Appendix 4

Memoranda and Papers

from Department of

Finance and Personnel

Central Procurement Directorate

Awareness Session

Assembly Section

Craigantlet Buildings

Stormont

BT4 3SX

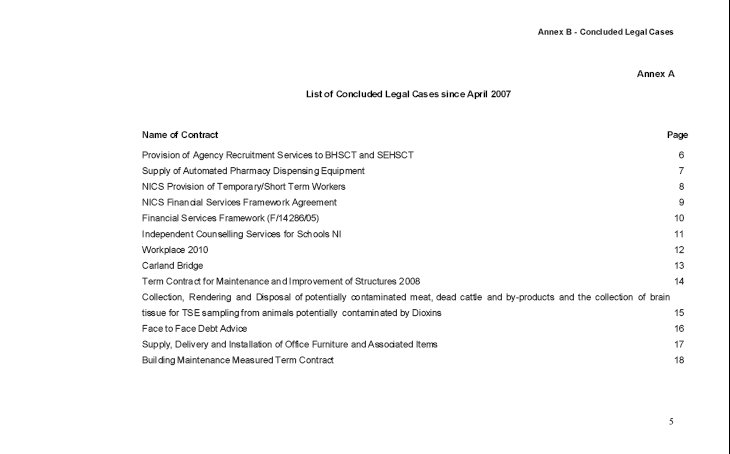

Tel No: 02890 529147

Fax No: 02890 529148

email: Norman.Irwin@dfpni.gov.uk

Mr Shane McAteer

Clerk

Committee for Finance and Personnel

Room 419

Parliament Buildings

Stormont

26 September 2008

Dear Shane

Please see attached briefing material for the Procurement Awareness Session with the Committee on 1 October 2008.

1. Procurement Board Strategic Plan 2008 – 2011

2. Procurement Practice in the new Northern Ireland

“Minimising the Risks

And

Maximising the Benefits"

I would be grateful if you could bring this material to the attention of Members in advance of next weeks meeting.

Yours sincerely,

Norman Irwin

Procurement Board

Strategic Plan 2008 - 2011

PROCUREMENT BOARD STRATEGIC PLAN – 2008-2011

Objective |

Target |

Actions |

|

1. |

Departments1 to ensure that the procurement process plays an optimal role in achieving efficiency savings while continuing to base procurement on best value for money (i.e. taking quality and policy outcomes into account alongside cost). |

Centres of Procurement Expertise (CoPEs) to work with Departments to identify how the procurement process can assist in the delivery of PfG commitments in a way that contributes to the most economically advantageous outcomes for the period 2008-2011. |

By 31 March each year Departments to produce annual procurement plans, which will include:- an assessment of the best value for money gains derived from the procurement process, including cash and non-cash gains, and the contribution the gains will make to their overall Efficiency Delivery Plans; details of how the procurement process will be used to assist in the delivery of the most economically advantageous outcomes; procurement measures to assist in the delivery of PfG commitments; and proposals to achieve a collaborative approach for common procurement items and cross-departmental impact from relevant procurement projects/programmes. |

ii The Procurement Board will monitor the implementation of the plans. |

|||

Objective |

Target |

Actions |

|

2. |

Departments to embed equality of opportunity and sustainable development in their procurement practice. |

1. By March 2011 Departments to implement the Guidance on Equality of Opportunity and Sustainable Development in Public Sector Procurement. |

DFP to take forward ; the approval and launch of the guidance, the issue of the guidance under cover of a DAO, |

ii. Departments to implement the guidance on integration of equality of opportunity and sustainable development into procurement processes. |

|||

iii. Procurement Board to assess the effectiveness of the guidance in year three. |

|||

Departments to take account of sustainable development principles when procuring works, supplies and services. |

By December 2008, CoPEs to produce Sustainable Procurement Action Plans to deliver sustainable development priorities within their unique portfolio of contracts. |

||

ii. By December 2008 Departments to ensure that Sustainable Development principles are considered in capital investment decisions on all publicly funded building and infrastructure projects. |

|||

iii. By 30 September 2008 CoPEs to have appropriate systems in place to allow access by SMEs and SEEs to opportunities for doing business with public sector organisations. |

|||

iv. By March 2009 CoPEs to have provided basic training in sustainable procurement for all procurement staff. |

|||

3. |

Departments to maintain compliance with the Achieving Excellence initiative within the management of capital construction projects over the period 2008 - 2011. |

1. By 31 March 2009, Departments to achieve a score of 90% maturity to act as best practice clients in accordance with Achieving Excellence (AE). |

i. Departments to monitor and report on compliance with the AE initiative. |

ii. CPD to: coordinate and present Departmental reports twice yearly to the Procurement Board, maintain close links with the construction industry to promote and embed AE principles, maintain a network of AE Champions, Chair PPG Works & Services Sub-Group. |

|||

4. |

By 2011. at least 95% of all Departmental procurement spend, to be channelled through a Centre of Procurement Expertise (CoPE). |

A minimum of 95% of the value of Departmental procurement spend should be undertaken or supported by a CoPE by 31 March 2009 and where this minimum is not met Departments must seek to reduce the level of spend not influenced by a CoPE by 25% year on year over the period 2008 – 2011. |

Where less than 95% of a Department’s procurement spend is channelled through a CoPE that Department should agree actions to reduce this by 25% year on year over the period 2008 – 2011. |

CPD to monitor and report twice yearly to the Procurement Board on progress. |

|||

5. |

Contracts to be awarded on the basis of the most economically advantageous tender (MEAT). Any exceptions to this should be subject to formal approval by the Head of Procurement for the relevant Centre of Procurement Expertise. |

1. By March 2009. |

Departments to work with CoPEs to meet this objective. |

ii. CPD to collate and report progress to the Procurement Board twice yearly. |

|||

iii. Procurement Board to monitor progress against this target. |

|||

6. |

By 31 March 2010 each Centre of Procurement Expertise (CoPE) to achieve reaccreditation of CoPE status. |

1. By 31 March 2009 CPD to initiate the process for reaccreditation of CoPEs capability and conclude reaccreditation by 31 March 2010. |

CPD to appoint an independent assessor. |

CoPEs to agree a common methodology and scoring matrix with the Assessor. |

|||

Each CoPE to be scored against the agreed methodology. |

|||

CPD to report outcome to Procurement Board and seek its endorsement of continued CoPE status as appropriate. |

|||

7. |

Each Centre of Procurement Expertise (CoPE) to engage with key markets to secure capacity within the market place to deliver best value for money from procurement. |

1. By April 2009 to develop awareness and commence implementation of a supplier development programme. |

Undertake key contractor spend analysis and identify high sustainability impact contractors. |

Develop supplier awareness, on sustainability issues through a programme of early and continuous engagement on procurements and through sharing best practice. |

|||

[1] Throughout this strategy all references to Departments include their Agencies, NDPDs and Public Corporations

_fmt.jpeg)

_fmt1.jpeg)

_fmt2.jpeg)

_fmt3.jpeg)

_fmt4.jpeg)

_fmt5.jpeg)

_fmt6.jpeg)

_fmt7.jpeg)

_fmt8.jpeg)

_fmt9.jpeg)

_fmt10.jpeg)

_fmt11.jpeg)

_fmt12.jpeg)

_fmt13.jpeg)

_fmt14.jpeg)

_fmt15.jpeg)

_fmt16.jpeg)

_fmt17.jpeg)

_fmt18.jpeg)

_fmt19.jpeg)

_fmt20.jpeg)

_fmt21.jpeg)

_fmt22.jpeg)

_fmt23.jpeg)

_fmt24.jpeg)

_fmt25.jpeg)

_fmt26.jpeg)

_fmt27.jpeg)

_fmt28.jpeg)

_fmt29.jpeg)

_fmt30.jpeg)

_fmt31.jpeg)

_fmt32.jpeg)

_fmt33.jpeg)

_fmt34.jpeg)

_fmt35.jpeg)

_fmt36.jpeg)

_fmt37.jpeg)

_fmt38.jpeg)

_fmt39.jpeg)

_fmt40.jpeg)

Construction Industry Forum for Northern Ireland – Procurement Task Group

Summary Paper for DFP Committee Meeting on 29 April 2009

Background

1. In response to the economic downturn the Minister announced the formation of a Construction Industry Forum for Northern Ireland, Procurement Task Group in the Assembly on the 15 December 2008.

