Public Accounts Committee

Report on Transforming Land Registers: The LandWeb Project

Together with the Minutes of Proceedings of the Committee

Relating to the Report and the Minutes of Evidence

Ordered by The Public Accounts Committee to be printed 13 May 2010

Report: NIA 56/09/10R Public Accounts Committee

Session 2009/2010

Fifteenth Report

Membership and Powers

The Public Accounts Committee is a Standing Committee established in accordance with Standing Orders under Section 60(3) of the Northern Ireland Act 1998. It is the statutory function of the Public Accounts Committee to consider the accounts, and reports on accounts laid before the Assembly.

The Public Accounts Committee is appointed under Assembly Standing Order No. 56 of the Standing Orders for the Northern Ireland Assembly. It has the power to send for persons, papers and records and to report from time to time. Neither the Chairperson nor Deputy Chairperson of the Committee shall be a member of the same political party as the Minister of Finance and Personnel or of any junior minister appointed to the Department of Finance and Personnel.

The Committee has 11 members including a Chairperson and Deputy Chairperson and a quorum of 5.

The membership of the Committee since 9 May 2007 has been as follows:

Mr Paul Maskey 3 (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

The Lord Browne 1,8,9

Mr John Dallat

Mr David Hilditch 4,7

Mr Trevor Lunn

Mr Patsy McGlone 2,6

Mr Mitchel McLaughlin

Mr Stephen Moutray 10

Ms Dawn Purvis

Mr Jim Shannon 5

1 |

Mr Mickey Brady replaced Mr Willie Clarke on 1 October 2007 |

1 |

Mr Ian McCrea replaced Mr Mickey Brady on 21 January 2008 |

1 |

Mr Jim Wells replaced Mr Ian McCrea on 26 May 2008 |

2 |

Mr Thomas Burns replaced Mr Patsy McGlone on 4 March 2008 |

3 |

Mr Paul Maskey replaced Mr John O’Dowd on 20 May 2008 |

4 |

Mr George Robinson replaced Mr Simon Hamilton on 15 September 2008 |

5 |

Mr Jim Shannon replaced Mr David Hilditch on 15 September 2008 |

6 |

Mr Patsy McGlone replaced Mr Thomas Burns on 29 June 2009 |

7 |

Mr David Hilditch replaced Mr George Robinson on 18 September 2009 |

8 |

Rt Hon Jeffrey Donaldson replaced Mr Jim Wells on 18 September 2009 |

9 |

The Lord Browne replaced Rt Hon Jeffrey Donaldson on 19 April 2010 |

10 |

Mr Stephen Moutray replaced Mr Jonathan Craig on 19 April 2010 |

Table of Contents

List of abbreviations used in the Report

Report

The Benefits Resulting from the LandWeb System

The Significant Increase in the Expected Value of the LandWeb Agreement

The Importance of Fully Considering Requirements and Clearly Defining an Output Specification

The Need to Consider Intellectual Property Rights

The Need for Agreements Such as LandWeb to be Transparent

The Setting of Fees and Generation of Surplus Income

Appendix 1:

Appendix 2:

Appendix 3:

Appendix 4:

List of Abbreviations used in the Report

BT - British Telecom

C&AG - Comptroller and Auditor General

The Department - Department of Finance and Personnel

DFP - Department of Finance and Personnel

LPS - Land and Property Services

PFI - Private Finance Initiative

Landweb - Private Finance Initiative Concession Agreement

Executive Summary

1. Land Registers plays a key role in the conveyancing process when property is exchanged and records updated and is responsible for registering estates throughout Northern Ireland. To improve efficiency and customer service, Land Registers signed a Private Finance Initiative Concession Agreement (“LandWeb") with British Telecom (BT) in 1999. LandWeb has transformed Land Registers’ business enabling it to process vastly increased numbers of applications, particularly during the period of the unprecedented property boom, resulting in faster turnaround times for applications. In addition it provides a secure electronic archive for documents. Computerisation has also enabled Land Registers to provide enhanced levels of customer service through a direct access facility, for use by the legal profession, via the internet (LandWeb Direct).

2. The Committee acknowledges that LandWeb has transformed Land Registers’ business from an antiquated paper-based system, but considers that better value for money could have been secured for the tax payer and Land Registers’ customers.

3. Evidence to the Committee suggests that the deal negotiated, with its incremental implementation approach, has been more lucrative to British Telecom than envisaged in its original bid of £17 million. Additions and changes to the Agreement since 1999 have increased its capital value from an estimated £46 million in 1999, to a current reported estimate of £78 million. This is due to windfall gains resulting from the property boom and the add-ons to the original Agreement.

4. When defining the project scope and developing the original output specification, Land Registers lacked the strategic vision to appreciate how computerisation could transform its business. As a result it failed to identify important interdependencies between the Land Registry and Registry of Deeds systems and necessary future training requirements.

5. The Committee has identified evidence of poor project management, short-comings in risk management and a lack of necessary skills and experience in the Land Register’s project team before, during and after the procurement.

6. Public bodies must be alert to the potential benefits of retaining intellectual property rights. In the case of LandWeb, BT’s retention of those rights has been a factor resulting in Land Registers being in an overdependent position with BT. This means that other potential providers of services, for example training, must negotiate with BT to use the LandWeb system.

7. In the Committee’s view, rather than planning and anticipating its staffing requirements, Land Registers waited until a situation reached crisis point before acting. This has lead to BT effectively acting as a job agency providing casual staff, which has cost over £16 million to date. Whilst the Committee acknowledge the pressures Land Registers was operating under at that time, the provision of this support by BT also enabled it to realise revenue through processing transactions more quickly. In addition, as the provision of this support has not been subject to a competitive tendering process, it is difficult to assess if value for money was achieved.

8. In addition, internal delays in progressing legislation within the Department resulted in compensation payments totalling £2.6 million being paid from public funds to BT over a five-year period for loss of income.

9. The Department and Land Registers do not have access to information on BT’s financial position and profitability. This limits their ability to manage risks, negotiate effectively and develop a functioning partnership. There is an opportunity in 2014 at the Agreement break point to assess BT’s rate of return and press BT to provide appropriate mechanisms, such as benchmarking, profit- sharing and open book accounting.

10. Land Registers has been charging too much for its services resulting in it generating surplus income of over £30 million since 2003. This could be viewed as a form of indirect local taxation levied on Land Registers’ customers. It is also important that where such surpluses are surrendered, the use made of those funds for other public services is not out of public view, but properly approved by the Assembly.

11. It is disappointing that lessons emerging from this project were not identified by the Department and disseminated earlier. Many of the issues such as the need to properly scope projects; to manage risks to delivery; and to develop and harness essential skills were also evident in the Department’s later Shared Services projects, examined by the Committee in 2008. Although this project predates the Gateway review process it nevertheless demonstrates the importance of subjecting major projects to ongoing review.

Summary of Recommendations

Recommendation 1

1. The Committee recommends that DFP reminds Departments of the importance of considering the full range of services to be delivered in a major business transformation project. This includes identifying underlying interdependencies within the organisation and between systems when defining the scope and developing an output specification.

Recommendation 2

2. The Committee recommends that DFP puts in place a register of public sector staff with project and programme management skills and experience. This will enable Departments to effectively plan future resource requirements; enable strategic oversight and management of these key skills; and ensure that future projects will benefit from this experienced pool of staff.

Recommendation 3

3. The Committee recommends that DFP reminds Departments of the importance of public bodies considering the potential benefits of retaining intellectual property rights and to seek appropriate advice. DFP should also alert public bodies to the risk of overdependency in a contractual arrangement, which can be a barrier to successful contract completion, reduce competition and result in less innovation in the market.

Recommendation 4

4. The Committee recommends that the Department undertakes a market testing exercise to assess the value for money of the ongoing staff support services currently being provided by BT. Public bodies must be careful when making significant changes to Agreements, and the presumption should be in favour of competition.

