of grounds and buildings to be used for purposes of recreation or leisure-time occupation, and extends to the provision of facilities for those purposes by the organising of any activity.

2 Savings and other provisions as to past transactions

(1) Nothing in this Act shall be taken to restrict the purposes which are to be regarded as charitable independently of this Act.

(2) Nothing in this Act—

(a) shall apply to make charitable any trust, or validate any disposition, of property if before the seventeenth day of December, nineteen hundred and fifty-seven, that property or any property representing or forming part or it, or any income arising from any such property, has been paid or conveyed to, or applied for the benefit of, the persons entitled by reason of the invalidity of the trust or disposition; or

(b) shall affect any order or judgment made or given (whether before or after the passing of this Act) in legal proceedings begun before that day; or

(c) shall require anything properly done before that day, or anything done or to be done in pursuance of a contract entered into before that day, to be treated for any purpose as wrongful or ineffectual.

(3) Except as provided by sub-section (4), nothing in this Act shall require anything to be treated for the purposes of any enactment as having been charitable at a time before the date of the passing of this Act, so as to invalidate anything done or any determination given before that date.

(4) As respects stamp duty on any instrument executed before the date of the passing of this Act, this Act shall not require anything to be treated as having been charitable for the purposes of section eight of the Finance Act (Northern Ireland), 1952 M1 (which excepted instruments in favour of charities and others from certain increases of stamp duty under the Finance Act (Northern Ireland), 1947 M2), unless it would have been so treated in accordance with the practice applied by the Ministry of Finance, for the purposes of the said section eight, immediately before the eighteenth day of December, nineteen hundred and fifty-two; but subject to that and to paragraphs (a) and (b) of sub-section (2), where more stamp duty has been paid on an instrument executed on or after the said eighteenth day of December and before the date of the passing of this Act than ought to have been paid having regard to section one, the provisions of sections ten and eleven of the Stamp Duties Management Act, 1891 M3, shall apply as if a stamp of greater value than was necessary had been inadvertently used for the instrument, and relief may be given accordingly, and may be so given notwithstanding that, in accordance with the provisions of section twelve of the Stamp Act, 1891 M4, the instrument had been stamped before the passing of this Act with a particular stamp denoting that it was duly stamped.

An application for relief under the said section ten as applied by this sub-section may be made at any time within two years from the date of the passing of this Act, notwithstanding that it is made outside the time limited by that section.

Annotations:

M1 1952 c. 13

M2 1947 c. 15

M3 1891 c. 38

M4 1891 c. 39

3 Application to Crown

This Act shall bind the Crown to the full extent authorised or permitted by the constitutional laws of Northern Ireland.

4 Short title

This Act may be cited as the Recreational Charities Act (Northern Ireland), 1958.

Appendix 2

Minutes of Proceedings

Thursday 18 September 2008

Room 144 Parliament Buildings

Present:

Mr Danny Kennedy

Mr Raymond McCartney

Mr Alban Maginness

Mr Declan O’Loan

Mr Ian Paisley Jnr

Mr David Simpson

Mr Peter Weir

Attendees:

Mr Kevin Shiels, Committee Clerk

Ms Aoibhinn Treanor, Clerk

Mr Oliver Bellew, Assistant Clerk

Mr Lindsay Dundas, Clerical Officer

Apologies:

Mr Tom Elliott

Mr Stephen Farry

Mr Alex Maskey

Mr Jimmy Spratt

Mr John O’Dowd

2.07pm the meeting opened in closed session with the Committee Clerk in the Chair.

1. Apologies

The apologies were noted.

2. Election of Chairperson and Deputy Chairperson

The Clerk took the chair for the election of a committee chairperson and asked for nominations. Mr Simpson proposed that Mr Weir be Chairperson of the Committee. Mr Paisley Jnr seconded the proposal. Mr Weir accepted the proposal. There were no other nominees.

Agreed: That Mr Weir be Chairperson of the Committee.

The Chairperson took the chair for the election of a Deputy Chairperson and asked for nominations. Mr Paisley Jnr proposed that Mr Maginness be Deputy Chairperson of the Committee. Mr O’Loan seconded the proposal. Mr Maginness accepted the proposal. There were no other nominees.

Agreed: That Mr Maginness be Deputy Chairperson of this Committee.

2.09pm the Committee opened in public session

3. Declaration of Interests

The Chairperson invited Members in turn to declare any amendments to the Register of Members’ Interests.

4. Committee composition and procedures

Members noted the Committee composition and procedures which had been circulated in advance.

