| Homepage > The Work of the Assembly > Committees > Statutory > Enterprise, Trade and Investment > Reports | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Committee for Enterprise, Trade and InvestmentReport on the Committee's Inquiry into Barriers to the Development of Renewable Energy Production and its Associated Contribution to the Northern Ireland Economy - Volume 3Together with the Minutes of Proceedings of the Committee Ordered by The Enterprise, Trade and Investment Committee to be printed 27 January 2011 Session 2010/2011Third ReportTable of ContentsAppendix 4 – Research Papers1. Renewable Energy Workshops 2. Renewable Energy Event 3. FIT v ROC 4. Renewable Generation and Policy within selected EU Countries 5. Energy Act 2010 6. NIE Distribution Code 7. Planning and Grid Connection comparisons 8. Grid Connection 9. Governance Structures

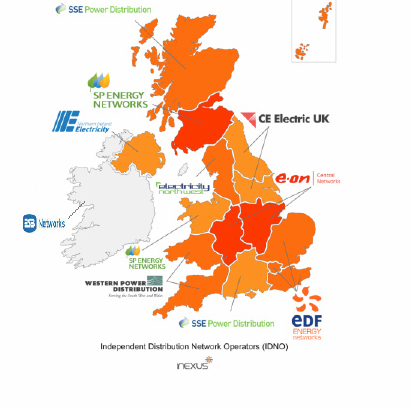

21 May 2010 NIAR 000-10 Aidan StennettKey points from the Committee for Enterprise, Trade and Investment's Renewable Energy Workshops1 Introduction On the 18 May 2010 the Committee for Enterprise, Trade and Investment held workshops with stakeholders from the renewable energy sector in Northern Ireland. The workshops featured contributions from specialists in the fields of economics, energy, and government. The following paper provides an overview of workshop discussions, outlining the key points raised. 2 Economic Issues Discussion on the economy focused on a number of inter-related issues – competitiveness, financing, risk and uncertainty, resources, and best practice. ResourcesStakeholders acknowledged the wealth of renewable energy resources available to Northern Ireland in the form of wind, grass and ocean energy. An analogy was drawn with Saudi Arabia and other oil producing countries, suggesting that if Northern Ireland could successfully harness its renewable energy potential it could become as important to the new global energy economy as those countries are to the current fossil fuel based energy market. Some participants argued that too much emphasis (investment and policy) was placed upon on-shore wind to the detriment of other forms of energy generation. Stakeholders also highlighted the human resources available in Northern Ireland. There was recognition that the skills required to grow the renewable industry already exist (particularly research and manufacturing), but it was necessary to figure out how best to utilise those skills. On the other hand, stakeholders suggested that the region has and could continue to suffer from a brain drain due to an underdeveloped indigenous renewables market (this is dealt with in more detail below). Participants were also keen to highlight Northern Ireland's 'vibrant manufacturing' base, which they felt could provide a sound foundation for the development of the renewable energy industry. CompetitionDiscussions noted that the Northern Ireland renewable energy industry competed on two levels – globally and locally. That is, the industry is situated within and faces competition from Northern Ireland and global energy markets. Stakeholders argued that Northern Ireland was at a competitive disadvantage in the global renewable market. A common view amongst participants was that competitors outside of Northern Ireland could offer cheaper products (both technology and energy). Stakeholders noted that base costs in Northern Ireland were higher than in the regions with which it competes. Norway and Denmark were cited as examples of low-cost regions exporting to the global market. Locally it was felt that the industry faced two obstacles. Firstly, Northern Ireland's energy sector was described as monopolistic. NIE's domination of the sector and the need to introduce greater competition into the market was highlighted. Secondly, stakeholders held the view that the indigenous renewable energy market was under-developed and that growth was slow. Invest NI's policy of favouring exporting companies was criticised in this regard. It was felt that, at current levels, the market could not fully absorb the skills available within the region, resulting in a brain drain. In addition, examples of firms developing innovative technologies in Northern Ireland only to subsequently move 'across the water to sell and to set up shop' were cited. Furthermore, it was suggested that renewable energy companies operating in Northern Ireland were often foreign owned, resulting in profits going elsewhere. Localisation or "communtisation" of the industry was put forward as a solution. That is, it was suggested that a cooperative model, within which local communities owned their energy system, might assist industry growth. Risk and uncertaintyStakeholders felt that risk aversion at both government and private-sector level hindered the growth of the industry. Risk aversion was thought to be particularly prevalent in the area of industry led innovation and research and development. It was felt that investment risk could be countered by investing in a broad renewable energy mix. Uncertainty was cited as a factor in encouraging the perception of risk. The lack of an over-arching government strategy was thought to drive uncertainty in the market. It was felt that industry was reluctant to invest due to limited reassurances from government. Stakeholders argued that the immediate publication and implementation of the Strategic Energy Framework would counter some of the doubt that currently exists within the industry. FinancingThe slow development of the industry was attributed, in part, to insufficient investment and the difficulties firms encounter in raising finance. The notion that EU funding was 'too difficult' and particularly prohibitive to SMEs was raised by a number of participants. Some felt that sourcing funding was too expensive and resource intensive. The industry would like clear advice on such funding. It was suggested that this could take the form of guidelines on what is available, the criteria to be met and case studies of firms who have successfully secured EU monies. Some participants expressed dissatisfaction with what they perceived as a funding structure (at all levels of government) that appeared to favour universities. It was suggested that universities were being generally more successful in securing funding. Stakeholders, however, recognised that Grant investment should not be the only method of financing growth. Alternative suggestions included low interest loans, a renewable levy on electricity, tax incentives for research and development, and home owners buying/investing in technology on the basis of future cost savings. There was a general consensus that the current Renewable Obligation Certificate (ROC) system bred uncertainty and ensured that banks were reluctant to finance renewable projects, particularly in the current economic climate. Stakeholders argued that a Feed In Tariff would be more desirable even if the levels of support offered were lower, such a system would allow industry to predict future prices with a greater degree of accuracy. It should be noted that a counter argument was raised during these discussions, that is, the ROC system was responsible for bringing money into the Northern Ireland economy. Best PracticeThroughout the discussions a number of countries were held up as example of best practice, specifically Denmark, Germany, Norway and Scotland. Stakeholders argued that rather than attempting to 'reinvent the wheel' industry growth would be better served by copying successful growth models from elsewhere. 3 Government Discussion on the opportunities and barriers associated with government issues focused on leadership, strategy, joined-up action, European Engagement and planning. LeadershipStakeholders felt that the government could demonstrate leadership and will by 'practicing what it preaches'. It was suggested that this could be achieved by utilising renewable technologies in government buildings, with Parliament Buildings cited as the ideal place to begin this process. It was similarly felt that decisive leadership could be shown by ensuring social housing employed renewable technology and energy efficiency into its design. In addition stakeholders suggested that government procurement practices could be more supportive of the renewables sector in general and renewable SMEs in particular. Discussions tapped into a wider debate concerning what the role of government should be and what was meant by leadership. Participants suggested the existence of a 'grant culture' and agreed there was a need to move away from this. Progress would better served by a government who saw its role as facilitating industry growth. It was felt that the government should not overplay its role in sustainable energy rather it should incentivise the market, nurture it and provide it with customers without taking ownership of it. Stakeholders would like the government to clearly define its position on economic and regulatory intervention in the market place. StrategyParticipants acknowledge that the renewable energy targets set at EU and UK level were challenging. There was some concern with regard to how these could be achieved in a Northern Ireland context. As outlined above, participants were critical of the absence of a long-term renewable strategy. This, it was argued, has created a vacuum, which has been filled by uncertainty and instability. The lack of a long-term strategy was thought to be particularly problematic since the industry itself was attempting to plan 20-25 years ahead. Participants acknowledged that the introduction of the Energy Act (2008) in the rest of the UK[1] had removed this uncertainty. It was hoped that the SEF would achieve the same in Northern Ireland. Discussions also revealed that certain sectors from within the industry felt that they were insufficiently consulted during the drafting of the SEF. This concern was voiced by representatives of 'less-developed' technologies in particular. Again, participants felt this was symptomatic of the government's focus on on-shore wind. There was concern that the SEF would not adequately consider and target other technologies. This, it was suggested, could prevent the development of an efficient renewable energy mix in Northern Ireland. In a similar vein, participants expressed concern that previous strategic thinking had focussed on electricity generation whilst largely ignoring the significant contribution of heat generation. Some groups expressed the view that a macro level debate about energy cost in Northern Ireland was necessary. Joined-up actionThere was a consensus amongst participants that energy was a cross-departmental issue. They suggested, however, DETI was the only department that considered energy as a high priority. Fragmentation across government departments and agencies was also thought to cause confusion in the market place. Participants added that fragmentation led to difficulties in securing funding. Consequently, participants argued that the combination of these two factors suggested the need for greater cooperation at a departmental level. Some suggested a more radical solution in the creation of a single department with a sole remit for all energy issues. European EngagementDiscussion on Europe acknowledged the wealth of EU (e.g. €50bn R&D Budget) funding potentially accessible by companies in Northern Ireland. The role of Invest NI in calling for proposals was recognised. There was however, a suggestion that EU funding was impenetrable and difficult to understand, as a result greater guidance from government was requested. Although not explicitly stated, recognition during the discussions of the Northern Ireland Executive Office in Brussels' remit for assisting SMEs in securing funding implied that this could be an area for future exploration. PlanningA number of participants suggested that Northern Ireland's planning system was slow and over-bureaucratic, stifling growth as a result. A review of planning, with a view to streamlining and simplifying process, was suggested. 4 Energy Discussions on energy issues raised issues concerning infrastructure, public opinion, the research base and the energy mix. InfrastructureParticipants held the view that the there is a lack of infrastructure to support the level of development required. Particular focus was paid to the grid, which was thought to be underdeveloped. In addition there was a degree of criticism from groups concerning the grid on two points: that the developer pays for connections; and that government consultation on grid connection has focused on large-scale wind producers. Some participants suggested that infrastructural change could necessitate difficult choices. The government and public may be required, for example, to weigh infrastructural improvements against the aesthetic beauty of the countryside. Public opinionDiscussions focused on a perceived lack of understanding amongst the public on energy issues and the role of renewable energy. Some suggested that a significant cultural barrier to the full acceptance of renewable energy existed in Northern Ireland. Participants agreed that educating the public would assist the growth of a low carbon economy. There was, however, some debate over who would be responsible for providing this education. One suggestion was to roll-out trial projects to show-case renewable technology. Related discussions questioned whether renewables are viewed negatively by the public. Participants suggested that problems associated with delays, waste, planning and finance have resulted in a negative backlash from the community. The Rose Energy plant was cited as an example of this. The research baseThere was considerable praise of Northern Ireland's academic research base amongst groups. Participants also suggested that technological advancement had been born from necessity, one contributor referred to an Economist article which claimed that 15 renewable energy technologies had been developed globally as a result of oil rising to £150 per barrel. Participants expressed the view that future needs would continue to drive technology, for Northern Ireland to lead the way, however, the government must assist in creating a business environment conducive to innovation. As outlined above, groups expressed concern that the lack of an indigenous renewable energy market may be contributing to a brain drain and motivating innovative firms to seek markets elsewhere. The energy mixStakeholders questioned why there was an over-reliance on wind energy in Northern Ireland. Issues of intermittency and energy storage were raised by some. It was suggested that the focus on wind power was understandable since the technology was at a later stage of development and because 'wind power was the easiest to harness'. In general, groups were supportive of a varied energy mix. Two arguments in favour of this were raised. On the one hand it would ensure sustainability, accounting for occasion of no wind for example. On the other hand it would allow investors from the private and public sector to spread risk. In a related point, some suggested that technological solutions to energy production should only be viewed as part of the solution. To some, ensuring energy efficiency was an important initial step. [1] It should be noted that while the Energy Act extends to the whole of the UK a large proportion of its provisions do not extend to Northern Ireland.