2. The Procurement Task Group (PTG) met on the 17 December 2008 and on five further occasions during the period January to March 2009.

Membership

3. The PTG is chaired by Des Armstrong, Director – Central Procurement Directorate and includes representation from the Government Construction Clients Group (GCCG) and the Construction Industry Group for Northern Ireland (CIGNI). GCCG is represented by those clients, which also act as Centres of Procurement Expertise (CoPEs) involved in construction procurement. CIGNI is represented by nominees from the Professional College, Contractors College and the Specialist Sub-contractors’ College. (A full list of PTG members is included at Annex A.)

Terms of Reference

4. The PTG was constituted to develop practical principles to be applied to future construction procurement activity undertaken by all bodies governed by Northern Ireland Public Procurement Policy. In particular, PTG has considered how to:-

(i) further develop the partnership between Government and the construction industry;

(ii) facilitate the delivery of projects to the marketplace as quickly as possible;

(iii) deliver best value for money projects that meet the sustainability objectives set out in the Programme for Government; and

(iv) provide wider stakeholders with confidence that the procurement process is modern, robust and fair.

(The full Terms of Reference are included at Annex B.)

Progress to Date

5. The Task Group has made significant progress and an interim report was presented at a CIFNI meeting on 9 April, which was attended by the Minister. The interim report (attached at Annex C) includes seven key principles to be applied to future public sector construction procurement. The principles aim to:

(i) enhance the visibility of Government construction procurement opportunities to facilitate industry workload planning;

(ii) provide recurrent opportunities for enterprises of all sizes;

(iii) maximise the opportunities for enterprises to benefit from public sector construction contracts through participation in the supply chain;

(iv) reduce the cost and timescale of the pre-qualification process for the selection of tender short-lists;

(v) reduce tender bid costs;

(vi) deliver projects that represent best value for money; and

(vii) reduce the likelihood of a legal challenge.

6. In addition to the seven principles, the interim report includes some 25 actions with dates for implementation. Whilst some of these actions can be introduced with immediate effect, it is acknowledged that full implementation will require further detailed development work. It is therefore proposed that a number of CIFNI Working Groups be established to complete this further work and that the actions be introduced in an incremental manner and in full by December 2009.

7. In recognition of their importance to the local economy, a number of these actions are specifically targeted at SMEs, both as main contractors and as partners in the supply chain.

8. The Task Group also considered the most appropriate procurement and contract strategies that should be adopted by the public sector. They concluded that Framework Agreements have the potential to deliver better value for money than stand-alone contracts. Frameworks, both single-provider and multi-provider, have therefore been endorsed by the Task Group for the procurement of construction works and services.

completion of the final report

9. Since the CIFNI meeting on the 9 April detailed discussions have taken place among PTG members with a view to finalising the report for endorsement by the Procurement Board at its meeting on 7 May 2009.

(Two of the issues to be finally agreed are the number of contractors that should be included in tender lists and the number/value of projects to be included in a single provider framework.)

10. Subject to the approval of the Procurement Board, it is intended that the report will be signed by Des Armstrong and Colin McCarthy, Chairman of CIGNI, in recognition of CIGNI and GCCGs’ commitment to implement the proposals and to work together in a spirit of mutual trust and co-operation.

Membership of Procurement Task Group

Central Procurement Directorate:

Chair |

Des Armstrong |

Gary McCandless |

|

Sid Fairfield |

|

Stewart Heaney |

Construction Industry Group:

Professional College |

Colin Shaw |

Colin McCarthy |

|

George Coulter |

|

Specialist Sub-Contractors College |

Alfie Watterson |

George Stewart or other deputy |

|

Contractors College |

John Armstrong |

Enda Brady |

|

Daniel Dixon |

|

Eugene McKenna |

|

Mark Lowry |

|

CIG Executive Secretary |

Ciarán Fox |

Government Clients:

NIHE |

Trevor Neill |

DE |

Eugene Rooney/Stephen Creagh |

DRD Roads |

Bob Cairns |

DHSSPS Health Estates |

Eddie Brett |

NI Water |

Trevor Haslett |

Translink |

Clive Bradberry |

Procurement Task Group - Terms of Reference

Background

The Minister for Finance and Personnel has requested that a Procurement Task Group be constituted to develop practical solutions that will:-

- further develop the partnership between Government and the construction industry;

- facilitate the delivery of projects to the market place as quickly as possible;

- deliver best value for money projects that meet the sustainability objectives set out in the Programme for Government; and

- provide wider stakeholders with confidence that the procurement process is modern, robust and fair.

Terms of Reference

The Task Group will consider the issues listed below and, where appropriate, make recommendations to CIFNI in April 2009:-

- Review and disseminate the list of public sector projects, provided by Government Construction Clients, that are scheduled to move forward to the market place over the next three months in order to build confidence in the construction sector that there will be a flow of work in the short term.

- Agree the principles to be applied to future construction procurement activity undertaken by all bodies governed by NI Public Procurement Policy. This process will take into account:-

- recent legal judgements

- value for money

- the needs of the local construction industry

- bid costs

- the transparency and degree of certainty of deal flow

- sustainability requirements/whole life costing

- Consider how to maximise the opportunities for small contracting firms to bid for, or benefit from, public sector construction contracts.

- Consider the introduction of an independent early warning system for procurement queries and an alternative dispute resolution procedure that would mitigate the need for legal action.

- Provide feedback on the project and programme monitoring process operating through the Online Tracking System.

Annex C

Interim Report for Discussion

at CIFNI on 9 April 2009

Procurement Task Group Report

x April 2009

The Government Construction Clients Group (GCCG) and the Construction Industry Group for Northern Ireland (CIGNI) have agreed that the following principles will be applied to future construction procurement activity undertaken by all bodies governed by Northern Ireland Public Procurement Policy[1].

Principle 1 – Visibility of opportunities

Aim: |

|

Provide the construction industry with up-to-date information on progress on construction works and services contracts that are in the process of coming to the marketplace. This will facilitate workload planning by providing the industry with visibility of forthcoming opportunities for consultants, main contractors, sub-contractors and supply sectors of the industry. |

|

Actions: |

Target Date |

Until the Investment Strategy for Northern Ireland (ISNI) information website is launched, Central Procurement Directorate will continue to provide the construction industry with a composite monthly update report, based on information provided by Government Construction Clients. |

Currently in place |

Launch the ISNI information website and ensure that Departments update the data on a monthly basis to provide the construction industry with online access to Departments’ approved investment plans. For each project, the website shall include details of the construction related contracts including their value, programme and procurement route. |

Launch date to be announced |

Principle 2 – Recurrent opportunities to bid

Aim: |

|

Procurement and contract strategies to be structured in a way that provides recurrent opportunities for enterprises of all sizes to bid for construction related public sector contracts. |

|

Actions: |

Target Date |

Government Construction Clients will procure construction works, and where appropriate services, using one or more of the following contract strategies: on an individual project basis; as a bundle of projects to be completed as part of a single contract; as a bundle of projects to be completed as part of a single-provider framework agreement; through a multi-provider framework agreement for projects of a dissimilar nature; as part of a term contract (for minor works/maintenance projects). An explanation of the key features of each of these contract strategies is set out in Appendix 1. |

Future contracts |

Joint Ventures – a CIFNI working group will consider how procurement processes currently accommodate applications from joint ventures. The group will seek to ensure that Government Construction Clients have processes in place that allow smaller enterprises to come together to genuinely compete against applications from a single entity. |

30 June 2009 |

Financial Standing – a CIFNI working group will consider the current minimum standards for economic and financial standing for contracts of various values and complexity. The group will seek to ensure that the minimum standards set by Government Construction Clients do not exclude small and medium sized enterprises (SMEs) from being short-listed to tender for contracts that they are capable of completing. |

30 June 2009 |

Develop SMEs – a CIFNI working group will consider how SMEs can be given further opportunities for growth through participation in public sector construction contracts. The group will seek to ensure that the minimum standards set by Government Construction Clients for technical and professional ability do not exclude SMEs from being short-listed to tender for contracts on the basis of them not having experience of identical work when they have other relevant experience. |