5. Draft Forward Work Programme

Members noted the draft forward work programme and discussed possible dates for future meetings.

Agreed: Members agreed that the Committee should meet on Tuesday afternoons at 3.00pm.

Agreed: Members agreed to invite the following organisations to give oral evidence before the Committee:

On 23rd September:

- Northern Ireland Office Officials accompanied by representatives of Department of Finance and Personnel and the Compensation Agency.

Agreed: Members agreed that the NIO Minister should be invited to attend, if available.

On 30th September

- The Ancient Order of Hibernians

- The Grand Orange Lodge of Ireland

On 7th October

- The Law Society

- The Association of Insurers

6. Press Notice

Members noted a draft press notice prepared by the Clerk for publication.

Agreed: Members agreed the content of the press notice and were content that the notice should be published on Monday 22nd September.

2.29pm Mr Simpson left the meeting

7. Any other business

The Chairperson advised Members that legal advice, if required, could be provided to the Committee by Hugh Widdis, the Assembly Legal Adviser.

Agreed: Members agreed that a press release should be issued to inform the public of the formation of the Committee and its remit.

8. Date and time of next meeting

The Committee agreed that it would meet on Tuesday 23 September 2008 at 3pm.

Future meetings are as follows:

Tuesday 30 September 3pm

Tuesday 7 October 3pm

Tuesday 14 October 3pm

2.34pm the Chairperson adjourned the meeting.

Mr Peter Weir MLA

Chairperson, Ad Hoc Committee

23 September 2008

Tuesday 23 September 2008

Room 135 Parliament Buildings

Present:

Mr Peter Weir, Chairperson

Mr Alban Maginness

Dr Stephen Farry

Mr Danny Kennedy

Mr Raymond McCartney

Mr David McNarry

Mr Alex Maskey

Mr John O’Dowd

Mr Declan O’Loan

Mr Ian Paisley Jnr

Mr David Simpson

Mr Jimmy Spratt

Attendees:

Mr Kevin Shiels, Committee Clerk

Ms Aoibhinn Treanor, Clerk

Mr Oliver Bellew, Assistant Clerk

Mr Lindsay Dundas, Clerical Officer

3.04pm the meeting opened in public session.

1. Apologies

There was an apology from Mr D Simpson, that he would be unable to attend the beginning of the meeting but would join later.

The Chairman welcomed Mr David McNarry as a replacement for Mr Tom Elliott on the Committee.

2. Draft minutes of the meeting held on 18 September 2008

Agreed: The draft minutes were agreed.

3. Matters Arising

3.1 The Chairperson invited Members to declare any amendments to the Register of Members’ Interests via the Clerk.

3.2 Members noted that a Press Notice from the Committee would be published in the media on Wednesday 24th September 2008 seeking comments by Monday 6th October 2008.

3.3 The Chairperson advised Members that a Press Release about the Committee’s work had also been drafted and would be issued on 24th September.

4. Evidence Session

The Chairperson welcomed the following Officials and invited them to brief the Committee:

Brian Grzymek – Deputy Director Criminal Justice Services, NIO

David Kyle - Criminal Justice Services, NIO

David Hamill – Criminal Justice Services, NIO

James McKay – NIO Legal Advisors Branch

Henry Spence – Land and Property Services, DFP

Ray Jones – Head of Operations, Compensation Agency

The Officials briefed the Committee on the provisions of the draft Order. This was followed by a question and answer session.

Mr Simpson joined the meeting at 3.32pm

Mr O’Dowd left the meeting at 3.52pm.

Agreed: Mr Spence, DFP, agreed to provide the Committee Clerk with information on the number and category of halls that had gained exemption from rates under the provisions of Article 41 (2)(e) or Article 41A of the Rates (NI) Order 1977.

The Chairperson thanked the Officials for the briefing. The Officials left the meeting at 4.16pm.

5. Any other business

Agreed: Members agreed that the Clerk should send a letter to the Ancient Order of Hibernians inviting representatives to give oral evidence to the Committee. It was agreed that the Clerk should also consider seeking evidence from insurance companies/brokers who may provide cover for some of the other bodies listed for the purposes of Article 41A.

8. Date and time of next meeting

The Committee agreed that it would meet on Tuesday 30 September 2008 at 3pm in Room 135.

Future meetings are as follows:

Tuesday 7 October 3pm

Tuesday 14 October 3pm

4.24pm the Chairperson adjourned the meeting.