14 June 2010 Aidan StennettCommittee for Enterprise, Trade and Investment – Renewable Energy EventNIAR 248-10Paper providing details of Committee for Enterprise, Trade and Investment renewable energy event including content of workshop discussions as well as additional information. Paper 248/1014 June 2010Research and Library Service briefings are compiled for the benefit of MLA's and their support staff. Authors are available to discuss the contents of these papers with Members and their staff but cannot advise members of the general public. We do, however, welcome written evidence that relate to our papers and these should be sent to the Research & Library Service, Northern Ireland Assembly, Room 139, Parliament Buildings, Belfast BT4 3XX or e-mailed to RLS@niassembly.gov.uk Executive SummaryOpening remarksDuring the event's opening speeches delegates were briefed on ocean energy, renewable energy in Northern Ireland and European Union perspectives. Ocean Energy: three sources of ocean energy were identified – wave energy, offshore wind and tidal current flow. In all three cases the resource potential is estimated to equal or exceed the resources available elsewhere in Europe. It was estimated that exploitation of ocean energy could feasibly produce a net present value to the economies of Northern Ireland and the Republic of Ireland of €9bn by 2030. Renewable energy in Northern Ireland: delegates were briefed on the environmental, social and economic role renewable energy plays. Opportunities for SMEs were identified in: developing new technologies and services; business diversification; exporting knowledge; and the availability of research and development skill that could attract inward investment. Barriers were identified in: investor fixation on payback periods; the availability of finance; shortage of suitably skilled workers; lack of long term policy direction; lack of information for consumers; and the gap between strategic and operative actions. The future development of the industry was thought to depend on: customer education; developing engagement with European partners; and establishing links between government and industry. European Union: delegates were briefed on the European context to industry development. A bleak picture of current economic context was painted but the speaker was optimistic that the EU could emerge from crisis stronger through collective action. Key elements of the 'resource efficient Europe' theme of the Europe 2020 strategy were outlined. These included: mobilisation of financial instruments; encouraging market-based instruments; decarbonisation of the transport sector; the formation of a European supergrid; and a revised Energy Efficiency Action Plan. WorkshopsThe workshops focused on three areas – economy, government and energy. The main areas of discussion under each heading were:

The following is summary of the key points raised under each sub-heading, additional background information is included where appropriate. EconomyCompetition – delegates noted that the renewable energy industry had to compete both locally and globally. They argued that NI was at a competitive advantage globally and that the renewable energy market was underdeveloped globally. Additional Information – to contextualise the level of competition within Europe it is useful to examine the internal and external development of Europe's 'big hitters'. Denmark: has 'developed a world class turbine industry and has had one of the most aggressive energy efficiency programmes in the EU'. In 1991 92% of the regions energy was produced from oil. By 2006 this had declined to 54% with wind and biomass generation increasing significantly. As an exporter Denmark exports the highest promotion of energy technologies and equipment relative to total national goods exports in EU-15 (2006). Germany: As of 2006, 21GWs of wind power was installed in the region. By the same period Germany was producing 3.6m tonnes of biodiesel which equates to 30% of global supply. The growth of Germany's renewable industry has been attributed to, in part, the adoption of a feed-in-tariff. Biofuel production has also benefitted from tax exemptions. As early as 2002, Germany's renewable technology exports accounted for 20% and 10% of its wind and solar production respectively. Resources – delegates highlighted the wealth of renewable energy resources available in Northern Ireland, as well as the significant human resource available. Some, however, felt too much emphasis had been placed on onshore wind energy to the detriment of other forms of energy. Additional InformationEnergy resource: A 2004 study by Action Renewables into Northern Ireland's renewable energy resource estimated that total feasible renewable energy resource in the region was 1133MW of installed electrical generation capacity, providing 4,113GWh per annum. This majority resource was expected to be sourced from wind energy – onshore wind (565MW), offshore wind (500MW – nominal with further exploration required). The viable tidal energy resource available to Northern Ireland has been calculated at 530GWH/yr. DETI's draft Strategic Energy Framework (SEF) outlines five scenarios for wind generation in 2020:

Human resource: Oxford Economics has calculated two scenarios for Northern Ireland job creation going forward to 2020 – a baseline scenario of 5,000 per annum and an apsiprational scenario of 7,300 per annum. In both cases they estimate jobs in the utilities sector to increase by 200 per annum. They predict, that to meet demands in the baseline scenario, it would require 7.3% increase in engineering and technology graduates. This increases to 8.1% under the aspirational scenario. Oxford Economics expressed concern, however, that 'even under the baseline forecast there would be a shortfall in subject areas such as mathematical & computer sciences, engineering &technology, law and creative art & design graduates'. To this they add: 'perhaps the emergence of 'green jobs', the reshaping of the financial and professional services sector and a more developed tourist industry will alter the shape of the skills mix and a different aspirational path may emerge'. The Oxford Economics report also notes that currently many jobs requiring STEM subjects were located in the England's Greater South East. Risk and uncertainty – delegates stated that both government and industry were risk adverse. Uncertainty, it was argued, had encouraged this aversion. The lack of a coherent government strategy was thought to be key. Additional Information – Results of the 2007 UK Innovation Survey found that Northern Ireland had the second lowest rate of business innovation of all UK regions during the period 2004 to 2006. Cost was the most often cited reason for not partaking in innovation. Other reasons included lack of knowledge and market factors. Financing – delegates argued that EU funding was too difficult to access and that alternatives to grant funding should be explored; that the Renewable Obligation Certificates (ROCs) bred uncertainty and Feed-in-Tariffs should be pursued. Additional Information – the current value of £45 is based on a buy out fee (£37.19) plus anticipated buy out fee redistribution per ROC. The Department has stated that Northern Ireland does not currently have the legislative powers to introduce a feed-in tariff. Best Practice – Denmark, Germany Norway and Scotland were put forward as regions that Northern Ireland should emulate – space does not permit a full analysis of these regions, a separate research paper on best practice may be useful going forward. GovernmentLeadership – delegates argued that the government should lead the way by introducing renewable generation in public sector buildings and social housing. They also stated that more could be done to encourage renewable sector SMEs to become involved in the procurement process. Additional Information – the Carbon Trust has estimated that the public sector accounts for 5% of Northern Ireland's total energy use and approximately 70,000 tonnes of carbon dioxide annually. They estimate that 20% of its energy use could be saved by an investment of £120-180 million on basic measures with a payback of 4-6 years. This would result in recurring cost savings of £30 million per annum. Strategy – delegates acknowledged challenging targets at EU, UK and NI level but were again critical of the absence of a long-term NI strategy. They were also critical of what they saw as a lack of direction on renewable heat generation. Additional Information – EU aims to ensure 20% of total energy production is from renewables by 2020. The UK has a 2020 target of 15% renewable energy contribution to total energy demand – made up of 30% electricity production, 12% heat generation and 10% transport. The draft SEF suggests a Northern Ireland target of 40% electricity generation and 10% heat. As of 8 June 2010, the final SEF remains unpublished. Minister statements suggest it will be available in four to six weeks. The draft SEF states that DETI has no statutory powers to allow it to work in the area of renewable heat. The Energy Act 2008 provides the statutory powers for a renewable heat incentive scheme to be introduced across England, Wales and Scotland. Join-up action – delegates felt that interdepartmental action was insufficient and argued for a single body/department with soul responsibility for energy matters. Additional Information – the draft SEF refers to the establishment of an Interdepartmental Working Group on Sustainable Energy that would develop a report on joined-up action. To date no such report has been produced. European Engagement – delegates noted that substantial EU funding was available for R&D but argued that EU funding was impenetrable and difficult to understand. Additional Information – further information on EU issues will provided to the Committee as part of a substantive paper on EU engagement and the European Commission Work Programme 2010. Planning – the planning system was regarded as slow and over-bureaucratic. Additional Information – the Northern Ireland Audit Office's review of Planning Service performance found that the agency had: consistently failed to meet targets; had taken significantly longer than planned to implement PPS agreements; cost per planning application increased by 59% from 2004-05 to 2008-09; and the number of decisions per planner has fallen by 19 per cent in the last two years. EnergyInfrastructure – the grid was deemed to be underdeveloped. It was also felt that consultation on grid improvements had focussed on the opinions of wind producers to the detriment of others. There was also criticism on the developer pays model. Additional Information – EriGrid estimate that to ensure the Single Electricity Market grid is fit for use will require investment of approximately €4bn. Public opinion – delegates argued that there was a lack of understanding amongst the public on energy issues and the role of renewable energy in the future energy mix. They also felt that renewables had developed a bad image. Additional Information – a Department of Energy and Climate Change (DECC) (2009) survey found that only 3% of the public sample professed to not recognising any form of renewable energy. An earlier survey (2003) found that out all regions in the UK, Northern Ireland had the highest level of total awareness of renewables. It also found that Northern Ireland had the highest number of respondents who thought renewables were a good idea, that they were preferable to fossil fuels, and would stongly agree with a clean renewable energy generating site built in their area. The research base – Northern Ireland's research base was praised and delegates expressed the view that future needs would continue to drive technological development. Additional Information – issues regarding the research base are addressed in the skills section above. Energy Mix – some delegates felt that there had been an over-emphasis on the role and development of wind technologies. Groups were supportive of a varied renewable energy mix. Delegates also felt that energy generation through renewables was only part of the solution arguing for increased energy efficiency development. Additional Information – onshore wind forms a major part of energy generation in 2020 in all five scenarios outlined in the Draft SEF. It is second only to fossil fuels. The reliance on onshore wind is perhaps pragmatic as it is 'the most economically and technically advanced of all renewables, able to compete in cost with other conventional generation and deliver on a large scale'. Contents1 Introduction 2 Opening remarks 2.1 Sustainable Energy Authority of Ireland: Marine Renewables – a development opportunity for Ireland 2.2 Action Renewables: Renewable Energy in Northern Ireland 2.3 European Commission Office in Northern Ireland 3 Economic Issues 3.1 Competitiveness 3.2 Resources 3.3 Risk and uncertainty 3.4 Financing 3.5 Best Practice 4 Government Issues 4.1 Leadership 4.2 Strategy 4.3 Joined-up action 4.4 European Engagement 4.5 Planning 5 Energy 5.1 Infrastructure 5.2 Public opinion 5.3 The research base 5.4 The energy mix IntroductionThe following paper provides further information on the Committee for Enterprise, Trade and Investment's renewable energy workshops held on the 18 May 2010. It supplements the previous briefing (NIAR241) by presenting a summary of delegate comments alongside other information (where appropriate) in order to place delegate statements into context. The paper begins by providing a brief overview of the event's opening speeches. Opening remarksPrior to the workshops, delegates received briefings from a number of specialists: Eoin Sweeny of Sustainable Energy Authority of Ireland; Michael Doran of Action Renewables; Maurice Maxwell of the European Commission Office in Northern Ireland; and Richard Hogg of Limavady Gear Company Ltd. The following section provides an overview of these opening remarks. Regrettably, it has not been possible to secure a copy of Richard Hogg's speech and as such it is absent from the overview. 2.1 Sustainable Energy Authority of Ireland: Marine Renewables – a development opportunity for Ireland Eoin Sweeny, from the Ocean Development Unit of the Sustainable Energy Authority Ireland, briefed delegates on availability of and opportunity presented by Ocean Energy in the waters surrounding the Island of Ireland. Ocean Energy offers three separate opportunities for development: wave energy, most prevalent off the west coast; tidal current flow, concentrated in the North East and Irish sea; and offshore wind, available around all of island. In all three cases the Island of Ireland had an estimated resource to rival or in cases exceed that available to the rest of Europe.[1] Significantly the presentation, drawing on a previous economic study, noted that: There is currently sound quantitative evidence that a fully developed island of Ireland Ocean Energy sector providing a home market and feeding a global market for renewable energy could by 2030 produce a total net present value of up to €9 billion to the Irish and Northern Irish economies.[2] Further to this it was noted that despite a degree of uncertainty surrounding the factors determining success it was thought that there was 'good precedent for a belief that Ocean Energy will delver on its promise: the technology development and cost reductions of onshore wind and electricity generating gas turbines being prime examples of this'.[3] 2.2 Action Renewables: Renewable Energy in Northern Ireland Michael Doran, Director of Action Renewables Northern Ireland, presented delegates with information on: the role of renewable energy; the opportunities and barriers for SMEs in the renewable energy industry in Northern Ireland; factors influencing the renewable energy industry; the role of government; and the future of the renewable industry. Renewable energy's role was thought to be threefold: environmental, tackling climate change; societal, ensuring energy security; and economic, assisting in energy price stability and job creation. Opportunities for SMEs were identified in: developing new technologies and services; business diversification; exporting knowledge; and the availability of research and development skill that could attract inward investment.