30 June 2009 |

Principle 3 – Supply chain practice

Aim: |

|

In recognising that not all enterprises will be in a position to contract directly with the public sector, Government Construction Clients will seek to maximise the opportunities for those enterprises to benefit from public sector contracts through participation within the supply chain. |

|

Actions: |

Target Date |

Government Construction Clients to proactively manage contracts to ensure main contractors deliver on their commitments to:- openly advertise supply chain opportunities; administer subcontract tender processes in a fair and transparent manner that represents best value for money; use subcontract conditions that are fair and reflect the terms and conditions of the main contract; adhere to the ‘Code of Practice for Government Construction Clients and their Supply Chains’ ; and provide Government Construction Clients with open book access to supply chain accounts to allow payment progress through the supply chain to be periodically verified. |

Future contracts |

Fair Payment – a CIFNI working group will consider expanding the ‘Code of Practice for Government Construction Clients and their Supply Chains’ to include:- a ‘Fair Payment Charter’; and a requirement that first tier subcontractors provide 360° feedback directly to the Government Construction Client on monthly payment progress from the main contractor through the supply chain. The group will seek to ensure that all subcontractors benefit from fair and transparent payment practices, which are essential to underpinning successful integrated working on construction projects. |

31 Dec 2009 |

Principle 4 – Effective and efficient pre-qualification process

Aim: |

|

To reduce the costs for enterprises submitting Pre-Qualification Questionnaires (PQQ) by ensuring that PQQs are consistent, proportionate to the size and complexity of the contract and structured in a way that facilitates all enterprises which have the required capacity and capability. |

|

Actions: |

Target Date |

Efficient Pre-Qualification process – a CIFNI working group will consider if the resources required by enterprises to complete Pre-Qualification Questionnaires (PQQs) for numerous individual projects can be reduced. The group will seek to explore how Government Construction Clients could:- Reduce the number of questions within the PQQ; Use a PQQ, or parts of a PQQ, for selection for more than one project; and Reduce the time given to suppliers to submit PQQs and the time required for assessment in order to bring work to the marketplace more quickly. |

31 July 2009 |

Standardised Pre-Qualification Questionnaire (PQQ) – a CIFNI working group will consider those parts of a PQQ that could be common to all contracts. As far as practicable, the group will seek to develop a standardised PQQ template for use across all Government Construction Clients. |

31 Dec 2009 |

Pre-Qualification Questionnaire (PQQ) Health and Safety section – a CIFNI working group will consider how Government Construction Clients’ duties under the Construction (Design and Management) Regulations (Northern Ireland) 2007 could be fulfilled using a more streamlined health and safety section within the PQQ. The group will seek to reduce the number of health and safety related questions in the PQQ. |

31 Dec 2009 |

Registration with Constructionline and e-sourcingNI – a CIFNI working group will:- Review the role of Constructionline within public sector construction procurement processes; and Promote awareness of the roll-out of the e-sourcingNI, electronic tendering system, across all Centres of Procurement Expertise (CoPEs). |

31 Oct 2009 |

Principle 5 – Effective and efficient tender process

Aim: |

|

Reduce the cost for contractors tendering for public sector construction contracts |

|

Actions: |

Target Date |

Number of firms short-listed for invitation to tender – in order not to unnecessarily burden the construction industry, Government Construction Clients will short-list the minimum number of firms for invitation to tender sufficient to ensure adequate competition. Normally this will mean five, or up to a maximum of six, tenderers will be short-listed per contract. |

Future contracts |

Government Construction Clients will, as far as practicable, avoid the use of single stage design and build contracts for projects where the cost of developing the design from feasibility stage would place a significant cost burden on tenderers. |

Future contracts |

CIGNI recognises and supports the benefits of early contractor involvement. Where design and build is the preferred procurement route, Government Construction Clients will develop the project outline design (typically to RIBA stage C, D or E – dependent on the nature and complexity of the project) prior to the appointment of the design and build team in order to reduce tender bid costs. |

Future contracts |

For other procurement methodologies Government Construction Clients will consider developing the design (typically to RIBA Stage D) in order to reduce tender bid costs. |

Future contracts |

Principle 6 – Best value for money

Aim: |

|

Construction Procurement must represent best value for money |

|

Actions: |

Target Date |

Contracts should not be awarded solely on lowest price. Contract awards based on lowest price can incentivise tenderers to underbid to win work and rely on variations to make a profit. It can also result in a reduction in the quality of the finished product and undermine the additional social, environmental and economic benefits of the project. Contract awards based on lowest price also tend to lead to a fractious relationship between the Government Construction Client and the contractor. In support of best value for money, contracts should be awarded on the basis of the Most Economically Advantageous Tender (MEAT). |

Future contracts |

In determining MEAT, Government Construction Clients will undertake a comprehensive evaluation of tenders against predetermined quality and price criteria linked to the subject matter of the contract. The quality score will be evaluated on the merits of the tenderer’s proposals and how they will add value to the project. The Contractor will be required, by the terms of the contract, to deliver on the proposals set out in its quality/price submission. |

Currently included in contracts |

Where a tender price is considered to be abnormally low, the Government Construction Client will take all reasonable steps to ensure that it is satisfied that all contractual requirements can be met for the tender price prior to award. Where a tenderer is concerned that a contract is to be awarded at an abnormally low price it will raise its concerns with the relevant CoPE, at Director level. |

Future contracts |

The construction industry will deliver high quality infrastructure projects on behalf of Government Construction Clients. In particular, contractors will commit to:

|

Currently included in contracts |

Principle 7 – Reduce likelihood of legal challenge

Aim: |

|

Construction procurement should be structured in away that reduces the likelihood of a legal challenge |

|

Actions: |

Target Date |

Compliance with best practice – where a procurement exercise is considered not to have followed:-

CIGNI will raise this issue with the Director of the relevant CoPE. Where a Government Construction Client persistently fails to comply with these principles, Central Procurement Directorate will work with them to share best practice and improve their processes. |

Future contracts |

Dispute Avoidance/Resolution – a CIFNI working group will develop an early warning system for potential disputes and an alternative dispute resolution procedure that will mitigate the need for legal action. The group will seek to ensure that the dispute resolution procedure developed is sufficiently robust to allow CIGNI to endorse and fully support the agreed process. |

31 Oct 2009 |

Improving Processes – by standardising the pre-qualification process there should be less likelihood, across the wide range of Government Construction Clients, of an individual competition not following Government construction procurement policy. |

|

Maximising opportunities – by providing recurrent opportunities for contractors of all sizes to bid for public sector contracts, the incentive to challenge a procurement process should be reduced. |

Future contracts |

Conflict of interest – where a consultant is appointed directly, or as part of a team, by a Government Construction Client to progress a project to tender stage, the Government Construction Client shall exclude the consultant from forming part of the design and build team on the basis of the potential for a conflict of interest to arise. |

Future contracts |

An explanation of the key features of each of the contract strategies set out in Principle 2(a).

2(a)(i) Procurement on an individual project basis

Larger projects will normally be procured as individual projects.

2(a)(ii) Procurement of a bundle of projects as part of a single contract.

Where two or three projects of a similar nature are to be procured simultaneously then these projects may be bundled together as a single contract.

2(a)(iii) Procurement of a bundle of projects as part of a single-provider framework agreement.

In those market sectors where projects of a similar nature reoccur, Government Construction Clients will, where appropriate, procure capital building works using single-provider framework agreements.

Each framework agreement could include up to five projects totalling any value up to a maximum of c£75m. The projects could be selected by geographic location, value, or other factors deemed relevant by the Government Construction Client.

Normally five or up to a maximum of six contractors would be short-listed to tender for the first project. The contractor providing the MEAT for the first project would be appointed to the framework agreement and would be awarded the first project. The contractor’s performance would be monitored using Key Performance Indicators (KPIs), relevant and proportionate to the size and complexity of the project.

Provided its performance is satisfactory, the contractor would be awarded projects two to five without further competition on a project by project basis. Value for money would be assured through indexation and by building in efficiency savings.

Certainty of workflow for the individual contractor will allow effective investment and cost saving measures to be made.

Operation of a framework agreement on this basis would be dependent on the development of a robust pricing mechanism compliant with the Public Contracts Regulations 2006.