Mr Peter Weir MLA

Chairperson, Ad Hoc Committee

30 September 2008

Tuesday 30 September 2008

Room 135 Parliament Buildings

Present:

Mr Peter Weir, Chairperson

Mr Alban Maginness

Mr Allan Bresland

Mr Simon Hamilton

Mr Danny Kennedy

Mr Raymond McCartney

Mr David McNarry

Mr John O’Dowd

Mr Declan O’Loan

Mr David Simpson

Attendees:

Mr Kevin Shiels, Committee Clerk

Ms Aoibhinn Treanor, Clerk

Mr Oliver Bellew, Assistant Clerk

Mr Lindsay Dundas, Clerical Officer

3.03pm the meeting opened in public session.

1. Apologies

Apologies were received from Mr S Farry and Mr A Maskey. Mr S Hamilton deputised for Mr J Spratt and Mr A Bresland deputised for Mr I Paisley Jnr.

The Chairperson invited Members to declare any amendments to the Register of Members’ interests in advance of oral evidence from the Loyal Orders. Mr Bresland, Mr Hamilton, Mr Kennedy, Mr McNarry and Mr Simpson all declared interests as members of the institutions.

2. Draft minutes of the meeting held on 23 September 2008

Agreed: The draft minutes were agreed.

3. Matters Arising

3.1 The Chairperson advised Members that, to date, Committee staff had not received any responses to the Press Notice published in the main newspapers on Wednesday 24th September.

3.2 Members noted responses from two Executive Ministers to the NIO consultation on the Draft Order. The responses had been forwarded by NIO officials for Members’ information.

3.3 The Committee noted a briefing paper by the Clerk based on information provided by Mr Henry Spence of the Department of Finance and Personnel, following a request from Members for further information on the number, and categories, of halls that had gained exemption from rates under the provisions of Article 41 (2) or Article 41 A of the Rates (NI) Order 1977.

3.4 The Chairperson advised Members that the Clerk had just established contact with the Ancient Order of Hibernians and the Order was now considering the invitation to provide either oral or written evidence. The Chairperson indicated that Tuesday 7th October would be a suitable date for oral evidence, if the Order chose to do so.

3.5 Mr McCartney advised the Chairperson that he had received a tentative approach from the Ulster Council of the GAA about giving evidence to the Committee.

Agreed: Members agreed to wait to see if an official request was made to the Clerk by the GAA Ulster Council. If the Council wished to provide oral evidence this could probably be taken on 7th October.

3.6 The Chairperson advised the Committee of a written submission from Mr Stephen James of Oval James Insurance Brokers and informed Members that a copy of the paper would be circulated before the next Committee meeting.

3.7 The Chairperson advised Members that the Committee was awaiting a response from the Law Society in relation to giving evidence. Potentially therefore, there could be four organisations (Insurance, AOH, Law Society and GAA) wishing to give oral evidence on 7th October. The Clerk was asked to inform Members as soon as possible and at latest by Monday afternoon 6th October, of the number and details of organisations giving evidence at the meeting on 7th October.

4. Evidence Session

The Chairperson welcomed the following representatives of the Loyal Orders and invited them to brief the Committee:

Louis Singleton – Co. Armagh Institution

David Hume – Director of Services, Grand Orange Lodge of Ireland

Millar Farr – Sovereign Grand Master, Royal Black Institution

William Abernethy – Treasurer, Royal Black Institution

The representatives gave a written and oral submission to the Committee. This was followed by a question and answer session.

Agreed: As a result of Members’ requests, the representatives agreed to provide the Committee with further information on increased insurance premiums for halls which had been attacked, and information on halls which had been left uninsured as a result of attacks. It was agreed that these examples should be anonymised.

Mr O’Dowd left the meeting at 3.59pm.

The meeting was adjourned due to a division in the Assembly Chamber at 4.06pm.

The meeting was reconvened at 4.18pm.

The Chairperson invited Mr David Kyle, NIO, who was present in the public gallery, to comment in relation to a query from Members.

The Chairperson thanked the representatives of the Loyal Orders for the briefing. The Representatives left the meeting at 4.22pm.

5. Any other business

None.

8. Date and time of next meeting

The Committee agreed that it would meet on Tuesday 7 October 2008 at 3pm in Room 135.

Future meetings are as follows:

Tuesday 14 October 3pm

4.26pm the Chairperson adjourned the meeting.

