| Membership | What's Happening | Committees | Publications | Assembly Commission | General Info | Job Opportunities | Help |

PUBLIC ACCOUNTS COMMITTEE Report on the TOGETHER WITH THE PROCEEDINGS OF THE COMMITTEE Ordered by the

The Public Accounts Committee to be printed Wednesday 9 October 2002 FIRST REPORT FROM PUBLIC ACCOUNTS COMMITTEE Standing Orders under Section 60(3) of the Northern Ireland Act 1998 have provided for the establishment of the Public Accounts Committee. It is the statutory function of the Public Accounts Committee to consider the accounts and reports of the Comptroller and Auditor General laid before the Assembly. The Public Accounts Committee is appointed under Standing Order No. 51. It has the power to send for persons, papers and records and to report from time to time. Neither the Chairperson nor Deputy Chairperson of the Committee shall be a member of the same political party as the Minister of Finance and Personnel or of any junior minister appointed to the Department of Finance and Personnel. The Committee Members were appointed by the Assembly on 24 January 2000. They will continue to be Members of the Committee for the remainder of the Assembly, unless it orders otherwise. The Chairperson Mr Billy Bell and the original Vice-Chairperson Ms Sue Ramsey were previously appointed on 15 December 1999. Ms Ramsey was replaced on the Committee by Mr Conor Murphy on 4th July 2002. The full membership of the Committee is as follows:-

All publications of the Committee (including press notices) are on the internet at archive.niassembly.gov.uk/accounts.htm All correspondence should be addressed to The Clerk of the Public Accounts Committee, Room 371, Parliament Buildings, Stormont, Belfast, BT4 3XX. The telephone number for general inquiries is: 028-9052-1532. The Committee's e-mail address is: michael.rickard@niassembly.gov.uk. TABLE OF CONTENTS Report on the Northern Ireland Tourist Board Introduction Our Principal Recommendations and Conclusions General Findings The Unsatisfactory Nature of the Department's Evidence Grant to the Malone lodge Hotel Use of a Corporate Credit Card in New York Use of Credit Cards in the Public Sector Excessive and Inappropriate Hospitality Spending in New York Unapproved Salary Increases Paid to Directors Payments to the Former Chief Executive Payments to the Former Deputy Chief Executive Discrimination Cases Failure to Follow Proper Procedures in Awarding Print Contracts The Chairman's Conflict of Interest The Government Procurement Service Appointments to the Boards of Public Bodies Inadequate Handling of Staff Complaints Departmental Oversight and Control Failures Proceedings of The Committee Relating to the Report Minutes of Evidence (Wednesday 24th April 2002 & Thursday 30th May 2002) 16 Correspondence of 1 October 2002 from Mr David Thomson, Treasury Officer of Accounts. Note: THE PUBLIC ACCOUNTS COMMITTEE HAS AGREED REPORT ON THE NORTHERN IRELAND TOURIST BOARD INTRODUCTION 1. The Public Accounts Committee met on 30 May 2002 to consider a range of reports on Northern Ireland Tourist Board matters. These were:

2. Our witnesses were:

3. In taking evidence, the Committee focused on a number of issues raised by the C&AG's reports. These were:

OUR PRINCIPAL RECOMMENDATIONS AND CONCLUSIONS ARE AS FOLLOWS: GENERAL 4.1 This report deals with a catalogue of serious failures of management, corporate governance and financial control that should never have been allowed to occur to the extent that they did, for as long as they did, in any part of the public service. Main Report, paragraph 6. 4.2 We have reached the alarming conclusion that, for many years, there was no effective control over expenditure in the Board's New York Office. Main Report, paragraph 8. 4.3 The Department must make absolutely sure that, from the outset, Tourism Ireland and Invest Northern Ireland put in place robust systems of control in all their overseas offices. Main Report, paragraph 8. 4.4 In general we have found in our work to date, that other Departments have readily co-operated with our investigations and answered our questions clearly and directly. However, at the evidence session on this topic, we were disturbed at the extent to which the DETI Accounting Officer and his team gave the impression of defending the indefensible. It seemed to us that they were trying to put a spin on some of the most blatant examples of malpractice and impropriety. The blunt message that we have for any Accounting Officer who is tempted not to answer our questions fully is that we will insist on further investigation by the C&AG and exercise our full powers to call for papers and additional witnesses until we are satisfied that all the relevant facts have been revealed. Main Report, paragraph 9. 4.5 We do recognise that, over the years, many fine and dedicated staff have given quality service to the Tourist Board. It is unfortunate that such dedicated staff were let down by what we have had to conclude was a culture of apathy, incompetence and lack of respect for proper procedures at the top of the organisation. Aspects of this culture appeared to extend right to the heart of the Department itself. In 1998, the Board's own Finance Manager alerted senior management to a wide range of control weaknesses. We commend this individual for exposing important matters of public interest, particularly since it seems to us that staff who raised legitimate questions about standards of propriety and financial control in the organisation were branded as troublemakers and marginalised. Main Report, paragraph 10. 4.6 This Committee wants the Audit Office to pay particular attention to the Tourist Board in future audits, as well as the tourism support activities which have now been transferred to other bodies, because it is clear that expenditure in this area is at a significantly higher risk than it should be. This enhanced level of audit scrutiny should be kept in place until we are convinced that the resources we vote in this area are not at high risk. The Board's problems have been so wide-ranging and deep-rooted and the Department's record so poor in not following-up previous undertakings to put them right, that we are asking the Assembly's Enterprise, Trade and Investment Committee to join us in monitoring progress. The Department has referred to the remedial action it is taking. This should now be put to us in the form of a comprehensive Action Plan addressing the full range of problems which have emerged. Main Report, paragraph 13. 4.7 We were astonished at the poor quality of the Department's evidence to us; this applies both to the written evidence the Department asked to be included in the C&AG's report, and the performance of the Departmental Accounting Officer and his team at the oral evidence session. Main Report, paragraph 14. 4.8 We take an extremely dim view of receiving detailed corrections only one week before the planned evidence session and indeed to receiving further unsubstantiated corrections on the morning of the session. Main Report, paragraph 16. 4.9 From beginning to end there has been a competence deficit in DETI's dealings with us. DFP Guidance states that Departments should check draft NIAO reports meticulously at every stage. However, we want to see the guidance further refined. Departments should be required to apply equally careful checks to any material they ask the C&AG to include in his report. Main Report, paragraph 17. 4.10 The quality of oral evidence given by the Accounting Officer and supporting witnesses was most unsatisfactory. There were a considerable number of instances of what seemed to us to be inconsistent, evasive and even misleading answers to our questions. The Accounting Officer has a constitutional obligation to account to the Assembly for the use of resources which have been voted to his Department and which were under his stewardship. On matters of fact, we have a right to a straight answer to a straight question. In this session, despite the length of time involved, we did not get the factual answers which we needed and were forced to take the unusual step of writing to the Accounting Officer to seek clarification on twenty-five separate issues and to ask for forty-seven additional pieces of information. This is not the first time we have had to make this point with DETI. Following our January hearing on LEDU Fraud we said we found the extent to which officials attempted to "stonewall" our questions disturbing and unacceptable. Main Report, paragraph 18. 4.11 The Accounting Officer's letter to the Committee of 9 July 2002 has addressed many of our concerns and we accept his assurances that the provision of unsatisfactory evidence was not wilful or out of any disrespect for the work of the Committee. However, it is still our view that some of his answers do not stand up well to scrutiny and we draw attention to these in the report. We are still not completely satisfied that this Department has been as open and forthcoming as we, and the public we represent, expect and deserve. We expect an Accounting Officer to recognise, where there is clear proof, that errors were made and to acknowledge the responsibility of those involved. Main Report, paragraph 19. 4.12 It is totally unacceptable for an Accounting Officer to decide for himself what this Committee needs to know; that decision the Committee reserves for itself. Main Report, paragraph 20. 4.13 The Department's reluctance to provide some of the information we asked for creates the suspicion that this might have had more to do with trying to conceal embarrassing details than with genuine confidentiality considerations. Under Standing Order 55 this Committee has the power to send for persons, papers and records. This certainly includes the right to see personnel records and legal advice in cases which have been completed and where large sums of taxpayers' money has been paid out for departmental actions when we consider them relevant to our enquiries. If a department truly believes that certain papers should be treated as confidential we will consider carefully any case it puts to us and act appropriately. Main Report, paragraph 20. GRANT TO THE MALONE LODGE HOTEL 4.14 It is very clear from our evidence session that there were serious shortcomings in the Board's case handling procedures. Main report, paragraph 21. 4.15 The Board's monitoring procedures failed to pick up that the project approved by the Planning Service was materially different to the one which it had approved. By the time the Board recognised its error, it had already paid 90 per cent of the grant, amounting to some £453,000. Main report, paragraph 23. 4.16 We are not persuaded that the failures in this case can simply be blamed on an individual case officer, no longer in the Board's employ. In our view, the failures surrounding this project were much more systemic in nature, than has been conceded by the Department. Main report, paragraph 25. 4.17 We were told that procedures have since been tightened significantly. While this is welcome, it will not, in itself, guarantee that similar failings will not arise in the future. The breakdown in the Malone Lodge case stemmed largely from a failure to properly apply an existing control procedure - the review of the planning permission. Due to the carelessness of the case officer and the absence of an effective supervisory check, the Board failed to detect that the project planning approval did not meet the terms of the Board's offer of assistance. If the Board is to properly fulfil its responsibilities in safeguarding large sums of taxpayers' money, it must ensure that its control procedures are properly applied in future. Main report, paragraphs 26 and 27 . 4.18 Better communication with the Planning Service in this case might have alerted the Board, at a much earlier stage, to the planning irregularities that its own control procedures failed to detect. In keeping with the principle of 'joined-up government', we expect the Board, as a matter of priority, to examine closely how its links with Planning Service can be improved. Main report, paragraph 29. 4.19 One of the most disturbing aspects of this case is that the Board received prior warnings about the planning irregularity, but failed to properly act on these warnings. The Board responded to these warnings on three occasions, each time giving an assurance that payments would not be made until all statutory planning approvals had been satisfied. This assurance was also repeated by the Minister. We were astonished to learn that, despite all these assurances, the Board subsequently made three payments totalling £453,000 to the project, even though the appropriate planning approval had not been obtained. Main report, paragraph 30. 4.20 The misplaced reliance on an earlier, flawed review of the planning permission by the case officer does not excuse the Board's failure to properly investigate the later warnings from the Residents' Association. Had it done so, the improper payment of grant could have been avoided Main report, paragraph 31. 4.21 Despite the Board's apparent recognition of the risks in the project, it had not seen fit to put its instruction to exercise "particular care", in writing. Given the concerns surrounding this case, this instruction should have been formally minuted. Main report, paragraph 32. 4.22 It appears to us that the Board regarded the Residents' Association largely as 'troublemakers' and, as such, failed to give their letters the level of scrutiny warranted. This was a serious error in judgement. Given the important nature of the Residents' Association warnings, the problematic planning history of the project and the amount of taxpayers' money involved, the Board's failure to thoroughly investigate the warnings was nothing short of gross negligence. Main report, paragraph 33. 4.23 We were told that new complaints procedures have been introduced, to ensure that correspondence from external groups is now subject to "more formal action". While we welcome this, we must point out that it is not just the formality of the procedures that is important, but also the quality of the scrutiny which underpins them. Main report, paragraph 34. 4.24 Since the Malone Lodge irregularities came to light, no check had been carried out on the other cases assisted under the scheme. We would ask the Department to arrange for this check to be undertaken and the results reported back to the Committee. Main report, paragraph 35. 4.25 The Board said that it had no evidence to suggest that the project promoters wilfully misled them with regard to planning matters. We found this statement astonishing and the Accounting Officer's explanation wholly unconvincing. We were also astonished to learn that the Board did not even seek an explanation from the promoters, as to why they had not kept the Board informed of the changes to the project. Given that the Board had paid out over £450,000 to a project that did not comply with the conditions of offer, its failure to challenge the promoters points to an appalling degree of indifference to its stewardship of public monies. Main report, paragraphs 36 and 38. 4.26 One of our main concerns on this case is the Board's decision not to enforce 'clawback' of grant. The Board had been given legal advice that reclaiming the grant would be difficult, should the project be delivered according to the original Letter of Offer. Main report, paragraphs 39 and 41. 4.27 We have grave reservations about the Board's handling of the clawback issue. Its approach appears to have been one of 'all is well that ends well'. Although the project now appears to be in line with the offer, the means by which this has been achieved is a matter of concern. The Board's decision not to enforce the conditions of offer means that no action is being taken against the promoters, despite their failure to keep the Board fully informed. In our view, this sends out the wrong message to recipients of grants from the Department and its NDPBs - that conditions can be ignored. This undermines the integrity of selective financial assistance schemes and places taxpayers' money at risk. Conditions of offer are an essential safeguard and we expect the Department to make it clear that they must be rigorously enforced. Main report, paragraph 42. 4.28 This Committee expects Departments and Agencies to be entirely forthright in their dealings with the Audit Office and any action which undermines the effectiveness of the C&AG and this Committee will not be tolerated. Main report, paragraph 43. 4.29 In examining tourism grants in 1995, the Westminster PAC concluded that the Board had operated with sheer laxity in relation to its own guidelines, with early projects showing an astonishing range of failures of supervision and management. We find it disconcerting that, in the wake of such a stern reprimand in 1995, the Board's handling of the Malone Lodge case contained similar failings. It appears that nothing much has changed. It is vitally important, therefore, that in response to this Committee's report, the Department and Board take the appropriate steps to ensure that the lessons are learned and fully applied in the future. Main report, paragraphs 44 and 45. USE OF A CORPORATE CREDIT CARD IN NEW YORK 4.30 We find the circumstances surrounding use of the corporate credit card extremely disturbing. When the problems with the credit card first emerged in 1996 the Tourist Board was negligent in three respects:

Main Report, paragraph 46. 4.31 What is most shocking to this Committee is that, even though £4,000 worth of receipts are still missing, the Department continues to assert that the Manager's spending was wholly commensurate with his work. In the absence of the key supporting documentation the Accounting Officer simply cannot substantiate such a claim; it is disturbing that he would even try to. Main Report, paragraph 48. 4.32 We learned from the C&AG's supplementary report of 22 May that the Tourist Board credit card was still being used inappropriately as late as November 2001. This was despite the fact that the C&AG had reported his concerns about how the card was being used on 21 August 2001. It is unacceptable that the Department failed to take any action for a further three months on a matter which needed to be tackled with the utmost urgency. Main Report, paragraph 50. 4.33 In our view, expenses incurred by the New York Manager while on Tourist Board business in the United Kingdom should have been paid under standard travel and subsistence regulations. We want to know whether the Manager obtained prior approval for the car hire arrangement, the makes and models of cars hired and the extent of any private mileage. Main Report, paragraph 51. 4.34 Given what we know about the Manager's history of charging personal expenditure to the credit card and with over £4,000 of hospitality spending still unsupported by original documentation, we think that it is important that the detail of the credit card statements is subject to a further review by the Department. The review should seek to establish the circumstances of all significant items of expenditure which are not clearly related to hospitality for guests of NITB. We would like this exercise to be carried out in consultation with the Audit Office. Main Report, paragraph 51. 4.35 We think it is questionable whether the New York Manager should contribute virtually nothing out of his own pocket towards his accommodation and vehicle costs when he is on either side of the Atlantic. NITB seems to treat him as though he is domiciled in Northern Ireland when he is in New York and domiciled in New York when he is in Northern Ireland. NITB has pointed out that allowances payable to the New York Manager are consistent with the British Tourist Authority's "overseas conditions of service". This may be so, but the Department must, in our view, find more cost-effective ways of running overseas offices. The New York office cost £1 million to run in 2000-2001. From what we have seen there is likely to be scope for economies. Main Report, paragraph 52. 4.36 The Department has given the Manager a number of formal warnings about his conduct. Yet we are told that the Board will only take a final view on disciplinary action "once due process is complete." Senior management have been aware of the circumstances surrounding the use of the card since April 2001. It is unacceptable that over a year later, they have not taken a final view on the appropriate disciplinary action. We expect to be informed when further disciplinary action is taken. We want to see full details on the disciplinary action on this case as soon as it is completed. Main Report, paragraph 53. 4.37 We are very disturbed at evidence that the New York Manager simply did not have the qualifications and experience specified in the advertisement for the job. We cannot understand how someone could be appointed to this important post, representing Northern Ireland overseas, who did not meet the core criteria. This is a very important matter which seems to reflect adversely on the integrity of public appointment procedures. DFP has, of course, an overall responsibility for promoting proper appointment procedures in the public service. In this case we want DFP to carry out its own independent investigation of the circumstances surrounding the appointment of the New York Manager and report its findings to us in the Memorandum of Reply. We want to know who sat on the selection panel and whether there were any applicants who did have a degree and/or marketing qualification. If there were no such applicants we want to know why the post was not re-advertised. Should DFP be unable to carry this out, we would expect the C&AG to investigate this matter and report back to the Committee. Main Report, paragraph 54. 4.38 We acknowledge that credit cards can be a cost-effective tool in purchasing arrangements. But if their use is not adequately controlled, individuals can bypass the normal procedures for incurring expenditure. It is essential therefore, that Departments put a separate and rigorous control system in place before they issue credit cards to individuals. We therefore welcome DFP's decision to issue comprehensive new guidance on the use of credit cards by public bodies. Main Report, paragraph 56. 4.39 The key message is that credit card transactions must be subject to the same rules that apply to all other methods of public spending. There must, above all, be full documentation of all transactions. Main Report, paragraph 57. 4.40 When public employees incur substantial expenses in the course of their work, there is a well established procedure for the employer to provide an advance or 'imprest' based on the anticipated cost. In our view, Departments should give explicit guidance on what circumstances, if any, staff expenses (travel and subsistence) can be met by Departmental credit cards rather than the usual imprest arrangements. This would be a safeguard for staff, as well as for the public purse. Main Report, paragraph 58. EXCESSIVE AND INAPPROPRIATE HOSPITALITY SPENDING IN NEW YORK 4.41 We were shocked at the laxity in controlling expenditure on overseas hospitality in the Tourist Board. It is particularly disturbing that this laxity seems to have been deeply embedded in the culture of the organisation over many years. Warnings and advice from the auditors and from the Tourist Board's own staff were not acted on. No one emerges with credit from the evidence we heard on this issue but, in particular, the various Accounting Officers involved signally failed in their duty to ensure sound controls were in place and that value for money could be demonstrated. It seems to us that senior staff in the Board and in the Department were well aware of this laxity in overseas spending, but none of them had sufficient regard for the public interest to bring it under control. Main Report, paragraphs 59. 4.42 We recognise that the NITB has, belatedly, accepted the key recommendations of the NIAO Management Letter of March 2001. It is indicative of the Board's attitude that it took a report by the C&AG and a public evidence session by this Committee before NITB could bring itself to put in place some basic procedures. Main Report, paragraph 60. 4.43 We want to make it absolutely clear that even if some of the hospitality expenditure described in the C&AG's report has helped to boost Northern Ireland Tourism revenue (and that is debatable) the failure of the Board to put proper procedures in place for hospitality expenditure is reprehensible. The Departmental Accounting Officer needs to recognise that when he is explaining a value for money judgement it is not enough to point to the benefits alone. He also has to consider the cost, to ensure that there is proper financial control and be able to demonstrate the cost-effective use of public money. Main Report, paragraph 61. 4.44 We find it incredible that four public employees, while working, can spend £74, which is roughly equal to the basic weekly retirement pension in Northern Ireland, on drinks for themselves. Yet the Department sees nothing amiss in this; it offered no adequate explanation, no apology and no regrets. Main Report, paragraph 62. 4.45 It would appear that by 2000 no one in the Tourist Board was prepared to challenge significant breaches of the organisation's hospitality procedures. This is hardly surprising given that Finance staff who had previously attempted to ensure adherence to procedures were in the words of the former Finance Manager subject to "constant hostility, bitterness and resentment". Main Report, paragraphs 63 and 99. 4.46 We want DFP to issue fresh guidance to Departments; they must ensure that all spending incurred in extending hospitality to guests or business contacts is clearly recorded as 'hospitality'. Hospitality at the taxpayers' expense is always a sensitive issue. For that reason the total amount spent each year on hospitality must be recorded separately in the annual accounts of each Department and every subsidiary body. Main Report paragraph 65. 4.47 We want the Department to investigate whether there is any evidence of lapses in recording hospitality and gifts accepted by NITB staff and report back to us what they have found. The Department must make absolutely sure that it has the procedures in place to ensure that all gifts and hospitality received are properly authorised and recorded in the register. Main Report, paragraph 66. UNAPPROVED SALARY INCREASES PAID TO DIRECTORS 4.48 We find it unsatisfactory, but typical of the quality of management decisions in the Board, that salary increases totalling £43,000 over a period of years were awarded to two Directors without the Department's approval. This is a clear example of NITB flouting the terms of its Financial Memorandum with the Department. It is extremely disturbing that the then Chief Executive, who had actually signed the Financial Memorandum in August 1996, awarded these unapproved payments. Main Report, paragraphs 67 and 68. 4.49 It seems to us that the Directors, who were rewarded for taking on these additional duties, did not perform them effectively. The Director of International Marketing was in charge of the New York Office, which as we have established was operating outside normal financial controls. The Director of Finance and Investment was in charge of the Accounts Branch which was paying credit card bills without having original receipts. Main Report, paragraph 69. 4.50 We are concerned at the casual way the Department has treated the failure of senior management in the Tourist Board to follow key requirements set out in the Financial Memorandum. It is not enough for Departments to agree Financial Memoranda with their subsidiary bodies, they must ensure that these requirements are implemented, and take appropriate action where they are not. Main Report, paragraph 70. PAYMENTS TO THE FORMER CHIEF EXECUTIVE 4.51 In 2000-01 NITB awarded its former Chief Executive consultancy contracts worth £34,000. None of this work was subject to public tender, in direct contravention of DFP Guidelines. We found it extraordinary that NITB, with the agreement of the Department, told the C&AG that in this case it regarded competitive tendering as a waste of public money. The Department tried to tell us that the way it awarded further work to the former Chief Executive followed DFP Guidelines: it is clear to us that it did not. This case is very important because the Departmental Accounting Officer himself, the person appointed to ensure proper procedures, was involved in approving an arrangement which did not provide for proper tendering of contracts, or document any rationale to show the value for money of the arrangement adopted. This sets an appalling example to staff at lower levels. Any member of the public might well perceive this as a case of "jobs for the boys". NITB and the Department have no defence against such allegations because of their collective failure to follow the rules. Main Report, paragraph 71 and 72. PAYMENTS TO THE FORMER DEPUTY CHIEF EXECUTIVE 4.52 We are astonished that the Deputy Chief Executive who, we were told, did not enjoy the respect or confidence of his colleagues, who had just been investigated for possible misconduct, was given such a very generous handout to end his contract. Indeed, it seems that this individual's contribution to the NITB was so negative, that it was considered worthwhile to spend £64,000 to dispose of him rather than have him serve out the last year of his contract. We strongly question the appropriateness of handing-out a pay-off in such circumstances. Main Report, paragraph 74. 4.53 We asked to see a copy of the reference provided to the former Deputy Chief Executive as part of his settlement. The reference, signed by the Chairman, was totally positive in tone. It made no mention of the problems his management style had created for the organisation, the opinion he was held in by his colleagues, or the circumstances of his departure. In our view the reference gave a misleading impression to any prospective employer. We consider that it was wrong for the Board to dispose of a troublesome employee in a way that left other public employers exposed. Main Report, paragraph 75. 4.54 It seems to us that the problems in this case were a clear result of appointing the wrong person for the job. We find it astonishing that the Board did not require either a degree or a professional marketing qualification for a senior management job which was so important to the successful marketing of Northern Ireland. We want the Department to review its procedures for appointing senior staff to its NDPBs. It is vital, for the future of the Northern Ireland economy, that high calibre appointments are made to these posts. Main Report, paragraph 76. DISCRIMINATION CASES 4.55 Since 1997 NITB has spent £114,700 defending and settling discrimination cases. In that period five employment cases were settled out-of-court. A further three cases are ongoing. This level of litigation is unusual and unhealthy for an organisation of the size and status of the Tourist Board. These cases would seem to indicate that it is not just financial management which is incredibly weak in NITB, the standard of personnel management also appears to be wholly unsatisfactory. Main Report, paragraph 77. 4.56 We are left with the distinct impression that conscientious whistleblowers, who raised legitimate questions about standards of financial control and propriety in the organisation, were branded troublemakers and marginalised. Main Report, paragraph 78. 4.57 NITB paid £22,500 to an unsuccessful applicant for the post of Group Marketing Director in 1996. The successful applicant was the former Deputy Chief Executive. We are aware that legal counsel advised NITB that its failure to keep a proper record of the interview process would weaken its case at a Tribunal. It is unacceptable for a public body to display such a casual approach to proper recruitment practices. Main Report, paragraph 79. FAILURE TO FOLLOW PROPER PROCEDURES IN AWARDING PRINT CONTRACTS 4.58 The Tourist Board was in clear breach of its own simple rules that all contracts over £15,000 should be put out to open competition. The Department was unable to provide us with a satisfactory explanation why basic tendering procedures were broken over and over again for the best part of a decade. Main Report, paragraph 80. 4.59 One of the most shocking aspects of this is that, as far back as 1997, senior staff in the Board were fully aware that the way they were handling print contracts was wrong and that they would be exposed if the C&AG found out about it. Main Report, paragraph 81. 4.60 In our view, the Board completely failed in its duty to adhere to the core public service values of fairness, objectivity and propriety in its award of substantial print contracts to W&G Baird. It is clear, that other companies in the printing sector who were not given the opportunity to tender, or whose lower bids were ignored, were treated most unfairly. It was totally unacceptable for the Board to persist with flawed tendering procedures which it knew to be wrong. Main Report, paragraph 82. 4.61 Information supplied by the Department revealed that over £885,000 of print work was awarded to companies other than W&G Baird between 1994-95 and 1999-2000. 97% of the work was awarded to firms submitting the lowest tender. In the same period W&G Baird obtained print contracts worth £1,436,000. W&G Baird was the lowest bidder for only 13% of the work it was given. These figures suggest a quite extraordinary degree of favouritism towards W&G Baird in the award of print contracts. Main Report, paragraph 83. THE CHAIRMAN'S CONFLICT OF INTEREST 4.62 The C&AG asked the former Deputy Chief Executive what was the source of his market intelligence on the only bidder for the Breakaways contract, he was told that it had arisen in discussion with the NITB Chairman. We found this new information worrying because we had been told repeatedly that Mr. Bailie had no involvement in these contract procedures. Yet here he was having a conversation with an official about the bid for a brochure and suggesting that checks should be carried out on the credit worthiness of the bidder. Main Report, paragraph 86. 4.63 It was, in our view, entirely wrong for the former Deputy Chief Executive to raise any aspect of the "Breakaways" competition with the Chairman, and when he was approached it was inappropriate for the Chairman to give advice. The Department told us that the Chairman was sufficiently insulated by the Tourist Board's procedures in relation to conflicts of interest; he played no role in awarding print contracts. The Accounting Officer told us that the Chairman had assured him that he also played no part in the tender at the Baird's end. Main Report, paragraph 89. 4.64 After extensive correspondence the Department eventually conceded that the discussion between the Chairman and the former Deputy Chief Executive, however casual, should not have taken place. It is disturbing that the Accounting Officer did not recognise much sooner that the use of advice which emanated from the Chairman on any publishing contract was not consistent with the degree of separation of interests which is essential for public confidence in the integrity of the Board's purchasing procedures. Main Report, paragraph 89. 4.65 One of the standard safeguards for dealing with conflict of interests is the requirement for Board members to withdraw from any meeting considering matters which they (or close family members) have a direct or indirect pecuniary interest. The Tourist Board case has demonstrated that this type of safeguard is incredibly easy to circumvent, and is completely worthless and ineffective in circumstances where off-the-record discussions about a publishing contract take place between a Chairman and a senior official. Main Report, paragraph 90. 4.66 We must emphasise that an ill-judged discussion of this nature can cause irreparable damage to public confidence in the integrity of the procedures for awarding contracts, irrespective of the quality of formal safeguards an organisation might have in place for dealing with conflicts of interest. Main Report, paragraph 90. THE GOVERNMENT PROCUREMENT SERVICE 4.67 We want DFP to provide this Committee with details of any other public bodies who have consistently refused to use the Government Procurement Service for purchasing particular services or commodities. We want the C&AG to pay particular attention to these bodies in future audits. Main Report, paragraph 93. APPOINTMENTS TO THE BOARDS OF PUBLIC BODIES 4.68 In our view, one of the key lessons from the Tourist Board case is that it is highly undesirable to make an appointment to the Board of a public body and completely inappropriate to make an appointment to the sensitive position of Chairperson, in circumstances where the prospective appointee's company is carrying out substantial commercial business worth over £1.4m with the public body. The only effective way of dealing with conflicts of interest of this magnitude is to prevent them from happening in the first place. The solution is as simple as that. Main Report, paragraph 94. 4.69 While we welcome the action now being taken by the Department to tighten up its procedures for handling conflicts of interest, we think this does not go far enough. In our view, the guidance needs to spell out clearly that it would not be appropriate to make an appointment to the Chair of a public body in circumstances where the prospective appointee's company is carrying out substantial commercial business with the public body. Main Report, paragraph 98. INADEQUATE HANDLING OF STAFF COMPLAINTS 4.70 Having seen the documentation, we accept that the Finance Manager's allegations, that NITB were breaching proper procedures, were investigated and some minor changes followed. But the far-reaching changes in attitudes and procedures which were called for, never happened. Indeed the then Chief Executive in response to the Finance Manager said; "there have been a number of clear lapses in relation to procedures but nothing overly serious". He went on to say that she should accept that "a balance must be struck between getting our job done and maintaining procedural standards". We find this astonishing. It is little wonder that we found numerous examples of NITB staff failing to follow key procedures, given this was the attitude at the top of the organisation. Main Report, paragraph 102. 4.71 In our view, the investigation into the serious allegation of impropriety in the handling of the Breakaways contract was hopelessly inadequate on a number of counts:

Main Report, paragraph 103. 4.72 The failure to deal properly with the serious concerns of staff has undoubtedly contributed to the appalling working relations within NITB. Like so many of the problems facing the Tourist Board a change in attitude is called for and this change has to come from the top. It seemed to us that the Departmental Accounting Officer was reluctant to face up to the inadequacies in the Acting Chief Executive's handling of this complaint. The Committee wants to receive a commitment from the Department that staff complaints will receive a proper hearing and investigation and that staff are formally notified in writing of the outcome of such an investigation. This is no more than what is generally recognised as good practice, and it is deeply disturbing that we have had to press the Accounting Officer to accept this in a formal commitment. Main Report, paragraph 104. DEPARTMENTAL OVERSIGHT AND CONTROL FAILURES 4.73 Given that there was a senior departmental representative on the Board, who attended all its meetings and had, so the Department told us, a 'close understanding' of the Board's activities, it is difficult for this Committee to accept that the Department could not have identified these significant breaches of proper procedures at a much earlier stage. In light of this, we are repeating the recommendation we made in the LEDU fraud report that DFP review, and where necessary tighten, its guidance on the role and responsibilities of the departmental representatives on the Boards of NDPBs. Main Report, paragraph 105. 4.74 The Committee's view is that the causes of the problems experienced by the Tourist Board lie as much with the Department and its Accounting Officers, as they do with the Tourist Board. In a case such as this, where there were persistent administrative failings in an NDPB, year after year, we believe the primary responsibility must be that of the Departmental Accounting Officers. They have signally failed to perform their supervisory duty. Main Report, paragraph 106. 4.75 The Department told us that a serious deficiency in its oversight arrangements was that from 1993 it had used the "holding company model" as the framework for its relationship with its NDPBs. We agree that this was a serious deficiency. The idea that these NDPBs could be so self-contained that the Departmental Internal Audit Service should be reporting to them alone should have been recognised as dangerous nonsense at the outset. Main Report, paragraph 107. 4.76 It seems to us that the internal audit set-up at the Tourist Board was fundamentally defective. The Department's Internal Audit Service carried out the internal audit function for the Board, but we note from the C&AG's Memorandum of 22 May 2002, that there had been a failure to report significant audit findings, either to the Department or to the Audit Office. Main Report, paragraph 108. 4.77 The Departmental Accounting Officer relies on his internal audit staff to provide him with an assurance that key financial and management controls are operating effectively in the NDPBs under his control. This cannot happen when serious lapses in control arrangements are not formally reported. Full disclosure of internal audit work is also crucial to the C&AG's ability to form a sound opinion on the Departmental Accounts and to report to us on his findings. We welcome DFP's decision to issue fresh guidance on this matter. Main Report, paragraph 109. 4.78 It is clear to us that the Department needs to have a critical look at the culture and effectiveness of its Internal Audit Service. Main Report, paragraph 110. 4.79 In our view, the arrangements the Departmental Accounting Officer had in place for discharging his responsibilities in relation to the Tourist Board were wholly inadequate. We hope the Accounting Officer now understands that, in the circumstances where he is primarily accountable for every pound voted to him and he passes on to an NDPB, it is not enough to accept that if a Financial Memorandum exists, the necessary controls are in place. He should ensure, with the support of a vigorous, independently-minded and well resourced Internal Audit Service, that the controls are being applied effectively. Main Report, paragraph 111. 4.80 At the evidence session we formed the impression that the Departmental Accounting Officer was attempting to shift the responsibility for deficiencies in control in the Tourist Board to the Board's Accounting Officer. It was only after further correspondence with this Committee that the Departmental Accounting Officer fully acknowledged his responsibility for, "ensuring that an effective system of internal financial control is maintained and operated." The Committee wants it made absolutely clear to all Accounting Officers that we attach great weight to the section of the Accounting Officer's Memorandum from which this phrase is taken. We expect the Accounting Officer to be able to demonstrate for all the subsidiary bodies for which he is responsible, that he has mechanisms in place to ensure that financial controls are working in practice. Main Report, paragraph 112. 4.81 The DETI Accounting Officer has now outlined the steps which have been taken to improve the situation. This Committee will ensure that the implementation of these new arrangements is monitored very closely. Main Report, paragraph 113. GENERAL FINDINGS 5. It is very clear from the evidence presented to us that the way in which the Tourist Board has been operating in recent years falls far short of what we expect in a public body. This not only lets down the taxpayer, it lets down people in the tourism industry who have a right to expect a professional and efficient organisation to administer the £15 million of public money per annum which is available to support tourism. 6. This report deals with a catalogue of serious failures of management, corporate governance, and financial control that should never have been allowed to occur, to the extent that they did, for as long as they did, in any part of the public service. Control over credit card and hospitality expenditure was virtually non-existent. The Board's own tendering procedures were broken over and over again for the best part of a decade. We found fundamental errors in the Board's core business of awarding grants to hotels, salary payments to directors which were not properly approved, defective recruitment procedures and wholly unsatisfactory arrangements for dealing with conflicts of interest and staff complaints. There was also a very unhealthy level of litigation on equal opportunities issues. 7. It seems to us that the whole management ethos of the Tourist Board was wrong. Financial controls were seen as a hindrance to getting the job done. Approvals from the Department were not sought when required. Guidelines and rules were there to be broken. It is important that this ethos is changed and changed quickly. There is now a new Chief Executive of the Tourist Board, we wish him well. It is important that the Department supports him in the challenging task ahead. 8. We have reached the alarming conclusion that, for many years, there was no effective control over expenditure in the Board's New York Office. Responsibility for New York and the other overseas offices has, of course, recently moved from NITB to Tourism Ireland Limited. Invest Northern Ireland also operates a number of overseas offices. The Department must make absolutely sure that, from the outset, Tourism Ireland and Invest Northern Ireland put in place robust systems of control in all their overseas offices. 9. In general we have found in our work to date, that other Departments have readily cooperated with our investigations and answered our questions clearly and directly. However, at the evidence session on this topic, we were disturbed at the extent to which the DETI Accounting Officer and his team gave the impression of defending the indefensible. It seemed to us that they were trying to put a spin on some of the most blatant examples of malpractice and impropriety. The blunt message that we have for any Accounting Officer who is tempted not to answer our questions fully is that we will insist on further investigation by the C&AG and exercise our full powers to call for papers and additional witnesses until we are satisfied that all the relevant facts have been revealed. Chairman's Letter to the Accounting Officer, 26 June 2002, Appendix 10. 10. We do recognise that, over the years, many fine and dedicated staff have given quality service to the Tourist Board. It is unfortunate that such dedicated staff were let down by what we have had to conclude was a culture of apathy, incompetence and lack of respect for proper procedures at the top of the organisation. Aspects of this culture appeared to extend right to the heart of the Department itself. In 1998, the Board's own Finance Manager alerted senior management to a wide range of control weaknesses. We commend this individual for exposing important matters of public interest, particularly since it seems to us that staff who raised legitimate questions about standards of propriety and financial control in the organisation were branded as troublemakers and marginalised. C&AG's Report on the 2000-01 Accounts,