2(a)(iv) Procurement using a multi-provider framework agreement for projects of dissimilar nature

It is recognised that for some diverse market sectors, such as those where Central Procurement Directorate acts as the CoPE, there is limited recurring need for projects of a similar nature. A single provider framework agreement may not therefore be appropriate as the initial project may not reflect the nature and work content of projects two to five.

Government Construction Clients should consider establishing a number of multi-provider framework agreements of limited duration. The value of the framework agreement should normally be limited to c£50m per provider (ie c£250m for a framework agreement with five providers). This approach would mean that unsuccessful contractors would have further opportunities to bid for a larger number of smaller framework agreements as part of the regular (normally 2 to 3 year) framework agreement renewal process.

With multiple providers included in the framework agreement, value for money would be assured through secondary competitions, despite the varying nature of the work.

This form of framework agreement would provide considerable savings in cost and time by:-

(i) removing the need for pre-qualification for each project;

(ii) transferring learning from one project to another;

(ii) improving working relationships;

(iv) providing continuous workflow; and

(v) speeding up the procurement process.

Operation of a framework agreement on this basis would be dependent on the development of a robust pricing mechanism compliant with the Public Contracts Regulations 2006.

2(a)(v) Procurement using a term contract (for minor works/maintenance projects).

Term contracts will be used to deliver maintenance and minor works where the delay and cost of continuous repetitive tendering would be prohibitive.

The ‘Code of Practice for Government Construction Clients and their Supply Chains’ requires Government Construction Clients to be consistent to the Code of Practice principles in their dealings with their supply chains.

Government Construction Clients will, in turn, expect their supply chains to apply the Code principles in the dealings between supply chain partners.

The Code encapsulates the twelve guiding principles that are the basis of Northern Ireland’s public procurement policy and the three further principles suggested by the construction industry.

Code of Practice Principles

1. Transparency – to achieve openness in policy and its delivery.

2. Competitive Supply – to procure using competitions unless there are convincing reasons to the contrary.

3. Consistency – to ensure that supply chains can expect that procurement policy will be consistent across the public sector.

4. Effectiveness – to meet the commercial, regulatory and socio-economic goals of Government in a balanced manner appropriate to the procurement requirement.

5. Efficiency – to ensure that all procurement processes are carried out as cost effectively as possible.

6. Fair Dealing – to treat supply chains fairly, including protecting commercial confidentiality where required, and not to impose unnecessary burdens or constraints on suppliers or potential suppliers.

7. Integrity – to ensure that there is no corruption or collusion with supply chains or others.

8. Informed Decision-Making – to base decisions on accurate information and monitor requirements to ensure that they are met.

9. Legality – to conform to EU and other legal requirements.

10. Integration – to pay due regard to Government’s other economic and social policies rather than cut across them.

11. Responsiveness – to endeavour to meet the aspirations, expectations and needs of the community serviced by the procurement.

12. Accountability – to ensure that effective mechanisms are in place to enable Accounting Officers and their equivalents in other bodies to discharge their responsibilities on issues of procurement risk and expenditure.

13. Plus three additional principles

14. Selection – to ensure that supply chains are selected on the basis of the optimum combination of whole life cost & quality (or fitness for purpose) to meet the customer’s requirements.

15. Incentivise – to ensure that supply chains are remunerated in a way that encourages them to deliver good quality construction work on time and to budget.

16. Conditions of Contract – to ensure that the Conditions of Contract support teamwork and partnering.

In signing this report the Construction Industry Group for Northern Ireland and the Government Construction Clients Group commit to:-

(i) implement the principles in this report; and

(ii) work together in a spirit of mutual trust and co-operation, in order to deliver high quality public sector construction projects in Northern Ireland.

Colin McCarthy |

Des Armstrong |

[1] Includes Departments, Agencies, Non-Departmental Public Bodies and other organisation that are financed mainly (ie by more than 50%) by the public sector - herein thereafter referred to as ‘Government Construction Clients’.

Small and Medium Sized Enterprises Access to Public Procurement Opportunities

From: Norman Irwin

Date: 15 May 2009

Summary

Business Area: Central Procurement Directorate

Issue: This paper outlines the progress on measures aimed at making public procurement opportunities more accessible by SMEs

Restrictions: N/A

Action Required: To note

Background

A key objective of the Northern Ireland Sustainable Procurement Action Plan is to increase access to public sector procurement opportunities for SMEs and SEEs through the public tender process or participation in supply chains.

With Small and Medium sized Enterprises (SMEs) accounting for some 99.7% of all businesses in Northern Ireland, Central Procurement Directorate (CPD) and the Centres of Procurement Expertise (CoPEs) recognise their importance in the provision of goods, works and services to the public sector. CPD has been working with both SMEs and Social Economy Enterprises (SEEs) to break down any barriers to tendering and encourage more SMEs to compete for government contracts.

Current measures

Visibility of opportunity

Following the Review of Public Procurement, which reported in 2002, Departments, their Agencies and Non-Departmental Public Bodies, have in place Procurement Control Limits (PCLs) for the procurement of goods, works and services. The PCLs recommended the optimum level of market exposure required to ensure that the transaction cost of procurement procedures is efficient, whilst maintaining a sufficient level of supplier sourcing to achieve value for money through competition. The PCLs currently require all procurement opportunities estimated to exceed £30K[1] to be publicly advertised. These limits apply to all public sector procurement covered by Procurement Policy[2].

When selecting suppliers to be invited to submit a tender for construction related procurements below the £30k threshold, CoPEs agreed with the construction industry that Constructionline would be used to select the suppliers to be invited to tender. Background information on Constructionline is included at Annex A.

When selecting suppliers to be invited to submit a tender for procurements above £30k and below the EU threshold (currently £90k for goods & services and £3.5m for works) the procurement opportunity is placed on the website of the CoPE responsible for the procurement. (For construction related procurement, suppliers are also required to be registered with Constructionline or equivalent)

CPD also places a weekly advertisement in the Belfast Telegraph, Irish News and Newsletter highlighting all current procurement opportunities available and the need to visit CPD’s website for more details. In addition, there are electronic links from CPD’s website to all other CoPE’s websites.

Where a contract is estimated to exceed the EU threshold, it is a requirement under the Public Contracts Regulations 2006 that the opportunity must be advertised in the Official Journal of the European Union (OJEU). All opportunities published in OJEU are accessible from the OJEU website. Once the opportunity has appeared in OJEU it is replicated on the relevant CoPE’s website.

Joint venture and supply chain opportunities

CPD and the CoPEs encourage SMEs to join together as consortia to bid for contracts. To support SME participation, procurement opportunities are structured so that smaller enterprises can come together to compete against applications from a single entity.

It is also recognised that not all organisations will contract directly with the public sector and that some SMEs will look for opportunities within the supply chains that will be formed by successful tenderers. For this reason, CPD has included within the ‘Contractors’ quadrant of the Northern Ireland Sustainable Procurement Action Plan (SPAP) an action that requires main contractors to publish opportunities for sub-contracting within their supply chain on their website and/or, where appropriate, in the local Press.

A Sustainability Task Group, acting under the auspices of the Construction Industry Forum for Northern Ireland (CIFNI) has also developed ‘Proposals for Promoting Equality and Sustainable Development by Sustainable Procurement in Construction’. These proposals, included in new public sector construction contracts from December 2008, require main contractors to sign up to a ‘Code of Practice for Government Construction Clients and their Supply Chains’. This Code requires main contractors to deal fairly with their subcontractors and wider supply chain thereby encouraging SMEs to seek sub-contract opportunities.

Support and guidance

Central Procurement Directorate (CPD) provides support to both SMEs and SEEs and has regular engagement with representative and lead bodies from both groups. The purpose of this engagement is to help SMEs and SEEs by increasing their understanding of the procurement process through, for example, supporting ‘meet the buyer’ events.

CPD has also published a guidance document ‘Public Procurement – a guide for small and medium sized enterprises’ for SMEs and SEEs seeking to do business with the public sector. A companion guide has also been published for public sector purchasers (‘Public Procurement – removing the barriers to SMEs’) which outlines steps to help remove barriers faced by these suppliers. This guidance is available on CPD’s website.