Mr Peter Weir MLA

Chairperson, Ad Hoc Committee

7 October 2008

Tuesday 7 October 2008

Room 135 Parliament Buildings

Present:

Mr Peter Weir, Chairperson

Dr Stephen Farry

Mr Alban Maginness

Mr Alex Maskey

Mr Allan Bresland

Mr Danny Kennedy

Mr David McNarry

Mr Declan O’Loan

Mr Jimmy Spratt

Attendees:

Mr Kevin Shiels, Committee Clerk

Ms Aoibhinn Treanor, Clerk

Mr Oliver Bellew, Assistant Clerk

Mr Lindsay Dundas, Clerical Officer

3.04pm the meeting opened in public session.

1. Apologies

Apologies were received from Mr R McCartney, Mr J O’Dowd and Mr D Simpson. Mr A Bresland deputised for Mr I Paisley Jnr.

2. Draft minutes of the meeting held on 30 September 2008

Agreed: The draft minutes were agreed.

3. Matters Arising

3.1 The Chairperson advised Members that the Committee deadline for written submissions had passed and that no responses had been received.

3.2 The Chairperson advised Members that the NIO had received one further response to its consultation. The additional response was received from Lisburn City Council and supported the draft Order.

3.3 A response from the Grand Orange Lodge was tabled for Members’ information. The response contained anonymised examples of increased insurance premiums being paid by Orange halls and also information on halls with no insurance.

3.4 The Clerk briefed the Committee on various other organisations in relation to giving evidence before the Committee. Members noted that a response had been received from the Ancient Order of Hibernians, advising the Committee that it was generally content with the proposals and would not be giving evidence. Members noted written evidence from the Law Society which confirmed they would not be giving oral evidence. The Clerk advised Members that the Ulster Council of the GAA had not submitted any correspondence nor made contact, therefore oral evidence from representatives of the Insurance Industry would be the final evidence to the Committee.

Agreed: Members agreed to discuss the Law Society submission in closed session later in the meeting.

4. Evidence Session

Members noted a written submission from Stephen James of Oval James Insurers entitled The Story So Far. In advance of oral evidence from representatives of the Insurance Industry, the Chairperson invited Members to declare relevant interests.

The Chairperson welcomed the following representatives of the Insurance Industry and invited them to brief the Committee:

Stephen James – Oval James Insurance Brokers and Board Member, Faculty of Insurance Brokers

Stephen Boyles – Business Manager, Zurich Commercial and NI Chairman of the Association of British Insurers

The representatives gave an oral submission to the Committee. This was followed by a question and answer session.

Mr Kennedy joined the meeting at 3.21pm.

The Chairperson thanked the representatives of the Insurance Industry for the briefing. The Representatives left the meeting at 4.02pm.

The meeting was adjourned due to a division in the Assembly Chamber at 4.08pm.

Mr McNarry and Dr Farry joined the meeting at 4.21pm.

The meeting was reconvened in closed session at 4.22pm.

A memo from the Assembly’s Assistant Legal Adviser was tabled for Members’ attention. The memo addressed comments contained within the submission from the Law Society regarding Equality Impact screening undertaken by the NIO. It was agreed that the legal opinion should be referred to the NIO for comment.

The Chairperson advised Members that, due to the tight timescale to complete its remit, the Committee needed to give the Clerk a steer in relation to:

1. the generality of the Draft Order;

2. the proposed ‘sunset’ clause; and

3. any other issues.

Members gave some initial thoughts on these issues and it was agreed that a more detailed discussion on the Committee’s draft report would be held on 14th October 2008.

5. Any other business

None.

6. Date and time of next meeting

The Committee agreed that it would meet on Tuesday 14 October 2008 at 3pm in Room 135.

5.01pm the Chairperson adjourned the meeting.

Mr Peter Weir MLA

Chairperson, Ad Hoc Committee

14 October 2008

Tuesday 14 October 2008

Room 135 Parliament Buildings

Present:

Mr Peter Weir, Chairperson

Mr Alban Maginness, Deputy Chairperson

Dr Stephen Farry

Mr Simon Hamilton

Mr Danny Kennedy

Mr Raymond McCartney

Mr David McNarry

Mr Alex Maskey

Mr John O’Dowd

Mr Declan O’Loan

Mr David Simpson

Mr Jimmy Spratt

Attendees:

Mr Kevin Shiels, Committee Clerk

Ms Aoibhinn Treanor, Clerk

Mr Lindsay Dundas, Clerical Officer

At 3.10 pm the meeting opened in public session.

1. Apologies

Mr Simon Hamilton deputised for Mr Paisley.

2. Draft minutes of the meeting held on 7 October 2008

Agreed —The draft minutes were agreed.

3. Matters Arising

3.1 There were no matters arising.

4. Responses to NIO’s Consultation

4.1 The Chairperson advised Members that responses to the NIO (from Lisburn Council and the DUP) had been copied to Members for information. No further responses had been received by the NIO as of 13 October 2008.

5. Consideration of Draft Committee Report

5.1 The Chairperson referred Members to papers distributed in Members’ packs: a written submission provided by the SDLP, a response from the NIO to the concerns raised in legal advice to the Clerk re equality issues, and the draft Committee Report. He proposed that the Committee should discuss these during its consideration of the draft Report and that this be done in closed session.

Agreed: That the Committee would discuss the draft Report in closed session.

Mr Kennedy left the meeting at 3.13pm

In Closed Session

Mr McNarry joined the meeting at 3.15 pm

5.2 The Chairperson introduced the draft Report and proposed that Members approve the following sections:

Background to the Report — read and agreed.

Overview: Proposed draft Criminal Damage (Compensation) (Amendment) (Northern Ireland) Order 2008 — read and agreed

Appendix 1: Relevant Legislation — read and agreed.

Appendix 2: Minutes of Proceedings — read and agreed.

Appendix 3: Minutes of Evidence — read and agreed.

Appendix 4: List of Witnesses who presented oral evidence to the Committee — read and approved.

Appendix 5: Written Submissions to the Committee — read and agreed.

5.3 Consideration of the Committee’s Conclusions and Recommendations Section

Main Objective of the draft Order

Mr McCartney said that Sinn Féin was unable to support the legislation until a full equality impact assessment had been undertaken. Mr O’Loan stated that the SDLP was not convinced that the proposed amendment was the best method of addressing the issue and thought that the measure should be wider in its scope and application. He asked that the SDLP submission summarising their position be appended to the Committee Report.

Mr Maginness left the meeting at 3.26 pm.

After consideration it was agreed that the SDLP and Sinn Féin views should be reflected in the Committee Report under relevant subject headings, but that the majority decision was in favour of a broad welcome to the general objective..

Agreed: that the Committee give a broad welcome to the general objective of the draft Order, but also reflect nuances of opinion in the Report

Mr O’Loan left the meeting at 3.33 pm.

Insurance Issues

Agreed: that the Report include a general commendation of the efforts of the industry in obtaining insurance for many community halls.

Mr O’Dowd joined the meeting at 3.35 pm.

Mr Maginness and Mr O’Loan rejoined the meeting at 3.38 pm.

Sunset Clause

The Committee discussed options around retention or removal of the sunset clause.

Division: Question put, that the sunset clause be retained.

Ayes: Mr Maginness

Mr O’Dowd

Mr McCartney

Mr O’Loan

Noes: Mr Weir

Mr Simpson

Mr Spratt

Mr Hamilton

Mr McNarry

Agreed: that a recommendation be included that the sunset clause should be removed.

SDLP Submission

Mr O’Loan and Mr Maginness proposed that the inclusion of the SDLP submission as an appendix to the Report be put to a vote.

Division: Question put, that the SDLP submission be appended to the Report.

Ayes: Mr Maginness

Mr O’Dowd

Mr McCartney

Mr O’Loan

Noes: Mr Weir

Mr Simpson

Mr Spratt

Mr Hamilton

Mr McNarry

Agreed: that the SDLP submission should not be appended to the Report.

Resources

Agreed: that the Committee should acknowledge the assurance given by NIO officials re comprehensive spending review cover.

Dr Farry joined the meeting at 3.45 pm.

Equality Impact Screening of the Proposals

Mr Kennedy rejoined the meeting at 3.48 pm.

Mr Maskey joined the meeting at 3.54 pm.

After discussion around the equality issues the Chairperson proposed the following form of words for the Committee Report:

“The Committee notes that concerns have been raised as regards the adequacy of the equality screening that has been carried out. While the SDLP and Sinn Féin members believe that a full EQIA is needed, and the DUP, UUP and Alliance Party members believe that it may not be needed, the Committee recommends that the NIO must demonstrate and ensure that the draft legislation has been adequately and sufficiently equality proofed”.

Agreed: that a form of words on the above lines be included in the Committee Report.

Mr McNarry left the meeting at 4.00pm

Publicity to the Legislation when Introduced

Agreed: that the proposed draft recommendations re publicity be included in the Committee report.