Recommendation 5

5. The Committee recommends that the Department undertakes a rigorous value for money assessment on the rate of return information provided by BT. The Department must press BT to provide appropriate mechanisms, such as profit-sharing; benchmarking; market testing; and open book accounting. In the Committee’s opinion the public sector must have this as a right and not have to bargain for it in the 2014 break-point negotiations for LandWeb.

Recommendation 6

6. The Committee recommends that the Department puts in place an action plan ahead of break point negotiations. This must fully consider its negotiating strategy and identify a suitably experienced and qualified negotiating team. This may benefit from drawing on the experience and advice of bodies such as the Strategic Investment Board.

Recommendation 7

7. The Committee recommends that the Department continues to closely monitor the activities of Land Registers to ensure that its fees reflect the cost of delivering its services. Excessive surpluses should be avoided as they represent an indirect local tax on Land Registers’ customers. It is also important that where such surpluses are surrendered, the use made of those funds for other public services is not out of public view, but properly approved by the Assembly.

Recommendation 8

8. The Committee recommends that the Department puts in place the necessary arrangements between its Departmental Solicitors Office and Land Registers to ensure the timely progression of legislation to enable the appropriate fee to be charged to customers and avoid the potential for claims for compensation.

Introduction

1. The Public Accounts Committee met on 18 March 2010 to take evidence regarding the Comptroller and Auditor General’s report ‘Transforming Land Registers: The LandWeb Project’. The witnesses were:

- Mr Stephen Peover, Accounting Officer, Department of Finance and Personnel (the Department);

- Mr John Wilkinson, Chief Executive, Land and Property Services (LPS);

- Mrs Patricia Montgomery, Director of Customer and Business Improvement, LPS;

- Mr Craig Apsey, Chief Operating Officer, British Telecom;

- Mr Kieran Donnelly, Comptroller and Auditor General; and

- Ms Fiona Hamill, Treasury Officer of Accounts, DFP.

2. The Committee was provided with additional information on the 26th February 2010 and also wrote to Mr Peover on 19 March 2010 with queries following the evidence session. He replied on 13 April 2010.

3. Land Registers signed a Private Finance Initiative Concession Agreement (“LandWeb") with BT in 1999. The potential value of the Agreement, which was dependent on the number of transactions successfully processed, was assessed at £46 million.

4. The Agreement period was seventeen years (two years for implementation and fifteen operational) with a break option at year twelve. The implementation period was subsequently extended from two to five years with the LandWeb system becoming fully operational in July 2004. This lengthened the Agreement period to twenty years; Land Registers estimates that the Agreement value is now in the region of £78 million.

The Benefits Resulting from the LandWeb System

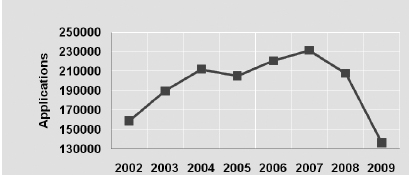

5. The Committee acknowledges that LandWeb has transformed Land Registers business providing it with the ability to process vastly increased application levels, particularly during the period of the unprecedented property boom. This has resulted in faster turnaround times for applications and has also provided a secure electronic archive for documents. Computerisation has also enabled Land Registers to provide enhanced levels of customer service through a direct access facility, for use by the legal profession, via the internet (LandWeb Direct).

6. The Committee is reassured by steps taken by Land Registers to reduce the number of poor-quality paper-based applications submitted by the legal profession, but is concerned that the rejection rate for applications is still about 25 per cent. Land Registers has introduced a scheme to encourage people to use e-registration rather than registration by paper, and the 2010 Fees Order provides a financial incentive to use e-registration through reduced fees.

7. The Committee is encouraged to hear that for electronic applications the rejection rate is only 2 per cent and commends Land Registers’ efforts to encourage more people to use the e-registration system. The Committee is also fully supportive of the e-registration scheme and the resulting savings for legal practices, which will, in turn, save their clients up to £95 on a transaction.

The Significant Increase in the Expected Value

of the LandWeb Agreement

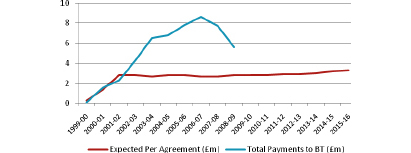

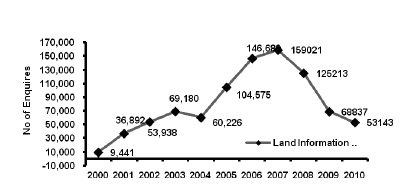

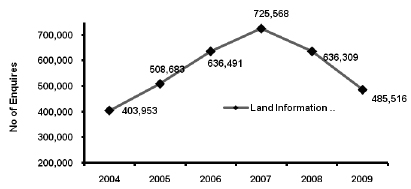

8. Evidence to the Committee suggests that the deal negotiated, with its incremental implementation approach, has been more lucrative to BT than it envisaged in its original bid, due to windfall gains resulting from the property boom (BT’s income is based on the transactions processed) and the add-ons to the original Agreement. Figure One demonstrates that total payments of £54 million made to BT to date have far exceeded levels expected in the original Agreement. Extensions to the contract account for 46% or £25 million of payments made to date.

Figure One:

Total payments to BT have significantly exceeded those expected in the Agreement signed in 1999

Source: Department of Finance and Personnel

The Importance of Fully Considering Requirements and Clearly Defining an Output Specification

9. BT was appointed as preferred bidder in December 1998 when its bid was £17.5 million for a contract period of ten years. This increased to £46 million and a contract period of 17 years in the space of eight months. The Committee is not fully satisfied with the explanations provided for this substantial increase. This indicates to the Committee that the output specification prepared did not fully consider Land Registers’ business requirements. The Department also acknowledged that their negotiators could probably have been better. The Committee is not convinced that the market was tested properly.

10. The Department accepts that mistakes were made. One example is the failure to identify the high level of interdependency between the Land Registry and Register of Deeds systems. At preferred bidder stage, BT was quick to spot the importance to Land Registers of computerising the Registry of Deeds at an estimated cost of £3.5 million.

11. In another example the Agreement was extended for enhanced business training services in September 2006. The Committee is surprised that BT was engaged to undertake the business training review exercise supporting the contract extension, for which BT has been paid £1.8 million to December 2009. Furthermore the Committee is of the opinion that this training requirement should have been anticipated and included in the original Agreement.

12. Evidence requested by the Committee also indicates that Land Registers has paid BT, as an add-on to the original contract, over £1 million for 61 computers and associated software licences; network connections; services and storage. This is equivalent to £16,000 per unit and indicates to the Committee that if you buy computers from a single supplier without competition, you are at risk of paying above the market price.

Recommendation 1

13. The Committee recommends that DFP reminds Departments of the importance of considering the full range of services to be delivered in a major business transformation project. This includes identifying underlying interdependencies between systems when defining the scope and developing an output specification.

The Importance of Departmental Oversight

and Having a Suitably Qualified and

Experienced Project Team

14. Despite evidence of poor project management and a failure to adequately identify and manage key risks to the project, the LandWeb system has successfully transformed the way Land Registers operates. This is in no small part due to BT’s ability to deliver on a complex transformation of Land Registers’ business. The Committee acknowledges the commitment shown by Land Registry staff in undertaking this complex project. However, it concurs with the Department’s view that there was not sufficient experience in Land Registers at the time to be fully aware of the potential of Information Technology to transform land registration and the associated processes.

15. The project highlights yet again a point the Committee has raised in previous reports, that sponsor departments must ensure that public sector bodies, for which they are responsible, have the necessary skills and experience in place to effectively manage procurement and negotiation with private sector bidders.

16. The lack of experience in Land Registry is reflected in its significant reliance on external support which has cost in excess of £1.5 million. The original estimates included in the business case for advisory services of £0.2 million clearly demonstrate that Land Registers had a very limited understanding of the enormity of the task ahead. The Department’s retrospective approval of an additional £1.4 million for advisory services is sadly yet another example presented to the Committee of poor departmental control over expenditure.

17. The Department acknowledged that the Project Board did not meet often enough and that governance arrangements did not work in the way in which they should have. The Project Board failed to meet regularly. For example, in 2002 there was a gap of seven months and thereafter the gaps between meetings varied from three to five months to the end of 2005. During these periods there were significant extensions to the Agreement relating to back conversion, map reconstruction and engagement of BT casual support staff.

18. DFP has taken some steps to develop the skills and capacity of its staff which the Committee acknowledged in its 2009 ‘Report on Shared Services for Efficiency’. Although the LandWeb project preceded the NI Civil Service Reform projects examined in the Shared Services report, the evidence of poor project management and a failure to adequately identify and manage key risks, again highlights the importance of ensuring that departments have access to suitably qualified and experienced individuals who can effectively manage the procurement, negotiation, implementation and operation of such complex projects. The Committee also highlighted the need for a pool of experts from the wider public sector, who have extensive skills and experience of successfully delivering IT projects in its 2009 ‘Report on Statement of Rate Levy and Collection’.

Recommendation 2

19. The Committee recommends that DFP puts in place a register of public sector staff with project and programme management skills and experience. This will enable Departments to effectively plan future resource requirements; enable strategic oversight and management of these key skills; and ensure that future projects will benefit from this experienced pool of staff.

The Need to Consider Intellectual Property Rights

20. Public bodies must be alert to the potential benefits of retaining intellectual property rights. The Committee is aware that the wider public sector, whether here or in GB, can potentially benefit from re-using processes and software solutions developed by another public body. The Committee notes the Department’s comment that when the contract was signed in 1999, it was not that common to have intellectual property rights. However, the opportunity was missed to potentially secure these rights for the benefit of both Land Registers in Northern Ireland and the wider public sector in Great Britain.

21. In the case of LandWeb, BT’s retention of those rights has been a factor resulting in Land Registers being in an overdependent position with BT. This means that other potential providers of services, for example training, must negotiate with BT to use the LandWeb system. Three other possible suppliers were consulted about whether they wanted to participate in a tendering process to provide the enhanced training services (paragraph 11). However, they did not want to do so, as they thought that it would be too complex to integrate their systems with the BT system.

Recommendation 3

22. The Committee recommends that DFP remind Departments of the importance of public bodies considering the potential benefits of retaining intellectual property rights and to seek appropriate advice. DFP should also alert public bodies to the risk of overdependency in a contractual arrangement which can reduce competition and result in less innovation in the market.

The Need to Rigorously Test Prices for Additional Work or Services and to Have the Option to Have Work Carried Out by Alternative Suppliers

23. Due to staffing shortages, compounded by growing backlogs of work, Land Registers could not meet certain commitments under the Agreement. The solution adopted was to engage BT to provide staff to undertake the work. Whilst the Committee acknowledges the pressures Land Registers was operating under at that time, the provision of this support by BT also enabled it to realise revenue through processing transactions more quickly.

24. There is a risk that value for money may be compromised, particularly if large changes to the Agreement are given to an incumbent supplier and not subject to effective competition. The continued engagement of staff supplied by BT — which is effectively acting as a job agency — through a single tender action has cost £16 million to date. The Committee notes the Department’s comments that it was “an effective way of dealing with a problem". However, as the provision of this support has not been subject to a competitive tendering process, it is difficult to assess whether value for money was achieved.

25. The Committee is further concerned that Land Registers disclosed its in-house costs to BT and these formed the basis for the fees charged for casual support staff provided by BT. The Committee considers that Land Registers’ “showing its hand" does not demonstrate good business acumen nor produce a competitive deal for customers. Public bodies must rigorously test prices for additional work or services and should have the opportunity to select alternative suppliers of their choice.

Recommendation 4

26. The Committee recommends that the Department undertakes a market testing exercise to assess the value for money of the ongoing staff support services currently being provided by BT. Public bodies must be careful when making significant changes to Agreements, and the presumption should be in favour of competition.

The Need for Agreements Such as LandWeb

to be Transparent

27. It is important that in PFI Agreements the public sector is fully sighted on the contractor’s costs, overheads and profits and that there are appropriate mechanisms for checking that the risks and rewards are fairly proportioned over the period of the Agreement. Contrary to current best practice, the LandWeb Agreement signed with BT specifically precludes sight of information such as “the make-up of the charges, including, without limitation, BT costs, overheads and profit". This makes it difficult for the Committee to make judgements regarding value for money of the services provided by BT .

28. The Committee does not agree with the Department’s assertion that it was the commercial reality of the time. There is evidence of projects in GB which predated the LandWeb Agreement that provided for open book access. Although the guidelines at the time did not force open book accounting this Committee is of the opinion that the project team, their advisors and the department missed an opportunity.

29. The Agreement provides for a break option review period starting in 2011. At that point Land Registers has an opportunity to assess BT’s rate of return.

30. The Department told the Committee that, at the contract break point, in 2014, it expects BT to demonstrate the value for money that it gets from current arrangements. The Committee is encouraged by BT’s undertaking to include consideration of open-book accounting in the context of current best practice as part of those negotiations. However, the Committee considers that, in order to align with current practice, open book accounting should be provided as a matter of course and not be part of a negotiation process. This Committee will follow closely the outworking of the break option negotiations and expects the Department to secure a good deal for Land Registers’ customers.

31. In the years after the Agreement was signed, the Northern Ireland property market experienced an unprecedented boom in conveyancing. This situation generated increased levels of income for Land Registers (reflected in the huge surpluses generated) and presumably windfall levels of transaction charges for BT. The Committee in its 2007 ‘Report on Surplus Land in the PFI Education Pathfinder Projects’, stressed the importance of protecting the public sector interests through appropriated profit-sharing arrangements. The lack of transparency and profit-sharing mechanisms in the LandWeb Agreement does not allow Land Registers to verify nor share in any potential windfall gains.

Recommendation 5

32. The Committee recommends that the Department undertakes a rigorous value for money assessment on the rate of return information provided by BT. The Department must press BT to provide appropriate mechanisms, such as profit-sharing; benchmarking, market testing and open book accounting. In the Committee’s opinion the public sector must have this as a right and not have to bargain for it in the 2014 break-point negotiations for LandWeb.

Recommendation 6

33. The Committee recommends that the Department puts in place an action plan ahead of break point negotiations. This must fully consider its negotiating strategy and identify a suitably experienced and qualified negotiating team. This may benefit from drawing on the experience and advice of bodies such as the Strategic Investment Board.

The Setting of Fees and Generation

of Surplus Income

34. A key driver for computerisation was a reduction in fees to customers, thus lowering conveyancing costs. Land Registers is legally obliged to recover the full costs associated with the operation of its activities. However, it is clear to the Committee that Land Registers has been charging its customers too much for its services resulting in it generating surplus income of over £30 million since 2003. Whilst, under current arrangements this surplus income is surrendered to the Consolidated Fund and available to fund other public sector services in Northern Ireland, it could be considered as a form of indirect local taxation levied on Land Registers’ customers.

35. The Department explained that the surpluses “arose because fee levels were not adjusted quickly enough in response to the rise in the market". One major stumbling block in the past had been the protracted negotiations with DFP’s Departmental Solicitors Office, with one Fees Order taking in excess of two years to enact. The Committee is heartened to see that the 2010 Fees Order has been processed a lot more quickly.

36. The Department confirmed that, due to internal delays, it failed to put in place the necessary legislation to enable the appropriate fee to be charged to customers for electronic searches of the Registry of Deeds. However, BT was entitled to be paid a transaction fee per search. The Department’s solution was a monthly compensation payment to BT, which to the Committee’s concern, continued to be paid for around five years, at a cost of £2.6 million.

Recommendation 7

37. The Committee recommends that the Department continues to closely monitor the activities of Land Registers to ensure that that its fees reflect the cost of delivering its services. Excessive surpluses should be avoided as they represent an indirect local tax on Land Registers’ customers. It is also important that where such surpluses are surrendered, the use made of those funds for other public services is not out of public view, but properly approved by the Assembly.

Recommendation 8

38. The Committee recommends that the Department puts in place the necessary arrangements between its Departmental Solicitors Office and Land Registers to ensure the timely progression of legislation to enable the appropriate fee to be charged to customers and avoid the potential for claims for compensation.

Appendix 1

Minutes of Proceedings

of the Committee

Relating to the Report

Thursday, 11 March 2010

Room 144, Parliament Buildings

Present: Mr Paul Maskey (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr Jonathan Craig

Mr John Dallat

Rt Hon Jeffrey Donaldson MP

Mr Patsy McGlone

Mr Mitchel McLaughlin

Mr Trevor Lunn

Ms Dawn Purvis

Mr Jim Shannon

In Attendance: Ms Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Miss Danielle Best (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr David Hilditch

2:03 pm the meeting opened in public session.

5. Briefing on NIAO Report ‘Transforming Land Registers: The LandWeb Project’.

Mr Kieran Donnelly, C&AG, Mr Brandon McMaster, Director; and Mr Sean Beattie, Audit Manager; briefed the Committee on the report.

2:46 pm Mr Shannon entered the meeting.

2:47 pm Mr Dallat left the meeting.

2:50 pm the meeting went into closed session.

The C&AG continued to brief members in private session.

3:00 pm Ms Purvis left the meeting.

3:02 pm Mr Dallat entered the meeting.

3:03 pm Mr Shannon left the meeting.

3:05 pm Mr Shannon entered the meeting.

3:14 pm Mr McGlone left the meeting.

3:25 pm Mr Donaldson left the meeting.

3:27 pm Mr Donaldson entered the meeting.

3:30 pm Mr Dallat left the meeting.

The witnesses answered a number of questions put by members.

[EXTRACT]

Thursday, 18 March 2010

The Senate Chamber, Parliament Buildings

Present: Mr Paul Maskey (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr Jonathan Craig

Mr John Dallat

Rt Hon Jeffrey Donaldson MP

Mr Patsy McGlone

Mr Mitchel McLaughlin

Mr Trevor Lunn

Mr Jim Shannon

In Attendance: Ms Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Miss Danielle Best (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr David Hilditch

Ms Dawn Purvis

2:00 pm The meeting opened in public session.

2. Evidence Session on the Northern Ireland Audit Office Report ‘Transforming Land Registers: The LandWeb Project’.

The Committee took oral evidence on the above report from:

- Mr Stephen Peover, Accounting Officer, Department of Finance and Personnel (DFP);

- Mr John Wilkinson, Chief Executive, Land and Property Services (LPS);

- Mrs Patricia Montgomery, Director of Customer and Business Improvement, Land and Property Services (LPS); and

- Mr Craig Apsey, Chief Operating Officer, British Telecom (BT).

2:06 pm Mr Shannon entered the meeting.

2:35 pm Mr Dallat left the meeting.

2:41 pm Mr Dallat entered the meeting.

2:50 pm Mr Donaldson entered the meeting.

2:50 pm Mr Shannon left the meeting.

2:52 pm Mr Shannon entered the meeting.

3:05 pm Mr McGlone left the meeting.

3:13 pm Mr Dallat left the meeting.

3:18 pm Mr Dallat entered the meeting.

3:24 pm Mr Craig left the meeting.

3:28 pm Mr McGlone entered the meeting.

3:37 pm Mr Dallat left the meeting.

3:39 pm Mr McGlone left the meeting.

3:44 pm Mr Dallat entered the meeting.

3:45 pm Mr McLaughlin left the meeting.

3:46 pm Mr Donaldson left the meeting.

3:48 pm Mr McGlone entered the meeting.

3:50 pm Mr Shannon left the meeting.

4:10 pm Mr Donaldson entered the meeting.

4:19 pm Mr McGlone left the meeting.

The witnesses answered a number of questions put by the Committee.

Agreed: The Committee agreed to request further information from the Department.

[EXTRACT]

Thursday, 25 March 2010

Room 144, Parliament Buildings

Present: Mr Paul Maskey (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr John Dallat

Mr David Hilditch

Mr Mitchel McLaughlin

Ms Dawn Purvis

Mr Jim Shannon

In Attendance: Ms Aoibhinn Treanor (Assembly Clerk)

Mr Vincent Gribbin (Assistant Assembly Clerk)

Miss Danielle Best (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr Jonathan Craig

Rt Hon Jeffrey Donaldson MP

Mr Patsy McGlone

Mr Trevor Lunn

2:06 pm The meeting opened in public session.

7. Issues arising from the oral evidence session on NIAO report ‘Transforming Land Registers: The Landweb Project’

The Committee considered an issues paper from the oral evidence session on NIAO report ‘Transforming Land Registers: The Landweb Project’.

Agreed: The Committee agreed the issues contained in the paper as discussed.

[EXTRACT]

Thursday, 13 May 2010

Room 144, Parliament Buildings

Present: Mr Paul Maskey (Chairperson)

The Lord Browne

Mr John Dallat

Mr David Hilditch

Mr Trevor Lunn

Mr Mitchel McLaughlin

Mr Patsy McGlone

Mr Stephen Moutray

Ms Dawn Purvis

Mr Jim Shannon

In Attendance: Ms Aoibhinn Treanor (Assembly Clerk)

Mr Phil Pateman (Assistant Assembly Clerk)

Miss Danielle Best (Clerical Supervisor)

Mr Darren Weir (Clerical Officer)

Apologies: Mr Roy Beggs (Deputy Chairperson)

2:00 pm the meeting opened in public session.

7. Consideration of the Draft Committee Report on ‘Transforming Land Registers: The LandWeb Project’.

Paragraphs 1 –20 read and agreed.

Paragraph 21 moved to new para 12.

Paragraphs 22-24 read and agreed.

Paragraph 25 read, amended and agreed.

Paragraph 26 read and agreed.

Paragraphs 27 and 28 read, amended and agreed.

3:08 pm Mr Dallat and Mr McGlone entered the meeting.

Paragraphs 29 – 32 read and agreed.

3:14 pm Mr Hilditch left the meeting.

3:15 pm Mr Moutray left the meeting.

Paragraph 33 read, amended and agreed

Paragraphs 34 – 38 read and agreed.

Consideration of the Executive Summary

Paragraphs 1 – 11 read and agreed subject to the amendments agreed to in the main report.

Agreed: Members agreed to redact the information requested in the correspondence and include the correspondence received in the report.

Agreed: Members ordered the report to be printed.

Agreed: Members agreed that the report would be embargoed until 00.01 am on Thursday, 3 June 2010.

Agreed: Members agreed to launch the report with a press release to be agreed at a later meeting and subject to press interest to participate in a media pre-brief.

3:27 pm Mr McGlone left the meeting.

3:28 pm The Lord Browne left the meeting.

[EXTRACT]

Appendix 2

Minutes of Evidence

18 March 2010

Members present for all or part of the proceedings:

Mr Paul Maskey (Chairperson)

Mr Roy Beggs (Deputy Chairperson)

Mr Jonathan Craig

Mr John Dallat

Mr Jeffrey Donaldson

Mr Trevor Lunn

Mr Patsy McGlone

Mr Mitchel McLaughlin

Mr Jim Shannon

Witnesses:

Mr Craig Apsey |

BT |

|

Mrs Patricia Montgomery |

Land and Property Services |

|

Mr Stephen Peover |

Department of Finance and Personnel |

Also in attendance:

Mr Kieran Donnelly |

Comptroller and Auditor General |

|

Ms Fiona Hamill |

Treasury Officer of Accounts |

1. The Chairperson (Mr P Maskey): We move on to discuss the Audit Office report ‘Transforming Land Registers: The LandWeb Project’. I remind members and visitors to switch off their mobile phones and other electronic devices, as they interfere with the recording equipment. Mr Stephen Peover, the accounting officer for the Department of Finance and Personnel (DFP), will introduce us to his colleagues.

2. I also welcome Mr Kieran Donnelly, the Comptroller and Auditor General, and Ms Fiona Hamill, the Treasury Officer of Accounts.

3. Given that no members wish to express any interests in the matter, we can proceed.

4. Mr Stephen Peover (Department of Finance and Personnel): With me today are John Wilkinson, chief executive of Land and Property Services (LPS), Patricia Montgomery, director of customer and business improvement and registrar of titles in Land and Property Services, and Craig Apsey from BT.

5. The Chairperson: We have a lot of questions to get through, so please be succinct and to the point when answering members’ questions, and please do not leave out any information. Paragraph 1.2 sets out the key aims for the LandWeb agreement, which include: the electronic accessing of information, thereby reducing turnaround times; improving performance quality; reducing registration costs; and creating a secure archive. To what extent has each of those objectives been achieved? How do you continue to monitor that progress?

6. Mr Peover: May I begin by focusing on the key positives of the project? I think that, by and large, the project has been a success. As someone who was not in the Department at the time, I can say that without any sense of personal pride about it. The project has won a number of awards and met all its ministerial targets, and it has dealt with a substantial increase in the number of applications and managed to process many more applications within target. In fact, it has processed 86% of applications within target, as opposed to something like 52% in 1999-2000. The project has provided a secure archive for the documents, and it has rolled out compulsory first registration across Northern Ireland. It has also led to customer savings, estimated at up to £6·8 million, on access to land information. That has saved people having to travel to access information.

7. It has also obviated the criticisms that the Lay Observer for Northern Ireland made about the system in the past, it has reduced the average level of fees to below the level in 2000 and it has enabled us to begin the implementation of e-registration, subject to take-up by the legal profession. Therefore, it has done quite well in achieving the objectives that were set.

8. The Chairperson: Thank you. Appendix 3 of the report states that the Westminster Public Accounts Committee expected “substantial progress" to be made on the computerisation of the registry by 1995. However, we can see clearly that the service was not operational until July 2004, which was nine years later. Are you satisfied that that represents a prompt and adequate response to the Westminster Public Accounts Committee’s recommendation in 1995, especially for a system that is key to the effective operation of conveyancing in the North of Ireland? That question needs to be answered.

9. Mr Peover: It was an adequate response, but it would be difficult to argue that it was prompt. However, there were reasons for that. As you know, the project eventually became a free-standing arrangement under which the contractors are paid through a transactional charge. This was done a very long time ago, and a different Department was involved — the Department of the Environment (DOE) in those days — and, as I understand it, there was no capital money to invest in the system and there was a period during which the resources were not available. Subsequent to that, when a way forward was found through a PFI process, which, I think, DFP suggested originally, it took time to negotiate the contract. You will that see that one of the timelines in the report sets out the various stages. Given the nature of the contract, those dates were not unreasonable. However, if you are asking whether it could have been done sooner, the answer is yes.

10. The Chairperson: Nine years is unreasonable.

11. Mr Peover: A lot of the delay was due to the unavailability of public money to invest in the project.

12. Mrs Patricia Montgomery (Land and Property Services): At the time, we were running under departmental running costs, and, therefore, any moneys that were coming in as fees were paid into the Department, and the Department was paying us back moneys. However, we did not have any capital funding. Therefore, we had to change the way that the organisation was funded. We went into the net running costs, and we were charged with raising fees to cover our costs. We still did not have capital moneys at that stage to invest, or certainly, we did not have enough, and that is why we had to go down the route of the PFI.

13. The Chairperson: Paragraphs 4.2 to 4.7 deal with the project management arrangements. Any outside observer looking at this matter would be entitled to conclude that there was a very cosy relationship between BT and Land Registers. Are you satisfied that everything was above board and that there was no impropriety in that arrangement?

14. Mr Peover: Yes, I am satisfied that there was no impropriety. You are right to say that a close working relationship exists. Looked at another way, however, I would regard that as evidence of a good partnership working between the Department and BT. We were not simply hiring a contractor to provide a service and then walking away from it. We were working in a long-term strategic partnership with a contractor to achieve the benefits that we talked about earlier.

15. If you are asking whether the governance arrangements were adequate, technically speaking, the project board did not meet often enough, and the arrangements about how issues would be signed off were not clear enough. If you ask me whether that made much difference in practical terms, the answer would probably be no.

16. A diagram in the report shows the project management structure, but it does not show the tier above that, which is where the Department and the Minister gave clearance. Therefore, major decisions were not just kept within the project governance arrangements; they were escalated to the Department and the Minister. In practical working terms, when the project board was not meeting, the people who should have been on that board, had it met, had regular meetings under another guise. In fact, there were hundreds of meetings over a period of time. Craig was located in our buildings, and there was daily contact between him and his equivalent on our side.

17. I can do nothing but hold my hands up and say that, technically speaking, the governance arrangements did not work in the way in which they should have. However, in practical terms, that has not led to a deficit in the project, and I believe that there was certainly no impropriety in the way in which the project was managed.

18. The Chairperson: Given the Minister for Regional Development’s actions last Friday over the single-tender actions in NI Water and taking paragraphs 3.19 to 3.22 of the Audit Office report into account, is there a difference between what happened in NI Water and the appointment of casework assistance to Land Registers at a cost of approximately £15 million?

19. Mr Peover: I cannot speak in detail about NI Water; it is not my area of responsibility. I must be careful in what I say, but as I understand it, some of NI Water’s contracts may have been particularly manipulated to ensure that tendering was not required. In our case, we entered into a partnership with BT to work on a particular project. During the development of that project, in the post-tender negotiations and as a result of the working relationship that developed along the way, opportunities arose to do additional things. We took legal advice on whether it was legitimate to do those things with our partner, BT, and the advice was that it was legitimate to do so under European contract law. Therefore, we acted with expediency and for other reasons, which are set out in the report. I do not know enough about the situation in NI Water, but, on the face of it, I think that the two cases are not comparable.

20. The Chairperson: I am not asking you to comment on NI Water; I just made the comparison, because that case received media coverage recently. In your case, appointment caseworks cost in the region of £15 million, and a single-tender action was involved. Did you talk to other companies about the tender for the project?

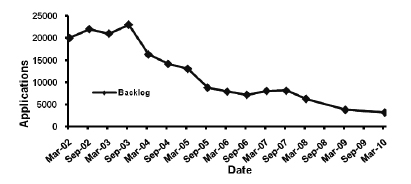

21. Mr Peover: The term “single-tender action" does not quite describe what happened with casework assistance. We needed a resource to clear a backlog that was escalating out of control. At one stage, the backlog was as high as 28,000 cases. We were under pressure from the legal profession, the community, the Committee for Finance and Personnel and politicians, so the problem needed to be resolved. Had we tested the market directly, a delay would have been introduced to the process.

22. The Chairperson: It took you nine years. Rather than talking about delays, we are concerned at this stage to ensure that there was value for money and fairness in the procurement and tendering processes. In 1995, the Westminster Public Accounts Committee said what could and should have been done by then, yet it took you until July 2004. Should those issues not have been addressed in that time?

23. Mr Peover: Do you mean that we should have addressed the casework assistance problem in 1995? The backlog arose after that time. Many additions to the contract came about as a result of genuinely unforeseeable circumstances. For example, no one — certainly not us — foresaw the increase in the number of transactions that came about as a result of the boom in the housing market here. European legislation allows contracts to be extended or expanded in genuinely unforeseeable circumstances. Furthermore, having taken the best advice that we could at the time, things arose that our specialist advisers did not foresee. That meant that the contract process for working with our partner had to be adjusted. I take your point; however, genuinely unforeseeable and urgent problems arose in a political context that was such that we needed to respond quickly to those pressures. John Wilkinson and I were talking about the matter earlier, so he may wish to say something about the management and operational side of LPS.

24. Mr John Wilkinson (Land and Property Services): I joined LPS in 2007, which was at the back end of the heat of battle in the project. At that time, the Northern Ireland housing market was experiencing an unprecedented boom. I am a chartered surveyor with 35 or 36 years of experience, and I had not seen anything like that in my life, even in London and the south-east in the late 1980s.

25. When rolling out the LandWeb project, the Land Registry, as it was, ran into a period when the housing market was booming. That boom added to the volume of transactions and meant that values increased by about 45% over a very short period. All those things added to the complexity and the scale of the project and made it very difficult and very challenging for everyone who was involved at the time. However, looking at it from the other side now, my feeling is that the project was a huge success, as the permanent secretary outlined, and it is moving forward and enabling us to register property in Northern Ireland.

26. Mr Peover: If we go back to the 28,000 backlog, we estimate that it sits at just over 3,000 cases for 2009-2010. That means that the process has reduced the backlog substantially.

27. The Chairperson: I was not questioning the effectiveness of the system; I am questioning why it was not put out to tender. You said that time could have been an element and that it could have taken a bit longer. How much longer would it have taken had it been put out to tender?

28. Mr Peover: If it had gone to tender, it would have taken at least a year, and probably two years, by the time that it went through the processes. It would certainly have taken a year.

29. Mr Wilkinson: The difficulty was that we were dealing with a problem that was escalating by the month. Patricia has some of the figures on that. However, my take on the situation was that in 2007 in particular, every week was another week of difficulty.

30. The Chairperson: Conversations were had with BT, and it has put in a very effective system. However, did you even speak to anyone else about putting in a similar type of system?

31. Mr Peover: Bear in mind, the system that was in use was a BT system. As I understand it, there was no great interest from other people, because they would have had to pick up the system that BT already had in place and they would have had either to try to run a system alongside that or to have a different system. The skills and the staff were available through BT, so we were quite happy with it.

32. The Chairperson: If you are saying that there was no great interest from other people, that means that you spoke to other people.

33. Mr Peover: Yes.

34. Mrs Montgomery: We were aware of who else was in the market, although we did not formally test the market. Certainly, in conversations that we had with other providers, no one was suggesting that they had any interest.

35. The Chairperson: Who would they have been? Do you have any details?

36. Mrs Montgomery: We spoke to other providers in Northern Ireland, who were the same people whom we would have talked to about the training project, that is, the computerised learning and reference archive (CLARA) project.

37. The Chairperson: Do you have names of companies, for example?

38. Mrs Montgomery: I think that Fujitsu would have been one such company. Of course, we would have gone back to the original people who bid on the contract, who I think were Fujitsu.

39. The Chairperson: It would be useful if you could give the Committee that information. I am asking those probing questions because some people from outside might see a cosy relationship, and we want to address that to ensure that that was not the case. Therefore, we would appreciate it if we could have the details of who you spoke to and what their thoughts were.

40. Mr Peover: We regard it as a good relationship, rather than as a cosy relationship.

41. The Chairperson: Those are your words. We are trying to expel that suggestion from what people on the outside think. Therefore, more information on that would be useful.

42. My questions were about setting the scene, so members will have more detailed questions to ask.

43. Mr McGlone: I want to expand on the Chairperson’s point. The Committee’s briefing documents state, specifically on the computerisation of the Registry of Deeds function, that BT was clearly involved and that the contract was clearly tied up with BT. However, the notes state that that opportunity was not offered to other bidders, even though one, prior to BT’s appointment, had expressed an interest in developing that specific area. Do you not have those details with you?

44. Mr Peover: Do you mean the details of the other contractors?

45. Mr McGlone: One contractor had specifically expressed an interest in the project.

46. Mrs Montgomery: That was the other bidder. Originally, there were three bidders for the contract.

47. Mr McGlone: Is that specifically on the Registry of Deeds function?

48. Mrs Montgomery: Yes. One of the other bidders was interested in the LandWeb contract.

49. Mr McGlone: Were they not offered the opportunity to bid?

50. Mrs Montgomery: They did not want to take it forward.

51. Mr McGlone: I want to be clear in my mind about this. Did they express their interest and then withdraw it?

52. Mrs Montgomery: Yes.

53. Mr McGlone: Did they do that formally to you?

54. Mrs Montgomery: Yes. I think that that is correct.

55. Mr McGlone: Was there no question of the contract being tendered to other potentially interested companies at that point?

56. Mrs Montgomery: No. We did not go out to tender to any other company.

57. Mr McGlone: Thank you. That probably clarified that point. Mr Apsey, your CV is very extensive. I am sure that you have brought a lot to the project. Your CV states that you joined BT in 1995 with a background in marketing and that you were then a civil servant working in the ICT department of the former Department of Social Security (DSS). Did you work for BT, then the Civil Service, and then go back out again?

58. Mr Craig Apsey (BT): I joined the Civil Service in 1985 as an executive officer programmer. I worked my way through to senior executive officer, running quite a large IT programme in the DSS. In 1995, I moved to BT.

59. Mr McGlone: You did not work at the ICT department of the DSS as a civil servant?

60. Mr Apsey: I worked in the ICT department of the DSS between 1985 and 1995.

61. Mr McGlone: On behalf of BT?

62. Mr Apsey: No; as a civil servant.

63. Mr McGlone: Did you leave BT?

64. Mr Apsey: No, I did not join BT until 1995. I joined the Civil Service in 1985, and I joined BT in 1995. I have been with BT ever since.

65. Mr McGlone: OK. That is unclear.

66. The Chairperson: We need to stick to the —

67. Mr McGlone: I just wanted to establish the sequence of involvement.

68. Mr Peover, you referred to the number of processes. I am interested in this matter, because your former colleagues from DOE met the Committee to discuss the Planning Service, problems with electronic planning information for citizens (e-PIC), overspends and running behind times. At one point during the questioning in that meeting, one of your former colleagues highlighted certain issues and referred to the involvement of Central Procurement Directorate (CPD) in the project. Was Central Procurement Directorate, or whatever its equivalent may have been at that stage, involved in this project?

69. Mr Peover: CPD did not exist as an organisation in that form at that time. I think that that advice was taken from the Central Computer and Telecommunications Agency (CCTA), which was the predecessor of the Office of Government Commerce (OGC). All those organisations have changed over time. Advice was also taken from legal advisers.

70. Mr McGlone: Was there not an equivalent in DFP to deal with the matter at that stage?

71. Mr Peover: Central Procurement Directorate did not exist in that form in those days.

72. Mr McGlone: I want to get it clear in my mind. Was there no equivalent of CPD at that stage in DFP?

73. Mr Peover: Advice was also taken from the Central Information and Technology Unit for Northern Ireland (CITUNI). Procurement advice was available in the Department.

74. Mr McGlone: There appears to have been a pattern of issues with procurement and tendering and so on. I am trying to establish the extent of the involvement of DFP and CCTA with the advice that they may have given about the project.

75. Mr Peover: Advice was taken from them about the extension of the contract.

76. Mr McGlone: Perhaps it is inappropriate of me to ask that entirely of you today, because that advice was given quite a while ago. However, I am sure that there are documents on that that could be provided to us.

77. Mr Peover: Bear in mind that documents from that long ago may have been destroyed as a result of the normal destruction schedules for files and so on. I cannot guarantee that documents are available from as far back as that, but we will check. I am not sure, but the Audit Office may have done some checks as part of the process of preparing the report.

78. Mr McGlone: They probably would have been flagged up if they had been done. The report that we are considering is nearly two years old. I want to get into a number of details. We clearly want to investigate the demonstration of value for money, and I think that you referred loosely to customer savings of £8·1 million.

79. Mr Peover: The savings were £6·8 million.

80. Mr McGlone: How did you come up with that figure?

81. Mr Peover: That calculation was done as part of the benefits realisation exercise, which looked at the costs to the legal profession of having to inspect deeds manually. Manually inspecting deeds meant having to go to an office in Belfast and spend time getting hold of and looking at deeds, rather than going through LandWeb.

82. Mr McGlone: Did somebody decide that it would take a solicitor who is based in Cookstown or Magherafelt, for example, a certain length of time to travel to Belfast? Did somebody do that exercise?

83. Mrs Montgomery: Yes.

84. Mr McGlone: Are you saying that that is a saving to the customer?

85. Mr Peover: Yes, it is a saving to the legal profession.

86. Mrs Montgomery: It is a substantial saving to any solicitor who is now able to use LandWeb to access the information. Previously, they had to go to Belfast whenever they wanted to examine deeds.

87. Mr McGlone: Given this competitive day and age in which some solicitors are out of work, do you think that perhaps that does not stack up quite as neatly as the figures suggest?

88. Mrs Montgomery: I actually think that the figures and the hourly rate that we used are probably very low. Pre-LandWeb, it was common practice for solicitors to drive to Belfast, because that was the only place that they could get hold of documents. Therefore, they were taking a large chunk out of their day to look over the deeds.

89. Mr Peover: The cost of travel is not the only issue; the cost of their time must also be considered. Whenever a solicitor is in the car or sitting in the Land Registry office looking at documents, they are not doing whatever else they should be doing.

90. Mr McGlone: I am aware of that, but I am also aware that a number of solicitors would write to Belfast to get the information. I used to deal with quite a number of cases in which there were a lot of delays, and, invariably, the solicitors who were involved informed me that they were writing to Belfast for the documents. However, that is only an interesting by the by.

91. I want to get back to the chronology of the report. Paragraph 1.13 states that since the agreement was signed, Land Registry has encountered an unprecedented increase in business as a result of the buoyancy of the property market. Obviously, that created a windfall. Did Land Registry receive, or benefit from in any way, any of BT’s windfall profits? If so, by how much?

92. Mr Peover: You say “windfall profits", but it is not done that way.

93. Mr McGlone: Explain to me how it is done.

94. Mr Peover: BT is paid by transaction cost, and there is a standard rate of charges for specific transactions. Whenever the number of transactions rises, BT gets more money, and whenever the number of transactions falls, BT gets less money. Effectively, if the system does not work, BT does not get paid. The contract is one in which the risk of performance passes to BT. Therefore, whenever the market is up, BT benefits, and whenever the market falls, BT loses. It is paid only by transactions. There is no standing charge, and we are not paying BT a set fee, regardless of the number of transactions. That is the way that it works, so I would not call that a windfall profit.

95. Mr McGlone: BT, therefore, benefited tremendously from this during the boom. Is it benefiting at all now?

96. Mr Peover: It is suffering now. I can’t speak for BT, but as the number of transactions falls, it earns less money from the contract.

97. Mr McGlone: Therefore, does that mean that, in boom times, BT benefited and the Department did not?

98. Mr Apsey: The systems themselves have to be upgraded in times of boom, and BT has to put in additional support and equipment. If the Department had taken a standard procurement route on this project, it would have ended up with a very large change control from the company that it gave the contract to. In the event, going with BT resulted in an upgrade to the systems at no cost to the Department, because we had service levels to run to and we were not going to get paid if the systems could not deal with the transactions that were going through. Having made that investment, there was a downturn in the housing market. That means that that equipment is now sitting idle. The risk was transferred to BT because that is where it was best placed to sit. As a consequence, if you take the overall life cycle of the programme, there is still a real question mark over whether BT will ever make a profit from the deal.

99. Mr McGlone: You said that upgrades had been done at no cost to the Department. However, there seems to have been quite a cost to the public purse.

100. Mr Peover: There was no cost to the public purse. It is a transaction-based contract. People who use the service pay for the service.

101. Mr McGlone: Perhaps I can explain what I mean. The value of the agreement was £46 million at 1999 prices, which is a negotiated increase of 163% on BT’s original bid.

102. Mr Peover: That is not a cost to the public purse; it is a cost to the public.

103. Mr McGlone: We are dancing on a head of a pin with that point.

104. Mr Peover: It is an important point that those who use the service pay for it; that is a fairly common feature of systems of this type. You suggested that the Department did not benefit. However, it did.

105. Another theme in the report is that we should have responded more quickly to the increasing market and that we should have reduced fees. The Department and the public purse benefited because money from the surpluses went into the Consolidated Fund.

106. Mr McGlone: Forgive me if I am having a wee dull moment, but you are saying that, at one level, there was no benefit to the Department, yet there was benefit to the public purse.

107. Mr Peover: No, I did not say that. When the market was rising, the Department took in more fees. Some of those fees went out in transactions to BT to pay for its part, and the rest was used to cover the Department’s running costs. Indeed, we made a surplus. As you can see in the report, there is a theme that the surpluses were allowed to accumulate to too high a level. Land Registers was not, and the LPS is not, a trading fund. It cannot accumulate surpluses and build them up as reserves, so it passed them back to the Department, which put them in the Consolidated Fund. They were then used for public expenditure in Northern Ireland.

108. Mr McGlone: That is the point that I was trying to get to — the overall benefit to the public purse.

109. We will move on to the actual transaction charges from BT. Based on the model submitted in support of BT’s bid, what was BT’s estimate of the number of chargeable transactions in a year, and how did that compare with actual throughput?

110. Mr Peover: Which part of the report are you referring to?

111. Mr McGlone: I am referring to paragraph 1.13 of the report.

112. Mr Peover: I do not know what BT’s original estimate of the number of chargeable transactions was. Bear in mind that if a number of transactions is involved in an interaction with the Department, only one charge is paid to BT as part of that total.

113. Mr McGlone: A financial model was apparently submitted in support of BT’s bid, which would, presumably, have been based on the number of transactions chargeable in the course of a year. You may not have that model with you today. I am happy enough to have that sent to the Committee.

114. Mr Peover: Are you talking about the original bid back in 1998?

115. Mr McGlone: Yes; there was an estimate of the number of chargeable transactions in a year.

116. Mr Peover: Craig has been with us from the start. He may have that personal knowledge.

117. Mr Apsey: There was a number of different transaction types, depending on the nature of the transaction. They ranged in price from compulsory first registrations (CFR), which had the highest costs — I am sorry, but I cannot remember what those costs were — right through to land information system charges, which had the lowest. I can assure the Committee that, as is always the way with life, the highest charge ended up coming through at 50% of the transaction volume that we predicted, and the lowest charge came in at about 200% of the predicted volume. However, the two costs did not cover each other. In the end, the overall volume that came through was lower for us.

118. Mr McGlone: Back to my original question; do you have that financial model?

119. Mr Apsey: The financial model was submitted as part of the bid.

120. Mr McGlone: So, we can get that.

121. Mr Peover: We will look for a copy of the relevant section of the bid.

122. Mr Shannon: Stephen, I want to raise a concern that I believe the Committee also shares. Paragraphs 1.10 and 1.11 state that the value of the project increased from £17 million to £46 million in the space of eight months. That is quite worrying. Anyone who saw that figure would wonder how that could happen. Who was responsible for drawing up the initial output specification? What skills did they have, and did they have the necessary vision to appreciate how IT could be used to re-engineer and transform the Land Registers’ business? That is a big issue, and I am keen to hear your answer, as is the whole Committee.

123. Mr Peover: I have to admit a number of things. First, I do not think that there was sufficient experience in Land Registers at the time for it to have been fully aware of the potential for IT to transform land registration and the associated processes. We have all learned lessons as the process has gone on. Some mistakes were made, and the failures include the issue with the Registry of Deeds at the outset. That was a mistake, and there is no point in trying to pretend otherwise. We had to deal with the matter subsequently, and it has been successful. The process was very complicated. Craig can describe the practical complexities involved, because the technology was quite difficult. The paper part of the transaction was easy enough, but the mapping part proved to be quite a problem.