More recently CPD published guidance on the integration of ‘Equality of Opportunity and Sustainable Development into Public Sector Procurement’ which provides advice on how Contracting Authorities might achieve sustainable outcomes, including increased access for SMEs through procurement.

In addition, individual suppliers can request information and clarification on specific tenders from CPD and are routinely offered feedback on the quality of their tenders following the completion of tender competitions. The purpose of this feedback is to assist individual SMEs or SEEs to compete more effectively for future opportunities.

e-SourcingNI

CPD introduced an e-SourcingNI web portal in May 2008 to manage CPD’s procurement opportunities. Up to March 2009, approximately 4,400 suppliers registered on the system of which over 60% have self-designated as SMEs. During that period, 564 procurement opportunities were managed using the system and 2045 tenders were submitted electronically.

The e-SourcingNI portal:-

- Provides a one stop shop for all CPD procurement opportunities;

- Is accessible 24hrs/7days per week; and

- Has on-line & telephone help lines.

SEEs who have registered on eSourcingNI, will have opportunities to compete for public sector contracts. Public sector buyers will also shortly be able to identify goods and services supplied by SEEs allowing, where appropriate, low value competitions to be directed to this sector.

Next steps

General procurement

The Procurement Board in December 2008 approved the use of e-SourcingNI as a single sourcing tool for all the existing CoPEs in Northern Ireland. All CoPEs should be using this common portal by early 2010.

CPD is planning to extend the functionality of the e-sourcingNI portal to include the facility to register, free of charge, company details and allow this data to be maintained for use on any tender documentation submitted via the portal [ie one-stop-shop for company details].

Construction - work load planning

The Strategic Investment Board (SIB) and CPD have developed a Delivery Tracking System (DTS) for major ISNI projects. The DTS provides a platform, to record delivery progress from pre-tender to completion.

The DTS was rolled out to all Departments and related public bodies in October 2008. This followed substantive completion of technical design of the system by SIB and initial training of public sector users.

Over 500 projects are currently logged on the DTS. A number of departments are currently reviewing and updating project/programme details on the system and implementing procedures to embed the DTS in their business planning processes.

In order to provide the construction industry with up-to-date information on the progress of construction works and services contracts that are in the process of coming to the marketplace an ISNI information portal has also been developed to provide the general public, and in particular the construction industry, with detailed, up to date information drawn from the DTS. Information held includes departmental ownership, the number and nature of projects, timeline for delivery and project costs. This information will facilitate SME workload planning by providing the industry with visibility of forthcoming opportunities for consultants, main contractors, sub-contractors, specialist contractors and the supply sectors.

OFMDFM have provisionally planned to launch the ISNI information portal on 11 June 2009, at a Construction Employers Federation procurement conference which is being supported by CPD and SIB.

Construction - Procurement Task Group report

In recognition of the importance of SMEs to the local economy the CIFNI Procurement Task Group (PTG) has also considered how to further maximise the opportunities for SMEs to bid for, or benefit from, public sector construction contracts, both as main contractors and as partners in the supply chain. The PTG Report includes a number of actions, to be taken forward by CIFNI working groups, specifically aimed at addressing issues relating to SMEs. The Actions are included as Annex B.

The PTG Report was approved by the Procurement Board at its meeting on 7 May 2009.

Annex A

Constructionline

Constructionline is the UK’s register of local and national construction and construction-related suppliers who are pre-qualified to work for public and private sector buyers. It is owned by the Department for Business, Enterprise & Regulatory Reform and supported by the Office of Government Commerce and the Department of Communities and Local Government.

Its aim is to provide efficiency savings to public and private sector procurers and the construction industry as a whole by streamlining procurement procedures. Constructionline was established in response to recommendations in Sir Michael Latham’s 1994 Report, ‘Constructing the Team’ and Sir John Egan’s 1998 Report, ‘Rethinking Construction’.

Its procedures follow Government’s current understanding of EU public procurement legislation and it is managed in accordance with a strict interpretation of the legal framework applicable to pre-qualification, thereby reducing associated risks for procurers.

In March 2002, the Northern Ireland Executive agreed that Constructionline (or a body who carries out an equivalent certification function) should be used to pre-qualify contractors for all contracts above £30k and below the Public Contracts Regulations 2006 (“EU Regulations") threshold.

Benefits of Constructionline

The primary purpose of Constructionline is to remove the need for suppliers to submit to each client buyer, contract-by-contract, pre-qualification information and supporting documents, thus reducing the administrative burden of repeatedly filling in pre-qualification questionnaires.

When selecting suppliers to be invited to submit a tender for procurements below the £30k threshold, the Construction Industry Forum for Northern Ireland agreed, in June 2006, that Constructionline should also be used to generate automatically a transparent and auditable list of appropriate pre-qualified contractors to be invited to tender. This means that registration with Constructionline may also provide contractors with tender opportunities.

For works contracts above 30k and below the EU Regulations threshold the public sector does not require contractors to submit details that are available from Constructionline e.g. details of their financial standing, professional conduct, etc. This reduces the resources required by contractors to complete pre-qualification questionnaire forms for public sector procurement competitions. It also means that public sector procurement staff do not need to reassess this information, providing time and cost savings, and freeing up staff for other work.

Registration Process

To join Constructionline suppliers have to register once and then provide renewal information annually, freeing up valuable resources that can be used to deliver more efficient and effective services. This information is assessed to a common, transparent standard, and buyers should only need to request project-specific information on additional criteria where required.

Constructionline is completely free of charge for public sector buyers to use and for a supplier the cost of registering with Constructionline depends on yearly turnover, as set out in the tableon the following page.

Yearly turnover |

Annual Constructionline Fee (excluding VAT) |

£0 to £249,999 |

£90 |

£250,000 to £999,999 |

£230 |

£1,000,000 to £1,999,999 |

£390 |

£2,000,000 to £4,999,999 |

£440 |

£5,000,000 to £19,999,999 |

£650 |

£20,000,000 to £49,999,999 |

£950 |

£50,000,000 and above |

£1,380 |

Annex B

Examples of actions from the PTG Report that relate to SMEs

Action |

|

(2a) |

Joint Ventures – a CIFNI working group will consider how procurement processes currently accommodate applications from joint ventures. The group will seek to ensure that Government Construction Clients have processes in place that allow smaller enterprises to come together to genuinely compete against applications from a single entity. |

(2b) |

Financial Standing – a CIFNI working group will consider the current minimum standards for economic and financial standing for contracts of various values and complexity. The group will seek to ensure that the minimum standards set by Government Construction Clients do not remove the potential for small and medium sized enterprises (SMEs) to be short-listed to tender for contracts that they are capable of completing. |

(2c) |

Develop SMEs – a CIFNI working group will consider how SMEs can be given further opportunities for growth through participation in public sector construction contracts. The group will seek to ensure that the minimum standards set by Government Construction Clients for technical and professional ability do not remove the potential for SMEs to be short-listed to tender for contracts on the basis of them not having experience of identical work when they have other relevant experience. |

(3a) |

Fair Payment – a CIFNI working group will consider expanding the ‘Code of Practice for Government Construction Clients and their Supply Chains’ to include:- (i) a ‘Fair Payment Charter’; and (ii) a requirement that first tier subcontractors provide 360° feedback directly to the Government Construction Client on monthly payment progress from the main contractor through the supply chain. The group will seek to ensure that all contractors and subcontractors benefit from fair and transparent payment practices, which are essential to underpinning successful integrated working on construction projects. |

(4a) |

Efficient Pre-Qualification process – a CIFNI working group will consider if the resources required by enterprises to complete Pre-Qualification Questionnaires (PQQs) for numerous individual projects can be reduced. The group will explore and make recommendations on how Government Construction Clients could:- (i) Reduce the number of questions within the PQQ; (ii) Use a PQQ, or parts of a PQQ, for selection for more than one project; and (iii) Reduce the time given to suppliers to submit PQQs and the time required for assessment in order to bring work to the marketplace more quickly. |

(4b) |

Standardised Pre-Qualification Questionnaire (PQQ) – a CIFNI working group will consider those parts of a PQQ that could be common to all contracts. As far as practicable, the group will seek to develop a standardised PQQ template for use across all Government Construction Clients. |

(4c) |

Pre-Qualification Questionnaire (PQQ) Health and Safety section – a CIFNI working group will consider how Government Construction Clients’ duties under the Construction (Design and Management) Regulations (Northern Ireland) 2007 could be fulfilled using a more streamlined health and safety section within the PQQ whilst ensuring that high standards of health and safety are maintained. |

(4d) |

Registration with Constructionline and e-sourcingNI – a CIFNI working group will:- (i) Review the role of Constructionline within public sector construction procurement processes; and (ii) Promote awareness of the roll-out of the e-sourcingNI, electronic tendering system, across all Centres of Procurement Expertise (CoPEs). |

[1] In the case of construction related professional services procurement, CoPEs have agreed that all appointments estimated to exceed £5k in value would be publicly advertised. This policy exceeds the requirements set out in the PCLs and was agreed with the construction industry in Northern Ireland through the Construction Industry Forum for Northern Ireland (CIFNI)

[2] NI Procurement Policy applies to Departments, Agencies, NDPBs and Public Corporations. It does not apply to Local Authorities.

DFP - Procurement Issues -

Follow up Response

Assembly Section

Craigantlet Buildings

Stormont

BT4 3SX

Tel No: 02890 529147

Fax No: 02890 529148

email: Norman.Irwin@dfpni.gov.uk

Mr Shane McAteer

Clerk

Committee for Finance and Personnel

Room 419

Parliament Buildings

Stormont

5 June 2009

Dear Shane

Public Procurement Opportunities for SME’s

Background

At its meeting on 20 May 2009, Committee members requested clarification on a number of issues which arose during the evidence session with officials from the Central Procurement Directorate. The clarification is set out below, in the order requested.

1. Copy of IntertradeIreland Report

The report entitled ‘All Island Public Procurement Competitiveness Study’ has not yet been published by IntertradeIreland. When published, a copy will be forwarded to the Committee.

2 Application of the Public Contract Regulations 2006 to the procurement of social housing

Public procurement in Northern Ireland is governed by the EU Treaty, EU Procurement Directives and the Public Contracts Regulations 2006 (the “Regulations") that implement the Directives in the UK.

The Regulations set out the legal framework for public procurement. They apply when public sector organisations seek to acquire supplies, services, or works. The Regulations also apply to subsidised contracts that are over 50% publicly funded. In such cases, the organisation receiving the funding is in fact deemed a Contracting Authority for the purpose of the application of the Regulations. For example, in the case where a Housing Association receives public funding to procure a social housing scheme, it is the Housing Association on whom the obligation to secure compliance with the Regulations is placed. However, in the event that the Housing Association does not comply with the Regulations, then the Regulations require the funding department to recover the funding provided.

The Regulations set out procedures that must be followed before awarding a contract when its value exceeds set thresholds, unless it qualifies for a specific exclusion e.g. if it is a contract solely for the acquisition of land. Even when a procurement competition is not subject to the Regulations, (for example because the estimated value of a contract falls below the relevant threshold), EU Treaty-based principles of non-discrimination, equal treatment, transparency, mutual recognition and proportionality apply.

The case law of the European Community has developed considerably of late, in particular through the Auroux decision of the European Court of Justice (ECJ). This requires that a Contracting Authority look at the main purpose of the transaction to determine whether or not it is a contract that is subject to the Regulations.

In the case of social housing, the transaction is to achieve the development of the site by construction of housing for the Housing Association. The predominant purpose is the construction of housing and not the acquisition of the land. The contract is therefore considered a works contract and the Regulations apply. If the works were not the main objective of the contract, but were incidental to another objective, the Regulations would not apply.

As a result of the Auroux decision, contracts that might have in the past been awarded by Housing Associations to developers to purchase land and design and build the schemes without competition, now appear to be in scope of the procurement rules.

The ECJ ruling is not concerned with the specific type of construction contract used, but rather, it highlights the fact that consideration needs to be given on a case by case basis as to whether the Regulations should be applied to procurement activity of this type. Irrespective of whether the contract is for the design and build of the houses, or relates to a more traditional approach where design and construction are procured separately, the Regulations are likely to apply.

The competition that may result from the application of the Regulations to a particular procurement will be open to all firms with the necessary capability either to tender directly or as part of the developers team, dependent on the procurement route being followed.

3. Number of Northern Ireland SMEs that have been successful in winning contracts procured by CPD

The number of works, supplies and services contracts awarded to Northern Ireland SMEs[1] during 2008/09 are set out in Table 1 below. The table includes all new contracts where CPD was responsible for the procurement, but excludes contracts awarded by other Centres of Procurement Expertise and individual orders issued under existing contracts. Where further breakdown information is available on whether the enterprise is micro (<10 employee), small (<50) or medium sized (<250) this information has been included. The information as to whether an enterprise is micro, small or medium sized has been collated from the self-designations entered by enterprises when registering with either the e-SourcingNI Portal or Constructionline.

Table 1

Contracts awarded by CPD 1 April 2008 – 31 March 2009 |

Number |

Total number of Contracts Awarded |

|

Total number of contracts awarded |

69 |

Number awarded to Northern Ireland micro businesses |

3 |

Number awarded to Northern Ireland small businesses |

6 |

Number awarded to Northern Ireland medium sized businesses |

31 |

Number awarded to larger Northern Ireland enterprises that are not SMEs |

4 |

Number of works contracts awarded to enterprises registered outside Northern Ireland |

9 |

Number of service contracts awarded to enterprises registered outside Northern Ireland |

16 |

Supplies and Services contracts (Non construction) |

|

Total number of contracts awarded |

279 |

Number awarded to SMEs |

192 |

Number awarded to larger enterprises that are not SMEs |

87 |

4. Number of Northern Ireland SMEs that have submitted tenders for the CPD Integrated Consultant Team (ICT) framework agreement.

CPD commenced the procurement of a framework agreement for the provision of construction related professional services in March 2009. The competition invited tenders from multidiscipline teams to be returned by 15 May 2009. Each team comprises a team leader and a further seven team members of various disciplines. Preliminary analysis of the tenders has highlighted the statistics set out in Table 2 below.

Table 2

Total number of tenders received |

29 |

Number of tenders submitted by joint ventures |

1 |

Number of Northern Ireland SMEs that submitted tenders |

8 |

Number of enterprises which although not a Northern Ireland SME, have a practice office in Northern Ireland |

10 |

Total number of other individual enterprises included within the 29 multidiscipline teams |

83 |

Total number of other individual enterprises included within the 29 multidiscipline teams that are Northern Ireland SMEs |

47 |

Total number of other individual enterprises included within the 29 multidiscipline teams that are not Northern Ireland SMEs, but have a practice office in Northern Ireland |

13 |

5. Number, value and type of contract awarded over the past 3 years to companies not registered in Northern Ireland.

The number and value of non-construction related supplies and services contracts awarded to companies registered/not registered in Northern Ireland in the three years from 1 April 2005 to March 2008 are set out in Table 3A below.

Table 3A[2]

Period - 1 April 2005 – 31 March 2008 |

|

Total number of contracts awarded to companies registered in Northern Ireland |

1316 |

Value of these contracts |

£666m |

Total number of contracts awarded to companies registered outside Northern Ireland |

326 |

Value of these contracts |

£307m |

The details of contracts awarded during this period to companies not registered in Northern Ireland are set out in Annex A.

The number and value of construction related works and services contracts awarded to companies registered/not registered in Northern Ireland in the three years from 1 April 2006 to March 2009 are set out in Table 3B below.

Table 3B

Period - 1 April 2006 – 31 March 20092 |

|

Total number of contracts awarded to companies registered in Northern Ireland |

121 |

Total Value of contracts awarded |

£130.9m |

Total number of contracts awarded to companies registered outside Northern Ireland |

37 |

Total Value of contracts awarded |

£11.4m |

The details of contracts awarded during this period to companies not registered in Northern Ireland are set out in Annex B.

Tables 3A & 3B and Annexes A & B include all new contracts where CPD has been responsible for the procurement, but excludes contracts awarded by other Centres of Procurement Expertise and individual orders issued under existing contracts.

6. Statistics on the use of Constructionline by Northern Ireland SMEs.

Constructionline is the UK’s register of local and national construction and construction-related suppliers, pre-qualified to work for public and private sector buyers. The number of Northern Ireland SMEs registered with Constructionline is set out in Table 4 below.

Table 4

Number |

|

Northern Ireland enterprises registered with Constructionline |

1639 |

Micro businesses |

848 |

Small businesses |

630 |

Medium sized businesses |

147 |

Non SMEs |

14 |

7. Output from the Construction Industry Forum for Northern Ireland (CIFNI) – Working Groups

The Procurement task Group report includes seven key principles and some 25 actions. Whilst some of these actions can be introduced with immediate effect, it is acknowledged that full implementation will require further detailed development work. A number of CIFNI working groups are being established to complete this work before the end of the year. CPD will keep the committee informed of the output of the working groups.

Yours sincerely,

NORMAN IRWIN

Contract Title |

Contract Value |

Supplier Name |

Address |

Postal Code |

DOE EHS New Survey Grade GPs and Electronic Distance Measuring Equipment |

£49,250.00 |

Leica Geosystems Ltd |

Milton Keynes |

MK5 8LB |

Council Armagh District Photocopiers |

£16,332.00 |

NRG Group Ltd |

Birmingham, West Midlands |

B7 4AP |

DETI NITB Human Resource Management System (HRMS) |

£35,000.00 |

Snowdrops Systems Limited |

Oxon |

OX28 6FF |

Supply, Delivery, and Servicing of a High Output MFP for EHS |

£390,000.00 |

Xerox (Uk) Limited |

West Sussex |

BN14 8RJ |

DEL - Appointment of a CLAS Consultant |

£1,740.00 |

LA International Computer Consultants Ltd |

Stoke-On-Trent |

ST1 5UB |

DEL - IT Health Check Consultant |

£5,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DARD Liquid Media |

£130,000.00 |

Becton Dickinson |

Oxford |

OX4 3LY |

DFP OBD Provision of Accounting Support |

£7,950.00 |

KPMG |

Watford |

WD1 1DA |

DHSSPS Audit of Statutory Residential Homes for Older People |

£85,000.00 |

KPMG |

Watford |

WD1 1DA |

DHSSPS HPA Sexual Health & Drugs Information Campaigns |

£79,927.00 |

Convenience Advertising |

Ireland |

|

Provision of Advice, Metrics & Benchmarking Services for OBC NICS ICT Service Rationalisation |

£90,000.00 |

Gartner |

Dublin 4, Ireland |

|

SEUPB Consultants to Undertake Article 4 Checks (PEACE II) |

£22,500.00 |

KPMG |

Watford |

WD1 1DA |

DARD - Supply, Delivery and Installation of a Replacement Sonar for RV Corystes |

£106,450.00 |

Simrad Limited |

Banffshire |

AB56 1UQ |

NIAO Supply, Installation and Servicing of MFPs Feb 2005 |

£32,737.00 |

NRG Group Ltd |

Birmingham, West Midlands |

B7 4AP |

NICS Government Library Service Library Management System |

£136,450.00 |

Sirsi |

Herts |

EN6 3JW |

OFMDFM NI e-Gov Unit ICT Strategy |

£78,339.00 |

Gartner |

Dublin 4, Ireland |

|

SEUPB Implementing Bodies for PEACE II Programme Extension |

£4,168,770.00 |

Combat Poverty Agency |

Islandbridge |

Dublin 8 |

DETI - Events managment for Geoparks Conference Sept 2006 |

£27,498.00 |

Ultimate Communications |

Republic Of Ireland |

ROI |

DOE EHS LC/MC/MC System |

£157,200.00 |

JVA Analytical Ltd |

Dublin 2 |

ROI |

Invest NI - International Image Research |

£30,900.00 |

Promar International |

Cheshire |

CW1 6ZY |

Del - Essential Skills Qualitative Research |

£45,738.00 |

Frontline Consultants |

Scotland |

FK8 2NN |

DETI Sample Peparation and Geochemical Analysis of Stream Sediments |

£407,000.00 |

British Geological Survey |

Nottingham |

NG12 5GG |

DFP BDS Consultancy Support for a Health Check on the PSN (R) |

£48,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DEL - Verification of Learner Signatures |

£10,072.00 |

KPMG |

Watford |

WD1 1DA |

DCAL Review & Consultation on Strategy for Sport in Northern Ireland |

£46,300.00 |

Genisis |

Dublin 2 |

ROI |

DRD Ready Mixed Concrete |

£300,000.00 |

Tarmac Precast Concrete |

Clwyd |

LL15 2UG |

DOE EHS Laboratory Electronic Document & Record Control System |

£28,582.00 |

Ideagen Software Ltd |

Derbyshire |

DE4 3EJ |

Invest NI - Secutiry Systems |

£120,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

NITB - Regional Tourism Partnership for the western Region |

£28,615.00 |

Business Tourism Solutions |

|

EH6 5QG |

Invest NI - Trade Advisory Service in Holland |

£140,000.00 |

Kurtz International Marketing + Management B.V |

The Netherlands |

|

DHSSPS IT Networks Health Check |

£8,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

EHS - Scoping Study on Assessing The Condition of Invertrebrates on ASSI’s |

£5,000.00 |

Dr Keith Alexander |

Exeter, Devon |

EX1 3AQ |

OFMDFM - CLAS Consultancy Support for the NICS EDRM Implementation Project |

£10,504.00 |

Soctim Consulting |

Hankelow, Cheshire |

CW3 0JA |

DETI NITB - Delivery of the Masterclass Series for Tourism Business |

£55,100.00 |

Stark Events |

Glasgow |

G12 8JJ |

DETI NITB - Business Visitor Attitude Survey |

£19,350.00 |

Tourism Development International |

Co Dublin |

ROI |

DEL - CLAS Consultant for OITFET |

£2,900.00 |

LA International Computer Consultants Ltd |

Stoke-On-Trent |

ST1 5UB |

DEL - IT Health Check For OITFET |

£4,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DOE - The Management of Waste Fridges and Freezers |

£600,000.00 |

M Baker Recycling Ltd |

Exeter |

EX1 1TL |

DOE EHS - DNA Analysis of Irish Red Grouse Feathers |

£22,954.00 |

Dept of Biological Sciences |

Milton Keynes , Uk |

MK7 6AA |

CCEA Class Assessment Record Folders and Associated Forms |

£32,760.00 |

Williams Lee |

Duncru Industrial Estate |

Belfast |

DFP - RCA IT Support to Achieve Security Accreditation on a Replacement Project |

£20,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DETI - CLAS Consultant |

£7,500.00 |

Newell & Budge Ltd |

|

EH4 3ER |

NSMC Consultant to Provide Business Case/Economic Appraisal for Joint Secretariat Accommodation |

£22,950.00 |

KPMG |

Watford |

WD1 1DA |

DETI - Energy Legal Advisers |

£270,000.00 |

Simmons & Simmons |

|

EC2Y 9SS |

DRD - Consultancy Support on Re-Design + Implementation of Sophus Anti-virus Infrastructure |

£7,150.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DCAL Arts Council Building Feasibility Study for Nothern Bank Site, Waring Street |

£42,835.00 |

KPMG |

Watford |

WD1 1DA |

DETI HSENI - Telephone Service |

£6,000.00 |

National Interpreting Service |

London |

E1 6EP |

DE - CESG Check-Based Assessment of De Network Infrastructure |

£12,800.00 |

Newell & Budge Ltd |

|

EH4 3ER |

NISRA General Register Office (GRO) Consultant to Review Workload of District Registration Staffing |

£40,000.00 |

KPMG |

Watford |

WD1 1DA |

DCAL- PRONI- Appointment of a CLAS consultant to carry out a CRAMM review |

£20,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DoE Planning Service - Householder Retail Study for BNMAP 2015 |

£26,785.00 |

Roger Tym & Partners |

|

WC2A 2EY |

Patient Administration System - iSoft Licensing |

£3,146,975.00 |

iSoft plc |

Manchester |

M1 6 LT |

Invest NI - Benchmarking Tools for the Shared Services and IT Sector |

£41,933.00 |

IBM Business Consulting Service |

London |

SE1 9PZ |

DEL - CMS Health Check |

£4,000.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DCAL-Supply of Electrofishing Back Pack |