5.4 Action on Draft Report

Agreed: that the Committee Clerk should take account of the Committee’s decisions to finalise the Report. A revised version should be circulated to Members on 15 October and any minor amendments or a “content” reply should be sent to the Clerk by close of play on 16 October.

Agreed: Committee Report ordered to be printed (on 17 October).

Agreed: that the Motion proposed by the Chairperson be tabled in the Business Office for the plenary debate on 4 November.

Agreed: that the witnesses be notified of the date and indicative timing of the debate.

6. Any Other Business

Dr Farry mentioned the impact of the legislation on existing hate crimes provisions. It was agreed that related issues such as this could be mentioned during the plenary debate on the Committee’s Report on 4 November but were not appropriate for coverage in the Report.

Agreed: that the Chairperson should sign off the minutes of the meeting on behalf of the Committee to allow them to be included in the printed report.

4.20 pm The Chairperson adjourned the meeting..

Mr Peter Weir MLA

Chairperson, Ad Hoc Committee

16 October 2008

Appendix 3

Minutes of Evidence

23 September 2008

Members present for all or part of the proceedings:

Mr Peter Weir (Chairperson)

Mr Alban Maginness (Deputy Chairperson)

Mr Stephen Farry

Mr Danny Kennedy

Mr Alex Maskey

Mr Raymond McCartney

Mr David McNarry

Mr John O’Dowd

Mr Declan O’Loan

Mr Ian Paisley Jnr

Mr David Simpson

Mr Jimmy Spratt

Witnesses:

|

Mr Brian Grzymek |

Criminal Justice Services, Northern Ireland Office |

|

Mr Ray Jones |

The Compensation Agency |

|

Mr Henry Spence |

Land and Property Services |

|

Mr James McKay |

Legal Advisers Branch, Northern Ireland Office |

1. The Chairperson (Mr Weir): We proceed to the evidence session, and I invite Mr Grzymek to make his presentation to the Committee.

2. Mr Brian Grzymek (Northern Ireland Office): I have brought a few people to cover the range of questions that might arise in the meeting. James McKay is one of the Northern Ireland Office’s (NIO) legal advisers, and he has been involved in drafting the legislation; David Hamill is one of my staff; David Kyle is one of my deputies in the NIO; Ray Jones is attending on behalf of the chief executive of The Compensation Agency; and Henry Spence is from the Department of Finance and Personnel (DFP), and he can provide helpful advice on the rating aspects of the proposal.

3. I will give a 10-minute overview of the background of the proposal and the areas to which it relates. We are here to clarify the background and circumstances of this proposal and to listen to the Committee. This afternoon’s meeting is part of a consultation process. Yesterday, I spoke to the Minister about today’s meeting, and he asked me to convey his apologies for his non-attendance; he has party business to attend to. However, he stressed that he wants to develop the proposed process, and he is happy to listen to the thoughts and considered views of members of the Committee.

4. The draft Criminal Damage (Compensation) (Amendment) Order (Northern Ireland) 2008 is part of a wider consultation that the Government are developing. We are seeking the views of the Assembly, and others, on the proposal to introduce additional criteria to the Criminal Damage (Compensation) (Northern Ireland) Order 1977. The criteria relate, specifically, to community halls, and I will explain how they are defined in the proposal. The consultation was initiated in June, when the NIO issued a consultation document that was laid before Parliament. It was sent to the Assembly, and all Members have received a copy. It was also distributed more widely within the community, and we have received a number of responses already.

5. The aim of our proposal and the new criteria is to provide additional access to statutory compensation for designated community halls, which are at risk of being subject to criminal damage. The damage caused by attacks, the loss of the facility and the repair costs, for instance, for the community halls can have a serious detrimental impact on the local communities in Northern Ireland, which rely on those facilities for many purposes.

6. Community halls play a vital role in maintaining the strength and social infrastructure in the areas that they serve. Therefore, the Government believe that it is right that steps are taken to support the local facilities through amending the Criminal Damage (Compensation) (Northern Ireland) Order 1977 in relation to statutory criminal damage compensation.

7. I am sure that members are aware that the general trend towards criminal damage in Northern Ireland has been in decline in recent years, and that is reflected in the activity of The Compensation Agency. The Government see that as part of their normalisation strategy in Northern Ireland. In the past number of years, the Government took the view that criminal damage in such buildings as community halls was a matter for the commercial insurance industry rather than the statutory system. The current limited statutory criminal damage scheme was seen as being sufficient. Members might recall that it focuses on damage that is caused by three or more persons or by an organisation, and which, subsequently, results in a Chief Constable’s certificate.