Looking to the future, developing Northern Ireland's renewable industry was a task that required:

2.3 European Commission Office in Northern Ireland Maurice Maxwell of the European Commission Office in Northern Ireland provided a European Context to renewable development. He began by painting a bleak picture of the current economic context – unemployment, sluggish structural growth and excessive levels of debt – but was optimistic that the EU could exit the crisis stronger if collective action was taken to create a 'smart, sustainable and inclusive economy delivering high levels of employment, productivity and social cohesion'. Delegates were briefed on the Europe 2020 strategy. Key elements under the strategy's 'resource efficient Europe' theme include:

Economic IssuesDelegate discussions on the economy examined a number of inter-related issues – competitiveness, financing, risk and uncertainty, resources and best practice. 3.1 Competitiveness What delegates saidDiscussions noted that the Northern Ireland renewable energy industry competed on two levels – globally and locally. That is, the industry is situated within and faces competition from Northern Ireland and global energy markets. Stakeholders argued that Northern Ireland was at a competitive disadvantage in the global renewable market. A common view amongst participants was that competitors outside of Northern Ireland could offer cheaper products (both technology and energy). Locally it was felt that the industry faced two obstacles. Firstly, Northern Ireland's energy sector was described as monopolistic. NIE's domination of the sector and the need to introduce greater competition into the market was highlighted. Secondly, stakeholders held the view that the indigenous renewable energy market was under-developed and that growth was slow. Invest NI's policy of favouring exporting companies was criticised in this regard. It was felt that, at current levels, the market could not fully absorb the skills available within the region, resulting in a brain drain. In addition, examples of firms developing innovative technologies in Northern Ireland only to subsequently move 'across the water to sell and to set up shop' were cited. Furthermore, it was suggested that renewable energy companies operating in Northern Ireland were often foreign owned, resulting in profits going elsewhere. Localisation or "communitisation" of the industry was put forward as a solution. That is, it was suggested that a cooperative model, within which local communities owned their energy system, might assist industry growth. CommentaryThe European Union publication 'Panorama of energy' (2009) is useful for placing the above comments into context as it provides an insight into the renewable energy industries of other EU countries, countries with which Northern Ireland would hope to compete. It is worth examining a number of regions in greater detail to provide a better understanding of their various stages of renewables development. For the purposes of this paper discussion is confined to the often cited European 'big hitters' – Denmark and Germany – a more complete analysis of EU countries, using the panorama as a starting point may be worthwhile in going forward. Denmark, according to the study, has 'developed a world class turbine industry and has had one of the most aggressive energy efficiency programmes in the EU' as such it is defined as a 'low energy intensity' and 'low carbon intensity' economy.[4] Looking at energy generation, in 1991 92% of the region's energy came from coal; by 2006 this had declined to 54%. Energy production from oil has also declined in the same period. Coal and oil production has declined as wind and gas have entered into the system (as of 2007 wind accounted for just over 15% of domestic energy supply[5]).[6] Increased use of biomass has also led to a decline in fossil fuel reliance. Figure 1 demonstrates the changes in Denmark's electricity production between 1991 and 2006. Energy efficiency has also been significant. Between 1980 and 2006 the Danish economy grew by approximately 50%; in the same period energy consumption has remained almost static.[7] As an exporter Denmark holds 'a leading position among the EU-15 for exports of energy technologies relative to total national goods exports'. Figures 3 and 4 below demonstrate this explicitly (note Figure 3 represents energy exports as a percentage of total exports, as opposed to total national exports). The largest proportion of Danish energy exports (technology and equipment) go to Germany (17%), followed by the UK and the USA. These three markets account for 40% of the region's total energy and equipment exports.[8] Denmark's successes in developing its renewable energy industry both internally and externally should be placed in context however. Denmark is the only net exporter of energy in the EU (as of 2009), largely due to oil and gas resources in the North Sea. Furthermore, the region has 'some of the highest energy and environmental taxes and levies in the EU'.[9] Figure 1: Denmark gross electric power generation by source[10]

Figure 2: Exports of energy technologies and equipment

Figure 3: Exports of Energy Technologies and Equipment relative to Total National Goods Exports

Germany in the first ten years of the twentieth first century Germany emerged as a world leader in renewable energy, particular in the development and exploitation of wind and biodiesel. As of 2006, 21GWs of wind power was installed in the region. By the same period Germany was producing 3.6m tonnes of biodiesel, 30% of global supply. According to the EU, the region is 'expected to easily surpass its target under the existing Directive (2001/77/EC) for renewable electricity of 12.5% in 2010'. The country had already reached 12% by 2006. Germany has set a target of 18% of final energy consumption from renewables by 2020 and has made a commitment to produce 25-30% of electricity from renewable sources by the same year.[11] Figure 4 provides an overview of German electricity production between 1991 and 2006. It is notable that despite the growth in wind generation the country, in 2006, still relied on coal considerably, with nuclear energy making up a significant proportion of electricity production. The growth of Germany's renewable industry has been attributed to, in part, the adoption of a feed-in-tariff. Biofuel production has also benefitted from tax exemptions.[12] Recent data on German renewable technology exports is difficult to locate. However, it is evident that as early as 2002 Germany's renewable technology exports accounted for 20% and 10% of its wind and solar production respectively. By the same period the country's renewable technology exports were estimated to value €350m, or around 10% of domestic production.[13] Figure 4: Germany gross electric power generation by source