£4,000.00 |

Electracatch International |

Co Dublin |

|

DHSSPS Environmental Cleanliness Standards in HS Trust Facilities |

£80,000.00 |

KPMG |

Watford |

WD1 1DA |

DVTA - Supply & Delivey of Equipment/Solutions for Roadside Enforcement of Drivers Legislation |

£62,350.00 |

Lisle Design |

Fife |

KY16 9DA |

DFP BDS Training & Development to support delivery of a high Value Sustainable Consultancy Service |

£115,100.00 |

Core Context Consulting |

Cheltenham |

GL50 3AW |

DFP - Consultancy Support to Progress the NICS ICT Service Review Programme |

£260,190.00 |

Mantix Limited |

|

EC3N 2LRr |

DFP - Security Health Check 2005 |

£3,900.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DFP - RMADS Review 2005 |

£13,200.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DETI - Energy Efficiency Consultancy |

£19,915.00 |

The Association for the Conservation of Energy |

|

N1 8PT |

DRD Ports and Public Transport: Review of the Management of ‘Public Service Obligation’ for NIR |

£21,950.00 |

KPMG |

Watford |

WD1 1DA |

DARD Supply and Delivery of an In Situ Sterilizable Fermenter System |

£27,298.00 |

Masons |

|

EC1R 0ER |

DHSSPS Comparison of UK Waiting Times Definitions |

£20,950.00 |

System Concepts Ltd |

London |

WC2R 0EZ |

DARD - Supply, Delivery, Installation and Commissioning of an LC-Triple Quadrupole Mass Spectrometer |

£300,000.00 |

Water Technology Ltd |

|

ROI |

OFREG Completion of the Phoenix Gas Price Control Review |

£249,999.00 |

Mazars LLP |

|

EC3A 7NR |

DoE EHS - N.I. Air Quality Archiving and Website |

£95,000.00 |

AEA Technology |

Oxfordshire |

OX11 0RA |

DEL - Investors in People - Practitioner Development |

£100,000.00 |

David Hunter |

Glasgow, Scotland |

G62 7LG |

Invest NI - Established Business Programme for |

£74,907.00 |

Strategem Ltd |

Manchester |

M21 7AZ |

DETI NITB - Appointment of Specialist Advisor for World Class Visitor Attractions |

£17,500.00 |

Stevens & Associates |

Swansea, Wales |

SA4 6SD |

DFP BDS CLAS CESG Review of Accreditation Document Set |

£1,950.00 |

Newell & Budge Ltd |

|

EH4 3ER |

DARD AFBI - Provision of Wide Area Network for AFBI |

£99,100.00 |

BT Business Communications |

London |

SE1 8BB |

DARD Supply and Delivery of an 8.0m to 10.7m Steel Workboat |

£174,841.00 |

Liverpool Water Witch Marine |

|

L5 9UZ |

DRD Water Service NI Customer Billing and Contract Computer System |

£74,000,000.00 |

Xansa |

Reading |

|

EHS: Support for Preparation & Implementation of IPPC for Existing Farms in the Intensive Agric. Sec |

£74,375.00 |

SAC Analytical Services Department |

Midlothian |

EH26 0QE |

DOE - EHS Provision of Sign Manufacture for Environment and Heritage Service |

£65,000.00 |

Shelley Signs Ltd |

Shropshire Rotherham, Sout |

TF9 2BX |

DARD Harvester and Forwarder |

£250,000.00 |

Komatsu Forest |

Cumbria |

CA6 5TJ |

DETI NITB - Supply of Signage for the Northern Ireland Tourist Board |

£140,000.00 |

Dee-Organ Ltd |

Renfrewshire |

PA3 4HP |

DETI - Assessment of Tourism Contribution to the NI Economy |

£35,847.00 |

Cogent SI Ltd |

Scotland |

DG2 0RL |

Invest NI - Study to determine NI International Vendor Capability |

£28,500.00 |

Business Control Solutions |

Peterborough |

PE1 1TT |

DRD Rural Transport Fund Review |

£33,885.00 |

TAS Partnership Ltd (The) |

Preston |

PR1 8BU |

DETI: Supply, Delivery and Support of MFPs |

£135,655.00 |

Xerox (Uk) Limited |

West Sussex |

BN14 8RJ |

Purchase of a Ferry Vessel |

£89,000.00 |

Redfinn Boats |

Co Meath, Ireland |

|

DETI Exhibition and Interpretative Design for the Giant’s Causeway Visitors Centre |

£516,430.00 |

Land Design Studio Ltd |

London |

TW9 4BH |

DARD Replacement Marine Cranes |

£126,300.00 |

Thistle Group |

Aberdeenshire |

AB42 1TF |

OFMDFM Provision of ICT Support Services |

£77,000.00 |

BT Business Communications |

London |

SE1 8BB |

DFP Workplace 2010 Intranet Site |

£4,875.00 |

Hewlett-Packard Ltd |

Berks |

RG12 1BQ |

DETI Provision of Article 4 Management Checks under Article 4 of Commission Regulation EC 438/2001 |

£23,750.00 |

KPMG |

Watford |

WD1 1DA |

DARD - Genetic Analyser |

£68,508.00 |

Applied Biosystems |

Cheshire |

WA3 7QH |

DARD - Supply & Delivery of Protective Clothing |

£150,000.00 |

James Boylan Safety (JBS) |

Co Monaghan |

ROI |

DCAL Review of Belfast Central Library’s Central Role |

£12,900.00 |

Kentwood Associates |

Reading |

RG31 6DE |

InterTradeIreland Provision of Joint Facilitator and Secretariat Services to NSRG |

£29,233.00 |

D’Arcy Smyth & Associates |

2 |

|

DFP CPG Professional Skills for Government Seminars Awareness Training |

£6,750.00 |

National School for Government |

Ascot |

SL5 0QE |

|

£88,865,004.00 |

|

|

|

DARD Supply and Delivery of Grilles |

£45,000.00 |

GH Engineering |

Co Tyrone |

|

DETI Companies Registry On-line Project |

£233,000.00 |

Enterprise Registry Solutions |

Dublin |

|

DCAL Provision of Financial Services for Review and Evaluation of Irish FA/Linfield FAC Agreement |

£42,900.00 |

KPMG |

Watford |

WD1 1DA |

DETI- Provision of Sample Preparation and Organic Geochemical Analysis of Urban Soils |

£91,386.00 |

Alcontrol Geochem |

Manor Road, Hawarden, Chester |

CH5 3US |

Invest NI - Provision of Financial Services Consultant |

£52,875.00 |

Terry McCaughey & associates |

London |

SW6 3SE |

DARD: Suply, Delivery, Installation and Servicing of Photocopiers |

£197,015.00 |

Ricoh UK Ltd |

Feltham, Middlesex |

TW13 7HG |

DETI - FDI Research Project |

£59,050.00 |

Experian Business Strategies |

|

EH1 2BB |

DETI - Wireless Broadband on Street Furniture in a City Centre Environment |

£8,000.00 |

Mason Communications Ireland |

Dublin 4 |

ROI |

DFP- Technical Consultancy Support to Broadband |

£69,600.00 |

Mason Communications Ireland |

Dublin 4 |

ROI |

DEL - Delivery of the Employment Support Programme |

£3,000,000.00 |

Action Mental Health |

|

ECIY ORT |

NICS WP 2010 Provision of a CLAS consultant for IT Security Evaluation |

£8,000.00 |

Evolve Business Consultancy Ltd |

Farnham, Surrey |

GU10 1DW |

DOE Image Management System |

£52,280.00 |

PIDCAR |

St Albans |

AL3 6PH |

DCAL OSNI Flying Contract |

£335,280.00 |

Woodgate Aviation Ltd |

Ballasalla, Isle Of Man |

IM99 6AB |

DoE EHS Helicopter Hire Services |

£45,000.00 |

PLM Dollar Group Ltd |

Inverness |

IV2 7XB |

Ulster Scots Agency Photocopier for US Academy Implementation Group |

£2,697.00 |

NRG Group Ltd |

Birmingham, West Midlands |

B7 4AP |

DARD Provision of Facilities Services for CAFRE at 3 Colleges |

£1,047,684.00 |

Eurest |

|

|