| Homepage > The Work of the Assembly > Committees > Environment > Reports | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ms Julie Broadway |

Department of the Environment |

1. The Chairperson: The next item is a briefing on the draft local government (finance) Bill. On 17 June 2008, the Minister of the Environment, Sammy Wilson, notified the Committee of his intention to bring forward a Bill, subject to the agreement of the Executive, to deal with the modernisation of local government finance, councillors' remuneration, the introduction of a severance scheme for councillors, the creation of transition committees, and the introduction of controls over council borrowing, disposals, contracts and the application of capital receipts and reserves prior to reorganisation.

2. An accompanying policy paper requested that the Committee note the policy content and drafting of the proposed Bill, and the Department's intention to consult on the policy and draft Bill simultaneously. A date for introduction was not provided, but the Department confirmed that the Bill will not proceed by accelerated passage.

3. The Minister informed the Committee by letter that he is considering the possibility of moving the enabling provisions regarding the timing of the proposed severance scheme and the introduction of transition committees into the local government contracts and compulsory purchase Bill. The Minister has not made a final decision on the matter.

4. Committee members have been provided with a copy of the local government (finance) Bill policy paper, and a copy of a letter from the Minister, Mr Sammy Wilson, dated 13 July 2008, which provided clarification on Assembly procedure for the Bill. Departmental briefing notes are included.

5. Ms Julie Broadway (Department of the Environment): The main aims of the proposed local government (finance) Bill will be to modernise the legislative framework for financial management by district councils, to enable the Department to make severance arrangements for councillors, and to introduce preliminary provisions to assist with the reorganisation of local government from 26 to 11 district councils.

6. The proposed Bill will cover four main areas. I will deal with local government finance provisions first.

7. Most of the legislative framework for local government finance has been in place for more than 30 years and requires amendment in order to bring it up to date and in line with current best practice. District councils in Northern Ireland are subject to departmental controls, for example they need to get departmental approval before borrowing, applying capital receipts and applying sums to capital, or renewal and repairs, funds. The proposed Bill will make provision to relax some of the current departmental controls, thereby enabling district councils to manage their financial affairs to best effect on behalf of ratepayers.

8. That will align the framework of local government finance in Northern Ireland with the most appropriate and modern finance practices elsewhere in the UK. The proposed Bill will introduce a prudential regime for capital finance, enabling councils to decide prudent and affordable levels of debt, in line with guidance produced by the Chartered Institute of Public Finance and Accounting. It will extend to all Departments the power to pay grants in relation to their areas of responsibility, rather than just to the Department of the Environment, which is the case at present.

9. The Bill will make provision in respect of councillors' remuneration and severance. A councillors' remuneration working group was established by a previous Environment Minister in 2005, and it made its recommendations in June 2006. Those included setting up an independent remuneration panel to consider the system, and level, of allowances payable to councillors.

10. Furthermore, the working group recommended the introduction of severance arrangements for councillors. It is proposed that the legislation should implement those recommendations by providing enabling powers for the Department to establish the remuneration panel and to make provision for severance arrangements for councillors who do not stand for re-election. The Department intends to issue a more detailed paper on severance by the end of the year.

11. The Bill will make preliminary arrangements for restructuring local government. In the period leading up to reorganisation, it is important to introduce controls on specific financial commitments by existing councils, so that the new district councils do not inherit unreasonable financial commitments from the date of reorganisation. The aim is to prevent an existing council from binding a new council to sizeable, or long-term, contracts or loan arrangements, or from disposing of land, property or capital receipts and reserves without referral to the other council or councils with which it will join to make a new council.

12. It is proposed that the legislation should require an existing council to obtain written consent from all councils due to join with it in the formation of a new local government district before entering into any of the above transactions that exceed specified financial limits. Departmental officials are in the process of developing a policy in that regard.

13. In addition, it is proposed that the Bill should require existing councils that are due to amalgamate in the formation of a new district council to form joint committees — known as transition committees — to prepare for the introduction of the new councils. The Bill will include an enabling power for the Department to make subordinate legislation to specify the functions and powers of the transition committees.

14. I now turn to the timetable for the local government (finance) Bill. We currently await the Executive's agreement to the policy proposals, and its permission to proceed with drafting the Bill. Subject to the Executive's approval, we plan to consult on the proposals and draft legislation at the end of 2008 and the beginning of 2009. The legislation must come into operation at the beginning of a financial year, and it is anticipated that that will be April 2010.

15. As the Chairperson mentioned, it is likely that the severance and councillors' remuneration provisions, the transition committee provisions, and the controls on council finances in the run-up to reorganisation will be moved into the local government (contracts and compulsory purchase) Bill before its introduction to the Assembly. That would ensure that the provisions are introduced as soon as possible. They are not being moved into the local government (contracts and compulsory purchase) Bill at present because the consultation document on the Bill has already been drafted and we do not want to hold up the consultation process. However, the provisions will have been consulted on before they are moved into contracts legislation.

16. Mr Weir: In discussing the local government (finance) Bill — and, in particular, transition committees — I declare an interest as a member of the policy development panel on governance.

17. I presume that the independent panel will advise on the level of councillors' remuneration allowance and on the severance scheme after 2011. There would not be much point in that panel being set up to look at remuneration provisions before 2011.

18. Mr Ian Maye (Department of the Environment): The Minister's intention is to establish the committee in the run-up to 2011, so that it can provide proposals for remuneration.

19. Mr Weir: I presume that severance will be dealt with separately and not by that panel because it would need to be done a lot more quickly.

20. I appreciate that we are broadly discussing enabling powers for transition committees to be formed by councils.

21. Perhaps a definitive decision has not yet been taken; however, the powers of the transition committees will be dependent upon the attitude to a shadow period. Has the Department come to a definitive view on whether there will be a post-election shadow period? If it has decided that there will not, the powers of the transition committees will have to be fairly strong to deal with such issues as the appointment of chief executives, staffing issues, and a range of other matters.

22. Mr Maye: The Minister has not yet reached a firm view. It is a cross-cutting issue, so he will have to take his firm view to the Executive to seek their agreement on whether there should be a shadow period. There have been discussions in the strategic leadership board on the issue. At its last meeting, the board agreed that it would commission a paper jointly prepared by the Northern Ireland Local Government Association (NILGA) and departmental officials to explore the pros and cons of a shadow period. That paper is due to be considered at the next meeting of the strategic leadership board on 3 October 2008.

23. The Minister's view will be informed by that paper and by the discussion that flows from it. He will then reach a view on whether there should be a shadow period, and engage, as necessary, with others to bring that view to the Executive.

24. Mr Weir: I know that enabling powers have been given, but before anything was put in place as regards severance — either negotiations or discussions with the representative bodies in particular — from a councillor's point of view, the body that played the biggest role in that regard is probably the NAC. Is the intention to hold some level of discussion with that body beforehand?

25. Mr Maye: The Minister already met the NAC to discuss those issues. He assured the NAC that he would work with it to draw up detailed proposals and to consult widely on those.

26. Mr Weir: I was intrigued by the reference to the control mechanisms in relation to capital receipts. I understand — and it is justified — that there is a level of constraint on councils to ensure that they do not take a short-sighted view and attempt to get their money's worth, sell assets or commit to various capital projects.