3.2 Resources What delegates saidStakeholders acknowledged the wealth of renewable energy resources available to Northern Ireland in the form of wind, grass and ocean energy. An analogy was drawn with Saudi Arabia and other oil producing countries, suggesting that if Northern Ireland could successfully harness its renewable energy potential it could become as important to the new global energy economy as those countries are to the current fossil fuel based energy market. Some participants argued that too much emphasis (investment and policy) was placed upon on-shore wind to the detriment of other forms of renewable energy generation. Stakeholders also highlighted the human resources available in Northern Ireland. There was recognition that the skills required to grow the renewable industry already exist (particularly research and manufacturing), but it was necessary to figure out how best to utilise those skills. On the other hand, stakeholders suggested that the region has and could continue to suffer from a brain drain due to an underdeveloped indigenous renewables market (this is dealt with in more detail below). Participants were also keen to highlight Northern Ireland's 'vibrant manufacturing' base, which they felt could provide a sound foundation for the development of the renewable energy industry. CommentaryResourcesAgain, to put delegate statements in context it is worth examining Northern Ireland's theoretical resource in more detail. A 2004 study by Action Renewables into Northern Ireland's renewable energy resource noted that total installed fossil fuel capacity in Northern Ireland was 1400MW, while electricity demand was approximately 8150GWh per annum of which 3% was provided by renewables.[14] The same report estimated that total feasible renewable energy resource in the region was 1133MW of installed electrical generation capacity, providing 4,113GWh per annum. This majority resource was expected to be sourced from wind energy – onshore wind (565MW), offshore wind (500MW, nominal with further exploration required).[15] Table 1, below, provides a breakdown of findings from the Action Renewables study. The table suggests that after wind the next largest potential sources of energy are landfill gas (23.7MW capacity producing 177GWh per annum) and Municipal Solid Waste (MSW) (13MW capacity producing (111GWh per annum).[16] Tidal stream energy has not been included in the figures. The Sustainable Energy Ireland study Tidal and Current Energy Resources in Ireland (2004), estimates that waters around the Island of Ireland contain a theoretical tidal resource of 230TWH/yr. The same report, however, calculates the viable resource as 915GWH/yr. Northern Ireland's viable resource is calculated as 530GWH/yr (57% of the total viable resource in Irish waters). Northern Ireland's viable resource was found to be spread across four sites: the North East Coast (273GWH/yr), Strangford Lough (130GWH/yr), Copeland Island (125GWH/yr) and Lough Foyle (2GWH/yr).[17] The figures for on shore wind contained in Table 1 are considerably less ambitious than those contained in DETI's Draft Energy Strategy. The strategy outlines five renewable electricity generation scenarios for 2020 – 30%, 33%, 37%, 42% and 49%. The corresponding levels of wind generation for each scenario are as follows:

Scenario 3 has a lower installed wind capacity as it envisages 300MW of installed tidal stream energy (other scenarios target 50MW tidal stream), whereas Scenario 5 envisages 300MW of installed large-scale biomass generation (see Table 2 for further details).[18] Table1: Summary of the feasible renewable electricity resource in Northern Ireland by county[19]

Table 2: Northern Ireland Energy Mix Scenarios 2020[20]

Human resourceIn response to the UK Government's consultation on its UK Renewable Energy Strategy (2008), Energy and Utilities Skills, the Skills Sector Council for the gas, power, waste management and water industries stated: Critical to delivering the 2020 energy target will be getting the right skills, in the right places, at the right time and in the right quantities. Energy & Utility Skills - The Sector Skills Council for the electricity, gas, waste management and water industries, UK Renewable Energy Strategy Consultation Response They added, however, that uncertainty over future demand, particularly in the area of emerging technologies, presented a 'complex challenge'. To assist with this complexity the organisation recommended the government promote:

A 2009 Oxford Economics report for the Department for Employment and Learning on Northern Ireland identified the following strengths and weaknesses in Northern Ireland's skills base. Strengths:

Weaknesses:

The report noted that many jobs requiring high-level management qualifications or STEM subjects were located in the England's Greater South East. A headline figure illustrates the scale of Northern Ireland's difference with the UK average; that is, if Northern Ireland had sector concentrations equivalent to the UK average, there would be 4,000 more STEM degree holders in work.[24] The report forecasts, under a baseline scenario, job creation of 5,000 jobs per annum between 2008 and 2020. Under an aspirational scenario this would increase to 7,300 per annum. In both scenarios job creation in the utilities sector is predicted to be 200 per annum. To meet the demands of the baseline would require a 7.3% increase in engineering and technology graduates. Under the aspirational scenario, an 8.1% increase would be required. The report notes that the energy sector is a particularly STEM 'hungry' sector.[25] In 2008/09 a total of 660 Northern Ireland domiciled students gained an engineering and/or technology degree at a UK higher education institution. Of these, 105 were postgraduate degrees, 30 of which were doctorates. Of those gaining undergraduate degrees, 100 qualified with first class honours and 200 second class-upper division.[26] Oxford Economics' ultimate conclusion, however, is that 'even under the baseline forecast there would be a shortfall in subject areas such as mathematical & computer sciences, engineering & technology, law and creative art & design graduates'. To this it adds: Perhaps the emergence of 'green jobs', the reshaping of the financial and professional services sector and a more developed tourist industry will alter the shape of the skills mix and a different aspirational path may emerge.[27] 3.3 Risk and uncertainty What delegates saidStakeholders felt that risk aversion at both government and private-sector level hindered the growth of the industry. Risk aversion was thought to be particularly prevalent in the area of industry-led innovation and research and development. It was felt that investment risk could be countered by investing in a broad renewable energy mix. Uncertainty was cited as a factor in encouraging the perception of risk. The lack of an over-arching government strategy was thought to drive uncertainty in the market. It was felt that industry was reluctant to invest due to limited reassurances from government. Stakeholders argued that the immediate publication and implementation of the Strategic Energy Framework would counter some of the doubt that currently exists within the industry. CommentaryInnovationResults of the UK 2007 UK Innovation Survey found that Northern Ireland had the second lowest rate business innovation of all UK regions during the period 2004 to 2006. During this period 57% of all Northern Ireland enterprises were innovation active, compared to 69% in Eastern England the region with the highest proportion of innovative enterprises. In Northern Ireland, large enterprises were more likely to be innovative that SMEs. Cost was the most often cited reason for not partaking in innovation. Other reasons included lack of knowledge and market factors. StrategyFor commentary on strategy development please see section on Government issues below. 3.4 Financing What delegates saidThe slow development of the industry was attributed, in part, to insufficient investment and the difficulties firms encounter in raising finance. The notion that EU funding was 'too difficult' and particularly prohibitive to SMEs was raised by a number of participants. Some felt that sourcing funding was too expensive and resource intensive. The industry would like clear advice on such funding. It was suggested that this could take the form of guidelines on what is available, the criteria to be met and case studies of firms who have successfully secured EU monies. Some participants expressed dissatisfaction with what they perceived as a funding structure (at all levels of government) that appeared to favour universities. It was suggested that universities were being generally more successful in securing funding. Stakeholders, however, recognised that Grant investment should not be the only method of financing growth. Alternative suggestions included low interest loans, a renewable levy on electricity, tax incentives for research and development, and home owners buying/investing in technology on the basis of future cost savings. There was a general consensus that the current Renewable Obligation Certificate (ROC) system bred uncertainty and ensured that banks were reluctant to finance renewable projects, particularly in the current economic climate. Stakeholders argued that a Feed In Tariff would be more desirable even if the levels of support offered were lower, such a system would allow industry to predict future prices with a greater degree of accuracy. It should be noted that a counter argument was raised during these discussions, that is, the ROC system was responsible for bringing money into the Northern Ireland economy. CommentaryRenewable Obligation CertificateThe Northern Ireland Renewable Obligation (NIRO) is the main mechanism DETI employ to encourage renewables development. NIRO places a legal requirement on all licensed electricity suppliers to provide evidence to Ofgem that a specified proportion of the energy they supply to consumers contains has been generated using renewable sources. Ofgem issues suppliers meeting these requirements with a certificate – ROC – for every MWh of eligible renewable generation. NIRO also allows ROCs to be used as evidence of compliance. ROCs can be openly traded. Alternatively suppliers are permitted to pay a buy out fee to Ofgem for each MWh of the specified quantity that is not covered by presenting ROCs; the buy out fee for 2009/10 is £37.19 per MWh. At the end of each obligation period proceeds from buy-outs are redistributed amongst suppliers in proportion to the number of ROCs they produced. A ROCs Market value (approximately £45) is equal to the buy out fee plus anticipated buy out fee redistribution per rock.[28] Feed-in-TariffAs mentioned earlier the EU has, in part, attributed the utilisation FIT for the development of renewable technology in Germany. The 2008 Energy Act saw FITs introduced to parts of the UK (not Northern Ireland) for micro-generation. Under the UK system a household using 4,500KWH of electricity per annum that installed 2.5KW of solar PV panels would receive the following the FIT:

As outlined above, delegates were keen to see a FIT introduced in Northern Ireland. In February 2010, when announcing changes to the ROC system, the Department stated: Northern Ireland does not currently have the legislative powers to introduce a feed-in tariff. That is why DETI has proposed to amend the NIRO to provide increased support for NI small-scale generation under the NIRO to replicate, so far as possible in NI the support levels being proposed under the FIT. 3.5 Best Practice What delegates saidThroughout the discussions a number of countries were held up as examples of best practice, specifically Denmark, Germany, Norway and Scotland. Stakeholders argued that rather than attempting to 'reinvent the wheel' industry growth would be better served by copying successful growth models from elsewhere. CommentarySpace does not permit a useful analysis of each region's renewable strategy (although some information on Denmark and Germany is provided above) - a separate paper on this topic is likely to be worthwhile going forward. Government IssuesDiscussion on the opportunities and barriers associated with government issues focused on leadership, strategy, joined-up action, European Engagement and planning. 4.1 Leadership What delegates saidStakeholders felt that the government could demonstrate leadership and will by 'practicing what it preaches'. It was suggested that this could be achieved by utilising renewable technologies in government buildings, with Parliament Buildings cited as the ideal place to begin this process. It was similarly felt that decisive leadership could be shown by ensuring social housing employed renewable technology and energy efficiency into its design. In addition stakeholders suggested that government procurement practices could be more supportive of the renewables sector in general and renewable SMEs in particular. Discussions tapped into a wider debate concerning what the role of government should be and what was meant by leadership. Participants suggested the existence of a 'grant culture' and agreed there was a need to move away from this. Progress would better be served by a government who saw its role as facilitating industry growth. It was felt that the government should not overplay its role in sustainable energy rather it should incentivise the market, nurture it and provide it with customers without taking ownership of it. Stakeholders would like the government to clearly define its position on economic and regulatory intervention in the market place. CommentaryThe 'Green New Deal for Northern Ireland' drawing a Carbon Trust study states that: Northern Ireland's public sector organisations (including local authorities, healthcare trusts and universities) account for over 5% of NI's total energy use and around 700,000 tonnes of carbon dioxide annually. Total annual expenditure on energy from imported fossil fuels is around £130 million.[30] It has estimated that: 20% of its (public sector) energy use could be saved by an investment of £120-180 million on basic measures with a payback of 4-6 years giving recurring cost savings of £30 million per annum.[31] 4.2 Strategy What delegates saidParticipants acknowledge that the renewable energy targets set at EU and UK level were challenging. There was some concern with regard to how these could be achieved in a Northern Ireland context. As outlined above, participants were critical of the absence of a long-term renewable strategy. This, it was argued, has created a vacuum, which has been filled by uncertainty and instability. The lack of a long-term strategy was thought to be particularly problematic since the industry itself was attempting to plan 20-25 years ahead. Participants acknowledged that the introduction of the Energy Act (2008) in the rest of the UK[32] had removed this uncertainty. It was hoped that the SEF would achieve the same in Northern Ireland. Discussions also revealed that certain sectors from within the industry felt that they were insufficiently consulted during the drafting of the SEF. This concern was voiced by representatives of 'less-developed' technologies in particular. Again, participants felt this was symptomatic of the government's focus on on-shore wind. There was concern that the SEF would not adequately consider and target other technologies. This, it was suggested, could prevent the development of an efficient renewable energy mix in Northern Ireland. In a similar vein, participants expressed concern that previous strategic thinking had focussed on electricity generation whilst largely ignoring the significant contribution of heat generation. Some groups expressed the view that a macro level debate about energy cost in Northern Ireland was necessary. CommentaryTargetsThe EU Renewable Roadmap outlining its long-term renewables strategy called for a mandatory target of 20% share of renewables in the energy mix by 2020. The target was endorsed by EU leaders in 2007. The target called for a focus on three areas – electricity generation, biofuels, and heating and cooling systems.[33] The previous UK government had initial aspired to follow this 20% target, but backtracked. In 2007 the then Energy Minister stated: We're negotiating with the European commission, but it's got to be a considerable figure…It's got to be somewhere between 10% and 15%. The rationale behind this retraction was that the EU directive did not specify that member states had to meet the 20% target so long as it was met across Europe as a whole.[34] As such, the UK Renewable Strategy 2009 was predicated on a 15% renewable energy contribution to total energy demand by 2020. This overarching figure is to be achieved through:

Progress on the Strategic Energy FrameworkThe Draft Strategic Energy Framework (SEF) consultation began in July 2009 and ended in September of the same year. As recently as 8 June 2010 the final strategy remained unpublished. On that date the Minister stated: I am pleased to report that the Department received some 70 responses to the consultation on the strategic energy framework. Officials have carried out a detailed analysis of the responses, which has been helpful to me and will be useful in shaping the final document. I aim to have the final version of the SEF to the Executive in the next four to six weeks and, in any event, before the summer recess.[37] Heat generationThe Draft SEF has the following to say on the issue of renewable heat: Currently DETI has no statutory powers to allow it to work in the area of renewable heat – the Department's powers limit it to electricity and gas. DETI will therefore ask the Executive and the Northern Ireland Assembly for the statutory powers necessary to take this important area of work forward.[38] The Energy Act 2008 provides the statutory powers for a renewable heat incentive scheme to be introduced across England, Wales and Scotland.[39] 4.3 Joined-up action What delegates saidThere was a consensus amongst participants that energy was a cross-departmental issue. They suggested, however, DETI was the only department that considered energy as a high priority. Fragmentation across government departments and agencies was also thought to cause confusion in the market place. Participants added that fragmentation led to difficulties in securing funding. Consequently, participants argued that the combination of these two factors suggested the need for greater cooperation at a departmental level. Some suggested a more radical solution in the creation of a single department with a sole remit for all energy issues. CommentaryJoined-up action is a feature of the Draft Strategic Energy Framework. The draft document states that the: …establishment of an Interdepartmental Working Group on Sustainable Energy November 2008, will ensure a more coordinated approach across Government to the promotion of sustainable energy, including energy efficiency and renewable energy.[40] It notes too, that a key challenge of this group is to 'develop a report of recommendations in respect of coordinated sustainable energy by the end of this year, including appropriate structure(s) to continue joined up delivery'.[41] To date the working group has not produced a report. 4.4 European Engagement What delegates saidDiscussion on Europe acknowledged the wealth of EU (e.g. €50bn R&D Budget) funding potentially accessible by companies in Northern Ireland. The role of Invest NI in calling for proposals was recognised. There was however, a suggestion that EU funding was impenetrable and difficult to understand. As a result greater guidance from government was requested. Although not explicitly stated, recognition during the discussions of the Northern Ireland Executive Office in Brussels' remit for assisting SMEs in securing funding implied that this could be an area for future exploration. CommentaryFurther information on EU issues will provided to the Committee as part of a substantive paper on EU engagement. This paper will scrutinise sections of the European Commissions Work Programme 2010 relevant to the work of the ETI Committee, including energy. 4.5 Planning What delegates saidA number of participants suggested that Northern Ireland's planning system was slow and over-bureaucratic, stifling growth as a result. A review of planning, with a view to streamlining and simplifying the process, was suggested. CommentaryThe Northern Ireland Audit Office's report on Planning Service Performance (2009) found that:

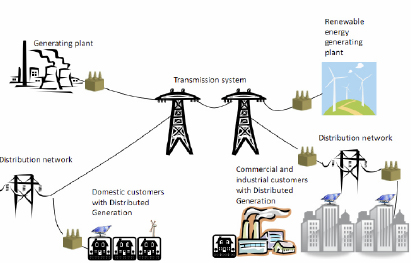

EnergyDiscussions on energy issues raised issues concerning infrastructure, public opinion, the research base and the energy mix. 5.1 Infrastructure What delegates saidParticipants held the view that the there is a lack of infrastructure to support the level of development required. Particular focus was paid to the grid, which was thought to be underdeveloped. In addition there was a degree of criticism from groups concerning the grid on two points: that the developer pays for connections; and that government consultation on grid connection has focused on large-scale wind producers. Some participants suggested that infrastructural change could necessitate difficult choices. The government and public may be required, for example, to weigh infrastructural improvements against the aesthetic beauty of the countryside. CommentaryGrid 25 sets out EirGrid's all-island grid upgrade strategy for 2008-2025. On the grid EirGrid has stated: Capacity has remained largely unchanged in the last 20 years, a period that has seen a growth of 150% in the electricity demand being carried by the system… to facilitate the necessary increase in renewable generation and to adequately meet the demands of the electricity customer, the capacity of the bulk transmission system will need to be doubled by 2025.[43] The body estimate that to ensure the SEM grid is fit for use will require investment of approximately €4bn. Such levels of investment would:

5.2 Public opinion What delegates saidDiscussions focused on a perceived lack of understanding amongst the public on energy issues and the role of renewable energy. Some suggested that a significant cultural barrier to the full acceptance of renewable energy existed in Northern Ireland. Participants agreed that educating the public would assist the growth of a low carbon economy. There was, however, some debate over who would be responsible for providing this education. One suggestion was to roll-out trial projects to show-case renewable technology. Related discussions questioned whether renewables are viewed negatively by the public. Participants suggested that problems associated with delays, waste, planning and finance have resulted in a negative backlash from the community. The Rose Energy plant was cited as an example of this. CommentaryIn a 2009, a Department of Energy and Climate Change (DECC) survey into public awareness and attitudes to renewable energy in GB, found that only 3% of the sample professed to not recognising any form of renewable energy. Survey results for individual technology types where as follows:

The same survey found the 60% of respondents strongly supported the use of renewables, while a further 25% slightly agreed.[45] "Attitudes and Knowledge of Renewable Energy amongst the General Public", published by the Central Office of Information in 2003 provides similar information for the UK as a whole. The report found that total awareness of renewable energy source was higher in Northern Ireland than other regions of the UK, see Figure 5 below. Northern Ireland also had the highest proportion of respondents who thought renewable energy was a 'very good idea' (see Figure 6). Similarly, a higher proportion of Northern Ireland respondents believed that renewable energy was preferable to fossil fuels (see Figure 7). Finally, Northern Ireland had the highest proportion of respondents who would 'strongly agree' with having a renewable energy generating built in their local area (see Figure 8).[46] Figure 5: Total awareness of renewable energy sources

Figure 6: Personal opinion of renewable energy

Figure 7: Personal opinion of renewable energy compared to fossil fuels

Figure 8: Personal opinion of renewable energy - "I'd be happy to have a 'clean' renewable energy generating station built in my local area"