paragraph 22. 11. As one of our members pointed out at the evidence session, there was a disturbing contrast between the treatment of unsatisfactory senior managers and the handling of junior staff, mainly women, who raised concerns about poor procedures in the Board. Minutes of Evidence, paragraph 678. 12. The Department acknowledged that, during the 1990s, there were substantial deficiencies in both NITB management and in its own arrangements for monitoring and controlling this important NDPB. The Department moved much too slowly to deal with these deficiencies. We have now received an assurance from the Accounting Officer that he is ".totally committed to effecting the necessary changes". He has outlined steps taken to improve the situation, beginning with the decision not to renew the Chief Executive's contract in March 2000. Accounting Officer's Letter of 9 July 2002, Appendix 12. 13. This Committee wants the Audit Office to pay particular attention to the Tourist Board in future audits, as well as the tourism support activities which have now been transferred to other bodies, because it is clear that expenditure in this area is at a significantly higher risk than it should be. This enhanced level of audit scrutiny should be kept in place until we are convinced that the resources we vote in this area are not at high risk. The Board's problems have been so wide-ranging and deep-rooted and the Department's record so poor in not following-up previous undertakings to put them right, that we are asking the Assembly's Enterprise, Trade and Investment Committee to join us in monitoring progress. The Department has referred to the remedial action it is taking. This should now be put to us in the form of a comprehensive Action Plan addressing the full range of problems which have emerged. THE UNSATISFACTORY NATURE OF THE DEPARTMENT'S EVIDENCE 14. We were astonished at the poor quality of the Department's evidence to us; this applies both to the written evidence the Department asked to be included in the C&AG's report, and the performance of the Departmental Accounting Officer and his team at the oral evidence session. 15. It is a long-established practice that Audit Office reports are cleared with Departmental Accounting Officers before publication to ensure accuracy and completeness and to confirm a balanced and fair presentation. Ensuring that the report is accurate, complete and fairly presented means that this Committee is presented with an agreed set of findings as a basis for conducting an effective examination. This enables the Committee to concentrate constructively on the main issues involved and not be distracted by disputes on essential facts. 16. The Department was sent the first of four drafts of the C&AG's report on the Tourist Board Accounts on 21 August 2001 and a final version was agreed by the Accounting Officer on 13 December 2001. Given this, we found it most unsatisfactory that the Department sent us substantial corrections to material which had already been included in the C&AG's report at the Department's request. The Department clearly had a reasonable period of time to get its contribution to the C&AG's report right; it is a serious matter that it did not. This Committee has repeatedly stressed, as has the Westminster Public Accounts Committee before us, the importance of agreed reports. We take an extremely dim view of receiving detailed corrections only one week before the planned evidence session and indeed to receiving further unsubstantiated corrections on the morning of the session. Accounting Officer's Letter of 20 May 2002,

Appendix 4. 17. The Department told us that the late corrections to the agreed report were due to the exceptionally high turnover of senior management within the Tourist Board; current staff did not have in-depth knowledge of these matters. During its preparations for the hearing, the Tourist Board said it found evidence that some information it supplied for the agreed report was incorrect. We do not consider this explanation to be acceptable. There was nothing in the additional material submitted to us that could not have been made available had the Department looked for it earlier. From beginning to end there has been a competence deficit in DETI's dealings with us. DFP Guidance states that Departments should check draft NIAO reports meticulously at every stage. However, we want to see the guidance further refined. Departments should be required to apply equally careful checks to any material they ask the C&AG to include in his report. Accounting Officer's Letter of 20 May 2002, Appendix 4. 18. The quality of oral evidence given by the Accounting Officer and supporting witnesses was most unsatisfactory. There were a considerable number of instances of what seemed to us to be inconsistent, evasive and even misleading answers to our questions. The Accounting Officer has a constitutional obligation to account to the Assembly for the use of resources which have been voted to his Department and which were under his stewardship. On matters of fact, we have a right to a straight answer to a straight question. In this session, despite the length of time involved, we did not get the factual answers which we needed and were forced to take the unusual step of writing to the Accounting Officer to seek clarification on twenty-five separate issues and to ask for forty-seven additional pieces of information. This is not the first time we have had to make this point with DETI. Following our January hearing on LEDU Fraud we said we found the extent to which officials attempted to "stonewall" our questions disturbing and unacceptable. Chairman's Letter to the Accounting Officer

of 26 June 2002, Appendix 10. 19. We accept that the Accounting Officer had to deal with an extensive range of issues, in what was an exceptionally long session. However, this is no excuse for providing inconsistent and confusing evidence. The Accounting Officer's letter to the Committee of 9 July 2002 has addressed many of our concerns and we accept his assurances that the provision of unsatisfactory evidence was not wilful or out of any disrespect for the work of the Committee. However, it is still our view that some of his answers do not stand up well to scrutiny and we draw attention to these in the report. We are still not completely satisfied that this Department has been as open and forthcoming as we, and the public we represent, expect and deserve. We expect an Accounting Officer to recognise, where there is clear proof, that errors were made and to acknowledge the responsibility of those involved. Accounting Officer's Letter of 9 July 2002,

Appendix 12. 20. The Accounting Officer told us he had been hesitant in giving full details of certain matters during his evidence to the Committee because ".of having to deal with sensitive personnel information." The Accounting Officer ought to have shared his difficulties with the Committee, and if he felt it appropriate, offered to submit a confidential note supplying the information we requested. It is totally unacceptable for an Accounting Officer to decide for himself what this Committee needs to know; that decision the Committee reserves for itself. When we asked for additional material to be sent to us as a result of unsatisfactory evidence, we were told that a number of items could not be released because they related to confidential personnel matters. We do not accept this. The Department's reluctance to provide some of the information we asked for creates the suspicion that this might have had more to do with trying to conceal embarrassing details than with genuine confidentiality considerations. Under Standing Order 55 this Committee has the power to send for persons, papers and records. This certainly includes the right to see personnel records and legal advice in cases which have been completed and where large sums of taxpayers' money has been paid out for departmental actions when we consider them relevant to our enquiries. If a department truly believes that certain papers should be treated as confidential we will consider carefully any case it puts to us and act appropriately. Accounting Officer's Letter of 9 July 2002, Appendix 12. GRANT TO THE MALONE LODGE HOTEL The adequacy of the Board's project monitoring and control procedures 21. It is very clear from our evidence session that there were serious shortcomings in the Board's case handling procedures. In May 1999, the Board offered financial assistance of some £503,000 for an 18-bedroom extension to the Malone Lodge Hotel. The Board's offer included a pre-commencement condition that copies of any statutory approvals that were required, such as planning approvals, were to be obtained before building works commenced. Another condition was that the project promoters would not, without the prior written approval of the Board, make any material alterations or additions to the project. 22. Unknown to the Board, the required planning permission for the 18-bedroom hotel extension was refused by Planning Service. Instead, the promoters sought and obtained planning permission for a 6-bedroom extension to the hotel, with a separate permission for 6 (2-bedroom) apartments in an adjoining building. The project actually delivered by the promoters - a 6-bedroom extension to the hotel and a separate apartments complex - was therefore materially different from the one which the Board had approved. Contrary to the offer conditions, no written approval for these changes was obtained from the Board. Indeed, the promoters failed to keep the Board informed about the changes to the approved plans. 23. The Board's monitoring procedures failed to pick up that the project approved by the Planning Service was materially different to the one which it had approved. The Board also failed to note that the planning permission received specifically precluded interconnection between the hotel and apartments buildings. The fact that the hotel and apartments could not be interconnected meant that the project being developed was not, therefore, a 51-bedroom hotel, as required by the Board's financial assistance offer. However, by the time the Board recognised its error, it had already paid 90 per cent of the grant, amounting to some £453,000. C&AG's report on Malone Lodge, paragraphs 2 to 5 and 15. 24. We asked the Accounting Officer why the Board's controls had failed to identify the planning discrepancies in this case. He told us that the Board's case officer had not checked the project planning approval in sufficient detail. The Accounting Officer accepted that this had been a serious breakdown in procedure and one which should not have happened. When we asked whether the case officer had been disciplined, we were told that he had left the Board's employ before the problem had come to light. Minutes of Evidence, paragraphs 37, 38, 81

to 94 and 141 to 147. 25. We are not persuaded that the failures in this case can simply be blamed on an individual case officer, no longer in the Board's employ. It is clear, for example, that there was no supervisory check on the work of the case officer. We also note that the Board's Quality Assurance team failed to detect the planning irregularities, when it physically inspected the hotel premises some nine months later. In our view, the failures surrounding this project were much more systemic in nature, than has been conceded by the Department. C&AG's report on Malone Lodge, paragraph 15. 26. The Accounting Officer told us that procedures have since been tightened significantly. He said that the Board now uses professional help from within the Department of Finance and Personnel's Construction Service, to ensure that planning consents, received in support of applications for payment of grant, conform to the project approved by the Board. We were also told that the Board has revised its quality assurance procedures, so that inspectors will now have the report from Construction Service and a copy of the approved plans, on an inspection visit. 27. While we welcome the introduction of these new procedures, this will not, in itself, guarantee that similar failings will not arise in the future. The breakdown in the Malone Lodge case stemmed largely from a failure to properly apply an existing control procedure - the review of the planning permission. Due to the carelessness of the case officer and the absence of an effective supervisory check, the Board failed to detect that the project planning approval did not meet the terms of the Board's offer of assistance. If the Board is to properly fulfil its responsibilities in safeguarding large sums of taxpayers' money, it must ensure that its control procedures are properly applied in future. Minutes of Evidence, paragraphs 38, 45 to 51 and 56. 28. In response to the issues raised in this case, the Board had told the Audit Office that it considered there was scope to improve its communication and co-operation with the Planning Service. We asked the Accounting Officer to elaborate on what new procedures had been agreed over the 18 months since the irregularities in this case came to light. We did not get a satisfactory answer to our question. The Accounting Officer simply repeated what he had already told us - that the Board now uses Construction Service to check planning approvals. 29. In our view, the additional check by Construction Service in no way obviates the need for the Board to improve its direct communication and co-operation with Planning Service. Better communication with the Planning Service in this case might have alerted the Board, at a much earlier stage, to the planning irregularities that its own control procedures failed to detect. In keeping with the principle of 'joined-up government', we expect the Board, as a matter of priority, to examine closely how its links with Planning Service can be improved. Minutes of Evidence, paragraphs 45 to 51. 30. One of the most disturbing aspects of this case is that, even though the Board received prior warnings about the planning irregularity, it failed to properly act on these warnings. In June and July 1999, the Lower Malone Residents' Association wrote to the Board warning that the owner of Malone Lodge was building apartments and pointing out that these represented a "covert application for a commercial extension to the hotel". The Board responded on three occasions, each time giving an assurance that payments would not be made until all statutory planning approvals had been satisfied. This assurance was also repeated by the Minister. We were astonished, therefore, to learn that, despite all these assurances, the Board subsequently made three payments totalling £453,000 to the project, even though the appropriate planning approval had not been obtained. It was only after a further letter from the Residents' Association, in October 2000, that the Board eventually recognised its error. C&AG's report on Malone Lodge, paragraphs 3, 9 and 10. 31. When we asked how, in the light of the warnings in 1999, the Board still failed to detect the irregularities; the Accounting Officer told us that the fault lay in the initial breakdown in procedure by the case officer (paragraph 23 above). We do not accept this explanation. The misplaced reliance on an earlier, flawed review of the planning permission by the case officer does not excuse the Board's failure to properly investigate the later warnings from the Residents' Association. Had it done so, the improper payment of grant could have been avoided. Minutes of Evidence, paragraphs 37, 141 and 142. 32. We were surprised to learn that, because of the history of planning difficulties in this case and the Residents' Association complaints, the Board had instructed its case officer to exercise "particular care" on the project. Unfortunately, this had no demonstrable effect on the work of the officer concerned. Nor apparently, did it result in an effective supervisory check. We also noted that, despite the Board's apparent recognition of the risks in the project, it had not seen fit to put its instruction to exercise particular care, in writing. Given the concerns surrounding this case, this instruction should have been formally minuted. C&AG's report on Malone Lodge, paragraph 15 33. It appears to us that the Board regarded the Residents' Association largely as 'troublemakers' and, as such, failed to give their letters the level of scrutiny warranted. This was a serious error in judgement. Even where it is believed that the issues raised by a pressure group have little or no substance, it is still incumbent upon a public body to exercise due diligence, to ensure that no material matter is overlooked. Given the important nature of the Residents' Association warnings, the problematic planning history of the project and the amount of taxpayers' money involved, the Board's failure to thoroughly investigate the warnings was nothing short of gross negligence. 34. During the evidence session the Board's Chief Executive told us that new complaints procedures have been introduced, to ensure that correspondence from external groups is now subject to "more formal action". While we welcome these new procedures, it must be borne in mind that in the Malone Lodge case, it was the former Chief Executive himself who wrote to the Residents' Association, stating that payments would not be made until all statutory planning approvals had been satisfied. Clearly therefore, it is not just the formality of the procedures that is important, but also the quality of the scrutiny which underpins them. Minutes of Evidence, paragraphs 143. 35. Because of the control failures in this case, some £453,000 of taxpayers' money was wrongly paid to the promoters. We asked the Accounting Officer if the Board had checked whether there were any other cases where the requisite planning permission had not been obtained before grant was paid. Unfortunately, this was another instance during the evidence session where we did not get a satisfactory answer. The Accounting Officer merely told us that he was not aware of any other such cases and commented that the Board had examined its procedures. It would appear, therefore, that since the Malone Lodge irregularities came to light, no check has been carried out on the other cases assisted under the scheme. Accordingly, we would ask the Department to arrange for this check to be undertaken and the results reported back to the Committee. Minutes of Evidence, paragraphs 40 to 44. On the Board's lack of enforcement of its Letter of Offer conditions 36. The Board said that it had no evidence to suggest that the project promoters wilfully misled them with regard to planning matters in this case. We find this statement astonishing. The Board's Letter of Offer included clear and very specific conditions attaching to the grant, including stipulations that:

37. Contrary to these conditions, the promoters submitted one set of plans, showing a single integrated hotel, for approval by the Board. They submitted a different set of plans, for a hotel and separate apartments, for approval by the Planning Service. The Board was unaware that two sets of plans existed. The promoters then accepted three grant instalments of around £450,000 of taxpayer's money from the board, even though they did not have planning permission for a 51-bedroom hotel. And by having an interconnection between the hotel and the apartment building, the promoters also breached a condition of planning permission, forbidding such a link. C&AG's report on Malone Lodge, paragraphs

14 and 15. 38. In light of this, we asked how, precisely, the Board had arrived at its view that it had not been misled by the promoters. Once again, we were disappointed with the poor quality of the response to our question. The Accounting Officer sought to explain the promoters' failure to keep the Board apprised of developments by referring to the 12 to 15 month lapse of time between the original processing of the case and the submission of grant claims. We find the Accounting Officer's explanation wholly unconvincing. We were also astonished to learn that the Board did not even seek an explanation from the promoters, as to why they had not kept the Board informed of the changes to the project. Given that the Board had paid out over £450,000 to a project that did not comply with the conditions of offer, its failure to challenge the promoters points to an appalling degree of indifference to its stewardship of public monies. Minutes of Evidence, paragraphs 72 to 80

and 95 to 102. 39. One of our main concerns on this case is the Board's decision not to enforce 'clawback' of grant. Under the Letter of Offer, the applicant is required to repay grant if any information provided to the Board is misleading, or there has been a failure to disclose any material fact, or if any material change is made to the works without the prior written consent of the Board. We asked how the Board's decision not to clawback grant could be justified, given that the project very clearly did not meet the terms of the offer. 40. We were told that the project that has finally been delivered by the promoters is, in essence, the same as the one originally approved by the Board. This followed Planning Service approval of a revised planning application in February 2002. The Accounting Officer assured us, however, that there was no question of the Board having casually accepted matters. He pointed to the Board's letter of March 2001 to the promoters which made it clear that failure to deliver the project and comply with all the offer conditions would result in the Board demanding repayment of grant. C&AG's report on Malone Lodge, paragraph

19. 41. We asked whether the Board has, at any time, sought a legal opinion on whether the grant already paid could be recovered. The Board had been given legal advice that reclaiming the grant would be difficult, should the project be delivered according to the original Letter of Offer. Minutes of Evidence, paragraphs 130 to 133. 42. We have grave reservations about the Board's handling of this matter. Its approach appears to have been one of 'all is well that ends well'. Although the project now appears to be in line with the offer, the means by which this has been achieved is a matter of concern. The Board's decision not to enforce the conditions of offer means that no action is being taken against the promoters, despite their failure to keep the Board fully informed. In our view, this sends out the wrong message to recipients of grants from the Department and its NDPBs - that conditions can be ignored. This undermines the integrity of selective financial assistance schemes and places taxpayers' money at risk. Conditions of offer are an essential safeguard and we expect the Department to make it clear that they must be rigorously enforced. Minutes of Evidence, paragraph 1071. 43. One other area of concern was the provision of misleading information to the C&AG by the Board. Following discovery of the planning irregularities, the Board wrote to the project promoters in March 2001 stating that the project "was certified and operating in contravention of the statutory planning approval". Yet, some five months later, in a letter to the Audit Office, the Board stated that it "does not consider that the hotel has at any time been operating in contravention of the statutory planning approval". Despite extensive questioning by the Committee, the Accounting Officer and the Chief Executive signally failed to explain the inconsistency. We have concluded that the Board's response to the Audit Office was misleading and, as such, wholly unacceptable. This Committee expects Departments and Agencies to be entirely forthright in their dealings with the Audit Office and any action which undermines the effectiveness of the C&AG and this Committee will not be tolerated. C&AG's report on Malone Lodge, paragraphs

5 and 14. 44. Overall, this case has highlighted a range of weaknesses within the Board's core business area of awarding grants to hotels. It is of particular concern that this is not the first time that the Board's handling of tourism development grants has been found wanting by a Public Accounts Committee. In examining the scheme in 1995, the Westminster PAC concluded that the Board had operated with sheer laxity in relation to its own guidelines, with early projects showing an astonishing range of failures of supervision and management. 45. We find it disconcerting that, in the wake of such a stern reprimand in 1995, the Board's handling of the Malone Lodge case contained similar failings. It appears that nothing much has changed. It is vitally important, therefore, that in response to this Committee's report, the Department and Board take the appropriate steps to ensure that the lessons are learned and fully applied in the future. Minutes of Evidence, paragraphs 149 and 1071. USE OF A CORPORATE CREDIT CARD IN NEW YORK 46. We find the circumstances surrounding use of the corporate credit card extremely disturbing. We learned that, in 1996, the New York Manager charged personal expenditure to this credit card. We asked the Department to provide details of what had happened in 1996, but were told there were no records. In 1997, following discussions with then Chief Executive, the Manager stopped using the card. In the C&AG's report, the Department stated that the New York Manager stopped using the corporate card on the instructions of senior management, because of concerns about its use. The Department told us eight days before our evidence session that this was incorrect; there had been a discussion, but no instruction to stop using the card. We do not find the Department's revised version of events at all convincing. In the absence of any contemporary documentation the full story will perhaps never be known. What we can say is that when the problems with the credit card first emerged in 1996 the Tourist Board was negligent in three respects:

Minutes of Evidence, paragraphs 214 and 713. 47. The Manager started to use the card again in December 1999, but told no-one in the Tourist Board. An Accounts Clerk spotted the card was being used in July 2000 and on three occasions asked for the receipts to be sent to Head Office; these requests were ignored. Incredibly, no-one else noticed that the monthly bill from the British Tourist Authority included thousands of pounds of credit card spending until April 2001. By this stage the Manager had charged £24,000 to the card and could not or would not supply back-up documentation for much of this spending. Minutes of Evidence, paragraphs 254 to 276. 48. The Department told us that the Manager eventually produced duplicate receipts for some credit card expenditure, leaving a balance of £4,023 for which there are no receipts. The Manager has now agreed to repay this amount, at the rate of £100 a month. It will be November 2005 before the full amount is recovered by NITB, six years after use of the credit card resumed. What is most shocking to this Committee is that, even though £4,000 worth of receipts are still missing, the Department continues to assert that the Manager's spending was wholly commensurate with his work. In the absence of the key supporting documentation the Accounting Officer simply cannot substantiate such a claim; it is disturbing that he would even try to. Accounting Officer's Letter of 9 July 2002, Annex 25. 49. The Department told the C&AG that it had a written statement from the Manager that the card had not been used for personal expenditure, and assured him that all expenditure was appropriately incurred. The Department later admitted to us that items of personal expenditure had been charged to the card since its use was resumed in 1999, and these had only recently been repaid. As we have seen (paragraph 46 above) the Manager had a history of using the card improperly for personal spending dating back to1996. C&AG's Report on the 2000-01 Accounts,

paragraphs 2 to 7. 50. We learned from the C&AG's supplementary report of 22 May that the Tourist Board credit card was still being used inappropriately as late as November 2001. This was despite the fact that the C&AG had reported his concerns about how the card was being used on 21 August 2001. It is unacceptable that the Department failed to take any action for a further three months on a matter which needed to be tackled with the utmost urgency. C&AG's Memorandum of 22 May 2002, Appendix 5. 51. When we insisted on seeing all credit card statements for the New York Manager's card we discovered that the potential scale of the abuse was more serious than we first thought:

Given what we know about the Manager's history of charging personal expenditure to the credit card and with over £4,000 of hospitality spending still unsupported by original documentation, we think that it is important that the detail of the credit card statements is subject to a further review by the Department. The review should seek to establish the circumstances of all significant items of expenditure which are not clearly related to hospitality for guests of NITB. We would like this exercise to be carried out in consultation with the Audit Office. Accounting Officer's Letter of 9 July 2002,