8. That being said, in 2006 and 2007, in particular, there was an unexpectedly sharp increase in the number of attacks on isolated and vulnerable community halls in many parts of the Province. Linked to that, perhaps, in May 2006, the DUP proposed an amendment in Parliament that sought to include some additional buildings under subsection 4 of the Criminal Damage (Compensation) (Northern Ireland) Order 1977. In effect, that would have included buildings that are exempt from rates because of their usage and their belonging to one of eight specified organisations — that relates to some earlier rating legislation. Had the amendment been successful, those buildings would have been treated as if they were agricultural buildings for the purpose of criminal damage legislation. They, therefore, would have been included, almost automatically, under the terms of the legislation if they were subject to significant criminal damage.

9. That amendment was supported by virtually all the local parties in Northern Ireland, along with the Conservatives and Liberal Democrats. However, it was defeated in the parliamentary vote. The Government recognised that widespread cross-party support for the amendment, including the support of all the Northern Ireland MPs who were present in the House at the time. After that amendment was defeated, they decided to give further thought to the issue, which was clearly one of concern across political parties in Northern Ireland.

10. The damage caused by attacks on community halls, the loss of the facility and the repair costs can have a significant impact on the local communities that use the halls. Typically the halls that are subject to damage are isolated, and they often do not have large memberships or commercially related links, such as bars, that can provide them with a source of income. They are, therefore, quite vulnerable. Those halls are often isolated, and they clearly cannot access the existing criteria under the current statutory compensation arrangements. Even if they could, it is often the case that there is no evidence to support their claim. It may well be that three people had attacked the hall, but if it happens in the middle of the night, no one may have seen the attack taking place. Thus, in exercising its responsibilities, The Compensation Agency may not be in a position to conclude that compensation is appropriate.

11. There are particular problems for those types of halls, particularly in rural and isolated areas. Essentially, it comes down to the difficulty in obtaining evidence to prove that the damage was caused by three or more people. The police clearly do all that they can to ensure that those halls are protected, but they cannot sit outside every rural community hall 24 hours a day. If they are not there, they may have difficult in obtaining evidence or may be unable to certify that the damage was the result of terrorist or paramilitary activity.

12. The increase in attacks on those halls caused further problems for the people who owned or managed them because they had a detrimental effect on their insurance premiums. We received reports that some facilities were finding it increasingly difficult to sustain normal insurance arrangements. In other words, they became even more vulnerable because they were not insured and they did not have access to statutory compensation. Thus, for such organisations or facilities, an attack could be terminal.

13. Ministers and officials met the insurance representatives, essentially with the aim of looking for a commercial insurance solution to the problem. Unfortunately, those meetings were inconclusive, and with the number of attacks increasing in 2007, Ministers felt that, as an alternative, consideration should be given to mending the current criminal damage provisions. The outcome was that the Government decided that the best way forward was to add a further criterion to the current Order to give all eligible community halls easier access to compensation for criminal damage. The big problem was defining what we meant by community halls. There is another side to the coin; although we wanted to protect those isolated and vulnerable halls, at the same time, most facilities in Northern Ireland are covered by insurance — and rightly so. The Government did not want to distort the insurance market by giving wide-scale access to statutory compensation where it was not necessary.

14. That would have had an immediate impact on the Exchequer, and downstream, if passed on to a devolved Administration, might well have carried with it a significant cost — a cost that should, perhaps, be borne by the insurance industry but that, instead, could have fallen to Government.

15. Our main concern, therefore, was to see how best to focus the legislation so that it addressed the problem in point about isolated community facilities, yet at the same time was not so wide-reaching that it resulted in a distortion of the insurance market or, indeed, a change in behaviour.

16. The Government looked at how those eligible community halls that they wanted to target could be distinguished from other halls. In discussions with Department of Finance and Personnel colleagues and others, it was concluded that the new criteria for the Order should be targeted at, and specific to, community halls in the same way as for rates exemption. There has already been a great deal of work on the rating side in order to identify community halls that receive exemption from rates under the Rates (Northern Ireland) Order 1977.

17. The Government, in looking at how to identify the range of community halls that they were seeking to target, was drawn to two elements of the Rates (Northern Ireland) Order 1977; first, article 41(2)(e), which relates to halls or facilities that are deemed as being used for charitable purposes under the Recreational Charities Act (Northern Ireland) 1958; and, secondly, article 41A, a more recent addition to the Rates (Northern Ireland) Order 1977, which, in effect, extended it to cover a small number of named organisations.