124. You asked me whether we had a clear vision at the outset of what might be achieved by that process, and the answer has to be no. It would be foolish to pretend otherwise. However, the process has developed very effectively along the way as we have learnt the system’s potential. I may be doing a disservice to my colleagues and our predecessors by saying that.

125. Mrs Montgomery: Our problem was that masses of work came through the door. We had a terrible problem with storage. We were unable to turn work around quickly enough; backlogs were building up, and we knew that we had to do something. We were also very concerned that we did not have a secure back-up system.

126. A combination of those factors meant that we were failing to provide a decent service to the customer, and we had to do something about it. IT seemed the right way to move forward. We initially worked on the basis of the Land Registry being the subject of the IT project. We were going to leave the Registry of Deeds, the idea being that the introduction of compulsory first registration, which was part and parcel of the IT, would mean that property would be moved from the old, unregistered Registry of Deeds system into the new Land Registry system. We were quite hopeful that that would happen fairly quickly. However, as we moved through the process for Land Registry, it became clear that it was not going to be that quick and that we were going to have to hold on to the Registry of Deeds. That is why the Registry of Deeds became integrated into the whole project. We realised that the two systems had to marry to get proper cohesion between a Registry of Deeds sale and a CFR coming into action to provide a land registration.

127. Mr Peover: To be fair to our predecessors, I would like to add a further comment. The Chairperson opened the session by referring to the objectives set out in paragraph 1.2 of the report. Those objectives have been largely achieved. With more insight, we might have achieved other things, and progress has been made along the way. The systems in our sister agencies in the rest of the UK and in the South are evolving and developing. They have sometimes provided services that they subsequently withdrew because of concerns about security of access, and so on. Therefore, those matters are evolving, and I would not want to be too hard on those who originally drew up the specifications. By and large, they did a good job, and the objectives set out in paragraph 1.2 have largely been achieved.

128. Mr Shannon: There seems to be agreement that the issue may not be how the system was drawn up and designed. However, the question that we all want answered concerns the amount of money involved in each case.

129. Without being presumptuous about age, I will say that, as we are all of a similar vintage, we can all remember the TV programme ‘Double Your Money’. Here we have an equivalent Civil Service show that is better than the one on TV, which could be called “Quadruple Your Money". The cost rose from £17 million to £46 million and then to £78 million. I am sure that those involved could not believe their luck; all their Christmases had come at once. How can you honestly tell Committee members who are accountable to the taxpayer, and who, like yourselves, are taxpayers, that such an astronomical and quick rise in cost constitutes value for money?

130. Stephen, in your response to an earlier question, you talked about England and elsewhere being involved in similar processes. Compared to what has happened there, does the process here represent value for money? It may be unfair to ask about what happened in England and Wales, but I raise the issue because it was mentioned.

131. Mr Peover: Sorry, I should have come back to your point about the costs as set out in the report. I want to say a number of things. The report states that we are talking about different price bases. Therefore, the £17·5 million and the £46 million cited represent two different price levels. If we were to do the £46 million at present cost, it would come to £27·5 million or so. That is the more relevant comparison.

132. The contract was extended; additional things were done. For example, we have spent almost £15 million on casework assistance, which was a discrete item that was considered in its own right and added to the figure of £78 million. The figure of £78 million is fairly shaky in the sense that we are making assumptions about how things will pan out over the lifetime of a contract. Given the variability in the property market and the present downturn, we believe that the figure is now considerably less than £78 million. However, we do not know what will happen next year or in subsequent years.

133. Any attempt to predict the value of the contract over its lifetime is fraught with difficulty. As John said, in his experience as a valuer, and in our experience as citizens, there has never before been a property market boom on the scale of that which occurred between 2006 and late 2007 to early 2008. House prices were rising; the average house price rose by 54% in that period. That was an unusual phenomenon, and prices have now dropped. I do not know where prices will go this year, next year or the year after, but it would be unusual if they were to revert to the level of the boom years. It is difficult to estimate the value of the contract over its lifetime. We do not think that it is as high as £78 million, but your guess is as good as ours.

134. Mr Shannon: The only people who are rubbing their hands are those from BT. Stephen, as paragraph 1.10 outlines, you were, effectively, dealing with one bidder in that eight-month period. I am thinking of the figures of £17 million and £46 million. The Committee and the taxpayer are entitled to see value for money. How can you be sure that the market was tested properly and that the agreement that, according to the report, was signed in July 1999 represented the best value for the taxpayer and for government?

135. Mr Peover: A process of competitive tendering took place, and I shall save BT’s embarrassment by saying that I understand that its bid was the best by far at the time. We went through a process of contract negotiation and added elements such as the Registry of Deeds, casework assistance and training programmes. In a sense, therefore, the contract has been expanded. Our original decision was based on the fact that we thought that the agreement represented good value for money. Having tested the market, we had good reason to believe that.

136. Mr Shannon: That is open to dispute. I do not think that we all accept your assertions, why is why we are asking our questions. Given that the figures have doubled, tripled and quadrupled, we have to ask where the value is for the taxpayer. I accept your point, but it does not seem to add up. The taxpayer looks at the issue simply. He or she wants to know why the cost of the contract was four times what it was at the start.

137. Mr Peover: It may sound like a pedantic point, but it is not the taxpayer who stumps up the cost; the fee payer does. It must be considered whether the fees in Northern Ireland are outrageous compared with those elsewhere. We do not think that they are; in fact, our fees are the second lowest, on average, across the UK. Our fees are well within the normal range of fees and are very much like those of our sister agencies. The expansion in value was partly due to the additions to the contract, and it was also substantially due to the fact that the market shot up out of all proportion to our previous experience. The contract is funded by fees rather than by the taxpayer, so if people were to start selling houses like there was no tomorrow, the level of fee income and the level of payments to BT would increase with the number of transactions. Neither the Department nor the system can control that.

138. Mr Shannon: One might conclude from paragraph 1.10 that BT got all that it asked for from the contract; indeed, Patsy made a similar point last week. That seems to be the case when one considers the amount of money that BT has been able to negotiate. Who negotiated the original agreement with BT? The key question, which was asked last week, is: what training did the Department have in making a deal that would be of good value? What experience did its staff have? Who made the deal with the private sector? I am not suggesting that the person be named, but we want to know whether that person had any training, relevant experience or negotiating skills.

139. Mr Peover: They certainly had experience in land registry, and they also had the support of consultants on the legal and PFI aspects. A long negotiation process took place with BT as part of the general process. There was a competitive tendering arrangement, and BT’s bid was by far the best. Our negotiators could probably have been better, but we think that they did a good job.

140. Mrs Montgomery: The team of advisers was led by the legal team that was appointed, and they were responsible for drafting and negotiating the documents.

141. Mr Shannon: Do you believe that they did a good job?

142. Mrs Montgomery: Yes.

143. Mr Shannon: You do, even though the costs are very different? Did that ever strike you as being unusual? I am not trying to be smart in asking that question. I believe that it is important that we have the opportunity to ask it.

144. Mr Peover: As I said at the outset, the fact that our fees are no higher now than they were in 2000 is an indication that we have done quite well in that contract. There was a huge increase in the volume of transactions, which resulted in much more money coming in both to us and to BT, although that has now dropped.

145. Mr Wilkinson: The other factor that affected the value of the contract was the big rise in house prices in Northern Ireland, because fees were based on an ad valorem scale. Therefore, that was another issue, alongside the volume of transactions. Again, the big increase in house prices added to fee charges.

146. Mr Peover: I mentioned that the average house price rose by 54% during that period. Obviously, that generated additional resources through the fees that came in.

147. Mr Shannon: I am not entirely sure that I am satisfied fully with your answers, Stephen. I see things simply. I believe that the public see things simply, too. We are not convinced.