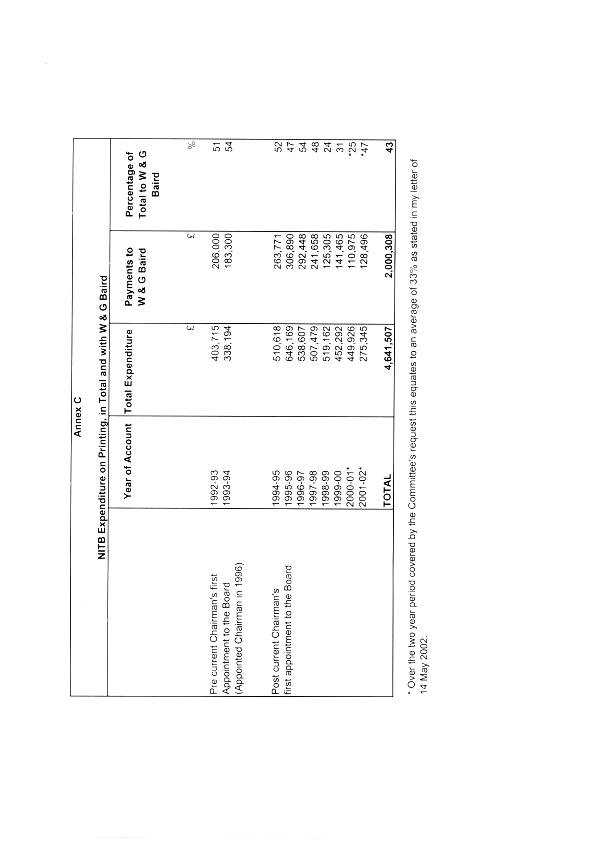

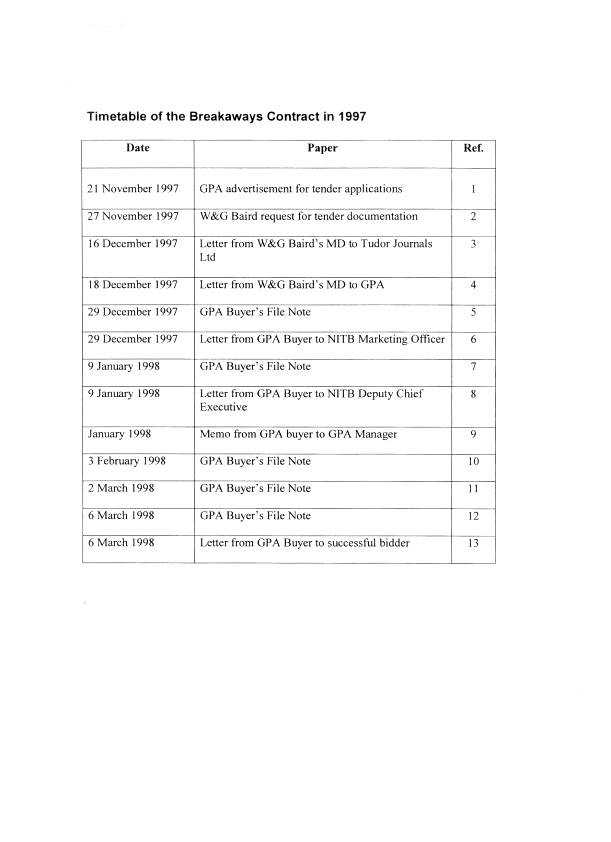

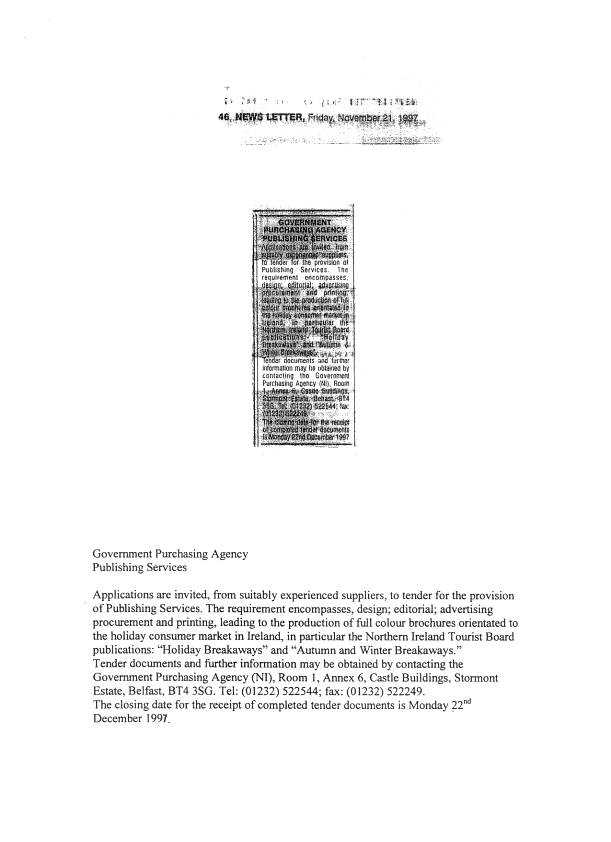

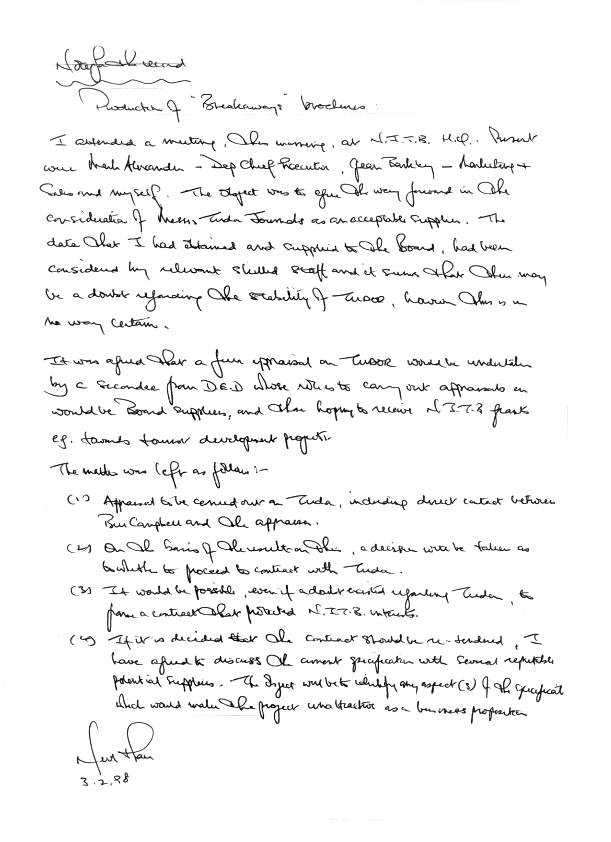

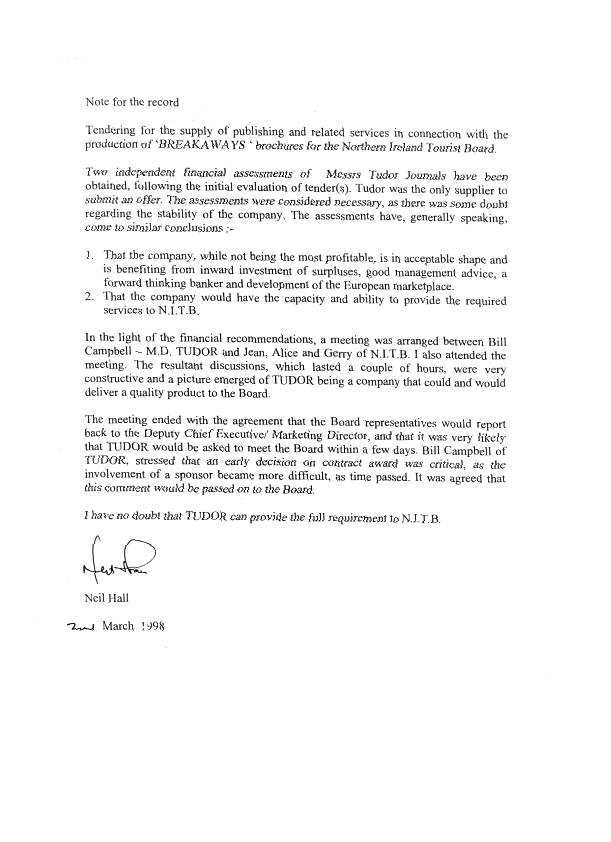

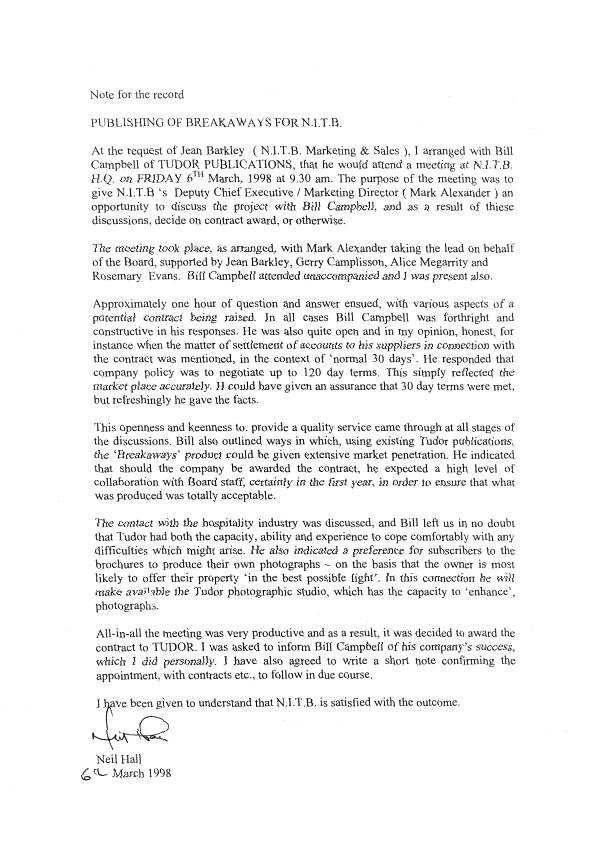

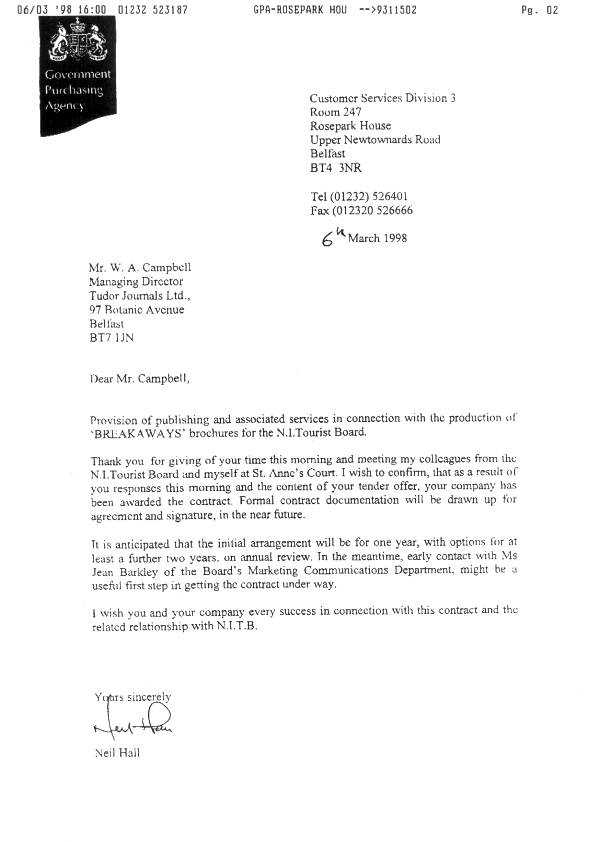

Annexes 25 and 28. 52. We think it is questionable whether the New York Manager should contribute virtually nothing out of his own pocket towards his accommodation and vehicle costs when he is on either side of the Atlantic. NITB seems to treat him as though he is domiciled in Northern Ireland when he is in New York and domiciled in New York when he is in Northern Ireland. We note that the rent and other overseas allowances he received were higher than his basic salary. In the two year period up to March 2001 he received over £49,000 in rent allowance and a further £16,000 in allowances in respect of car leasing, car parking, car registration and insurance. The taxpayer also paid his electricity bills (£1,738), car repair costs (£2,809) and medical/dental bills (£3,030). NITB has pointed out that allowances payable to the New York Manager are consistent with the British Tourist Authority's "overseas conditions of service". This may be so but the Department must, in our view, find more cost-effective ways of running overseas offices. The New York office cost £1 million to run in 2000-2001. From what we have seen there is likely to be scope for economies. C&AG's Memorandum of 22 May 2002, Appendix