18. Those two sections together refer exclusively to buildings that are used wholly or mainly for the purposes that are declared to be charitable under the Recreational Charities Act (Northern Ireland) 1958, or, in the case of those covered by article 41A, are used or are available for such use.

19. Taking that approach, the Government have gone further than the 2006 amendment. Rather than limiting the proposal to the eight bodies listed in article 41A of the Rates (Northern Ireland) Order 1977, the Government have expanded the provision to include other community halls that are exempt from rates under article 41(2)(e) of the Rates (Northern Ireland) Order 1977. That, in essence, broadens the coverage to quite a wide range of halls, which serve their local communities across Northern Ireland.

20. The Government’s concerns were initially raised by attacks on Orange Halls, of which there was a spate, particularly in 2007. Having said that, other halls are vulnerable, too, and the Government, in looking at this area, thought that important and focused on community halls that are used for charitable purposes. It is, therefore, much broader than looking at just the eight organisations, including the Ancient Order of Hibernians and the Order of the Knights of St Columbanus. The aim was to broaden that list in order to cover more at-risk halls while, at the same time, not creating such a large spread of coverage as to distort the insurance industry or other practices.

21. Eligibility for compensation will be dependent on the individual property meeting the already established criteria under the relevant parts of the rates legislation. That makes it relatively straightforward to identify halls that are covered, and will give some certainty with regard to coverage. That was considered to be the fairest and simplest way of focusing the legislation on community halls that are being used, or able to be used, for community welfare purposes.

22. The amendment simply creates an additional route to statutory compensation for those community halls that are exempt from rates under the relevant DFP legislation. The majority of facilities would already be eligible under existing statutory criteria — up to two thirds or more of facilities suffering criminal damage would normally be covered in any event under the three or more persons involved in the attack, or Chief Constable’s certificate, criteria.

23. However, that clearly left a gap. The aim of this addition to the legislation is to help to close that gap. Therefore, properties that may suffer criminal damage are still eligible to apply for compensation under the current provisions of the Criminal Damage (Compensation) (Northern Ireland) Order 1977. At the same time, this amendment broadens that coverage to areas that were identified as being in the gap.

24. The Government appreciate that the proposed provision is focused on community halls at a time when our society is moving forward and criminal damage is generally on the decline. Therefore, they have had to weigh up the need for the legislation — that is, a specific, short-term problem — against their commitment to promoting normalisation of arrangements in a post-conflict society. They appreciate that an open-ended commitment to extending statutory compensation could distort the commercial insurance market and involve a commitment of further public expenditure that would stretch beyond the life of the current Administration and into that of a future devolved Department.

25. The amendment provides a simpler route to applying for compensation for community halls that are exempt from breaks under articles 41(2)(e) or 41A. The Government consider that to be an exceptional arrangement, and one that they would see terminating as normal society gains strength in Northern Ireland. For that reason, they propose the additional criterion that the legislation will have a sunset clause, so that it is time limited to a period of three years. This is in recognition of the fact that the recent increase in the level of attacks on community halls runs against the prevailing trend because, even since last year, there has been a downward trend in the number of attacks on such halls.

26. The Government see a current need for the legislation but their hope and expectation is that the need will disappear over the life of the legislation, hence the legislation can be allowed to lapse. That is why the Government have included the sunset clause of three years, after which the legislation would lapse unless the Minister at the time assessed what had happened during that time and decided that the legislation was still required — in that instance, the Assembly would have the power to extend the legislation for a further period.

27. Finally, the Minister acknowledges that the proposed legislation does not and should not cover all facilities in the community. Some people, I am sure, will argue that the legislation could go further. The Minister is concerned that the legislation must be carefully targeted to avoid an open-ended extension of statutory intervention in this area. The Government consider the proposal to be a workable and manageable way of dealing with the issue of increased attacks on community halls. The proposal focuses resources on supporting isolated, vulnerable, yet vital community facilities that have been at risk of increased criminal damage and that have not been effectively covered by the current criminal damage legislation.

28. That is a run-through of what has led to the legislation — I am conscious that the Committee will have several questions. My job and that of my colleagues is to give some clarity on the thinking behind the Minister’s proposals if we can and, otherwise, to listen carefully to members’ thoughts and relay them to the Minister.

29. The Chairperson: Brian, you indicated that you have received some responses to your consultation already — will you give some more detail about that?