5.3 The research base What delegates saidThere was considerable praise of Northern Ireland's academic research base amongst groups. Participants also suggested that technological advancement had been born from necessity, one contributor referred to an Economist article which claimed that 15 renewable energy technologies had been developed globally as a result of oil rising to £150 per barrel. Participants expressed the view that future needs would continue to drive technology, for Northern Ireland to lead the way. However, the government must assist in creating a business environment conducive to innovation. As outlined above, groups expressed concern that the lack of an indigenous renewable energy market may be contributing to a brain drain and motivating innovative firms to seek markets elsewhere. 5.4 The energy mix What delegates saidStakeholders questioned why there was an over-reliance on wind energy in Northern Ireland. Issues of intermittency and energy storage were raised by some. It was suggested that the focus on wind power was understandable since the technology was at a later stage of development and because 'wind power was the easiest to harness'. In general, groups were supportive of a varied energy mix. Two arguments in favour of this were raised. Firstly, a varied energy mix would supply consistency by providing alternatives during periods of no wind. Secondly, it would allow public and private sector investors to spread risk. In a related point, some suggested that technological solutions to energy production should only be viewed as part of the solution. To some, ensuring energy efficiency was an important initial step. CommentaryAs outlined in Table 2 (above), in all of DETI's five scenarios for energy generation in 2020, wind is the dominate form of renewable generation. It is, in fact, envisaged to be the second largest form of generation, with only traditional fossil fuel generation providing more generation to the mix.[47] This reliance is likely to be pragmatic as 'onshore wind energy is the most economically and technically advanced of all renewables, able to compete in cost with other conventional generation and deliver on a large scale'.[48] [1] Sustainable Energy Authority of Ireland, Marine Renewable – a development opportunity for Ireland presentation to Committee for Enterprise, Trade and Investment renewable energy workshop event 18 May 2010 [2] Ibid [3] Ibid [4] European Commission, Eurostat Panorama of energy - Energy statistics to support EU policies and solutions (2009) p34-37 [5] World Council for renewable energy, Danish Renewable Energy Policy http://www.wcre.de/en/images/stories/pdf/WCRE_Maegaard_Danish_RE_Policy.pdf (accessed 09/06/2010) [6] European Commission, Eurostat Panorama of energy - Energy statistics to support EU policies and solutions (2009) p34-37 [7] Ibid [8] Danish Energy Agency, Energy technology 11% of total Danish goods exports Denmark is spearheading development and export of energy technology and equipment http://www.ens.dk/en-US/Info/news/Factsheet/Documents/EKSPORTTEK.pdf_engelsk.pdf (accessed 09/06/2010) [9] European Commission, Eurostat Panorama of energy - Energy statistics to support EU policies and solutions (2009) p34-37 [10] Ibid [11] European Commission, Eurostat Panorama of energy - Energy statistics to support EU policies and solutions (2009) p37 - 40 [12] Ibid [13]Eberhard Jochem, Reinhard Madlener, and Wilhelm Mannsbart, "Renewable Energy Technology Diffusion: Prospects of the German and Swiss Industry in the World Markets," Proceedings of the World Renewable Energy Congress VII (2002) [14] Action Renewables A Study into the Renewable Energy Resource in the Six Counties of Northern Ireland (July 2004) [15] Ibid [16] Ibid [17] Action Renewables A Study into the Renewable Energy Resource in the Six Counties of Northern Ireland (July 2004) [18] DETI A Draft Strategic Energy Framework for Northern Ireland 2009 (July 2009) p38 [19] Action Renewables A Study into the Renewable Energy Resource in the Six Counties of Northern Ireland (July 2004) [20] DETI A Draft Strategic Energy Framework for Northern Ireland 2009 (July 2009) p38 [21] Ibid [22] Oxford Economics/DEL, Forecasting future skill needs in Northern Ireland – Final report (2009) [23] Ibid [24] Ibid [25] Ibid [26] Department for Employment and Learning, Qualifications gained at UK Higher Education Institutions: Northern Ireland analysis 2008/09 pp14-19 http://www.delni.gov.uk/he_qualifications_0809.pdf [27] Oxford Economics/DEL, Forecasting future skill needs in Northern Ireland – Final report (2009) [28] DETI The Northern Ireland renewable Obligation (NIRO) An Outline of its Operation http://www.detini.gov.uk/niro_-_how_it_works__2_.pdf (accessed 10/06/2010) [29] Feed in Tariff UK Facts on Feed-in-Tariff http://www.fitariffs.co.uk/ (accessed 10/06/10) [30] Friends of the Earth, The Green New Deal for Northern Ireland, http://www.foe.co.uk/resource/briefings/ni_green_new_deal.pdf (accessed 10/06/2010) [31] Ibid [32] It should be noted that while the Energy Act extends to the whole of the UK a large proportion of its provisions do not extend to Northern Ireland. [33] Euractiv, EU renewable energy policy http://www.euractiv.com/en/energy/eu-renewable-energy-policy/article-117536 (accessed 10/06/10) [34] The Guardian Minister confirms retreat from 20% renewable energy target (Oct 2009) http://www.guardian.co.uk/environment/2007/oct/24/renewableenergy (accessed 10/06/2010) [35] DECC The UK Renewable Energy Strategy (2009) p8 [36] Energy Ireland Yearbook 2010 p17 [37] Northern Ireland Assembly Official Report, Tuesday 8 June 2010, http://archive.niassembly.gov.uk/record/reports2009/100608.htm (accessed 10/06/2010) [38] DETI A Draft Strategic Energy Framework for Northern Ireland 2009 (July 2009) p21 [39] DECC Renewable Heat Incentive Consultation on the proposed RHI financial support scheme (February 2010) [40] DETI A Draft Strategic Energy Framework for Northern Ireland 2009 (July 2009) p17 [41] Ibid [42] Northern Ireland Audit Office The Performance of Northern Ireland's Planning Service – Report to the Northern Ireland Assembly by the Comptroller and Auditor General http://www.niauditoffice.gov.uk/pubs/onepress.asp?arc=False&id=231&dm=0&dy=0 (accessed 11/06/2010) [43] EirGrid Grid 25 http://www.eirgrid.com/EirgridPortal/uploads/Announcements/EirGrid_GRID25.pdf [44] DECC Renewable energy awareness and attitudes research: management summary (2009) [45] Ibid [46] Central Office of Information on behalf of: Department of Trade and Industry Scottish Executive, National Assembly for Wales, Department of Enterprise, Trade and Investment, Attitudes and Knowledge of Renewable Energy amongst the General Public (August 2003) [47] DETI A Draft Strategic Energy Framework for Northern Ireland 2009 (July 2009) p38 [48] Renewable UK (formally British Wind Energy Association) Onshore Wind: Powering Ahead A Report Prepared by BWEA (2006)

13 September 2010Aidan StennettIncentivising renewable electricity – a comparison of Renewable Obligation Certificates and Feed-in tariffsNIAR 300-10Paper examining the two main financial incentives used to stimulate renewable electricity development in Europe. Paper 300-10 13 September 2010 Executive SummaryThe following paper outlines two incentives designed to stimulate renewable electricity generation – Renewable Obligation Certificates and Feed-in Tariffs – as well as examining the debate surrounding their relative effectiveness. It should be noted that Northern Ireland does not have legislative powers to introduce a Feed-in Tariff at this point. Renewable Obligation CertificatesThe Renewable Obligation model is a quota based system that requires electricity suppliers (or transmission service operators in some cases) to supply increasing amounts of electricity sourced from renewable generation. In order to demonstrate that their obligations have been met suppliers must produce a Renewable Obligation Certificate (ROC) for every Megawatt hour (MWh) of electricity they supply to the relevant authority (Ofgem in the UK). Should they fail to produce the predetermined amount of ROCs, suppliers are required to pay a buy-out fee (in Northern Ireland this was £37.19 per MWh during 2009/10). The proceeds of this buy-out fee are redistributed amongst suppliers who have produced the required amount of ROCs in a particular period. ROCs are issued, free of charge, to generators for every MWh of renewable electricity produced. These are then sold to suppliers as a separate entity to the electricity itself. This has the effect of creating two markets and two revenue streams for generators – the electricity market and the ROC market. ROCs act as a premium on top of the market price (spot price) of electricity, and as such act as an incentive to RE development by contributing to its cost. Demand, within ROC market, is stimulated by the legal requirement placed upon suppliers to produce an increasing number of certificates at the end of each obligation period. The buy-out fee and redistribution mechanism serve as an extra incentive for suppliers to purchase and hold ROCs. Since the price of a ROC and the price paid for renewable electricity are determined by market forces, the revenue streams available to generators in jurisdictions operating this system are variable. Northern Ireland, like the rest of the UK utilises ROC system. These systems offer different incentives for specific technology types by banding ROC levels according to technology (e.g. Onshore wind up to 50kw installed capacity receives the equivalent of four ROCs per MWh produced, where as Offshore wind receives the equivalent of two ROCs). Certificates issued as part of the Northern Ireland Renewable Obligation and Great Britain Renewable Obligation are mutually tradable across the UK. Feed-in TariffsAt their most basic FITs work by setting a fixed price for renewable electricity for a fixed rate of time. Suppliers (or transmission service operators) are obliged to purchase every MWh of renewable electricity produced. There are two broad categories of FITs – market-independent FITs and market-dependent FITs. Within each category there are number of subcategories which operate at various levels of complexity. There are four examples of market-independent FITs:

Market-dependent FITs include: