Session 2007/2008

First Report

COMMITTEE FOR SOCIAL DEVELOPMENT

Report on the Charities Bill

(NIA 9/07)

Ordered by Committee for Social Development to be printed 1 May 2008

Report: 30/07/08R (Committee for Social Development)

This document is available in a range of alternative formats.

For more information please contact the

Northern Ireland Assembly, Printed Paper Office,

Parliament Buildings, Stormont, Belfast, BT4 3XX

Tel: 028 9052 1078

Membership and Powers

The Committee for Social Development is a Statutory Departmental Committee established in accordance with paragraphs 8 and 9 of the Belfast Agreement, section 29 of the Northern Ireland Act 1998 and under Standing Order 46.

The Committee has power to:

- consider and advise on Departmental budgets and annual plans in the context of the overall budget allocation;

- consider relevant secondary legislation and take the Committee stage of primary legislation;

- call for persons and papers;

- initiate inquires and make reports; and

- consider and advise on any matters brought to the Committee by the Minister for Social Development.

The Committee has 11 members including a Chairperson and Deputy Chairperson and a quorum of 5.

The membership of the Committee since 9 May 2007 has been as follows:

Mr Gregory Campbell MP (Chairperson)

Mr David Hilditch (Deputy Chairperson)

Mr Mickey Brady

Mr Thomas Burns

Mr Fred Cobain

Mr Jonathan Craig

Ms Anna Lo

Mr Alban Maginness

Mr Fra McCann

Mrs Claire McGill

Miss Michelle McIlveen

Table of Contents

Report

Executive Summary

Introduction

Consideration of the Bill

Clause-by-Clause Scrutiny of the Bill

Appendix 1

Minutes of Proceedings Relating to the Report

Appendix 2

Minutes of Evidence

Appendix 3

Written Submissions

Appendix 4

Other Papers

Appendix 5

List of Witnesses

Executive Summary

1. The overall aim of the Bill is to introduce an integrated system of registration and regulation as well as supervision and support of registered charities. In particular the Bill will:

- provide a definition of “charity” and “charitable purpose”;

- establish the Charity Commission for Northern Ireland (CCNI) and the Charity Tribunal for Northern Ireland;

- create a register of charities;

- provide for a new form of charitable body (a charitable incorporated organisation); and,

- deal with the regulation of charities and public charitable collections.

2. The Committee agreed that it was content with clause 1, clauses 4 to 15, clauses 17 to 26, clauses 28 to 31, clauses 33 to 44, clauses 47 to 51, clauses 53 to 56, clauses 58 to 65, clause 68, clauses 71 to 91, clauses 94 to 98, clauses 105 to 106, clauses 109 to 113, clauses 115 to 121, clauses 123 to 145, clauses 147 to 158, clauses 160 to 164, clauses 167 to 179, clauses 181 to 186, schedules 1 to 5 and schedule 7.

The Committee agreed to recommend to the Assembly that the following clauses be amended as agreed between the Committee and the Department for Social Development (the Department):

Clause 2 – Meaning of “charitable purpose”

Clause 2(3)(a)(i) to read – “a religion which involves belief in one god or more than one god,”.

Although it did not preclude a belief in ‘one god’, clause 2 as drafted did not specifically mention a belief in one god. This amendment would reflect that the advancement of religion also includes a belief in one god.

Clause 3 – The “public benefit” test

Clause 3(3)(a)(ii) to read – “detriment incurred or likely to be incurred by the public,”.

Clause 3 as drafted uses the term “disbenefit”. Substituting the word “detriment” in place of “disbenefit”, would remove the ambiguity of the term disbenefit.

Clause 16 – Register of charities

Clause 16(4) to read -

“(4) The register shall contain—

(a) the name of the charity,

(b) if the charity is a designated religious charity within the meaning of section 165, a statement to that effect, and

(c) such other particulars of, and such other information relating to, the charity as the Commission thinks fit.”

The insertion of clause 16(4)(b) would ensure that the charities register contains a separate statement if an organisation has been granted designated religious charity status.

Clause 52 – Power to order taxation of solicitor’s bill

The Department agreed to remove clause 52 from the Bill as it duplicated provisions already contained within existing legislation i.e. the Solicitors (Northern Ireland) Order 1976.

Clause 122 – Power to transfer all property of unincorporated charity

Clause 122 to read -

“(b) either-

(i) it does not hold any designated land, or

(ii) the total market value of all designated land which it holds does not exceed £90,000.00; and

(13A) In this section “market value”, in relation to any land held by a charity, means—

(a) the market value of the land as recorded in the accounts for the last financial year of the charity, or

(b) if no such value was so recorded, the current market value of the land as determined on a valuation carried out for the purpose.”

This amendment would provide for an exception for a transfer of designated land that has a value of £90,000 or under.

Clause 159 – Power of Department to give financial assistance to charitable, benevolent or philanthropic institutions

The Department agreed to remove clause 159 from the Bill as Article 3 of the Social Need (Northern Ireland) Order 1986 already makes corresponding provision for Northern Ireland in this respect.

Clause 165 – Application of Act in relation to designated religious charities

Clause 165(3) to read – “No order shall be made under this section unless a draft of the order has been laid before and approved by a resolution of the Assembly”.

This amendment would reflect the provisions in clause 167(7), ensuring that any order made by the Department to extend exemptions to designated religious charities would be subject to approval by resolution of the Assembly.

Clause 166 – Designation, etc of religious charities

Clause 166(3)(c) to read – “has been established in Northern Ireland for at least 5 years;”.

A number of criteria have to be met to achieve designated religious charity status. Clause 166(3)(c) as drafted requires a charity to be established in Northern Ireland for at least 10 years. This amendment would reduce the requirement from 10 years to 5 years.

The Department agreed to remove clause 166(3)(d) from the Bill which would have required a religious organisation to have had at least 1000 members.

Amendments to the Bill following amendments made to the Charities Act 1993 (contained in the Companies Act 2006)

3. As a result of the introduction of the Companies Act 2006, a number of technical amendments are required to dovetail charity and company law. The Department proposed amendments to clauses 46, 66, 67, 69, 70, 92, 93, 99, 100, 102, 103, 107, 108, 180 and schedule 6 of the Bill following amendments made to the Charities Act 1993 and the introduction of the Companies Act 2006. Minister also gave notice of her intention to oppose the question that clause 104 stand part of the Bill. The Committee agreed to recommend to the Assembly that the clauses and schedule be amended as agreed between the Committee and the Department. The text of the amendments can be found at Appendix 4.

Miscellaneous drafting amendments and corrections

4. The Department proposed miscellaneous drafting amendments and corrections to clauses 27, 32, 45, 57, 114, 146, 180, and schedules 6, 8 and 9 of the Bill. The Committee agreed to recommend to the Assembly that the clauses and schedules be amended as agreed between the Committee and the Department. The text of the amendments can be found at Appendix 4.

Guidance to be issued by the Charity Commission for Northern Ireland

5. The Committee noted that the Charity Commission for Northern Ireland will issue detailed guidance on a number of areas including the role and duties of trustees and the public benefit requirement. The Committee looks forward to considering this guidance at a later date.

Enabling powers

6. The Committee noted that the Bill will introduce enabling powers to make regulations in a number of areas including annual statements of accounts, annual reports and annual returns by charities. The Committee looks forward to receiving and scrutinising the policy proposals for these regulations in due course.

Introduction

1. The Charities Bill (NIA 9/07) (the Bill) was referred to the Committee for consideration in accordance with Standing Order 31(1) on completion of the Second Stage of the Bill on 15 January 2008.

2. The Minister for Social Development (the Minister) made the following statement under section 9 of the Northern Ireland Act 1998:

“In my view the Charities Bill would be within the legislative competence of the Northern Ireland Assembly.”

3. The overall aim of the Bill is to introduce an integrated system of registration and regulation as well as supervision and support of registered charities. In particular the Bill will:

- provide a definition of “charity” and “charitable purpose”;

- establish the Charity Commission for Northern Ireland (CCNI) and the Charity Tribunal for Northern Ireland;

- create a register of charities;

- provide for a new form of charitable body (a charitable incorporated organisation); and

- deal with the regulation of charities and public charitable collections.

4. The Bill as drafted has 14 Parts and 9 Schedules as follows:

Part 1: Introductory

Part 1 comprises clauses 1 to 5 and deals with the definition of “charity” and “charitable purpose”. Clause 3, which sets out the public benefit test in relation to charitable purpose, specifies that no particular purpose is to be presumed to be for the public benefit. When determining whether a body provides public benefit, regard must be had to how any benefit gained by members of the institutions and disbenefit incurred by the public compares with the benefit gained by the public.

Part 2: The Charity Commission for Northern Ireland

Part 2 comprises clauses 6 to 11 (and Schedule 1) and provides for the establishment of a body corporate to be known as the Charity Commission for Northern Ireland. Clauses 7 to 10 deal with the Commission’s objectives, functions, general duties and incidental powers. Clause 11 provides for an “official custodian” for charities in Northern Ireland.

Part 3: The Charity Tribunal for Northern Ireland

Part 3 comprises clauses 12 to 15 (and Schedules 2, 3 and 4) and covers the creation of a Tribunal to hear appeals against some types of decisions made by the Commission.

Part 4: Registration of Charities And Charitable Names

Part 4 comprises clauses 16 to 21 and requires the Commission to keep a register of charities. The Bill does not provide for any exemptions from the requirement to register.

Part 5: Information Powers

Part 5 comprises clauses 22 to 25 and empowers the Commission to institute inquiries into any aspect of the work of a particular charity or class of charities. The Commission will be able to call for the disclosure of documents and to disclose information in pursuit of its functions.

Part 6: Application of Property Cy-Près and Assistance and Supervision of Charities by Court and Commission

Part 6 comprises clauses 26 to 57 and covers the powers of the Commission and the Court to make schemes for the protection of charities. Clauses 41 and 42 deal with the circumstances in which property can be vested in the official custodian while clauses 43 and 44 enable the Commission or Court to establish “common investment funds” and “common deposit funds”.

Part 7: Charity Land

Part 7 comprises clauses 58 to 63 (and Schedule 5) and allows charities to dispose of charity property in most circumstances. Charities must seek an order of the Court, or of the Commission, before disposing of charity property in certain circumstances, for example, where the disposal is to a connected party.

Part 8: Charity Accounts, Reports and Returns

Part 8 comprises clauses 64 to 73 (and Schedule 6) and deals with the duty of charities to keep accounting records, issue statements of accounts and arrange for their accounts to be audited. Clause 65 empowers the Department for Social Development to prescribe the form and contents of such accounts for a charity with an annual income in excess of £100,000. Clauses 66 and 67 further specify the auditing requirements to be placed on a charity in accordance with its income. Clauses 69 and 70 set out the requirement on charities to prepare annual reports and specify the arrangements for public inspection of such reports.

Part 9: Charity Trustees

Part 9 comprises two Chapters covering clauses 74 to 95. Chapter 1 deals with the incorporation of charity trustees and in particular, clause 74 empowers the Commission to issue a certificate of incorporation establishing the trustees of a charity (not the charity itself) as a body corporate. Chapter 2 sets out a number of other provisions relating to charity trustees, including provisions concerning persons disqualified for being trustees and remuneration, etc.

Part 10: Charitable Companies

Part 10, which comprises clauses 96 to 104, makes provision with respect to charitable companies including rules covering amendments to their objects and the audit and examination of their accounts.

Part 11: Charitable Incorporated Organisations

Part 11 comprises clauses 105 to 121 (and Schedule 7) and provides for the constitution of Charitable Incorporated Organisations, a new legal entity for charities. Its purpose is to avoid the need for charities that wish to benefit from incorporation to register as companies and be liable to dual regulation.

Part 12: Powers of Unincorporated Charities

Part 12 comprises clauses 122 to 129 and deals with the rules under which unincorporated charities may transfer their property to other charities, replace their current charitable purposes with new ones, or modify their constitutional powers or procedures.

Part 13: Funding of Charitable Institutions

Part 13 comprises four Chapters covering clauses 130 to 160. Chapter 4 provides definitions for “charitable institution” and “collector”. Chapter 1 deals with the regulation of public charitable collections – both street collections (described as “collections in a public place”) and those conducted door-to-door. Clauses 136 to 141 cover the need for individuals or organisations that wish to promote collections to obtain a public collections certificate and empowers the Commission to either issue or refuse such a certificate. Clauses 142 to 148 deal with the requirement on promoters to obtain a permit for most public collections and empower the Commission to issue such permits. Chapter 2 provides for the detailed regulation and control of fund raising and Chapter 3 empowers the Department to give financial assistance to bodies whose activities directly or indirectly benefit the whole or any part of Northern Ireland.

Part 14: Miscellaneous and Supplementary

Part 14 comprises clauses 161 to 186 (and Schedules 8 and 9). It contains provisions relating to the merger of charities, the application of the Bill in relation to designated religious charities, and institutions which are not charities under the law of Northern Ireland, and deals with a number of technical matters relating to the Commission.

Schedule 1 – The Charity Commission for Northern Ireland

Schedule 2 – The Charity Tribunal

Schedule 3 – Appeals and applications to Tribunal

Schedule 4 – References to the Tribunal

Schedule 5 – Meaning of “connected persons” for purposes of section 58(2)

Schedule 6 – Group accounts

Schedule 7 – Further provision about Charitable Incorporated Organisations

Schedule 8 – Minor and consequential amendments

Schedule 9 – Repeals

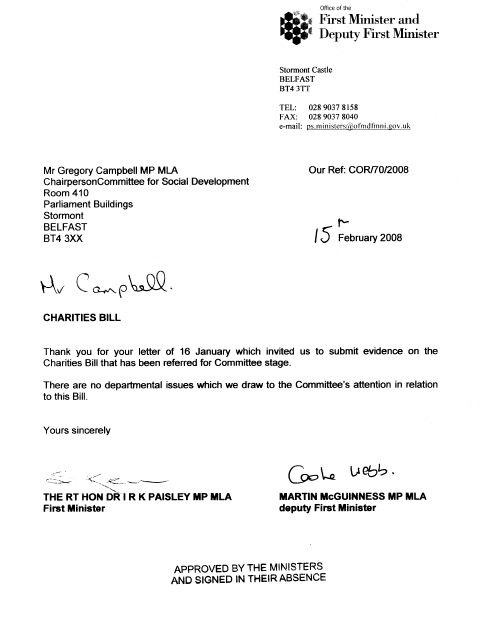

5. During the period covered by this Report, the Committee considered the Bill and related issues at 15 meetings - on 31 May 2007; 10, 17, 24 and 31 January 2008; 7, 14, 21 and 28 February 2008; 6 and 13 March 2008; 3, 10 and 17 April 2008 and 1 May 2008. The relevant extracts from the Minutes of Proceedings for these meetings are included at Appendix 1.

6. The Committee had before it the Charities Bill (NIA 9/07) and the Explanatory and Financial Memorandum that accompanied the Bill.

7. On referral of the Bill to the Committee after Second Stage, the Committee wrote to key stakeholders. On 16 January 2008 advertisements were inserted in the Belfast Telegraph and News Letter, and on 17 January 2008 an advertisement was inserted in the Irish News seeking written evidence on the Bill. In addition, the Northern Ireland Council for Voluntary Action (NICVA) publicised, via its website and newsletters, that the Committee was seeking written evidence on the Bill.

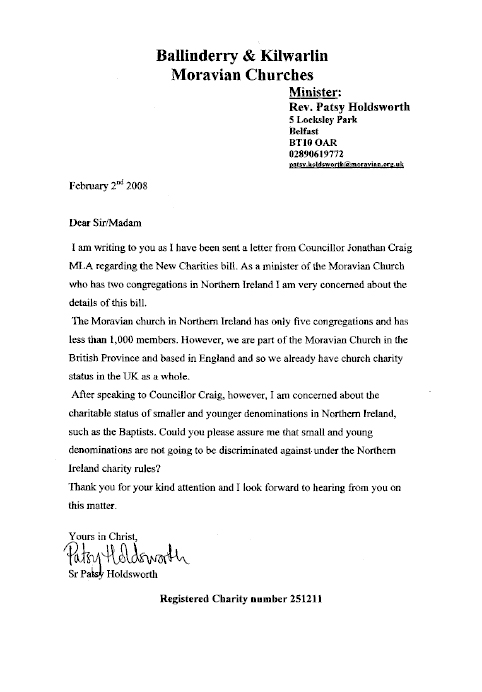

8. A total of 53 organisations responded to the request for written evidence and a copy of the submissions received by the Committee is included at Appendix 3.

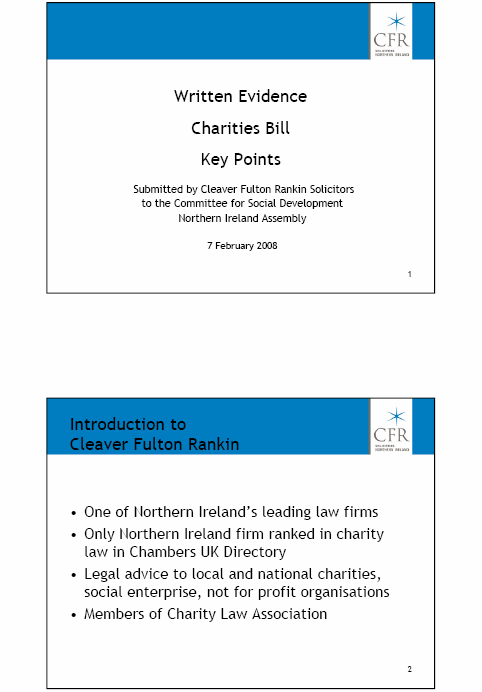

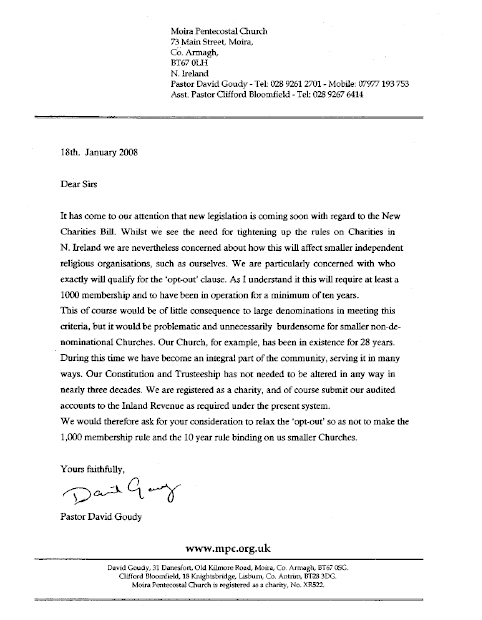

9. On 31 May 2007, prior to the introduction of the Bill, the Committee took evidence from Departmental officials on the purpose and main provisions of the proposed Bill. The Committee took further evidence from Departmental officials on 10 January 2008. Following the referral of the Bill for Committee Stage, the Committee took evidence from CO3 on 17 January 2008; the Northern Ireland Council for Voluntary Action (NICVA) on 24 January 2008; the Volunteer Development Agency on 31 January 2008; Cleaver Fulton Rankin Solicitors on 7 February 2008; the Police Service of Northern Ireland on 14 February 2008; the Evangelical Alliance Northern Ireland on 21 February 2008; the Presbyterian Church in Ireland on 28 February 2008; and Magheraknock Mission Hall and a group made up of representatives from the following religious groups: Jordan Victory Church; Kingdom Life Faith Centre; Moira Pentecostal Church and Mount Zion Free Methodist Church, on 6 March 2008. The Minutes of Evidence are included at Appendix 2.

10. The Committee began its clause-by-clause scrutiny of the Bill on 28 February 2008 and concluded this on 17 April 2008 – see Appendix 2.

Extension of Committee stage of the Bill

11. On 12 February 2008, the Assembly agreed to extend the Committee Stage of the Bill to 27 June 2008.

Report on the Charities Bill

12. At its meeting on 1 May 2008, the Committee agreed its report on the Bill and agreed that it should be printed.

Consideration of the Bill

13. On 31 May 2007, prior to the introduction of the Bill, the Committee took evidence from Departmental officials on the purpose and main provisions of the proposed Bill – see Appendix 2. The Committee noted that the overall aim of the Bill was to introduce an integrated system of registration and regulation as well as supervision and support of registered charities.

14. The Committee took further evidence from Departmental officials on 10 January 2008, as it understood that changes had been made to the proposed Bill. The officials outlined the changes that had been made to the proposed Bill as a result of discussions that had taken place between the Department and some religious bodies in Northern Ireland and other regulators across the United Kingdom and Ireland – see Appendix 2.

15. One of the key changes that had been made to the proposed Bill was the introduction of designated religious charity status (clauses 165 and 166). The Committee noted that the Commission would have the power to recognise certain charities as “designated religious charities’ (if specific conditions were met) and that clauses 33-36 of the Bill would not apply to those charities. In effect, this would mean that the Commission could not remove trustees or appoint an interim manager to protect members and any other trustees if there was a suspicion of wrong-doing. However, the Commission would have the power under clause 22 to investigate a designated religious charity if it believed there were grounds to do so.

16. The Committee welcomed the introduction of the Commission’s power to designate religious charities, given that such charities would already have sufficient internal governance structures in place to deal with investigations, suspensions, maladministration and misconduct.

17. During consideration of oral and written evidence submitted to the Committee, it became clear to Members that there was some misunderstanding around the designation of religious charities. A number of religious charities believed that, if they could not satisfy the conditions to be designated as a religious charity, they would be unable to register as a charity or that their charitable status would be removed. The Committee would wish to highlight that: 1) any religious organisation would be able to apply for charitable status and that an organisation’s ability to satisfy the conditions to be met to achieve designated religious charity status would have no bearing on an application, and 2) a religious charity would not lose its charitable status if it was unable to satisfy the conditions to be met to achieve designated religious charity status. An Assembly Research and Library Service briefing note which provides information on designated religious charity status is attached at Appendix 4.

Evidence from the Chief Officers 3rd Sector

18. On 17 January 2008, the Committee took oral evidence from CO3 (Chief Officers 3rd Sector) - see Appendix 2. CO3 advised the Committee that it welcomed the establishment of a Charity Commission (the Commission) and strongly emphasised the need for it to be independent; properly established; adequately resourced; and, accountable in its operations. CO3 expressed a number of concerns in relation to the Bill, including:

- The potential increase in levels of bureaucracy and accountability for charities, and in particular, smaller charities. Given that the legislation will not sit in isolation, CO3 highlighted the possibility of overburdening organisations by requiring them to prepare submissions and annual returns for various departments as well as the Commission;

- Proportionality in relation to regulation and auditing requirements. CO3 was of the view that the legislation did not adequately recognise the need for proportionality and that this would affect the Commission’s ability to regulate charities of all sizes;

- The lack of obligation on the Commission to consult on any revision to the public benefit test guidance; and

- The Commission’s objectives. CO3 considered that the Commission’s objectives did not reflect that it should value and safeguard the importance and contribution of charities in Northern Ireland.

Evidence from the Northern Ireland Council for Voluntary Action

19. On 24 January 2008, the Committee took oral evidence from NICVA (Northern Ireland Council for Voluntary Action) – see Appendix 2. NICVA expressed its support for the Charities Bill, however it raised concerns in relation to a number of overarching areas of the Bill, including:

- The Commission’s role to give advice on matters of regulation and more general guidance. NICVA was of the view that the Commission should give regulatory advice but that general advice should be given by independent umbrella bodies in the sector;

- The register of charities. NICVA welcomed the establishment of a register of charities to be maintained by the Commission, however, it questioned whether or not the wording used in the Bill was sufficient to ensure that every charity which operates in Northern Ireland will be required to register, and whether or not a separate non-compulsory register would be established for those charities that are not charities under the law of Northern Ireland but which operate for charitable purposes in or from Northern Ireland;

- The role of trustees. NICVA recommended that the general duties of trustees be included in the Bill;

- Legal representation on the Commission. NICVA considered that the Commission’s membership should include more than one legally qualified member;

- The lack of obligation on the Commission to consult on any revision to the public benefit test guidance; and

- The need for adequate resourcing of the Commission. NICVA argued strongly for the Commission to be well resourced to allow it to fulfil its functions and not hinder the administration of charities.

Evidence from the Volunteer Development Agency

20. On 31 January 2008, the Committee took oral evidence from VDA (Volunteer Development Agency) – see Appendix 2. VDA expressed its support for the Charities Bill and highlighted the vital role played by volunteers in the charitable sector in Northern Ireland. VDA raised a number of concerns in relation to the Bill, including:

- The potential for the legislation to create a greater and unnecessary bureaucracy. Particular concerns were raised regarding proportionality in the provision of annual accounts information;

- The Commission’s general duties. VDA was of the view that the legislation should state clearly that the Commission should value and safeguard the contribution of charities;

- The definition and role of a trustee. VDA felt that the legislation should include a wider definition of a trustee and a trustee’s role, to give clarity as to what is expected of such individuals;

- The need for adequate resourcing of the Commission. VDA argued strongly for the Commission to be well resourced to allow it to fulfil its functions and avoid unnecessary delays for charities;

- The lack of obligation on the Commission to consult on any revision to the public benefit test guidance;

- The definition of sport. VDA expressed concern that the definition of sport related exclusively to the promotion of health; and

- The Commission’s role in issuing permits for collections. VDA felt that local councils, with local knowledge, would be better placed to issue permits for charity collections.

Evidence from Cleaver Fulton Rankin Solicitors

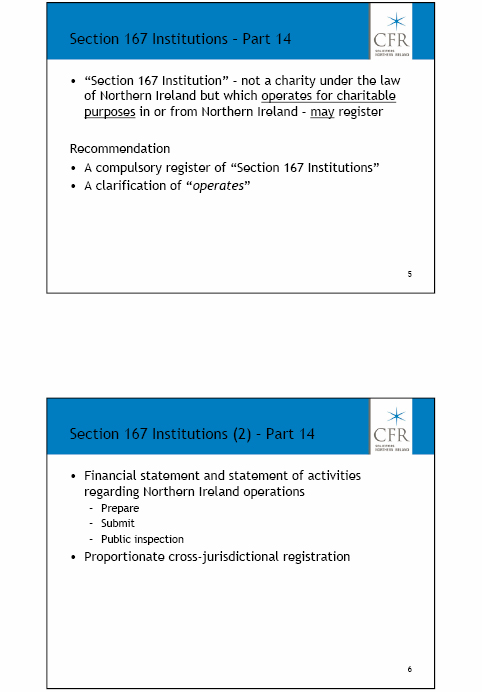

21. On 7 February 2008, the Committee took oral evidence from Cleaver Fulton Rankin Solicitors (CFR) – see Appendix 2. CFR welcomed the establishment of a Commission and the new regulatory framework for the charity sector in Northern Ireland. CFR pointed out that the need for transparency and openness should be balanced by proportionate reporting levels and emphasised the importance of properly resourcing the Commission to allow it to carry out its functions. During the evidence session, CFR highlighted a number of practical points which it felt needed clarification, including:

- The registration of charities. CFR felt that the legislation should be clearer about which organisations would be required to register as a charity and recommended a compulsory register for charities that are not charities under the law of Northern Ireland but which operate for charitable purposes in or from Northern Ireland;

- The definition of ‘operates’. CFR felt that it was important to define the term ‘operates’ within the legislation;

- The obligation on section 167 institutions to prepare, in respect of each financial year, a financial statement and a statement of activities. CFR highlighted that such organisations would only be required to prepare such documents and recommended that they also be required to submit them to the Commission so that they could be made available for public inspection;

- The lack of obligation on the Commission to consult on any major revision to the public benefit test guidance. CFR was keen for charities to be consulted, given that a change to the public benefit guidance could result in a charity losing its status at some point;

- Taxation of a solicitor’s costs. CFR was of the view that there should be taxation of solicitors’ costs, but was concerned that this provision may be in conflict with the provisions of the Solicitors (Northern Ireland) Order 1976;

- Charity accounts, reports and returns. CFR had some concerns that the requirement for all charities to make their accounts publicly available may have a negative financial impact on smaller charities due to the costs associated with audits. CFR was of the view that trustees should be able to select an appropriate person to scrutinise accounts;

- The receipt of legacies. CFR highlighted that the receipt of a legacy could mean that a charity would fall into a higher level of auditing scrutiny for a given year, and that there would be a higher financial cost attached to this;

- The regulation of small company charities. CFR identified a gap between company law and charity law in respect of who would regulate small company charities;

- The transfer of property of an unincorporated charity to a charitable incorporated organisation. CFR recommended that an exception be made for a transfer of designated land which had a very low value;

- Designated religious charity status. CFR was of the view that the register of charities should contain a statement if a body has applied for/has been granted designated religious charity status and should indicate whether such a designation has been withdrawn for any reason;

- The Department’s power to modify any provisions of the Bill with regard to designated religious status. CFR considered that any order made by the Department to modify such provisions of the Bill should be approved by resolution of the Assembly; and

- Mergers of charities and the transfer of gifts. CFR expressed some concern that a gift that takes effect on or after the date of a merger could be lost if there is a gap between the date of a merger and the date a merger is registered. CFR recommended that a gift be effective from the date of transfer to avoid any loss.

Evidence from the Police Service of Northern Ireland

22. On 14 February 2008, the Committee took oral evidence from the Police Service of Northern Ireland (PSNI) – see Appendix 2. PSNI welcomed the proposals contained in the Bill, and in particular, those relating to the establishment the Commission and a register of charities. PSNI also welcomed the controls to be put in place to prevent the criminal exploitation of charities or the establishment of mock charities. A number of issues were raised during the evidence session, including:

- The need to notify PSNI individuals of a charitable collection taking place. Although PSNI welcomed the introduction of a centralised point for the issue of certificates for charitable collections, it identified a need for the local district or area commander to be notified when a charitable collection would be taking place in their area; and

- The need for a formal Memorandum of Understanding (MOU). PSNI recommended that a formal MOU be drawn up between the PSNI and the Commission to provide a framework for closer working arrangements on issues of mutual interest, such as vetting arrangements for applicants, trustees etc.

Evidence from Evangelical Alliance Northern Ireland

23. On 21 February 2008, the Committee took oral evidence from Evangelical Alliance Northern Ireland (EANI) – see Appendix 2. EANI welcomed the opportunity to contribute constructively to the scrutiny of the legislation and raised a number of issues, including:

- The need for missionary work, at home and overseas, to be viewed as part of the advancement of religion. EANI felt that the legislation was unclear about whether public benefit must be gained in Northern Ireland or whether it could be gained overseas;

- The need for the public benefit test to take account of benefits that are not tangible, for example, spiritual benefit;

- The use of the word ‘disbenefit’ in relation to the public benefit test. EANI argued strongly for the term ‘disbenefit’ to be replaced by the word ‘harm’. EANI was of the view that the word ‘disbenefit’ was vague and had never been tested in law;

- The lack of obligation on the Commission to consult on revisions to the public benefit test guidance. EANI appreciated that consultation for a minor revision would not be the most effective way to proceed. However, it was concerned that it could develop into a loophole whereby major revisions of the guidance could be introduced without consultation; and

- The lack of opportunity for smaller religious organisations to achieve designated religious charitable status.

Evidence from the Presbyterian Church in Ireland

24. On 28 February 2008, the Committee took oral evidence from the Presbyterian Church in Ireland (PCI) – see Appendix 2. PCI supported the main aims of the Bill however it raised a number of concerns, including:

- The lack of opportunity for smaller religious organisations to achieve designated religious status;

- The absence of a definition of ‘public benefit’. PCI was concerned that, in the future, the spiritual aspect of what religious organisations do might be questioned as to whether or not it is of public benefit. PCI argued strongly for the legislation to recognise that spiritual nurture and development is also of public benefit;

- The definition of religion. PCI felt that the definition of religion should include the belief in one, or more than one god;

- The Commission’s power to change the name of a charity. PCI was concerned that a number of organisations used the word ‘presbyterian’ in their name and sought some assurance that the Presbyterian Church would be able to continue to use the word ‘presbyterian’;

- The format for annual statements of accounts. PCI supported high levels of transparency and accountability but was concerned about the impact the legislation would have on some of its congregations in respect of the prescribed format for statements of accounts;

- The effect bequests might have on reporting requirements. PCI pointed out that the receipt of a legacy could mean that a charity would fall into a higher level of auditing scrutiny for a given year, and that there would be a higher financial cost attached to this;

- The registration of trustees. PCI advised the Committee that it had approximately 1,200 trustees and was concerned that all would have to be registered individually; and

- Changes to the Law of the Church (Church Code). PCI was concerned that the legislation would require it to report to the Commission, every change made to the Law of the Church.

Evidence from Magheraknock Mission Hall

25. On 6 March 2008, the Committee took oral evidence from representatives of Magheraknock Mission Hall – see Appendix 2. The representatives welcomed the provisions in the Bill that would allow for scrutiny of charities to ensure that they were being legally managed for public benefit. However, the representatives had serious concerns in relation to some of the criteria to be satisfied to achieve designated religious charity status, namely the requirement for a religious organisation to have at least 1000 members and the requirement for it to have been established for at least 10 years.

Evidence from Kingdom Life Faith Centre, Moira Pentecostal Church, Mount Zion Free Methodist Church and Jordan Victory Church

26. On 6 March 2008, the Committee took oral evidence from representatives of Kingdom Life Faith Centre, Moira Pentecostal Church, Mount Zion Free Methodist Church and Jordan Victory Church – see Appendix 2. The representatives supported the main aims of the Bill, but raised some concerns, including:

- The criteria to be met to achieve designated religious status. It was felt that the requirement to have at least 1000 members and to have been established for at least 10 years was discriminatory;

- The lack of recognition of ‘church discipline’. Representatives were concerned that an interim manager or trustees who may not agree with a church’s ethos could be appointed by the Commission to administer or manage the property and affairs of a charity; and

- The bureaucracy in relation to charitable appeals and public charitable collections.

Clause-by-Clause Scrutiny of the Bill

27. The Committee undertook its formal clause-by-clause scrutiny of the Bill on 3, 10 and 17 April 2008 – see Appendix 2.

Clause 1 – Meaning of “charity”

28. The Committee agreed to clause 1 as drafted.

Clause 2 – Meaning of “charitable purpose”

29. The Committee noted the conditions to be met for a body to be recognised as a charity in law, namely that its charitable purpose falls under the 12 heads as listed at clause 2(2), and that it is of public benefit. The Committee welcomed that the current four heads of charity (relief of poverty, advancement of education, advancement of religion and advancement of arts and culture) would be replaced by 12 charitable purposes and that there would be a residual purpose that would leave scope for future developments in the charitable sector.

30. The Committee highlighted differences between the Bill’s charitable purposes definition and that within the English Charities Act 2006, including the absence of the promotion of the efficiency of the armed forces or the Crown, police, fire rescue services or ambulance services, and the inclusion of the advancement of peace and community relations (under the heading relating to human rights and resolution of conflict). Concern was expressed that potentially conflicting issues may arise as to how an institution, which is a charity under Northern Ireland law, avails of tax exemptions under the Income and Corporation Taxes Act 1988. The Committee drew attention to the possibility that HM Revenue and Customs (Bootle) may apply the law of England and Wales in determining charitable purposes when a Northern Ireland registered charity applies for a tax exemption. The Committee was reassured by the Department that the promotion of the efficiency of the armed forces, the Crown etc., although not explicitly mentioned in the legislation, is and always has been a charitable purpose in the United Kingdom. The Committee was further reassured by the Department that it had worked closely with HM Revenue and Customs during the drafting of the Bill and that a Memorandum of Understanding between HM Revenue and Customs and the Commission was under consideration.

31. The Committee considered whether a broader definition such as the European definition of “sport” should be adopted. However, after discussion with the Department it was satisfied that the definition was sufficiently broad and acknowledged that it was the same definition as used in the rest of the United Kingdom.

32. The Committee raised a concern in relation to the definition of ‘religion’ for charitable purposes. The Committee was content that non-deity and multi-deity groups would be able satisfy the definition for charitable purposes but expressed concern that the definition, although it did not preclude a belief in ‘one god’, did not specifically mention a belief in one god.

33. At the request of the Committee, the Department agreed to amend clause 2 to reflect that the advancement of religion also includes a belief in one god.

34. The Committee agreed to clause 2 subject to the Committee being satisfied with the wording of the proposed amendment. The Committee agreed to the text of the amendment as proposed by the Minister.

Proposed amendment, clause 2(3)(a)(i)

“(3) In subsection (2)—

(a) in paragraph (c) “religion” includes—

(i) a religion which involves belief in one god or more than one god,”.

Clause 3 – The “public benefit” test

35. The Committee noted the requirement for all charitable purposes to provide public benefit, and that it would not be presumed that a purpose of a particular description was for public benefit. The Committee had some sympathy with those bodies that felt that the advancement of religion should be presumed to be of public benefit but agreed that there should be no exemptions.

36. The Committee considered that benefits to the public must be capable of being recognised, identified, defined or described but not necessarily be capable of being quantified or measured. The Committee agreed that the need for benefits that are not tangible or measurable, such as spiritual benefits, should be recognised by the Commission in determining whether or not a charitable purpose is for public benefit.

37. The Committee raised concerns in relation to the use of the term ‘disbenefit’. It was argued that the term ‘disbenefit’ was ambiguous and ill-defined and was vulnerable to political exploitation. In considering this matter, the Committee noted that the Charity Commission for England and Wales used the terms ‘detriment’ or ‘harm’ and agreed that either would be more appropriate.

38. At the request of the Committee, the Department agreed to amend clause 3 to substitute the word “detriment” in place of “disbenefit.”

39. The Committee agreed to clause 3 subject to the Committee being satisfied with the wording of the proposed amendment. The Committee agreed to the text of the amendment as proposed by the Minister.

Proposed amendment, clause 3(3)(a)(ii)

“(3) In determining whether an institution provides or intends to provide public benefit, regard must be had to—

(a) how any—

(i) benefit gained or likely to be gained by members of the institution or any other persons (other than as members of the public), and

(ii) detriment incurred or likely to be incurred by the public, in consequence of the institution exercising its functions compares with the benefit gained or likely to be gained by the public in that consequence”.

Clause 4 – Guidance as to operation of public benefit requirement

40. The Committee noted that this clause provided for the Commission to produce guidance on the operation of the public benefit requirement. The Committee agreed that the guidance should: raise awareness and understanding of the public benefit requirement amongst the charitable sector and the public; explain clearly and concisely how the public benefit requirement operates in practice; and, explain fully the requirement for charity trustees to report on public benefit.

41. A number of respondents expressed concern that the Commission would not be obliged to consult on any revision to its public benefit guidance, if it felt it was unnecessary to so. The Committee agreed that the Commission should reserve the right to have the discretion to make minor changes to the guidance but, given that the public benefit test would be applied in line with the guidance, the Committee was of the view that any material changes to the guidance should be subject to public consultation.

42. The Committee agreed to clause 4 as drafted.

Clause 5 – Special provisions about recreational charities, sports clubs, etc.

43. The Committee considered the implications of this clause which would preclude a registered Community Amateur Sports Club (CASC) from becoming a charity. The Committee raised this matter with the Department and was reassured to note that a CASC could amend its constitution and objectives to be recognised as a charity and that the Commission would provide advice and guidance on this matter.

44. The Committee agreed to clause 5 as drafted.

Clause 6 – The Charity Commission for Northern Ireland

45. The Committee noted that this clause provided for the establishment of a Charity Commission for Northern Ireland, and detailed the structure of that body in relation to its Commissioners. In response to an enquiry by the Committee, the Department informed Members that the appointment of Commissioners would be subject to the Public Appointment Process to establish criteria, and that the whole process would be overseen by the Office of the Commissioner for Public Appointments. The Committee was content that the Commission should include at least one legally qualified member. The Committee agreed that, while appointments to the Commission should be based on merit, efforts should be made to ensure that the charity sector is adequately represented and that there is a fair gender balance.

46. The Committee agreed to clause 6 as drafted.

Clause 7 - The Commission’s objectives

47. The Committee noted that the Commission would be first and foremost a regulatory body and was content with its five objectives. The Committee was content that the Commission’s duty to value the importance of charities to civil society was reflected in clause 9.

48. The Committee agreed to clause 7 as drafted.

Clause 8 – The Commission’s general functions

49. The Committee considered the general functions of the Commission including its role as both regulator and advisor. In considering this matter, the Committee noted that the Charity Commission for England and Wales had performed a dual regulatory and advisory function efficiently for a number of years and that the umbrella bodies for the sector had continued to play an important role in providing advice and guidance to charities. The Committee was content with the Commission’s dual role. The Committee agreed that it was important for the Commission to differentiate between its advisory and regulatory functions and make it clear in all its communications, the distinction between advice and instructions.

50. The Committee acknowledged the excellent work of the umbrella bodies in Northern Ireland in providing advice and guidance to the charitable sector and expressed a desire to see this work continue.

51. The Committee agreed to clause 8 as drafted.

Clause 9 – The Commission’s general duties

52. The Committee noted that clause 9 dealt with how the Commission performs its functions. Members had expressed some concern about the effective use of resources and whether the Commission had the potential to grow and expand beyond its role. However, the Committee was content that this clause seeks to ensure that the Commission operates and uses the money that it receives in an efficient, effective and economical manner.

53. In considering the Commission’s general duties, the Committee reflected on the regulatory burden that would be placed on charities, and in particular, smaller charities. The Committee agreed that the Commission should, in performing its functions, have due regard to its duty to ensure that regulation is fair and proportionate.

54. The Committee agreed to clause 9 as drafted.

Clause 10 – The Commission’s incidental powers

55. The Committee agreed to clause 10 as drafted.

Clause 11 – The official custodian for charities in Northern Ireland

56. The Committee agreed to clause 11 as drafted.

Clause 12 – The Charity Tribunal for Northern Ireland

57. The Committee agreed to clause 12 as drafted.

Clause 13 – Practice and procedure

58. At the request of the Committee, the Department agreed to consider how clause 13 could be amended to allow the Commission to make provision for applicants to be represented by special advocates at a Charity Tribunal. The Department considered that there was merit in this suggestion and agreed to consider further if and when there were developments in this area in England and Wales.

59. The Committee agreed to clause 13 as drafted.

Clause 14 – Appeal from Tribunal

60. The Committee agreed to clause 14 as drafted.

Clause 15 – Intervention by Attorney General

61. The Committee agreed to clause 15 as drafted.

Clause 16 – Register of charities

62. The Committee noted that all bodies operating as charities under the law in Northern Ireland must be registered in the register of charities. The Committee also noted that under clause 167, all bodies that are not charities under the law of Northern Ireland, but which operate in Northern Ireland, must also be registered in a parallel register of charities.

63. The Committee had asked the Department to consider if clause 16 could be amended to ensure that Assembly approval was required for any further exemptions for designated religious charities. The Committee subsequently agreed that an amendment was not required as this provision would be included in the amended clause 165(3).

64. At the request of the Committee, the Department agreed to amend clause 16 to ensure that the charities register contained a separate statement if an organisation had been granted designated religious charity status.

65. The Committee agreed to clause 16 subject to the Committee being satisfied with the wording of the proposed amendment. The Committee agreed to the text of the amendment as proposed by the Minister.

Proposed amendment, clause 16(4)(a)

“(4) The register shall contain—

(a) the name of the charity,

(b) if the charity is a designated religious charity within the meaning of section 165, a statement to that effect, and

(c) such other particulars of, and such other information relating to, the charity as the Commission thinks fit.”

Clause 17 – Duties of trustees in connection with registration

66. The Committee agreed to clause 17 as drafted.

Clause 18 – Effect of, and claims and objections to, registration

67. The Committee agreed to clause 18 as drafted.

Clause 19 – Status of registered charity to appear on official publications, etc.

68. The Committee agreed to clause 19 as drafted.

Clause 20 – Power of Commission to require charity’s name to be changed

69. The Committee noted that this clause would allow the Commission to require that a charity changes its name for certain reasons e.g. if it is the same name as that of another charity (whether registered or not), or if it is considered to be offensive or misleading. The Committee sought clarification from the Department that the Presbyterian Church in Ireland would not be required to change its name because other charities had ‘Presbyterian’ in their names. The Department assured the Committee that providing each organisation had a distinct name i.e. that it was not the same as, or in the opinion of the Commission too like another charity’s name, a name change would not be required.

70. The Committee agreed to clause 20 as drafted.

Clause 21 – Effect of direction under section 20 where charity is a company

71. The Committee agreed to clause 21 as drafted.

Clause 22 – General power to institute inquiries

72. The Committee agreed to clause 22 as drafted.

Clause 23 – Power to call for documents and search records

73. The Committee agreed to clause 23 as drafted.

Clause 24 – Disclosure of information by and to the Commission

74. The Committee agreed to clause 24 as drafted.

Clause 25 – Supply of false or misleading information to Commission, etc.

75. The Committee agreed to clause 25 as drafted.

Clause 26 – Occasions for applying property cy-près

76. The Committee agreed to clause 26 as drafted.

Clause 27 – Application cy-pres of gifts of donors unknown or disclaiming

77. The Department proposed a technical amendment to clause 27. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 28 - Application cy-pres of gifts made in response to certain solicitations

78. The Committee agreed to clause 28 as drafted.

Clause 29 – Cy-pres schemes

79. The Committee agreed to clause 29 as drafted.

Clause 30 – Charities governed by charter

80. The Committee agreed to clause 30 as drafted.

Clause 31 – Concurrent jurisdiction with High Court for certain purposes

81. The Committee agreed to clause 31 as drafted.

Clause 32 – Further powers to make schemes or alter application of charitable property

82. The Department proposed a technical amendment to clause 32. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 33 – Power to act for protection of charities

83. The Committee noted that clause 33 would not apply to a designated religious charity. The Committee strongly supported this exemption, given that such a charity would already have sufficient internal governance structures in place to deal with investigations, suspensions, maladministration and misconduct.

84. The Committee agreed to clause 33 as drafted.

Clause 34 – Power to suspend or remove trustees, etc. from membership of charity

85. The Committee noted that clause 34 would not apply to a designated religious charity. The Committee strongly supported this exemption, given that such a charity would already have sufficient internal governance structures in place to deal with investigations, suspensions, maladministration and misconduct.

86. The Committee agreed to clause 34 as drafted.

Clause 35 – Supplementary provisions relation to interim manager appointed for a charity

87. The Committee noted that clause 35 would not apply to a designated religious charity. The Committee strongly supported this exemption, given that such a charity would already have sufficient internal governance structures in place to deal with investigations, suspensions, maladministration and misconduct.

88. The Committee agreed to clause 35 as drafted.

Clause 36 – Power to give specific directions for protection of charity

89. The Committee noted that clause 36 would not apply to a designated religious charity. The Committee strongly supported this exemption, given that such a charity would already have sufficient internal governance structures in place to deal with investigations, suspensions, maladministration and misconduct.

90. The Committee agreed to clause 36 as drafted.

Clause 37 – Power to direct application of charity property

91. The Committee agreed to clause 37 as drafted.

Clause 38 – Copy of order under section 33, 34, 36 or 37, and Commission’s reasons, to be sent to charity

92. The Committee agreed to clause 38 as drafted.

Clause 39 – Publicity relating to schemes

93. The Committee agreed to clause 39 as drafted.

Clause 40 – Publicity for orders relating to trustees or other individuals

94. The Committee agreed to clause 40 as drafted.

Clause 41 – Entrusting charity property to official custodian, and termination of trust

95. The Committee agreed to clause 41 as drafted.

Clause 42 – Supplementary provisions as to property vested in official custodian

96. The Committee agreed to clause 42 as drafted.

Clause 43 – Schemes to establish common investment funds

97. The Committee agreed to clause 43 as drafted.

Clause 44 – Schemes to establish common deposit funds

98. The Committee agreed to clause 44 as drafted.

Clause 45 – Meaning of “Scottish recognised body” and “England and Wales charity” in sections 43 and 44

99. The Department proposed a technical amendment to clause 45. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 46 – Power to authorise dealings with charity property, etc.

100. The Department proposed a technical amendment to clause 46 to reflect amendments made to the Charities Act 1993 as contained in sections 181(4) and 226 of the Companies Act 2006. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 47 – Power to authorise ex gratia payments, etc.

101. The Committee agreed to clause 47 as drafted.

Clause 48 – Power to give directions about dormant bank accounts of charities

102. The Committee agreed to clause 48 as drafted.

Clause 49 – Power to give advice and guidance

103. The Committee agreed to clause 49 as drafted.

Clause 50 – Power to determine membership of charity

104. The Committee agreed to clause 50 as drafted.

Clause 51 – Powers for preservation of charity documents

105. The Committee agreed to clause 51 as drafted.

Clause 52 – Power to order taxation of solicitor’s bill

106. At the request of the Committee, the Department agreed to remove clause 52 from the Bill as it duplicated provisions already contained within existing legislation i.e. the Solicitors (Northern Ireland) Order 1976.

107. The Committee agreed that clause 52 should be removed from the Bill. The Minister gave notice of her intention to oppose the question that clause 52 stand part of the Bill.

Clause 53 – Power to enter premises

108. The Committee agreed to clause 53 as drafted.

Clause 54 – Proceedings by Commission

109. The Committee agreed to clause 54 as drafted.

Clause 55 – Proceedings by other persons

110. The Committee agreed to clause 55 as drafted.

Clause 56 – Report of section 22 inquiry to be evidence in certain proceedings

111. The Committee agreed to clause 56 as drafted.

Clause 57 – Powers in relation to certain English, Welsh and Scottish charities

112. The Department proposed a technical amendment to clause 57. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 58 – Restriction on dispositions

113. The Committee noted that no land held by or in trust for a charity could be disposed of without an order of the Court or of the Commission. The Committee sought an assurance from the Department that the restriction on dispositions would not apply to the regulation of co-ownership housing schemes. The Department assured the Committee that there was an exemption for such schemes under clause 58(10)(a).

114. The Committee agreed to clause 58 as drafted.

Clause 59 – Supplementary provisions relating to dispositions

115. The Committee agreed to clause 59 as drafted.

Clause 60 – Release of charity rentcharges

116. The Committee agreed to clause 60 as drafted.

Clause 61 – Restrictions on mortgaging

117. The Committee noted that clause 61 would not apply to a mortgage for which “general or special authority” had been given in accordance with clause 58(10)(a). The Committee was satisfied that mortgages under legally established schemes, such as co-ownership housing schemes, would be excluded.

118. The Committee agreed to clause 61 as drafted.

Clause 62 – Supplementary provisions relating to mortgaging

119. The Committee agreed to clause 62 as drafted.

Clause 63 – Interpretation of Part 7

120. The Committee agreed to clause 63 as drafted.

Clause 64 – Duty to keep accounting records

121. The Committee considered the duty on trustees to keep accounting records as a very important part of maintaining and building public confidence in the charity sector. The Committee agreed that the Commission should ensure that any relevant guidance for trustees should be comprehensive and easy to read.

122. The Committee agreed to clause 64 as drafted.

Clause 65 – Annual statement of accounts

123. The Committee was in favour of a high level of transparency and accountability in respect of a charity’s financial activity but recognised that charities already faced considerable levels of auditing and reporting requirements. The Committee noted that the format for an annual statement may be prescribed by regulation. The Committee agreed that, in considering the format for annual statements of accounts, the Commission should take into consideration the audit requirements of other regulatory bodies.

124. The Committee agreed to clause 65 as drafted.

Clause 66 – Annual audit or examination of charity accounts

125. The Committee noted the three distinct income bands which would determine a) whether accounts would be required to be examined or audited; and, b) who would be eligible to conduct an examination or audit. The Committee was content that the differing levels of auditing requirements based on income would address any proportionality issues raised.

126. The Committee had some sympathy with those organisations that had expressed concern that the receipt of a legacy for a given year could move a charity into a higher income band, resulting in a higher level of auditing requirement than would have been the case if the legacy had not been received. The Committee acknowledged that this could have financial implications for a charity but agreed that it would not be appropriate to disregard certain types of income when considering audit thresholds.

127. The Committee understood that this clause would not apply to charities that are also companies (clause 66(10)) and that companies would continue to be regulated by company law. However, the Department informed the Committee that the Companies Act 2006 was being enacted over a period of time, and that amendments would be made in order to dovetail company and charity legislation in England and Wales. The Department advised that it was monitoring the situation and that amendments would be made to reflect changes in company law. The Committee noted that clause 181 provided a power to make such amendments.

128. The Department consequently proposed technical amendments to clause 66 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendments as proposed by the Minister. The text of the amendments can be found at Appendix 4.

Clause 67 – Supplementary provisions relating to audits, etc.

129. The Department proposed a technical amendment to clause 67 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 68 – Duty of auditors, etc. to report matters to Commission

130. The Committee agreed to clause 68 as drafted.

Clause 69 – Annual reports

131. The Committee noted the duty on charity trustees to prepare, in respect of each financial year, an annual report to be sent to the Commission. The Committee noted that the format for an annual report may be prescribed by regulation. The Committee considered that the requirement to produce an annual report was important in respect of maintaining and building public confidence in charitable activities. However, it agreed that the Commission should seek to request information commensurate with the size of a charity.

132. The Department proposed a technical amendment to clause 69 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 70 – Public inspection of annual reports, etc.

133. The Department proposed technical amendments to clause 70 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendments as proposed by the Minister. The text of the amendments can be found at Appendix 4.

Clause 71 – Annual returns by charities

134. The Committee noted the duty on each charity to prepare, in respect of each financial year, an annual return to be sent to the Commission. The Committee noted that the format of such a return may be prescribed by regulation. The Committee considered that the requirement to produce an annual return was an important issue in respect of maintaining and building public confidence in charitable activities. However, it agreed that the Commission should seek to request information commensurate with the size a charity.

135. The Committee agreed to clause 71 as drafted.

Clause 72 – Offences

136. The Committee agreed to clause 72 as drafted.

Clause 73 – Group Accounts

137. The Committee noted that clause 73 made provision for charities with a parent body to submit a group account rather than individual accounts for each charity. The Department advised that it would be for the charity, rather than the Commission, to decide whether to submit a group account or individual charity accounts.

138. The Committee agreed to clause 73 as drafted.

Clause 74 – Incorporation of trustees of a charity

139. The Committee agreed to clause 74 as drafted

Clause 75 – Estate to vest in body corporate

140. The Committee agreed to clause 75 as drafted.

Clause 76 – Applications for incorporation

141. The Committee agreed to clause 76 as drafted.

Clause 77 – Nomination of trustees, and filling up vacancies

142. The Committee agreed to clause 77 as drafted.

Clause 78 – Liability of trustees and others, notwithstanding incorporation

143. The Committee agreed to clause 78 as drafted.

Clause 79 – Certificate to be evidence of compliance with requirements for incorporation

144. The Committee agreed to clause 79 as drafted.

Clause 80 – Power of Commission to amend certificate of incorporation

145. The Committee agreed to clause 80 as drafted.

Clause 81 – Records of applications and certificates

146. The Committee agreed to clause 81 as drafted.

Clause 82 – Enforcement of orders and directions

147. The Committee agreed to clause 82 as drafted.

Clause 83 – Gifts to charity before incorporation to have same effect afterwards

148. The Committee agreed to clause 83 as drafted.

Clause 84 – Execution of documents by incorporated body

149. The Committee agreed to clause 84 as drafted.

Clause 85 – Power of Commission to dissolve incorporated body

150. The Committee agreed to clause 85 as drafted.

Clause 86 – Interpretation of Chapter 1

151. The Committee agreed to clause 86 as drafted.

Clause 87 – Persons disqualified for being trustees of a charity

152. The Committee understood that the charities legislation in the Republic of Ireland had not yet been enacted, therefore it was not possible at this stage to amend the Bill to extend the provision to disqualify trustees who had been removed from office in the Republic of Ireland. However, the Committee asked the Department to consider if the clause could be amended to disqualify trustees who had been removed from office in other countries where charities legislation did exist. The Department advised the Committee that it did not hold information on charity regulation outside the UK and Ireland and that this suggestion would not be practical. The Committee accepted the Department’s response. The Committee agreed that the Department should revisit this area when the Republic of Ireland’s charity legislation has been enacted, and give consideration to an amendment to the legislation that would allow the disqualification of trustees who have been removed from office in the Republic of Ireland.

153. The Committee agreed to clause 87 as drafted.

Clause 88 – Person acting as charity trustee while disqualified

154. The Committee agreed to clause 88 as drafted.

Clause 89 – Remuneration of trustees, etc. providing services to charity

155. The Committee agreed to clause 89 as drafted.

Clause 90 – Supplementary provisions for purposes of section 89

156. The Committee agreed to clause 90 as drafted.

Clause 91 – Disqualification of trustee receiving remuneration under section 89

157. The Committee agreed to clause 91 as drafted.

Clause 92 – Power to relieve trustees, auditors, etc. from liability for breach of trust or duty

158. The Department proposed a technical amendment to clause 92 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 93 – Court’s power to grant relief to apply to all auditors, etc. of charities which are not companies

159. The Department proposed a technical amendment to clause 93 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 94 – Trustees’ indemnity insurance

160. The Committee agreed to clause 94 as drafted.

Clause 95 – Trustees

161. The Committee agreed to clause 95 as drafted.

Clause 96 – Winding up

162. The Committee agreed to clause 96 as drafted.

Clause 97 – Alteration of objects clause

163. The Committee agreed to clause 97 as drafted.

Clause 98 – Invalidity of certain transactions

164. The Committee agreed to clause 98 as drafted.

Clause 99 – Requirement of consent of Commission to certain acts

165. The Department proposed a technical amendment to clause 99 to reflect amendments made to the Charities Act 1993 as contained in sections 181(4) and 226 of the Companies Act 2006. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 100 – Name to appear on correspondence, etc.

166. The Department proposed a technical amendment to clause 100 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 101 – Status to appear on correspondence, etc.

167. The Department proposed a technical amendment to clause 101 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 102 – Duty of charity’s auditors, etc. to report matters to Commission

168. The Department proposed a technical amendment to clause 102 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 103 – Investigation of accounts

169. The Department proposed a technical amendment to clause 103 to reflect amendments made to the Charities Act 1993 as contained in the Charities Act 2006 (Charitable Companies Audit and Group Account Provisions) Order 2008; and the Companies Act 2006 (Consequential Amendments, etc.) Order 2008 – Schedule 1, paragraphs 1 and 192. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 104 – Annual audit or examination of accounts of charitable companies

170. The Minister gave notice of her intention to oppose the question that clause 104 stand part of the Bill. The Committee agreed that clause 104 should be removed from the Bill.

Clause 105 – Nature and constitution

171. The Committee agreed to clause 105 as drafted.

Clause 106 – Constitution

172. The Committee agreed to clause 106 as drafted.

Clause 107 – Name and status

173. The Department proposed a technical amendment to clause 107 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4. The Committee also agreed to the text of a new clause (107A) to be inserted after clause 107- Civil consequences of failure to disclose name and status. The text of the new clause can also be found at Appendix 4.

Clause 108 – Offences connected with name and status

174. The Department proposed a technical amendment to clause 108 to reflect amendments made to the Charities Act 1993 by paragraphs 7-12 of Schedule 3 to the Companies Act 2006 (Consequential Amendments) Order 2008.The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 109 – Application for registration

175. The Committee agreed to clause 109 as drafted.

Clause 110 – Effect of registration

176. The Committee agreed to clause 110 as drafted.

Clause 111 – Conversion of charitable company or registered industrial and provident society

177. The Committee agreed to clause 111 as drafted.

Clause 112 – Conversion: consideration of application

178. The Committee agreed to clause 112 as drafted.

Clause 113 – Conversion: supplementary

179. The Committee agreed to clause 113 as drafted.

Clause 114 – Conversion of community interest company

180. The Department proposed a technical amendment to clause 114. The Committee agreed to the text of the amendment as proposed by the Minister. The text of the amendment can be found at Appendix 4.

Clause 115 – Amalgamation of CIOs

181. The Committee agreed to clause 115 as drafted.

Clause 116 – Amalgamation: supplementary

182. The Committee agreed to clause 116 as drafted.

Clause 117 – Transfer of CIO’s undertaking

183. The Committee agreed to clause 117 as drafted.

Clause 118 – Regulations about winding up, insolvency and dissolution

184. The Committee agreed to clause 118 as drafted.

Clause 119 – Power to transfer all property of unincorporated charity to one or more CIO’s

185. The Committee agreed to clause 119 as drafted.

Clause 120 – Further provision about CIO’s

186. The Committee agreed to clause 120 as drafted.

Clause 121 – Regulations

187. The Committee agreed to clause 121 as drafted.

Clause 122 – Power to transfer all property of unincorporated charity

188. The Committee had asked the Department to consider if this clause could be amended to provide for an exception for a transfer of designated land that had a very low value. Legislative Council advised the Department that the term ‘of a very low value’ would be unacceptably vague and that a figure would need to be quoted. The amended clause was drafted on this basis and a figure of £90,000 has been quoted.

189. The Committee agreed to the text of the amendment as proposed by the Minister.

Proposed amendment, clause 122 (b) and (13A)

“(b) either -

(i) it does not hold any designated land, or

(ii) the total market value of all designated land which it holds does not exceed £90,000.00; and

(13A) In this section “market value”, in relation to any land held by a charity, means -

(a) the market value of the land as recorded in the accounts for the last financial year of the charity, or

(b) if no such value was so recorded, the current market value of the land as determined on a valuation carried out for the purpose.”

Clause 123 – Resolution not to take effect or to take effect at later date

190. The Committee agreed to clause 123 as drafted.

Clause 124 – Transfer where charity has permanent endowment

191. The Committee agreed to clause 124 as drafted.

Clause 125 – Power to replace purposes of unincorporated charity

192. The Committee agreed to clause 125 as drafted.

Clause 126 – Power to modify powers or procedures of unincorporated charity

193. The Committee agreed to clause 126 as drafted.

Clause 127 – Power of unincorporated charities to spend capital: general

194. The Committee asked the Department to consider the comments made by the Charity Commission for England and Wales in relation to available endowment funds. The Department consulted the Office of the Legislative Counsel and advised that it would await any amendments in Great Britain before making a corresponding provision for Northern Ireland.

195. The Committee agreed to clause 127 as drafted.

Clause 128 – Power of larger unincorporated charities to spend capital given for particular purpose

196. The Committee agreed to clause 128 as drafted.

Clause 129 – Power to spend capital subject to special trusts

197. The Committee agreed to clause 129 as drafted.

Part 13 - Chapter 1 of the Bill (Clauses 130 - 148)

198. The Committee had expressed concern that Part 13, Chapter 1 of the Bill (Public Charitable Collections) would not apply to internet fundraising activity. The Committee raised the matter with the Department and was informed that internet fundraising was an evolving area and would be difficult to regulate at this point. The Committee noted that the Department had held discussions with other charity regulators who are compiling advice and guidance in the area of internet fundraising and that the Institute of Fundraising for Great Britain had issued a code of practice for internet fundraising which was available to charities in Northern Ireland. The Committee accepted that regulation at this stage would not be appropriate but agreed that the Commission should consider this matter and issue appropriate guidance for Northern Ireland.

Clause 130 – Regulation of public charitable collections

199. The Committee agreed to clause 130 as drafted.

Clause 131 – Charitable appeals that are not public charitable collections

200. The Committee agreed to clause 131 as drafted.