27. I also understand that there is a need to consult with the neighbouring councils that will form that body. Will the Department have any mechanism to examine whether obtained written consent is reasonable? There could be a situation in which there are two councils, with one council having a particular capital project in mind. The neighbouring council might not be keen on spending that amount of money, and it will refuse. That project could be frivolous, or it could be something that is very much in the public interest. Is there any check or balance to ensure that a council cannot unreasonably block the decisions of other councils' on that basis? Will there be any mechanism — potentially from the DOE or some sort of appeal mechanism from the council — either in relation to the sale of an asset or the building of it to ensure that —

28. The Chairperson: If I could come in on that point, Peter. That will become an interesting area because if a transition body is making a decision in a shadow period, a new council could come in and try to unravel that decision, depending on that council's priorities are. I am intrigued by that.

29. Before you answer, I saw that Mr Gallagher indicated that he sought clarification on an earlier issue.

30. Mr Gallagher: I am afraid that I do not seek clarification. I will make a comment on how messy the approach of the Department is in relation to the arrangements. Prior to 3 July 2008, Minister Arlene Foster came to the Committee and said that there would be no shadow councils. She also said that in the Assembly. On 3 July 2008, the successor to the post, Sammy Wilson, came to the Committee with Stephen Peover. Mr Peover said that there would be no shadow year; instead there would be formal transitional committees. That was his wording.

31. There are significant issues to be taken forward either in shadow or transitional committee form, preferably in shadow form, if a serious attempt is to be made to exercise democratic control in relation to local government in the future.

32. The Department today tells the Committee that it does not know whether there will be shadow committees. In fact, the witnesses have made it clear that the Department is again rethinking whether to form shadow or transitional committees. Therefore, it is disappointing that, after all this time — and when the public feels there is not much Assembly business time to waste — we are again in the situation where the Department cannot make up its mind.

33. Mr Maye: I will respond to that comment first. It is fair to say that the position of the current and the previous Ministers was that they were minded not to have a shadow period. However, in discussion with the sector, through the strategic leadership board and with the parties, it was realised that significant issues had to be addressed before a final and firm decision was taken.

34. The decision on whether to permit a shadow period will have an impact on the powers and responsibilities of the transitional committees. The Department's view, shared by the local government sector, is that transitional committees will be needed. However, the precise roles, responsibilities and powers of those committees will flow from the decision on whether to have a shadow period.

35. Because all of the Department's plans and preparations flow from that political decision, it is something that must be tied down quickly. It is, therefore, something that the Department and its Minister want to address as soon as possible. However, the Minister wants to work with the sector to ensure that everyone understands the consequences of whatever decision is reached.

36. The Chairperson: Mr Weir raised several points.

37. Ms Broadway: I would like to return to the point about checks and balances in relation to the controls. The policy is not full developed on that. We can take those points onboard for consideration.

38. Mr Weir: We must have a mechanism that enables an appeal to the Department in cases involving an unreasonable refusal of written consent.

39. The Chairperson: Does that cover everything that you raised, Peter?

40. Mr Weir: The witnesses have covered most of the points in their answers.

41. Mr Ford: I want to follow through on some of those points, because it seems to me that there are more gaps than detail. I am not blaming the witnesses because there are unknown factors, but it is not satisfactory to be consulted on a Bill in which it is admitted that the issue of a transitional committee is not dealt with in a clear manner.

42. The Minister says nothing in paragraphs 29 and 30 of his memo to the Committee about whether it is planned to have a body that would liaise for a general chat now and again about how things might go; or whether, in the absence of a shadow period, it could be given quite wide-ranging powers. In that context, it is possible that every member of the transitional committee might retire or fail to be elected to the new body. It is a relatively new concept in these islands that anybody should be granted the power to bind their successors in such a way.

43. Specifically, on severance pay, in your submission you promised a paper by the end of the year. There was also talk of moving the issue of severance pay into the local government (contracts and compulsory purchase) Bill. Given that the rest of the Bill will be subject to Executive approval, which may take some time; is an end-of-the-year timescale a reasonable one in which to make those kind of decisions?

44. Ms Broadway: The Bill will contain an enabling provision on severance, and the detail will be in regulations. In order to develop a severance scheme, we propose that the detail go out to consultation by the end of the year.

45. Mr Ford: That will get you off the hook for the next few months, but the detail of the severance scheme will also require proper consultation — even if it is secondary legislation. The problems of this autumn may be solved by leaving everything to secondary legislation, but it will do nothing to advance the course of local government reform, if we are stuck in that position.

46. Mr Maye: It is our intention to consult on the detail of a severance scheme while the Bill's provisions are brought before the Assembly, thereby informing the Committee and the Assembly, as a whole, of the detail of the proposals while they consider the broad enabling provisions of the Bill.

47. Our Minister has taken that view in consultation with all the political parties. The broad intention is to ensure that a fully fledged severance scheme is in place as early as possible — probably in early summer or late autumn — in 2009. Certainly, that scheme should be available from then. Meanwhile, discussions among the NAC, the political parties, and the strategic leadership board continue.

48. Mr Boylan: You talked about a severance scheme for councillors who opt not to stand for re-election. From a personal perspective, would the severance scheme also cover councillors who decide to co-opt for whatever reason? If so, will you clarify when that might happen?

49. The Chairperson: Are we trying to ….? [Laughter.]

50. Mr Boylan: You do not have to answer that last question.

51. Will the severance scheme cover all elected representatives who, for one reason or another, may need to step down or to be co-opted?

52. Mr Maye: The Minister has opened discussions on the issue of co-option with the Secretary of State; it is up to the Northern Ireland Office and the Secretary of State to decide whether to make legislation pertaining to that. Those discussions are at an early stage and have not yet reached fruition. Broadly speaking, the Minister intends to have the necessary arrangements for co-option, whatever they may be, to be put in place at the same time as the severance scheme is launched, so that the two work hand-in-hand.

53. Mr Boylan: Will you ensure that any remuneration dates back to 2005, Chairperson? [Laughter.]

54. The Chairperson: I see what you are getting at.

55. Those among us who are councillors will know that it takes only one objection to a member's being co-opted to scupper the process and to put the decision to a by-election, which brings with it associated difficulties — not necessarily the cost to ratepayers. The legislation should address that key area by ensuring a smooth transition of members.

56. Ms Broadway: The Minister will discuss that issue with NIO, which governs the legislation required to address that issue.

57. Mr Gallagher: I want to return to the issue of the timetables for the two Bills. You said that the local government (contracts and compulsory purchase) Bill must come before the Assembly in February 2009. You also said that the local government (finance) Bill — which provides for the formation, functions and powers of transition committees — will go out to consultation in late 2008 or early 2009. Towards the end of your presentation, Julie, you said that parts of the local government (finance) Bill may be incorporated into to the local government (contracts and compulsory purchase) Bill.

58. I think that the parts of the local government (finance) Bill to which you referred relate to transition committees. Therefore, as Mr Ford said, it is a new concept to have councils going out of business and making all the decisions for their successors who have yet to be elected. As it is such a complicated and detailed matter, it is not very satisfactory, at the eleventh hour, to start piling detailed matters from one Bill into another Bill that is before the Assembly.

59. We know how these things work. There would be very little time for any discussion about the matter. There may be a consultation period, but it is unsatisfactory for the Department to take short cuts when making serious business decisions, which will have huge implications for the way in which local government and their workers, including those in the most senior positions, operate in the future. Yet, you are suggesting that that is what the Department may do.

60. Mr Maye: Perhaps it would be best if I explain why the Minister feels that such action might be necessary. His views were not formed by a discussion with his departmental officials. He has explored with us the feasibility of moving certain provisions on severance and transition committees across to the local government (contracts and compulsory purchase) Bill, because his party colleagues and other political parties made a request for a severance scheme to be put in place at the earliest possible date in the run-up to the creation of the new councils in 2011. That is why he asked us to keep that possibility open and to ensure that the Committee is briefed on it.

61. Furthermore, the Minister is receiving representations from party colleagues, from other parties and from the strategic leadership board, requesting that we should aim to have formal statutory transition committees in place as early as possible in the implementation process leading up to the creation of the new councils in 2011. Therefore, the Minister is not putting forward those proposals on a whim. They are the result of discussions with colleagues on the strategic leadership board and with other political parties. However, no firm decisions have been taken on whether that is the route that we will take. The outcome very much depends on the discussions that we have with the Committee, on discussions that the Minister has with his party colleagues and others, and also on discussions within the strategic leadership board and the policy development panels.

62. Mr Gallagher: In relation to transition committees, my party colleagues on the strategic leadership board have not indicated that they want business to be done in that way. That is a fact.

63. Mr Maye: The reason that we are exploring the shadow-period issue again is that those involved want to ensure that the arrangements that are put in place for transition committees are agreed by all parties and are agreed across the sector, so that we have a clear understanding from the outset about what those committees are set up to deliver and why. That view is being put forward by all the parties on the strategic leadership board. They want to ensure that we have a clear understanding as to what the committees are empowered to do.

64. The Chairperson: There is more talking to be done and decisions to be taken.

65. Mr Maye: A fair bit more.

66. The Chairperson: Paragraph 7 of the draft policy paper relates to the proposal of a new borrowing power so that district councils will be free to raise finance for capital expenditure, without the need for prior approval from the Department. Forgive my ignorance in these financial matters, but in his draft policy paper, the Minister says: "I also propose reserve powers for my Department to set limits on borrowings and credit but I envisage that these would only be used in exceptional circumstances."

67. How do you ascertain that a council has gone beyond the limit whenever the deed is already done? If the councils are given the independence to do what they will, but at the same time the Department reserves powers to set limits on borrowing, the two do not seem to be compatible, unless there is a mechanism that I am missing, or has not been worked out yet.

68. Mr Maye: We see that situation replicated in other parts of the UK and in other jurisdictions. The intention is to relax the borrowing regime to make it easier for councils to put forward their capital programmes, finance those programmes and develop their services. The reserve power is a power of final resort, where it is clear that the council has gone, or is proposing to go, well beyond the pale.

69. The Chairperson: That is the issue. How is that power triggered, other than a council member saying that he or she opposes the level of borrowing and will bring the matter to the attention of the Department? The action may be too late, or it may be illegal.

70. Ms Marie Finnegan (Department of the Environment): The controls that are available under the Local Government Act (Northern Ireland) 1972 are very tight. A council requires departmental approval if it wants to borrow money to build a leisure centre, for example, or to buy a vehicle. Local authorities in GB are subject to more relaxed controls, and are left to draw up their own capital programmes. However, they must assure their ratepayers that what they are doing is affordable, prudent and sustainable. Councils in GB set their own borrowing limits. They set their capital budgets in their annual budgets, within which they must determine their borrowing limits.

71. That system seems to work quite well in other regions. It is backed up by the Prudential Code, which sets out benchmarks and provides guidance. We plan to mirror the GB pattern. It is new to us, but it would loosen up matters for councils and allow them to take control. The auditors would still come in at the end of the day to ensure that any borrowing, any loans were being serviced.

72. The Chairperson: I am trying to get this into my head. Forgive me for drawing such an analogy, but, say, if a council turns radically left or bolshie and makes a decision — that kind of scenario —by the time the auditors arrive the decision will have been taken. It is a case of closing the stable door after the horse has bolted. I am trying to determine how such a system could work. I understand the principle and the theory, and that it will allow councils some autonomy, and some extra elbow room to make decisions without having to go back to the Department on every occasion. On the other side, what is the mechanism for allowing that reserved power to be used?

73. Mr Maye: There are several mechanisms that can initiate the process. It could be a complaint from a member of the public who is concerned about a council's spending plans, or a complaint from one or more councillors. There could be a challenge within the council on the basis of whatever new governance arrangements are agreed. Such a challenge could be submitted to the Ombudsman or to the Minister.

74. The Chairperson: What I am trying to get at here is whether there is a requirement? You are expecting someone out there to have the goodwill and ability to do it themselves, the ability to look at it and decide that it is a bit through-other. Is there an onus or duty upon officers to do that?

75. Mr Maye: A reporting mechanism?

76. The Chairperson: I wonder whether it works that way elsewhere. It may well never have occasion to happen. However, there seems to be a concept built in here without mechanism.

77. Mr Maye: We will explore what the arrangements are in England, Scotland and Wales, and find out how it is used in practice, if at all. My understanding is that it has been used very infrequently.

78. The Chairperson: It will be interesting to hear when it has happened and if it has happened too late — that sort of thing.

79. Mr Ford: I appreciate that the answer to this question is "I do not know", but I ask it anyway. What exact provisions of the draft local government (finance) Bill are being considered for transfer to the local government (contracts and compulsory purchase) Bill? We understand that they include the severance payments and the transition committees, but does it also include the potential transitional financial controls?

80. Mr Maye: No. At this point, consideration is limited primarily to severance provisions and possibly to the transition committee provisions as well.

81. The Chairperson: There are no further questions from members. Thank you very much indeed for attending today. Undoubtedly, we will be seeing you again.

23 April 2009

Members present for all or part of the proceedings:

Mr Patsy McGlone (Chairperson)

Mr Cathal Boylan (Deputy Chairperson)

Mr Roy Beggs

Mr Trevor Clarke

Mr David Ford

Mr Tommy Gallagher

Mr Ian McCrea

Mr Daithí McKay

Mr Alastair Ross

Mr Peter Weir

Witnesses:

Ms Julie Broadway |

Department of the Environment |

|

Mr George Craig |

arc21 |

|

Mr Damien McMahon |

North West Region Waste Management Group |

|

Mr Gev Eduljee |

SITA UK |

82. The Chairperson (Mr McGlone): I welcome Ms Marie Finnegan, Ms Julie Broadway, Mr Denis McMahon and Mr Tommy McCormick from the Department of the Environment. I invite you to give the Committee an overview of the draft Local Government (Contracts and Compulsory Purchase) Bill. You have been asked to remain after you give your evidence, because representatives from the other groups, including SITA, may raise issues from which we might learn something. The Department may have overlooked something or could benefit from learning about experiences elsewhere. Similarly, the other groups may learn from your experiences.

83. The consultation on the draft Local Government (Contracts and Compulsory Purchase) Bill ended on 12 March 2009. At our meeting on 11 December 2008, the Committee requested a departmental briefing on the synopsis of responses to that consultation. Members should note that the draft Bill makes provision for local authorities to establish long-term financial arrangements under public-private partnerships (PPPs) and public-private initiatives (PPIs) to enable Northern Ireland's landfill-directive obligations to be met.

84. The draft Local Government (Finance) Bill has been delayed, but, owing to time pressures, the Department is considering consulting on the severance and transitional-arrangements elements of the draft Bill separately in advance, before adding them to the Local Government (Contracts and Compulsory Purchase) Bill. The relevant consultation documents will be considered later in the meeting.

85. Members should note that the Committee has given a commitment to the Department that it will not seek an extension to the Committee Stage of those draft Bills, and the Department has agreed not to seek accelerated passage. However, in Committee on 26 February 2009, the Minister said that the squeeze on time is getting tighter because the draft Local Government (Contracts and Compulsory Purchase) Bill has not yet received Executive clearance.

86. Mr Weir: I forgot to mention at the beginning that, should there be any discussion on the transitional arrangements, I declare an interest as a member of one of the transition committees and, more pertinently, of policy-development panel A, which is tasked with the governance of the transitional arrangements.

87. The Chairperson: Thank you for that. Members' packs contain a synopsis of responses to the consultation on the draft Local Government (Contracts and Compulsory Purchase) Bill, along with copies of the policy documents for that draft Bill and for the draft Local Government (Finance) Bill. Written updates on the draft Bills are included for Committee members' information.

88. Julie will give the Committee an initial overview of the draft legislation. I ask that you take 10 or 15 minutes in which to do that, before taking queries from members.

89. Ms Julie Broadway (Department of the Environment): I thank the Committee for affording us the opportunity to brief it on the consultation responses to the draft Local Government (Contracts and Compulsory Purchase) Bill. In addition, I will update members on the current position of the draft Local Government (Finance) Bill.

90. First, I shall introduce my colleagues and tell you about their specific interests in the two draft Bills. Denis McMahon is from the Department's planning and environmental policy group (PEPG), which deals with the waste-infrastructure programme. Marie Finnegan is the head of the finance branch of the local government policy division (LGPD), and Tommy McCormick and I are from that division's policy and legislation branch.

91. We last briefed the Committee on the two draft Bills in September 2008, so I will bring members up to date with what has happened with both since then. On 5 March 2009, the Executive gave policy clearance for the draft Local Government (Finance) Bill. Instructions have been sent to the legislative draftsmen, and the Bill is being drafted. It is anticipated that it will be drafted by the end of May 2009, when we will seek the Executive's approval to commence consultation on both the policy and the draft Bill. We hope to be in a position to consult on the proposals from July to October. The consultation will take place over the summer, so we are aiming to conduct a four-month consultation. The consultation document will, of course, be referred to the Committee before it is issued, and we will send the Committee a synopsis of the responses once the consultation period has concluded.

92. The Local Government (Contracts and Compulsory Purchase) Bill will take the form of a local government Bill rather than a contracts Bill, because of the need to add certain measures from the draft Local Government (Finance) Bill to it. The main purpose of the legislation will be to clarify councils' power to contract with the private sector in order to remove any concerns that contractors and their financiers may have about entering into such contracts. That will reduce the possibility of delays, particularly in the waste-infrastructure procurement process. In addition to the provisions on local government contracts, the Bill will contain provisions to enable councils to acquire land by means other than by agreement, such as vesting for waste-management purposes.

93. In our evidence to the Committee in September 2008, which I have already mentioned, we indicated that two other elements will be added to the Bill: severance arrangements for councillors; and transition committees. For the Committee's information, the consultation documents for those provisions have been issued, with a closing date of 31 May 2009.

94. The main aim today, however, is to brief the Committee on matters for which consultation has already taken place, primarily on contracts. The consultation document, which included a copy of the draft Bill, was issued in December 2008, with a closing date for replies set at 12 March 2009. We received 14 replies to the consultation: seven from councils; three from waste-management groups; and two from other local government bodies. We have forwarded a synopsis of those replies to the Committee, together with the Department's response to the points that were raised.

95. We are happy to take questions in response to the matters that I have outlined.

96. Mr Weir: I seek some clarification on a couple of points. Am I right to assume that the compulsory-purchase powers for vesting apply not only to councils but to groups of councils? For example, would each of the three waste-management groups be able to avail itself of those powers?

97. Mr Denis McMahon (Department of the Environment): That is correct.

98. Mr Weir: Much focus and, to be fair, urgency has been directed towards waste management as a result of the European Union's focus on it. I presume that there may be implications for the future, both good and bad. If, for example, shared services were being considered as part of the review of public administration, would there be opportunities for groups of councils to come together to avail themselves of those powers?

99. Ms Denis McMahon: Yes.

100. Mr Gallagher: The urgency to which Mr Weir referred is an important element. Given the pace of development heretofore, I do not quite see how the development of public-private partnerships will match that urgency. In the great majority of public-private partnerships, there is a history of delays and further delays. Given the different economic climate that we are experiencing, such delays will continue to operate for the foreseeable future. What are your views on the need for urgency in the development of public-private partnerships?

101. Mr Denis McMahon: There are two points to be made. First, we must ensure that there is confidence in the market. Frankly, there is no point in entering into any tendering process unless one is going to get an appropriate response from the market. We have had a strong response from the market, as demonstrated by the number of bidders, and, so far, we have two waste-management groups at that stage of the procurement process.

102. That is one area that may be a bit better than some other areas of private investment, because a public-private partnership is a long-term, fairly safe type of contract for the private sector to enter into. However, it is very important that legislation is in place to reassure potential private-sector partners that the councils are going to have the appropriate vires. In the past, in England, there have been cases in which councils have found that something has gone wrong but have not had the power to address the problem or make the payments. That is the sort of thing about which the banks get very nervous.

103. When we get to the financing stage, several options are available. We tend to think of public-private partnerships as having one particular model, which is the one that applied in the past. However, one of the distinguishing characteristics of the procurement exercise is that, through the strategic waste infrastructure fund (SWIF), which is published, we will probably end up using some Government capital. Therefore, it is not necessarily a case of going to the bank for everything. In fairness to the waste-management groups — one of which the Committee will be talking to today — and without getting into the issue of public-private partnerships, as far as budgets go, they have met all their timetable targets very effectively. That is what we need to see now that we are in the middle of a procurement process.

104. At a later stage in the procurement process, an opportunity will arise to address the funding issue, but that will depend on the market conditions throughout. Between now and the end of 2010, when the contracts will be ready to be signed, we must have absolute clarity on the issue of vires. This is a very important step in that process.

105. Mr Gallagher: You said that you are confident that, in the waste sector, such partnerships will move forward fairly quickly. If I understood you correctly, you said that it will be different in the waste sector than its will be in those sectors in which we have been developing public-private partnerships. Is that correct?

106. Mr Denis McMahon: All the sectors have different strengths and weaknesses, and one of the strengths of the waste sector is that it provides a service that will definitely be required. It is secure, because long-term solutions are required. That reassures the banks, perhaps more so than other sectors do.

107. Mr Gallagher: The business will always be there, so to speak.

108. Mr Ford: I shall make a couple of procedural points. In annex A to your letter to the Committee of 20 April 2009, it states: "There has been a slight slippage in the legislative timing for the Bill and it is now expected to become operational from November 2009."

109. Are you confident that there will be enough time for the Bill, including the added provisions to deal with severance and transitional arrangements, to have a proper Committee Stage and still be enacted by November 2009?

110. Ms Broadway: Yes, the provisions on severance and the transitional arrangements are enabling provisions. The body of the provisions will appear in the more detailed regulations. We are confident about that.

111. Mr Ford: Good. All nine respondents referred to aspects that they considered necessary in what was described as the "next phase of legislation". Their request for a power for councils to take part in a joint venture is to be addressed a forthcoming local government Bill. What is the timing for that particular Bill?

112. Ms Broadway: We will not be in a position to have those provisions in place in time for the third Bill that we plan to introduce, which will be known as the Local Government (Reorganisation) Bill. We are working on the policy proposals for that piece of legislation, so those provisions will appear the next Bill. Therefore, that will happen after May 2011.

113. Mr Ford: Is that likely to satisfy the need for the development of joint ventures?

114. Mr Denis McMahon: No. If that need exists, it is not likely. However, the key question is whether that need exists. The waste-management groups are currently working towards having a project structure that will not require a joint venture. Therefore, at this stage, we do not see a joint venture as being a real option. However, it is useful and important to have that option. We would like to have that option in place, and, in an ideal world, we would have it in place now.

115. Mr Ford: Are you satisfied that, for the next three or four years, the three existing groups will be adequate?

116. Mr Denis McMahon: We are content that a joint venture will not be required for the purpose of those procurement processes that are currently under way. However, we would like to have provisions on the statute books in the event of their ever being required in future. The waste-management groups have raised some other points that, it is important to stress, are absolutely critical. The powers to make guarantees, warranties, and indemnities will have to be in place in time for the contracts to be signed in 2010. Those powers are all being built into —

117. Mr Ford: I appreciate that, under your suggested timescale, those powers should be included in legislation very soon.

118. Mr Denis McMahon: It is critical that they are. If they are not in place soon, that would cause us a problem, but we are very confident that those will be put in place through the waste Bill, proposals for which are currently out for consultation.

119. The Chairperson: When will that consultation be completed?

120. Mr Denis McMahon: It will be competed at the end of May.

121. The Chairperson: Thanks you. I ask you to take a seat in the Public Gallery, please, because we may need clarification on some points that other witnesses raise.

122. The next item is the briefing by arc21 and the North West Regional Waste Management Group (NWRWMG) on the draft Local Government (Contracts and Compulsory Purchase) Bill. Representatives from SWaMP2008 are unable to attend today.

123. The committee contacted arc21 and NWRWMG on 3 March 2009 to request details of their responses to the consultation on the draft Bill. A copy of the response from SWaMP2008 was received and has been included in members' packs. Representatives from arc21 and NWRWMG have been invited to brief members on their views on the draft Bill.

124. We are joined by Mr George Craig, who is the financial director of arc21, and Ciaran Quigley, who is its legal adviser. Damien McMahon from Derry City Council also joins us — tá fáilte romhat, a Uasail Mac Mathúna — as does Eamon Molloy, who is NWRWMG's development officer. You are all very welcome.

125. The evidence session will follow much the same format as the departmental briefing did. You will be given 10 or 15 minutes in which to brief the Committee, and there will then be an opportunity to answer members' questions. I am sure that you will feel at liberty to tell us about any issues that may not have cropped up during the questioning of the departmental officials, or about any likely problems or possible solutions.

126. Mr Beggs: I declare an interest as a member of Carrickfergus Borough Council.

127. Mr Eamon Molloy (North West Region Waste Management Group): I begin by thanking the Committee for giving us the opportunity to appear before it again. We view this meeting very much as a follow-up to our previous engagement with the Committee at the end of 2008, when local government raised the issue of vires and legislative provision.

128. We wish to speak specifically today about the waste-infrastructure programme in which we are all engaged. It is fair to say that developments have occurred since we were last in Committee, and that will be referred to in due course by our legal representatives here today. Local government's chief concern is that a sufficient legislative framework be in place to allow the waste-infrastructure programme to be implemented, allowing it to meet its obligations; that is, to meet its targets to avoid potential fines. Another issue is when the necessary legislation will pass through the House.

129. At the outset, I should have apologised for the absence of our colleague from SWaMP2008, who is unable to attend today.

130. The Chairperson: Do you have concerns about the timing of the legislation?

131. Mr E Molloy: No. We heard earlier from departmental officials that the timings should be satisfactory. At our previous meeting, the Committee raised the issue of timings, but things have moved on since then.

132. Mr George Craig (arc21): On behalf of arc21, I thank you for the invitation to appear before the Committee. I offer apologies from our chief executive, John Quinn, who cannot be here today. We welcome developments on the issue of vires. It is an important issue for arc21 and local government, and, in particular, for generating greater confidence. We are inviting submissions of outline solutions, which is a very important stage of our procurement process. We anticipate that, over the next year and a half, we will reach the stage at which we will award a contract at the end of 2010. Therefore, it is encouraging that, for bidders' confidence, the issue of vires is being addressed progressively. Ciaran Quigley, who is the legal adviser for Belfast City Council, will address legal issues for the draft Bill.

133. The Chairperson: Do you have anything to add, Mr Quigley?

134. Mr Ciaran Quigley (arc21): I act in the role of general legal counsel for arc21. We have been considering for some time now the issue of vires for major waste-disposal contracts that we are about to enter into. We had a number of specific issues that we originally thought would not be addressed in the draft Local Government (Finance) Bill. However, the situation has moved on somewhat, and the Department has now produced a draft waste Bill, which will pick up on some of our concerns over what is not covered in the draft Local Government (Contracts and Compulsory Purchase) Bill. Therefore, we view the legislation in a positive light, but we hope that outstanding matters will be addressed by the draft waste Bill. The only issue for us now is one of timing.

135. We thought that the Bill did not cover the technical issues concerning the vires — the powers — of local authorities in Northern Ireland over waste contracts or any big PPP/PFI contract. For example, we have concerns about the powers of district councils to give guarantees, warranties and indemnities when working in a subregional situation. That is the situation at present with the three subregional groups that have been established. Therefore, a question arises about whether one council could guarantee the performance of a contract by another council or, indeed, by the subregional group. That was a legal concern. Another concern is the issue of councils entering into joint and several liability arrangements.

136. Another substantive issue, which was mentioned earlier, is the whole question of joint-venture arrangements, and the power of district councils and subregional groups to enter into such arrangements. In our view, none of those issues is covered by the draft Local Government (Contracts and Compulsory Purchase) Bill, which is really a translation of legislation that was brought into force in Great Britain in 1997.

137. However, the fact that the Government have now recognised that those are issues that need to be resolved, and that the vehicle for doing that is the waste Bill, we are much more comforted. Our only concern is the timing, and at this stage, we do not know the timing for the waste Bill.

138. The Chairperson: You seem to be fairly satisfied, except for the timing of the Bill. If there is anything that you need clarified, the Committee can request that that be done here today.

139. Mr Damien McMahon: The issues mentioned by Mr Quigley are, to a very great degree, common to all three groups, and we would not take away from them. The Department did, I believe, propose initially that some of the issues that needed addressing would be addressed through the two forthcoming Local Government Bills, which are designed primarily to cater for the arrangements under RPA.

140. However, now we have the waste Bill, and I must say that, at first glance, it seems very much to address the issues that were talked about. In general, therefore, we are content enough with how things are progressing. With regard to timing: I believe that we had identified with the Department ?and it had accepted ? that the draft Local Government (Contracts and Compulsory Purchases) Bill does not, in itself, really address the necessary vires issues.

141. A central point that we made was that those are such major contracts, much bigger than anything in which local government has been involved, that there needs to be specific, direct legislative provision rather than having to rely on a hotchpotch of powers. One concern that we had about the draft Local Government (Contracts and Compulsory Purchases) Bill was that it does not address the vires issues; it is geared more towards providing comfort to contractors. That, in itself, is important, too, but it should not be regarded as a Bill that provides powers to local government in the context of that waste.

142. A central part of the draft Local Government (Contracts and Compulsory Purchases) Bill is "safe harbour" provisions. That applies to all council functions, and not specifically to waste management, although that was the trigger for the Bill. Our concern all along was that, yes, in itself, that is good, but it is not enough to deal with all the issues that are raised. However, I agree with Mr Quigley that as things have developed, and as we heard from the Department today, they seem to be moving along satisfactorily.

143. The Chairperson: Thank you.

144. Mr Beggs: You said that the timing is crucial. I take it that in order for you to get the quotations for which you are hoping in the PPP stage, all those items have to be in place at the appropriate time. Just to be clear: are you saying that the waste Bill could end up being the critical timing issue for when you can trigger that process?

145. Mr Damien McMahon: Yes, I think that the waste Bill will be critical, and we would want to be sure that by the time that we come to contract-signing, the provisions that, it appears, will be in the waste Bill are in place.

146. The Chairperson: What would be the earliest potential time for signing?

147. Mr G Craig: The end of 2010.

148. Mr Beggs: Surely, it would need to be in place well before that so that those who are tendering would have that degree of certainty.

149. The Chairperson: We shall clarify that with the Department. There are several issues on that. It comes down to the issue of timing. The date that we were given previously for closure of consultation on the waste Bill should have been 3 July 2009, not the end of May.

150. Thank you for that. Another private firm is here to share its views. I am sure that you are known to each other, and I would be surprised if you have not met. I ask you to stay with us. Thank you.

151. Go raibh míle maith agat.

152. We will now have a briefing from SITA UK on the challenges facing waste management. I advise members that Mr Noel Brady from SITA wrote to the Committee in September 2008 to ask to brief us on waste-management issues. At our meeting on 18 September, the Committee agreed that representatives from SITA should be invited to attend a future meting to consider the Local Government (Contracts and Compulsory Purchase) Bill.

153. SITA UK has provided a memorandum on the challenges facing waste management, and members should note that SITA welcomes some of the initiatives that are included in the strategy document, especially the removal of the link between best practicable environmental option (BPEO) and the planning process bringing Northern Ireland in line with other Administrations. I advise members that the Waste Management Advisory Board called for clear leadership to enable the strategy to be implemented as planned. Members should note that SITA endorses that recommendation and hopes that the structural changes related to the planning process will support and deliver Northern Ireland's waste-management strategy.

154. Mr David Palmer-Jones, chief executive officer (CEO), Gev Eduljee, public affairs director, and Marshall Hay, development officer for Northern Ireland are here from SITA UK. You are all very welcome to share your knowledge and practice with us. You have heard some of the presentations that have been made today. If you have any comments or observations to make on those, you are welcome to do so. I ask you to take a maximum of fifteen minutes, and members will then put their queries.

155. Mr David Palmer-Jones (SITA UK): Thank you, Mr Chairman, for inviting us to present to the Committee. I am the CEO of SITA UK. Gev Eduljee is the head of external affairs, and Marshall Hay is the commercial manager with SITA Northern Ireland.

156. SITA UK has had a waste-management operation in Northern Ireland for over 10 years, and it is the largest service provider here, employing over 90 staff. We are particularly pleased to have been given the opportunity to come to speak to you about some of the current issues that you face. We approached the Committee with a view to giving evidence in 2007. That is clearly included in the minutes on your website. As the waste agenda gathers pace, our appearance today is timely.

157. It is also, perhaps, rather sensitive. You are, undoubtedly, aware that we are responding to a call for tender from arc21 for the provision of waste-management services, so we are acutely aware of the need to preserve the integrity of the bidding process, both from the standpoint of SITA UK as a bidder and from that of arc21 as a tendering authority.

158. With that in mind, we respectfully decline to respond to questions that relate specifically to arc21 waste-management plans and to the details of our bid, and to questions that might be construed as compromising the bidding process. However, with that proviso, we are more than happy to speak to and engage with the Committee on general issues relating to the delivery of Northern Ireland's waste-management strategy.

159. Waste management in the UK is undergoing a radical change as the policy landscape responds to EU legislation on landfilling, to the treatment of waste materials as a second resource in the revised waste framework directive and, especially, to the climate change agenda, which has brought renewable energy and resource conservation to the forefront of policy development. Waste management is now recognised, rightly, as playing a key role in developing a low-carbon strategy for the UK.

160. Along with the rest of the UK, waste management in Northern Ireland is influenced by a number of common but interrelated drivers, which were discussed in our submitted memorandum. However, I will pick out the four main elements, because it is important for members to understand.

161. First, the legislative requirement for the diversion of municipal waste from landfill will require the creation of an alternative new infrastructure comprising a range of technological options for the treatment of specific material streams and the residual stream. Delivery of that infrastructure poses planning and funding challenges, which have to be resolved within the timescale allowed by the landfill directive, if onerous penalties are to be avoided.

162. Secondly, the landfill tax, which is apt at present, is a critical business driver. It is currently at a level of £40 a ton, which favours, marginally, the recycling recovery option over direct landfilling. That, perhaps, applies to commercial industrial waste in particular, but, as the tax increases, it is becoming more of an issue for local government. The UK Government have consulted on the future development of landfill tax, and as announced in yesterday's Budget, it will increase further by £8 a ton, to reach £72 a ton by 2013. That puts it among the highest in Europe. That increase will only add further pressure on the planning process to deliver an alternative capacity in the timescales.

163. Thirdly, funding is an important element. The senior debt market, as members will understand, has undergone a rapid change in the past year as a corrective to the credit squeeze in the wider economy. That applies to all types of projects, including PPPs and PFIs. Senior debt-funders are more risk averse now, and, often, they are seeking returns over a shorter period. That pushes up the cost of debt financing and, therefore, the overall cost of the service.

164. Fourthly, planning is also an important element. We comment on the challenges in delivering planning consent, even when applications, such as this, are plan-led. We stress the importance of strand six in the national waste strategy, which deals with learning and communication and the partnership approach to the process of infrastructure delivery. Four stakeholders have a part to play in ensuring that the national waste-management strategy is implemented. If there is one message that I would like to leave you with, it is that leadership and community engagement are at the heart of infrastructure delivery. Plan-led infrastructure and delivery presuppose that the community that is participating in a consultative process owes its waste strategy to the waste authority and that the latter should express and act on the wishes of its community.

165. By the same token, a service provider such as SITA UK has an equal responsibility to engage with the community vis-à-vis safe operation, environmental protection and contributing to the local economy.

166. The Chairperson: You are a big conglomerate with a lot of experience in this industry, what lessons can we learn from your experience elsewhere?

167. Mr Palmer-Jones: When I look at the situation in Northern Ireland, I see a pragmatism. One of the biggest issues is planning. If there is one element that causes difficulty in producing the infrastructure that is required to meet the new challenges, it is planning. Northern Ireland has the ability, because your planning structure is slightly different to those in England, Wales and Scotland. Your process has a more strategic element, which allows the more difficult and more sensitive strategic planning permissions to be agreed. In that sense, you have the capacity to do it. However, I come back to the need for consultation and leadership. You face major planning issues, and there will be a requirement for strong leadership from the Committee and the other local politicians who will make the decisions.

168. Mr Ford: In the past, some of us have perhaps taken the view that the three waste-management groups are small in comparison with some of the potential authorities that are planned for GB. Do you have any views on that? Clearly, those three groups are providing leadership that could not be provided by the 26 district councils. Should we perhaps be considering moving to a single authority for Northern Ireland?

169. Mr Palmer-Jones: As you can appreciate, that starts to stray into difficult territory. Our business runs on volume. In order to get cost-effective treatments, volume is quite important. Thus, the idea of bringing the 26 councils together into three groups was, initially, an intelligent move. We do not see any of those groups as being of a size that would not attract some form of interesting competition or not give the volume effect that our business requires to give a good price. I do not think that you should be concerned with that.

170. Mr Ford: You referred to the proposal for a £72 a ton landfill tax. Clearly, that is getting beyond what you described as the marginal position. At this stage, what experience has SITA had of the different technologies?

171. Mr Palmer-Jones: We talk in terms of the tipping point. Gavin and I were involved in the consultation with the Department of Environment, Food and Rural Affairs (DEFRA) on the landfill tax. We encouraged the Department to increase the landfill tax. Today, at £40, it has a marginal effect on allowing other technologies to come into play. At £72 a ton, the price for alternative treatments will approach £100. That will happen quite soon — 2013 is not so far away — and will mean that all other forms of technology — such as energy from waste, anaerobic digestion, in-vessel composting, and, of course, recycling, which is already an influence — will become available. That visibility will give the private sector confidence in its investment. We told DEFRA that it is very important for us to have that visibility in order to plan for the future, given that we know that the tipping point will be reached around 2010. It allows us, and gives us confidence, to continue with our planning and with the building of the new infrastructure, which is required to meet your targets.

172. Mr Ford: As a company, has SITA had any experience of technologies such as anaerobic digestion (AD)?

173. Mr Palmer-Jones: Absolutely. Five or six years ago, perhaps certain technologies, such as AD, were feared, or seen as being more avant-garde. However, having asked the interested parties to find a balanced approach using new solutions — from organic solutions to energy from waste — we have seen a lot of money going into new technologies. As a result, those new technologies have become much more robust. It comes back to the need for robust solutions, specifically on PPP contracts, so that funders will be interested in them. I think that we are seeing a continued improvement in technology, which allows for the tipping point to be reached and for new technologies to arrive on the scene. Obviously, we are very encouraged by that.

174. Mr Beggs: One of the financers dropped out of the hospital project in Enniskillen, although I think that the money has since been recovered. Does, what could almost be described as, the nationalisation of some of the banks mean that the Government will be able to apply pressure so that money will be available for projects such as that?

175. Mr Palmer-Jones: Take Manchester as an example. It has an extremely complicated PFI solution, through which the Treasury created a fund, as was mentioned earlier, to assist in the latter stages of such projects. The fund provides what is perhaps the final part of financing, to make sure that projects are delivered. If you have a good, robust solution, and the risk is apportioned in a fair manner, good projects will still get funding. We still have the ability to find funding, even long-term funding, as long as the structure of the deal is sensible and robust, and the technology, as I said, is of a more pragmatic nature.

176. Mr Beggs: Do you see what is coming together in Northern Ireland as fitting into that category?

177. Mr Palmer-Jones: I do not see anything that worries me. As I said earlier, people in Northern Ireland have a pragmatic approach. I will leave it at that.

178. Mr Ford: You may have heard the earlier discussion about Rose Energy's plan for chicken-litter incineration, which is a technology that has not attracted community buy-in. Will you provide us with some information on the work that you have done with community engagement, which you highlighted in your paper?

179. Mr Marshall Hay (SITA UK): It is important to meet the community. SITA has been providing exclusive support to businesses and the community in Northern Ireland through arena network. That is a community action programme, which is tailored to meet with communities to find ways to help and support them in implementing activities such as litter-picking, tidy-ups and initiatives for their homes.

180. We have held three workshops in Belfast, Ballymena and Londonderry, which were well attended and positive. On meeting with local people, we focus on ensuring that they take ownership of what is happening. It has been positive, and SITA has done that for quite a while.

181. Our children are Northern Ireland's future. SITA has provided environmental information through the classroom 2000 network for Key Stages 2 and 3. The pack has been put together by education professionals, and it has been well welcomed. It is important to put the information to the community. The problem arises if the community is not brought along with the project; that can result in problems. The community needs to own a project and to buy into it.

182. Mr Gev Eduljee (SITA UK): The general principle with which we approach consultation is to engage as early as possible. Most of our contracts are won on the strength of specific technological solutions. In the early stage, following the award of contract, we are able to develop information sheets and other information regarding the technologies and how they fit together in providing the overall solution for the community.

183. We also provide information about the company. For instance, we provide information on our compliance record and details on what and where we operate. We also invite communities to engage with us; we have nothing to hide. Communities can visit any of our facilities and talk to us about any aspects of our proposals.

184. If a site has been allocated as part of a contract, we are able to do things at a more local level. In such cases, we engage with the local parish councillors and other local representatives and leaders, and we like them to visit our facilities. Some companies have run competitions in which they have asked the local community to design key facilities in their area. That gives them an opportunity to decide what type of technologies they want and what they want to see done with plants' outputs. Such suggestions must be within limits, because there are contractual obligations to meet.

185. Once planning applications have been submitted, there is a statutory duty to engage. We do that by trying to spread our proposals as far as possible. Roadshows are one way in which to engage with the public and to encourage comment. That is separate to what local authorities have to do as part of their statutory job in community involvement.

186. All round, we have found that the earlier we start, the better it is for all concerned — projects come to fruition at the earliest possible time. Of course, there is no guarantee for that. In extremis, a community can reject an application. In that case, there is a statutory right of appeal, and matters are settled at that stage. We would prefer not to go to that stage because it means more delay, but that does not obviate the principle of starting early on both sides.

187. The Chairperson: Unless any other member has anything to add or has a query, I thank you for your time, gentlemen. Invariably, if this process goes on, we will meet again at some stage. Thank you for sharing your experiences.

188. I will ask one of the departmental officials to clarify the issue of the timing. There is a fairly consistent theme there. Can you give us a specific outline of the timing of the sequence that we are going through?

189. Mr Denis McMahon: I apologise for giving the wrong date earlier; that did not help. We are out to consultation; that is due to end on 3 July 2009. The draft waste Bill is due to come before the Assembly in January 2010, and to be formally in place by June 2010. Therefore, the first contracts should be ready to be signed in late 2010. That is the current process, but we would be happy to follow up with the details in writing.

190. Mr Beggs: You have indicated that the legislation would be in place for contracts to be signed, but surely it has to be in place and firmed-up in advance of that, so that the tenderers can have the certainty that the contents will be enacted as presented. Ultimately, that would give them a level of confidence in tendering, because they would know under what rules they would be operating. Does the legislation not need to be in place well before the signing stage?

191. Mr Denis McMahon: Ideally, it would be in place now. In fact, ideally, it would have been in place three months ago. The more confidence that we can give the market, the better, but it absolutely has to be in place at the time of signing the contracts. There has to be a level of belief from the tenderers that we are going to have it in place by the time the contracts are signed.

192. So far, we have had a strong response from the market, and they are fruitfully participating in the procurement process. We have been working very closely with the waste-management groups on this issue, particularly over the past six months, to make sure that everybody is clear about what is being done about the draft waste Bill, and when.

193. The Chairperson: Maybe it might be appropriate if one of the representatives of the waste groups comes forward. I do not want to bounce anybody if they do not want to come forward; I just want to hear what your views might be on that sequence of timing.

194. Mr E Molloy: Thank you, Chair. We would be perfectly satisfied if that timetable is adhered to. As Denis said, it is crucial that the market has confidence, and in an ideal world, the legislation would already be in place. However, the fact that we can confidently engage with the market, knowing that the legislation is going to be in place, gives us a sufficient safeguard.

195. Mr Beggs: Presumably, you will be going through some form of select list — a shortlist — at least, that is the way in which other large contracts are operated. At what point will you seek best and final tenders? Presumably, you would like this in place before you reach that final stage?

196. Mr E Molloy: Ideally, yes. The entire process is 18 months long, so —

197. The Chairperson: Can you just clarify what process?

198. Mr E Molloy: Sorry, the entire procurement process will take 18 months, so we will be engaged in a competitive dialogue. We will engage directly with the potential bidders. We need to be able to relay the details of the provisions of the Bill to them. By that stage, we will know the provisions of the legislation; after the consultation is completed by January 2010, when the Bill is presented to the Assembly.

199. As long as we have that information, we can be confident in our engagement with the market, and that should engender sufficient confidence in the market.

200. The Chairperson: Is the process that you spoke about the 18-month one that starts at the end of next year?

201. Mr E Molloy: We are engaged in the process.

202. The Chairperson: Are you happy for the timetable that has been outlined to be adhered to?

203. Mr E Molloy: Realistically, if that timetable is adhered to, we should all be able to proceed with confidence.

204. The Chairperson: Mr McMahon, will you outline the details of that in writing?

205. Ladies and gentlemen, thank you for your time. This evidence session has proven useful in distilling the issues and thus sorting out a timetable.

3 December 2009

Members present for all or part of the proceedings:

Ms Dolores Kelly (Chairperson)

Mr Cathal Boylan (Deputy Chairperson)

Mr Roy Beggs

Mr John Dallat

Mr David Ford

Mr Danny Kinahan

Mr Adrian McQuillan

Mr Alastair Ross

Witnesses:

Ms Julie Broadway |

Department of the Environment |

206. The Chairperson (Mrs D Kelly): I welcome the officials who are from local government policy division in the Department of the Environment. We have Julie Broadway, grade 7; Brenda Mooney, acting grade 7; Janet Cooper, deputy principal, and Marie Cochrane, deputy principal. I invite you to make your presentation, which should take five to 10 minutes, and then take questions from members. I remind members that the Minister is due to attend the Committee at 11.00 am and will have to leave at 11.45 am. Therefore, it is important that we keep to time in this session.

207. Ms Julie Broadway (Department of the Environment): Thank you for the opportunity to brief the Committee on the draft local government (finance) Bill. I will introduce my colleagues and outline their interest in the Bill. Brenda Mooney and Janet Cooper work on finance policy in the Department's local government policy division, and Marie Cochrane and I are members of local government division's policy and legislation branch.

208. The main aim of the Bill is to modernise the current legislative framework relating to local government finance and councillors' remuneration in Northern Ireland. District councils in Northern Ireland are currently subject to departmental controls. For example, they need to get departmental approval before borrowing, and before applying capital receipts and sums to capital or to renewal and repairs funds. The Bill will make provisions that relax some of those departmental controls, enabling district councils to manage their own financial affairs to best effect on behalf of ratepayers. It will align the framework for local government finance in Northern Ireland with the most appropriate modern finance practices elsewhere in the UK.

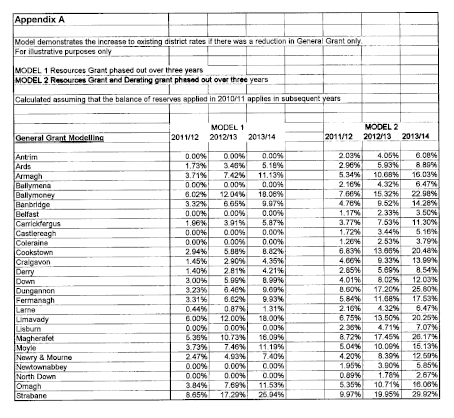

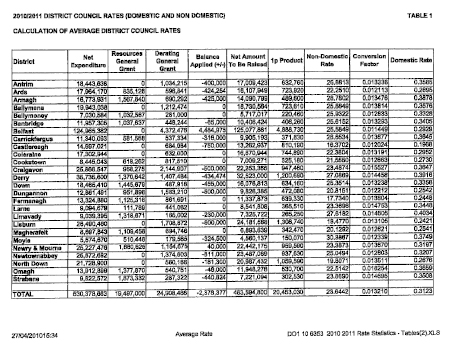

209. The Bill will introduce a prudential regime for capital finance that will enable councils to decide prudent and affordable levels of debt in line with guidance produced by the Chartered Institute of Public Finance and Accounting. It will introduce the power to invest; it will extend to all Departments the power to pay grants in relation to their areas of responsibility rather than that power being just for the Department of the Environment, and it will provide clarification around the general grant that is paid to councils. That grant consists of two separate elements, a derating element and a resources element, but that has caused some confusion in the past. Therefore, the general grant is to be replaced by two separate grants, a derating grant and a rates support grant.

210. The Bill will enable the Department to implement the recommendation of the councillors remuneration working group that an independent remuneration committee should be set up to consider the system of allowances payable to councillors and also the level of allowances payable. In addition, the Bill consolidates, into one enactment, all the provisions dealing with payments to councillors.

211. We last briefed the Committee on the draft Bill in April 2009 after the Executive had agreed to the policy proposals and the drafting of the Bill. On 24 July 2009, a consultation document, which included a copy of the draft Bill, was issued, and the closing date for replies was 31 October. We received 28 replies, including a number of replies that were received after the closing date. Those replies included 10 from councils, one from a change manager representing three councils, four from joint committees of councils, two from political parties, two from local government organisations, two from professional bodies, one from a trade union, one from a government Department, and five others. A synopsis of the replies has been provided to the Committee, but that synopsis does not include a reply from one council. However, the response of that council largely mirrored the comments of the Association of Local Government Finance Officers, the Northern Ireland Local Government Association (NILGA) and the other councils. We will update the synopsis to include that council.

212. The majority of respondents welcomed the Bill and the Department's proposals to modernise the current legislation on finance and councillors' remuneration. In particular, councils and local government organisations welcomed the greater freedom for councils to manage their own financial affairs without having to obtain consent from the Department. However, there was some concern that that freedom would be restrained by regulations. A number of respondents asked for more information about the proposed regulations, for example, in relation to the accounting practices to be followed, controlled reserves, use of capital receipts, and allowing borrowing limits to be set for national economic reasons.

213. The Department will, as required by clause 43 of the Bill, hold consultations on the proposed regulations and guidance, and it will advise the Committee in advance of those consultations. Before the Bill reaches Committee Stage, we will prepare a memorandum of delegated powers to set out in more detail what will be included in the regulations.

214. Respondents sought further clarification in a number of areas, for example, whether certain costs would be included in determining an affordable borrowing limit. Clause 1 of the Bill will require each council to designate a chief financial officer. The majority of respondents to that provision asked for clarification of the qualifications that would be required for a chief financial officer and stated that the roles of chief executive and chief financial officer should be separate.

215. With regard to the Department's proposal to replace the general grant with two grants, the derating grant and the rates support grant, 12 respondents asked whether consideration would be given to carrying out a review of the statutory formula. The main concern was whether that formula would still be appropriate for councils following re-organisation. Some respondents also expressed concerns that the rates support grant could be calculated as nil. I stress that there is no change in policy here. This is simply a name change. It is a matter of replacing the two elements of the current general grant with two separate grants. The formula is exactly the same. At the moment, the resources element of the general grant can currently be calculated as nil.